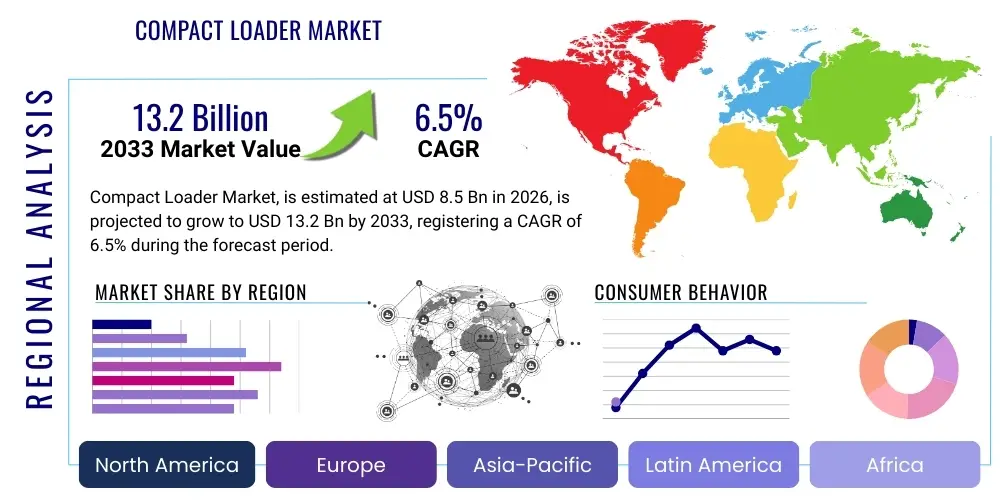

Compact Loader Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437990 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Compact Loader Market Size

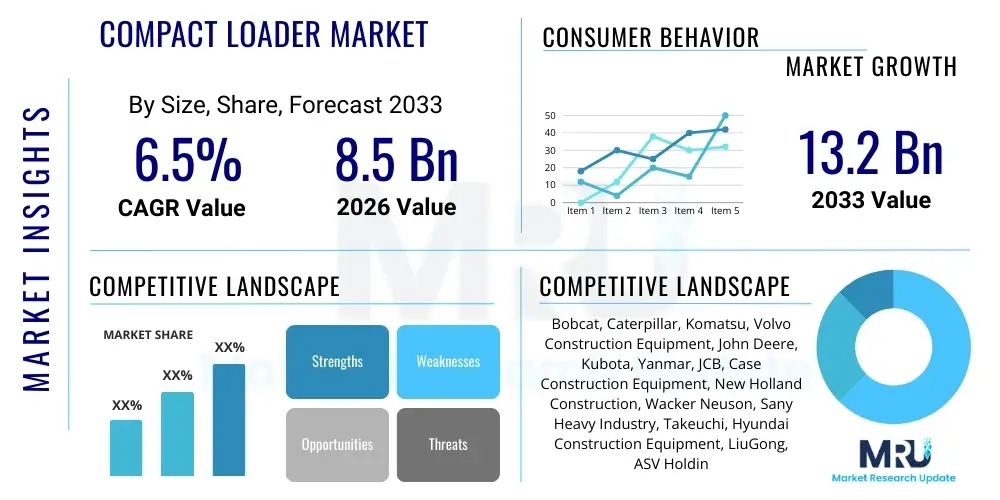

The Compact Loader Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $13.2 Billion by the end of the forecast period in 2033.

Compact Loader Market introduction

Compact loaders are versatile, multi-purpose heavy machinery characterized by their small frame and robust operational capabilities, making them indispensable in confined work spaces where traditional heavy machinery is impractical. These machines, including Skid Steer Loaders (SSLs) and Compact Track Loaders (CTLs), are primarily utilized for material handling, excavation, demolition, and site preparation across various industries. Their core benefit lies in their maneuverability, hydrostatic drive systems, and the ability to accept a wide range of hydraulic attachments, transforming a single machine into a multipurpose tool, significantly enhancing operational efficiency and reducing overall project time.

The product description encompasses machinery designed for high torque and low ground pressure, essential for navigating soft or delicate terrain. CTLs, equipped with rubber tracks, offer superior traction and flotation compared to wheeled SSLs, which dominate hard-surface applications. Major applications span residential and commercial construction, extensive landscaping projects, agricultural tasks such as feeding and manure removal, and municipal maintenance operations. The inherent adaptability of compact loaders, coupled with advancements in telematics and operator comfort, solidifies their position as foundational equipment in modern job sites globally.

Driving factors for market expansion include accelerated urbanization, leading to an increase in smaller-scale construction and infrastructure projects requiring agile equipment. Furthermore, rising labor costs and a persistent focus on job site safety are pushing contractors toward highly mechanized solutions that minimize manual effort and increase output. The replacement cycle for aging fleets in developed economies, alongside robust infrastructure investment in emerging markets, contributes significantly to sustained demand for new, technologically advanced compact loader models.

Compact Loader Market Executive Summary

The Compact Loader Market is experiencing robust growth driven by rapid technological integration, specifically in electrification and automation, alongside strong demand from the residential construction and agriculture sectors. Business trends indicate a shift towards rental services and fleet sharing models, particularly among small and mid-sized contractors, seeking cost efficiency without the burden of capital expenditure. Manufacturers are heavily investing in telematics solutions and machine control systems to enhance predictive maintenance capabilities and optimize utilization rates, addressing the industry's focus on total cost of ownership (TCO).

Regionally, North America and Europe remain mature markets characterized by high adoption rates of advanced features like hydraulic quick couplers and sophisticated attachment control systems, with a strong focus on emission reduction standards (e.g., Tier 4 Final/Stage V). Conversely, the Asia Pacific region, particularly China and India, presents the highest growth potential, fueled by massive government investments in smart city development and rural infrastructure, driving volume sales of both Skid Steer and Compact Track Loaders. Latin America and MEA are stabilizing markets, showing increasing adoption linked to mining activities and agricultural mechanization initiatives.

Segment trends reveal that Compact Track Loaders (CTLs) are significantly outpacing Skid Steer Loaders (SSLs) in terms of market share gain, attributed to their superior performance in varied terrain and increasing preference in landscaping and earthmoving applications. The segment covering operating capacity of 1,000–2,000 lbs dominates sales, representing the sweet spot for versatility across typical construction and agricultural tasks. The agriculture application segment is projected to exhibit a particularly strong CAGR, benefiting from the global trend toward automated and smaller-scale farm equipment capable of maneuvering within barns and specialized crop areas.

AI Impact Analysis on Compact Loader Market

User queries regarding AI's influence in the compact loader market frequently center on operational autonomy, predictive failure analysis, and enhancing operator safety through intelligent assistance systems. Key themes highlight the expectation that AI will transition compact loaders from sophisticated, operator-dependent machines to semi-autonomous or fully autonomous units capable of executing complex tasks like grade control, trenching, or repetitive material movement with minimal human intervention. Concerns typically revolve around the required investment for integrating high-level sensor fusion and AI processing, data security protocols for collected machine telemetry, and the necessary reskilling of the existing workforce to manage and supervise AI-driven fleets. Users also express strong interest in how AI can optimize fuel consumption and minimize wear-and-tear through intelligent throttle management and hydraulics control.

The adoption of AI in compact loaders is fundamentally reshaping fleet management and job site execution. Machine learning algorithms are crucial for processing vast amounts of telematics data (engine performance, hydraulic pressure, cycle times) to identify subtle patterns indicating impending component failure, thereby shifting maintenance from reactive to predictive scheduling. This capability drastically reduces unexpected downtime, a critical factor in equipment rental businesses. Furthermore, AI-powered vision systems, combined with LiDAR and radar, provide enhanced situational awareness, enabling features like automatic obstacle avoidance and zone restricting, significantly improving on-site safety and mitigating collision risks, especially in crowded urban construction zones.

Looking forward, AI is expected to drive higher levels of automation, progressing towards 'co-bot' operations where human operators define the overall task parameters, and the machine's AI executes the task path, attachment modulation, and material loading sequence with optimized precision. This integration includes deep learning models for optimizing the bucket fill factor in real-time based on material density and texture, maximizing payload efficiency for every cycle. Such innovations promise significant reductions in operational costs and provide a competitive edge to companies utilizing advanced, AI-enabled compact loader technology.

- AI-driven Predictive Maintenance: Utilizing machine learning on telematics data to forecast component failure and schedule preventative repairs.

- Autonomous Operation Systems: Enabling repetitive tasks (e.g., loading, hauling) to be executed without direct operator control, increasing utilization time.

- Enhanced Safety and Collision Avoidance: AI-powered sensor fusion providing real-time obstacle detection and automatic machine stop/slowdown functions.

- Optimized Fuel Efficiency: Intelligent algorithms managing engine throttle and hydraulic flow based on real-time workload requirements.

- Intelligent Grade and Attachment Control: Machine learning systems assisting in maintaining precise grade and optimizing attachment movement for complex tasks.

DRO & Impact Forces Of Compact Loader Market

The compact loader market is heavily influenced by dynamic forces, primarily driven by increasing construction activity globally, particularly focused on smaller-scale infrastructure and residential projects where these machines excel due to their size and versatility. Technological advancements, such as the introduction of electric and hybrid compact loaders and improved ergonomic design, serve as key drivers, attracting investment and expanding the application scope into environmentally sensitive areas. However, market growth is significantly restrained by the cyclical nature of the construction industry and the volatility of raw material costs, which impact manufacturing expenses and the final price point of the equipment.

The primary opportunities lie in the accelerating adoption of electric compact loaders, which address stringent emission regulations and operational cost concerns, especially in Europe and North America. Furthermore, developing sophisticated telematics and AI integration offers manufacturers a pathway to recurring revenue streams through software services and enhanced equipment maintenance contracts. The rapid mechanization of the agricultural sector in emerging economies presents a high-volume opportunity for simplified, robust compact loader models. These internal and external forces continuously shape investment strategies, product development cycles, and regional distribution networks within the heavy equipment sector.

The impact forces operate on multiple levels; regulatory pressures concerning engine emissions (Tier/Stage standards) force significant R&D spending on powertrain diversification, while macroeconomic indicators, such as interest rate fluctuations and government stimulus packages for infrastructure, directly influence capital equipment purchasing decisions by contractors. The intense competitive landscape compels manufacturers to innovate continuously, offering better TCO through durability and high attachment versatility, ensuring the compact loader remains a foundational, highly efficient asset on the modern job site.

Segmentation Analysis

The Compact Loader Market is segmented primarily based on machine type, which determines mobility and operational environment; operating capacity, defining the load handling capabilities; and application, highlighting the dominant end-use sectors. Understanding these segments is crucial for manufacturers to tailor product specifications—such as hydraulic flow and horsepower—to meet specific industry demands. The shift in segmentation preferences, particularly the rise of Compact Track Loaders over Skid Steer Loaders, indicates an increasing need for machines capable of working effectively in soft, muddy, or hilly terrains typical of large infrastructure developments and extensive landscaping projects.

The segmentation by operating capacity directly correlates with machine size and price point, dictating whether the loader is suitable for residential DIY projects or heavy-duty commercial construction tasks. The mid-range capacity segment (1,000–2,000 lbs) currently holds the largest market share due to its optimal balance between lifting power, machine footprint, and cost effectiveness. Application-based segmentation reveals that construction and agriculture remain the cornerstone demand centers, but emerging applications in industrial material handling, particularly in logistics and large warehousing facilities, are creating new, specialized sub-segments requiring enhanced safety features and indoor operational suitability.

- By Type:

- Skid Steer Loaders (SSLs)

- Compact Track Loaders (CTLs)

- Mini Track Loaders (MTLs)

- By Operating Capacity:

- Less than 1,000 lbs

- 1,000–2,000 lbs

- Above 2,000 lbs

- By Application:

- Construction (Residential, Commercial, Infrastructure)

- Agriculture

- Landscaping and Grounds Maintenance

- Mining and Quarrying

- Industrial and Utility

Value Chain Analysis For Compact Loader Market

The value chain for the Compact Loader Market initiates with the upstream analysis involving raw material procurement, encompassing steel, specialized alloys, hydraulic components, and advanced electronic controls. Key upstream suppliers include steel manufacturers, engine producers (e.g., Kubota, Cummins), and component specialists providing transmissions and axles. Efficiency in this stage relies heavily on managing supply chain logistics, stabilizing commodity prices, and ensuring compliance with stringent quality standards for critical components like high-pressure hydraulic pumps and advanced filtration systems, which are vital for machine longevity and performance.

The midstream focuses on manufacturing and assembly, where major OEMs design and produce the final machinery. This stage involves significant investment in R&D for product differentiation, incorporating features like electro-hydraulic controls, optimized cabins, and proprietary telematics hardware. Distribution channels form the critical downstream element, primarily leveraging large, established dealer networks that handle sales, financing, parts, and maintenance services. Direct sales channels are increasingly utilized for large-volume fleet orders, while indirect distribution via third-party rental companies allows manufacturers to capture demand from short-term or smaller-scale projects.

The market heavily relies on robust aftermarket support, constituting spare parts sales, maintenance contracts, and equipment servicing. This service-centric approach significantly contributes to the total revenue generated throughout the machine's lifecycle. End-users evaluate the entire value proposition, including the dealer network's responsiveness and the availability of specialized attachments, often prioritizing reliable local support over initial purchase cost. This complex interaction between manufacturing innovation, effective distribution, and comprehensive aftermarket service dictates competitive advantage within the compact loader industry.

Compact Loader Market Potential Customers

The primary customer base for compact loaders spans multiple industries, with construction contractors forming the largest segment. These include general contractors specializing in residential and light commercial building, who value the machine's ability to operate in confined urban settings, and specialized subcontractors focused on earthmoving, demolition, or utility installation. The need for versatile equipment capable of managing diverse tasks, from moving pallets of materials to grading lots, makes compact loaders essential tools for optimizing efficiency on small to mid-sized job sites.

The agricultural sector represents a rapidly growing customer segment, utilizing compact loaders for material handling tasks such as stacking hay bales, feeding livestock, clearing barns, and light field work. Farmers increasingly seek robust, maneuverable machines that can operate reliably in dusty or muddy conditions, driving demand for CTLs with high flow hydraulics to run powerful attachments like silage defacers or large rotary cutters. Government and municipal entities also constitute significant buyers, purchasing loaders for road maintenance, snow removal, park upkeep, and general infrastructure repair, often prioritizing models meeting high environmental and safety specifications.

Furthermore, landscaping professionals and equipment rental companies are major end-users. Landscapers rely on these machines for site preparation, moving bulk materials (soil, mulch), and intricate grading tasks, favoring the precision offered by modern control systems. Equipment rental fleets, seeking high utilization rates and broad application suitability, invest heavily in popular models and a wide range of quick-change attachments to cater to a diverse client base, ensuring the market reach extends beyond those capable of large capital purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $13.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bobcat, Caterpillar, Komatsu, Volvo Construction Equipment, John Deere, Kubota, Yanmar, JCB, Case Construction Equipment, New Holland Construction, Wacker Neuson, Sany Heavy Industry, Takeuchi, Hyundai Construction Equipment, LiuGong, ASV Holdings, Ditch Witch, Gehl, Terex, Merlo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compact Loader Market Key Technology Landscape

The compact loader market is defined by a continuous push toward smarter, more efficient, and sustainable equipment, with technology deployment focusing heavily on powertrain innovation and digital integration. Electrification stands out as a core technological shift, addressing both environmental mandates and operational needs, particularly in noise-sensitive environments and indoor applications. Manufacturers are launching battery-powered compact loaders, which offer zero emissions and significantly reduced noise pollution, relying on advanced battery management systems (BMS) and efficient electric motors to match the hydraulic power output of their diesel counterparts. This transition requires overcoming challenges related to battery energy density, charging infrastructure availability, and minimizing recharge downtime on active job sites.

Digital technologies, primarily telematics and IoT, are fundamentally changing how compact loaders are utilized and maintained. Modern machines are equipped with onboard sensors transmitting real-time operational data—including location, fuel consumption, idle time, and error codes—to fleet managers via cloud platforms. This capability supports predictive maintenance schedules, optimizes machine deployment across multiple projects, and improves security through geo-fencing and remote diagnostics. Furthermore, the integration of advanced hydraulic controls, such as electro-hydraulic joysticks and proprietary control schemes, provides superior precision and customizable response settings, allowing operators to fine-tune machine performance based on the specific attachment or task requirements, greatly enhancing versatility.

Looking at operator interface and safety, technology is focused on automation readiness and ergonomic improvements. Features like sophisticated rearview cameras, 360-degree visibility systems, and Load Sense Technology (LST) assist the operator, minimizing fatigue and accident risk. The foundation for future autonomous operations is being laid through technologies like GPS-enabled grade control systems and attachment recognition software. These features streamline complex tasks, ensuring high repeatability and reducing reliance on manual measurements, marking a significant step toward full job site automation within specific, contained environments.

Regional Highlights

- North America: North America represents a mature and technologically advanced market, dominating global revenue share due to robust residential construction, high infrastructure spending, and substantial fleet replacement cycles. The region shows a strong preference for Compact Track Loaders (CTLs) over Skid Steer Loaders (SSLs) due to diverse terrain and weather conditions. Key growth drivers include the massive expansion of the rental equipment industry and the stringent adoption of Tier 4 Final emission standards, which favor technologically advanced or electric models.

- Europe: Europe is characterized by strict environmental regulations (Stage V emissions) and high labor costs, driving rapid adoption of electric and hybrid compact loaders. Market growth is stimulated by urbanization and small-scale infrastructure projects requiring maneuverable, low-noise equipment. Western European countries, particularly Germany and the UK, are early adopters of advanced safety features and telematics integration, focusing heavily on operational efficiency and sustainable construction practices.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR, primarily fueled by massive infrastructure development and the rapid mechanization of agriculture, particularly in China, India, and Southeast Asian nations. While the initial demand is often for cost-effective, high-volume SSL models, increasing regulatory focus on construction safety and efficiency in metropolitan areas is gradually pushing the market toward CTLs and modern features. Government initiatives promoting smart cities act as major catalysts for equipment modernization.

- Latin America: This region demonstrates moderate growth driven by mining activities, agricultural expansion, and steady investment in localized infrastructure projects. The market often favors durable, robust equipment with simpler electronic systems to minimize maintenance complexity in remote areas. Fluctuations in commodity prices, particularly minerals and agricultural exports, heavily influence capital expenditure decisions for compact loaders in countries like Brazil and Argentina.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries due to large-scale construction projects (e.g., smart city development, tourism infrastructure). Demand is tied to large-capacity loaders capable of operating effectively in harsh, arid climates. African markets show nascent but promising growth linked to expanding road networks and increasing agricultural productivity efforts, primarily driven by international development funding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compact Loader Market.- Bobcat (A Doosan Company)

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- John Deere (Deere & Company)

- Kubota Corporation

- Yanmar Holdings Co., Ltd.

- JCB (J.C. Bamford Excavators Ltd.)

- Case Construction Equipment (CNH Industrial N.V.)

- New Holland Construction (CNH Industrial N.V.)

- Wacker Neuson SE

- Sany Heavy Industry Co., Ltd.

- Takeuchi Mfg. Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- LiuGong Machinery Co., Ltd.

- ASV Holdings, Inc.

- Ditch Witch (The Charles Machine Works, Inc.)

- Gehl (Manitou Group)

- Terex Corporation

- Merlo S.p.A.

Frequently Asked Questions

Analyze common user questions about the Compact Loader market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Skid Steer Loader (SSL) and a Compact Track Loader (CTL)?

The key difference is the undercarriage: SSLs use rubber tires, making them suitable for hard, improved surfaces (e.g., concrete or asphalt), offering speed and maneuverability. CTLs use rubber tracks, providing superior flotation, better traction, and reduced ground pressure, ideal for working on soft, uneven, or muddy terrain.

How is electrification impacting the Compact Loader Market?

Electrification is introducing zero-emission, low-noise compact loaders, addressing environmental regulations and demand for indoor or urban operation. While initial costs are higher, electric models offer reduced operational costs (fuel and maintenance) and are increasingly favored in environmentally sensitive projects, particularly in Europe and North America.

Which application segment holds the largest share of the compact loader market?

The Construction application segment, encompassing residential, commercial, and infrastructure development, currently holds the largest market share. This dominance is due to the compact loader's versatility in tasks such as material handling, excavation, and site preparation required across all phases of building projects.

What is the role of telematics in modern compact loaders?

Telematics enables fleet managers to remotely monitor machine performance, location, utilization, and health metrics in real time. This technology is vital for optimizing fleet deployment, scheduling predictive maintenance, improving security through geo-fencing, and ultimately reducing the total cost of ownership (TCO).

What is the projected growth rate (CAGR) for the Compact Loader Market through 2033?

The Compact Loader Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven by global infrastructure investment and technological advancements in machine autonomy and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager