Companion Animal Parasiticides Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440116 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Companion Animal Parasiticides Market Size

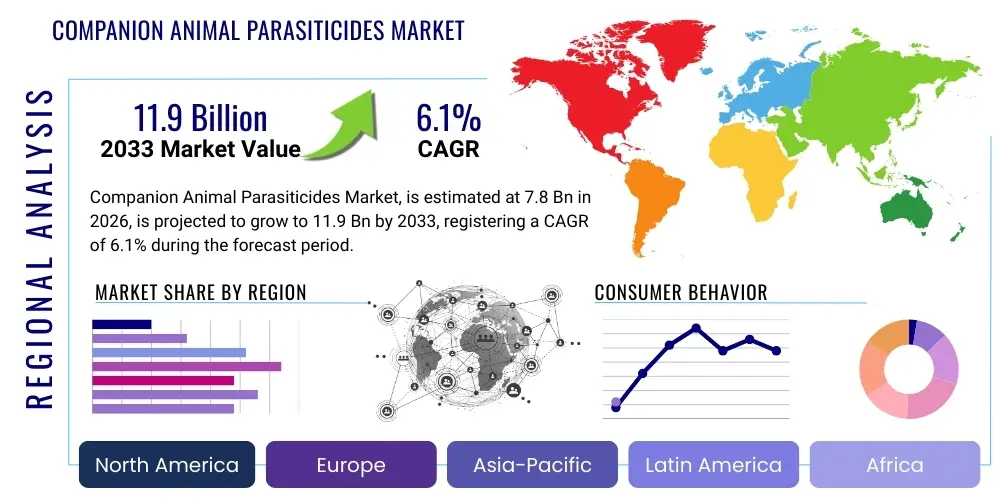

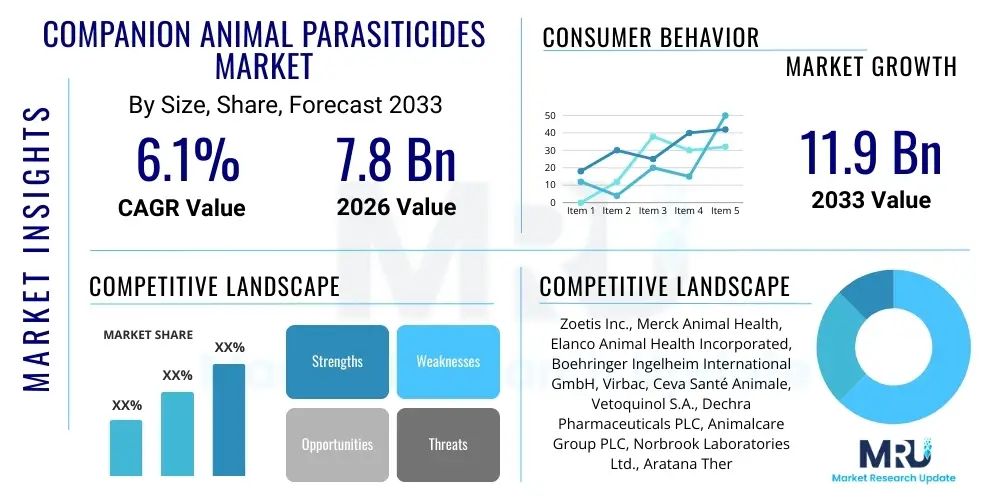

The Companion Animal Parasiticides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 7.8 billion in 2026 and is projected to reach USD 11.9 billion by the end of the forecast period in 2033.

Companion Animal Parasiticides Market introduction

The Companion Animal Parasiticides Market encompasses a vital segment within animal healthcare, dedicated to the prevention and treatment of parasitic infections in pets such as dogs, cats, horses, and other domesticated animals. These products are formulated to combat a wide array of external parasites, including fleas, ticks, mites, and lice, as well as internal parasites like heartworms, roundworms, hookworms, and tapeworms. The primary objective of these pharmaceutical interventions is to safeguard the health and well-being of companion animals, thereby enhancing their quality of life and preventing potential health complications that can arise from parasitic infestations. Beyond individual pet health, the application of parasiticides also plays a crucial role in public health by mitigating the risk of zoonotic diseases, which are infections transmissible from animals to humans, underscoring the broader societal benefits of effective parasite control. This dual benefit fuels consistent demand and continuous innovation within the market, as pet owners and veterinary professionals prioritize both animal and human health.

Products available in the market are diverse, ranging from topical solutions like spot-ons and sprays, which are applied directly to the pet's skin, to oral medications, including chewable tablets and liquid formulations, which offer systemic protection. Injectable options provide long-lasting efficacy, while medicated collars and shampoos offer convenience for specific types of infestations. Each product type is designed to target specific parasites and accommodate different animal species and owner preferences, emphasizing versatility in treatment approaches. Key active ingredients often include fipronil, permethrin, selamectin, afoxolaner, sarolaner, and moxidectin, among others, each with distinct mechanisms of action against various parasitic organisms. The continuous research and development efforts in this sector are focused on improving efficacy, enhancing safety profiles, broadening the spectrum of activity, and extending the duration of protection, striving to offer more convenient and effective solutions for pet owners and veterinarians alike.

The market is primarily driven by several key factors, including the global increase in pet ownership and the growing trend of pet humanization, where pets are increasingly viewed as integral family members, leading to greater investment in their health and welfare. Heightened awareness among pet owners regarding the risks associated with parasitic diseases and the importance of preventive care, often propagated by veterinary education and public health campaigns, further stimulates market growth. Advancements in veterinary medicine and the continuous introduction of novel, more effective, and safer antiparasitic formulations contribute significantly to market expansion. Moreover, changing climatic conditions in various regions are expanding the geographic range and seasonality of certain parasites, making year-round protection more critical. These synergistic factors collectively underscore the robust growth trajectory and sustained demand within the companion animal parasiticides market, reflecting a global commitment to improving animal health outcomes.

Companion Animal Parasiticides Market Executive Summary

The Companion Animal Parasiticides Market is experiencing dynamic shifts, characterized by robust growth stemming from increasing global pet ownership, particularly in emerging economies, and an escalating emphasis on preventive pet healthcare. Business trends highlight a strong focus on innovation, with companies investing heavily in research and development to introduce next-generation broad-spectrum parasiticides that offer extended efficacy and enhanced safety profiles. The market is witnessing a trend towards consolidation, as major pharmaceutical companies acquire smaller, specialized firms to expand their product portfolios and geographical reach, leading to a more competitive landscape. E-commerce platforms and online veterinary pharmacies are emerging as significant distribution channels, providing greater accessibility and convenience for pet owners, alongside traditional veterinary clinics and pet specialty stores. The human-animal bond continues to strengthen, driving pet owners to prioritize premium and effective healthcare solutions, which in turn boosts demand for high-quality parasiticides.

Regionally, the market exhibits varied growth patterns. North America and Europe, as mature markets with high rates of pet ownership and established veterinary infrastructures, continue to represent significant revenue bases, driven by steady demand for advanced preventive care solutions. However, the Asia Pacific region, especially countries like China and India, is projected to demonstrate the highest growth rate due to rapidly rising disposable incomes, changing lifestyles that favor pet adoption, and increasing awareness of pet health. Latin America and the Middle East & Africa also present considerable opportunities, as economic development fosters a growing middle class capable of affording pet care services and products. These regions are witnessing expanding veterinary service networks and a gradual shift from reactive treatment to proactive parasite prevention, further contributing to regional market expansion. Understanding these regional nuances is critical for market players to tailor their strategies effectively and capitalize on localized growth opportunities.

Segment-wise, the market is primarily driven by product types such as oral parasiticides and spot-ons, which offer convenience and high efficacy against a broad spectrum of parasites. Oral medications, particularly chewable forms, are gaining popularity due to ease of administration and reduced risk of environmental contamination, while spot-ons remain a staple for their topical benefits and long-lasting protection. The dog segment consistently holds the largest share due to the widespread ownership of dogs, but the cat segment is experiencing accelerated growth as cat ownership rises globally. In terms of parasite type, flea and tick control remains the dominant segment, given the high prevalence and year-round threat posed by these ectoparasites, followed closely by heartworm prevention and treatment for various internal worms. Distribution channel trends show veterinary clinics as the primary point of sale, reinforced by professional recommendations, but the rapid growth of online retail is redefining consumer purchasing habits, offering a competitive alternative and expanding market reach.

AI Impact Analysis on Companion Animal Parasiticides Market

The impact of Artificial Intelligence (AI) on the Companion Animal Parasiticides Market is becoming increasingly pronounced, addressing common user questions about enhancing diagnostics, accelerating drug discovery, and optimizing treatment protocols. Users are keen to understand how AI can lead to more precise identification of parasitic infections, shorten the development cycle for new antiparasitic compounds, and facilitate personalized medicine for pets. Concerns often revolve around the accuracy of AI-driven diagnostic tools, the ethical implications of data collection, and the accessibility of advanced AI solutions for all pet owners. Expectations are high for AI to transform current practices by offering predictive analytics for parasite outbreaks, streamlining supply chains, and enabling more effective monitoring of pet health, ultimately leading to improved animal welfare and more efficient market operations. The integration of AI promises to enhance the entire lifecycle of parasiticides, from early research and development to post-market surveillance and consumer interaction, offering significant advancements in efficacy, safety, and convenience for both veterinary professionals and pet owners.

- Enhanced Diagnostic Accuracy: AI-powered imaging analysis and machine learning algorithms can more accurately identify parasitic presence and species, reducing misdiagnosis and leading to more targeted treatment.

- Accelerated Drug Discovery & Development: AI algorithms can analyze vast datasets of chemical compounds, predict drug efficacy and toxicity, and accelerate the identification of novel antiparasitic molecules, significantly cutting R&D time and costs.

- Personalized Treatment Plans: AI can process individual pet data (breed, age, weight, geographical location, health history) to recommend the most suitable parasiticide and dosage, optimizing treatment outcomes and minimizing side effects.

- Predictive Analytics for Outbreaks: AI models can analyze environmental data, climate patterns, and historical infestation rates to predict potential parasite outbreaks, enabling proactive preventive measures and timely product distribution.

- Optimized Supply Chain & Inventory Management: AI can forecast demand with higher accuracy, optimize logistics, and manage inventory levels for parasiticides, ensuring product availability and reducing waste across the distribution network.

- Advanced Resistance Monitoring: AI can analyze genetic data of parasites to detect emerging resistance patterns to existing parasiticides, guiding the development of new formulations and informing treatment guidelines.

- Smart Monitoring Devices: Integration of AI with wearable pet devices can track parasite exposure risks and treatment adherence, providing real-time data to pet owners and veterinarians for improved compliance and efficacy.

DRO & Impact Forces Of Companion Animal Parasiticides Market

The Companion Animal Parasiticides Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate its trajectory. Key drivers include the ever-increasing global pet population and the deepening human-animal bond, which translates into greater expenditure on pet health and wellness, including preventive parasite control. Rising awareness among pet owners and veterinary professionals about the prevalence and zoonotic potential of parasitic diseases further fuels demand. Technological advancements have led to the development of more effective, safer, and convenient broad-spectrum parasiticides, continuously improving treatment outcomes and compliance. Additionally, changing climatic conditions are expanding the geographical range and seasonality of parasites, making year-round protection a growing necessity and thereby boosting market demand for persistent solutions. These factors synergistically propel the market forward, encouraging innovation and wider adoption of parasite control measures.

However, the market also faces significant restraints that temper its growth. The relatively high cost of advanced parasiticides can be a barrier for some pet owners, particularly in price-sensitive markets, sometimes leading to non-compliance or the use of less effective, cheaper alternatives. The ongoing challenge of developing parasite resistance to existing active ingredients necessitates continuous research and development, which is a costly and time-consuming endeavor for manufacturers. Stringent regulatory approval processes for new veterinary pharmaceuticals demand extensive clinical trials and safety assessments, contributing to high R&D costs and longer market entry times. Furthermore, the availability of counterfeit or unregulated products, especially through unauthorized online channels, poses risks to animal health and undermines legitimate market players, impacting consumer trust and market integrity. Addressing these restraints requires collaborative efforts from industry, regulatory bodies, and veterinary communities to ensure product quality, affordability, and responsible use.

Amidst these challenges, significant opportunities exist for market expansion and innovation. Emerging economies, characterized by a growing middle class and increasing pet adoption rates, represent largely untapped markets with substantial growth potential. The development of novel broad-spectrum parasiticides that offer enhanced efficacy against multiple parasite types with simplified dosing regimens presents a key opportunity for product differentiation and market leadership. The burgeoning e-commerce sector and digital health platforms offer new avenues for product distribution and consumer engagement, improving accessibility and convenience. Moreover, a greater focus on preventive healthcare and the adoption of integrated parasite management strategies, which often include combination therapies, are driving demand for comprehensive solutions. These opportunities, coupled with ongoing research into new active ingredients and delivery systems, underscore the dynamic and evolving nature of the market, offering substantial scope for future growth and innovation despite existing hurdles.

Segmentation Analysis

The Companion Animal Parasiticides Market is meticulously segmented across various parameters to provide a detailed understanding of its dynamics, consumer behavior, and product preferences. This segmentation allows for targeted marketing strategies and product development, addressing the specific needs of different animal types, parasite infestations, product delivery methods, and distribution channels. The intricate structure of the market is influenced by geographical variations in parasite prevalence, regulatory landscapes, pet ownership trends, and economic factors. Analyzing these segments is crucial for stakeholders to identify growth pockets, assess competitive intensity, and formulate informed business strategies that resonate with distinct customer bases and regional requirements.

- Product Type:

- Spot-On: Topical formulations applied to a small area of the pet's skin, offering convenience and sustained release.

- Oral: Chewable tablets, pills, or liquids administered by mouth, often preferred for ease of use and systemic action.

- Injectables: Long-acting formulations delivered via injection, providing extended protection and ensuring compliance.

- Collars: Medicated collars releasing active ingredients over an extended period, primarily for flea and tick control.

- Sprays: Topical applications for immediate relief and broader coverage on the pet's coat.

- Shampoos: Therapeutic shampoos used for treating existing infestations and providing short-term residual effects.

- Animal Type:

- Dogs: The largest segment due to high ownership rates and diverse needs for parasite control.

- Cats: A rapidly growing segment, driven by increasing cat ownership and specific product formulations.

- Horses: Includes equine parasiticides for internal and external parasites, crucial for performance and health.

- Other Companion Animals (e.g., rabbits, ferrets): A niche but growing segment requiring specialized parasiticidal solutions.

- Parasite Type:

- Fleas & Ticks: Dominant segment due to high prevalence, nuisance factor, and disease transmission capabilities.

- Heartworm: Critical segment for canine and feline health, requiring specific preventive and treatment medications.

- Roundworms: Common internal parasites in puppies and kittens, requiring regular deworming.

- Hookworms: Internal parasites that can cause anemia and gastrointestinal issues, especially in young animals.

- Whipworms: Intestinal parasites prevalent in dogs, often requiring specific treatment protocols.

- Tapeworms: Internal parasites acquired through intermediate hosts, requiring targeted treatment.

- Other Internal Parasites: Includes a range of less common but significant gastrointestinal and systemic parasites.

- Distribution Channel:

- Veterinary Clinics & Hospitals: Primary channel driven by professional diagnosis, prescription, and client education.

- Pet Specialty Stores: Retail outlets offering over-the-counter parasiticides and pet care products.

- Retail Pharmacies: Increasingly stocking a range of veterinary parasiticides, especially for over-the-counter options.

- E-commerce & Online Pharmacies: A rapidly expanding channel offering convenience, competitive pricing, and broad product selection.

Value Chain Analysis For Companion Animal Parasiticides Market

The value chain for the Companion Animal Parasiticides Market is an intricate network spanning research, development, manufacturing, distribution, and end-user engagement, each stage adding significant value to the final product. The upstream segment begins with extensive research and development (R&D), where pharmaceutical companies invest heavily in discovering novel active ingredients, optimizing existing compounds, and developing advanced formulations. This involves significant scientific expertise in parasitology, chemistry, and pharmacology, leading to patentable intellectual property. Raw material procurement, including active pharmaceutical ingredients (APIs) and excipients, forms the next critical step. Suppliers of these specialized chemicals must adhere to stringent quality standards and regulatory compliance, ensuring the purity and efficacy of the final product. Contract research organizations (CROs) often play a crucial role in conducting preclinical and clinical trials, supporting the complex regulatory approval process before a product can enter the market, thereby laying the foundational scientific and material groundwork.

Midstream activities involve the manufacturing and production processes, where raw materials are transformed into finished parasiticidal products, such as oral tablets, spot-on solutions, or injectable formulations. This stage requires state-of-the-art manufacturing facilities that comply with Good Manufacturing Practices (GMP) to ensure product quality, consistency, and safety. Packaging, labeling, and quality control are also integral parts of this stage, ensuring that products are correctly identified, protected, and meet all regulatory specifications. Following manufacturing, the products move into the distribution phase. This involves warehousing, logistics, and transportation networks designed to efficiently deliver products from manufacturing sites to various points of sale across different geographical regions. Supply chain optimization, including cold chain management for sensitive products, is paramount to maintain product integrity and ensure timely availability to the market. Efficient distribution minimizes costs and ensures that products reach veterinary clinics, retail stores, and online pharmacies in optimal condition.

Downstream activities focus on reaching the end-users—pet owners, veterinarians, and animal care institutions—through various direct and indirect distribution channels. Direct channels often involve pharmaceutical companies engaging directly with large veterinary hospital groups or specialized clinics, providing sales support, technical information, and training. This direct engagement fosters strong professional relationships and ensures products are prescribed appropriately. Indirect channels encompass a broader network, including wholesalers and distributors who act as intermediaries, supplying products to a multitude of independent veterinary practices, pet specialty stores, and retail pharmacies. The rise of e-commerce platforms and online veterinary pharmacies represents a significant shift in indirect distribution, offering pet owners convenient access to a wide range of products, often at competitive prices. Effective marketing, sales, and educational initiatives targeted at both veterinarians and pet owners are crucial at this stage to drive product adoption, build brand loyalty, and ensure the responsible and informed use of companion animal parasiticides, completing the value cycle from discovery to consumption.

Companion Animal Parasiticides Market Potential Customers

The Companion Animal Parasiticides Market primarily targets a diverse group of end-users and buyers, all united by their commitment to the health and well-being of animals. The largest and most influential customer segment comprises individual pet owners, who are increasingly knowledgeable and proactive about their pets' health. With the growing trend of pet humanization, owners are more willing to invest in premium, effective, and convenient parasiticidal solutions recommended by veterinary professionals. This segment's purchasing decisions are heavily influenced by factors such as product efficacy, safety profiles, ease of administration, and veterinary advice, making pet owner education and accessibility crucial for market penetration and sustained demand. Their evolving expectations often drive innovation towards more user-friendly and broad-spectrum products, reflecting a deep emotional and financial investment in their pets' welfare.

Another significant customer base is the professional veterinary community, including veterinary clinics, animal hospitals, and specialized animal healthcare centers. These professionals serve as gatekeepers for many prescription-based parasiticides, providing diagnoses, administering treatments, and offering expert recommendations to pet owners. Their purchasing decisions are driven by clinical efficacy, safety for various animal species and ages, breadth of parasite coverage, and the reputation of the pharmaceutical manufacturers. Veterinary practices often stock a range of parasiticides to cater to diverse patient needs and specific regional parasite challenges, playing a critical role in both the distribution and application of these products. Their role extends beyond mere sales, encompassing client education on preventive care, which solidifies their position as key influencers and direct buyers within the market ecosystem.

Beyond individual pet owners and veterinary professionals, other key customers include large-scale animal shelters, rescue organizations, and professional breeders who manage multiple animals and require bulk purchasing of cost-effective and efficient parasite control solutions. These institutional buyers prioritize products that offer comprehensive protection, ease of mass administration, and strong safety records to maintain the health of their animal populations. Retail channels, such as pet specialty stores, agricultural supply stores, and increasingly, general retail pharmacies, also serve as critical access points for over-the-counter parasiticides, catering to owners who seek convenience and non-prescription options. Furthermore, the burgeoning e-commerce sector has created a new class of digital-first buyers, including pet owners and smaller veterinary practices, who leverage online platforms for purchasing, price comparison, and product information, indicating a significant shift in purchasing behavior and market access dynamics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.8 billion |

| Market Forecast in 2033 | USD 11.9 billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis Inc., Merck Animal Health, Elanco Animal Health Incorporated, Boehringer Ingelheim International GmbH, Virbac, Ceva Santé Animale, Vetoquinol S.A., Dechra Pharmaceuticals PLC, Animalcare Group PLC, Norbrook Laboratories Ltd., Aratana Therapeutics (now part of Elanco), Kyoritsu Seiyaku Corporation, Parnell Pharmaceuticals, Neogen Corporation, Heska Corporation, Biogenesis Bago S.A., ECO Animal Health Group plc, Bimeda Animal Health, Zydus Animal Health, Intervet Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Companion Animal Parasiticides Market Key Technology Landscape

The Companion Animal Parasiticides Market is consistently evolving, driven by an advanced technology landscape focused on enhancing efficacy, safety, and convenience of parasite control. A primary area of innovation lies in the development of novel active ingredients with broad-spectrum activity against multiple parasite types, addressing the growing challenge of drug resistance. This includes new chemical entities from classes like isoxazolines (e.g., afoxolaner, sarolaner, fluralaner), which offer extended residual efficacy against fleas and ticks, as well as macrocyclic lactones for heartworm and other internal parasites. The research and development process leverages advanced molecular biology techniques and high-throughput screening to identify potent compounds, along with sophisticated computational chemistry for predicting drug-target interactions and optimizing lead candidates, thereby accelerating the discovery phase and improving the success rate of new product pipelines.

Beyond active ingredients, significant technological advancements are also evident in drug delivery systems and formulation science. Sustained-release technologies, such as microencapsulation and transdermal patches, are being utilized to provide longer-lasting protection from a single application, thereby improving pet owner compliance and reducing the frequency of dosing. Palatable oral formulations, particularly chewable tablets, have transformed administration, making it easier and less stressful for both pets and owners. Furthermore, combination therapies, which integrate multiple active ingredients into a single product, are gaining prominence. These formulations target a wider range of parasites simultaneously, offering comprehensive protection against both external and internal threats with a single dose, streamlining treatment protocols for veterinarians and simplifying preventive care routines for pet owners, exemplifying a shift towards holistic parasite management solutions.

The technological landscape also incorporates advancements in diagnostics and digital integration. Molecular diagnostic tools, such as PCR-based tests, provide rapid and highly accurate identification of parasitic species, enabling veterinarians to prescribe more targeted and effective treatments. Serological tests for heartworm and other internal parasites have also seen significant improvements in sensitivity and specificity. Beyond direct product technologies, digital platforms and data analytics are increasingly playing a role. This includes veterinary practice management software that helps track parasite control schedules and compliance, as well as telehealth services that facilitate remote consultations and prescription refills. The integration of artificial intelligence and machine learning holds promise for predictive analytics regarding parasite prevalence and resistance patterns, further optimizing preventive strategies. These interconnected technological innovations collectively contribute to a more effective, efficient, and user-friendly approach to companion animal parasiticide management, ensuring better health outcomes for pets.

Regional Highlights

- North America: This region is a dominant market for companion animal parasiticides, characterized by high pet ownership rates, significant pet humanization trends, and advanced veterinary infrastructure. The strong emphasis on preventive healthcare and consumer willingness to invest in premium products drive steady market growth.

- Europe: A mature market with stringent animal welfare regulations and a high adoption of pet insurance. Western European countries contribute significantly due to well-established veterinary care systems and sustained demand for broad-spectrum parasiticides, with a growing focus on environmentally friendly solutions.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by rising disposable incomes, rapid urbanization leading to increased pet adoption, and a burgeoning awareness of pet health. Countries like China, India, and Japan are key growth engines, with expanding veterinary networks and evolving pet care practices.

- Latin America: This region presents significant growth opportunities, driven by an expanding middle class, increasing pet ownership, and developing veterinary services. Brazil and Mexico are prominent markets, showing a gradual shift towards organized pet healthcare and preventive parasite control.

- Middle East and Africa (MEA): An emerging market with considerable untapped potential. Growth is attributed to increasing pet ownership in urban centers, rising awareness of zoonotic diseases, and improving access to veterinary care, although market penetration for advanced parasiticides remains relatively lower compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Companion Animal Parasiticides Market.- Zoetis Inc.

- Merck Animal Health

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International GmbH

- Virbac

- Ceva Santé Animale

- Vetoquinol S.A.

- Dechra Pharmaceuticals PLC

- Animalcare Group PLC

- Norbrook Laboratories Ltd.

- Aratana Therapeutics (now part of Elanco)

- Kyoritsu Seiyaku Corporation

- Parnell Pharmaceuticals

- Neogen Corporation

- Heska Corporation

- Biogenesis Bago S.A.

- ECO Animal Health Group plc

- Bimeda Animal Health

- Zydus Animal Health

- Intervet Inc.

Frequently Asked Questions

What are companion animal parasiticides?

Companion animal parasiticides are veterinary pharmaceutical products designed to prevent and treat parasitic infestations in pets like dogs, cats, and horses. They target external parasites such as fleas, ticks, and mites, as well as internal parasites including heartworms, roundworms, and tapeworms, safeguarding pet health and preventing zoonotic diseases.

What are the primary drivers for the Companion Animal Parasiticides Market growth?

The market is primarily driven by increasing global pet ownership, the rising trend of pet humanization leading to greater investment in pet health, growing awareness among owners about parasitic disease risks, and continuous technological advancements in product development offering more effective and convenient solutions.

What challenges does the Companion Animal Parasiticides Market face?

Key challenges include the high cost of advanced parasiticides which can limit accessibility, the development of parasite resistance to existing active ingredients necessitating continuous R&D, stringent regulatory approval processes, and the prevalence of counterfeit products affecting market integrity and pet safety.

How is AI impacting the Companion Animal Parasiticides Market?

AI is significantly impacting the market by enhancing diagnostic accuracy for parasitic infections, accelerating the drug discovery and development process for new antiparasitic compounds, enabling personalized treatment plans for pets, and providing predictive analytics for parasite outbreaks, leading to more efficient and effective interventions.

What are the key segments within the Companion Animal Parasiticides Market?

The market is segmented by Product Type (e.g., spot-ons, oral, injectables), Animal Type (e.g., dogs, cats, horses), Parasite Type (e.g., fleas & ticks, heartworm, internal worms), and Distribution Channel (e.g., veterinary clinics, pet specialty stores, e-commerce), each with distinct market dynamics and growth patterns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager