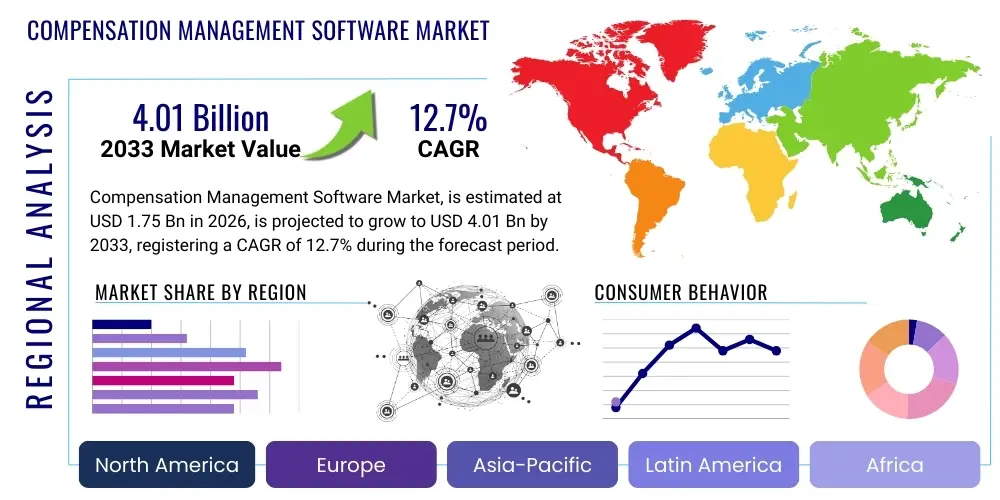

Compensation Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436557 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Compensation Management Software Market Size

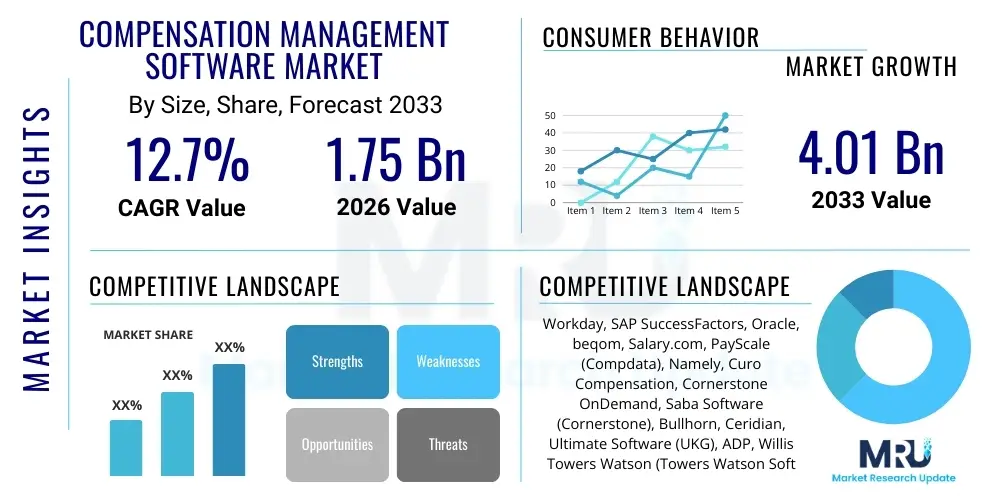

The Compensation Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.7% between 2026 and 2033. The market is estimated at $1.75 Billion in 2026 and is projected to reach $4.01 Billion by the end of the forecast period in 2033.

The robust expansion of the Compensation Management Software (CMS) market is driven primarily by the escalating need for operational efficiency and transparency in workforce management across large and mid-sized enterprises globally. Organizations are shifting away from manual, spreadsheet-based compensation planning towards automated, integrated software solutions to manage salary structures, variable pay, long-term incentives, and global pay equity compliance. This technological pivot ensures that compensation strategies are directly aligned with business objectives, performance metrics, and evolving regulatory requirements, particularly those related to pay transparency and fairness.

Furthermore, the increased complexity of global talent markets and remote work models necessitates sophisticated tools capable of handling multi-jurisdictional compliance and localized pay scales. CMS platforms provide real-time data analytics, enabling HR and finance departments to model different compensation scenarios, assess the financial impact of total rewards programs, and make data-driven decisions regarding employee retention and recruitment. The shift toward cloud-based (SaaS) deployments is accelerating adoption, offering scalability, lower upfront costs, and continuous feature updates, making enterprise-grade compensation management accessible to a broader range of businesses seeking competitive advantage through strategic rewards programs.

Compensation Management Software Market introduction

The Compensation Management Software market encompasses integrated technological solutions designed to automate, streamline, and optimize the process of planning, budgeting, distributing, and administering employee compensation packages. This includes base salary administration, short-term incentives (bonuses), long-term incentives (stock options, equity), and total rewards statements. The software acts as a centralized repository for compensation data, ensuring consistency, compliance with global regulations, and strategic alignment with organizational performance goals. Key product features typically include compensation modeling, pay equity analysis, performance calibration, and integration capabilities with existing Human Capital Management (HCM) and Enterprise Resource Planning (ERP) systems, moving compensation planning from a reactive annual task to a proactive, continuous strategic function.

Major applications of CMS span across diverse industry verticals, driven by the universal need to manage highly distributed and performance-driven workforces. Primary users include HR professionals, compensation analysts, financial planning and analysis (FP&A) teams, and line managers who require tools for efficient resource allocation and budgetary control. The benefits derived from adopting CMS are substantial, including enhanced compliance through automated audit trails, reduced errors associated with manual data entry, improved employee perception of fairness and transparency, and significantly faster compensation cycles. Strategically, CMS allows organizations to utilize compensation as a lever for achieving specific business objectives, such as attracting top-tier talent in specialized fields and improving organizational profitability by optimizing compensation spend.

Driving factors propelling market growth include the intensifying war for talent, which mandates competitive and dynamic compensation structures, and the increasing global regulatory focus on pay equity and gender pay gap reporting. Additionally, the proliferation of large datasets necessitates advanced analytical capabilities embedded within compensation systems to derive actionable insights from market benchmark data and internal performance metrics. The continuous migration of enterprise workflows to cloud infrastructure further fuels demand, as organizations seek agile, scalable SaaS solutions that support rapid deployment and provide mobile accessibility for geographically dispersed managerial teams, thereby solidifying the market's trajectory towards digitalization and strategic integration within the overall HR technology stack.

- Market Intro: Integrated software solutions automating the planning, administration, and optimization of employee total compensation packages, ensuring strategic alignment and regulatory compliance.

- Product Description: Cloud-based or on-premise systems offering functionality for base pay management, variable pay (bonus/commission) processing, long-term incentive tracking, and complex pay equity modeling.

- Major Applications: Annual compensation planning cycles, merit increase modeling, bonus pool allocation, sales incentive management, regulatory reporting, and internal pay parity audits.

- Benefits: Increased data accuracy, reduced compliance risk, enhanced operational efficiency, improved transparency, and better alignment of rewards with individual and corporate performance.

- Driving Factors: Global focus on pay equity, rising complexity of multi-national pay structures, demand for advanced workforce analytics, and the need to retain high-performing talent.

Compensation Management Software Market Executive Summary

The Compensation Management Software market is undergoing rapid evolution, shifting from fragmented, on-premise solutions towards integrated, cloud-native platforms that emphasize real-time analytics and predictive modeling. Current business trends indicate a strong focus on enhancing the user experience for both administrators and employees, driving vendors to embed sophisticated simulation tools and transparent communication features directly into the platforms. Key vendors are prioritizing mergers and acquisitions to consolidate niche expertise, particularly around equity management and advanced predictive AI capabilities, which allows them to offer comprehensive Total Rewards suites that address all components of remuneration, linking directly to performance metrics and talent acquisition strategies.

Regionally, North America maintains the dominant market share due to the early and widespread adoption of sophisticated HCM technologies, coupled with stringent financial reporting and disclosure requirements that necessitate automated audit trails. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by the rapid digital transformation of large enterprises in emerging economies like China, India, and Southeast Asia, and the increasing influence of multinational corporations establishing localized compensation frameworks. European markets are driven primarily by strict regulatory requirements, such as GDPR and national pay transparency laws, mandating solutions capable of detailed, multi-country reporting and immediate compliance adjustments, thereby favoring scalable SaaS offerings.

Segment trends reveal that the deployment type segment is heavily skewed towards cloud-based solutions, reflecting the enterprise-wide mandate for flexibility and scalability. Among the organizational size segments, Large Enterprises currently contribute the largest revenue share, but the Small and Medium-sized Enterprises (SMEs) segment is exhibiting accelerated adoption rates, facilitated by subscription-based, modular CMS products that are easier to implement and manage. Functionally, modules focusing on variable pay management and sales performance incentive funds are experiencing significant uptake, aligning with the growing corporate strategy of linking a higher proportion of employee compensation directly to measurable outcomes and corporate profitability, ensuring efficient utilization of compensation budgets.

AI Impact Analysis on Compensation Management Software Market

User queries regarding the impact of Artificial Intelligence (AI) on Compensation Management Software frequently center on issues of fairness, predictive capabilities, and ethical bias. Common questions include: "How can AI eliminate pay gaps?", "Will AI automate the entire compensation planning process?", and "What data security risks does feeding sensitive salary data into an AI model pose?". These concerns reflect a keen interest in moving beyond mere automation towards strategic augmentation, where AI provides objective recommendations rather than solely managing administrative tasks. Users expect AI to seamlessly integrate market benchmarking data, internal performance metrics, and economic forecasts to suggest optimal merit pools and individual pay adjustments, maximizing talent retention while adhering to budgetary constraints.

The key thematic expectation is the transition from descriptive analytics (what happened last year) to prescriptive analytics (what compensation decision should be made now). AI algorithms are being leveraged to continuously monitor and analyze vast volumes of structured and unstructured employee data, identifying anomalous compensation patterns that could signal potential pay equity issues or flight risks among high-value employees. This proactive identification capability drastically reduces the compliance burden and mitigates legal risks associated with discriminatory pay practices. Furthermore, AI-driven sentiment analysis of employee feedback can provide nuanced insights into the perceived fairness of the compensation structure, allowing HR to adjust communication strategies or modify reward packages dynamically.

The commercial application of AI is primarily focused on sophisticated scenario planning and predictive budgeting. By simulating various macroeconomic conditions, inflation rates, and competitor compensation moves, AI models help finance and HR teams forecast the budgetary impact of different compensation strategies with high accuracy. This capability supports proactive budget allocation and ensures that compensation spend yields the highest possible return on investment in terms of talent acquisition and retention. Vendors are aggressively incorporating machine learning components to improve the accuracy of job grading and market pricing, ultimately positioning CMS platforms as essential strategic tools rather than purely transactional HR systems, significantly raising the overall value proposition of the software.

- Enhanced Pay Equity Audits: AI algorithms continuously scan compensation data to detect statistically significant pay disparities based on protected characteristics, flagging potential biases before they escalate into compliance issues.

- Predictive Retention Modeling: Machine Learning analyzes an employee's total compensation relative to market benchmarks, performance, and internal fairness, predicting the likelihood of voluntary turnover based on salary competitiveness.

- Automated Compensation Recommendations: AI suggests optimal merit increase percentages or bonus allocations for individual employees by balancing performance ratings, budget limitations, and market salary data, reducing managerial subjectivity.

- Dynamic Budget Allocation: Predictive models forecast future compensation costs based on projected hiring, turnover, and external economic factors, enabling real-time adjustment of merit pools and incentive funds.

- Intelligent Benchmarking: AI automatically cleanses and correlates internal job roles and compensation data with external market data sources, providing highly accurate, localized market pricing recommendations.

- Optimized Sales Incentive Planning: AI analyzes sales performance data to design commission plans that maximize sales force motivation and corporate profitability, identifying optimal payout curves and thresholds.

DRO & Impact Forces Of Compensation Management Software Market

The Compensation Management Software market is propelled by strong systemic drivers, but simultaneously faces structural restraints and benefits from significant strategic opportunities, creating complex impact forces that shape investment decisions and market penetration. The primary driver is the accelerating shift towards a performance-driven culture, where organizations globally recognize compensation as the most tangible link between employee effort and corporate success, demanding integrated, analytical tools to manage this linkage effectively. However, the market faces friction due to the high initial implementation costs and the substantial change management required to transition large, entrenched organizations away from legacy systems and manual processes, which often presents a significant barrier to entry for smaller vendors.

A crucial restraint is the inherent sensitivity and complexity of integrating compensation data across disparate HR, payroll, and finance systems, particularly in multinational organizations where data privacy laws differ significantly across jurisdictions. This complexity demands highly customizable and secure integration frameworks, increasing the technical requirements and implementation timelines. Opportunities, conversely, are abundant, particularly in addressing the growing demand for Total Rewards management, encompassing wellness benefits, recognition, and equity alongside traditional pay. This expansion allows CMS providers to evolve into holistic Total Rewards management platforms, capturing a larger share of the HR technology budget and providing a more integrated employee value proposition.

The most pervasive impact force is the regulatory landscape, specifically the global momentum towards mandatory pay transparency and stricter gender pay gap reporting (such as the EU Pay Transparency Directive). This force is non-negotiable and compels organizations, irrespective of size or region, to invest in automated software capable of generating accurate, auditable, and legally compliant compensation reports instantly. This regulatory pressure acts as a powerful catalyst, overcoming inertia related to implementation costs and accelerating the adoption cycle, ultimately driving innovation in embedded compliance and analytical features within CMS solutions, ensuring continuous market growth grounded in necessity.

Segmentation Analysis

The Compensation Management Software market is comprehensively segmented based on deployment model, organizational size, component type, and application type, providing detailed insight into targeted product development and regional adoption patterns. The deployment model segmentation clearly illustrates the industry's preference for scalable, subscription-based services, with the Cloud-based segment dominating market revenue and exhibiting the highest growth trajectory, largely displacing traditional On-premise installations due to superior flexibility, lower total cost of ownership (TCO), and faster deployment cycles essential for agile HR management. The component segmentation emphasizes the software solution itself over professional services, although consulting and integration services remain crucial during initial setup and custom configuration for large enterprises with complex compensation structures.

Segmentation by organizational size highlights a bifurcated market strategy: Large Enterprises represent the core revenue base, utilizing highly customized, feature-rich solutions capable of handling global compensation mandates, multiple currencies, and complex equity schemes. Conversely, Small and Medium-sized Enterprises (SMEs) represent a rapidly expanding opportunity, favoring simplified, standardized, and cost-effective SaaS solutions designed for quick implementation and focused primarily on core compensation administration and basic incentive tracking. This SME focus necessitates vendors offering tiered pricing and modular features to cater to diverse budgetary constraints and technical capabilities, expanding the overall market penetration beyond traditional large corporate customers.

Further analysis into application type segmentation demonstrates the pivotal role of variable pay management and sales performance management (SPM) within the broader CMS ecosystem. As organizations increasingly link compensation directly to measurable performance, the demand for sophisticated tools capable of modeling complex commission structures, managing bonus payouts accurately, and providing real-time visibility into incentive achievement is escalating. This focus signifies that CMS is no longer merely an administrative tool but a strategic instrument used by sales and HR leaders to drive specific business outcomes, requiring deep integration with CRM systems and financial planning tools to ensure seamless data flow and reliable payout execution.

- By Deployment Type:

- Cloud-based (SaaS)

- On-premise

- By Component:

- Software/Platform

- Services (Consulting, Implementation, Training & Support)

- By Organizational Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Base Pay and Salary Planning

- Variable Pay Management (Bonuses, Merit)

- Long-Term Incentive (LTI) Management (Equity, Stock Options)

- Sales Performance Management (SPM) / Commissions

- Pay Equity Analysis and Compliance

- By End-Use Industry:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Others (Government, Education)

Value Chain Analysis For Compensation Management Software Market

The value chain for the Compensation Management Software market begins with the Upstream Analysis, which focuses primarily on core technology development, data aggregation, and infrastructure providers. Upstream activities involve specialized software development kits (SDKs), AI/ML libraries for predictive modeling, and robust cloud infrastructure services (AWS, Azure, GCP) that form the foundational architecture of SaaS CMS platforms. Key upstream partners are essential for securing scalability, reliability, and global deployment capabilities. Additionally, partnerships with specialized market data providers (e.g., compensation survey firms) are critical, as the accuracy and currency of salary benchmarking data directly influence the utility and competitiveness of the final CMS product.

The Midstream phase is dominated by the Core Software Development and Integration activities carried out by the CMS vendors themselves. This involves coding, quality assurance, feature enhancement (e.g., building new AI modules or compliance reporting features), and crucial integration efforts. Seamless integration with existing HCM systems (like Oracle, SAP SuccessFactors, Workday) and payroll processors is paramount to the product’s success. Efficient platform security, compliance with data localization standards, and rapid deployment capabilities are midstream elements that differentiate leading vendors, defining the time-to-value for enterprise customers. Sales and marketing, particularly focusing on vertical-specific solutions and strategic channel partnerships, also form a significant part of this value realization stage.

Downstream Analysis focuses on distribution channels and end-user adoption. CMS is typically distributed via Direct Sales (for large enterprises requiring complex contracts and customizations) and Indirect Channels, including specialized HR technology consultants, system integrators, and value-added resellers (VARs). Post-sale activities, such as implementation support, training, and ongoing technical maintenance, are critical for ensuring customer success and high renewal rates. The flow of value concludes with the End-User (HR/Finance departments) deriving strategic benefits, using the software for efficient salary administration and strategic workforce planning, thereby validating the entire value chain through demonstrable ROI and compliance adherence.

Compensation Management Software Market Potential Customers

The primary End-Users and buyers of Compensation Management Software are large multinational corporations operating across multiple geographies and mid-sized enterprises experiencing rapid growth and expanding compliance complexity. These organizations require centralized platforms to standardize compensation practices, manage diverse pay policies, and ensure global equity across varied jurisdictions. Target buyers within these organizations typically include the Chief Human Resources Officer (CHRO), VP of Compensation & Benefits, the Financial Planning & Analysis (FP&A) team, and the Chief Financial Officer (CFO), who seek systems that offer both strategic HR optimization and rigorous financial control over labor costs. The demand is particularly acute in highly regulated or knowledge-intensive sectors like BFSI and IT, where compensation is a major operational expense and a critical competitive tool.

A rapidly expanding customer segment is the Small and Medium-sized Enterprise (SME) market, especially those with 100 to 1,000 employees. As SMEs mature, they quickly outgrow manual spreadsheets, facing escalating administrative overhead and increasing pressure to professionalize their HR functions to compete for talent against larger competitors. They seek cost-effective, easily implementable, and scalable cloud solutions (SaaS) that can manage basic merit cycles, bonus payouts, and simple compliance reporting without requiring dedicated IT infrastructure. Vendors are increasingly tailoring modular offerings specifically for this segment, providing focused functionality without the complexity or high cost associated with full-scale enterprise solutions, thereby dramatically broadening the accessible market.

Furthermore, industry-specific potential customers, such as healthcare networks and large retail chains, represent high-value targets due to their large, diverse employee bases and complex shift-based, variable pay structures. Healthcare often requires sophisticated compensation models for nurses and specialized physicians, while retail demands robust commission and bonus tracking for sales associates. These sectors prioritize CMS platforms that offer deep integration with industry-specific scheduling and payroll systems, as well as highly specialized modules for managing performance incentives and complex shift differentials, positioning the software as a necessary operational tool rather than a discretionary HR expenditure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.75 Billion |

| Market Forecast in 2033 | $4.01 Billion |

| Growth Rate | 12.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Workday, SAP SuccessFactors, Oracle, beqom, Salary.com, PayScale (Compdata), Namely, Curo Compensation, Cornerstone OnDemand, Saba Software (Cornerstone), Bullhorn, Ceridian, Ultimate Software (UKG), ADP, Willis Towers Watson (Towers Watson Software), IBM, Paycom, Ascentis, Xactly, Betterworks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compensation Management Software Market Key Technology Landscape

The current technology landscape of the Compensation Management Software market is defined by four core technological pillars: Cloud Computing, Advanced Analytics, Application Programming Interface (API) Connectivity, and Artificial Intelligence/Machine Learning (AI/ML). Cloud computing, primarily Software as a Service (SaaS) models, is foundational, providing the necessary scalability, continuous updates, and global accessibility required for managing dynamic, geographically dispersed workforces. The shift to SaaS has significantly reduced the barriers to entry for SMEs and accelerated the pace of innovation, allowing vendors to push new features, particularly compliance updates and security patches, instantly to all customers worldwide, ensuring system currency and reliability.

Advanced Analytics and Business Intelligence (BI) tools are deeply embedded within leading CMS platforms, transforming raw compensation data into strategic insights. These technologies allow HR and Finance users to perform complex scenario planning, model the financial impact of different salary increases or bonus structures, and conduct detailed segmentation analysis of compensation expenditures. Robust reporting frameworks support mandatory regulatory reporting, such as gender pay gap disclosures, with automated data extraction and visualization. The emphasis is on providing actionable insights through intuitive dashboards, enabling managers to understand compensation competitiveness relative to external benchmarks and internal performance metrics in real-time.

API Connectivity is critical for the CMS market due to the necessity of seamless integration with a wide ecosystem of related enterprise systems. Modern CMS solutions utilize open APIs to interface efficiently with core HCM systems (for employee data), ERP platforms (for financial data and budgeting), payroll systems (for processing payouts), and external market data providers. This seamless data exchange eliminates manual processes, reduces data integrity issues, and ensures that compensation decisions are based on the most accurate and up-to-date performance and financial information. Finally, the growing implementation of AI/ML, detailed earlier, focuses on optimizing pay equity, predictive turnover risk assessment, and automating the challenging task of market pricing complex or hybrid job roles.

Regional Highlights

- North America (Dominance and Innovation): North America holds the largest share of the CMS market, driven by high technology adoption rates, the presence of major software vendors (SaaS leaders), and a corporate culture that emphasizes performance-based compensation and sophisticated total rewards strategies. Stringent financial regulations and complex compliance requirements, particularly regarding stock options and executive compensation disclosure, compel large U.S. and Canadian firms to adopt robust, audit-ready software. Innovation here is centered around AI integration for predictive analytics and advanced equity management solutions.

- Europe (Regulation and Compliance Focus): Europe is characterized by market growth driven primarily by regulatory compliance, notably the implementation of the General Data Protection Regulation (GDPR) and various national pay transparency mandates (e.g., in the UK, Germany, and the EU's forthcoming directive). Organizations require CMS solutions capable of handling multilingual, multi-currency operations and producing legally compliant reports on gender pay gaps. The maturity of the HR tech ecosystem means strong demand for cloud-based, integrated solutions that offer data residency options and highly customizable compliance features suitable for the diverse regulatory environment.

- Asia Pacific (APAC) (Fastest Growth Trajectory): APAC is expected to demonstrate the highest CAGR, fueled by the rapid expansion of multinational corporations setting up regional headquarters and the aggressive digital transformation initiatives across large local enterprises in China, India, and Australia. Market growth is stimulated by the increasing need to standardize compensation practices across diverse labor markets and manage complex variable pay structures required by high-growth tech and manufacturing sectors. Adoption is concentrated in metropolitan areas, favoring scalable SaaS models to manage rapidly growing, distributed workforces efficiently.

- Latin America (LATAM) (Stabilizing Infrastructure): Market adoption in LATAM is gradually increasing, moving away from legacy systems towards modern CMS platforms. Drivers include the push for centralization of HR functions among regional conglomerates and the need to manage high inflation rates and currency fluctuations that require dynamic salary adjustment mechanisms. Market challenges include varied labor laws and lower initial HR technology budgets compared to North America, leading to a strong preference for cost-effective, modular cloud solutions.

- Middle East and Africa (MEA) (Emerging Opportunities): The MEA market, while smaller, presents unique opportunities driven by large-scale governmental digitalization projects (e.g., Saudi Vision 2030, UAE's digital economy goals) and the influx of global businesses. Compensation structures are often complex, involving allowances and specialized incentive schemes. Adoption is concentrated within the BFSI, Oil & Gas, and Technology sectors, where managing expatriate compensation packages and ensuring local labor law compliance are critical requirements for CMS systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compensation Management Software Market.- Workday, Inc.

- SAP SuccessFactors

- Oracle Corporation

- beqom

- Salary.com

- PayScale (Compdata)

- Namely

- Curo Compensation

- Cornerstone OnDemand

- Bullhorn, Inc.

- Ceridian HCM Holding Inc.

- Ultimate Software Group, Inc. (UKG)

- Automatic Data Processing, Inc. (ADP)

- Willis Towers Watson

- IBM Corporation

- Paycom Software, Inc.

- Ascentis

- Xactly Corp

- Betterworks

- BambooHR

Frequently Asked Questions

Analyze common user questions about the Compensation Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Compensation Management Software (CMS) and how does it differ from traditional HRIS?

Compensation Management Software is a specialized tool focused explicitly on the strategic planning, budgeting, administration, and execution of employee pay, bonuses, and incentives. While a traditional Human Resources Information System (HRIS) or HCM platform handles core administrative tasks like payroll and employee records, CMS provides advanced analytical capabilities, scenario modeling, and pay equity auditing necessary for strategic compensation decision-making and ensures compliance across complex pay structures. CMS integrates with, but typically offers deeper functional expertise than, general HRIS modules.

How is the adoption of Cloud-based CMS solutions impacting the market?

Cloud-based (SaaS) CMS solutions are the primary driver of market growth, fundamentally changing deployment dynamics. They offer enhanced scalability, reduce the Total Cost of Ownership (TCO) by eliminating large upfront hardware investments, and allow for faster, more frequent feature updates, particularly rapid compliance with new global regulations. This model makes sophisticated compensation management accessible to Small and Medium-sized Enterprises (SMEs) that previously lacked the resources for traditional on-premise deployments, significantly expanding the customer base.

What role does AI play in improving pay equity and reducing compensation bias?

Artificial Intelligence (AI) and Machine Learning (ML) are crucial for addressing pay equity by analyzing large datasets to identify statistically significant pay disparities that cannot be explained by legitimate factors like tenure or performance. AI models help eliminate unconscious bias by providing objective, data-driven recommendations for salary adjustments, ensuring that compensation decisions align strictly with defined metrics and regulatory requirements, thereby mitigating legal risk and improving workforce fairness perception.

Which geographical region leads the Compensation Management Software market in terms of revenue and innovation?

North America currently leads the Compensation Management Software market in terms of overall revenue and technological innovation. This dominance is due to the presence of key technology vendors, high enterprise IT spending, and sophisticated regulatory environments requiring advanced solutions for compliance and complex financial reporting. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, driven by accelerated digital transformation across its rapidly growing economies.

What are the key challenges organizations face when implementing new Compensation Management Software?

Key challenges include ensuring seamless integration with existing core HR, payroll, and financial systems, which is often complex, especially in legacy environments. Additionally, data integrity issues stemming from disparate data sources pose a risk. Significant organizational resistance to change, requiring substantial investment in change management and specialized training for HR and finance teams, is also a critical hurdle to achieving successful CMS implementation and maximizing system utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager