Compliance as a Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431898 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Compliance as a Service Market Size

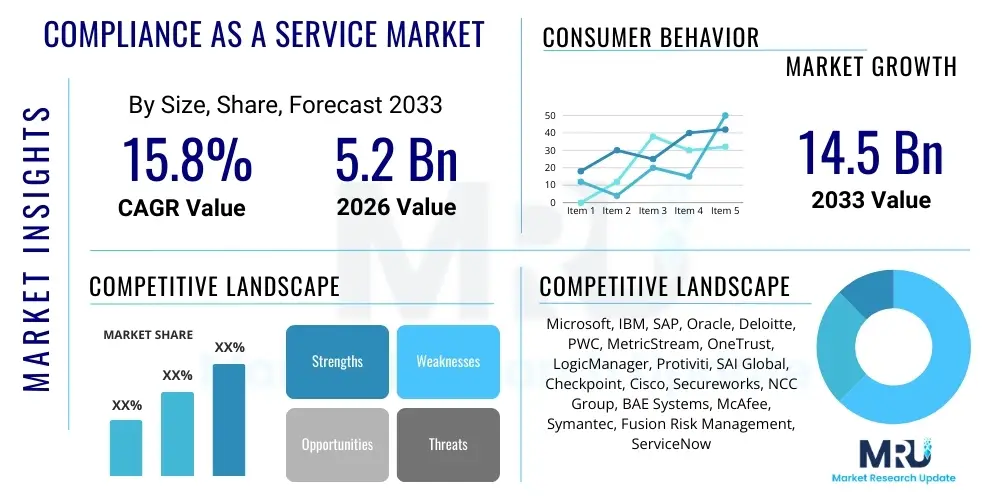

The Compliance as a Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 14.5 Billion by the end of the forecast period in 2033.

Compliance as a Service Market introduction

The Compliance as a Service (CaaS) Market encompasses cloud-based solutions and integrated services designed to help organizations meet increasingly complex regulatory and legal requirements across various jurisdictions. CaaS leverages advanced technologies, including artificial intelligence, machine learning, and automation, to monitor, manage, and report compliance status in real-time. This model shifts the burden of maintaining up-to-date regulatory knowledge and implementing corresponding controls from the client organization to the specialized service provider. The primary objective of CaaS is to reduce compliance risk, lower operational costs associated with manual audits and reporting, and enhance organizational agility in responding to rapidly changing global compliance mandates such as GDPR, HIPAA, SOX, and various industry-specific financial regulations. The demand for CaaS is directly correlated with the global surge in regulatory enforcement actions and the necessity for robust data governance frameworks, making these services indispensable for enterprises seeking sustainable growth and risk mitigation.

Major applications of CaaS span critical enterprise functions, including financial compliance (anti-money laundering, transaction monitoring), data privacy management, IT security compliance, and environmental, social, and governance (ESG) reporting. Product descriptions often highlight modular platforms that offer automated policy enforcement, continuous control monitoring, and centralized reporting dashboards tailored to specific industry verticals like Banking, Financial Services, and Insurance (BFSI) and Healthcare. The flexibility and scalability inherent in the CaaS model allow both small and medium-sized enterprises (SMEs) and large corporations to access enterprise-grade compliance capabilities without significant capital expenditure on internal infrastructure or hiring extensive specialized compliance staff. This accessibility is a key differentiating factor, enabling market penetration across diverse geographical and operational landscapes, particularly in regions where regulatory frameworks are still evolving rapidly or resource constraints limit internal compliance development.

Driving factors for market acceleration include the exponential growth in enterprise data volumes, necessitating automated data governance tools; the increasing complexity and volume of cross-border regulations requiring immediate adaptation; and the growing recognition that compliance failures can result in massive financial penalties and significant reputational damage. Benefits realized by adopting CaaS include enhanced visibility into organizational risk posture, standardized control frameworks across disparate business units, and accelerated response times to audit requests. Furthermore, the inherent specialization of CaaS providers ensures that clients remain current with regulatory changes, mitigating the constant operational headache of tracking legislative amendments. The transition towards hybrid and multi-cloud environments further strengthens the necessity for unified, third-party compliance oversight, ensuring seamless adherence across complex technological stacks and operational boundaries.

Compliance as a Service Market Executive Summary

The Compliance as a Service (CaaS) market is undergoing rapid evolution, driven primarily by globalization, digital transformation, and tightening regulatory scrutiny across major economic sectors. Current business trends indicate a strong shift towards specialized, vertical-specific CaaS offerings, moving beyond generic compliance solutions. Enterprises are prioritizing platforms that offer integrated Governance, Risk, and Compliance (GRC) capabilities, focusing on continuous monitoring rather than periodic checks. Furthermore, mergers and acquisitions play a crucial role, as major technology vendors acquire niche GRC firms to integrate sophisticated compliance modules into their existing cloud service portfolios, thereby offering comprehensive, bundled solutions. Adoption rates are particularly high among organizations operating in high-risk environments, such as cross-border financial institutions and global healthcare providers, where data localization and privacy mandates pose continuous operational challenges.

Regionally, North America maintains the dominant market share, primarily due to stringent regulations like HIPAA, CCPA, and advanced financial compliance mandates, coupled with the early adoption of cloud technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth in APAC is fueled by emerging economies implementing new national data protection laws (e.g., in India, China) and increased foreign investment driving the need for international compliance standards. European markets continue to demonstrate robust demand, mandated by the pervasive reach of GDPR and ongoing efforts to standardize financial regulations across the EU bloc. Strategic investments are focusing on localizing service capabilities to address unique jurisdictional requirements in MEA and Latin America, where digital maturity is accelerating alongside regulatory framework development.

Segment trends highlight the Services component (including consulting, training, and managed services) as the faster-growing segment, reflecting the complexity of initial CaaS integration and the need for expert guidance in policy mapping and control implementation. Within industry verticals, BFSI and Healthcare remain the largest consumers of CaaS, given their critical data sensitivity and heavy regulatory burdens. However, the Manufacturing and Retail sectors are demonstrating significant uptake, driven by supply chain compliance requirements and payment card industry (PCI) data security standards. Enterprise size segmentation shows that while large enterprises are the primary revenue contributors, SMEs are increasingly adopting entry-level or scalable CaaS solutions due to the affordability and ease of deployment offered by cloud-native platforms, enabling them to meet complex compliance requirements without excessive internal resource allocation.

AI Impact Analysis on Compliance as a Service Market

Users frequently inquire about the practical implementation of AI in compliance, specifically asking: "How can AI automate audit trails?" "Does AI reduce the cost of regulatory reporting?" and "What are the compliance risks associated with using AI itself (AI governance)?" These questions reveal a dual focus: users expect AI to significantly enhance efficiency and predictive capabilities in compliance management, moving from reactive responses to proactive risk mitigation. Simultaneously, they express concerns regarding the ethical use of AI, ensuring transparency (explainability), fairness, and maintaining compliance with regulations like GDPR when processing sensitive data through automated systems. The central theme emerging from user queries is the transition toward intelligent, continuous compliance monitoring that reduces human error while demanding robust governance mechanisms for the AI systems themselves.

AI's primary influence is enabling continuous monitoring and anomaly detection, fundamentally transforming traditional periodic compliance audits into real-time risk assessment processes. Machine learning algorithms are deployed to analyze vast datasets—including transaction logs, communication records, and system configurations—to detect subtle deviations from established regulatory controls. This capability drastically reduces the time required for internal reviews and external audits. Furthermore, Natural Language Processing (NLP) is used extensively by CaaS providers to rapidly ingest, categorize, and interpret regulatory updates published by government bodies worldwide. This automated interpretation ensures that CaaS platforms can adapt their control frameworks instantaneously, providing clients with immediate guidance on necessary policy adjustments, thereby guaranteeing regulatory readiness.

Beyond automation, AI is crucial in enhancing predictive compliance modeling, allowing organizations to simulate the impact of potential policy changes or system configurations on their compliance posture before implementation. This predictive capability is vital in complex global operations. However, the integration of AI also introduces new compliance challenges, particularly around data bias, model drift, and ensuring data lineage integrity, necessitating a new domain known as Responsible AI or AI Governance. CaaS vendors are addressing this by building specialized modules that track model performance, document decision-making processes, and provide auditable records of AI-driven actions, ensuring that the technology itself adheres to ethical and legal standards, thus solidifying AI's role as both a driver of efficiency and a new area requiring specialized compliance solutions.

- AI enables continuous control monitoring (CCM) replacing periodic audits.

- Machine Learning algorithms detect subtle compliance anomalies and fraudulent patterns.

- Natural Language Processing (NLP) automates the ingestion and interpretation of new regulatory texts.

- Predictive modeling simulates regulatory impacts and enhances proactive risk management.

- AI integration necessitates new AI Governance modules to ensure transparency and ethical compliance.

- Reduces operational costs associated with manual data analysis and regulatory reporting.

- Facilitates dynamic mapping of internal controls to external regulatory frameworks in real-time.

DRO & Impact Forces Of Compliance as a Service Market

The Compliance as a Service market dynamics are governed by a robust interplay between escalating global regulatory complexity (Driver) and persistent concerns regarding data sovereignty and vendor lock-in (Restraint), countered by massive opportunities presented through the integration of cutting-edge technologies like AI, blockchain, and advanced cloud infrastructure (Opportunity). These elements converge to define the overall Impact Forces shaping market adoption. The accelerating pace of digital transformation across all industries mandates immediate and scalable solutions for data governance and security, amplifying the attractiveness of outsourced, expertise-driven compliance management. This necessitates providers to not only offer technological solutions but also robust advisory services to navigate intricate, multi-jurisdictional compliance landscapes effectively. The combined force of regulatory pressure and technological advancement is fundamentally restructuring traditional approaches to risk management.

Primary drivers include the explosion of data volumes and the subsequent need for rigorous data protection laws (like GDPR, CCPA, and sector-specific rules such as DORA in finance). Furthermore, organizations, particularly SMEs, face significant challenges in recruiting and retaining specialized compliance personnel, making CaaS an economical and efficient alternative for accessing necessary expertise. The increased scrutiny and severity of financial penalties for non-compliance act as a strong deterrent, compelling organizations to invest proactively in comprehensive CaaS platforms. These drivers collectively push compliance spending from discretionary budget items into mandatory operational expenditures. The rapid shift to remote work models has further complicated endpoint and data compliance, requiring cloud-native, centralized CaaS solutions to maintain control across decentralized operational environments, ensuring compliance integrity regardless of employee location.

Key restraints include deeply ingrained organizational hesitance regarding third-party management of highly sensitive compliance data, often linked to data sovereignty concerns in multi-national operations. High initial integration costs and complexity when transitioning legacy systems to cloud-based CaaS platforms also deter adoption, particularly for highly regulated industries with customized internal IT environments. However, these restraints are being mitigated by the strong opportunities arising from technological integration. The development of specialized CaaS offerings for niche industries, the use of blockchain for secure, transparent audit trails, and the incorporation of automated reporting features through API integration with enterprise resource planning (ERP) systems represent significant growth avenues. The overall impact forces are strongly positive, favoring market expansion as the cost-benefit analysis increasingly leans towards CaaS adoption as a strategic necessity for long-term operational resilience and risk mitigation, positioning regulatory complexity as a catalyst for innovation.

Segmentation Analysis

The Compliance as a Service Market is comprehensively segmented across several dimensions, primarily focusing on the type of offering (Component), the scale of the customer (Enterprise Size), and the specific operational requirements (Industry Vertical). This segmentation allows vendors to tailor their solutions precisely, addressing the varying regulatory burdens and technological maturity levels present across different market subsets. The delineation between Solutions (software platforms, dashboards) and Services (consulting, integration, managed support) is crucial, as many clients initially seek expert services to define their compliance strategy before adopting the core technology platform. The segmentation reflects the market's maturity, moving from general GRC tools to highly focused, scalable, and customizable modules that cater specifically to distinct regulatory or geographical needs, ensuring targeted market penetration and maximum value delivery to the end-user.

The segmentation by Enterprise Size is particularly insightful, demonstrating differing adoption drivers. Large enterprises seek comprehensive, customizable global platforms capable of integrating with complex legacy IT infrastructures and managing compliance across multiple international subsidiaries. Their needs focus on centralized governance and risk aggregation. Conversely, Small and Medium-sized Enterprises (SMEs) prioritize ease of deployment, cost-effectiveness, and out-of-the-box compliance templates tailored to common regulations (e.g., PCI DSS, basic data privacy). CaaS platforms offering standardized, subscription-based models are crucial for capturing the SME segment, which represents a massive and underserved pool of potential customers who lack the internal resources to manage compliance manually.

Industry Vertical segmentation reveals the concentrated demand in highly regulated fields. BFSI requires stringent operational resilience and anti-money laundering (AML) compliance, driving demand for specialized transaction monitoring solutions. Healthcare mandates absolute adherence to patient data privacy (HIPAA, HITECH), fueling demand for data encryption and access control modules within CaaS frameworks. The growing significance of IT and Telecom highlights the need for cloud security compliance and supply chain risk management, especially concerning vendors accessing sensitive network infrastructure. Analyzing these vertical needs ensures that CaaS vendors develop functionally rich, industry-specific solutions that directly address the most critical pain points of their target clientele, enabling higher solution stickiness and faster return on investment for the adopting organization.

- By Component:

- Solutions (Software Platforms)

- Services (Consulting, Managed Services, Training & Education)

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- IT and Telecom

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Energy and Utilities

- By Deployment Model:

- Cloud-based

- On-premise

Value Chain Analysis For Compliance as a Service Market

The Value Chain for the Compliance as a Service Market commences with upstream activities focused on foundational technological components and regulatory intelligence gathering. Upstream suppliers primarily include core cloud infrastructure providers (e.g., AWS, Azure, Google Cloud) that host the CaaS platforms, foundational software developers providing GRC core engines, and specialized data providers offering real-time legislative updates and regulatory content feeds from global bodies. The quality and timeliness of these regulatory feeds are paramount, as they directly impact the service provider's ability to maintain the currency and accuracy of their compliance rulesets and automated controls. Efficiency in this phase hinges on robust API integration and partnerships with legal research firms to ensure comprehensive global coverage, thereby minimizing the lag between regulatory publication and platform update deployment.

The midstream phase involves the core CaaS providers, who transform raw regulatory intelligence and cloud infrastructure into scalable, consumable compliance products and services. Key activities here include solution development (building modules for specific compliance areas like AML, GDPR, or ESG), platform customization, continuous control mapping, and integrating automation tools (AI/ML) for monitoring and reporting. Strategic importance is placed on service delivery—the ability to provide expert consulting, deployment, and ongoing managed services. Differentiation is achieved through specialized industry knowledge, security certifications, and the ability to offer flexible deployment options (public, private, or hybrid cloud), ensuring the platform meets stringent client data governance requirements. This phase requires significant investment in cybersecurity, data privacy architecture, and regulatory domain expertise.

Downstream activities involve the distribution channel and the direct interaction with end-users. Distribution relies on a hybrid approach: direct sales teams handling large enterprise accounts requiring customized GRC implementations, and indirect channels leveraging partnerships with system integrators, managed security service providers (MSSPs), and IT consulting firms. These partners play a critical role in localized deployment, integration with legacy systems, and providing regional support, especially in complex markets like APAC and MEA. Direct channels are crucial for high-value contracts and proprietary platform sales, whereas indirect channels enable wider market reach, especially into the SME segment and across diverse geographical locations. End-user satisfaction, characterized by ease of use, report accuracy, and responsiveness to regulatory changes, dictates long-term contract renewal and market reputation, emphasizing the importance of robust post-sales support and regulatory adaptation services.

Compliance as a Service Market Potential Customers

The primary potential customers and end-users of Compliance as a Service solutions span virtually every sector engaged in digital operations and subject to external regulatory oversight, but they are most concentrated within highly regulated industries where compliance risk translates directly to significant financial and legal exposure. The core buyer persona includes Chief Compliance Officers (CCOs), Chief Information Security Officers (CISOs), and Heads of Risk Management across various corporations. These decision-makers are actively seeking solutions that offer holistic risk visibility, reduce manual workload, and provide irrefutable evidence of control effectiveness to auditors and regulators. The complexity of modern regulations means that compliance requirements are no longer purely legal or IT functions but strategic operational priorities, driving adoption across multiple internal business units.

Financial Services and Healthcare represent the highest density of potential customers due to mandates such as Basel III, MiFID II, HIPAA, and continuous anti-money laundering (AML) requirements. In BFSI, the need for real-time transaction monitoring and customer due diligence, coupled with the pressure to adhere to data residency rules, makes CaaS indispensable for maintaining operational licenses and avoiding hefty fines. In Healthcare, the sheer volume and sensitivity of Protected Health Information (PHI) necessitate advanced encryption, access logging, and regulatory reporting mechanisms, which CaaS platforms offer as specialized modules. These sectors require vendors with deep domain expertise and solutions pre-configured to meet specific, non-negotiable industry standards, often favoring solutions that demonstrate proven integration capabilities with core banking and electronic health record (EHR) systems.

Beyond these highly regulated sectors, the emerging potential customer base lies within the Manufacturing and Retail/E-commerce industries. Manufacturers face increasingly complex supply chain compliance requirements, ESG reporting mandates, and quality control standards that require continuous monitoring, especially across globally distributed networks. Retail and E-commerce entities require rigorous adherence to Payment Card Industry Data Security Standard (PCI DSS) and evolving consumer privacy laws (e.g., CCPA for US customers). For these emerging segments, CaaS provides a scalable mechanism to implement mandatory security controls without requiring internal security teams to specialize in compliance auditing. The growing global focus on Environmental, Social, and Governance (ESG) reporting is also creating a new wave of demand, positioning CaaS providers as essential partners in demonstrating organizational accountability to investors and stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 14.5 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft, IBM, SAP, Oracle, Deloitte, PWC, MetricStream, OneTrust, LogicManager, Protiviti, SAI Global, Checkpoint, Cisco, Secureworks, NCC Group, BAE Systems, McAfee, Symantec, Fusion Risk Management, ServiceNow |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compliance as a Service Market Key Technology Landscape

The technological underpinnings of the Compliance as a Service market are defined by a fusion of advanced cloud infrastructure, automation, and intelligent data processing capabilities designed to deliver security, scalability, and continuous regulatory adherence. Cloud computing remains the foundational layer, allowing CaaS providers to offer multi-tenant architectures that scale resources dynamically and ensure ubiquitous accessibility to compliance platforms, irrespective of the client’s physical location. The shift towards hybrid and multi-cloud environments necessitates CaaS platforms that are inherently cloud-agnostic, capable of monitoring and reporting compliance controls consistently across different cloud service providers (CSPs) and on-premise infrastructure. Application Programming Interfaces (APIs) are critical technology enablers, facilitating seamless integration between the CaaS platform and the client's existing enterprise resource planning (ERP) systems, Customer Relationship Management (CRM) tools, and security controls, ensuring that compliance checks are embedded into daily operational workflows rather than existing as separate, siloed processes.

Automation and Artificial Intelligence (AI) constitute the key differentiators for next-generation CaaS solutions. Robotic Process Automation (RPA) is widely deployed for routine data collection, standardized reporting generation, and triggering alerts based on predefined policy violations, drastically minimizing human intervention and error rates. Machine Learning (ML) algorithms are utilized for complex tasks such as detecting suspicious transaction patterns in financial compliance (AML/KYC), identifying sensitive data leakage across endpoints, and prioritizing risk remediation actions based on predictive risk scoring. This intelligence allows CaaS platforms to shift from rules-based reactive monitoring to sophisticated, proactive risk anticipation. Furthermore, the use of Natural Language Processing (NLP) is paramount for efficiently processing and categorizing the massive influx of unstructured regulatory documentation, ensuring that the platform’s control library remains perpetually updated and relevant to the evolving legal landscape.

Blockchain technology is emerging as a powerful, albeit less mainstream, component within the CaaS landscape, primarily addressing the need for immutable audit trails and verifiable data provenance. Utilizing distributed ledger technology, CaaS vendors can record compliance activities, control changes, and audit results in a tamper-proof manner, which significantly simplifies the evidentiary requirements during external audits and enhances trust in reported data integrity. Moreover, advanced security technologies, including Zero Trust Architecture (ZTA) principles and sophisticated encryption techniques (e.g., homomorphic encryption for processing data while encrypted), are woven into CaaS offerings to ensure that the security measures protecting the compliance platform itself adhere to the highest industry standards, especially when handling Personally Identifiable Information (PII) and highly regulated corporate data. This continuous focus on robust security, coupled with intelligent automation, defines the cutting edge of the CaaS technology stack.

Regional Highlights

Regional dynamics in the Compliance as a Service market are fundamentally shaped by the local regulatory environment, the maturity of cloud adoption, and the presence of major technology hubs. North America stands as the dominant region, largely driven by the sheer scale of the U.S. economy, the stringent enforcement of security and privacy laws (e.g., HIPAA, SOX, CCPA), and the headquarters of major technology and financial corporations that require global CaaS integration. The high concentration of specialized CaaS and GRC vendors in this region further stimulates innovation and adoption. The robust legal framework and continuous federal and state-level regulatory updates create perpetual demand for automated compliance monitoring, establishing North America as the benchmark for CaaS technological standards and market size.

- North America: Dominant market share due to stringent regulations (HIPAA, SOX, CCPA) and high cloud adoption rates. Key focus on IT security and financial sector compliance. The U.S. remains the largest consumer, benefiting from mature CaaS ecosystems and strong vendor competition.

- Europe: Second largest market, propelled primarily by the General Data Protection Regulation (GDPR) and efforts to harmonize financial compliance across the EU (e.g., MiFID II, DORA). Demand is focused on data residency solutions and cross-border data transfer compliance. Germany and the UK are key national markets driving CaaS investment.

- Asia Pacific (APAC): Highest projected CAGR due to rapid digital transformation, increasing foreign investment, and the introduction of new national data protection laws (e.g., India’s Digital Personal Data Protection Act, China’s PIPL). Key countries like China, Japan, and Australia are driving demand for scalable, localized CaaS solutions, particularly in the BFSI and IT sectors. The market focuses heavily on scalability and regional regulatory variations.

- Latin America (LATAM): Emerging market characterized by evolving regulatory landscapes and increasing digitalization. Brazil and Mexico are core investment areas. Demand is often focused on foundational GRC platforms and basic cloud compliance, driven by international businesses expanding into the region and local businesses needing standardized operational risk controls.

- Middle East and Africa (MEA): Growth driven by large-scale governmental digital initiatives (e.g., Saudi Arabia's Vision 2030, UAE's digitalization efforts) and expanding financial hubs. Focus is on data localization mandates and cloud security compliance. While smaller in current size, the region offers substantial long-term growth potential due to government-led mandates for compliance infrastructure modernization.

Europe represents the second most significant market, where the ubiquity of GDPR enforcement has fundamentally reshaped the regulatory technology requirements for all organizations operating within the European Economic Area (EEA). European CaaS demand centers heavily on solutions providing granular control over data processing, demonstrating consent management, and ensuring compliance with complex cross-border data transfer mechanisms. The focus is less on sheer volume of compliance checks and more on the depth and accuracy of data lineage and privacy impact assessments. Regulatory bodies are increasingly collaborative, pushing CaaS providers toward developing integrated platforms that can handle multiple regulatory frameworks simultaneously, reducing fragmentation in compliance efforts across diverse EU member states.

The Asia Pacific region is expected to lead global growth rates, primarily driven by large-scale infrastructural projects, exponential growth in e-commerce, and the rapid maturation of national data protection legislation across major economies. Unlike North America and Europe, where CaaS adoption is mature, APAC markets are characterized by significant variations in regulatory maturity and enforcement, necessitating highly flexible and regionally adaptable CaaS platforms. The increasing pressure from international trade agreements and cross-border operations compels local businesses to rapidly adopt global compliance standards, thereby accelerating the uptake of specialized services for managing diverse regulatory environments from the ground up. This need for localized expertise and scalable infrastructure positions APAC as the most dynamic market for CaaS vendor investment and expansion over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compliance as a Service Market.- Microsoft

- IBM

- SAP

- Oracle

- Deloitte

- PWC

- MetricStream

- OneTrust

- LogicManager

- Protiviti

- SAI Global

- Checkpoint

- Cisco

- Secureworks

- NCC Group

- BAE Systems

- McAfee

- Symantec

- Fusion Risk Management

- ServiceNow

Frequently Asked Questions

Analyze common user questions about the Compliance as a Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Compliance as a Service (CaaS) and how does it differ from traditional GRC software?

CaaS is a cloud-based delivery model where a third-party provider manages an organization's compliance tasks, leveraging automation and real-time regulatory intelligence. Unlike traditional, often on-premise GRC software, CaaS includes managed services, continuous monitoring, and automated regulatory updates, shifting operational burdens and expertise requirements from the client to the vendor.

Which industries are driving the highest demand for CaaS solutions?

The Banking, Financial Services, and Insurance (BFSI) sector and the Healthcare industry are the primary drivers of CaaS demand globally. This is due to stringent mandates related to data security (HIPAA), financial transparency (AML), and regulatory frameworks requiring continuous, automated monitoring and highly accurate reporting to avoid severe penalties.

How does AI impact the security and efficacy of CaaS platforms?

AI significantly enhances CaaS efficacy by enabling continuous control monitoring, predictive risk modeling, and automating the ingestion and interpretation of new regulatory changes. For security, AI detects anomalies and suspicious activity in real-time, moving compliance from reactive auditing to proactive, intelligent risk management and improving overall defense posture.

What are the main risks associated with adopting a third-party CaaS solution?

The primary risks include data sovereignty concerns, particularly for multi-national companies needing to adhere to specific regional data residency laws, vendor lock-in preventing easy migration of compliance data, and the need for robust contractual agreements ensuring the CaaS provider maintains the required level of data security and regulatory expertise.

What is the projected growth trajectory for the Compliance as a Service Market in the Asia Pacific (APAC) region?

The APAC region is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) due to accelerating digital transformation, the rapid introduction of new data privacy and financial protection laws across emerging economies, and the growing necessity for localized, scalable solutions to meet diverse regional regulatory requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager