Composite Fabrication Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439413 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Composite Fabrication Technology Market Size

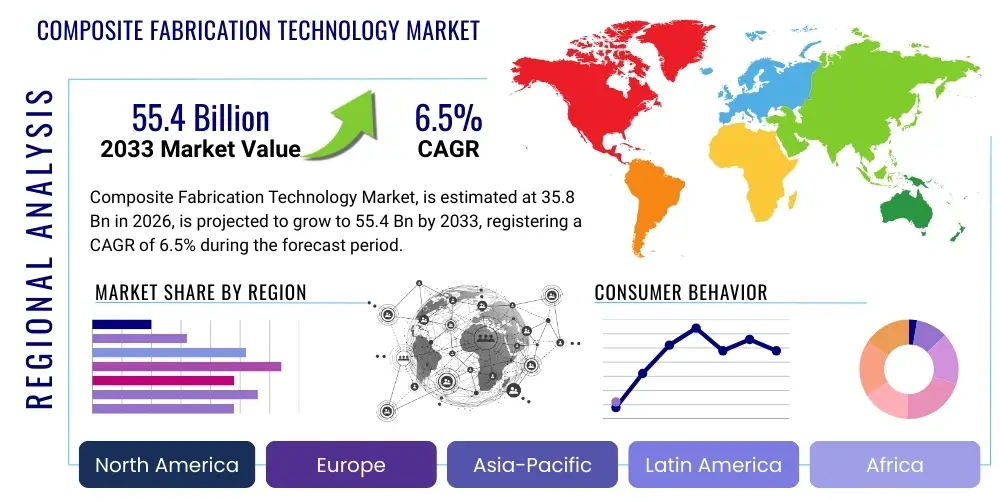

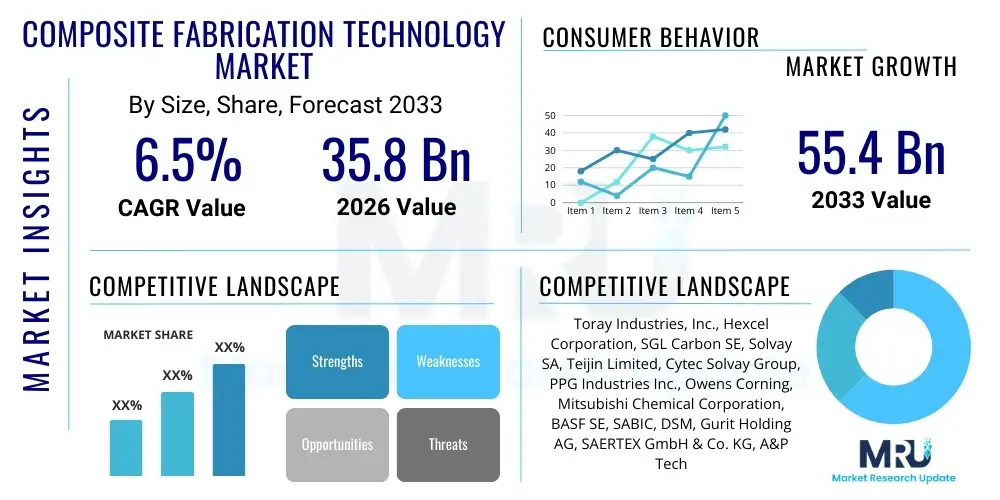

The Composite Fabrication Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 35.8 Billion in 2026 and is projected to reach USD 55.4 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global demand for lightweight, high-strength materials across critical industries such as aerospace, automotive, wind energy, and construction. The ongoing drive for fuel efficiency, emission reduction, and enhanced performance characteristics continues to fuel innovation and adoption within the composite sector.

The market expansion is further propelled by technological advancements in manufacturing processes, including automation, digitalization, and the emergence of more cost-effective fabrication methods. These innovations are making composite materials more accessible and viable for a broader range of applications, moving beyond traditional niche high-performance sectors into mass-market segments. Strategic investments in research and development, particularly in sustainable and recyclable composites, are also contributing significantly to this positive market outlook, addressing environmental concerns and expanding the material's appeal, thereby solidifying its position as a critical enabling technology for future industrial advancements.

Composite Fabrication Technology Market introduction

Composite fabrication technology encompasses a diverse range of processes and materials used to create composite structures, which are engineered materials made from two or more constituent materials with significantly different physical or chemical properties that remain separate and distinct at the macroscopic or microscopic level within the finished structure. The primary goal is to produce materials with superior properties compared to their individual components, typically focusing on high strength-to-weight ratio, stiffness, durability, and resistance to corrosion and fatigue. Key constituents often include high-performance fibers like carbon, glass, aramid, or basalt, embedded within a matrix material, commonly thermoset (e.g., epoxy, polyester) or thermoplastic resins, chosen for specific performance profiles.

Major applications for composite fabrication technology are widespread and critically important across various industrial sectors. In aerospace, it is indispensable for manufacturing lightweight aircraft components, fuselage sections, and satellite structures, leading to significant fuel savings, reduced structural weight, and enhanced operational performance. The automotive industry utilizes composites for chassis components, body panels, and electric vehicle battery enclosures to achieve vehicle lightweighting, improve fuel efficiency, extend electric range, and enhance safety features. The wind energy sector relies heavily on composite fabrication for producing large, aerodynamic wind turbine blades, which are crucial for efficient energy capture, structural integrity, and longevity in harsh environmental conditions.

Beyond these, composites find extensive use in marine applications for hulls and superstructures due to their exceptional corrosion resistance, reduced weight, and durability; in construction for composite rebar, bridge decks, and architectural panels offering superior strength and extended lifespan; and in sporting goods for high-performance equipment demanding extreme strength and light weight. The inherent benefits of composite materials, such as their exceptional strength-to-weight ratio, design flexibility, and resistance to environmental degradation, are primary driving factors. Moreover, increasing environmental regulations pushing for fuel efficiency and reduced emissions, coupled with the rising demand for high-performance, durable, and sustainable materials across global industries, are vigorously propelling the growth and innovation within the composite fabrication technology market, fostering a future of advanced material solutions.

Composite Fabrication Technology Market Executive Summary

The Composite Fabrication Technology Market is currently undergoing significant transformation, driven by a confluence of evolving business trends, distinct regional growth patterns, and dynamic shifts across its core segments. Business trends are largely characterized by an accelerating adoption of automation and digitalization, enabling more efficient and precise manufacturing processes while concurrently addressing labor skill gaps and improving overall productivity. Sustainability initiatives are also paramount, pushing for the development and integration of bio-based resins, recycled fibers, and more circular production methodologies, which are reshaping supply chains and product lifecycles across the industry, aligning with global environmental objectives and consumer demands for greener products.

Regionally, the market exhibits a robust growth trajectory, particularly in Asia-Pacific, where rapid industrialization, burgeoning manufacturing capabilities, and increasing investments in infrastructure and renewable energy projects are fueling substantial demand. North America and Europe, while representing more mature markets, continue to be innovation hubs, with strong emphasis on high-performance applications in aerospace, defense, and advanced automotive sectors, coupled with a growing focus on sustainable solutions, advanced research and development, and stringent regulatory compliance. Emerging markets in Latin America and the Middle East are also showing promise, driven by new infrastructure developments, energy projects, and diversification strategies, indicative of a globally expanding market footprint.

Segment-wise, the aerospace and defense sector remains a critical pillar, consistently demanding advanced composites for superior performance, extreme lightweighting, and structural integrity in demanding environments. However, the automotive industry is poised for substantial growth, largely influenced by the global shift towards electric vehicles (EVs) and the imperative for fuel efficiency in conventional vehicles, creating a robust demand for mass-producible, cost-effective composite components. The wind energy sector also continues its strong expansion, necessitating larger, more durable, and aerodynamically efficient composite blades for next-generation turbines. These trends collectively underscore a market moving towards greater industrialization, material innovation, and a more sustainable future, necessitating adaptable, advanced, and intelligent fabrication technologies to meet evolving global demands.

AI Impact Analysis on Composite Fabrication Technology Market

Common user questions regarding AI's impact on Composite Fabrication Technology often revolve around how artificial intelligence can address current industry challenges such as high material and processing costs, complex design optimization, quality control inconsistencies, and the time-consuming nature of research and development cycles. Users frequently inquire about AI's potential to automate intricate manufacturing steps, predict material performance under various operational conditions, and minimize defects proactively, ultimately seeking insights into how AI can make composites more economically viable and widely adoptable for mass-market applications. There is also significant interest in AI's role in accelerating the discovery and development of novel composite materials with enhanced properties and in bolstering sustainability efforts within the sector through optimized resource utilization and recycling.

Based on this analysis, the key themes, concerns, and expectations center on AI's capacity to revolutionize every stage of the composite lifecycle, from initial material design and virtual prototyping to sophisticated manufacturing processes, in-service performance monitoring, and end-of-life recycling. Users anticipate AI will unlock unprecedented levels of efficiency, precision, and intelligence in composite manufacturing, enabling sophisticated predictive models for material behavior and process parameters, thereby reducing reliance on extensive physical testing. The expectation is that AI will streamline complex workflows, mitigate human error, and facilitate quicker iteration cycles for both product design and manufacturing process optimization, directly leading to significant cost reductions, accelerated time-to-market, and substantial performance improvements previously deemed unattainable.

AI's influence is indeed transformative, offering solutions that range from optimizing material selection and accelerating design through generative algorithms to enhancing manufacturing precision via real-time process control and implementing robust quality assurance systems. By leveraging machine learning and advanced data analytics, AI can analyze vast datasets from simulations and production runs, identifying optimal parameters for resin curing, fiber placement, and pressure application, thereby minimizing waste, improving structural integrity, and significantly reducing overall production costs. This comprehensive integration of AI is set to propel composite fabrication technology into a new era of efficiency, innovation, and widespread industrial applicability, addressing some of the most persistent challenges in the field and enabling the creation of advanced, customized composite solutions at scale.

- Generative Design and Material Optimization: AI algorithms rapidly explore vast design spaces and optimize composite structures for weight, strength, stiffness, and performance across multiple load cases, simultaneously predicting optimal material combinations and lay-up configurations for specific applications.

- Predictive Manufacturing and Process Control: Machine learning models analyze real-time sensor data from fabrication lines to predict and prevent defects, optimize complex curing cycles, control fiber placement accuracy, and ensure consistent quality during various manufacturing stages, significantly reducing scrap rates and rework.

- Automated Quality Inspection and Defect Detection: AI-powered vision systems, integrated with non-destructive testing (NDT) techniques like ultrasound or thermography, analyze images and sensor data to automatically identify and classify flaws, voids, delaminations, and porosity with high accuracy and speed, surpassing human inspection capabilities.

- Supply Chain Optimization and Demand Forecasting: AI enhances the resilience and efficiency of the composite supply chain by predicting material shortages, optimizing inventory levels for expensive raw materials, streamlining logistics, and providing accurate demand forecasts based on market trends and production schedules.

- In-service Performance Monitoring and Predictive Maintenance: AI interprets data from embedded sensors in composite structures (e.g., aircraft components, wind turbine blades) to monitor structural health, detect early signs of damage or degradation, predict remaining useful life, and schedule maintenance proactively, thereby extending asset lifespan and reducing operational downtime.

- Accelerated Research and Development: AI rapidly analyzes vast experimental data, simulates new material compositions, predicts mechanical and chemical properties, and identifies promising material combinations, significantly shortening the development cycle for novel composite materials and advanced fabrication processes, leading to faster innovation.

- Enhanced Recycling and Circularity Strategies: AI assists in identifying and sorting different composite types for effective recycling, optimizing material separation processes, and facilitating the development of circular economy solutions for composites by analyzing material composition and potential reprocessing routes, addressing environmental concerns.

DRO & Impact Forces Of Composite Fabrication Technology Market

The Composite Fabrication Technology Market is driven by a compelling combination of factors, primarily the escalating global demand for lightweight and high-strength materials across critical sectors such as aerospace, automotive, and wind energy. Industries are increasingly seeking composite solutions to achieve superior performance characteristics, including improved fuel efficiency in transportation due to reduced vehicle weight, enhanced durability and corrosion resistance in infrastructure, and greater energy capture efficiency in renewable energy systems. The intrinsic advantages of composites, such as their exceptional strength-to-weight ratio, superior fatigue resistance, and extended service life compared to traditional materials, make them indispensable for meeting stringent regulatory requirements related to emissions reductions, safety standards, and structural integrity across various applications.

Despite these significant drivers, the market faces notable restraints that could temper its growth trajectory. The high initial investment costs associated with acquiring advanced manufacturing equipment and tooling, coupled with the inherent complexity of composite fabrication processes that often demand specialized skills, extensive training, and sophisticated infrastructure, pose significant barriers to entry and expansion for many manufacturers. Furthermore, the elevated cost of raw materials, particularly high-performance fibers like carbon fiber, and certain advanced resin systems, presents a continuous challenge, impacting the overall cost-effectiveness of composite parts. Concerns regarding the reparability and recyclability of thermoset composites, leading to environmental considerations and difficulties in end-of-life management, also contribute to market constraints and push for alternative, more sustainable solutions, necessitating substantial R&D investment.

Nevertheless, the market is brimming with opportunities for substantial expansion and innovation, poised to overcome current limitations through technological advancements. The emergence and increasing adoption of sustainable and bio-based composites, alongside the relentless development of advanced manufacturing techniques such as additive manufacturing (3D printing) specifically for composites, are opening new avenues for growth and cost reduction. The exploration of new application areas, including urban air mobility (UAM) vehicles, hydrogen storage tanks for clean energy, and advanced medical devices, further expands the addressable market for composite solutions. Moreover, the continuous integration of automation, digitalization, and Artificial Intelligence into fabrication processes promises to significantly reduce production costs, improve efficiency, enhance the overall quality and consistency of composite products, and accelerate development cycles, thereby mitigating many existing restraints and propelling the market forward into a new era of composite widespread adoption.

Segmentation Analysis

The Composite Fabrication Technology market is highly dynamic and diverse, segmented across various critical dimensions that provide a comprehensive understanding of its structure, growth drivers, and evolving applications. These segmentations are crucial for stakeholders to identify specific market niches, understand demand patterns, and strategize for future growth, enabling targeted product development and market penetration. The market can be dissected by the fundamental components of composites, such as the type of fiber and resin utilized, which are paramount as they dictate the material's final mechanical, thermal, and chemical properties, thereby determining its suitability for different high-performance applications and environments.

Furthermore, the manufacturing process employed is a key differentiator, significantly influencing production scale, cost-efficiency, design complexity, and the ultimate quality of the composite part. Advanced processes like Automated Fiber Placement (AFP) or Resin Transfer Molding (RTM) offer different advantages in terms of throughput, material waste, and part integration. Beyond material and process, the segmentation by end-use industry is paramount, as it directly reflects the demand landscape and the specific requirements of major sectors like aerospace, automotive, and wind energy. Each industry segment often demands tailored composite solutions, driving innovation in material science and fabrication techniques to meet sector-specific performance criteria, stringent regulatory compliance, and increasingly critical cost targets.

- By Fiber Type: This segmentation differentiates the market based on the type of reinforcement fibers used, which are critical for the composite's strength and stiffness.

- Carbon Fiber Composites: Known for exceptional strength-to-weight ratio and stiffness, primarily used in aerospace, high-performance automotive, and sporting goods.

- Glass Fiber Composites: Cost-effective with good strength, widely used in wind energy, marine, and construction applications.

- Aramid Fiber Composites: Valued for high impact resistance and toughness, found in ballistic protection and specialized industrial applications.

- Basalt Fiber Composites: Offers good thermal stability and chemical resistance, emerging in construction and automotive.

- Natural Fiber Composites: Environmentally friendly options gaining traction in automotive interiors and consumer goods.

- Other Advanced Fibers: Includes ceramic, metallic, and specialty polymer fibers for niche high-performance applications.

- By Resin Type: This category distinguishes composites based on the matrix material, which binds the fibers and dictates environmental resistance and processing.

- Thermoset Composites: Irreversibly cured resins (Epoxy, Polyester, Vinyl Ester, Phenolic, Bismaleimide, Polyurethane) offering excellent mechanical properties, heat resistance, and chemical stability.

- Thermoplastic Composites: Resins (PEEK, PEKK, PPS, PA, PP, PET, Polycarbonate) that can be re-melted and reshaped, offering better impact resistance, faster processing, and recyclability.

- Bio-based Resins: Derived from renewable resources, addressing sustainability concerns and offering a greener alternative.

- By Manufacturing Process: This segmentation focuses on the techniques used to combine fibers and resins into a final product, affecting scale, cost, and part complexity.

- Hand Lay-up & Spray Lay-up: Manual processes for low-volume production and complex shapes.

- Filament Winding: Automates winding fibers over a rotating mandrel for cylindrical or spherical parts (e.g., pipes, tanks).

- Pultrusion: Continuous process for producing constant cross-section profiles (e.g., rods, beams).

- Resin Transfer Molding (RTM) & Light RTM: Closed mold processes for higher volume, good surface finish, and precise dimensions.

- Vacuum Infusion Process (VIP): Uses vacuum pressure to draw resin into a dry fiber preform, reducing voids.

- Compression Molding: High-volume process for producing complex, high-strength parts using heat and pressure.

- Injection Molding: Suitable for high-volume production of small, intricate composite parts, often with short fibers.

- Automated Fiber Placement (AFP) & Automated Tape Laying (ATL): Robotic processes for precise, high-speed placement of pre-impregnated tapes or fibers, common in aerospace.

- Additive Manufacturing (3D Printing): Creates complex geometries layer by layer, suitable for prototypes and customized parts, including continuous fiber reinforcement.

- Prepreg Lay-up & Autoclave Processing: Utilizes pre-impregnated fabrics cured under heat and pressure for high-performance, critical parts.

- Sheet Molding Compound (SMC) & Bulk Molding Compound (BMC): Ready-to-mold compounds for high-volume, cost-effective parts.

- By End-Use Industry: This critical segmentation categorizes market demand based on the sectors applying composite technology.

- Aerospace & Defense: Commercial Aircraft, Military Aircraft, Space & Satellites, Drones/UAVs, demanding lightweight and high-performance structures.

- Automotive & Transportation: Passenger Vehicles (EVs & ICE), Commercial Vehicles, Rail, Public Transport, Marine (boats, yachts), aiming for lightweighting, fuel efficiency, and extended range.

- Wind Energy: Wind Turbine Blades, Nacelles, Towers, crucial for efficient and durable renewable energy generation.

- Construction & Infrastructure: Composite Rebar, Bridge Decks, Architectural Panels, Pipe Relining, offering durability, corrosion resistance, and extended lifespan.

- Sporting Goods: Bicycles, Rackets, Golf Clubs, Skis, Boats, where lightweight and strength enhance performance.

- Electrical & Electronics: Circuit Boards, Electrical Housings, Insulators, for high strength, low weight, and electrical properties.

- Pipes & Tanks: Oil & Gas (pipelines, storage tanks), Chemical Storage, Water Treatment, for corrosion resistance and structural integrity.

- Medical: Prosthetics, Orthotics, Imaging Equipment (CT, MRI), Surgical Instruments, valuing biocompatibility, radiolucency, and lightweighting.

- Others: Consumer Goods, Industrial Machinery, Mining Equipment, Robotics, and emerging niche applications.

Value Chain Analysis For Composite Fabrication Technology Market

The value chain for the Composite Fabrication Technology market is a complex ecosystem beginning with upstream raw material suppliers and extending through intricate manufacturing processes to downstream distribution and diverse end-use applications. The upstream segment primarily involves the production of foundational components, including high-performance fibers such as carbon, glass, aramid, and basalt, as well as various polymer resins like epoxy, polyester, vinyl ester, and a growing range of thermoplastics. These suppliers are critical innovators, constantly working on material improvements, cost reductions, and sustainability initiatives, directly influencing the performance, processability, and market adoption of subsequent composite products. Their R&D efforts, focused on enhancing fiber properties or developing faster-curing, more environmentally friendly resins, often dictate the future capabilities and competitive landscape of the entire composite industry.

Moving downstream, the mid-stream activities encompass the conversion of these raw materials into intermediate products and then into finished composite components. This involves material formulators who process raw fibers into fabrics, mats, or prepregs (pre-impregnated materials), or blend resins with additives to create specialized molding compounds (SMC, BMC). Subsequently, composite fabricators employ a wide array of processes such as Automated Fiber Placement (AFP), Resin Transfer Molding (RTM), pultrusion, filament winding, vacuum infusion, and compression molding to transform these intermediate materials into specific parts. These parts range from large aerospace fuselage sections and wind turbine blades to intricate automotive chassis components and sporting equipment, with the choice of fabrication technology heavily dictated by part complexity, volume requirements, desired performance specifications, and economic considerations.

The final stages of the value chain involve the distribution channels and the integration of composite parts into end-user products. Distribution can occur directly from large fabricators to Original Equipment Manufacturers (OEMs) in aerospace or automotive sectors for high-volume, customized components, or through specialized distributors catering to smaller enterprises and diverse industrial applications requiring off-the-shelf or semi-custom solutions. The effectiveness of direct versus indirect channels often depends on order volume, customization needs, geographic reach, and technical support requirements. Ultimately, the successful integration of composite components by end-users into their final products drives demand across the entire value chain, highlighting the interdependence of each segment and the critical need for seamless collaboration, technological exchange, and robust quality control throughout the entire lifecycle to achieve optimal market penetration and continuous innovation.

Composite Fabrication Technology Market Potential Customers

The potential customers for Composite Fabrication Technology are diverse, primarily comprising industries that prioritize performance characteristics such as extreme lightweighting, exceptional high strength, superior durability, and robust resistance to harsh environmental conditions like corrosion and fatigue. The aerospace and defense sector represents a cornerstone customer base, with demand stemming from manufacturers of commercial aircraft, military jets, helicopters, space launch vehicles, and satellites. These entities seek advanced composites to significantly reduce structural weight, enhance fuel efficiency, improve payload capacity, and extend the operational lifespan of their assets, making composites indispensable for both established and emerging aviation and space technologies, including urban air mobility (UAM) and advanced unmanned aerial vehicles (UAVs).

Another rapidly expanding customer segment is the automotive and transportation industry, including both traditional internal combustion engine (ICE) vehicle manufacturers and, more significantly, electric vehicle (EV) producers. These customers leverage composite fabrication technology to reduce vehicle weight, thereby substantially improving fuel economy in ICE vehicles and extending battery range in EVs. Composites are utilized for body panels, chassis components, battery enclosures, and structural safety parts, driven by stringent emissions regulations, consumer demand for efficiency and range, and the need for enhanced safety features and crashworthiness. The rail and public transport sectors are also increasingly exploring composites for lightweighting, noise reduction, and reducing maintenance requirements, contributing to overall operational cost savings.

Furthermore, the renewable energy sector, particularly wind turbine manufacturers, constitutes a substantial and growing customer group, requiring composites for the production of increasingly larger, more efficient, and structurally robust wind turbine blades to maximize energy capture and withstand extreme weather conditions. The marine industry, encompassing yacht builders, boat manufacturers, and naval vessel producers, extensively uses composites for hulls, decks, and superstructures due to their excellent corrosion resistance, reduced weight for increased speed and fuel efficiency, and design flexibility. Other significant customer segments include construction (for infrastructure reinforcement, bridge decks, and architectural elements demanding longevity), sporting goods (for high-performance equipment), medical devices (for prosthetics, orthotics, and imaging equipment valuing biocompatibility and radiolucency), and the oil & gas industry (for lightweight, corrosion-resistant pipes and storage tanks), each valuing the unique advantages that composite fabrication technology offers for their specialized and demanding applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.8 Billion |

| Market Forecast in 2033 | USD 55.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, Inc., Hexcel Corporation, SGL Carbon SE, Solvay SA, Teijin Limited, Cytec Solvay Group, PPG Industries Inc., Owens Corning, Mitsubishi Chemical Corporation, BASF SE, SABIC, DSM, Gurit Holding AG, SAERTEX GmbH & Co. KG, A&P Technology Inc., Spirit AeroSystems, Inc., Albany Engineered Composites, Kaman Corporation, Triumph Group, Inc., Vögele AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Fabrication Technology Market Key Technology Landscape

The key technology landscape of the Composite Fabrication Technology market is characterized by relentless innovation aimed at improving efficiency, reducing costs, and expanding the capabilities of composite materials for both mass production and highly specialized, critical applications. A cornerstone of this landscape involves advanced automation, prominently featuring Automated Fiber Placement (AFP) and Automated Tape Laying (ATL) systems. These robotic technologies enable the precise and rapid deposition of pre-impregnated fiber tapes or tow onto complex molds, dramatically reducing manual labor, improving material utilization by minimizing waste, and ensuring consistent part quality, which is especially critical in aerospace and high-performance automotive manufacturing where geometric precision and structural integrity are paramount.

Another transformative technological area is additive manufacturing, or 3D printing, specifically tailored for composites. This includes processes such as Fused Filament Fabrication (FFF) with chopped or continuous fiber reinforcement, Selective Laser Sintering (SLS) of polymer-composite powders, and various liquid resin-based methods utilizing composite fillers or continuous fiber impregnation. Additive manufacturing for composites facilitates the creation of highly complex geometries, customized parts with integrated functionalities, and functional prototypes, often bypassing expensive traditional tooling requirements. This significantly accelerates product development cycles, reduces lead times, and enables the production of parts with tailored anisotropic properties for specific performance demands across various industries, from medical to defense.

Furthermore, the pervasive integration of digital technologies, including advanced simulation software, digital twin technology, and real-time process monitoring, is fundamentally reshaping composite fabrication. Simulation tools predict material behavior under load, optimize manufacturing parameters, and assess failure modes, minimizing costly physical prototyping and trial-and-error. Digital twins create virtual replicas of manufacturing processes and physical products, allowing for continuous optimization, predictive maintenance, and enhanced asset management throughout the product lifecycle. Real-time sensors and data analytics embedded within the production line provide immediate feedback on critical process variables like temperature, pressure, and cure state, ensuring quality consistency, reducing waste, and enabling intelligent decision-making. These digital advancements, alongside new rapid-cure resin systems, advanced tooling materials, and enhanced non-destructive testing (NDT) techniques, collectively drive the industry towards more robust, cost-effective, sustainable, and scalable composite manufacturing solutions capable of meeting future industrial demands.

Regional Highlights

Global demand for composite fabrication technology exhibits distinct regional patterns, heavily influenced by industrialization levels, existing regulatory frameworks, significant R&D investments, and the concentration of key end-use industries within each geographical area. Each region presents unique growth opportunities and challenges, contributing differently to the overall market trajectory. Mature markets in North America and Europe, for instance, are characterized by high-value applications, extensive research infrastructure, and a strong emphasis on technological advancement and sustainability initiatives, driving innovation in advanced composite solutions. Meanwhile, the Asia-Pacific region is experiencing rapid and substantial growth driven by burgeoning manufacturing sectors, massive infrastructure development, and an expanding industrial base.

The strategic geographical distribution of composite manufacturing capabilities and consumer markets dictates investment flows, technological priorities, and supply chain configurations. Understanding these regional dynamics is crucial for market participants to tailor their strategies, optimize supply chains for efficiency and resilience, and identify prime locations for expansion or strategic partnerships. Factors such as government support for renewable energy projects, evolving automotive production trends, and the level of activity within the aerospace industry are key determinants of regional market performance and future growth potential in composite fabrication, showcasing a complex interplay of economic, environmental, and technological influences.

- North America: This region is a significant and mature market driven by strong, consistent demand from the aerospace and defense sectors, where composites are critical for extreme lightweighting, enhanced performance, and strategic capabilities. The automotive industry, particularly the accelerating electric vehicle manufacturing sector, is also a key growth driver, alongside substantial investments in cutting-edge research and development for advanced composite materials and innovative fabrication processes, maintaining its leadership in high-value applications.

- Europe: A leading global market, particularly prominent in the wind energy sector with extensive offshore wind farm projects that require increasingly larger and more sophisticated composite blades. Europe also boasts a robust automotive industry focused on premium and performance vehicles, coupled with a strong emphasis on sustainable composites and proactive regulatory frameworks promoting circular economy initiatives, fostering continuous innovation in eco-friendly fabrication methods and materials.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, APAC benefits from rapid industrialization, massive ongoing infrastructure development, and surging automotive production, especially in economic powerhouses like China, India, and Japan. Significant government support for manufacturing and renewable energy, coupled with a rapidly growing middle class and expanding industrial base, fuels widespread adoption across diverse and large-scale applications.

- Latin America: An emerging market experiencing growing investments in large-scale infrastructure projects, expansion in transportation networks, and increasing industrialization across various sectors. While currently a smaller share of the global market, the region offers promising future growth potential as economic development and industrial modernization continue, driving demand for durable, efficient, and cost-effective material solutions.

- Middle East and Africa (MEA): Growth in MEA is primarily observed in critical sectors such as the oil & gas industry for corrosion-resistant pipes and structures, large-scale construction projects requiring lightweight and durable materials, and burgeoning renewable energy initiatives, particularly solar and wind, in Gulf Cooperation Council (GCC) countries, reflecting diversification efforts and infrastructure investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Fabrication Technology Market.- Toray Industries, Inc.

- Hexcel Corporation

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Cytec Solvay Group (a subsidiary of Solvay SA)

- PPG Industries Inc.

- Owens Corning

- Mitsubishi Chemical Corporation

- BASF SE

- SABIC

- DSM (now part of DSM-Firmenich)

- Gurit Holding AG

- SAERTEX GmbH & Co. KG

- A&P Technology Inc.

- Spirit AeroSystems, Inc.

- Albany Engineered Composites

- Kaman Corporation

- Triumph Group, Inc.

- Vögele AG (part of Wirtgen Group, specializing in machinery)

Frequently Asked Questions

What are the primary drivers for the Composite Fabrication Technology Market growth?

The market is primarily driven by the escalating global demand for lightweight and high-strength materials across aerospace, automotive, and wind energy sectors, coupled with increasing requirements for fuel efficiency, emission reduction, and superior performance characteristics in various industrial applications.

How is Artificial Intelligence (AI) impacting composite fabrication processes?

AI is transforming composite fabrication by enabling generative design for material optimization, predictive manufacturing control to reduce defects, automated quality inspection, and accelerated R&D for novel materials, leading to increased efficiency, reduced costs, and enhanced product quality and innovation across the entire product lifecycle.

What are the major restraints hindering the growth of this market?

Key restraints include the high initial investment costs for advanced manufacturing equipment, the inherent complexity of fabrication processes requiring specialized skills, the high cost of raw materials (e.g., carbon fiber), and challenges related to the reparability and recyclability of certain composite types, particularly thermoset resins.

Which end-use industries are the largest consumers of composite fabrication technology?

The aerospace & defense, automotive & transportation, and wind energy sectors are the largest consumers, driven by their critical need for lightweight, durable, and high-performance components to meet stringent operational, safety, and environmental requirements, leading to improved efficiency and extended product lifespan.

What emerging trends are shaping the future of composite fabrication?

Emerging trends include the development and increasing adoption of sustainable and bio-based composites, the rise of additive manufacturing (3D printing) for composites, advanced automation and digitalization of production lines, and the growing demand for multi-functional and smart composite materials with integrated sensing capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager