Composite Graphite Flow Field Plate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433219 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Composite Graphite Flow Field Plate Market Size

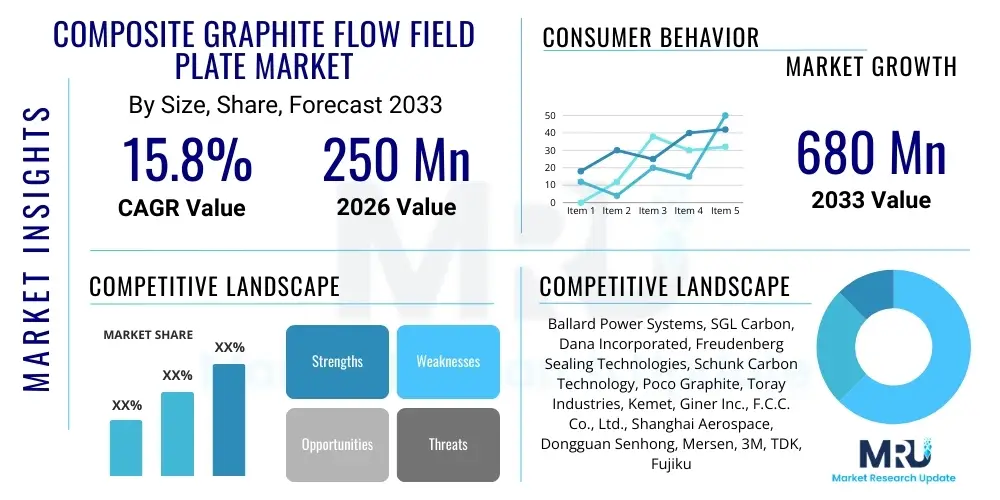

The Composite Graphite Flow Field Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 680 Million by the end of the forecast period in 2033.

Composite Graphite Flow Field Plate Market introduction

The Composite Graphite Flow Field Plate (FFP) Market is fundamentally driven by the escalating global demand for sustainable energy solutions, particularly in the realm of hydrogen fuel cells and advanced battery storage systems. These plates are critical, non-negotiable components in electrochemical devices, responsible for distributing reactant gases (like hydrogen and oxygen) efficiently and managing the flow of heat and electric current throughout the cell stack. Composite graphite, characterized by its combination of high purity graphite powder and specialized polymeric binders, offers a superior fusion of properties, including excellent electrical and thermal conductivity, exceptional corrosion resistance in acidic environments, and significantly reduced weight compared to traditional metallic or monolithic graphite materials. This advantageous material profile makes composite FFPs indispensable for achieving the stringent requirements of high power density, enhanced efficiency, and extended durability crucial for modern commercial energy conversion technologies, spanning from passenger vehicles to utility-scale energy storage installations.

The core product, the Composite Graphite Flow Field Plate, is manufactured through precision processes, predominantly compression molding or injection molding, which enables the fabrication of intricate, fine-featured flow channel designs necessary for optimizing reactant distribution, maximizing reaction kinetics, and facilitating effective water and heat management within the fuel cell stack. The composition typically involves a thermoset or thermoplastic resin reinforced with highly conductive carbonaceous materials. Functionally, the plate must serve multiple roles: creating defined pathways for gas flow, acting as an electrically conductive current collector linking adjacent cells in series, and providing structural integrity to the stack. By utilizing composites, manufacturers address the inherent mechanical brittleness and high machining costs associated with pure graphite plates, while simultaneously offering a lower resistivity solution compared to most corrosion-resistant metallic alloys, thus presenting a crucial balance of performance, processing ease, and long-term cost-effectiveness necessary for widespread commercialization, especially in the demanding automotive sector where lightweighting is paramount.

Major applications of these highly engineered flow field plates span across several burgeoning green technology sectors. They are essential components in Proton Exchange Membrane Fuel Cells (PEMFCs), powering Fuel Cell Electric Vehicles (FCEVs) and stationary Combined Heat and Power (CHP) units; they are foundational to the architecture of Redox Flow Batteries (RFBs), used for large-scale, long-duration grid energy storage; and they are crucial for advanced high-efficiency electrolyzers, which are vital for generating green hydrogen. The principal benefits derived from employing composite graphite plates include stable and high power output under various load conditions, a prolonged operational lifespan due to superior chemical inertness against electrolyte degradation, and a significantly reduced overall system weight, which directly translates into enhanced energy efficiency and extended range for mobile applications. The market expansion is fundamentally underpinned by robust governmental policies promoting hydrogen economies globally, significant infrastructural investments in hydrogen generation and dispensing, and the continuous industrial demand for lightweight, high-performance electrochemical components.

Composite Graphite Flow Field Plate Market Executive Summary

The Composite Graphite Flow Field Plate Market is currently experiencing a dynamic phase of rapid expansion, characterized by strategic shifts aimed at achieving mass-production capability and cost reduction. A primary business trend involves intense vertical integration and strategic collaborations where material science companies partner directly with major automotive and energy system OEMs to co-develop plates optimized for specific stack designs and operational environments. The market is witnessing a notable technical evolution focused on improving plate thickness reduction—targeting plates below 1.5mm—without compromising conductivity or mechanical strength. This necessitates advancements in high-pressure, high-precision compression molding and the deployment of automated manufacturing lines to drive down the cost per unit from the current high levels, positioning composite plates as a globally competitive solution against metallic alternatives, especially for high-volume automotive production. Furthermore, sustainability is becoming a key commercial driver, leading to R&D efforts in utilizing bio-derived or recycled polymers in composite binders.

Regionally, the market exhibits a bifurcated growth profile, heavily skewed towards Asia Pacific (APAC) as the established manufacturing and demand hub, contrasted by rapid acceleration in Europe and North America driven by policy mandates. APAC, spearheaded by Japan, South Korea, and particularly China, leverages existing infrastructure and aggressive government targets for FCEV adoption and hydrogen infrastructure deployment, maintaining its market dominance through volume production and competitive pricing. Conversely, Europe’s growth narrative is strongly linked to the deployment of large-scale PEM electrolyzers and stationary fuel cells, driven by the EU’s ambitious carbon neutrality goals and regulatory frameworks supporting green hydrogen production. North America, focusing on heavy-duty mobility (Class 8 trucks) and grid storage systems, emphasizes technological innovation, particularly in advanced materials and automated process control, receiving substantial stimulus from federal funding initiatives aimed at fostering domestic supply chain independence and high-performance material development.

Segmentally, the application landscape confirms that Proton Exchange Membrane Fuel Cells (PEMFCs) remain the largest revenue-generating segment, benefiting directly from the maturation of FCEV technology. However, the fastest growth trajectory is anticipated in the Redox Flow Battery (RFB) segment. This segment requires large-format, chemically robust composite plates, reflecting the global infrastructural pivot towards intermittent renewable energy and the subsequent need for long-duration grid storage capacity. Technology adoption trends show an increasing preference for sophisticated Polymer-Graphite Composites over Carbon Fiber Reinforced versions in certain cost-sensitive applications, as they offer an optimized balance of low resistivity, excellent durability, and better processing yields. Success in the market hinges on manufacturers’ ability to achieve consistency in quality at mass volumes and integrate seamlessly into the high-speed assembly lines of Tier 1 suppliers and OEMs.

AI Impact Analysis on Composite Graphite Flow Field Plate Market

User queries frequently highlight the potential of Artificial Intelligence (AI) and Machine Learning (ML) to revolutionize the material design and production efficiency within the Composite Graphite Flow Field Plate sector. Key concerns center around utilizing sophisticated algorithms to bypass the traditional, lengthy trial-and-error approach to material selection. Users want clarity on how ML models can analyze vast datasets of material properties (e.g., filler type, particle size distribution, binder molecular structure) and manufacturing parameters (molding pressure, curing time, temperature profiles) to predict optimal composite formulations that maximize electrical conductivity while ensuring low gas permeability and high mechanical stability. This integration is crucial for reducing R&D costs and accelerating the time-to-market for next-generation plates capable of supporting higher current densities and prolonged operational lifecycles.

Furthermore, a major focus of user interest is the application of AI in enhancing manufacturing scalability and quality assurance. The intricate nature of flow channels requires extremely high precision, making defect detection challenging in high-volume production. AI-driven computer vision systems, integrated with production lines, are expected to perform real-time, highly accurate quality inspections—identifying microscopic cracks, incomplete mold filling, or surface inconsistencies—far exceeding human capabilities. This automation promises to drastically improve manufacturing yields and reduce scrap rates, which is paramount for achieving the price points necessary for widespread FCEV adoption. The ability of AI to model complex, multi-physics phenomena—such as gas flow dynamics, heat transfer, and electrochemical degradation—through advanced simulation tools is viewed as a transformative element, enabling engineers to refine plate geometries virtually before costly physical tooling begins.

Ultimately, the consensus among market stakeholders is that AI will be instrumental in the cost curve reduction of composite graphite plates. By utilizing ML for predictive maintenance, operators can monitor stack performance and environmental factors to schedule replacements optimally, improving the reliability and reducing the total cost of ownership for end-users. AI’s capacity to optimize resource allocation, forecast material needs based on fluctuating demand, and refine energy consumption during manufacturing also contributes significantly to operational efficiency and supply chain resilience. The successful incorporation of these AI technologies is viewed not merely as an incremental improvement but as a critical enabler for reaching gigawatt-scale manufacturing capacity required by the global hydrogen and battery markets.

- AI-driven material informatics accelerate the discovery of optimal binder-graphite compositions, enhancing electrical conductivity and mechanical robustness. ML models predict the performance characteristics of novel composites, drastically reducing physical testing requirements.

- Machine learning algorithms optimize high-precision compression molding parameters (temperature, pressure profiles, cure cycles) in real-time to minimize internal void formation, eliminate warpage, and improve yield rates in large-scale production runs.

- Predictive maintenance models utilize stack sensor data (voltage, temperature gradients) and operational history to accurately forecast flow field plate degradation and potential failure points, extending the mean time between failures (MTBF).

- Computational Fluid Dynamics (CFD) simulations, often accelerated by AI, rapidly iterate and optimize intricate flow channel designs for superior reactant gas distribution, improved thermal dissipation, and efficient water management, leading to higher power density stacks.

- AI facilitates robust supply chain management by analyzing volatile raw material prices (graphite, carbon fiber) and predicting procurement needs, mitigating risks associated with supply bottlenecks and price fluctuations.

- Automated visual inspection systems using deep learning and computer vision significantly enhance quality control by detecting microscopic surface defects and dimensional inaccuracies during the rapid, high-volume manufacturing of composite plates.

- AI-enabled robotic handling systems improve the precision and speed of assembling delicate plates into large fuel cell and electrolyzer stacks, reducing labor costs and potential damage.

DRO & Impact Forces Of Composite Graphite Flow Field Plate Market

The Composite Graphite Flow Field Plate Market is strongly propelled by macro-environmental drivers focused on global energy transitions, notably the aggressive political and corporate pivot towards zero-emission technologies. The primary driver is the accelerating commercialization and deployment of Fuel Cell Electric Vehicles (FCEVs), particularly in heavy-duty and logistics segments, where the lightweight, high-performance nature of composite plates provides a distinct advantage in terms of energy efficiency and payload capacity. This driver is powerfully supported by regulatory mandates, such as the EU’s emission reduction targets and the US government’s commitment to hydrogen hubs, creating massive, consistent demand signals for high-quality components. Concurrently, the necessity for robust, long-duration energy storage systems is fueling the rapid adoption of Redox Flow Batteries (RFBs), which rely intrinsically on composite graphite for their electrode and flow structures, establishing a second major, high-growth application independent of the transport sector.

Conversely, significant restraints impede the unconstrained growth of the market, primarily centered on technological and economic bottlenecks. The manufacturing process of composite plates requires expensive precision tooling and high initial capital expenditure (CapEx) for fully automated production lines capable of producing sub-millimeter plates with tight tolerances. Furthermore, the inherent volatility and dependence on high-purity, specialized raw materials, particularly synthetic graphite or specific carbon fibers, introduce supply chain risks and cost fluctuations that challenge stable long-term pricing structures. A persistent technical constraint is the balancing act between maximizing mechanical strength—to enable thinner, lighter plates—and minimizing electrical resistivity, as polymer binders, while providing structure, inherently increase resistance compared to pure conductive materials. Overcoming these cost and technical hurdles is essential for realizing true mass-market penetration and achieving the critical cost per kilowatt target.

Opportunities for expansion are abundant, particularly in process innovation and vertical integration. The shift towards continuous, highly automated manufacturing techniques, such as injection molding combined with in-situ curing, promises to drastically lower the cycle time and cost per plate, moving the industry closer to parity with metallic plates. Furthermore, technological breakthroughs in developing novel, highly conductive, and chemically resistant polymer matrices offer avenues for next-generation plates that can operate reliably under harsher conditions (higher temperatures, wider pH ranges). Impact forces are characterized by escalating regulatory pressures forcing emission reduction, intensified R&D efforts aimed at materials substitution and advanced coating technologies, and strong competitive rivalry among established chemical giants and specialized fuel cell component manufacturers. The overall impact favors market acceleration, contingent upon successful cost reduction through technological scaling and improved supply chain robustness.

Segmentation Analysis

The Composite Graphite Flow Field Plate market segmentation provides a comprehensive view of how different product types, material compositions, and end-use applications contribute to overall market dynamics, performance requirements, and investment prioritization. Analyzing the market by Type reveals that bipolar plates, which are central to the stack architecture of PEMFCs and electrolyzers, constitute the largest and most strategically important segment, defining the stack’s voltage and overall efficiency. Segmentation by Application clearly delineates the market’s exposure to the volatile but high-potential mobility sector (PEMFCs) versus the more stable, utility-driven infrastructure sector (RFBs and Electrolyzers). This diversification cushions the market against slowdowns in any single end-user category and highlights the material's critical role across the hydrogen and renewable energy value chain. The Material segment details the technological competition between different composite formulations, emphasizing the crucial trade-offs between performance (Carbon Fiber Reinforced) and cost-effectiveness (Polymer-Graphite Powder composites) necessary for market penetration.

The dominance of Bipolar Plates within the Type segment is derived from their necessity in forming high-voltage stacks, where they manage electrical connection, gas distribution for two adjacent cells, and cooling requirements, demanding extremely low electrical resistance and high precision. While monopolar plates are simpler and used extensively in early-stage R&D or smaller stacks, bipolar plates drive the industrial volume and value. The Application analysis underscores the dual-market nature: while PEMFCs command current revenues due to the ongoing FCEV deployment cycles by major automotive OEMs, the Electrolyzer and RFB segments are projected to experience exponential growth, particularly post-2028, driven by the global imperative to produce green hydrogen and manage massive variable renewable energy sources on the grid. This segment shift dictates future material requirements, focusing on larger-format plates and long-term chemical resilience.

Material segmentation indicates continuous innovation. Carbon Fiber Reinforced Composites offer superior mechanical strength and conductivity, making them highly desirable for high-performance applications like military or high-end FCEVs where durability under rapid thermal cycling is paramount. Conversely, Natural Graphite Powder Composites mixed with polymer binders offer the most scalable and cost-effective solution, increasingly favored by manufacturers aiming for competitive pricing in commercial vehicle and stationary power segments. The market trend is leaning towards optimizing the percentage loading and morphology of graphite particles within the polymer matrix to achieve the required balance of low porosity (preventing gas crossover), high conductivity, and manufacturing ease. Strategic material choices are directly linked to the final target price and expected lifespan of the electrochemical device, making material innovation a central element of competitive differentiation.

- By Type:

- Bipolar Plates (Dominating volume and value due to stack requirements)

- Monopolar Plates (Used primarily in single-cell testing and smaller units)

- Unitized Plates (Integrating flow field and current collector functions)

- By Application:

- Proton Exchange Membrane Fuel Cells (PEMFC) (Automotive and Stationary Power)

- Redox Flow Batteries (RFB) (Grid-scale, long-duration energy storage)

- Electrolyzers (Water Electrolysis, Green Hydrogen Production)

- Industrial Processing (Chemical and Electroplating)

- By Material:

- Carbon Fiber Reinforced Composite (High mechanical strength and performance)

- Natural Graphite Powder Composite (Cost-effective and scalable solution)

- Polymer-Graphite Composite (Utilizing specialized thermoset and thermoplastic binders)

- By Manufacturing Process:

- Compression Molding (Most common for high-volume, high-precision plates)

- Injection Molding (Emerging technique for high throughput)

- Extrusion and Lamination

Value Chain Analysis For Composite Graphite Flow Field Plate Market

The upstream segment of the Composite Graphite Flow Field Plate value chain is concentrated around the sourcing and processing of specialized conductive raw materials. This includes high-purity, often exfoliated, graphite powder, various carbon fibers (e.g., PAN-based or pitch-based), and engineering-grade polymer resins, such as phenolic, epoxy, or various polyolefins, which act as the binding agent. The quality and particle morphology of the graphite are paramount, directly influencing the final plate's conductivity and gas permeability. Major graphite producers and chemical companies specializing in advanced polymers are the key players here. Critical value-added activities involve the micronization of graphite and the sophisticated compounding of the polymer-graphite mix to ensure uniform dispersion and optimal flow characteristics for the subsequent molding stage. Fluctuations in the global price of graphite and petrochemical-derived polymers significantly impact the final manufacturing cost, making supplier relationship management and long-term contracts critical for maintaining margin stability.

The midstream segment is characterized by complex and capital-intensive manufacturing processes. Composite plate manufacturers—ranging from dedicated component specialists like SGL Carbon and Schunk to specialized divisions of large conglomerates—undertake the high-precision molding. Compression molding is the predominant method, requiring expensive, precisely machined tooling to create the complex flow channel geometries and maintain tight dimensional tolerances essential for stack integration and performance. Value is added through precision engineering, quality control (QC), and achieving high throughput rates. As plates become thinner and stack designs become more complex, investment in automated quality inspection systems and advanced tooling maintenance becomes mandatory. The trend towards thinning plates and increasing active area size requires manufacturers to continuously refine their material handling and molding techniques to prevent warpage and ensure consistent through-plane conductivity.

The downstream segment focuses on market access, system integration, and end-user deployment. Distribution channels are highly specialized, often involving direct supply agreements (OEM supply) between the plate manufacturer and the fuel cell system integrator (e.g., Ballard Power Systems, Plug Power, or major automotive companies like Toyota). Indirect distribution, involving technical distributors, serves smaller R&D labs and specialized industrial applications. The ultimate end-users/buyers are Automotive OEMs (FCEV manufacturers), Grid Utilities (for RFB deployment), and Industrial Gas Producers (for electrolyzers). Success in the downstream market depends not only on the price point but crucially on the supplier’s reputation for quality, consistency, and the ability to meet extremely long-term warranty and durability requirements dictated by high-value energy systems like heavy-duty trucks (expected lifespan of 20,000+ hours). The proximity of manufacturing facilities to major fuel cell assembly hubs is increasingly important for minimizing logistics costs and optimizing the just-in-time supply model.

Composite Graphite Flow Field Plate Market Potential Customers

The primary and most lucrative customer base for Composite Graphite Flow Field Plates consists of Tier 1 and Tier 2 Fuel Cell System Integrators, alongside global Automotive Original Equipment Manufacturers (OEMs). These customers require high-volume, standardized plates optimized for Proton Exchange Membrane Fuel Cells (PEMFCs) used in FCEVs, including passenger cars, delivery vans, commercial buses, and heavy-duty trucks. Purchasing criteria for this group are exceptionally stringent, prioritizing lightweighting, extremely low electrical contact resistance, chemical compatibility with the GDL and membrane, and the proven ability to maintain performance integrity over tens of thousands of operating hours and high thermal cycling, essential for regulatory compliance and consumer confidence. Long-term supply contracts are the norm, necessitating suppliers with scalable, globally distributed manufacturing capabilities.

A rapidly expanding segment of high-value potential customers includes Electrolyzer Manufacturers, focusing on both PEM and Alkaline technologies, who are crucial players in the green hydrogen generation ecosystem. As industrial and utility-scale green hydrogen projects proliferate globally, these customers demand large-format, robust flow field plates capable of sustaining high current densities and resisting the aggressive chemical environment within the electrolyzer stack. Their purchasing decisions are often weighted towards materials that offer exceptional durability and high cost-efficiency at large scale, making specialized composite plates highly sought after for achieving efficient hydrogen production metrics (kg/hour). This market segment promises sustained growth, linked directly to global climate targets and energy independence strategies.

Furthermore, major Utility Companies and Energy Storage Solution Providers constitute a critical buyer group, particularly those deploying Vanadium Redox Flow Batteries (VRFBs) and other RFB chemistries for grid balancing and long-duration storage needs. For these applications, the composite plate often functions simultaneously as the flow field and the electrode material, requiring superior chemical inertness against harsh vanadium electrolytes and high mechanical stability over a 20-year lifespan. Finally, specialized R&D institutes, defense contractors, and producers of portable power devices (e.g., drone fuel cells) also constitute niche but high-value customers. These buyers often require custom-designed plates with unique geometries and performance characteristics. The purchasing cycle for all these customer groups is typically long, involving rigorous qualification processes (testing for durability, corrosion rate, and contact resistance) before entering into long-term supply agreements, emphasizing reliability and scalability as core buying criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 680 Million |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ballard Power Systems, SGL Carbon, Dana Incorporated, Freudenberg Sealing Technologies, Schunk Carbon Technology, Poco Graphite, Toray Industries, Kemet, Giner Inc., F.C.C. Co., Ltd., Shanghai Aerospace, Dongguan Senhong, Mersen, 3M, TDK, Fujikura Ltd., Nisshinbo Holdings, Mitsubishi Chemical, Nippon Graphite, Toyo Tanso, Tokai Carbon, Asbury Carbons, Showa Denko, Sinosteel Advanced Materials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Graphite Flow Field Plate Market Key Technology Landscape

The technological evolution of the Composite Graphite Flow Field Plate market is primarily centered on achieving higher power density and extending stack durability through superior material science and precision manufacturing engineering. A core technology is the optimization of the composite formulation itself, involving meticulous control over the particle size, morphology, and surface treatment of the conductive graphite filler, coupled with the selection of high-performance polymer binders (e.g., thermosets like phenolic resins or high-temperature thermoplastics). The objective is to maximize the electrical percolation network within the polymer matrix, thereby minimizing bulk electrical resistivity, while simultaneously ensuring the composite structure maintains low gas permeability to prevent cross-over between the anode and cathode channels. Current research focuses heavily on novel additives and functionalizing the graphite surface to improve compatibility and uniform dispersion within the polymer, which is vital for component homogeneity and performance reliability across the entire active area of the plate.

Manufacturing technology represents the second critical pillar of innovation. High-volume, high-precision compression molding remains the industry standard, requiring complex, expensive tooling that must withstand high pressures and temperatures over millions of cycles. Technological advancements here include implementing rapid heating/cooling cycles (RHC) and vacuum-assisted molding techniques to achieve defect-free plates with wall thicknesses as low as 0.5 mm, crucial for stack compaction and power density improvement. Furthermore, sophisticated channel design methodologies utilizing advanced Computational Fluid Dynamics (CFD) are becoming standard practice. These simulations allow engineers to model two-phase flow dynamics (gas and liquid water) to optimize serpentine, parallel, or proprietary flow patterns, ensuring efficient reactant distribution and crucial water management within the fuel cell stack without resorting to time-consuming and expensive physical prototype testing.

An emerging, high-impact technology involves the application of specialized surface coatings and treatments. While composite plates offer inherent corrosion resistance, coatings can be applied to reduce the interfacial contact resistance between the flow field plate and the adjacent Gas Diffusion Layer (GDL), which is often the largest single source of parasitic resistance in the cell. These coatings might be ultra-thin conductive polymers or carbon-based films. Additionally, precise manufacturing control over the hydrophobicity/hydrophilicity of the channel walls is critical for efficient water removal (liquid water pooling obstructs gas flow). Advanced laser etching and specialized texturing techniques are being explored to micro-engineer the surface topology, enabling passive water management and maintaining stable cell performance across varying humidity and load conditions. The integration of these material and processing innovations collectively determines the commercial viability and technological leadership in this highly specialized component market.

Regional Highlights

- Asia Pacific (APAC): APAC is the global stronghold for composite graphite flow field plates, maintaining over 50% of the global market share. This dominance is intrinsically linked to the established presence of FCEV leaders (Toyota, Hyundai) and the aggressive implementation of hydrogen mobility strategies in Japan, South Korea, and China. China’s dual focus on developing commercial FCEV fleets (buses, logistics) and leveraging RFBs for utility-scale energy storage creates unparalleled demand volume. Furthermore, the region benefits from mature, cost-competitive graphite and carbon processing supply chains, allowing regional manufacturers to offer highly competitive pricing necessary for mass-market adoption.

- Europe: Europe is designated as the region with the highest anticipated CAGR, driven by the Green Deal policies and significant public expenditure on the hydrogen value chain. The emphasis is heavily weighted towards large-scale industrial applications, specifically the development and deployment of mega-scale PEM and solid oxide electrolyzers for green hydrogen production. Countries like Germany, Norway, and the Netherlands are fostering localized production hubs (e.g., Hydrogen Valleys), leading to substantial demand for durable, industrial-grade composite plates required for stacks with high current density and long operational lifetimes.

- North America: North America presents a technologically dynamic market focused on heavy-duty mobility (Class 8 trucks, port equipment) and ensuring grid resilience through stationary fuel cells and RFBs. The market is supported by federal incentives, including the Inflation Reduction Act (IRA) and hydrogen hub funding, encouraging domestic manufacturing and R&D into advanced composite materials. Companies in the US and Canada are prioritizing innovations that lead to superior plate durability and reduced material dependency on offshore suppliers, positioning the region as a leader in high-performance, specialized plate technology.

- Latin America (LATAM): The LATAM market remains relatively nascent but is experiencing foundational growth, primarily concentrated in Chile and Brazil. Initial adoption is focused on pilot projects for industrial applications, such as using hydrogen fuel cells for mining equipment power and off-grid electricity generation in remote areas. The regional market growth is heavily dependent on the maturation of local hydrogen production capabilities and policy stability supporting infrastructure investment.

- Middle East and Africa (MEA): Growth in MEA is almost exclusively tied to massive green hydrogen export initiatives, particularly in Saudi Arabia and the UAE, leveraging abundant solar resources. These projects mandate the construction of enormous electrolyzer facilities, translating into large-volume, project-specific demand for industrial composite graphite flow field plates. Localized manufacturing is still developing, making the MEA market largely dependent on imports from established global suppliers in APAC and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Graphite Flow Field Plate Market.- Ballard Power Systems

- SGL Carbon

- Dana Incorporated

- Freudenberg Sealing Technologies

- Schunk Carbon Technology

- Poco Graphite

- Toray Industries

- Kemet

- Giner Inc.

- F.C.C. Co., Ltd.

- Shanghai Aerospace

- Dongguan Senhong

- Mersen

- 3M

- TDK

- Fujikura Ltd.

- Nisshinbo Holdings

- Mitsubishi Chemical

- Nippon Graphite

- Toyo Tanso

- Tokai Carbon

- Asbury Carbons

- Showa Denko

- Sinosteel Advanced Materials

Frequently Asked Questions

Analyze common user questions about the Composite Graphite Flow Field Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Composite Graphite Flow Field Plate in a fuel cell?

The primary function is to uniformly distribute reactant gases (hydrogen and air/oxygen) across the gas diffusion layer, collect the electrical current generated by the cell, and manage the thermal output and water byproduct removal, ensuring optimal stack performance and longevity through precise fluid dynamics control.

Why are composite materials preferred over solid graphite or metallic plates in certain applications?

Composite graphite plates are favored for their superior advantages in weight reduction, enhanced mechanical strength (reducing fragility), excellent corrosion resistance, and high manufacturing scalability through molding, resulting in lower production costs and improved power-to-weight ratios compared to traditional solid materials.

Which application segment drives the highest demand for these flow field plates?

The Proton Exchange Membrane Fuel Cell (PEMFC) segment, particularly within the automotive sector (FCEVs and commercial vehicles), currently drives the highest volume demand, closely followed by the rapidly expanding Electrolyzer market supporting global green hydrogen production goals.

What are the key technical constraints associated with composite graphite plates?

Key technical constraints include achieving ultra-low through-plane electrical resistivity and high mechanical integrity simultaneously, managing the long-term chemical degradation of the polymer binder under aggressive operating conditions, and reducing the significant tooling and material costs associated with high-precision molding for mass scale.

How does the use of AI benefit the production of flow field plates and material optimization?

AI benefits production by utilizing machine learning for material informatics to optimize the graphite/polymer ratio for conductivity, streamlining the complex compression molding process via real-time parameter control, and accelerating advanced flow channel designs using high-fidelity computational simulations.

What role does the Asia Pacific region play in the global Composite Graphite Flow Field Plate Market?

Asia Pacific is the leading region globally, holding the largest market share, driven by aggressive governmental support for the hydrogen economy in countries like China and South Korea, coupled with strong manufacturing infrastructure for FCEVs and electrochemical components.

Why is the Redox Flow Battery (RFB) segment showing such high growth potential?

The RFB segment exhibits high growth because composite graphite plates are ideal components for long-duration, grid-scale energy storage systems, offering the necessary chemical resistance to harsh electrolytes (like vanadium) and cost-effective scaling for utility applications worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager