Composite Material Cutting System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439068 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Composite Material Cutting System Market Size

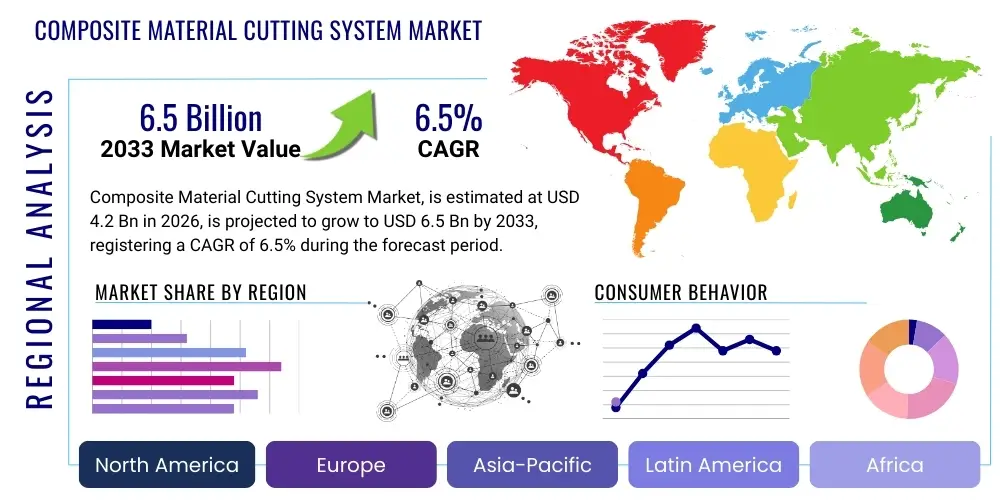

The Composite Material Cutting System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Composite Material Cutting System Market introduction

The Composite Material Cutting System Market encompasses specialized machinery and equipment designed for the precise and efficient processing of advanced composite materials, such as Carbon Fiber Reinforced Polymer (CFRP), Glass Fiber Reinforced Polymer (GFRP), and aramid fibers. These systems are crucial because traditional machining methods often result in material delamination, fiber pull-out, and excessive tool wear due to the inherent heterogeneity and hardness of composites. The cutting systems utilize various technologies, including highly precise waterjet cutters, advanced multi-axis CNC routers, high-power laser systems, and ultrasonic knife systems, each tailored to specific material characteristics and geometry requirements. The increasing demand for lightweight, high-strength components across critical industries—particularly aerospace and automotive—is the foundational driver for the adoption and evolution of these sophisticated cutting solutions.

Product categories within this market range from large-format, high-throughput systems used in aerospace primary structure manufacturing to compact, flexible robotic cutting cells deployed in the automotive and medical device sectors. Major applications span the manufacturing of aircraft components (wings, fuselage sections), wind turbine blades, high-performance vehicle chassis, and specialized sporting goods. Key benefits derived from implementing these advanced systems include superior cut quality, minimal material waste, increased production throughput, and enhanced repeatability and accuracy, which are paramount for ensuring component integrity and structural performance in safety-critical applications. Furthermore, modern composite cutting systems often integrate advanced sensor technologies and closed-loop control mechanisms to monitor and adapt cutting parameters in real-time, optimizing the process for complex 3D contours and varying material thicknesses.

The primary driving factors propelling the market forward include stringent regulatory requirements mandating fuel efficiency and emission reduction, which necessitates the use of lightweight composites in transportation. Simultaneously, continuous technological advancements in cutting methods, such as abrasive waterjet stability and the development of high-speed ultrasonic vibration generators, enhance the versatility and speed of processing. The expansion of the wind energy sector, which relies heavily on large-scale composite manufacturing for turbine blades, also significantly contributes to the market’s robust growth trajectory. Manufacturers are increasingly prioritizing automation and integration with Industry 4.0 principles, pushing for highly automated, digitally controlled cutting environments that minimize manual intervention and maximize operational efficiency.

Composite Material Cutting System Market Executive Summary

The Composite Material Cutting System market is experiencing significant growth fueled by the global shift towards lighter materials in high-value industries. Business trends indicate a strong focus on convergence between machine tool manufacturers and software providers to deliver comprehensive, integrated solutions, often incorporating simulation capabilities to predict and prevent material defects before physical cutting occurs. There is a pronounced industry movement toward modular system designs that allow end-users to scale production and adapt the system for different cutting technologies (e.g., swapping a waterjet head for a router) based on evolving production demands. Furthermore, sustainability is becoming a key purchase criterion, driving demand for systems that minimize material waste and energy consumption, particularly in highly competitive markets like automotive and consumer electronics.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, largely due to massive investments in aerospace manufacturing hubs (especially China and India) and the surging demand for wind energy infrastructure. North America and Europe maintain strong market share, primarily driven by established aerospace and defense industries which require the highest precision and regulatory compliance standards. Specifically, the US defense sector's increasing utilization of stealth aircraft and complex unmanned aerial vehicles (UAVs) provides sustained high-end demand. European countries, particularly Germany and France, focus on developing highly automated systems utilizing advanced robotics for composite processing, emphasizing precision and integration into sophisticated smart factory environments.

Segment trends underscore the dominance of the Waterjet Cutting System technology due to its capability to cut thick, abrasive composites without generating heat-affected zones (HAZ) or introducing mechanical stress, making it highly preferred for critical structural components. However, the Laser Cutting segment, specifically utilizing high-power fiber lasers or CO2 lasers, is rapidly gaining traction in thinner composite applications where speed is prioritized, such as prepreg cutting prior to lay-up. The aerospace and defense industry remains the largest end-user segment, demanding bespoke, highly certified machinery. Geographically, the fully automatic segment is projected to grow fastest, driven by labor cost optimization and the need for high volume, continuous manufacturing processes required in the electric vehicle (EV) battery casing and mass-produced sporting goods sectors.

AI Impact Analysis on Composite Material Cutting System Market

User queries regarding the integration of Artificial Intelligence (AI) into composite cutting systems frequently revolve around topics such as real-time defect prediction, optimization of tool paths for non-uniform materials, and predictive maintenance strategies. Users are keen to understand how AI can reduce the prohibitively high cost associated with composite material scrap caused by processing errors, especially delamination. Key concerns include the complexity of data labeling required for machine learning models and the integration of AI software into existing legacy cutting machinery. Expectations center on AI's ability to create a 'self-optimizing' cutting environment where machine parameters (pressure, speed, feed rate, oscillation frequency) are autonomously adjusted based on immediate feedback from acoustic emission sensors or high-speed cameras, ensuring optimal cutting quality regardless of minor material variations or tool wear conditions.

- AI enhances process control by analyzing sensor data (vibration, temperature, acoustics) to predict and prevent delamination or burning.

- Machine learning algorithms optimize tool path generation, minimizing cutting time and reducing fiber fraying in complex geometric cuts.

- Predictive maintenance models forecast component failure (e.g., pump seal degradation in waterjets), maximizing uptime and operational efficiency.

- AI-driven quality control utilizes computer vision to instantly verify cut edges against tolerance specifications, eliminating manual inspection bottlenecks.

- Autonomy in material loading and sequencing improves overall throughput, especially in highly automated production cells handling diverse batch sizes.

DRO & Impact Forces Of Composite Material Cutting System Market

The Composite Material Cutting System Market dynamics are dictated by a balanced interplay of strong industry drivers, inherent material restraints, vast technological opportunities, and significant external impact forces. The primary driver is the accelerating substitution of traditional metals (aluminum and steel) with lightweight composites across major industries to achieve energy efficiency and reduce life-cycle costs. This substitution trend is particularly evident in new generation aircraft and high-performance electric vehicles. Restraints largely stem from the high initial capital investment required for precision cutting systems, coupled with the ongoing expense of specialized consumables (e.g., abrasive garnet for waterjets, specific router bits for CFRP) and the critical need for highly skilled operators capable of managing complex, multi-axis machines and specialized programming languages. These factors often limit adoption among small and medium-sized enterprises (SMEs).

Significant opportunities arise from the increasing standardization of composite manufacturing processes and the development of cost-effective, high-speed cutting solutions specifically tailored for medium-volume applications outside of the premium aerospace sector, such as medical implants and consumer drones. The focus on developing hybrid cutting systems that combine two or more technologies (ee.g., ultrasonic and router) offers versatility and efficiency when dealing with multi-layered or sandwich composites. Furthermore, the burgeoning field of Additive Manufacturing (AM) often requires precise post-processing of polymer composites, opening new niche markets for these cutting technologies. Addressing the issue of sustainable composite waste management and recycling also presents a future opportunity for system manufacturers focused on efficient material utilization.

The key impact forces shaping the market include rapidly evolving international trade policies and tariffs, which affect the cost and supply chain efficiency of system components and finished machinery. Technological disruption, particularly the advancements in AI and robotics, forces manufacturers to continuously innovate and integrate smart features to maintain competitiveness. The economic stability of key end-user sectors, especially automotive production volumes and defense spending cycles, directly influences capital expenditure decisions for new cutting equipment. Regulatory pressures concerning workplace safety and environmental emissions also push manufacturers toward developing cleaner, quieter, and safer machinery, particularly systems that handle composite dust and volatile organic compounds (VOCs) effectively.

Segmentation Analysis

The Composite Material Cutting System market is comprehensively segmented based on the type of cutting technology employed, the specific material being processed, the industrial application (end-use industry), and the level of automation integrated into the system. Understanding these segmentations is critical for market participants to tailor their offerings to specific operational requirements, ranging from high-precision, low-volume aerospace needs to high-throughput, automated automotive production. The market analysis heavily relies on identifying the technological preference of each major end-user, such as the strong adoption of waterjet technology in marine and thick composite aerospace structures, versus the rising implementation of laser systems for prepreg cutting in textile preform preparation.

- By Technology:

- Waterjet Cutting Systems (Abrasive and Pure)

- Laser Cutting Systems (CO2, Fiber, and Nd:YAG)

- Ultrasonic Cutting Systems (Knives and Oscillators)

- Router and Milling Systems (CNC Multi-Axis)

- Other Systems (Plasma, EDM)

- By Material Type:

- Carbon Fiber Reinforced Polymer (CFRP)

- Glass Fiber Reinforced Polymer (GFRP)

- Aramid Fiber Composites

- Hybrid Composites and Sandwich Structures

- By End-Use Industry:

- Aerospace & Defense

- Automotive & Transportation

- Wind Energy

- Marine

- Construction and Infrastructure

- Electronics and Consumer Goods

- Medical Devices

- By Automation Level:

- Manual Systems

- Semi-Automatic Systems

- Fully Automatic Systems (Robotic Cells)

Value Chain Analysis For Composite Material Cutting System Market

The value chain for Composite Material Cutting Systems begins with upstream analysis focused on raw material suppliers and component manufacturers. Key upstream participants include suppliers of high-pressure pumps and intensifiers (for waterjet systems), laser source manufacturers (for laser systems), and advanced CNC control hardware and software providers. The efficiency and quality of these foundational components directly dictate the performance and reliability of the final cutting machinery. Highly specialized sensor manufacturers, providing acoustic emission sensors, sophisticated vision systems, and proprietary control algorithms, also form a critical part of the upstream ecosystem, enabling the necessary precision for composite processing.

Midstream activities involve the design, manufacturing, assembly, and integration of the specialized cutting systems. Original Equipment Manufacturers (OEMs) develop proprietary cutting heads, multi-axis robotic platforms, and user interfaces tailored for composite materials, focusing on structural rigidity and vibration dampening to ensure tight tolerances. Distribution channels typically involve a mix of direct sales channels for large, customized, high-capital equipment sold to aerospace majors, and indirect distribution through specialized local distributors and integrators who provide localized sales support, installation, and post-sale maintenance services, especially in geographically fragmented markets like Southeast Asia.

Downstream analysis centers on the end-users and the critical after-sales services required. These services include preventative maintenance contracts, the supply of high-wear consumables (nozzles, focusing tubes, abrasives, tooling), operator training, and software updates to incorporate new material processing parameters. The strong relationship between the OEM and the end-user for continuous process improvement and technical support is vital, given the complexity and high investment associated with these systems. The feedback loop from the downstream users concerning material compatibility and machine performance often drives the next cycle of innovation in upstream component design and midstream system integration.

Composite Material Cutting System Market Potential Customers

The primary potential customers for Composite Material Cutting Systems are large-scale manufacturing enterprises operating in sectors where component weight, strength-to-weight ratio, and structural integrity are non-negotiable performance parameters. The aerospace and defense industry represents the largest and most demanding customer base, encompassing commercial aircraft manufacturers, military contractors, and space launch vehicle producers. These buyers invest heavily in multi-million dollar, highly customized systems (predominantly waterjet and advanced milling) capable of handling primary structure components like wing spars, engine casings, and fuselage panels with aerospace-grade precision and full regulatory traceability.

The automotive industry, driven by the shift toward electric vehicles and the resultant demand for lightweight battery enclosures and body-in-white structures, constitutes a rapidly expanding customer segment. These customers prioritize high-speed, fully automated robotic cutting cells, often utilizing laser or high-speed router technology, focusing on high volume throughput and minimal cycle times. Tier 1 and Tier 2 suppliers to these major automotive OEMs are also critical purchasers, needing flexible systems that can adapt to rapid design changes and evolving material combinations (e.g., hybrid metal-composite joints).

Additional significant buyers include energy producers, specifically manufacturers of onshore and offshore wind turbine blades, which require very large-format waterjet or specialized router systems for trimming massive composite structures. The marine industry (yacht and high-speed boat manufacturers), specialized medical device producers (composite orthotics and prosthetics), and manufacturers of high-end consumer goods (sports equipment) also represent crucial, albeit smaller, segments of potential customers. These diverse customers all seek optimized processing solutions that guarantee material integrity and maximize yield efficiency for expensive raw composite materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omax Corporation, Flow International Corporation, WardJet Inc., KMT Waterjet Systems, Sandvik Group, Bystronic Group, TRUMPF GmbH + Co. KG, Hypertherm Inc., MultiCam Inc., Gerber Technology LLC, Lectra SA, CMS North America, Bullmer GmbH, Automated Dynamics, Mitsubishi Electric Corporation, Zund Systemtechnik AG, Kimla, Tecoi, Semyx Inc., Waterjet Sweden AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Material Cutting System Market Key Technology Landscape

The technology landscape of the Composite Material Cutting System market is defined by several distinct methods, each optimized for different material structures and precision requirements. Waterjet cutting remains a cornerstone technology, particularly the abrasive waterjet variant, preferred for its ability to cut thick, multi-layered composites without generating significant thermal stress or dust, which is critical for maintaining material integrity. Continuous innovation in waterjet focuses on improving pump efficiency (moving toward direct drive systems), enhancing nozzle longevity, and developing sophisticated five-axis and six-axis cutting heads integrated with precision measurement systems to handle complex 3D geometries common in aerospace components.

Laser cutting, historically challenging for thermoset composites due to thermal degradation (burning/delamination), has seen breakthroughs, especially with high-power fiber lasers and specialized wavelengths optimized for polymer matrices. This technology is now highly effective for cutting thin prepreg materials and dry fabrics quickly and accurately before the curing stage. Router and CNC milling systems are essential for edge trimming, drilling, and shaping cured, thick composite parts, though these require specialized diamond-coated tooling and highly efficient dust extraction systems to mitigate tool wear and health hazards. Advancements in CNC technology include high-speed spindles and active vibration cancellation to achieve smoother cuts and reduce micro-cracking in the composite structure.

Ultrasonic cutting systems, utilizing high-frequency oscillating knives, represent a niche but growing technology primarily used for cutting uncured or semi-cured composite materials, insulating foam cores, and specialized honeycomb structures. The advantage of ultrasonic vibration is the reduction of friction and resistance, resulting in clean, sealed edges with minimal fiber displacement. The overall trend across all technologies is toward greater automation and digitization, encompassing automatic material detection, robotic loading/unloading, and the integration of digital twin capabilities for simulation and real-time process monitoring, adhering to the stringent quality demands of modern manufacturing environments.

Regional Highlights

North America holds a dominant position in the Composite Material Cutting System Market, primarily driven by the massive presence of the global aerospace and defense industry base, notably in the United States. Demand is characterized by the procurement of high-cost, high-precision, multi-axis waterjet and CNC systems required for military and commercial aircraft production (Boeing, Lockheed Martin). The region is a pioneer in integrating advanced automation and robotics into composite manufacturing, particularly in the production of lightweight components for military unmanned systems and next-generation space exploration vehicles. Regulatory frameworks favoring domestic defense spending continue to guarantee a stable, high-value demand for specialized cutting solutions.

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is attributed to rapid industrialization, burgeoning manufacturing capabilities in China and India, and significant government initiatives supporting renewable energy, particularly wind power. The APAC market is characterized by substantial investment in mass transportation infrastructure and the increasing establishment of regional automotive and aerospace supply chains, driving demand for both high-speed laser/ultrasonic systems (for automotive prepreg) and large-format router systems (for wind turbine blades). Competitive pricing and localized system manufacturing are becoming crucial factors for market entry and sustained growth in this region.

Europe represents a mature and technologically advanced market, driven by stringent environmental standards and a strong tradition in high-performance automotive manufacturing (Germany) and civil aviation (France, UK). The region excels in R&D and the deployment of Industry 4.0 principles, favoring cutting systems that offer full connectivity, minimal environmental footprint, and maximum process efficiency. Investment is focused on retrofitting older systems with advanced AI/sensor technologies and developing highly efficient hybrid cutting solutions to cater to complex material stacks used in high-end vehicle production and renewable energy projects.

- North America: Market dominance driven by strong aerospace and defense sectors, focus on high precision, and early adoption of robotic integration. Key countries include the United States and Canada.

- Asia Pacific (APAC): Highest growth rate fueled by exponential expansion in wind energy, automotive (especially EV components), and increasing aerospace manufacturing capacity in China, India, and South Korea.

- Europe: High technological maturity, emphasis on automation, sustainable manufacturing practices, and consistent demand from automotive and civil aviation OEMs. Key countries are Germany, France, and the UK.

- Latin America (LATAM): Emerging market driven by local automotive assembly and limited aerospace maintenance activities, slowly increasing adoption of mid-range CNC and waterjet systems.

- Middle East and Africa (MEA): Growth tied to diversification efforts (away from oil), defense spending, and infrastructure projects; nascent but growing demand for specialized composite systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Material Cutting System Market.- Omax Corporation

- Flow International Corporation

- WardJet Inc.

- KMT Waterjet Systems

- Sandvik Group

- Bystronic Group

- TRUMPF GmbH + Co. KG

- Hypertherm Inc.

- MultiCam Inc.

- Gerber Technology LLC

- Lectra SA

- CMS North America

- Bullmer GmbH

- Automated Dynamics

- Mitsubishi Electric Corporation

- Zund Systemtechnik AG

- Kimla

- Tecoi

- Semyx Inc.

- Waterjet Sweden AB

Frequently Asked Questions

Analyze common user questions about the Composite Material Cutting System market and generate a concise list of summarized FAQs reflecting key topics and concerns.Which composite cutting technology offers the highest precision for aerospace components?

Abrasive Waterjet Cutting Systems generally offer the highest precision and minimal risk of material damage (delamination or heat-affected zones) for critical, thick composite aerospace components like CFRP spars and panels, especially when utilizing 5-axis or 6-axis configurations.

How does the integration of AI benefit composite cutting operations?

AI integration improves operational efficiency and quality by enabling real-time process monitoring, automatically optimizing feed rates and pressures based on sensor feedback, and implementing predictive maintenance to reduce costly machine downtime and material scrap.

What is the most cost-effective cutting method for high-volume thin composite prepregs?

Ultrasonic Cutting Systems and specialized Laser Cutting Systems (such as CO2 or high-power fiber lasers) are typically the most cost-effective solutions for high-volume processing of thin, non-cured composite prepregs and dry fabrics, prioritizing speed and clean edges before the curing stage.

What major material challenges do cutting systems face when processing hybrid composites?

Hybrid composites (e.g., carbon fiber and aluminum stacks) present challenges due to significant differences in hardness and thermal properties, necessitating hybrid cutting systems, such as combining high-pressure waterjet (for composites) with specialized milling tools (for metals) to achieve defect-free cuts in a single setup.

Which geographical region is expected to experience the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by substantial governmental and private investment in advanced manufacturing, renewable energy infrastructure (wind turbines), and the rapidly expanding electric vehicle production sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager