Composite Melt-Blown Filtration Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433668 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Composite Melt-Blown Filtration Material Market Size

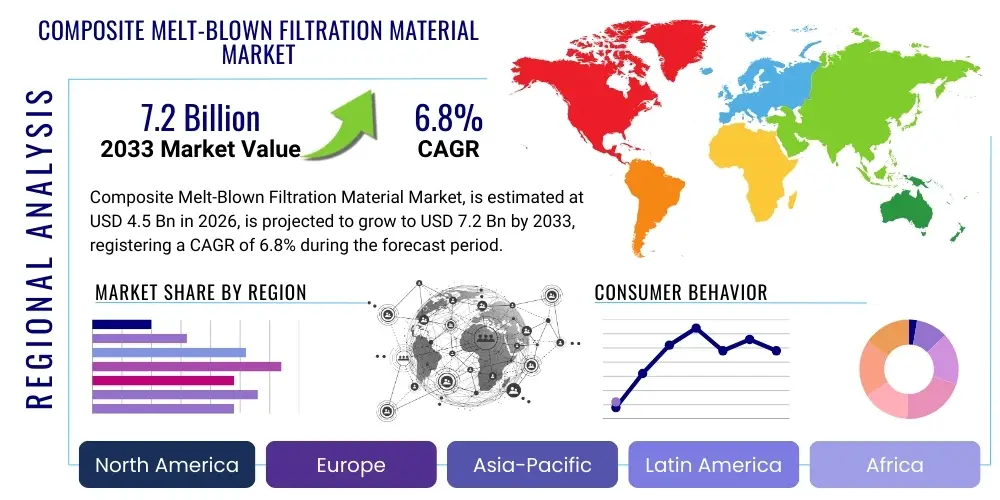

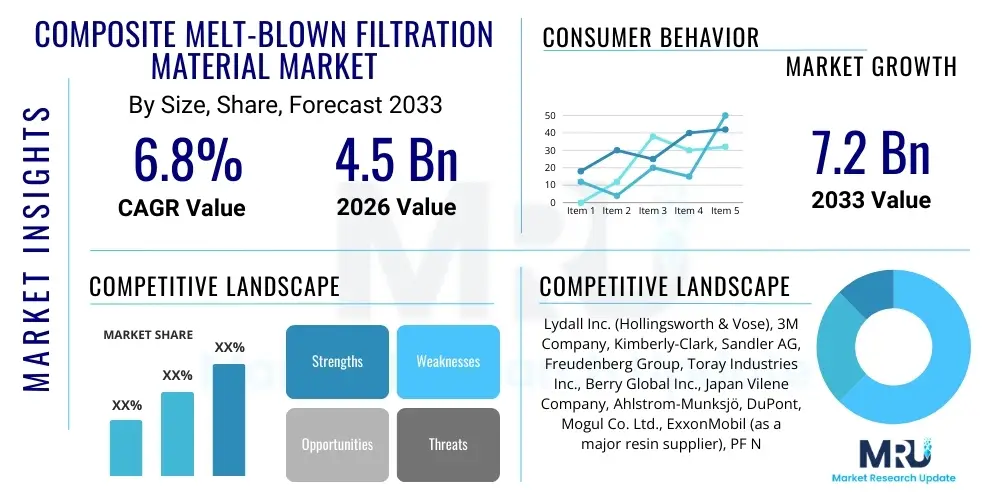

The Composite Melt-Blown Filtration Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033.

Composite Melt-Blown Filtration Material Market introduction

The Composite Melt-Blown Filtration Material Market encompasses high-efficiency nonwoven fabrics engineered through the melt-blowing process, specifically where two or more distinct layers or components are integrated to enhance filtration performance, mechanical strength, and service life. These materials typically combine a melt-blown layer (known for its ultrafine fiber structure and high particle capture efficiency) with support layers, often spunbond nonwovens for strength, or specialized media like activated carbon or electrostatically charged elements for specific contaminant removal. The primary appeal of composite structures lies in their ability to achieve superior barrier properties and high dirt-holding capacity without compromising air or liquid permeability, making them indispensable in critical applications such as high-efficiency particulate air (HEPA) filtration, medical masks, automotive cabin air filters, and industrial liquid separation systems. The base materials are predominantly thermoplastic polymers, including polypropylene (PP), polyethylene terephthalate (PET), and polybutylene terephthalate (PBT), selected based on the required chemical resistance and operating temperature of the final application.

Product description highlights the structural superiority of composite media over single-layer melt-blown media. Traditional melt-blown fabrics, while offering high filtration efficiency due to nanoscale fiber diameters, often lack the tensile strength and rigidity required for demanding industrial applications or pleating processes. Composite materials address this by layering, such as Spunbond-Meltblown-Spunbond (SMS) configurations, where the spunbond layers provide structural integrity, preventing deformation during high-flow conditions or intense operational stress, while the internal melt-blown core handles fine particle capture. This synergy enables manufacturers to design specialized media tailored precisely to filter specific contaminants, whether airborne pathogens (PFE and BFE standards), oil mist, or fine dust particles. Furthermore, the development of sophisticated composites integrating functional additives, such as antimicrobial agents or flame retardants, is rapidly expanding the utility of these materials across highly regulated sectors like healthcare and construction.

Major applications of composite melt-blown media span critical sectors globally. In the healthcare industry, they are fundamental components of surgical masks, N95 respirators, and various protective apparel, driven by rigorous regulatory standards and recurrent global health concerns. Automotive filtration utilizes these composites for superior engine intake filters and cabin air purification systems, responding to growing consumer demand for air quality control and stringent vehicular emission standards. Industrial and HVAC sectors represent the largest consumer base, employing these materials in high-volume air conditioning systems, cleanroom environments, and process gas purification. The driving factors for market growth are intrinsically linked to escalating global pollution levels (both air and water), heightened public awareness regarding respiratory health, and continuous advancements in regulatory frameworks, particularly in developing economies, which mandate higher performance standards for filtration technologies.

Composite Melt-Blown Filtration Material Market Executive Summary

The Composite Melt-Blown Filtration Material Market is characterized by robust growth stemming from synergistic technological advancements and increasing global emphasis on public health and environmental protection. Business trends indicate a pronounced shift toward customized, multi-functional composite media capable of addressing niche market demands, such as media with enhanced biodegradability or specialized media for extreme chemical environments. Mergers and acquisitions focusing on vertical integration—securing both raw material supply and advanced conversion capabilities—are prevalent among key market participants, aiming to stabilize supply chains that have historically demonstrated volatility, particularly during periods of geopolitical uncertainty or unforeseen global events. Furthermore, the industrial landscape is witnessing significant investment in high-throughput production lines capable of manufacturing complex layered structures, ensuring economies of scale while maintaining strict quality control necessary for medical and cleanroom applications. Innovation around electrostatic charging and surface modification techniques to improve particle capture efficiency without dramatically increasing pressure drop remains a core competitive differentiator.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in both production capacity and consumption, driven primarily by massive industrial expansion, rapid urbanization leading to severe air quality challenges (especially in China and India), and the established presence of large-scale manufacturing hubs for consumer electronics and automotive components. North America and Europe maintain significant market shares, characterized by a focus on high-value, highly regulated applications, particularly in pharmaceutical manufacturing, advanced HVAC systems, and high-end automotive filtration. These mature markets are largely influenced by stringent regulatory mandates, such such as the European Union’s requirements for energy-efficient filtration (e.g., ISO 16890 standards), pushing manufacturers toward media that offer optimal performance longevity and minimal energy expenditure. The Middle East and Africa (MEA) region, while smaller, is experiencing accelerated adoption driven by large infrastructure projects and increasing demands for water purification technologies in arid regions.

Segment trends underscore the dominance of the air filtration segment, particularly high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) media, reflecting the continuous need for clean environments in industrial, commercial, and residential settings. Within materials, polypropylene (PP) composites remain the largest segment due to their cost-effectiveness, chemical inertness, and ease of processing, although specialized polymers like fluoropolymers and advanced polyamides are gaining traction in high-temperature or corrosive applications. The healthcare end-use sector witnessed unprecedented growth acceleration following the global pandemic, solidifying its status as a consistently high-demand segment focused exclusively on certified, sterile composite media. Future growth trajectories suggest substantial expansion in liquid filtration composites, especially those utilized in process water treatment, chemical separation, and food and beverage processing, driven by global concerns over water scarcity and quality assurance.

AI Impact Analysis on Composite Melt-Blown Filtration Material Market

User queries regarding the intersection of Artificial Intelligence (AI) and the composite melt-blown filtration material market frequently center on how AI can enhance manufacturing precision, predict material performance under various conditions, and optimize the complex supply chain. Key user concerns revolve around the integration cost of AI systems, the requirement for specialized data infrastructure to train effective predictive models, and the tangible return on investment (ROI) from adopting AI in historically capital-intensive, high-volume production processes. Users seek confirmation that AI can genuinely improve fiber diameter consistency, reduce defect rates, and accelerate the development cycle for new composite structures without introducing unnecessary downtime. The overriding expectation is that AI will transition the manufacturing process from reactive quality control (post-production testing) to proactive process adjustment (real-time parameter manipulation), ensuring that high-specification media meet stringent regulatory thresholds consistently. Furthermore, there is strong interest in utilizing machine learning for demand forecasting, especially concerning volatile segments like medical filtration, enabling producers to dynamically adjust material inventory and production scheduling.

AI’s influence is rapidly transforming the production floor dynamics of composite melt-blown material manufacturing, moving beyond simple automation into complex, data-driven decision-making. Machine vision systems, powered by deep learning algorithms, are now capable of analyzing nonwoven web uniformity in real-time, detecting micro-defects such as streaks, holes, or density variations that are invisible to the human eye or rudimentary sensors. This application dramatically improves yield rates and guarantees the homogeneity required for high-grade filtration, particularly important for N95 and HEPA specifications. Predictive maintenance (PdM) is another critical area where AI excels, analyzing vibration patterns, temperature fluctuations, and pressure profiles of extruder screws, die tips, and ancillary equipment. By forecasting equipment failure before it occurs, AI minimizes unplanned production stoppages, which are particularly costly in continuous manufacturing lines, thereby optimizing overall equipment effectiveness (OEE) and ensuring stable capacity utilization necessary for large-scale production demands.

Beyond manufacturing, AI significantly contributes to material innovation and resource optimization. Researchers are employing AI-driven simulation platforms to model the filtration efficiency and pressure drop characteristics of various composite fiber configurations (e.g., varying fiber size distribution, web density, and layering sequences) before physical prototyping begins. This substantially shortens the research and development lifecycle for next-generation filtration media, enabling quicker response to evolving regulatory or application requirements, such as enhanced filtration for ultra-fine particulate matter (PM 0.3). Moreover, optimizing the utilization of raw thermoplastic polymers, which constitute a major operational cost, is achieved through AI algorithms that minimize scrap rates and optimize material blends based on real-time market pricing and desired material characteristics. This holistic application of AI across the value chain positions manufacturers to achieve higher material performance, reduced waste, and superior supply chain resilience, fundamentally altering the competitive dynamics of the composite melt-blown market.

- AI-driven real-time quality control using machine vision for defect detection in nonwoven webs.

- Optimization of melt-blowing process parameters (air flow, polymer throughput, die temperature) via machine learning models to ensure fiber consistency.

- Predictive Maintenance (PdM) of critical equipment, such as extruders and spinning heads, minimizing downtime and increasing operational efficiency.

- Acceleration of R&D cycles through AI simulation of novel composite structure performance (pressure drop and efficiency).

- Enhanced supply chain resilience and dynamic inventory management through AI-powered demand forecasting and raw material price prediction.

- Implementation of smart energy management systems to reduce the substantial power consumption associated with the high-velocity air used in the melt-blowing process.

- Automation of complex layering and lamination processes, ensuring precise structural integrity in multi-ply composite filters.

DRO & Impact Forces Of Composite Melt-Blown Filtration Material Market

The Composite Melt-Blown Filtration Material Market is subjected to a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively define its impact forces. Primary drivers include the global mandate for improved air and water quality, intensified by public health crises and increasingly stringent environmental regulations, particularly concerning vehicular emissions and industrial particulate matter. The rapid industrialization and urbanization across emerging economies necessitate massive deployments of high-efficiency filtration solutions in HVAC systems and pollution control equipment. Conversely, major restraints center on the significant volatility and reliance on petrochemical raw material prices (primarily polypropylene pellets), which directly impacts production costs and profit margins. Furthermore, the substantial capital expenditure required for establishing or upgrading melt-blowing production lines acts as a significant barrier to entry for new competitors. Opportunities are emerging through the adoption of sustainable materials, specifically bio-based or recycled polymers, and the integration of advanced functional components like nanofibers or photocatalytic elements to create highly specialized, premium filtration media.

The driving force exerted by regulatory compliance cannot be overstated. Global bodies and national governments are continually raising the minimum standards for air purification (e.g., ISO 16890 replacing EN779 in Europe, and stricter EPA standards in the U.S.). This regulatory push compels industries, from automotive manufacturing to healthcare, to upgrade their existing filtration systems with composite melt-blown materials that achieve higher efficiency classes (e.g., F9, E10-E12, or P3/N100 equivalent) while maintaining low energy consumption. The recurring health consciousness fueled by events such as the COVID-19 pandemic has permanently ingrained the necessity for high-performance respiratory protection, ensuring sustained, high-volume demand for composite filter media used in surgical masks and respirators. Additionally, the proliferation of centralized HVAC systems in commercial and residential buildings, aimed at mitigating airborne disease transmission and managing indoor air quality (IAQ), provides a resilient and growing demand base for these specialized materials.

However, the industry faces persistent structural restraints. The reliance on a limited number of specialized polymer grades, particularly for achieving specific electrostatic properties or thermal stability, exposes the market to significant supply chain risks. Furthermore, the inherent limitations in the disposal and biodegradability of conventional polypropylene-based melt-blown materials are attracting increasing scrutiny from environmental groups and regulators, necessitating substantial investment in research toward more sustainable alternatives. The competitive landscape is also characterized by intense pricing pressure, especially in commodity segments like standard face mask material, pushing manufacturers to continuously seek operational efficiencies through automation and scale. Opportunities for expansion hinge on technological diversification; for example, developing durable, washable composite media that reduce replacement frequency, or engineering smart filtration systems incorporating IoT sensors that monitor filter saturation and performance in real-time, thereby adding substantial value beyond the raw material itself.

Segmentation Analysis

The Composite Melt-Blown Filtration Material Market is meticulously segmented based on key differentiators, including the type of material used, the specific application of the filtration media, and the end-use industry utilizing the final product. Understanding these segmentations is crucial for identifying targeted growth pockets and competitive advantages. The segmentation by material type is fundamental, distinguishing between commodity polymers like polypropylene, which dominate mass-market applications due to their favorable cost-efficiency and inherent hydrophobic nature, and high-performance polymers such as polyethylene terephthalate (PET) or specialized fluoropolymers, which are reserved for applications requiring superior chemical resistance, thermal stability, or durability, such as high-temperature gas filtration in industrial plants. The layering structure itself often dictates the segment, with SMS (Spunbond-Meltblown-Spunbond) being the most prevalent composite structure across medical and industrial air filtration, offering the best balance of mechanical strength and filtration efficiency.

Application-based segmentation is perhaps the most dynamic area, reflecting the diverse utility of melt-blown composites. Air filtration constitutes the largest and most varied segment, encompassing respiratory protection (masks and respirators), general HVAC systems (residential and commercial), and specialized cleanroom environments (pharmaceutical and semiconductor manufacturing). Liquid filtration, while smaller, represents a high-growth area, driven by industrial process fluid purification, water treatment (including desalination pre-filtration), and blood filtration in medical devices. The performance requirements for liquid filtration composites differ significantly, often emphasizing pore size uniformity and high chemical compatibility over electrostatic charge retention. Furthermore, specialized filtration applications, such as oil absorption booms or battery separators, utilize unique composite melt-blown structures tailored for selective material separation or containment.

The end-use industry segmentation provides insight into consumption patterns and regulatory influences. Healthcare and Pharmaceutical represent a high-value, non-negotiable quality segment, governed by strict governmental standards (e.g., FDA, CE marking) for sterility and filtration efficacy against pathogens. Automotive is a technology-driven segment, constantly demanding higher efficiency for cabin air filters (to combat urban pollution) and lightweight, high-performance media for engine intake systems to enhance fuel efficiency and reduce emissions. The Industrial sector, encompassing power generation, cement, mining, and food & beverage, represents high-volume demand for robust media capable of handling heavy dust loads and extreme operating conditions. These diverse requirements necessitate continuous adaptation in composite material design, ranging from anti-static treatments for explosion-prone environments to antimicrobial layers for food safety applications, ensuring the market remains diversified and resilient to shocks in any single sector.

- By Material Type:

- Polypropylene (PP) Composites

- Polyethylene Terephthalate (PET) Composites

- Specialty Polymers (e.g., PBT, Nylon, Fluoropolymers)

- Bio-based/Sustainable Composites

- By Layering Structure:

- SMS (Spunbond-Meltblown-Spunbond)

- SMMS (Spunbond-Meltblown-Meltblown-Spunbond)

- Layered Media with Functional Components (e.g., Activated Carbon Layers)

- Single Melt-Blown Layer with Supporting Nonwovens

- By Application:

- Air Filtration (HVAC, HEPA/ULPA, Respiratory Protection)

- Liquid Filtration (Industrial Process Fluids, Water Treatment, Food & Beverage)

- Medical & Healthcare (Surgical Drapes, Masks, Barrier Fabrics)

- Automotive Filtration (Cabin Air Filters, Engine Intake Filters)

- By End-Use Industry:

- Healthcare & Pharmaceutical

- Industrial Manufacturing

- Automotive

- Residential & Commercial HVAC

- Food & Beverage Processing

Value Chain Analysis For Composite Melt-Blown Filtration Material Market

The value chain for the Composite Melt-Blown Filtration Material Market is intricate, spanning from the petrochemical industry to highly specialized end-users, involving multiple conversion steps where value is incrementally added. Upstream analysis focuses predominantly on the supply of thermoplastic resins, primarily polypropylene (PP), polyethylene (PE), and polyester (PET) pellets. The cost and availability of these commodity polymers are highly dependent on global oil and gas prices and the capacity utilization rates of major petrochemical producers. Fluctuations in upstream raw material costs represent the single largest risk factor for filtration media manufacturers, often dictating short-term pricing power and profitability. Key strategic actions in this segment involve securing long-term contracts and potentially integrating backward, though this is rare among pure-play filtration companies. The selection of specific polymer grades, tailored for high melt-flow index (MFI) required for the fine fiber formation in melt-blowing, is a critical technical requirement that limits the number of suitable suppliers.

The midstream segment involves the core manufacturing process: the conversion of polymer pellets into finished nonwoven media. This includes the melt-blowing process itself, followed by critical post-processing steps such as layering (combining spunbond and melt-blown webs), lamination, slitting, and, critically, electrostatic charging. This phase is characterized by high capital investment in machinery (extruders, die assemblies, winding systems) and significant technical expertise to control fiber diameter distribution, web density, and uniformity—all parameters essential for achieving certified filtration efficiency. Manufacturers in this segment compete heavily on production efficiency, quality consistency, and their ability to produce complex composite structures (e.g., graded density media or specialized SMS structures) that meet demanding specifications. Companies that integrate advanced technologies like in-line charging or antimicrobial treatment gain a significant advantage in the midstream market.

Downstream analysis covers the distribution channel, which is typically bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales through specialized distributors and converters. Direct distribution is common for high-volume, standard media sold to large medical device manufacturers or automotive filter producers who integrate the media directly into their final products. Indirect channels involve a network of specialized converters who purchase large rolls of composite media and process them further—pleating, cutting, assembling into cartridges, or fitting into frames—before selling to end-users (e.g., HVAC service providers, hospitals, or retailers). The profitability in the downstream segment is often driven by the ability to offer customized sizes, just-in-time delivery, and technical support. The choice between direct and indirect channels is often dependent on the geographic location and the technical complexity of the required finished product, with indirect channels facilitating greater market penetration in fragmented industrial settings.

Composite Melt-Blown Filtration Material Market Potential Customers

Potential customers for composite melt-blown filtration materials span virtually every industrial and consumer sector requiring controlled environment quality, material separation, or personal protection. The largest consumers are sophisticated entities that integrate these specialized materials into complex systems, requiring materials that offer consistent, certified performance. These end-users are highly sensitive to product quality and regulatory compliance, making long-term supplier relationships based on technical specifications and reliability paramount. Primary buyers include manufacturers of HVAC equipment (e.g., Carrier, Daikin), who require high-grade media for air handling units; automotive Tier 1 suppliers (e.g., Mann+Hummel, Donaldson) who produce filters for engine and cabin systems; and manufacturers of personal protective equipment (PPE) and medical devices (e.g., 3M, various surgical mask manufacturers) which necessitate materials meeting stringent BFE (Bacterial Filtration Efficiency) and PFE (Particle Filtration Efficiency) standards.

Beyond these core industrial giants, the secondary customer base comprises thousands of industrial processing plants, municipal water treatment facilities, and food and beverage manufacturers. For example, electronics manufacturers and semiconductor fabrication plants are crucial end-users, requiring ULPA-grade filtration to maintain cleanroom environments necessary for defect-free production. Chemical and petrochemical processing plants rely on composite melt-blown materials for process gas purification and solvent filtration, demanding high chemical and thermal resistance. Moreover, the retail segment, driven by residential air purifiers and vacuum cleaner bag manufacturers, constitutes a rapidly expanding consumer-facing market. These diverse customers share the common need for media that provides high dirt-holding capacity, low energy consumption (low pressure drop), and consistent efficiency over extended operational periods, making the structural benefits of composite melt-blown technology highly valuable across these varied applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lydall Inc. (Hollingsworth & Vose), 3M Company, Kimberly-Clark, Sandler AG, Freudenberg Group, Toray Industries Inc., Berry Global Inc., Japan Vilene Company, Ahlstrom-Munksjö, DuPont, Mogul Co. Ltd., ExxonMobil (as a major resin supplier), PF Nonwovens, Kimberly-Clark, Fiberweb (TWE Group), Shalag Nonwovens, Mitsui Chemicals, Innovatec Microfibre Srl, Nan Ya Plastics Corporation, Glatfelter Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Melt-Blown Filtration Material Market Key Technology Landscape

The technological landscape of the composite melt-blown filtration material market is defined by continuous innovation aimed at increasing filtration efficiency, reducing pressure drop (to lower energy consumption), and enhancing material durability and functional integration. The core technology, the melt-blowing process, has evolved significantly from conventional single-beam systems to advanced multi-beam, high-throughput lines capable of producing composite structures in-line without requiring external lamination. A primary focus is on fiber morphology control. Advanced systems now utilize precise control over air velocity, polymer flow rate, and die geometry to achieve highly consistent ultrafine fiber diameters, often in the sub-micron range (0.5 to 5.0 µm), which is crucial for HEPA and ULPA media performance. Furthermore, the integration of nanofiber layers—either electros pun directly onto the melt-blown substrate or through sophisticated lamination techniques—is a breakthrough, providing extremely high surface area and significantly boosting filtration efficiency for the smallest particulate matter (PM 0.3) without causing prohibitive pressure increases. This nanofiber integration represents a high-value technological niche.

Electrostatic charging technology is indispensable for maximizing the performance of composite melt-blown media, particularly for air filtration. While standard thermal charging (e.g., corona discharge) remains common, advanced manufacturers are utilizing triboelectric charging and hydro-charging techniques to create deep-charge media with persistent charge retention. This persistence is vital because the electrostatic attraction mechanism enhances particle capture, allowing the media to achieve high efficiency even with a more open physical structure, thereby maintaining a low pressure drop and reducing energy costs for HVAC systems. Technological advancements also focus on structural customization through gradient density filtration. This involves engineering the composite media with progressively finer fiber layers (coarser fibers facing the airflow, finer fibers inside) to maximize dust-holding capacity (DHC) and extend the filter's service life before replacement is necessary. This graded structure prevents premature surface loading, making the filter material highly effective for heavy industrial dust applications.

The latest wave of innovation centers on developing genuinely multifunctional composite materials. This involves integrating active ingredients directly into the polymer matrix or the composite layers. Examples include the incorporation of photocatalytic nanoparticles (such as TiO2) to enable the media to degrade volatile organic compounds (VOCs) and certain air pollutants upon exposure to UV light, transforming the filter from a passive barrier to an active air purification system. Similarly, antimicrobial agents (e.g., silver ions or copper compounds) are being compounded into the melt-blown fibers, particularly for medical and food handling applications, to inhibit microbial growth on the filter surface, preventing secondary contamination. Finally, sustainability-driven technology is pushing the use of chemically recycled or bio-based polymers (e.g., PLA or PHA) in melt-blown production. While achieving the necessary MFI and filtration performance with these novel polymers remains a technical challenge, significant R&D efforts are dedicated to making these sustainable composite materials viable for high-performance applications, positioning manufacturers for leadership in environmentally conscious markets.

Regional Highlights

The geographical distribution of the Composite Melt-Blown Filtration Material Market reflects distinct regulatory environments, levels of industrial maturity, and regional disparities in air quality challenges, leading to varied demand profiles across major regions. The Asia Pacific (APAC) region stands as the dominant market globally, driven by a convergence of high population density, rapid industrialization, and subsequent severe environmental issues, particularly in high-growth economies like China, India, and Southeast Asian nations. APAC accounts for the largest share of global consumption, primarily fueled by massive infrastructure projects, the expansion of manufacturing bases (electronics, textiles, automotive), and continuous high demand for respiratory protection (masks) due to pervasive urban smog and recurring regional health concerns. Production capacity is also concentrated in this region, benefiting from favorable manufacturing economics, although competition based on cost is extremely intense, leading to continuous investment in scale and automation to maintain thin margins. Regulatory bodies in APAC, while historically less stringent than in the West, are rapidly adopting higher international filtration standards, further boosting demand for high-performance composites.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on regulatory compliance and premium product performance. In North America, demand is heavily influenced by stringent EPA and OSHA regulations concerning occupational safety and industrial emissions, driving consumption in sophisticated industrial processes and the well-established automotive sector. The U.S. healthcare system also mandates the highest standards for medical-grade composites. Europe, conversely, is guided by the strictest energy efficiency mandates globally, notably the ISO 16890 standards for air filters, which prioritize media that maintain high efficiency while minimizing pressure drop. European manufacturers often lead innovation in sustainable filtration solutions, focusing heavily on recycling capabilities and reducing the environmental footprint of their products. Demand in these regions is less volume-driven but highly specification-dependent, favoring companies that offer patented technologies like permanent electrostatic charge or specialized chemical resistance.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting high potential growth. In LATAM, growth is uneven but accelerated by increasing foreign direct investment in manufacturing and heightened public awareness regarding air quality, particularly in large urban centers like São Paulo and Mexico City. Industrial growth in mining and infrastructure projects further stimulates demand for heavy-duty process filtration. The MEA region is witnessing significant consumption growth tied to massive construction and infrastructure projects, requiring extensive HVAC filtration in commercial buildings to manage desert dust and regional air quality issues. Furthermore, water scarcity in MEA drives robust demand for liquid filtration materials, including reverse osmosis pre-filters and advanced membrane support layers, positioning the market for sustained high growth in the non-air filtration segments.

- Asia Pacific (APAC): Dominant in volume and capacity; driven by urbanization, severe air pollution, and high manufacturing output (electronics, textiles). Focus on cost-effective, high-volume SMS media.

- North America: High-value market focused on strict regulatory compliance (OSHA, EPA); significant demand in healthcare (N95) and high-end automotive filtration; emphasis on proprietary charging technology.

- Europe: Focus on sustainability and energy efficiency (ISO 16890); technological leaders in bio-based and recyclable composite media; strong demand in pharmaceutical cleanrooms and advanced HVAC systems.

- Latin America (LATAM): Emerging market growth driven by industrial expansion (mining, processing) and increasing penetration of modern HVAC systems in commercial infrastructure.

- Middle East & Africa (MEA): Rapid growth in liquid filtration (water treatment) and high-efficiency dust filtration for large-scale construction and commercial HVAC applications in arid environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Melt-Blown Filtration Material Market.- Lydall Inc. (Hollingsworth & Vose)

- 3M Company

- Kimberly-Clark

- Sandler AG

- Freudenberg Group

- Toray Industries Inc.

- Berry Global Inc.

- Japan Vilene Company

- Ahlstrom-Munksjö

- DuPont

- Mogul Co. Ltd.

- ExxonMobil (Major Polymer Supplier)

- PF Nonwovens

- Fiberweb (TWE Group)

- Shalag Nonwovens

- Mitsui Chemicals

- Innovatec Microfibre Srl

- Nan Ya Plastics Corporation

- Glatfelter Corporation

- SABIC (Major Polymer Supplier)

Frequently Asked Questions

Analyze common user questions about the Composite Melt-Blown Filtration Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of composite melt-blown media over traditional single-layer media?

Composite melt-blown media offers enhanced performance by combining the high particle capture efficiency of ultrafine melt-blown fibers with the mechanical strength and rigidity of support layers, typically spunbond. This layered approach maximizes dirt-holding capacity, ensures structural integrity for pleating, and maintains a low pressure drop, leading to extended filter life and reduced energy consumption in operational systems.

How does electrostatic charging technology enhance the performance of composite melt-blown materials?

Electrostatic charging, achieved through processes like hydro-charging or corona discharge, imparts a persistent electrical charge to the melt-blown fibers. This charge allows the filter to capture particles through electrostatic attraction rather than purely mechanical sieving. This results in significantly higher filtration efficiency (PFE/BFE) for ultra-fine particulates (PM 2.5 and PM 0.3) at a lower density, thus dramatically reducing the resistance to airflow (pressure drop).

Which end-use industry drives the highest demand for specialized, high-performance composite media?

The Healthcare and Pharmaceutical industries drive the highest demand for specialized, certified high-performance composite media. These sectors require materials meeting stringent governmental standards (e.g., N95/FFP2, BFE 99.9%) for respiratory protection and sterile barrier fabrics, demanding consistency, chemical resistance, and guaranteed efficacy against pathogens and aerosols.

What role do sustainable materials play in the future development of the melt-blown market?

Sustainability is a critical opportunity area, focusing on the integration of bio-based polymers (like PLA) or chemically recycled polypropylene into composite structures. This development aims to address the environmental challenges associated with non-degradable nonwovens, positioning manufacturers to meet growing corporate and regulatory demands for environmentally responsible filtration solutions.

How is AI specifically impacting the quality control and R&D processes for composite melt-blown materials?

AI is transforming quality control by enabling real-time, automated defect detection using high-speed machine vision systems, ensuring unprecedented consistency in web uniformity. In R&D, AI-driven simulation accelerates the design of new composite layering and fiber configurations, drastically reducing the time and cost associated with physical prototyping to meet evolving efficiency standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager