Composite Plier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432399 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Composite Plier Market Size

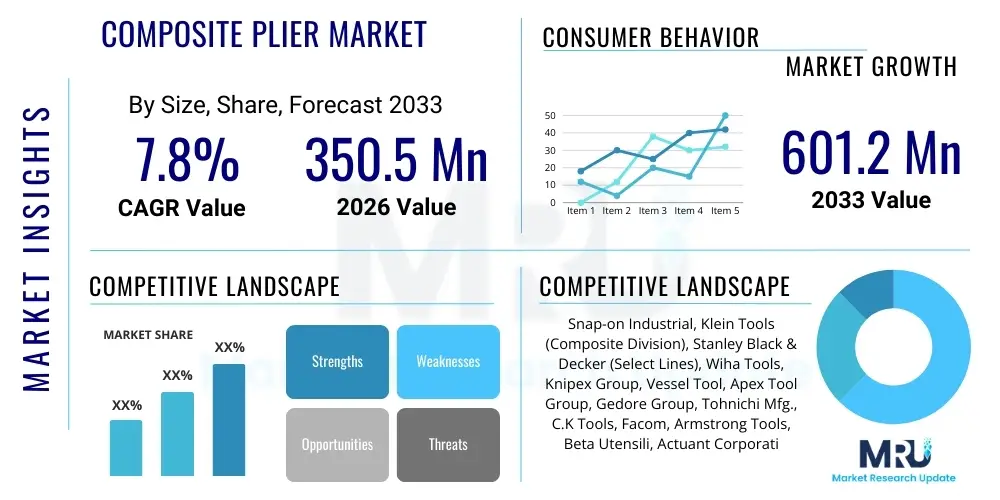

The Composite Plier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 601.2 Million by the end of the forecast period in 2033.

Composite Plier Market introduction

The Composite Plier Market specializes in the production and distribution of hand tools constructed from advanced polymer composites, reinforced primarily with materials such as glass fiber, carbon fiber, or specialized engineering plastics like Polyether Ether Ketone (PEEK). This specialized market segment addresses critical industrial requirements where traditional metal tools pose inherent risks related to electrical conductivity, magnetic interference, or potential surface marring. The core functionality of composite pliers—gripping, holding, bending, and cutting—is maintained, but the non-metallic construction transforms the tool into a safety and precision instrument vital for modern technological applications. The increasing complexity of electronic assemblies, the rapid deployment of high-voltage systems (particularly in the Electric Vehicle sector), and stringent regulatory standards demanding enhanced worker safety are the primary accelerators driving the penetration of these tools across global industries. The inherent dielectric properties of these materials ensure technician safety when working on live electrical components, a factor that is becoming non-negotiable in sophisticated manufacturing environments.

A key distinguishing feature of composite pliers is the engineering challenge of replicating the mechanical strength and durability of forged steel using polymer matrices. Successful market offerings utilize proprietary blending and molding techniques to orient reinforcing fibers optimally, ensuring high tensile and flexural strength, particularly at pivot points and gripping surfaces. Product categorization often depends on the level of reinforcement; for instance, high-performance applications in aerospace maintenance necessitate carbon fiber composites for maximum stiffness and minimum weight, while general electronics assembly may rely on glass fiber composites for adequate insulation at a lower cost point. Beyond non-conductivity, composite pliers are valued for their resistance to corrosive chemicals, oils, and solvents commonly found in industrial settings, significantly extending their operational lifespan compared to coated metal tools which may lose their protective finish. The tactile difference, often being lighter than comparable metal tools, also contributes to reduced operator fatigue during prolonged use, enhancing overall productivity and ergonomic compliance in large assembly operations.

The strategic deployment of composite pliers spans several high-value industries. In the automotive sector, the transition to high-voltage battery systems in Electric Vehicles (EVs) has created an enormous captive market, where technicians must exclusively use insulated or non-conductive tools to prevent fatal electrical accidents and potential damage to sensitive battery management systems. Similarly, the aerospace industry relies on these tools for working with sensitive avionics and delicate composite airframes, where avoiding scratches or metal contamination (Foreign Object Debris or FOD) is paramount to structural integrity and regulatory compliance. The demand is further amplified by advanced manufacturing sectors, including semiconductor fabrication and medical device assembly, where static discharge protection (ESD-safe properties) and non-magnetic materials are fundamental requirements. These specialized applications, underpinned by strict global standards and the economic push for enhanced safety, establish the Composite Plier Market as a technically specialized, high-growth niche within the broader hand tool industry.

Composite Plier Market Executive Summary

The Composite Plier Market is experiencing substantial expansion, forecasted by a robust CAGR, driven by global shifts toward electric mobility and rigorous industrial safety certifications. Current business trends highlight an intensified competitive landscape focusing on proprietary material science breakthroughs—specifically leveraging advanced materials like PEEK and high-modulus carbon fiber to overcome historical concerns about composite tool durability under high mechanical stress. Leading manufacturers are investing heavily in automation for precision molding processes to reduce production costs, making specialized composite tools more economically viable for broader industrial adoption beyond just the premium aerospace sector. Furthermore, the increasing complexity of regulatory compliance across global markets is compelling smaller enterprises to adopt certified non-conductive tools, thereby expanding the potential customer base and stabilizing long-term demand growth, even as global economic uncertainty fluctuates.

Geographically, market leadership remains concentrated in mature industrial economies. North America maintains dominance, benefiting from an established infrastructure supporting defense, aviation MRO, and a rapidly scaling domestic EV production sector, all demanding certified, premium composite solutions. However, the Asia Pacific (APAC) region is forecast to be the most dynamic growth area, fueled by aggressive government subsidies for EV manufacturing (especially in China) and the sheer scale of investment in consumer electronics production. This regional growth is shifting the global supply chain, with APAC becoming a critical source for high-volume, mid-range composite pliers suitable for electronics and general maintenance, challenging the traditional premium pricing structures set by European and North American tool makers. Competition in APAC centers on speed-to-market and localized certification compliance, ensuring market access to large, regional manufacturing contracts.

Analysis of market segments reveals that the Automotive application segment, particularly due to high-voltage EV service and assembly, is the single most important growth driver in terms of revenue opportunity. Segmentation by material indicates a rising preference for high-performance polymers (PEEK and Aramid composites) for applications requiring extreme environmental resistance (heat, chemicals), signaling a market premium placed on operational versatility and tool longevity. Conversely, the mass-market segment utilizing glass fiber reinforced plastics maintains steady volume due to its application in standard electrical maintenance. Overall, the market trajectory is defined by a dichotomy: the premium segment demands maximum technological specification and certification, while the volume segment demands optimization of cost and ergonomic efficiency, forcing manufacturers to diversify their product lines substantially to capture the full spectrum of industrial demand.

AI Impact Analysis on Composite Plier Market

Common user and industry queries concerning AI's influence on the Composite Plier Market frequently center on improving production efficiency, ensuring consistent material quality, and enhancing tool intelligence. Users ask whether AI-driven simulation can dramatically reduce the product development cycle by optimizing fiber layup patterns, crucial for balancing strength and weight in composite structures. There is also significant interest in how machine learning (ML) models can analyze non-destructive testing (NDT) data, such as ultrasonic scans, to detect microscopic defects or voids within the composite matrix far faster and more reliably than human inspection, thereby guaranteeing the safety rating of insulated tools. Furthermore, stakeholders inquire about integrating Internet of Things (IoT) sensors into high-value composite tools, enabling AI platforms to track tool usage, location, and calibration status in real-time, reducing the risk of using uncertified or fatigued equipment on critical assembly lines, particularly in aerospace and nuclear facilities. The consensus is that AI will be transformative in manufacturing consistency and quality assurance, which are major constraints in scaling the production of structurally complex composite tools.

- AI-driven Predictive Maintenance: Analyzing tool usage patterns and stress data to predict material degradation and schedule replacement, ensuring tools maintain certified safety standards over their operational lifecycle.

- Generative Design Optimization: Utilizing AI algorithms to simulate and optimize composite fiber orientation and ergonomic shapes, maximizing strength-to-weight ratio while adhering to strict dimensional tolerances.

- Quality Control and Defect Detection: Implementing Machine Vision and AI-based inspection systems during manufacturing to identify micro-cracks, voids, or inconsistencies in the composite structure post-molding with extremely high accuracy, essential for VDE certification.

- Supply Chain and Inventory Management: AI algorithms forecasting demand for specific high-performance composite materials (e.g., PEEK composites) and optimizing warehousing locations based on regional industrial project schedules and geopolitical risk assessment.

- Automated Assembly Integration: Developing composite tools compatible with collaborative robotic arms, leveraging AI vision systems for precise component placement, force feedback calibration, and ensuring non-marring interaction with delicate parts.

DRO & Impact Forces Of Composite Plier Market

The strategic expansion of the Composite Plier Market is fundamentally influenced by powerful drivers, systemic restraints, and lucrative opportunities. The primary driver is the global imperative for enhanced industrial safety, codified through rigorous standards like VDE (Germany) and ASTM (USA), mandating non-conductive tools in high-voltage environments, a requirement exponentially amplified by the Electric Vehicle revolution. This safety driver is complemented by the technological push for lightweighting in aerospace and precision manufacturing, where the high strength-to-weight ratio of carbon fiber composites translates directly into operational efficiency and fuel savings. The need to prevent Foreign Object Debris (FOD) and surface damage in sensitive assemblies further cements the role of composite tools. These drivers establish a high floor of mandatory demand, particularly in regulated industries, ensuring market stability and continuous investment in specialized product lines, moving the composite plier from a desirable option to a necessary compliance item.

However, significant restraints temper the market’s growth rate, primarily centered on economic viability and material perception. The specialized nature of composite manufacturing, involving expensive raw materials (PEEK, high-modulus carbon fiber) and complex, energy-intensive molding processes, results in a significantly higher unit cost compared to mass-produced, drop-forged steel pliers. This cost barrier restricts widespread adoption in general maintenance and DIY markets, limiting the total addressable market size. Additionally, despite technological advances, there is a persistent psychological barrier among veteran technicians regarding the ultimate durability and torque resistance of composite tools, particularly when comparing them directly to robust metal counterparts. Manufacturers must continuously invest in user education and verifiable stress testing data to overcome this ingrained skepticism. Furthermore, achieving reliable, certified high-voltage insulation requires strict quality control, and any material inconsistency can lead to expensive product recalls or safety failures, increasing operational risk for manufacturers.

The foremost opportunities for market players lie in developing specialized, application-specific multi-functional composite tools that integrate sensing or tracking capabilities, offering added value beyond basic mechanical function. This includes composite tools designed specifically for thermal management tasks in battery packs or tools with integrated torque-monitoring capabilities, appealing to the precision requirements of the aerospace sector. Geographically, penetration into high-growth, industrializing regions, especially within Asia Pacific (APAC) and Latin America, represents a vast untapped opportunity, provided manufacturers can localize production and offer price points competitive with regional equivalents. Impact forces further shaping the market include technological advancements in thermoplastic welding and advanced additive manufacturing, which promise to reduce material waste and allow for rapid customization, potentially lowering long-term production costs. Socio-economic impacts, such as global labor market trends prioritizing highly skilled technical roles with premium safety equipment, also exert positive pressure on demand for high-specification composite pliers, ensuring sustained market capitalization.

Segmentation Analysis

The Composite Plier Market segmentation provides a strategic framework for understanding diverse user needs, technological requirements, and consumption patterns across global industries. The segmentation by Type is crucial, ranging from standard general-purpose gripping pliers (often made from glass fiber composites for lower dielectric requirements) to highly specialized tools such as precision needle-nose pliers for micro-electronics or high-voltage insulated crimping tools certified to rigorous VDE standards. This variety dictates manufacturing complexity and pricing, with specialized and insulated tools commanding a significant premium due to the necessary certification and stringent quality assurance processes. The constant need for precision assembly in growing sectors, coupled with evolving ergonomic standards, forces continual product innovation within the "Type" segments, ensuring a dynamic and responsive product portfolio tailored to specific operator tasks, rather than offering a one-size-fits-all solution.

The Material segmentation is perhaps the most critical determinant of tool performance and cost. Carbon Fiber Reinforced Plastics (CFRP) offer maximum stiffness and lightweight properties, making them indispensable in weight-sensitive applications like aviation, while high-performance engineering thermoplastics like PEEK are favored where extreme chemical resistance, sterilization capability (e.g., medical), and high-temperature tolerance are mandatory, despite PEEK being one of the most expensive raw materials. Glass Fiber Reinforced Plastics (GFRP) represent the volume segment, offering adequate non-conductivity and good mechanical strength for general electrical and maintenance work at a more competitive price point. Understanding the material choice is central to both marketing the tool’s specific performance limits and managing the cost-of-goods-sold (COGS) structure, ensuring that the final product meets the required safety standards without being excessively priced out of its target application segment.

- By Type:

- Standard Gripping Pliers (Slip Joint, Linesman)

- Precision Pliers (Needle Nose, Bent Nose)

- Specialized Pliers (Crimping, Cutting, Locking Pliers)

- High-Voltage Insulated Composite Pliers

- By Material:

- Carbon Fiber Reinforced Plastic (CFRP)

- Glass Fiber Reinforced Plastic (GFRP)

- Aramid Fiber Composites

- PEEK (Polyether Ether Ketone) and other High-Performance Polymers

- By Application:

- Aerospace and Defense Maintenance

- Automotive (EV Manufacturing and Repair)

- Electronics and Electrical Assembly

- Telecommunications Infrastructure

- Medical Device Manufacturing

- General Industrial Maintenance

- By Distribution Channel:

- Offline Retail (Specialized Industrial Suppliers, Hardware Chains)

- Online Sales (E-commerce Platforms, Manufacturer Websites)

Value Chain Analysis For Composite Plier Market

The value chain for composite pliers is initiated by the sophisticated upstream sourcing of specialized raw materials, a phase characterized by high intellectual property barriers and strict quality specifications. Manufacturers rely on specialized chemical suppliers for high-grade polymer resins, such as engineering-grade Nylon, PBT, or advanced polymers like Ultem and PEEK, alongside reinforcing fibers (continuous carbon, chopped glass, or woven aramid). The technical challenge upstream involves ensuring the polymer compound offers optimal flow characteristics for complex mold geometries while maintaining uniform dispersion of the reinforcing fibers to guarantee structural integrity and dielectric performance. Collaboration between tool manufacturers and material suppliers is intense, often involving co-development of custom prepreg materials tailored for specific tooling requirements, which secures material consistency and establishes a significant barrier to entry for new competitors who lack access to proprietary composite formulas and processing expertise.

The core manufacturing and processing stage converts these raw composites into the finished tool through highly technical processes. Precision injection molding, often incorporating heating and cooling cycles optimized for fiber-reinforced materials, is utilized for high-volume standard tools. For extremely high-strength or complex geometries, compression molding or reaction injection molding (RIM) might be employed. The critical manufacturing step involves intricate post-molding processes such as precise deburring, surface finishing to ensure non-marring capability, and the precise assembly of pivot mechanisms, which may incorporate non-metallic or ceramic axles to maintain absolute non-conductivity. Quality assurance throughout this phase is non-negotiable, particularly the electrical testing protocols (e.g., dielectric breakdown voltage testing) required for VDE or IEC certification, which adds considerable cost and complexity compared to standard metal tool production. The efficiency in this phase is key to reducing the final unit cost, making automation and AI-driven quality checks essential investments.

The downstream segment, focused on distribution and sales, highlights the market's technical nature. The distribution channel is strategically segmented into direct and indirect routes. Direct sales are managed by technical sales teams targeting large OEM clients in aerospace and automotive sectors, offering customized tools, multi-year supply contracts, and comprehensive technical support necessary for integration into large-scale production environments. The indirect channel, dominating sales to MRO and smaller workshops, relies heavily on specialized industrial distributors (Offline) who act as technical consultants, providing necessary expertise on safety ratings, material compatibility, and regulatory compliance to end-users. E-commerce platforms (Online) are critical for reaching fragmented repair markets globally, offering detailed product specifications, virtual technical support, and streamlined logistics for standard composite tool purchases. The success of the downstream operation depends entirely on providing verifiable certification documentation and reliable technical education, transforming the simple act of selling a plier into a specialized technical transaction centered on risk mitigation and industrial compliance.

Composite Plier Market Potential Customers

The potential customer base for the Composite Plier Market is highly professionalized and predominantly industrial, segmented by the need for non-conductivity, non-marring capability, or extreme lightweight performance. Primary end-users are highly skilled technicians and engineers operating within safety-critical or precision-sensitive environments. The largest and most demanding segment includes Aerospace and Defense companies (MRO teams and assembly lines), which utilize composite tools for maintaining sensitive electronic systems, preventing foreign object debris (FOD) risk, and working with complex, weight-sensitive structures. Similarly, the burgeoning Electric Vehicle (EV) and Hybrid Vehicle manufacturing sectors represent rapidly growing customers, requiring certified non-conductive tools for assembly, maintenance, and diagnostics of high-voltage battery packs and power systems, prioritizing safety above all else.

Another significant customer group resides within the Electronics and Telecommunications industry, particularly in cleanroom environments or manufacturing settings dealing with sensitive circuitry and semiconductors. These buyers require tools that minimize the risk of electrostatic discharge (ESD) and physical damage (marring) to delicate components, favoring specialized composite materials like PEEK due to their intrinsic non-magnetic properties. Furthermore, industrial maintenance professionals working in chemical processing plants or near magnetic resonance imaging (MRI) equipment represent steady customers, relying on the chemical resistance and non-magnetic nature of certain composite compositions. These potential customers prioritize long-term durability and certification compliance (e.g., ISO, ASTM, or specific dielectric standards) over initial purchasing cost, making them ideal targets for premium, high-specification composite products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 601.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Snap-on Industrial, Klein Tools (Composite Division), Stanley Black & Decker (Select Lines), Wiha Tools, Knipex Group, Vessel Tool, Apex Tool Group, Gedore Group, Tohnichi Mfg., C.K Tools, Facom, Armstrong Tools, Beta Utensili, Actuant Corporation (Enerpac), Tecatool, Jonard Tools, Ideal Industries, Phoenix Contact, HellermannTyton, Greenlee Tools, Wera Tools, Bondhus Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Plier Market Key Technology Landscape

The technology landscape governing the Composite Plier Market is dominated by advancements in polymer and fiber engineering, crucial for maximizing tool performance under demanding industrial loads while maintaining essential non-conductive properties. A foundational technology is the optimization of thermoplastic composite manufacturing, specifically the use of long-fiber injection molding (LFIM) techniques. LFIM ensures that reinforcing fibers, often measuring several millimeters, are uniformly distributed and oriented strategically within the polymer matrix. This precise control over fiber architecture is paramount because it directly determines the tool's resistance to catastrophic failure, bending moment, and fatigue life. Furthermore, proprietary surface treatments and coatings are utilized to enhance grip ergonomics and provide specialized ESD (Electrostatic Discharge) safety characteristics for electronics assembly, where the material must be dissipative rather than purely insulative, representing a fine technological balance that requires specialized material blends.

Material science innovation remains a primary technology driver. The increasing adoption of high-performance polymers, notably PEEK (Polyether Ether Ketone), represents a significant leap. PEEK composite pliers are utilized in environments demanding extreme thermal stability (withstanding up to 260°C continuously) and aggressive chemical environments, such as aerospace maintenance near jet fuel or hydraulic fluids, far surpassing the limitations of standard Nylon or Glass Fiber Reinforced Plastics (GFRP). Another vital technological area involves the precision required for the tool’s hinge and pivot mechanisms. Since metal components cannot be used due to conductivity or magnetism restrictions, advanced ceramic inserts or self-lubricating, ultra-hardened polymer bearings are employed. These non-metallic pivot systems must withstand millions of open-close cycles without binding or failing, requiring advanced tribological studies and high-precision machining only possible with multi-axis CNC technology specifically adapted for composite materials.

Finally, certification and quality assurance technologies are indispensable components of the landscape. Manufacturers must employ sophisticated Non-Destructive Evaluation (NDE) techniques, such as industrial Computed Tomography (CT) scanning or highly tuned ultrasonic testing, to detect sub-surface voids, fiber misalignment, or internal defects that would compromise the dielectric strength of the tool. Compliance with VDE, IEC, and ASTM standards for insulation testing requires specialized, high-voltage testing rigs that apply voltages far exceeding the tools' rated capacity to ensure reliability, making this testing infrastructure a crucial technological investment. Looking forward, the integration of smart manufacturing principles, leveraging AI for instantaneous quality feedback and digital twins to simulate tool stress, promises to streamline production, reduce material waste, and guarantee that every composite plier reaching the end-user meets the required safety and durability profile, accelerating market competitiveness and customer trust.

Regional Highlights

- North America: Market leader in value, driven by defense, aerospace MRO, and intensive investment in EV battery assembly and service infrastructure. Requires high-spec CFRP and PEEK materials.

- Europe: Stable, high-value growth market anchored by strict VDE compliance, premium engineering brands, and strong automotive and automation sectors. Focus on safety, ergonomics, and tool certification.

- Asia Pacific (APAC): Highest CAGR market, propelled by the volume of electronics manufacturing, semiconductor fabrication, and the massive scaling of EV production in East Asia. Growing capability in domestic manufacturing of cost-effective and specialized composites.

- Latin America (LATAM): Developing market with pockets of high demand in emerging automotive assembly plants and telecommunications expansion, gradually adopting composite tools as safety protocols mature.

- Middle East & Africa (MEA): Niche demand concentrated in petrochemical maintenance (requiring high chemical and temperature resistance) and infrastructure projects, favoring non-sparking and non-magnetic material characteristics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Plier Market.- Snap-on Industrial

- Klein Tools (Composite Division)

- Stanley Black & Decker (Select Lines)

- Wiha Tools

- Knipex Group

- Vessel Tool

- Apex Tool Group

- Gedore Group

- Tohnichi Mfg.

- C.K Tools

- Facom

- Armstrong Tools

- Beta Utensili

- Actuant Corporation (Enerpac)

- Tecatool

- Jonard Tools

- Ideal Industries

- Phoenix Contact

- HellermannTyton

- Greenlee Tools

- Wera Tools

- Bondhus Corporation

- Hozan Tool Industrial

- Channellock Inc. (Specialty Lines)

Frequently Asked Questions

Analyze common user questions about the Composite Plier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of composite pliers over traditional steel tools?

The primary advantage is their non-conductive nature, providing essential electrical safety in high-voltage environments, coupled with significantly lighter weight and non-marring properties for precision work on delicate surfaces like aircraft skin or electronic components. They also offer superior chemical and corrosion resistance, making them ideal for specialized industrial MRO tasks.

Are composite pliers strong enough for heavy-duty industrial applications?

Modern high-performance composite pliers, often reinforced with carbon or aramid fibers and engineered using proprietary molding techniques, are certified for numerous critical heavy-duty tasks where non-conductivity, non-magnetic, or non-sparking properties are mandatory. They are specifically designed to meet or exceed the performance requirements for professional use in specialized industrial environments like EV service or aviation maintenance.

Which material segment drives the highest growth in the Composite Plier Market?

The PEEK (Polyether Ether Ketone) and Carbon Fiber Reinforced Plastic (CFRP) segments are exhibiting the highest revenue growth rates. This is attributed to their necessity in high-value applications such as aerospace and premium EV manufacturing, which demand maximum thermal stability, extreme chemical resistance, and the highest strength-to-weight ratios achievable in non-metallic tooling.

How do regulatory changes influence the demand for composite pliers?

Stringent regulatory changes, particularly those concerning occupational health and safety (OHS) and specialized certifications (like VDE or ATEX directives), directly drive demand. Compliance mandates the replacement of standard metal tools with certified non-conductive options, directly accelerating market adoption, especially across high-risk sectors like high-voltage electrical, energy, and telecom infrastructure maintenance.

In which region is the adoption of composite pliers expected to accelerate the fastest?

The Asia Pacific (APAC) region is projected to show the fastest acceleration in adoption. This growth is fundamentally fueled by substantial government and private sector investment in massive Electric Vehicle (EV) production facilities and the rapid scaling of domestic electronics and semiconductor manufacturing, creating enormous, localized demand for specialized, non-marring tooling solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager