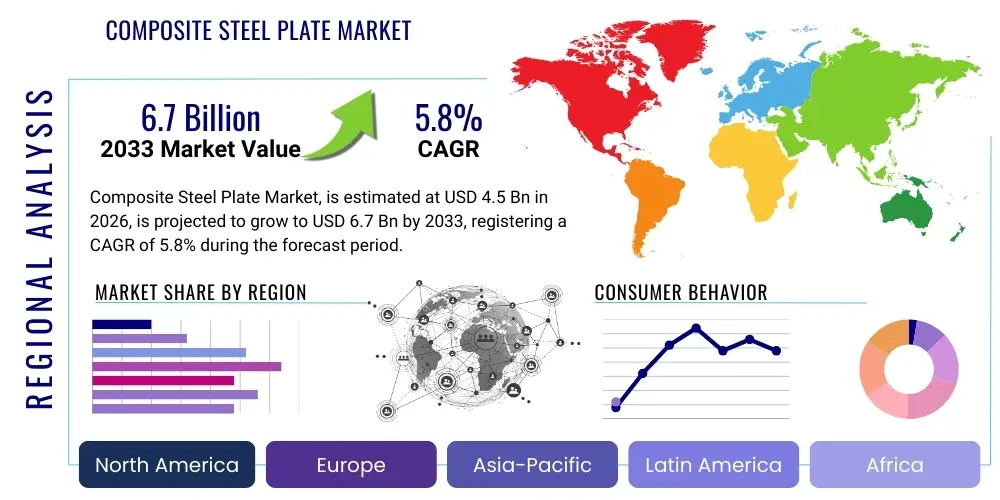

Composite Steel Plate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436502 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Composite Steel Plate Market Size

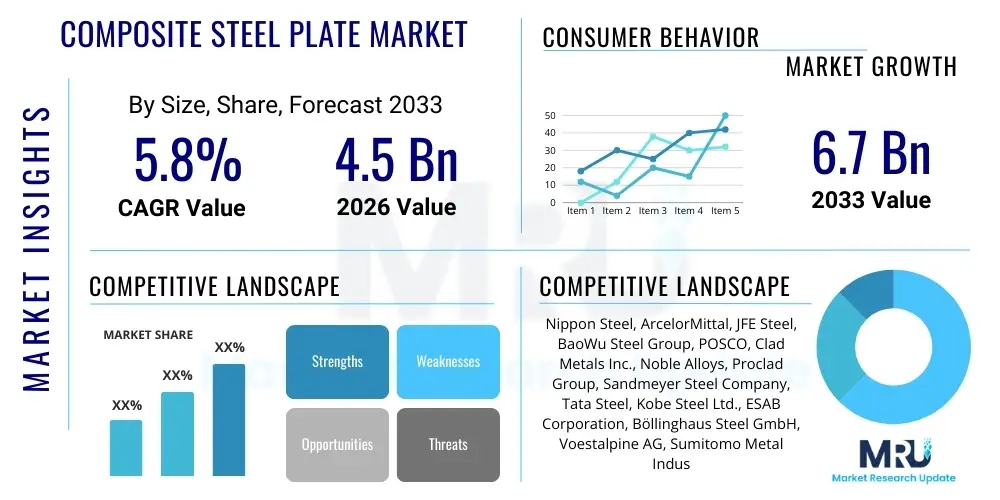

The Composite Steel Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Composite Steel Plate Market introduction

Composite steel plates, often referred to as clad plates, are engineered materials comprising two or more layers of different metals permanently bonded together. Typically, they feature a high-performance surface material (the cladding layer), such as stainless steel, nickel alloys, titanium, or copper, bonded to a thicker, less expensive base material, usually carbon or low-alloy steel. This sophisticated combination leverages the corrosion resistance, heat resistance, or wear resistance of the cladding material while maintaining the structural strength, high rigidity, and cost-effectiveness of the base plate. The primary objective is to achieve optimal material performance in demanding operating environments without incurring the prohibitive costs associated with fabricating entire structures from expensive, solid alloys. The engineering versatility allows these plates to be tailored precisely to application requirements, minimizing material waste and maximizing longevity, particularly in severe service conditions characterized by high pressure, extreme temperatures, and aggressive chemical exposure.

The burgeoning demand for advanced materials in critical infrastructure sectors, including petrochemicals, offshore drilling, nuclear power, and specialized manufacturing, is the principal catalyst driving market expansion. Composite steel plates offer a superior solution compared to monolithic materials in scenarios where both high structural integrity and exceptional surface protection are simultaneously required. For instance, in the oil and gas industry, these plates are vital for constructing pressure vessels, heat exchangers, and reactors that must withstand internal corrosive agents while maintaining mechanical stability under high operating pressures. The product description emphasizes the meticulous bonding process, typically achieved through explosion welding, roll bonding, or explosive roll bonding, ensuring a metallurgical bond that guarantees structural integrity across the interface between the distinct layers. Furthermore, the aesthetic and maintenance benefits in civil engineering and architectural applications, although minor compared to industrial use, contribute to niche market growth.

Major applications of composite steel plates span across capital-intensive industries. They are extensively utilized in the construction of liquefied natural gas (LNG) terminals and storage tanks, where cryogenic performance and resistance to corrosion are paramount. In the power generation sector, especially in coal gasification and nuclear facilities, these plates are essential for boiler parts and reactor components. The overarching benefit of composite steel plates lies in their economic efficiency and superior performance profile. They significantly reduce overall material costs compared to using solid high-alloy materials, extend the operational lifespan of equipment, and decrease maintenance downtime, thereby improving industrial productivity and safety compliance across diverse manufacturing and processing environments globally. The stringent regulatory environment concerning material performance in hazardous environments further solidifies the essential role of these materials in modern industrial infrastructure development.

Composite Steel Plate Market Executive Summary

The Composite Steel Plate Market is experiencing robust expansion driven primarily by accelerated investment in the global energy sector, particularly in complex offshore oil and gas projects and capacity expansion within the chemical processing industry. Business trends indicate a strong shift towards advanced manufacturing techniques, such as precision explosion welding and hybrid roll bonding, aimed at improving bond strength, reducing defects, and increasing the variety of material combinations available, particularly those involving refractory metals and specialized duplex stainless steels. Furthermore, consolidation among major steel producers and specialized cladding companies is shaping the competitive landscape, leading to enhanced vertical integration and optimized supply chains capable of handling large-scale infrastructure demands. Environmental regulations demanding longer operational lifecycles and reduced material consumption are reinforcing the value proposition of clad plates, positioning them as an essential component for sustainable industrial development. This executive overview highlights that strategic material sourcing and technological differentiation remain key competitive advantages in this highly technical market segment.

Regional trends demonstrate that Asia Pacific (APAC) holds the largest market share and is projected to exhibit the fastest growth, fueled by massive infrastructure development in China, India, and Southeast Asian nations, coupled with significant governmental investment in refining and petrochemical complexes. North America and Europe, while mature, maintain strong demand, particularly driven by modernization projects in aging energy infrastructure and stringent regulatory standards requiring high-performance materials in critical pressure equipment. The Middle East and Africa (MEA) region is exhibiting accelerated growth, directly tied to upstream oil and gas exploration and the construction of large-scale desalination and power generation plants, all necessitating corrosion-resistant composite materials. Overall, the global market trajectory is characterized by a geographic shift in manufacturing capacity and consumption towards emerging economies, while innovation leadership remains concentrated in established industrial centers.

Segmentation trends reveal that explosion-welded plates dominate the market due to their unparalleled bond strength and suitability for highly demanding applications, although roll-bonded plates maintain a significant share in applications requiring greater dimensional precision or lower cost profiles. In terms of material combination, the Carbon Steel/Stainless Steel segment remains the cornerstone, owing to its versatility and cost-efficiency in general corrosion protection. However, the fastest growth is anticipated in specialized combinations, such as Carbon Steel/Titanium and Carbon Steel/Nickel Alloys, reflecting the increasing prevalence of ultra-corrosive media and high-temperature environments in chemical and specialized manufacturing processes. The application segment growth is predominantly concentrated in the oil and gas sector (upstream and downstream), followed closely by the chemical processing industry, where material failure can lead to catastrophic operational and environmental consequences, thus mandating the use of highly reliable composite solutions.

AI Impact Analysis on Composite Steel Plate Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Composite Steel Plate Market frequently center on three key areas: optimizing the complex bonding processes, enhancing material quality control, and streamlining supply chain logistics for specialized alloys. Users are particularly concerned about how AI-driven predictive maintenance can be applied to clad structures in operation, extending their lifespan and predicting failure points related to bond integrity or cladding degradation. There is significant expectation that AI algorithms, particularly machine learning models trained on extensive production data, will revolutionize the explosion welding process by automating parameter tuning (e.g., explosive charge, standoff distance) to ensure higher bond quality and reduced defect rates, thereby addressing the inherent variability and precision challenges of current manual and semi-automated techniques. Furthermore, users anticipate that computer vision integrated with AI will significantly improve the speed and accuracy of non-destructive testing (NDT) and inspection of composite plates, especially ultrasonic and radiographic evaluations, minimizing human error and providing real-time quality assurance feedback directly to the manufacturing line, establishing a paradigm shift towards smart manufacturing in this heavy industry.

- AI integration optimizes explosion welding parameters, improving bond strength and reducing manufacturing variability.

- Machine learning algorithms predict material failure rates in clad plates under operating conditions, enabling highly accurate predictive maintenance schedules.

- Computer vision and automated NDT systems (e.g., ultrasonic testing) enhance quality control inspection speed and accuracy, reducing detection time for bonding defects.

- AI-driven supply chain management optimizes inventory levels for specialized cladding materials, mitigating cost volatility and lead time risks.

- Predictive modeling assists in simulating the performance of novel composite material combinations under extreme pressure and temperature, accelerating R&D cycles.

DRO & Impact Forces Of Composite Steel Plate Market

The dynamics of the Composite Steel Plate Market are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces (I) that collectively shape supply, demand, and technological evolution. Key drivers include the escalating global demand for high-performance, corrosion-resistant materials in critical industrial applications such as chemical processing, LNG production, and offshore infrastructure, where extreme operational environments necessitate specialized cladding solutions to ensure safety and longevity. These demand factors are often counterbalanced by significant restraints, primarily the high initial investment required for sophisticated cladding technologies (like explosion welding facilities) and the inherent complexity of manufacturing specialized composite materials, which necessitates rigorous quality assurance and highly skilled labor, contributing to higher production costs compared to standard steel plates. The market also faces restraint from the volatility in the prices of key raw materials, particularly nickel, titanium, and specialized alloys, which directly impacts the profitability and pricing stability of the final composite product.

Opportunities for market expansion are substantial, driven by the emergence of new applications in advanced fields such as concentrated solar power (CSP), waste-to-energy facilities, and hydrogen generation and storage infrastructure, all of which require highly specialized material specifications beyond traditional carbon steel capabilities. Furthermore, technological opportunities arise from continuous improvements in cladding techniques, including the development of cost-effective hybrid processes and laser cladding, which could potentially lower production barriers and expand the viable range of applications, particularly for smaller scale or niche industrial components. The push towards sustainable manufacturing and material efficiency also presents an opportunity, as composite plates are fundamentally a resource-efficient solution, allowing industries to achieve desired performance with less reliance on scarce or expensive high-alloy materials, appealing to corporate sustainability initiatives and governmental mandates worldwide.

The primary impact forces include stringent regulatory mandates concerning safety and environmental protection in industries such as nuclear power and petrochemicals, which solidify the necessity for high-integrity materials like composite plates, regardless of short-term economic fluctuations. Global geopolitical stability and trade policies significantly affect the supply chain for key alloys, acting as a powerful external force influencing production costs and material availability. Lastly, the pace of technological adoption, specifically the integration of automation and AI into manufacturing and inspection processes, acts as an internal impact force, determining which manufacturers can achieve necessary cost efficiencies and quality consistency to remain competitive on a global scale. These forces necessitate strategic planning regarding localization of production, diversification of supply sources, and continuous investment in process innovation to maintain market leadership and mitigate operational risks effectively.

Segmentation Analysis

The Composite Steel Plate Market is comprehensively segmented based on the method used for bonding, the specific combination of materials utilized, and the major end-use application sectors. This segmentation allows for precise market sizing and forecasting, reflecting the diverse technical requirements and procurement strategies across different industrial verticals. The differentiation in bonding methods—explosion welding versus roll bonding—is critical as it dictates the mechanical properties, maximum plate dimensions, and acceptable material pairings. Explosion welding typically yields superior metallurgical bonds and is preferred for extremely thick plates used in high-pressure vessels, whereas roll bonding offers greater surface precision and is often more economical for standard plate dimensions. Understanding the nuanced demand within each segmentation is crucial for manufacturers to align their production capabilities and marketing strategies with the specific needs of end-users in highly regulated sectors.

Further segmentation by material combination highlights the chemical and physical challenges addressed by the product. While the use of corrosion-resistant cladding like stainless steel (300 series) on carbon steel is widespread, the increasing complexity of industrial processes drives growth in highly specialized segments. Combinations involving nickel alloys (e.g., Inconel, Hastelloy) are essential for handling extremely aggressive acids and high-temperature oxidation environments in specialized chemical reactors. Conversely, titanium-clad steel plates are predominantly utilized in marine environments and certain chemical plants due to titanium's exceptional resistance to chloride stress corrosion cracking, offering high durability in seawater applications. The dynamic growth within the application segment underscores the reliance of capital-intensive industries on these engineered materials for operational continuity and safety performance.

- By Bonding Method:

- Explosion Welding (Dominant for heavy duty applications)

- Roll Bonding (Preferred for thinner plates and cost-sensitive applications)

- Explosive Roll Bonding

- Others (e.g., Weld Overlay, Laser Cladding)

- By Material Combination:

- Carbon Steel/Stainless Steel (Most common for general corrosion resistance)

- Carbon Steel/Nickel Alloys (Essential for high temperature and aggressive chemical environments)

- Carbon Steel/Titanium (Critical for marine and chloride environments)

- Carbon Steel/Copper & Copper Alloys

- Others (e.g., Zirconium/Steel, Aluminum/Steel)

- By Application:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical Processing & Petrochemicals

- Power Generation (Nuclear, Thermal, Renewables)

- Shipbuilding & Marine

- Industrial Equipment (Heat Exchangers, Storage Tanks, Pressure Vessels)

- Aerospace & Defense

Value Chain Analysis For Composite Steel Plate Market

The value chain for the Composite Steel Plate Market is intricate, beginning with the upstream sourcing of specialized base metals and high-performance alloys. Upstream analysis involves the procurement of bulk steel (carbon or low-alloy steel) from major integrated steel mills and the acquisition of expensive cladding materials, such as nickel, chromium, titanium, and their respective alloys, often sourced from specialized non-ferrous metal suppliers. The price volatility and scarcity of these high-purity alloys significantly influence the cost structure for cladding manufacturers. The core manufacturing stage involves sophisticated bonding processes—explosion welding requiring high safety standards and specialized facilities, and roll bonding necessitating large-scale hot rolling mills capable of handling dissimilar metals. Value addition at this stage includes rigorous quality control via NDT, preparation (cleaning, machining), and certification to meet international industry codes like ASME and EN standards, establishing a high barrier to entry for new market participants.

The downstream analysis focuses on the transformation of the composite plate into final components and its integration into industrial projects. Downstream activities involve specialized fabrication shops and heavy engineering companies that cut, form, and weld the clad plates into large structures such as reactor vessels, columns, and heat exchanger tube sheets. These fabricators require specific expertise in handling dissimilar metal welding to preserve the integrity of the cladding layer and the structural bond, adding complexity to the final manufacturing phase. The distribution channel is predominantly direct or highly specialized. Due to the custom nature and high value of these plates, manufacturers often engage directly with large engineering, procurement, and construction (EPC) firms or major end-user operators in the oil, gas, and chemical sectors.

Direct sales channels are favored for large, complex projects where technical consultancy and tailored specifications are paramount, allowing manufacturers to maintain tight control over quality and delivery schedules while providing specialized technical support. Indirect distribution, though less common, involves niche distributors or trading houses specializing in high-performance metals who maintain limited inventories for urgent or smaller maintenance, repair, and overhaul (MRO) requirements. The efficiency of the distribution chain is critical, as any delays can significantly impact multi-billion-dollar infrastructure projects. The high technical specification required at every stage, from material sourcing to final fabrication and deployment, emphasizes the importance of certified and audited processes across the entire value chain, minimizing risks associated with material failure in critical applications.

Composite Steel Plate Market Potential Customers

The primary consumers and end-users of composite steel plates are large-scale industrial operators and the heavy engineering firms contracted to build and maintain their facilities. In the energy sector, major integrated oil and gas companies (IOCs and NOCs) are key buyers, utilizing these plates for deep-sea pipelines, topside facilities, refinery pressure vessels, and high-temperature cracking units where resistance to hydrogen embrittlement and sulfidic corrosion is mandatory. Specifically, organizations involved in the processing of sour crude oil, natural gas liquefaction (LNG), and high-pressure steam generation represent core customer bases due to the severe environmental conditions inherent in their operations. These customers prioritize material reliability and certification above marginal cost savings, making quality and compliance critical purchasing criteria.

Another crucial customer group resides within the chemical processing and petrochemical industries, encompassing manufacturers of bulk chemicals, specialty chemicals, and fertilizer production facilities. These companies frequently deal with highly corrosive media such as sulfuric acid, nitric acid, and various chlorides, necessitating the use of specialized clad plates for storage tanks, reactors, and heat exchangers. Furthermore, major engineering, procurement, and construction (EPC) firms act as significant intermediaries, purchasing composite plates in bulk based on project specifications before fabricating them into the final products. These EPC customers are highly influenced by material lead times, technical specifications, and manufacturer track records, serving as the interface between the raw material supplier and the ultimate asset owner, and their procurement decisions dictate significant market volumes.

Finally, the power generation sector, particularly nuclear power plant operators and manufacturers of specialized components for thermal and waste-to-energy facilities, constitutes a high-value customer segment. Nuclear applications demand exceptionally high standards for material quality and traceability, often requiring unique combinations such as Zirconium-clad steel or specialized stainless steel clad solutions for containment vessels and spent fuel storage. The long operational lifespan expected of power infrastructure ensures sustained demand for high-integrity composite materials for both new construction and scheduled maintenance and component replacement. The purchasing decision for all these end-users is characterized by rigorous technical evaluation, adherence to international standards, and preference for certified suppliers with established reputations for reliability and long-term material performance guarantees.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel, ArcelorMittal, JFE Steel, BaoWu Steel Group, POSCO, Clad Metals Inc., Noble Alloys, Proclad Group, Sandmeyer Steel Company, Tata Steel, Kobe Steel Ltd., ESAB Corporation, Böllinghaus Steel GmbH, Voestalpine AG, Sumitomo Metal Industries, Wuxi Zhongtai Cladding Materials, DMS Clad, Precision Rolled Products, ATI Metals, Sheffield Forgemasters |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Steel Plate Market Key Technology Landscape

The technological landscape of the Composite Steel Plate Market is dominated by two primary bonding techniques: explosion welding and roll bonding, alongside continuous advancements in quality assurance and fabrication methods. Explosion welding (EXW) remains the preferred method for producing high-quality, thick clad plates, specifically where the material combination is challenging or the application demands maximum bond integrity, such as in high-pressure vessels. Recent technological improvements in EXW focus on optimizing the explosive dynamics through sophisticated computer modeling and simulation, allowing manufacturers to achieve precise control over the velocity and angle of impact. This refinement minimizes material waste, reduces residual stress in the plate, and expands the range of dissimilar metal combinations that can be successfully bonded, including previously difficult pairings like titanium to steel. Manufacturers are also exploring environmentally safer and more controlled explosive formulations to address regulatory concerns related to detonation, enhancing the process safety profile significantly.

Roll bonding technologies, encompassing both hot and cold rolling processes, are continuously being refined to improve efficiency and reduce production costs, making composite plates accessible for broader commercial applications. Key advancements include the development of specialized barrier layers and surface preparation techniques that enhance the diffusion bond integrity during the rolling process, especially for large, thin plates used in architectural or moderate corrosion resistance applications. Furthermore, hybrid bonding techniques, combining initial explosive bonding preparation with subsequent hot rolling, are gaining traction. This hybridization aims to capitalize on the superior bond strength initiation provided by EXW while leveraging the dimensional precision and scalability offered by traditional rolling mills, resulting in materials that meet stringent performance specifications more economically.

Beyond the core bonding methods, crucial technological development is occurring in the domain of post-processing, inspection, and welding. High-resolution non-destructive testing (NDT) methodologies, particularly advanced phased array ultrasonic testing (PAUT) and time-of-flight diffraction (TOFD), are now routinely used to verify the integrity of the bond interface across the entire surface area, ensuring zero defects in critical applications. The ability to precisely characterize the unbonded regions and measure bond shear strength accurately is paramount for certification. Moreover, specialized welding procedures and filler materials are constantly being developed to facilitate the successful fabrication and field repair of structures made from dissimilar metal combinations, mitigating the risk of embrittlement or failure at the weld seams. These technological investments ensure that composite steel plates continue to offer reliable and certifiable performance in the world's most demanding operational environments, driving competitive differentiation based on material quality and advanced manufacturing capabilities.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share and is projected to register the highest growth rate during the forecast period. This dominance is attributed to massive investments in infrastructure, particularly in China and India, focusing on expanding petrochemical capacities, refinery modernization, and the construction of new power generation facilities, including nuclear and thermal power projects. The rapid urbanization and industrialization across Southeast Asia also fuel demand for specialized pressure equipment, ensuring the region remains the powerhouse of composite steel plate consumption.

- North America: North America represents a mature, high-value market driven primarily by the stringent regulatory environment and the modernization of aging energy infrastructure. Demand is concentrated in the heavy oil extraction sector, natural gas processing, and specialized chemical manufacturing in the U.S. and Canada. The focus here is less on sheer volume growth and more on high-specification, customized products for severe service conditions, particularly in offshore deepwater exploration and refining operations requiring nickel alloy clad materials.

- Europe: The European market maintains stable demand, driven by the chemical and pharmaceutical sectors, as well as ongoing energy transition projects. Strict environmental regulations favor materials that offer extended service life and reduced maintenance, boosting the use of high-quality composite plates in specialized chemical reactors and processing plants. Germany, Italy, and the UK are key consumers, often focusing on high-precision roll-bonded plates for specific industrial components.

- Middle East and Africa (MEA): This region is characterized by explosive growth in demand tied directly to new upstream and downstream oil and gas projects, along with significant investment in desalination plants and large-scale power infrastructure across the Gulf Cooperation Council (GCC) countries. The highly corrosive nature of the region's crude oil (sour gas) and the coastal environment necessitate the extensive use of high-grade clad materials, particularly those clad with nickel and titanium alloys, positioning MEA as a critical growth engine.

- Latin America: Market growth in Latin America is tied to oil and gas exploration in countries like Brazil and Mexico, and mining operations. Economic fluctuations often influence project timelines, but long-term structural demand remains positive, especially for composite materials used in pipeline infrastructure and local refinery upgrades aimed at increasing capacity and reducing import reliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Steel Plate Market.- Nippon Steel Corporation

- ArcelorMittal

- JFE Steel Corporation

- BaoWu Steel Group

- POSCO

- Clad Metals Inc.

- Noble Alloys Inc.

- Proclad Group

- Sandmeyer Steel Company

- Tata Steel

- Kobe Steel Ltd.

- ESAB Corporation (Through specialized subsidiaries)

- Böllinghaus Steel GmbH

- Voestalpine AG

- Sumitomo Metal Industries (Now part of Nippon Steel)

- Wuxi Zhongtai Cladding Materials Co., Ltd.

- DMS Clad

- Precision Rolled Products (PRP)

- ATI Metals (Allegheny Technologies Incorporated)

- Sheffield Forgemasters

Frequently Asked Questions

Analyze common user questions about the Composite Steel Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using composite steel plates over solid high-alloy materials?

The primary advantage is cost-effectiveness combined with superior performance. Composite plates provide the corrosion or heat resistance of expensive high-alloy cladding (like titanium or nickel alloys) married to the structural strength and lower cost of carbon steel, reducing overall material expenditure significantly while ensuring functional integrity in severe environments.

Which bonding method dominates the market for heavy-duty pressure vessel fabrication?

Explosion welding (EXW) is the dominant method for heavy-duty applications such as large pressure vessels and reactors. EXW creates a true metallurgical bond with high shear strength, ensuring structural integrity and longevity under extreme temperature and pressure fluctuations typical of the oil, gas, and nuclear industries.

Which geographic region is expected to lead market growth for composite steel plates?

Asia Pacific (APAC) is projected to lead market growth, driven by substantial infrastructure investment, particularly the expansion of petrochemical refining capacities and power generation projects in major economies like China and India, creating immense demand for certified, high-performance clad materials.

What key material combinations are driving growth in specialized chemical processing?

The specialized chemical processing sector is increasingly demanding composite plates featuring Carbon Steel/Nickel Alloys (such as Inconel or Hastelloy) and Carbon Steel/Titanium combinations. These materials offer necessary resistance to aggressive acidic media and stress corrosion cracking that traditional stainless steel may not withstand.

How do global raw material price fluctuations impact the Composite Steel Plate market?

Fluctuations in the prices of key raw materials, particularly nickel, titanium, and specialized alloying elements, have a substantial impact on the market. Since cladding layers utilize these expensive metals, price volatility directly affects the manufacturing cost and pricing stability of the final composite plate, influencing procurement decisions in long-term projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager