Composite Truck Bodies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438142 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Composite Truck Bodies Market Size

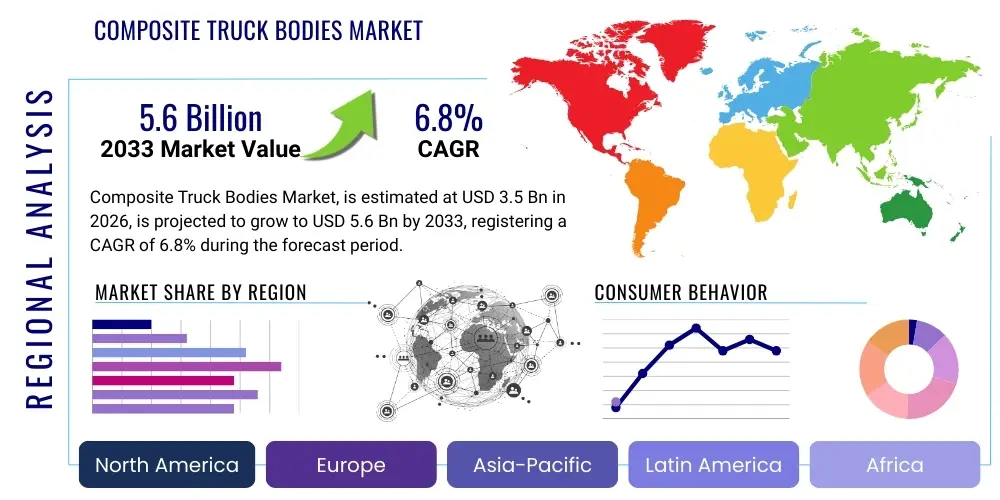

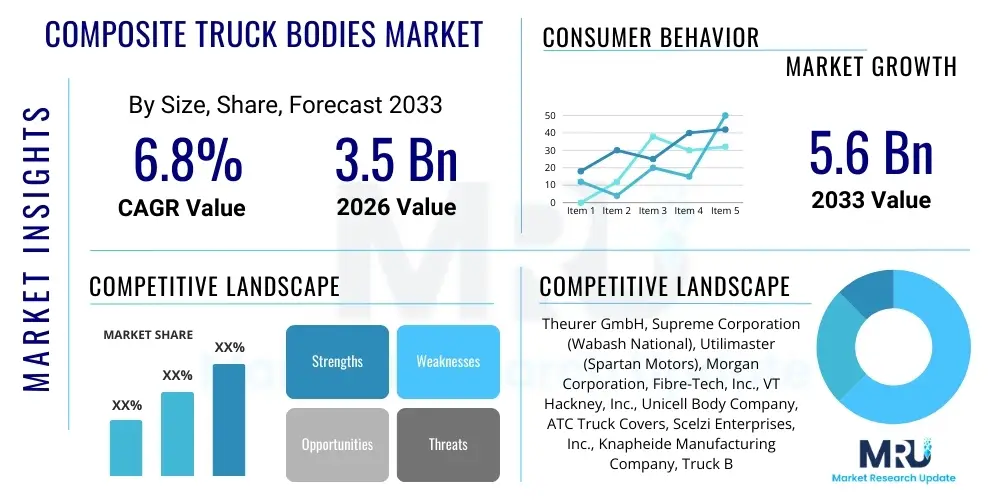

The Composite Truck Bodies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Composite Truck Bodies Market introduction

The Composite Truck Bodies Market encompasses the design, manufacture, and distribution of specialized truck bodies constructed primarily from advanced composite materials, such as fiberglass reinforced plastics (FRP), carbon fiber reinforced polymers (CFRP), and various polymer matrix composites. These bodies offer significant advantages over traditional metallic structures, primarily centered around reduced weight, enhanced durability, improved corrosion resistance, and greater design flexibility. The primary product differentiation lies in the material composition and the manufacturing techniques employed, including processes like resin transfer molding (RTM), vacuum infusion, and pultrusion, which ensure high structural integrity while minimizing mass. The continuous drive towards maximizing payload capacity and improving operational efficiency across logistics and utility sectors is the foundational pillar supporting market expansion. These specialized bodies are increasingly utilized in demanding environments where resistance to chemicals, moisture, and extreme temperatures is critical, thereby extending the lifecycle of the truck body and reducing long-term maintenance costs for fleet operators.

Major applications for composite truck bodies span diverse industrial and commercial sectors. The delivery and logistics segment, particularly last-mile delivery vehicles, utilizes composites extensively due to the need for lightweight bodies that support higher payload limits and improve fuel efficiency. Furthermore, service and utility vehicles, including those used by telecom and electric utility providers, leverage the non-conductive properties of composites, enhancing safety for field personnel. The refrigerated transport sector represents another crucial application, where composite materials offer superior thermal insulation compared to aluminum, leading to reduced energy consumption for cooling units and maintaining strict temperature control necessary for perishable goods transport. The inherent flexibility in composite fabrication allows for customized body designs optimized for specific vocational needs, addressing the unique challenges faced by specialized fleets, such as waste management and construction.

Key driving factors accelerating market adoption include stringent regulatory mandates concerning vehicle emissions and fuel economy, particularly in North America and Europe, which incentivize fleet modernization with lighter components. The rising adoption of electric trucks (EVs) further amplifies this demand, as weight reduction is paramount for maximizing battery range and optimizing energy consumption. Benefits derived from using composite truck bodies, such as extended operational lifespan, reduced fuel consumption (or increased EV range), lower maintenance requirements due to corrosion resistance, and improved accident repairability (often through panel replacement rather than complex welding), collectively contribute to a lower total cost of ownership (TCO) compared to traditional steel or aluminum bodies. These combined technological and economic benefits cement the position of composite materials as the preferred solution for the next generation of commercial vehicle architecture.

Composite Truck Bodies Market Executive Summary

The Composite Truck Bodies Market is navigating a phase of robust expansion, primarily fueled by global sustainability initiatives and the rapid transition toward electric commercial vehicles. Business trends indicate a pronounced shift from standard materials toward advanced, high-performance composites, such as hybrid materials combining carbon and glass fibers, to achieve optimal strength-to-weight ratios. Strategic alliances between composite manufacturers and major commercial vehicle original equipment manufacturers (OEMs) are becoming common, focused on standardizing modular composite body designs suitable for various truck chassis platforms. Furthermore, the market is witnessing technological integration aimed at improving manufacturing throughput, notably the incorporation of automation and robotics in composite layup and curing processes, which addresses the historical challenge of high production costs associated with manual composite fabrication.

Regionally, North America maintains market dominance, largely due to stringent fuel efficiency standards (e.g., Phase 2 GHG rules) and a high density of specialized service fleets demanding high durability and low maintenance. However, Asia Pacific (APAC) is projected to exhibit the fastest growth trajectory, driven by substantial infrastructural development in emerging economies like China and India, leading to increased demand for medium-duty and heavy-duty logistics and construction trucks. Europe, characterized by tight urban logistics constraints and high diesel prices, is rapidly adopting lightweight composite bodies for urban delivery fleets, often integrated into electric vehicle platforms. The regional dynamics are heavily influenced by the speed of EV adoption, with regions prioritizing range and payload capacity showing higher rates of composite body penetration.

Segment trends highlight the growing prominence of glass fiber reinforced polymers (GFRP) due to their favorable cost-performance balance, dominating the medium-duty and service body segments. However, carbon fiber composites, despite their higher cost, are gaining traction in premium heavy-duty and long-haul refrigerated applications where even marginal weight savings translate into significant operational advantages. By application, the delivery and logistics segment remains the largest consumer, driven by e-commerce expansion and the subsequent need for high-volume, reliable delivery vehicles. Conversely, the refrigerated transport segment is emerging as a critical growth area, capitalizing on the superior thermal properties of composite sandwich panels to optimize the cold chain logistics necessary for pharmaceuticals and sensitive food products.

AI Impact Analysis on Composite Truck Bodies Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Composite Truck Bodies Market frequently center on predictive maintenance, optimizing design processes, and enhancing manufacturing quality control. Common questions explore how AI algorithms can predict structural failures in composites based on operational stress data, how generative design using AI can create lighter, stronger body architectures, and the role of machine learning in optimizing the curing cycles and quality inspection of composite materials. Users are particularly keen on understanding AI's potential to reduce material waste during fabrication and personalize truck body designs based on specific fleet operational profiles. The key themes revolve around achieving manufacturing efficiency, enhancing product performance longevity, and ensuring higher safety standards through AI-driven diagnostics.

The implementation of AI is expected to revolutionize several aspects of the composite body value chain. In the design phase, generative design AI tools can rapidly iterate through thousands of potential composite layup patterns, fiber orientations, and structural geometries to minimize weight while adhering to stringent load-bearing requirements, far surpassing traditional engineering simulation capabilities. During manufacturing, AI-powered computer vision systems are deployed for non-destructive testing and quality assurance, inspecting composite panels for microscopic flaws, porosity, or improper fiber alignment in real-time. This dramatically improves consistency and reduces the high scrap rates historically associated with complex composite manufacturing, ensuring that components meet precise specifications before integration into the final vehicle assembly.

Furthermore, AI plays a crucial role in the operational lifespan of the truck body. Integrating sensor data from telematics systems with machine learning models allows fleet managers to monitor the structural health of the composite body, predicting when maintenance or repair is required due to localized stress or impact damage. This predictive maintenance approach extends the service life of the composite bodies, minimizes unscheduled downtime, and ensures that the material integrity remains high, providing a significant return on investment for high-capital fleets. This transition toward smart, connected composite bodies ensures maximum operational uptime and continuous performance optimization.

- AI-driven Generative Design: Optimizing fiber orientation and structural topology for maximal lightweighting and strength.

- Predictive Maintenance: Machine learning models analyze sensor data (stress, vibration, temperature) to forecast composite body structural integrity and schedule proactive repairs.

- Automated Quality Control (AQC): AI-powered computer vision inspecting composite layups and curing processes for defects, porosity, and delamination in real-time.

- Manufacturing Optimization: AI algorithms refining resin infusion rates and cure cycles to reduce cycle time, energy consumption, and material waste.

- Supply Chain Resilience: Predictive analytics enhancing the procurement and inventory management of specialized composite raw materials.

DRO & Impact Forces Of Composite Truck Bodies Market

The Composite Truck Bodies Market is fundamentally shaped by a confluence of driving forces related to operational efficiency, weight reduction targets, and material science innovation, while simultaneously facing constraints regarding initial investment and specific repair complexity. The primary driver is the necessity for fleet operators globally to comply with increasingly stringent environmental regulations, particularly those demanding improved fuel efficiency and lower CO2 emissions. Composites offer the most effective solution for achieving significant vehicular lightweighting, which directly correlates to reduced operational costs for Internal Combustion Engine (ICE) vehicles and extended battery range for Electric Vehicles (EVs). Furthermore, the superior corrosion resistance of composites compared to steel or aluminum provides an inherent advantage in harsh operating environments, extending the asset life and reducing capital expenditure over the long term. These factors collectively create a powerful incentive structure for market adoption.

However, the market growth faces significant restraints. The initial capital cost associated with composite truck bodies remains substantially higher than traditional metallic bodies, acting as a barrier to entry, particularly for smaller fleet operators. The manufacturing processes for composites (molding, curing) are often more complex and time-intensive than standard metal fabrication, requiring specialized equipment and skilled labor. Moreover, while composites are highly durable, repair after significant impact damage can be specialized, often requiring certified technicians and proprietary repair kits, unlike the standardized welding procedures for metal bodies. This complexity in repair logistics can occasionally lead to longer downtime, restraining widespread adoption in segments where quick turnaround maintenance is paramount.

Opportunities for market penetration are vast, particularly in addressing the burgeoning needs of the electric vehicle sector. As battery technology improves, the focus shifts to vehicle structure, making lightweight composites indispensable for achieving optimal EV performance metrics. The market is also presented with the opportunity to develop and commercialize bio-based and recyclable composite materials, addressing environmental concerns related to end-of-life disposal and aligning with circular economy principles. Impact forces, such as the increasing global adoption of e-commerce driving demand for optimized last-mile delivery vehicles, and technological advancements in automated composite manufacturing (e.g., 3D printing of molds and robotic layup systems), are constantly pushing the market toward higher volumes and lower unit costs. This interplay between mandatory regulatory drivers and technological opportunities dictates the market's robust long-term growth trajectory.

Segmentation Analysis

The Composite Truck Bodies Market is comprehensively segmented based on material type, vehicle category, and critical application areas, allowing for granular analysis of demand drivers and technological adoption patterns across different commercial sectors. This segmentation highlights the varying requirements across the logistics chain, from light-duty delivery vehicles needing maximum cost efficiency and maneuverability to heavy-duty trucks requiring unparalleled structural rigidity and durability for severe-service applications. Understanding these segments is crucial for manufacturers to tailor composite formulations and body designs to specific market needs, optimizing performance characteristics such as payload capacity, thermal insulation, and crash safety features. The dominance of glass fiber materials due to their cost-effectiveness contrasts sharply with the high-performance niche occupied by carbon fiber in weight-critical applications.

- By Material Type

- Glass Fiber Composites (GFRP)

- Carbon Fiber Composites (CFRP)

- Hybrid Composites

- Other Composites (Aramid, Natural Fibers)

- By Vehicle Type

- Light-duty Trucks (Class 1-3)

- Medium-duty Trucks (Class 4-6)

- Heavy-duty Trucks (Class 7-8)

- By Application

- Utility & Service Bodies

- Dry Freight & Delivery Bodies

- Refrigerated & Insulated Bodies

- Flatbed & Dump Bodies

- Specialty Bodies (e.g., Waste Management, Military)

- By End-Use Industry

- Logistics & Transportation

- Construction & Mining

- Retail & E-commerce

- Utilities & Telecommunication

- Food & Beverage

Value Chain Analysis For Composite Truck Bodies Market

The value chain for the Composite Truck Bodies Market begins with the upstream raw material suppliers, encompassing manufacturers of reinforcing fibers (glass, carbon, aramid), polymer resins (polyester, vinyl ester, epoxy), and core materials used in sandwich panels (e.g., foam, honeycomb structures). This stage is critical as the quality and cost of these fundamental inputs directly influence the final properties and economic viability of the truck body. Innovation at this stage is focused on developing cheaper, stronger fibers and faster-curing, low-VOC resin systems. Strong, long-term relationships with material suppliers are essential for ensuring a stable supply of high-grade composites and managing price volatility, which can be significant for materials like carbon fiber. The competitive landscape upstream is characterized by large chemical and material science companies focused on achieving economies of scale and specializing in tailored composite formulations for demanding automotive standards.

The midstream segment involves the core manufacturing and fabrication processes, where composite body builders transform raw materials into finished truck bodies. This process includes design, mold fabrication, composite layup (manual, automated tape laying, or filament winding), curing (autoclave or oven), and final finishing and assembly. Distribution channels play a dual role: direct sales and relationships with major OEMs (Original Equipment Manufacturers) for integration onto new chassis, and indirect channels involving independent truck body dealers and aftermarket modification centers. Direct distribution to OEMs ensures high-volume, standardized contracts, particularly for utility and refrigerated fleets. The quality of the manufacturing process, especially process control during curing, is a primary value-add, ensuring structural integrity and longevity of the body.

Downstream activities center on the installation, distribution, end-use, and post-sale service of composite truck bodies. The final users, including large fleet operators, rental companies, and specialized contractors, require robust service networks for maintenance and specialized composite repair. The indirect channel often involves third-party upfitters who specialize in integrating the composite body onto diverse chassis platforms based on customer specifications. The increasing complexity of electronic integration (sensors, telematics) within modern composite bodies necessitates strong collaboration between the body builder and the end-user fleet management systems. Efficiency in the downstream service loop—namely quick, reliable composite repair techniques—is vital for customer satisfaction and minimizing operational downtime, which heavily influences future purchasing decisions.

Composite Truck Bodies Market Potential Customers

The primary customers for composite truck bodies are large-scale commercial fleet operators across various industries, driven by the imperative to maximize efficiency, reduce lifetime costs, and comply with environmental mandates. Key end-users include third-party logistics (3PL) providers and dedicated contract carriers who operate massive fleets for dry freight and refrigerated transport, seeking the optimal balance of payload capacity, durability, and low fuel consumption. The proliferation of e-commerce has significantly boosted demand from last-mile delivery and parcel service companies, which require lightweight bodies to maximize vehicle maneuverability and increase the number of delivery stops per charge/fill-up, making lightweighting an economic necessity.

Another crucial segment comprises utility, construction, and telecommunication companies. These users require specialized service bodies that offer not only lightweight characteristics for better stability and off-road performance but also non-corrosive and, in the case of electric utilities, non-conductive properties for enhanced worker safety. For utility fleets, the longevity offered by composites in corrosive environments (e.g., road salt, chemicals) substantially reduces the frequency of body replacement, providing a strong return on investment. Customers in the construction sector, particularly those operating flatbed or specialized mobile workshop bodies, value the high strength and resistance to mechanical impact inherent in advanced composites.

Furthermore, government agencies, including municipal services (waste management, maintenance) and defense organizations, represent stable and high-volume potential customers. These entities often prioritize long-term durability, low lifecycle cost, and specialized features, such as electromagnetic shielding or reduced thermal signature achievable through specific composite structures. As electric vehicle adoption accelerates across all commercial sectors, the pool of potential customers is expanding rapidly, focusing specifically on composite body manufacturers that can integrate advanced thermal management solutions and seamlessly adapt bodies to new electric chassis architectures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Theurer GmbH, Supreme Corporation (Wabash National), Utilimaster (Spartan Motors), Morgan Corporation, Fibre-Tech, Inc., VT Hackney, Inc., Unicell Body Company, ATC Truck Covers, Scelzi Enterprises, Inc., Knapheide Manufacturing Company, Truck Bodies and Equipment International (TBEI), Continental Structural Plastics (Teijin), FUSO (Daimler), Great Dane, Kidron (General Body), Thermo King, Trans-Tex Industries, Lamberet SAS, Panelite, VFS Truck Bodies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Truck Bodies Market Key Technology Landscape

The technological landscape of the Composite Truck Bodies Market is characterized by a push towards faster, more consistent, and cost-effective manufacturing methods that can handle high-volume production demands. Advanced processing techniques are at the forefront of this innovation. Resin Transfer Molding (RTM) and Vacuum Assisted Resin Transfer Molding (VARTM) are increasingly utilized as they allow for precise fiber placement and composite consolidation, resulting in components with minimal void content and highly repeatable mechanical properties. These closed-molding processes significantly improve quality and reduce material waste compared to traditional open layup methods. Furthermore, pultrusion technology is gaining traction, particularly for manufacturing standardized structural elements like composite beams and frame members, offering continuous production speed and consistency essential for high-volume markets.

Material science is another vital technological area. Ongoing research focuses on developing thermoplastic composites, which offer superior impact resistance and, crucially, enhanced recyclability compared to traditional thermoset resins. This development addresses environmental concerns and provides manufacturers with materials that can be reformed or repaired more easily. Furthermore, the integration of advanced core materials, such as structural foams (e.g., polyurethane, PVC foam) and lightweight honeycomb structures, into sandwich panel construction is essential for refrigerated and high-load applications. These cores maximize stiffness and insulation performance without adding significant weight, optimizing the functional value of the composite body.

Digitization and automation are transforming the production floor. Robotic fiber placement and automated tape laying (ATL) technologies are enabling precise and rapid creation of complex composite geometries, minimizing human error and enhancing production efficiency. Furthermore, the incorporation of embedded smart sensors, utilizing technologies like Fiber Bragg Gratings (FBG) or piezoelectric films, allows the composite truck body itself to function as a data source. These sensors monitor real-time strain, temperature, and structural integrity, feeding data back into fleet management systems for predictive maintenance. This shift towards 'smart composites' is a critical technological trajectory, optimizing both manufacturing throughput and the long-term operational performance of the asset.

Regional Highlights

- North America (USA and Canada): Dominates the market share due to stringent fuel economy standards (e.g., Corporate Average Fuel Economy - CAFE standards and GHG Phase 2 regulations) and a highly competitive logistics sector demanding optimized fleet performance. High rates of adoption in service/utility fleets and substantial investment in electric commercial vehicle manufacturing make it a technology adoption leader.

- Europe (Germany, France, UK): Characterized by a strong regulatory push towards emission reduction and highly efficient urban logistics. Demand is particularly high for lightweight composite bodies utilized in medium-duty urban delivery vehicles and refrigerated transport, driven by high fuel prices and restrictive city access regulations for heavy vehicles.

- Asia Pacific (APAC) (China, India, Japan): Expected to register the fastest growth rate, fueled by massive expansion in e-commerce, rapid industrialization, and significant government investment in infrastructure and logistics networks. While GFRP solutions dominate due to cost sensitivity, increased urbanization and cold chain development are accelerating the adoption of high-performance composite refrigerated bodies.

- Latin America (Brazil, Mexico): Market expansion is contingent on economic stabilization and modernization of existing commercial fleets. Local manufacturers are beginning to explore composite solutions primarily for durability and corrosion resistance in challenging climatic conditions, focusing initially on specialized service and utility vehicles.

- Middle East and Africa (MEA): Growth is concentrated in Gulf Cooperation Council (GCC) countries, driven by infrastructure mega-projects and the need for highly insulated composite bodies for temperature-sensitive goods transport in extreme heat. The region is selectively adopting premium composites where operational resilience is a critical factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Truck Bodies Market.- Theurer GmbH

- Supreme Corporation (Wabash National)

- Utilimaster (Spartan Motors)

- Morgan Corporation

- Fibre-Tech, Inc.

- VT Hackney, Inc.

- Unicell Body Company

- ATC Truck Covers

- Scelzi Enterprises, Inc.

- Knapheide Manufacturing Company

- Truck Bodies and Equipment International (TBEI)

- Continental Structural Plastics (Teijin)

- FUSO (Daimler)

- Great Dane

- Kidron (General Body)

- Thermo King

- Trans-Tex Industries

- Lamberet SAS

- Panelite

- VFS Truck Bodies

Frequently Asked Questions

Analyze common user questions about the Composite Truck Bodies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using composite materials over aluminum or steel for truck bodies?

The primary benefits are significant weight reduction (improving fuel efficiency or EV range), superior corrosion resistance leading to longer asset lifespan, enhanced durability against minor impacts, and greater thermal efficiency, particularly crucial for refrigerated applications. Composites offer a lower total cost of ownership over the vehicle's lifespan.

How does the rising adoption of electric vehicles (EVs) affect the demand for composite truck bodies?

EV adoption significantly boosts the demand for composite truck bodies because lightweighting is critical for maximizing battery range and energy efficiency. Composites directly offset the substantial weight added by large battery packs, allowing EVs to maintain competitive payload capacities and operational distances.

What are the current limitations or restraints impacting the growth of the composite truck bodies market?

The main restraints include the high initial purchase price compared to traditional metallic bodies, the specialized equipment and complex processes required for composite manufacturing, and the need for specialized training and facilities for advanced composite repair, potentially increasing vehicle downtime following major damage.

Which application segment represents the largest market share for composite truck bodies?

The Dry Freight and Delivery Bodies segment holds the largest market share, driven by the massive expansion of the e-commerce and logistics sectors globally. These applications require durable, lightweight solutions for high-volume, last-mile delivery vehicles where payload maximization and operational efficiency are paramount.

Are composite truck bodies recyclable, and what technological advances are addressing end-of-life disposal?

Recyclability historically posed challenges for thermoset composites. However, technological advances in material science, particularly the development of thermoplastic composites, and chemical recycling processes (pyrolysis and solvolysis) are increasingly providing viable pathways for recovering fibers and resins, aligning the industry with circular economy goals.

What role does advanced manufacturing, such as RTM and Pultrusion, play in reducing composite costs?

Advanced manufacturing techniques like Resin Transfer Molding (RTM) and Pultrusion are crucial for cost reduction by enabling higher production volumes, greater process automation, and improved material utilization efficiency. These closed-molding systems enhance repeatability, minimize scrap, and reduce cycle times compared to manual fabrication.

How are composites used specifically in the refrigerated transport sector?

In refrigerated transport, composites are used to construct the insulated walls, floors, and roofs of the truck body. Composite sandwich panels, typically utilizing GFRP skins and foam cores, provide superior thermal insulation (lower K-factor) compared to aluminum, reducing the energy demand on the refrigeration unit and ensuring better temperature maintenance for sensitive cargo.

Which geographical region is expected to experience the fastest growth in composite truck body adoption?

The Asia Pacific (APAC) region is projected to experience the fastest growth, primarily due to rapid infrastructure development, explosive growth in the cold chain logistics sector, and rising awareness among fleet operators in countries like China and India regarding the long-term cost benefits of lightweight, durable truck bodies.

Do hybrid composites offer a better alternative than pure carbon fiber in most commercial truck applications?

Yes, for many commercial applications, hybrid composites (combining glass and carbon fibers) offer a more financially viable solution. They provide a favorable balance of stiffness, strength, and weight reduction approaching carbon fiber levels, but at a significantly lower material cost, making them ideal for high-volume, medium-duty segments.

How is structural health monitoring integrated into modern composite truck bodies?

Structural health monitoring (SHM) is achieved by embedding fiber optic sensors (like FBG sensors) or specialized strain gauges directly within the composite structure during the layup process. These sensors continuously monitor localized stress, impact damage, and strain, transmitting data wirelessly to predictive maintenance systems via integrated telematics.

What are the key differences between thermoset and thermoplastic composites used in this market?

Thermoset composites (epoxy, polyester) are generally used for their high strength, thermal stability, and low cost but are difficult to recycle. Thermoplastic composites (PEEK, Nylon matrices) are highly impact resistant and fully recyclable but typically require higher processing temperatures and costs, though they offer better end-of-life options.

In the Value Chain, why is the upstream raw material cost volatility a major concern?

Raw material cost volatility, especially concerning carbon fiber and specialized resins, is a major concern because these materials constitute a significant portion of the final product cost. Price fluctuations directly impact the competitiveness of composite bodies against cheaper steel alternatives, potentially hindering market penetration in cost-sensitive segments.

How do utility companies benefit specifically from non-conductive composite truck bodies?

Utility companies benefit significantly from the non-conductive nature of composite materials, particularly in service and aerial lift bodies. This property enhances the safety of field personnel working near energized power lines, reducing the risk of electrical hazards compared to working with metallic body structures.

What is the role of automation in reducing the complexity of composite truck body manufacturing?

Automation, including robotic layup systems and automated trimming, significantly reduces manufacturing complexity by ensuring precise fiber orientation and consistent material thickness. This automation minimizes reliance on highly skilled manual labor, improves component repeatability, and helps to bring down the overall unit cost, making composites more scalable.

Beyond lightweighting, what structural advantages do composites offer in high-impact scenarios?

In high-impact scenarios, composites can be engineered to absorb energy progressively and predictably upon failure, often referred to as controlled fragmentation. Unlike metal, which may dent or crumple, specialized composites can be designed to withstand higher strain levels before catastrophic failure and sometimes offer better fatigue resistance.

Why is the maintenance requirement generally lower for composite truck bodies?

Maintenance is lower primarily due to the inherent corrosion and rust resistance of composite materials, eliminating the need for periodic rust treatments and repairs common in steel bodies. Minor damage can often be repaired quickly with standardized patching kits, and major sections can sometimes be modularly replaced, minimizing complexity.

What are 'sandwhich panels' and where are they most commonly utilized in composite truck bodies?

Sandwich panels consist of a lightweight core material (like foam or honeycomb) bonded between two relatively thin, high-strength composite skins (GFRP or CFRP). They are most commonly utilized in refrigerated and insulated bodies, where they provide exceptional rigidity, strength, and superior thermal insulation with minimal weight.

How do global supply chain disruptions affect the market for composite raw materials?

Global supply chain disruptions significantly impact the market by causing delays and cost increases for specialized raw materials such as vinyl ester resins, carbon fiber precursors, and core foams. This necessitates manufacturers to adopt dual-sourcing strategies and hold higher inventory levels to maintain consistent production schedules.

What role does customization play in the competitiveness of composite truck body manufacturers?

Customization is a key differentiator. Composite manufacturing processes, particularly molding, allow for greater design freedom than metal fabrication. Manufacturers can offer highly customized body shapes, optimized aerodynamic profiles, and bespoke internal layouts tailored precisely to the specific vocational needs of diverse end-user fleets.

Which class of trucks (light, medium, heavy-duty) shows the highest percentage of composite material adoption?

Light-duty and Medium-duty trucks (Class 1-6) generally show the highest percentage of composite material adoption, especially for service, utility, and last-mile delivery applications. The focus here is intensely on lightweighting to meet urban efficiency requirements and maximize economic returns on shorter hauls.

How is the focus on sustainable manufacturing changing composite material selection?

The focus on sustainable manufacturing is driving manufacturers to explore natural fiber composites (e.g., flax, hemp) and bio-based resins to reduce the environmental footprint. It also encourages investment in manufacturing processes that require less energy and produce fewer volatile organic compounds (VOCs).

What is Generative Engine Optimization (GEO) in the context of this market report?

Generative Engine Optimization (GEO) ensures the report content is structured, detailed, and contextually rich, providing comprehensive, authoritative answers that language models (like those powering search or generative AI tools) can reliably extract and synthesize when queried about the Composite Truck Bodies Market trends, technologies, and forecasts.

Why is the Total Cost of Ownership (TCO) calculation favorable for composite bodies despite high initial cost?

TCO is favorable because the initial capital expenditure is offset by substantial operational savings over the vehicle's lifespan, including reduced fuel/energy costs due to lightweighting, significantly lower maintenance costs due to corrosion elimination, and extended service life of the asset.

What specific regulations are driving the shift toward lightweight composite materials in North America?

In North America, the primary regulations are the EPA and NHTSA's Greenhouse Gas (GHG) Emissions Standards for Medium- and Heavy-Duty Engines and Vehicles (Phase 2). These regulations mandate fleet-wide fuel efficiency improvements, making lightweight structural components like composite truck bodies essential for compliance.

How do manufacturers ensure fire safety when using composite materials in truck bodies?

Manufacturers address fire safety by incorporating specialized fire retardant (FR) additives and coatings into the composite resin matrices, particularly essential for high-risk applications like hazardous materials transport or certain utility service bodies, ensuring compliance with relevant automotive and transportation fire safety standards.

What impact does digital simulation have on the development phase of new composite truck bodies?

Digital simulation (Finite Element Analysis - FEA) is crucial, allowing engineers to accurately model the structural response of composite layups under various load conditions, crash scenarios, and thermal stress. This reduces the need for costly physical prototyping, speeds up the design cycle, and ensures optimal material usage and structural integrity before mass production begins.

Which material type, Glass Fiber or Carbon Fiber, holds the dominant volume share in the market?

Glass Fiber Composites (GFRP) hold the dominant volume share due to their significantly lower cost and established manufacturing processes, making them the preferred material for standard dry freight, general service, and high-volume refrigerated applications where high-end weight savings are less critical than cost efficiency.

How is the market addressing the environmental impact of chemical resins and composite waste?

The market is addressing this through the development and increased use of low-VOC (Volatile Organic Compound) resins, exploring bio-based polymer matrices derived from sustainable sources, and investing in advanced end-of-life recovery technologies, such as pyrolysis, to reclaim valuable fibers from cured composites.

What is the key technological innovation differentiating premium refrigerated composite bodies?

The key differentiation lies in the development of vacuum-infused, seamless composite sandwich panels with enhanced structural foam cores, which minimize thermal bridging and maximize insulation efficiency, thereby reducing the running time and fuel consumption of the refrigeration unit.

In the Value Chain, what distinguishes direct distribution channels from indirect channels?

Direct distribution involves manufacturers selling truck bodies directly to major commercial vehicle OEMs (for factory installation) or large national fleet operators. Indirect channels rely on independent distributors, dealers, and authorized upfitters who specialize in customizing and installing bodies onto various chassis for smaller or regional customers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager