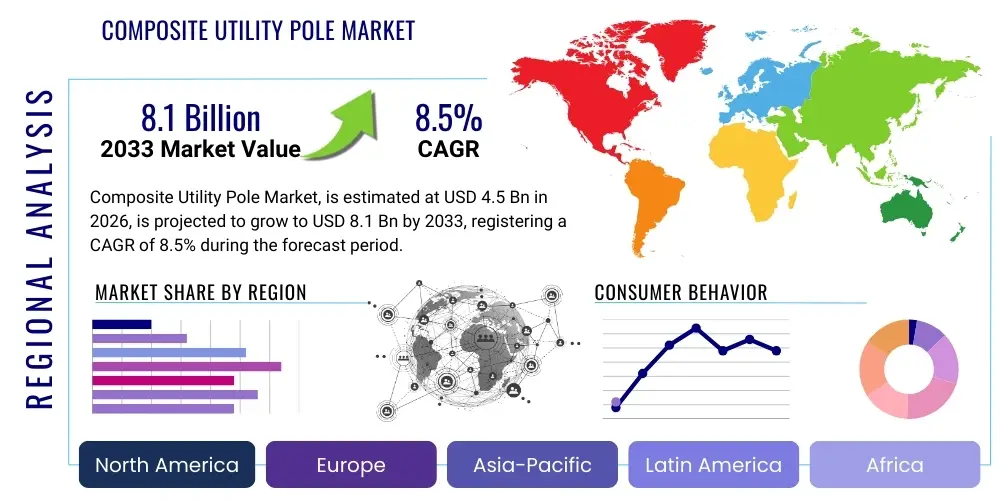

Composite Utility Pole Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438837 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Composite Utility Pole Market Size

The Composite Utility Pole Market is experiencing robust growth driven by increasing investments in grid modernization and the imperative for resilient infrastructure against severe weather events. The inherent advantages of composite materials, such as lightweight characteristics, superior resistance to corrosion, and extended service life, position them favorably against traditional materials like wood and concrete. This shift is particularly evident in coastal and high-stress environments where material degradation rates are accelerated.

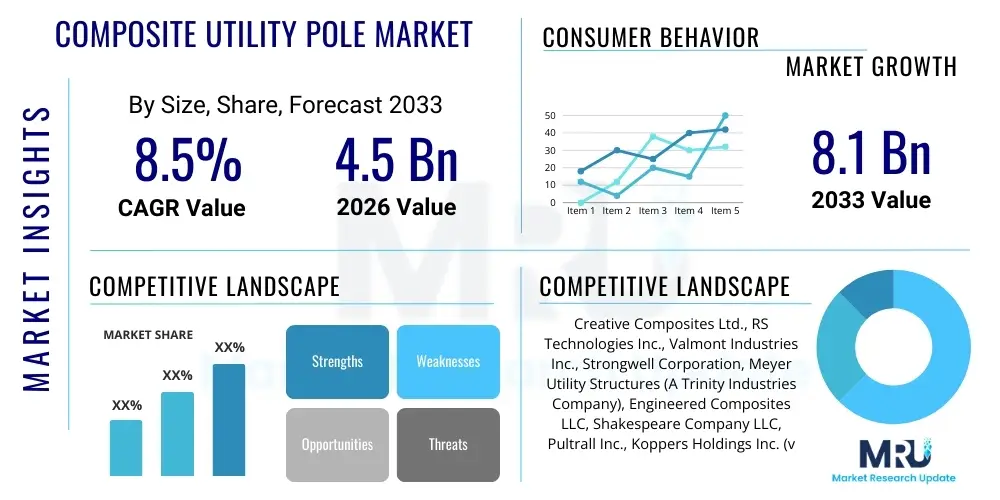

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This consistent expansion reflects global efforts by utility companies to reduce maintenance expenditures and improve reliability of power transmission and distribution networks. Legislative mandates promoting sustainable infrastructure development further underpin this trajectory, encouraging the adoption of Fiber-Reinforced Polymer (FRP) and other composite alternatives due to their lower environmental footprint compared to energy-intensive material production processes.

The market is estimated at $4.5 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033. This valuation encompasses poles utilized across various voltage levels and applications, ranging from low-voltage street lighting and telecommunication infrastructure to high-voltage transmission lines. The escalating demand for 5G network expansion and the associated requirement for new, durable pole infrastructure also significantly contribute to the overall market valuation growth during the projection period.

Composite Utility Pole Market introduction

The Composite Utility Pole Market involves the manufacturing and deployment of utility poles constructed primarily from advanced composite materials, such as Fiberglass Reinforced Polymer (FRP), carbon fiber, and various resin matrix combinations. These poles serve as essential infrastructure components for supporting overhead lines, including electric power transmission and distribution cables, telecommunication lines, and associated hardware. Unlike traditional materials (wood, concrete, and steel), composite poles offer key performance attributes like high strength-to-weight ratios, non-conductive properties, resistance to biological degradation (rot, insects), and immunity to corrosive elements, making them ideal for modern grid requirements and challenging climates.

Major applications of composite utility poles span across several critical sectors. In the power sector, they are extensively used for medium and high-voltage distribution lines, particularly in areas prone to hurricanes, ice storms, or seismic activity where structural integrity is paramount. For telecommunications, composite poles facilitate the rapid deployment of 5G infrastructure due to their lightweight nature and ease of installation. Furthermore, they are increasingly utilized in specialized applications such as street lighting, railway electrification, and remote off-grid solar or wind power installations where long service life and minimal maintenance are vital operational benefits.

The primary driving factors propelling the market include the global push for smart grid deployment, which necessitates highly reliable and long-lasting support structures; the need to replace aging, vulnerable infrastructure, particularly in developed economies; and growing awareness among utilities regarding the significant reduction in total lifecycle costs associated with composite poles compared to conventional materials. The substantial reduction in transportation and handling costs due to their lighter weight further enhances their appeal, streamlining deployment logistics and reducing installation time, which directly translates into cost savings for utility operators globally.

Composite Utility Pole Market Executive Summary

The Composite Utility Pole Market is witnessing substantial transformation characterized by technological advancements in material science and increasing regulatory support for sustainable and resilient infrastructure. Key business trends indicate a shift toward automated manufacturing processes utilizing winding and pultrusion techniques to optimize pole production efficiency and ensure consistency in structural quality. Strategic collaborations between composite material suppliers and major utility companies are accelerating pilot programs and large-scale deployments, particularly in North America and Asia Pacific, regions prioritizing infrastructure renewal and expansion. The market landscape remains competitive, with leading manufacturers focusing on developing modular designs and specialized coating technologies to enhance UV resistance and meet diverse local specifications.

Regionally, North America maintains the leading market share, primarily driven by mandatory replacement cycles necessitated by aging infrastructure and the critical need for storm hardening following numerous severe weather events. Europe is demonstrating steady growth, fueled by renewable energy integration projects and the requirement for non-conductive, environmentally compliant materials for new grid installations. However, Asia Pacific is projected to register the highest growth rate (CAGR), stimulated by rapid urbanization, massive infrastructure development in emerging economies like India and China, and significant governmental investment in expanding rural electrification and telecommunication networks. Latin America and MEA are seeing nascent adoption, largely concentrated in mining, oil and gas operations, and critical urban centers seeking improved grid reliability.

Segment trends reveal that the distribution voltage segment (up to 35 kV) dominates the market due to the sheer volume of poles required for local power delivery and smart city integration. In terms of material, Fiberglass Reinforced Polymer (FRP) remains the material of choice due to its proven performance and cost-effectiveness. The Transmission segment, though smaller in volume, represents higher value due to the large size and stringent structural requirements of the poles used. Overall, the market is structurally resilient, supported by non-discretionary utility spending and long-term infrastructure investment cycles globally, mitigating short-term economic fluctuations.

AI Impact Analysis on Composite Utility Pole Market

Common user questions regarding AI's impact on the Composite Utility Pole Market primarily center on efficiency improvements across the pole lifecycle: How can AI optimize pole design for specific environmental loads? Will machine learning enhance quality control during manufacturing? How can predictive maintenance, facilitated by AI, extend the pole's lifespan and reduce inspection costs? The key themes emerging from this analysis include the potential for AI-driven structural modeling to create more robust and material-efficient poles, the integration of AI in sensor data analysis for proactive fault detection, and the automation of supply chain logistics to better match production with complex deployment schedules across vast geographic areas. Users expect AI to move beyond simple data logging towards sophisticated decision-making support systems that ensure optimal asset performance and minimize downtime.

AI's influence is strategically important in the manufacturing phase where neural networks can analyze sensor data from pultrusion or winding machines to immediately identify and correct variations in fiber orientation or resin saturation, thereby maintaining consistent quality and structural integrity, which is critical for high-stress applications. Furthermore, AI algorithms are being utilized to analyze historical failure data and geographical specifics (soil conditions, wind speeds, ice loads) to inform the design optimization process, allowing manufacturers to tailor composite structures that precisely meet the localized regulatory and resilience demands, minimizing material over-specification and associated costs. This tailored approach enhances the competitiveness of composite poles.

In the operational phase, the integration of smart sensors into composite poles generates vast datasets regarding structural health, temperature variations, and vibration levels. AI and machine learning models process this data to provide predictive maintenance insights, flagging potential structural weaknesses or anomalies long before they result in a catastrophic failure. This transition from time-based maintenance to condition-based monitoring, enabled by AI analytics, significantly reduces operational expenditure (OPEX) for utilities, maximizes the uptime of transmission lines, and substantially extends the effective service life of the composite assets, reinforcing the long-term economic viability of composites.

- AI-Driven Design Optimization: Utilizing machine learning to simulate load profiles and optimize material composition and fiber orientation, leading to lighter, stronger, and more cost-effective pole designs tailored to specific geographic and climatic conditions.

- Enhanced Manufacturing Quality Control: Implementing computer vision and predictive algorithms in manufacturing lines (pultrusion/winding) to monitor material inputs and curing processes in real-time, ensuring zero-defect production consistency.

- Predictive Maintenance and Asset Management: Deploying AI models to analyze sensor data (vibration, strain, temperature) embedded within poles for early detection of structural anomalies, shifting utilities from reactive or scheduled maintenance to predictive, condition-based maintenance strategies.

- Automated Inventory and Supply Chain Management: Using AI to forecast demand accurately based on infrastructure project timelines, regional weather patterns, and replacement schedules, optimizing inventory levels and reducing logistics costs associated with transporting bulky infrastructure components.

- Fault Identification and Grid Resilience: AI integration with Supervisory Control and Data Acquisition (SCADA) systems, utilizing composite pole data to quickly isolate faults during grid disturbances, improving overall grid reliability and self-healing capabilities in smart grid environments.

DRO & Impact Forces Of Composite Utility Pole Market

The Composite Utility Pole Market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. The primary drivers revolve around the non-discretionary need for infrastructure modernization, regulatory pressure to enhance grid resilience against increasing climate variability, and the superior functional benefits of composites (lightweight, non-corrosive, long lifespan). These drivers create persistent demand, particularly for replacing vulnerable, aging wood poles in storm-prone regions. However, the market faces significant restraints, notably the high initial capital expenditure (CapEx) associated with composite materials compared to commodity wood or concrete poles, and a persistent lack of standardized global specifications and building codes which can slow adoption in diverse international markets. These factors collectively determine the rate and breadth of market penetration across different utility sectors.

Opportunities for growth are substantial, particularly emerging from the global expansion of 5G telecommunication networks which require dense, reliable infrastructure, and the massive ongoing investment in renewable energy integration. New solar and wind farms necessitate reliable transmission infrastructure, often located in remote or harsh environments where the durability of composite poles is uniquely advantageous. Furthermore, manufacturers have the opportunity to develop highly customizable, modular designs and specialized poles for niche applications (e.g., camouflage aesthetics for urban environments or specialized anti-vandalism features), broadening the application spectrum beyond traditional utility uses. The market is also heavily influenced by the opportunity to leverage recycled and bio-based composite materials, addressing sustainability mandates and mitigating concerns related to end-of-life disposal.

Impact forces acting upon the market include intense regulatory scrutiny favoring infrastructure hardening, which positively mandates the use of resilient materials; fluctuating raw material costs (especially glass fibers and petrochemical-derived resins), which directly affect manufacturing profitability; and competitive pressure from advancements in treated wood technologies or specialized steel structures. The power of buyers (large utilities) is high, demanding rigorous testing, warranties, and bulk purchasing discounts, while the threat of substitutes, while moderated by the unique performance profile of composites, remains a constant challenge. Technological innovation in pultrusion and filament winding techniques acts as a key accelerating force, continuously improving production speeds and lowering unit costs over time, thereby partially mitigating the high initial cost restraint.

Segmentation Analysis

The Composite Utility Pole Market is systematically segmented based on multiple critical factors, including the type of material used, the primary application area (voltage level), and the end-use sector. Understanding these segments is crucial for strategic planning, as different applications impose distinct structural requirements and economic constraints. The application segmentation, based on voltage, typically divides the market into Distribution (low-to-medium voltage) and Transmission (high-to-extra-high voltage), with distribution poles representing the largest volume demand due to their pervasive use in last-mile connectivity and local grids. Conversely, segmentation by material highlights the dominance of Fiberglass Reinforced Polymer (FRP) due to its cost-to-performance ratio and established manufacturing base, though niche materials like carbon composites are gaining traction in high-performance or ultra-lightweight applications.

The segmentation by end-user sector illustrates the diversified demand base. Electric utilities constitute the foundational and largest consumer group, driven by core infrastructure needs. However, the telecommunication sector is emerging as the fastest-growing segment, fueled by the relentless rollout of 5G networks which require dense pole placement and minimal signal interference. Furthermore, government agencies, including municipal organizations responsible for street lighting and public works, represent a stable, though smaller, segment focused heavily on longevity and reduced maintenance costs. This diversification buffers the market against reliance on any single sector's spending cycle, contributing to overall market stability.

Geographically, market segmentation provides crucial insights into regional drivers. North America leads due to mandatory storm-hardening programs and extensive infrastructure replacement cycles. The high growth projected for Asia Pacific, however, underscores the monumental investment in new grid construction and rapid urbanization across developing nations. Analyzing these segments helps manufacturers focus R&D efforts—for instance, developing highly flame-resistant poles for drought-prone North American forests or designing highly modular, rapidly deployable poles for fast-track infrastructure projects in APAC, ensuring product offerings are optimized for regional regulatory and environmental specificities.

- By Material Type:

- Fiberglass Reinforced Polymer (FRP)

- Carbon Fiber Composites

- Hybrid Composites (e.g., Fiberglass and Wood Core)

- By Application (Voltage Level):

- Distribution Poles (Up to 35 kV)

- Transmission Poles (35 kV to 230 kV)

- High Voltage Transmission Poles (Above 230 kV)

- By End-Use Sector:

- Electric Utilities

- Telecommunications

- Street Lighting and Municipal Infrastructure

- Railway Electrification

- Others (e.g., Renewable Energy Projects, Mining)

- By Pole Height/Length:

- Under 40 Feet

- 40 to 70 Feet

- Above 70 Feet (High-capacity/Transmission)

Value Chain Analysis For Composite Utility Pole Market

The value chain for the Composite Utility Pole Market begins significantly upstream with the sourcing and production of critical raw materials. This upstream analysis encompasses the petrochemical industry for resin systems (epoxy, polyester, vinyl ester), the glass industry for fiberglass reinforcements (rovings and mats), and specialized chemical suppliers for catalysts and curing agents. The cost and quality of these raw materials, which are often subject to global commodity price volatility, determine the final structural performance and production cost of the composite poles. Manufacturers often seek long-term supply agreements and dual sourcing strategies to mitigate supply chain risks and ensure a steady flow of high-quality components necessary for the demanding pultrusion and winding processes.

The midstream segment involves the core manufacturing process, where raw materials are transformed into finished poles through highly specialized techniques like continuous pultrusion (for constant cross-section poles) or filament winding (for tapered or complex geometries). This stage also includes crucial activities such as quality assurance, structural testing, and the application of protective coatings, particularly UV-resistant treatments which are vital for longevity. Distribution channels then link these manufacturers to the end-users. Direct sales models are prevalent for large-scale utility contracts, allowing manufacturers to offer tailored specifications, handle complex logistics, and provide engineering consultation. Indirect channels, involving specialized distributors or regional utility contractors, service smaller municipalities, retail lighting projects, and replacement markets.

The downstream analysis focuses on the installation, operational life, and end-of-life management of the poles. Installation requires specialized equipment and training, although the lightweight nature of composite poles often simplifies logistics compared to heavy concrete or steel. Crucially, the downstream also includes ongoing maintenance and inspection—an area increasingly being supported by AI-driven monitoring. End-of-life considerations, while still a developing area, include recycling and disposal protocols. The direct channel offers greater customer relationship management and feedback loop opportunities, enabling manufacturers to continuously refine product designs based on real-world performance data, further solidifying the relationship with high-volume electric and telecommunication utilities.

Composite Utility Pole Market Potential Customers

The primary end-users and buyers of composite utility poles are highly diverse yet functionally interdependent, driven fundamentally by the need for reliable overhead infrastructure. The most significant customer segment comprises large investor-owned utilities (IOUs) and public power organizations responsible for electricity transmission and distribution grids. These entities prioritize poles that offer superior long-term cost savings, resilience against extreme weather events (such as high winds and ice loading), and low life-cycle maintenance requirements. Their purchasing decisions are heavily influenced by regulatory mandates for grid hardening and disaster recovery capabilities, making performance specifications often more critical than initial material costs.

The second major customer group includes telecommunication carriers and infrastructure providers (e.g., tower companies and fiber network operators). With the global rollout of 5G and fiber-to-the-home (FTTH) initiatives, these customers demand poles that facilitate rapid deployment, possess non-conductive properties to minimize interference, and are structurally capable of supporting denser arrays of equipment. For this segment, ease of installation, speed of delivery, and the ability to integrate sophisticated mounting hardware without compromising structural integrity are key purchasing criteria, often preferring composite poles for their inherent lightweight and adaptability.

Further potential customers include government and municipal authorities involved in public works, road lighting, and traffic management systems, where aesthetics, vandal resistance, and minimal ongoing costs are paramount. Specialized industrial sectors, such as railway operators (for catenary support), mining operations (for temporary or permanent grid extensions in corrosive environments), and developers of large-scale renewable energy projects (solar farms, wind parks), also represent crucial niche markets. These customers often require specialized poles tailored for non-standard loads, highly corrosive settings, or remote locations where logistics and maintenance accessibility are challenging, highlighting the versatility of composite solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Creative Composites Ltd., RS Technologies Inc., Valmont Industries Inc., Strongwell Corporation, Meyer Utility Structures (A Trinity Industries Company), Engineered Composites LLC, Shakespeare Company LLC, Pultrall Inc., Koppers Holdings Inc. (via Osmose Utilities Services), PLP Composite Technologies, Inc., Highland Composites, NewTEK FRP Poles, Nanjing Hongrui Composite, Powertran, Inc., Pelco Structural, Inc., Duratel, General Cable Technologies Corporation, Lamiflex SpA, Composite Power Group, Allied Power |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composite Utility Pole Market Key Technology Landscape

The technology landscape for composite utility poles is fundamentally anchored in advanced polymer processing methods designed to achieve maximum strength-to-weight ratios and structural consistency. The two dominant manufacturing technologies are Pultrusion and Filament Winding. Pultrusion involves pulling reinforcing fibers (such as fiberglass) through a resin bath and then through a heated die, creating poles with a consistent cross-section, ideal for standard distribution poles. Filament winding, conversely, involves winding resin-impregnated filaments around a rotating mandrel at specific angles, allowing for the creation of tapered poles with complex stress profiles, better suited for high-load or transmission applications. Continuous improvements in these processes focus on faster cycle times, automated quality control (often utilizing sensors and AI), and minimizing material waste, directly addressing the core challenge of high manufacturing costs.

Material science innovation forms the second critical pillar of the technology landscape. Research is heavily focused on developing high-performance, fire-retardant resin systems and advanced UV stabilization coatings. Since composite poles are susceptible to surface degradation from prolonged solar exposure, specialized coatings that protect the polymer matrix are essential for achieving the advertised 80+ year lifespan. Furthermore, the development of hybrid pole structures, combining materials like fiberglass and carbon fiber, allows engineers to place higher stiffness or strength materials strategically, optimizing both performance and cost. New resin matrices, including bio-based or recycled polymers, are also emerging to meet growing sustainability criteria imposed by environmentally conscious utilities and governmental bodies.

Finally, smart technology integration is redefining the utility pole itself. The lightweight, non-conductive nature of composite materials makes them excellent hosts for modern monitoring and communication equipment. Key technological advancements include the embedding of structural health monitoring sensors (strain gauges, temperature sensors) directly into the pole during manufacturing. These sensors, coupled with wireless connectivity (IoT), facilitate real-time performance diagnostics and feed data into AI-driven predictive maintenance systems. This shift towards smart composite assets transforms the pole from a static structural component into an active, data-generating node within the intelligent power grid, supporting fault detection, load management, and enhanced overall system reliability.

Regional Highlights

Regional dynamics play a crucial role in shaping the deployment and technological evolution of composite utility poles, driven by varying climates, infrastructure maturity levels, and regulatory frameworks. North America, encompassing the United States and Canada, stands out as the most mature and dominant market. This leadership is primarily attributed to large-scale grid hardening initiatives, particularly in coastal regions (Florida, Gulf Coast) and wildfire-prone areas (California). The rapid replacement cycle of aging wood poles, often accelerated by state legislation requiring resilient infrastructure, ensures sustained, high-volume demand. Furthermore, the adoption of specialized poles for supporting heavy broadband and 5G equipment drives significant investment from telecommunication giants across the continent.

Asia Pacific (APAC) represents the fastest-growing region, characterized by massive infrastructure expansion projects in high-growth economies such as China, India, and Southeast Asian nations. The region’s growth is fueled by ambitious rural electrification targets, the necessity to build new transmission and distribution lines quickly, and significant governmental investment in smart city infrastructure. While initial cost sensitivity remains high in many parts of APAC, the logistical advantages (lighter weight, easier transport to remote locations) and the superior corrosion resistance necessary for maritime environments increasingly favor composite poles over traditional materials. Japan and Australia also represent key markets, focusing on replacing vulnerable infrastructure damaged by typhoons and wildfires, demanding high-specification, resilient structures.

Europe demonstrates steady, measured growth, primarily driven by strict environmental regulations and high standards for material longevity and aesthetics. European utilities emphasize sustainability, leading to increasing demand for poles utilizing sustainable or recyclable composite resins. Northern European countries utilize composites extensively due to their resistance to frost heave and chemical degradation, while Southern Europe focuses on their resistance to high temperatures and non-conductivity. Latin America and the Middle East & Africa (MEA) are emerging markets, with demand concentrated in areas with high material corrosion rates (coastal MEA) or in specialized industrial applications such as oil and gas field infrastructure and large-scale mining operations where logistical challenges and durability are critical factors determining material selection.

- North America (US & Canada): Dominant market share driven by mandatory grid resilience programs, replacement of aging infrastructure, high incidence of severe weather damage (hurricanes, ice storms), and extensive telecommunication infrastructure investments (5G, fiber optic deployment).

- Asia Pacific (APAC): Highest projected CAGR fueled by rapid urbanization, massive government investment in new power and communication grids (China, India), and the logistical advantages of lightweight materials for remote electrification projects across the region.

- Europe: Steady growth propelled by stringent environmental standards, focus on aesthetic integration in urban areas, robust renewable energy integration projects, and the utilization of composite poles in railway electrification and corrosive industrial zones.

- Latin America: Emerging market driven by necessary infrastructure improvements, particularly in countries experiencing high corrosion rates and seismic activity, with initial adoption concentrated in metropolitan areas and critical industrial infrastructure like mining.

- Middle East & Africa (MEA): Niche market demand focused on high-durability solutions for harsh, desert, and coastal environments (UAE, Saudi Arabia, South Africa), where corrosion and extreme temperatures rapidly degrade traditional materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composite Utility Pole Market. These companies are characterized by extensive manufacturing capabilities, proprietary composite formulation technology, global distribution networks, and a strong focus on securing long-term contracts with major regional utilities.- RS Technologies Inc.

- Valmont Industries Inc.

- Creative Composites Ltd.

- Strongwell Corporation

- Engineered Composites LLC

- Shakespeare Company LLC

- Pultrall Inc.

- Koppers Holdings Inc. (via Osmose Utilities Services)

- PLP Composite Technologies, Inc.

- Highland Composites

- NewTEK FRP Poles

- Nanjing Hongrui Composite

- Powertran, Inc.

- Pelco Structural, Inc.

- Duratel

- General Cable Technologies Corporation

- Lamiflex SpA

- Composite Power Group

- Allied Power

- Meyer Utility Structures (A Trinity Industries Company)

Frequently Asked Questions

Analyze common user questions about the Composite Utility Pole market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of composite utility poles over traditional wood or steel poles?

The primary benefit is the significantly lower total lifecycle cost, driven by their superior durability, inherent resistance to corrosion, rot, and insects, and a service life often exceeding 80 years, drastically reducing maintenance and replacement frequency. They also offer a high strength-to-weight ratio, simplifying transportation and installation logistics.

Are composite poles more expensive than traditional poles initially?

Yes, composite utility poles typically have a higher upfront procurement cost compared to standard pressure-treated wood or basic concrete poles. However, this higher initial investment is rapidly offset by the elimination of maintenance costs, extended operational lifespan, and enhanced resilience during extreme weather events, yielding a lower net present value (NPV) over the asset's lifetime.

How do composite poles contribute to grid resilience and smart grid implementation?

Composite poles enhance grid resilience by maintaining structural integrity during severe weather, unlike wood poles that often fail. They are non-conductive, improving safety and preventing ground faults. For smart grids, their internal structure easily accommodates embedded sensors and communication equipment, turning them into active data collection nodes for predictive maintenance and real-time network monitoring.

What are the key environmental concerns and sustainability aspects of composite poles?

Composite poles are often viewed favorably due to their inert nature (no chemical leaching, unlike treated wood) and their energy efficiency during transport (due to lightweight design). The main challenge remains end-of-life disposal and recycling, although research is accelerating in pyrolysis and mechanical recycling methods, and new bio-based resin systems are being introduced to improve their overall sustainability profile.

Which geographical region leads the global adoption of composite utility poles?

North America currently holds the leading market share in terms of adoption value. This is driven by regulatory mandates and large-scale utility programs aimed at enhancing infrastructure resilience against frequent hurricanes, ice storms, and wildfires, necessitating the immediate replacement of vulnerable wood and steel structures with high-performance composite alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager