Compositing Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433602 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Compositing Software Market Size

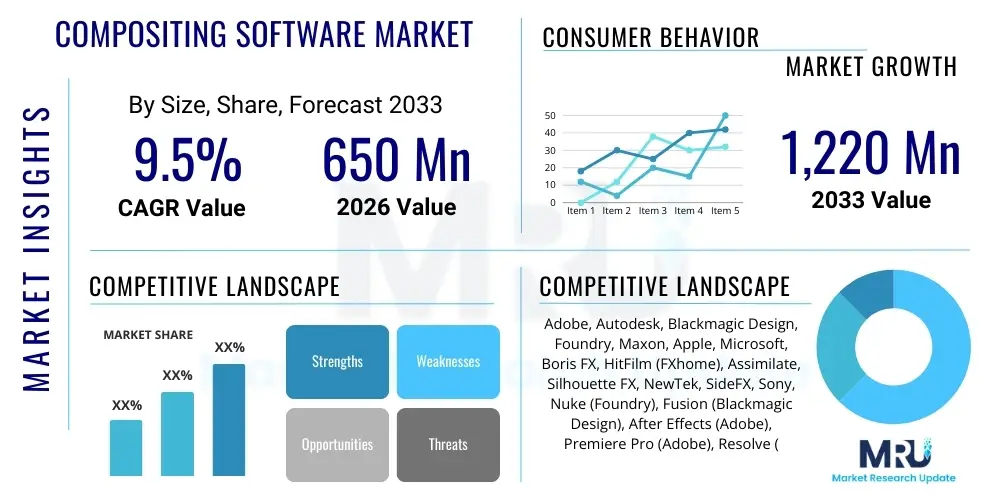

The Compositing Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,220 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the escalating global demand for high-quality visual effects (VFX) across various media platforms, particularly in the film, television, and gaming industries, necessitating sophisticated tools for seamlessly integrating diverse visual elements.

Market expansion is also supported by the increasing adoption of over-the-top (OTT) streaming services, which constantly require fresh, premium content featuring complex visual narratives. Compositing software, essential for color correction, merging layers, keying, rotoscoping, and final image assembly, is becoming a foundational tool in post-production pipelines. The transition from traditional studio setups to cloud-based, collaborative workflows is further accelerating market value, allowing smaller studios and independent artists to access high-end tools previously exclusive to major production houses.

Compositing Software Market introduction

The Compositing Software Market encompasses tools and applications designed for the post-production process of combining multiple visual elements—such as live-action footage, computer-generated imagery (CGI), matte paintings, and special effects—into a single, coherent image or sequence. Key product offerings range from industry standards like Nuke and Adobe After Effects to emerging open-source and subscription-based solutions, providing critical capabilities for visual storytelling in modern media. These tools are indispensable for creating seamless and photorealistic visual effects that define high-budget cinematic experiences and immersive gaming environments.

Major applications of compositing software span across film and television production, where complex VFX sequences require detailed layering and integration; advertising and marketing, for creating dynamic and engaging commercial content; and the burgeoning fields of virtual reality (VR), augmented reality (AR), and mixed reality (MR) content creation. Compositing software facilitates efficiencies in the often iterative and demanding process of post-production, offering benefits such as non-destructive editing, advanced keying techniques, precise motion tracking, and flexibility in adjusting complex scene parameters, all vital for achieving professional-grade output.

The market is primarily driven by factors including the continuous technological evolution in camera resolution and rendering capabilities, which necessitate equally powerful compositing tools to handle high data volumes and complex algorithms. Furthermore, the global proliferation of digital content consumption, coupled with the competitive environment among content creators to produce visually superior material, ensures sustained demand for advanced compositing solutions capable of pushing creative boundaries. These tools are central to enabling artists to realize intricate conceptual designs and maintain visual consistency across large-scale projects.

Compositing Software Market Executive Summary

The Compositing Software Market is characterized by intense competition among established vendors and rapid technological innovation focused on AI integration and real-time processing capabilities. Current business trends indicate a strong shift toward subscription-based licensing models, favored by both large studios seeking scalable deployment and individual freelancers requiring cost flexibility. Geographically, North America currently holds the largest market share due to the presence of major Hollywood studios and a mature media production ecosystem, although the Asia Pacific region is demonstrating the highest growth rate, fueled by expanding local film industries, particularly in India, China, and South Korea, coupled with significant growth in mobile gaming and animation production.

Segment trends highlight the dominance of film and television production as the primary application area, continuously pushing the need for high-end, node-based compositors. Concurrently, the rise of independent artists and smaller content creation houses is boosting the demand for more accessible, layer-based software solutions. The deployment segment shows an increasing preference for cloud-based services, primarily driven by the need for remote collaboration, enhanced scalability, and reduced latency in global production pipelines. This transition facilitates parallel processing and resource sharing, critical for managing large-scale visual effects projects.

Technological advancement, particularly in machine learning (ML) assisted tasks such as rotoscoping, keying, and tracking, is redefining workflow efficiencies, reducing manual labor, and enabling artists to focus more on creative output. This summary underscores a market rapidly evolving under the pressure of increasing content volume and the relentless pursuit of visual realism, positioning specialized software capabilities as a critical investment for industry stakeholders seeking competitive advantage in the digital media landscape. Strategic partnerships between software developers and hardware manufacturers are also key trends shaping future market dynamics.

AI Impact Analysis on Compositing Software Market

Users frequently inquire about how Artificial Intelligence (AI) will automate complex compositing tasks, specifically asking whether AI will eliminate the need for human compositors, what tools currently integrate AI for tasks like rotoscoping and keying, and how ML algorithms are improving render times and workflow efficiency. Based on these recurring themes, the consensus is that AI is acting as a powerful co-pilot rather than a replacement. Users expect AI to handle repetitive, labor-intensive tasks—such as automated green screen keying, intricate motion tracking, and procedural element generation—freeing up senior artists to concentrate on creative problem-solving, aesthetic refinement, and complex artistic supervision. There is significant interest in AI's potential to democratize high-end VFX by simplifying intricate processes for mid-level and independent creators, alongside concerns regarding data security and the proprietary nature of ML models trained on artistic work.

The integration of deep learning models into compositing pipelines is fundamentally changing production economics by dramatically reducing the time required for fundamental operations. For instance, AI-driven segmentation algorithms can isolate complex foreground elements with far greater speed and accuracy than traditional manual rotoscoping, a task historically known for being time-consuming and tedious. This paradigm shift means studios can undertake more ambitious projects within tighter deadlines and reduced budgets. Furthermore, AI is being applied to optimize resource allocation, predicting necessary rendering resources based on project complexity, thus minimizing idle time and maximizing computational efficiency in both on-premise and cloud rendering farms.

This transformative impact is not limited to efficiency; AI tools are also enhancing artistic capabilities. Generative models are starting to assist in background extension, intelligent texture synthesis, and even realistic fluid or particle simulation, providing artists with a broader palette of immediate, high-fidelity creative options. While this integration raises ethical and copyright questions concerning data used for model training, the industry views AI as an indispensable technological accelerant necessary to keep pace with the exponential growth in demand for visually rich content across all consumption platforms, from theatrical releases to social media campaigns, ultimately boosting the overall productivity and output quality of the market.

- AI significantly automates labor-intensive processes such as complex rotoscoping and background removal (keying), enhancing efficiency.

- Machine learning (ML) optimizes motion tracking and camera solve precision, reducing manual adjustment iterations.

- AI assists in procedural generation of elements (e.g., crowds, particles, foliage), expanding creative possibilities rapidly.

- Generative AI models are beginning to facilitate intelligent upscaling and denoising of low-resolution source footage for high-quality output.

- Predictive modeling optimizes rendering pipelines and resource management, leading to faster turnaround times and cost reduction.

- AI-powered tools democratize advanced VFX techniques, making them accessible to independent creators and smaller studios.

- Integration of deep learning provides sophisticated image segmentation and depth estimation capabilities necessary for complex 3D integration.

DRO & Impact Forces Of Compositing Software Market

The dynamics of the Compositing Software Market are governed by powerful market forces stemming from the continuous demand for visual spectacle, balanced against operational constraints and new technological horizons. Key drivers include the exponential growth of global digital content, particularly spurred by streaming video services (Netflix, Disney+, etc.) which necessitates constant investment in sophisticated post-production tools. Restraints, notably the high cost associated with professional licenses and the steep learning curve required for mastering advanced node-based software, often hinder adoption among emerging content creators and smaller studios in developing economies. Conversely, opportunities arise from the ongoing integration of AI into workflow automation and the expansion of immersive content (AR/VR/Metaverse), creating new use-cases for real-time compositing solutions.

The impact forces within the market are predominantly high, driven by technological evolution and consumer expectation. The bargaining power of buyers remains moderate; while large studios command favorable pricing due to bulk licensing, the availability of competitive and feature-rich alternatives (such as Nuke, Fusion, and After Effects) provides options across various price points. Supplier power is high, largely concentrated among a few dominant technology companies (e.g., Adobe, Foundry, Blackmagic Design) whose proprietary software ecosystems create switching costs for studios deeply invested in specific pipelines. The threat of new entrants is moderate; while building a professional-grade node compositor is challenging, the rise of open-source tools and niche, specialized applications poses a continuous threat to established market players.

The intensity of competitive rivalry is very high, fueled by continuous feature additions, performance upgrades, and aggressive pricing strategies, particularly in the mid-range segment targeting independent artists. Substitutes pose a low-to-moderate threat; while some in-camera effects or real-time rendering engines (like Unreal Engine) can bypass traditional compositing for certain tasks, the need for complex, layered post-production refinement for high-end media ensures that dedicated compositing software remains irreplaceable for the foreseeable future. The primary market thrust remains oriented toward tools that promise faster iteration, higher fidelity output, and seamless collaboration across geographically dispersed teams.

- Drivers (D): Global expansion of OTT platforms demanding high-quality VFX content; technological advances in camera sensors requiring higher fidelity post-processing; proliferation of animated and gaming content (cinematics).

- Restraints (R): High licensing costs for industry-standard software; requirement for specialized hardware and skilled professional compositors; persistent intellectual property and piracy issues in emerging markets.

- Opportunities (O): Integration with machine learning for workflow automation; expansion into augmented reality (AR) and virtual reality (VR) post-production pipelines; development of cloud-native, scalable compositing solutions.

- Impact Forces: High competitive rivalry driven by continuous feature innovation; Moderate bargaining power of buyers due to diverse product offerings; High supplier power due to strong proprietary ecosystems and high switching costs.

Segmentation Analysis

The Compositing Software Market is comprehensively segmented based on deployment model, the primary application area, the operating system utilized, and the specific end-user category. This segmentation provides critical insights into purchasing patterns and technological preferences across the global media production landscape. The segmentation by deployment reveals a dynamic shift towards cloud-based solutions, capitalizing on the need for remote accessibility and collaborative project management, moving away from restrictive on-premise installations, especially among start-ups and mid-sized entities.

Application-wise, the Film and Television sector remains the most lucrative segment, dictating the feature set and performance benchmarks for high-end software. However, the rapidly expanding Gaming sector, requiring efficient compositing for cinematic trailers, in-game cutscenes, and real-time environment integration, is showing accelerated growth. Operating system preference continues to be split, with professional studios favoring macOS and Linux environments for stability and pipeline integration, while independent artists often rely heavily on Windows platforms due to broader hardware compatibility and cost considerations.

Finally, end-user categorization differentiates between the needs of large studios (Large Enterprises), which require enterprise licensing, robust support, and custom pipeline integration, and the needs of Independent Artists/Freelancers, who prioritize affordability, ease of use, and integration with a broad range of consumer-grade hardware. Understanding these diverse segment requirements is vital for software vendors to tailor their pricing, distribution, and feature roadmaps effectively, ensuring product-market fit across the entire value chain of content creation.

- By Deployment Model:

- Cloud-based

- On-premise

- By Application:

- Film and Television Production

- Advertising and Marketing

- Gaming and Interactive Media

- Architectural Visualization and Simulation

- Education and Training

- By Operating System:

- Windows

- macOS

- Linux

- By End-User:

- Independent Artists/Freelancers

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises (Major Studios and Production Houses)

Value Chain Analysis For Compositing Software Market

The value chain for the Compositing Software Market begins with the upstream activities of software development and intellectual property creation. This stage involves significant investment in R&D, focusing on developing proprietary algorithms for advanced rendering, tracking, and machine learning integration. Key upstream players include specialized software engineering teams and academic research institutions contributing fundamental graphic technologies. These technological foundations are crucial for creating high-performance, stable, and feature-rich compositing tools that can meet the stringent demands of professional visual effects studios, dictating the core capabilities offered to the market.

The midstream phase involves the manufacturing (coding and packaging) and distribution channel strategy. Distribution can be direct (through proprietary websites and digital storefronts, characteristic of companies like Foundry and Adobe) or indirect, utilizing authorized resellers, system integrators, and value-added resellers (VARs) who provide localized sales, technical support, and enterprise integration services. The shift toward subscription models has centralized control further with direct digital distribution becoming the prevalent channel, enabling vendors to offer continuous updates and manage licensing dynamically. Effective distribution relies heavily on global cloud infrastructure to ensure rapid software delivery and continuous service uptime.

Downstream activities focus on the end-users: the media production companies, gaming studios, advertising agencies, and freelance artists who utilize the software for commercial content creation. The value generated downstream is realized through successful completion of visual effects work, contributing to the final media product (film, game, advertisement). This final stage also includes extensive post-sales support, training, and community engagement, which are critical for maintaining customer loyalty and ensuring the continuous skill development of the professional user base. The quality and efficiency of the compositing software directly impact the commercial viability and aesthetic success of the final delivered content.

Compositing Software Market Potential Customers

Potential customers for compositing software are predominantly centered within the digital media and entertainment ecosystem, representing end-users who require sophisticated image manipulation and integration capabilities. The largest segment comprises major film and television production studios (e.g., Warner Bros., Disney, Netflix in-house studios) that rely on enterprise-grade solutions for large-scale, tentpole projects requiring thousands of VFX shots. These customers prioritize pipeline stability, high-speed rendering, extensive customization options, and seamless integration with other industry-standard software like 3D modeling and editing suites. Their purchasing decisions are often tied to long-term enterprise agreements and service level commitments.

Another crucial customer segment includes mid-sized Visual Effects (VFX) houses and post-production facilities globally, often acting as vendors to the major studios. These customers seek robust yet scalable solutions, often favoring node-based software for its flexibility and complex workflow handling. For them, efficiency, cross-platform compatibility (especially Linux-based pipelines), and the availability of skilled personnel trained on the specific software are key purchasing drivers. They represent a significant volume driver for professional-grade licensing and associated plug-in sales.

Lastly, the rapidly expanding segment of independent content creators, freelance artists, YouTube content producers, and Small and Medium-sized Enterprises (SMEs) specializing in corporate video or localized advertising forms a broad customer base. These users are highly sensitive to cost and prefer user-friendly, layer-based software or freemium versions, emphasizing accessibility and integration with desktop editing systems. Their increasing demand fuels the growth of subscription services and lower-tier, feature-rich compositing tools, making them critical for market volume growth and democratization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,220 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adobe, Autodesk, Blackmagic Design, Foundry, Maxon, Apple, Microsoft, Boris FX, HitFilm (FXhome), Assimilate, Silhouette FX, NewTek, SideFX, Sony, Nuke (Foundry), Fusion (Blackmagic Design), After Effects (Adobe), Premiere Pro (Adobe), Resolve (Blackmagic Design), Natron. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compositing Software Market Key Technology Landscape

The technological landscape of the Compositing Software Market is rapidly advancing, focusing primarily on increasing processing speed, enhancing photorealism, and improving workflow collaboration. A core technological trend is the maturation of GPU acceleration and parallel processing frameworks (like CUDA and OpenCL), which enable real-time playback and faster rendering of highly complex, multi-layered scenes. This shift from reliance on CPU-bound processing has fundamentally lowered the barrier for achieving high-fidelity results and allows artists to iterate more quickly, a necessity given the tight production schedules of modern media. Furthermore, advanced color management systems (like OpenColorIO) are becoming standard, ensuring color consistency across different display devices and throughout the entire production pipeline, from acquisition to final delivery.

Another critical area of development is the integration of volumetric and point cloud data processing, driven by the needs of virtual production and modern 3D workflows. Compositing software now needs to efficiently handle large datasets generated by Lidar scanning or photogrammetry, integrating real-world spatial information directly into the digital environment. This is complemented by continuous improvements in motion tracking and stabilization algorithms, particularly those leveraging machine learning for automated feature detection and robust, sub-pixel tracking, greatly reducing the manual effort required for complex camera solves and object integration within live-action plates. Software providers are continually updating their toolsets to support emerging hardware standards and API enhancements.

Crucially, the rise of cloud-native architecture is redefining deployment models, enabling sophisticated collaborative features such as synchronized project sharing, secure asset management, and scalable cloud rendering services accessible globally. This facilitates remote work and distributed teams, crucial for international film production. Furthermore, the push towards standardized, open-source technology components, such as Python scripting for pipeline integration and standardized file formats (like OpenEXR for high dynamic range images), ensures interoperability between different software packages (e.g., Nuke, Maya, After Effects), reinforcing a flexible and robust technological ecosystem capable of handling highly customized enterprise workflows.

Regional Highlights

Regional analysis reveals significant variation in market maturity, growth drivers, and preferred technological stacks across key geographical regions. North America, anchored by the U.S. media industry, maintains the largest market share, driven by major studios, high investment in VFX innovation, and the early adoption of cutting-edge technologies like virtual production and AI tools. Europe follows closely, characterized by strong film production hubs in the UK, Germany, and France, often specializing in high-end television series and co-productions, with a growing emphasis on publicly funded R&D in creative technologies.

Asia Pacific (APAC) is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is fueled by the rapid expansion of local film industries (Bollywood, China's rapidly growing cinema), massive mobile gaming markets, and government initiatives supporting digital content creation. The region shows strong demand for both professional, high-end software and affordable, accessible tools for a burgeoning population of digital artists. Latin America and the Middle East & Africa (MEA) represent emerging markets, where growth is currently moderate but is expected to accelerate as local content creation industries mature and international streaming services increasingly commission regional content, driving demand for necessary post-production infrastructure and software licensing.

- North America: Dominant market share due to established Hollywood infrastructure, early adoption of high-end node-based compositors (Nuke, Fusion), and significant R&D spending on AI integration in post-production.

- Europe: Second largest market, focusing on television production, feature films, and commercial content; strong presence of key software developers and an emphasis on data security and privacy compliance standards.

- Asia Pacific (APAC): Highest expected growth rate, driven by expanding cinematic output in China and India, rapid growth in the gaming sector, and increasing investment in animation and localized content creation infrastructure.

- Latin America: Emerging market with increasing adoption spurred by localized advertising and growing national film industries, creating opportunities for more flexible, subscription-based software models.

- Middle East and Africa (MEA): Nascent market primarily focused on broadcast media and regional advertising; growth is accelerating due to investment in media free zones and digital infrastructure improvements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compositing Software Market.- Adobe (Focus on After Effects and Creative Cloud ecosystem)

- Autodesk (Integration with 3D suites like Maya and tools like Flame)

- Blackmagic Design (Developer of Fusion, integrated within DaVinci Resolve)

- Foundry (Developer of Nuke, the industry standard for high-end VFX)

- Maxon (Developer of Cinema 4D and Redshift, impacting 3D integration)

- Apple (Focus on Final Cut Pro ecosystem and Motion)

- Microsoft (Involved through cloud services and operating system optimization)

- Boris FX (Developers of Sapphire and Continuum, critical plug-in ecosystems)

- HitFilm (FXhome) (Targeting mid-range and independent artists)

- Assimilate (Developer of Scratch and Live FX)

- Silhouette FX (Specialized in rotoscoping and paint tools)

- NewTek (Provider of LightWave and related tools)

- SideFX (Developer of Houdini, critical for procedural effects integration)

- Sony (Involved through specialized production tools)

- Natron (Open-source alternative gaining traction among freelancers)

- Toon Boom Harmony (Specialized 2D animation and compositing)

- Pixar (Through contributions to Open standards like OpenEXR)

- AVID Technology (Integration with Media Composer and related editing systems)

Frequently Asked Questions

Analyze common user questions about the Compositing Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Compositing Software Market?

The Compositing Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven primarily by the sustained global demand for high-quality visual effects (VFX) content across streaming and theatrical platforms.

How is AI fundamentally changing the role of compositing software?

AI is transforming the market by automating labor-intensive tasks such as rotoscoping, keying, and motion tracking, significantly accelerating post-production workflows. This allows human compositors to focus more on creative problem-solving and complex artistic integration rather than repetitive manual processes.

Which deployment model is experiencing the highest growth in the market?

The Cloud-based deployment model is showing the highest growth. This acceleration is due to the increasing need for remote collaboration, enhanced project scalability, and accessibility for global production teams, moving away from restrictive on-premise installations.

Which geographic region currently dominates the Compositing Software Market?

North America holds the largest market share due to the established presence of major film and television production studios, high levels of technology investment, and a mature ecosystem for high-end visual effects and post-production services.

What are the primary factors restraining the adoption of professional compositing software?

Key restraints include the high initial cost of professional software licensing, the necessity for specialized hardware to handle complex renders, and the steep learning curve associated with mastering advanced, node-based compositing applications like Nuke.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager