Composition Fabrication Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440688 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Composition Fabrication Technology Market Size

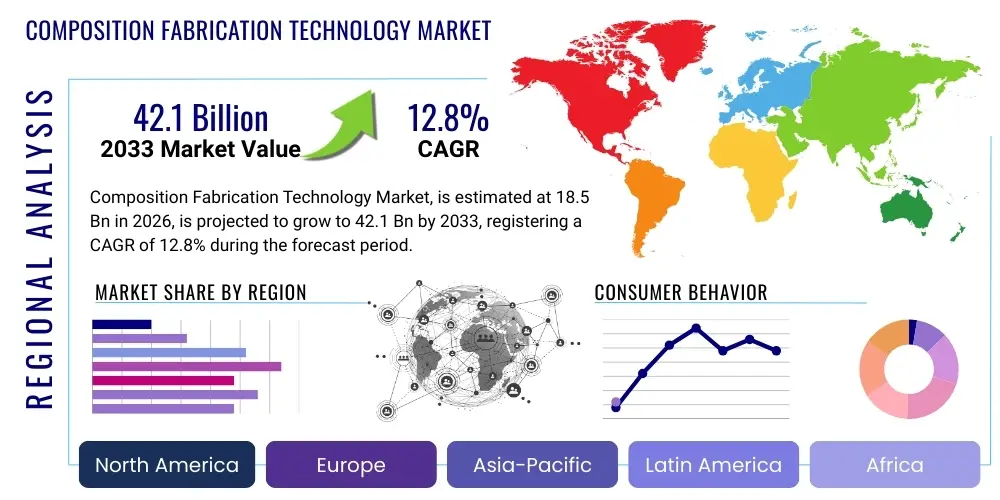

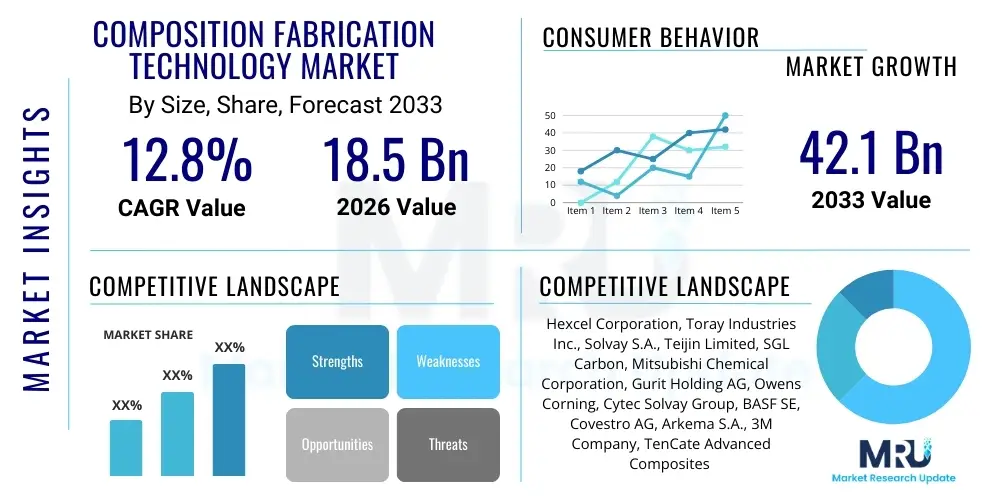

The Composition Fabrication Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 42.1 Billion by the end of the forecast period in 2033.

Composition Fabrication Technology Market introduction

The Composition Fabrication Technology Market encompasses the advanced processes and sophisticated machinery utilized for the manufacturing and assembly of composite materials, which are engineered materials formed from two or more constituent materials with significantly different physical or chemical properties and which remain separate and distinct at the macroscopic or microscopic level within the finished structure. These technologies enable the creation of high-performance, lightweight, and durable components across a myriad of industries. Key offerings include automated fiber placement (AFP), automated tape laying (ATL), resin transfer molding (RTM), vacuum assisted resin transfer molding (VARTM), pultrusion, filament winding, and advanced additive manufacturing techniques like 3D printing of composites. Major applications span the aerospace and defense sectors for aircraft structures and missile components, automotive industry for vehicle lightweighting and enhanced fuel efficiency, wind energy for turbine blades, marine for ship and boat construction, and construction for infrastructure development. The inherent benefits of composite materials—such as superior strength-to-weight ratios, corrosion resistance, excellent fatigue properties, and design flexibility—drive their increasing adoption.

The burgeoning demand for high-performance materials capable of operating under extreme conditions, coupled with stringent environmental regulations pushing for fuel efficiency and reduced emissions, serves as a primary driving factor for market expansion. Furthermore, the imperative for cost-effective and scalable manufacturing solutions, alongside continuous advancements in material science and automation, is propelling the evolution and adoption of these fabrication technologies. Innovations in smart manufacturing, Industry 4.0 integration, and the development of sustainable composite materials are also significantly influencing market dynamics, positioning composite fabrication technology as a critical enabler for future industrial growth and technological progression.

Composition Fabrication Technology Market Executive Summary

The Composition Fabrication Technology Market is currently witnessing robust expansion, largely propelled by escalating demand for lightweight yet high-strength materials across critical industries. Business trends indicate a significant shift towards automation, digitalization, and the integration of artificial intelligence and machine learning into fabrication processes, aiming to optimize production cycles, reduce waste, and enhance product quality. There is a strong emphasis on mergers and acquisitions among key players, as companies seek to expand their technological portfolios, market reach, and supply chain efficiencies. Furthermore, the development of sustainable composite materials and eco-friendly manufacturing processes is emerging as a pivotal business strategy, addressing growing environmental concerns and regulatory pressures. The market is also experiencing a surge in demand for customizable and multi-functional composite components, necessitating more agile and adaptable fabrication technologies.

From a regional perspective, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by rapid industrialization, burgeoning automotive and construction sectors, and increasing investments in renewable energy infrastructure, particularly wind power. North America and Europe continue to be dominant markets, characterized by significant R&D expenditures, a strong presence of aerospace and defense industries, and stringent regulatory frameworks that encourage the adoption of advanced materials. These regions are at the forefront of technological innovation, with substantial governmental and private sector funding directed towards next-generation composite fabrication. Meanwhile, emerging economies in Latin America, the Middle East, and Africa are showing promising potential, primarily fueled by infrastructure development projects and diversification efforts in their respective industrial landscapes.

Segmentation trends highlight the continued dominance of carbon fiber composites due to their unparalleled strength and stiffness, particularly in aerospace and high-performance automotive applications. However, glass fiber composites maintain a substantial market share owing to their cost-effectiveness and versatility across various industrial applications, including wind energy and marine. By technology, Automated Fiber Placement (AFP) and Automated Tape Laying (ATL) are experiencing significant adoption driven by their precision and efficiency in producing complex geometries for critical applications. Concurrently, additive manufacturing (3D printing) for composites is rapidly gaining traction, offering unprecedented design freedom and rapid prototyping capabilities. The aerospace and defense sector remains the largest end-use industry, but the automotive, wind energy, and marine sectors are demonstrating accelerated growth as manufacturers increasingly leverage composite benefits for performance, efficiency, and sustainability.

AI Impact Analysis on Composition Fabrication Technology Market

User queries regarding AI's impact on Composition Fabrication Technology frequently revolve around questions of efficiency gains, cost reduction, quality assurance, predictive maintenance capabilities, and the potential for accelerating design and development cycles. Users are keen to understand how AI can streamline complex manufacturing processes, optimize material usage, and minimize defects. Concerns often include the initial investment required for AI integration, data security implications, and the need for a skilled workforce capable of managing AI-driven systems. However, the overarching expectation is that AI will be a transformative force, enhancing precision, predictability, and profitability within the composite fabrication landscape.

The integration of Artificial intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing the Composition Fabrication Technology Market by introducing unprecedented levels of optimization and automation across the entire product lifecycle. AI-driven predictive analytics can analyze vast datasets from manufacturing processes, identifying potential defects before they occur and optimizing parameters for superior material properties and reduced waste. This capability significantly enhances quality control, moving from reactive inspection to proactive prevention. Furthermore, AI is pivotal in automating complex tasks, from material handling and precise ply placement in Automated Fiber Placement (AFP) to intelligent toolpath generation for robotic composite manufacturing, thereby boosting throughput and consistency while minimizing human error.

Beyond the factory floor, AI's influence extends into the design and engineering phases, particularly through generative design methodologies. AI algorithms can rapidly explore a multitude of design iterations for composite structures, optimizing for lightweighting, strength, and specific performance criteria that might be challenging for human designers to conceive. This dramatically shortens development cycles and unlocks novel architectural possibilities for composite components. Moreover, AI powers sophisticated supply chain management systems, predicting material demands, optimizing inventory, and mitigating potential disruptions. While the initial investment in AI infrastructure and the upskilling of the workforce represent challenges, the long-term benefits in terms of operational efficiency, cost savings, material utilization, and product innovation firmly establish AI as a critical enabler for the future growth and competitiveness of the Composition Fabrication Technology Market.

- Process Optimization: AI algorithms analyze real-time data to fine-tune manufacturing parameters, optimizing curing cycles, resin flow, and fiber placement for enhanced product quality and reduced waste.

- Predictive Maintenance: Machine learning models monitor equipment performance to predict potential failures, enabling proactive maintenance and minimizing costly downtime in fabrication lines.

- Quality Control and Inspection: AI-powered vision systems detect microscopic defects and inconsistencies in composite laminates with higher accuracy and speed than manual inspection, ensuring stringent quality standards.

- Generative Design and Material Optimization: AI assists engineers in rapidly exploring novel designs and material combinations, optimizing structures for maximum performance, minimal weight, and efficient material usage.

- Enhanced Automation and Robotics: AI drives intelligent robotic systems for precise material handling, automated lay-up, and finishing processes, increasing production speed, consistency, and safety.

- Supply Chain Efficiency: AI-driven analytics optimize raw material procurement, inventory management, and logistics, ensuring timely delivery and cost-effective operations across the supply chain.

DRO & Impact Forces Of Composition Fabrication Technology Market

The Composition Fabrication Technology Market is significantly influenced by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. A primary driver is the accelerating global demand for lightweight and high-performance materials, particularly from the aerospace and defense, automotive, and wind energy sectors, where composites offer substantial advantages in fuel efficiency, strength-to-weight ratio, and durability. Concurrently, technological advancements in automation, robotics, and digital manufacturing processes, including Industry 4.0 paradigms, are enhancing the efficiency, precision, and cost-effectiveness of composite fabrication, thereby expanding its applicability. Furthermore, the increasing focus on sustainability and circular economy principles is prompting the development and adoption of bio-based composites, recycled materials, and more energy-efficient manufacturing techniques, acting as a potent market stimulant. Regulatory pressures aimed at reducing emissions and improving safety standards across various industries also compel manufacturers to adopt advanced composite solutions.

Despite these powerful drivers, the market faces notable restraints. The high initial capital investment required for advanced composite fabrication equipment and infrastructure poses a significant barrier to entry for new players and limits adoption for smaller enterprises. The complexity associated with composite material selection, design, and manufacturing processes necessitates specialized expertise and skilled labor, which are currently in short supply, leading to increased operational costs and potential production bottlenecks. Additionally, the relatively high cost of advanced composite materials, such as carbon fibers, compared to traditional materials like steel or aluminum, can deter widespread adoption in cost-sensitive applications. Challenges related to the repair, recycling, and end-of-life management of composite materials also present environmental and economic hurdles that the industry is actively working to overcome.

Opportunities for growth are abundant and diverse. Emerging applications in urban air mobility (UAM), medical devices, and smart infrastructure present new avenues for market expansion, leveraging composites' unique properties for innovative product development. The ongoing research and development into novel composite materials, including self-healing composites, nano-composites, and thermoplastic composites, promise to unlock further performance enhancements and cost reductions. Furthermore, the increasing adoption of additive manufacturing (3D printing) for composites offers unprecedented design freedom and rapid prototyping capabilities, democratizing access to complex composite structures. Geopolitical stability and global economic growth act as crucial impact forces, influencing investment levels, supply chain resilience, and overall market demand. Technological breakthroughs, changes in trade policies, and shifts in consumer preferences towards sustainable and high-performance products will continue to shape the trajectory of the Composition Fabrication Technology Market, underscoring the necessity for continuous innovation and strategic adaptation among market participants.

Segmentation Analysis

The Composition Fabrication Technology Market is comprehensively segmented across various dimensions to provide a granular understanding of its diverse landscape and growth opportunities. This segmentation considers the different types of fabrication technologies employed, the specific material types utilized in composite manufacturing, the broad range of applications where these composites find use, and the distinct end-use industries that are the primary consumers of these advanced materials and technologies. Such a multi-faceted approach allows for precise market analysis, identifying key growth areas, competitive advantages, and the evolving needs of various market verticals, thereby enabling strategic planning and investment decisions for stakeholders across the value chain.

- By Technology:

- Automated Fiber Placement (AFP)

- Automated Tape Laying (ATL)

- Resin Transfer Molding (RTM)

- Vacuum Assisted Resin Transfer Molding (VARTM)

- Pultrusion

- Filament Winding

- 3D Printing (Additive Manufacturing)

- Hand Lay-up

- Spray Lay-up

- Compression Molding

- Sheet Molding Compound (SMC)

- Bulk Molding Compound (BMC)

- Prepreg Lay-up

- By Material Type:

- Carbon Fiber Composites

- Glass Fiber Composites

- Aramid Fiber Composites

- Basalt Fiber Composites

- Natural Fiber Composites

- Hybrid Composites

- Polymer Matrix Composites (PMCs)

- Thermoset Composites

- Epoxy

- Polyester

- Vinyl Ester

- Phenolic

- Thermoplastic Composites

- PEEK (Polyether Ether Ketone)

- PEI (Polyetherimide)

- PPS (Polyphenylene Sulfide)

- PA (Polyamide)

- Metal Matrix Composites (MMCs)

- Ceramic Matrix Composites (CMCs)

- By Application:

- Structural Components

- Non-Structural Components

- Interior Components

- Exterior Components

- Engine Components

- Propulsion Systems

- Fuselage

- Wings

- Rotor Blades

- Chassis

- Body Panels

- Sporting Goods Equipment

- Medical Implants

- By End-Use Industry:

- Aerospace & Defense

- Commercial Aircraft

- Military Aircraft

- Spacecraft & Satellites

- UAVs (Unmanned Aerial Vehicles)

- Automotive

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Luxury & Performance Cars

- Wind Energy

- Onshore Wind Turbines

- Offshore Wind Turbines

- Marine

- Recreational Boats

- Commercial Vessels

- Naval Ships

- Construction & Infrastructure

- Bridges

- Buildings

- Repair & Rehabilitation

- Sporting Goods

- Bicycles

- Rackets

- Skis & Snowboards

- Electrical & Electronics

- Circuit Boards

- Insulators

- Medical

- Prosthetics

- Imaging Equipment

- Surgical Tools

- Pipes & Tanks

- Consumer Goods

- Others (e.g., Industrial, Rail, Robotics)

Value Chain Analysis For Composition Fabrication Technology Market

The value chain for the Composition Fabrication Technology Market is intricate, spanning from raw material extraction to the integration of finished composite components into end products. The upstream segment of the value chain is dominated by raw material suppliers, including manufacturers of high-performance fibers such as carbon fiber, glass fiber, and aramid fiber, as well as suppliers of various resin systems (e.g., epoxy, polyester, vinyl ester, thermoplastic matrices). These suppliers often engage in extensive research and development to innovate new material formulations that offer enhanced properties or improved processability, forming the foundational elements of composite manufacturing. Complementing this, specialized machinery and equipment manufacturers provide the advanced fabrication systems, including AFP/ATL machines, RTM presses, pultrusion lines, and 3D printers, which are crucial for transforming raw materials into intermediate or finished composite parts. The quality and performance of upstream materials and machinery directly dictate the capabilities and cost-effectiveness of the subsequent fabrication processes.

Moving downstream, the value chain involves a diverse array of component manufacturers and fabricators who specialize in designing, molding, and assembling composite parts according to specific client requirements. These players often possess advanced engineering capabilities and utilize a combination of the aforementioned fabrication technologies to produce everything from aircraft fuselage sections to wind turbine blades and automotive body panels. Further down, these composite components are integrated into larger systems by end-product manufacturers or original equipment manufacturers (OEMs) across the aerospace, automotive, wind energy, marine, and construction sectors. This integration phase often requires specialized bonding, joining, and assembly techniques tailored for composite materials, ensuring optimal performance and durability of the final product. The demand from these end-product integrators significantly influences the production volumes and technological advancements within the upstream and midstream segments.

Distribution channels for composite fabrication technologies and components can be direct or indirect. Direct sales often characterize large-scale, high-value equipment or custom-engineered components, where direct engagement between the supplier/fabricator and the OEM ensures precise specification fulfillment and technical support. This direct model is prevalent in aerospace and defense where highly customized solutions are common. Indirect channels, involving distributors, agents, and value-added resellers, are typically employed for standardized materials, consumables, or less complex components, offering broader market reach and localized service. Online platforms are also emerging, particularly for smaller orders of raw materials or standard composite parts, enhancing accessibility and streamlining procurement. The effectiveness of these distribution channels is critical for market penetration, customer service, and the efficient flow of products and information throughout the entire composite fabrication ecosystem.

Composition Fabrication Technology Market Potential Customers

The potential customer base for the Composition Fabrication Technology Market is broad and expanding, encompassing industries that prioritize lightweighting, high strength-to-weight ratios, durability, and corrosion resistance in their products. Prominent among these are aerospace OEMs, including commercial aircraft manufacturers like Boeing and Airbus, military aircraft producers, and space exploration companies, all of whom heavily rely on advanced composites for primary and secondary structures to achieve fuel efficiency, extended range, and enhanced performance. Similarly, automotive manufacturers, ranging from luxury and high-performance vehicle brands to mainstream passenger car producers and electric vehicle (EV) innovators, are increasingly adopting composite components for chassis, body panels, and battery enclosures to reduce vehicle weight, improve safety, and extend battery range. The increasing demand for sustainable and efficient transportation solutions is a major driver for this segment.

Another significant customer segment includes wind turbine blade manufacturers, who are constantly seeking larger, more efficient, and lighter blades to maximize energy capture and reduce overall system costs. Composite materials are indispensable here, enabling the production of massive blades with exceptional aerodynamic properties and structural integrity. The marine industry, encompassing manufacturers of recreational boats, commercial vessels, and naval ships, also represents a robust customer base, leveraging composites for their superior corrosion resistance, reduced maintenance, and improved hydrodynamics. Furthermore, the construction and infrastructure sector presents growing opportunities, with composites being utilized for bridge decks, structural reinforcement, and modular building components due to their longevity, ease of installation, and resilience in harsh environments. This diverse array of end-users underscores the pervasive influence and critical importance of composition fabrication technologies across the global industrial landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 42.1 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexcel Corporation, Toray Industries Inc., Solvay S.A., Teijin Limited, SGL Carbon, Mitsubishi Chemical Corporation, Gurit Holding AG, Owens Corning, Cytec Solvay Group, BASF SE, Covestro AG, Arkema S.A., 3M Company, TenCate Advanced Composites (Toray), VESTAS Wind Systems A/S, LM Wind Power (GE Renewable Energy), Dassault Systèmes, Altair Engineering, Inc., Stratasys Ltd., EOS GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Composition Fabrication Technology Market Key Technology Landscape

The Composition Fabrication Technology Market is characterized by a rapidly evolving and sophisticated technological landscape, driven by the continuous pursuit of enhanced material performance, manufacturing efficiency, and cost reduction. Core to this landscape are advanced automated processes such as Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), which utilize robotic systems to precisely lay composite plies onto complex molds, ensuring optimal fiber orientation and minimal material waste. These technologies are increasingly integrated with sophisticated software for simulation and optimization, enabling engineers to predict material behavior and manufacturing outcomes with high fidelity. Alongside these, Resin Transfer Molding (RTM) and Vacuum Assisted Resin Transfer Molding (VARTM) remain crucial for producing high-quality parts with excellent surface finish and dimensional accuracy, particularly for larger structures, benefiting from innovations in resin chemistry and injection control systems that ensure uniform impregnation and void reduction.

A significant trend defining the current technological landscape is the proliferation of Industry 4.0 principles, including the adoption of the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and Machine Learning (ML) throughout the fabrication process. IIoT sensors are embedded in machinery to collect real-time data on temperature, pressure, and cure cycles, feeding into AI-powered analytics platforms that optimize process parameters, predict equipment failures, and ensure consistent product quality. Digital twin technology is also gaining traction, where virtual models of composite parts and manufacturing lines are created to simulate performance, test design changes, and streamline production planning without physical prototypes. This digital integration is transforming composite fabrication into a smarter, more adaptive, and data-driven manufacturing paradigm, fostering greater efficiency and innovation.

Furthermore, the market is experiencing rapid advancements in additive manufacturing (3D printing) for composites, allowing for the creation of intricate geometries and customized parts with integrated functionalities that were previously impossible with traditional methods. Technologies like Fused Deposition Modeling (FDM) with continuous fiber reinforcement, and powder bed fusion for composite powders, are opening new design possibilities and accelerating prototyping cycles. Concurrently, developments in sustainable fabrication technologies, such as those employing bio-based resins and natural fibers, or innovative recycling processes for end-of-life composites, are becoming increasingly vital. These technologies, coupled with advancements in non-destructive testing (NDT) methods like ultrasonic and X-ray inspection, ensure the structural integrity and reliability of composite components, collectively driving the Composition Fabrication Technology Market forward with capabilities that are both advanced and environmentally conscious.

Regional Highlights

- North America: This region stands as a significant innovation hub for composition fabrication technology, particularly driven by its robust aerospace and defense sector, which demands cutting-edge composite solutions for aircraft, missiles, and space applications. The automotive industry in North America is also increasingly adopting composites for lightweighting and electric vehicle development, propelled by stringent fuel efficiency standards and a focus on advanced manufacturing R&D. Substantial investments in R&D and a strong academic-industrial collaboration foster continuous technological advancements, maintaining the region's competitive edge in high-performance composites.

- Europe: Europe is a prominent market, characterized by strong demand from the wind energy sector for large turbine blades and a highly innovative automotive industry focusing on luxury and performance vehicles. Stringent environmental regulations and a strong emphasis on sustainability drive the adoption of eco-friendly composite materials and energy-efficient fabrication processes. Countries like Germany, France, and the UK lead in composite manufacturing research and industrial application, supported by comprehensive regulatory frameworks and significant public and private sector investments.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, fueled by rapid industrialization, expanding manufacturing capabilities, and burgeoning end-use industries such as automotive, construction, and consumer goods. Countries like China, India, Japan, and South Korea are witnessing substantial investments in infrastructure development and renewable energy, particularly wind power, creating immense demand for composite materials. The presence of a vast and growing manufacturing base, coupled with increasing R&D spending, positions APAC as a critical growth engine for the composition fabrication technology market.

- Latin America: This region represents an emerging market with significant growth potential, driven by increasing investments in infrastructure projects, automotive manufacturing, and the development of renewable energy capacities. While currently smaller in market share compared to more established regions, the industrial expansion in countries like Brazil and Mexico, coupled with a growing awareness of the benefits of composite materials, is expected to accelerate adoption rates in the forecast period. The focus on improving local manufacturing capabilities and reducing reliance on imports is also a key driver.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, primarily spurred by diversification efforts away from oil and gas, leading to investments in infrastructure development, renewable energy projects, and aerospace initiatives. Countries in the Gulf Cooperation Council (GCC) are particularly active in developing advanced manufacturing capabilities and fostering local composite production. While adoption is still in nascent stages for some applications, the long-term outlook remains positive as these economies mature and integrate more advanced materials into their industrial frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Composition Fabrication Technology Market.- Hexcel Corporation

- Toray Industries Inc.

- Solvay S.A.

- Teijin Limited

- SGL Carbon

- Mitsubishi Chemical Corporation

- Gurit Holding AG

- Owens Corning

- Cytec Solvay Group

- BASF SE

- Covestro AG

- Arkema S.A.

- 3M Company

- TenCate Advanced Composites (Toray)

- VESTAS Wind Systems A/S

- LM Wind Power (GE Renewable Energy)

- Dassault Systèmes

- Altair Engineering, Inc.

- Stratasys Ltd.

- EOS GmbH

Frequently Asked Questions

What are the primary benefits of Composition Fabrication Technology?

Composition Fabrication Technology offers a multitude of benefits that drive its adoption across various industries. Foremost among these is the ability to produce components with an exceptionally high strength-to-weight ratio, leading to significant lightweighting. This is crucial for sectors like aerospace and automotive, where reduced weight translates directly into improved fuel efficiency, extended range, and enhanced performance. Composites also boast superior durability and corrosion resistance compared to traditional metals, leading to longer service life and reduced maintenance requirements. Furthermore, these technologies allow for immense design freedom, enabling the creation of complex, integrated structures with fewer parts, which can simplify assembly and reduce overall manufacturing costs. The unique combination of these attributes makes composite materials indispensable for high-performance and demanding applications.

Which industries are the largest adopters of Composition Fabrication Technology?

The largest adopters of Composition Fabrication Technology are primarily industries that demand materials with exceptional performance characteristics and a keen focus on efficiency and longevity. The aerospace and defense sector stands as the leading consumer, utilizing composites for critical structural components in commercial aircraft, military jets, and spacecraft due to their lightweight properties and structural integrity. The automotive industry is rapidly increasing its adoption, particularly for electric vehicles and high-performance cars, to achieve weight reduction for improved fuel economy and battery range. The wind energy sector is another major adopter, relying heavily on composite materials for the construction of large, durable, and aerodynamically efficient turbine blades. Additionally, the marine industry extensively uses composites for boat hulls and superstructures due to their corrosion resistance and reduced maintenance needs, highlighting the broad industrial impact of these advanced fabrication methods.

What are the main challenges facing the growth of the Composition Fabrication Technology Market?

Despite its significant advantages, the Composition Fabrication Technology Market faces several key challenges that can impede its growth. One major hurdle is the high initial capital investment required for advanced fabrication equipment, such as Automated Fiber Placement (AFP) machines and sophisticated molding systems, which can be prohibitive for smaller enterprises. The cost of raw materials, particularly high-performance fibers like carbon fiber, remains higher than traditional materials, influencing overall product cost. Furthermore, the inherent complexity of composite material design and manufacturing processes demands specialized technical expertise and a highly skilled workforce, which is currently in short supply globally. Addressing the end-of-life management and recycling of composite materials also presents a significant environmental and economic challenge, as current solutions are often costly and not yet fully scalable, necessitating continuous innovation in sustainable practices.

How is sustainability impacting the Composition Fabrication Technology Market?

Sustainability is having a profound impact on the Composition Fabrication Technology Market, driving significant innovation and strategic shifts. There is an increasing demand for environmentally friendly solutions throughout the entire lifecycle of composite products. This includes the development and adoption of bio-based resins and natural fibers (e.g., flax, hemp) as sustainable alternatives to traditional petroleum-derived materials. Manufacturers are also focusing on optimizing fabrication processes to reduce energy consumption, minimize material waste, and decrease emissions, aligning with circular economy principles. Furthermore, significant research and investment are directed towards developing viable, scalable, and cost-effective recycling technologies for end-of-life composite components, moving away from landfill disposal. These efforts are not only driven by regulatory pressures and corporate social responsibility but also by growing consumer and industrial preference for sustainable products, positioning eco-conscious practices as a key competitive differentiator.

What role does automation play in composite fabrication?

Automation plays a pivotal and increasingly critical role in revolutionizing composite fabrication, fundamentally transforming the industry from labor-intensive manual processes to highly efficient and precise manufacturing. Automated systems, such as robotic Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), ensure unparalleled accuracy and repeatability in material lay-up, significantly reducing human error and improving part consistency. This automation directly translates to faster production cycles, higher throughput, and substantial reductions in labor costs. Beyond physical fabrication, automation extends to quality control through automated inspection systems, and to process optimization via data-driven feedback loops and AI-powered analytics, ensuring optimal curing, resin impregnation, and overall material performance. By integrating with Industry 4.0 principles, automation enhances connectivity, data exchange, and smart decision-making across the entire manufacturing ecosystem, making composite production more scalable, cost-effective, and resilient to market demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager