Compostable Cold Beverage Cup Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434041 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Compostable Cold Beverage Cup Market Size

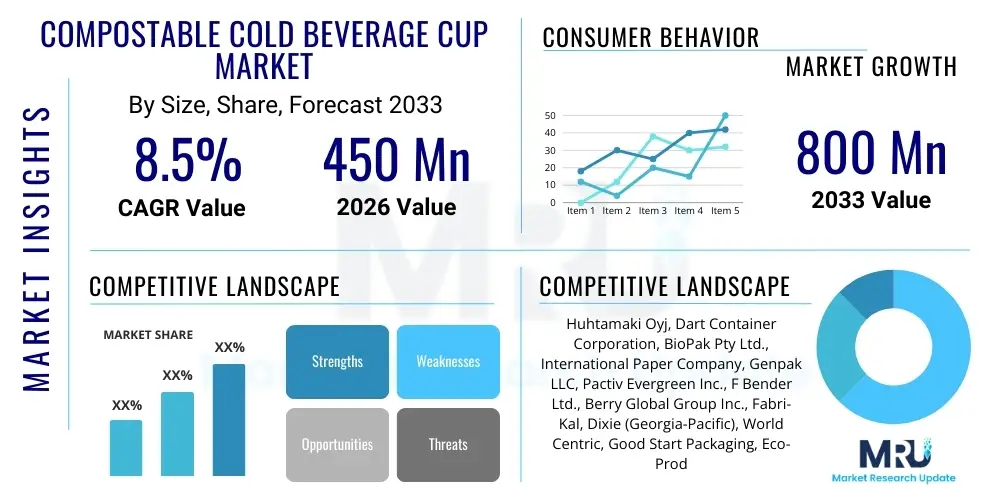

The Compostable Cold Beverage Cup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 800 million by the end of the forecast period in 2033.

Compostable Cold Beverage Cup Market introduction

The Compostable Cold Beverage Cup Market is defined by the production and sale of disposable cups designed explicitly for cold beverages, which are manufactured from materials capable of decomposing naturally in commercial or industrial composting facilities. These materials primarily include Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and specialized barrier-coated papers, offering a sustainable alternative to conventional petroleum-based plastics such as Polypropylene (PP) and Polyethylene Terephthalate (PET). The core product aims to mitigate plastic waste pollution, aligning with global circular economy objectives. Compostable cups maintain functional integrity, offering leak resistance and thermal stability required for chilled drinks, ranging from sodas and iced coffees to smoothies and juices. Their increasing adoption is largely driven by stringent governmental regulations restricting single-use plastics and growing consumer demand for eco-friendly packaging solutions across the quick-service restaurant (QSR), institutional catering, and event management sectors.

Major applications of compostable cold beverage cups span the entire foodservice industry ecosystem. QSR chains and large coffee retailers are pivotal adopters, integrating these cups into their corporate sustainability mandates. Furthermore, large-scale public events, music festivals, and sports stadiums are increasingly mandated or voluntarily choosing compostable options to manage high volumes of waste responsibly. The intrinsic benefits of these products—reduced environmental footprint, reliance on renewable resources (like corn starch or sugar cane), and compliance with evolving waste management systems—make them highly attractive in mature markets like North America and Europe. This transition addresses the critical end-of-life issue associated with traditional packaging, where recycling infrastructure often struggles with contamination and material multiplicity.

Driving factors underpinning market expansion include favorable regulatory environments, particularly the implementation of directives such as the EU Single-Use Plastics Directive (SUPD), which aggressively targets non-sustainable packaging. Additionally, significant investments in improving the performance and reducing the cost of biopolymer materials, such as enhancing PLA’s low-temperature flexibility and developing robust paper cup linings, are accelerating adoption. Brand reputation management also plays a crucial role; companies are utilizing compostable packaging as a key differentiator to appeal to environmentally conscious millennials and Generation Z consumers. The increasing availability and standardization of industrial composting infrastructure, though uneven across regions, further supports the viability and market entry of these sustainable solutions.

Compostable Cold Beverage Cup Market Executive Summary

The Compostable Cold Beverage Cup Market is experiencing robust acceleration, fueled primarily by structural shifts in global waste management policies and intensified corporate social responsibility agendas. Business trends indicate a consolidation among raw material suppliers (biopolymer producers) and specialized packaging manufacturers, focused on vertical integration to stabilize volatile input costs and secure proprietary technologies for advanced compostable coatings. Regional trends highlight Europe and North America as the primary revenue generators due to early and stringent regulatory enforcement, while the Asia Pacific region emerges as the fastest-growing market, driven by urbanization, expanding middle classes, and government initiatives in waste reduction, especially in countries like China and India, despite facing infrastructural challenges related to composting facilities. Technological focus remains on enhancing the heat resistance and durability of PLA-based products, alongside scaling up production of next-generation biopolymers like PHA, which offer superior biodegradability characteristics.

Segment trends underscore the dominance of Polylactic Acid (PLA) in terms of volume, largely due to its relative cost-effectiveness and mature production pathways, although the need for industrial composting remains a constraint. The paper segment, supported by compostable poly-lactic acid or aqueous coatings, is gaining traction, particularly for its perceived natural feel and ease of printing, positioning it strongly in the high-volume QSR sector. Furthermore, the market is witnessing a significant trend toward customized packaging designs, where brands leverage compostable cups not only for sustainability but also for enhanced consumer engagement and brand storytelling regarding their commitment to circularity. The institutional segment (schools, hospitals, corporate campuses) is also emerging as a reliable source of demand, adhering to procurement policies that prioritize sustainable consumables. Cost parity with conventional plastics, while not yet fully achieved, is rapidly improving, lowering the barrier to entry for smaller foodservice operations.

Overall, the market trajectory is highly sensitive to legislative changes. Bans on conventional plastic cups directly translate into immediate and significant growth opportunities for compostable alternatives. Investors are increasingly favoring companies demonstrating clear circular models, from sourcing renewable feedstocks to participating in end-of-life logistics, mitigating greenwashing risks. The competitive landscape is characterized by established packaging giants adapting their portfolios and innovative material science startups specializing purely in bioplastics. Success in this market is intrinsically linked to establishing secure, certified supply chains and actively participating in educating consumers and waste management operators about the proper disposal requirements for certified compostable products, thereby ensuring these materials genuinely fulfill their circular promise and avoid contamination of traditional recycling streams.

AI Impact Analysis on Compostable Cold Beverage Cup Market

User queries regarding AI's influence on the compostable cup market center predominantly on three areas: optimizing the complex biopolymer supply chain, enhancing material science R&D, and improving waste management efficiency. Users often ask how AI can predict feedstock price volatility (e.g., corn starch), accelerate the discovery of new, more resilient bioplastics (like faster-degrading PHA blends), and, critically, how smart waste sorting systems can accurately identify compostable cups to prevent their misdirection into recycling or landfill streams. The consensus theme is that AI acts as an enabler of efficiency and certification, helping the market overcome the inherent challenges associated with scaling specialized materials and complex end-of-life processing. Expectations are high that AI will drive down the premium price currently associated with compostable materials by optimizing production yields and reducing supply chain waste, thereby making these sustainable options universally accessible.

- AI-driven Supply Chain Forecasting: Utilizing machine learning models to predict fluctuations in agricultural feedstock prices (e.g., corn, sugar cane) to optimize procurement strategies for PLA and PHA producers, stabilizing input costs.

- Accelerated Material Discovery: Employing generative AI and computational chemistry to simulate and test new polymer formulations, speeding up the development of bioplastics with improved thermal stability and barrier properties for cold cups.

- Smart Sorting and Waste Management: Integration of computer vision and AI algorithms into Material Recovery Facilities (MRFs) and composting centers to accurately identify certified compostable cups, ensuring they are directed to the correct industrial composting process and minimizing contamination.

- Demand Sensing and Production Optimization: Using advanced analytics to forecast regional demand spikes, driven by legislative deadlines or large events, enabling manufacturers to adjust production schedules and inventory levels efficiently.

- Enhanced Certification Traceability: Implementing blockchain technology, monitored and verified by AI, to provide transparent proof of material origin and end-of-life compliance, combatting greenwashing claims.

- Process Optimization in Biopolymer Manufacturing: Applying predictive maintenance and operational intelligence in fermentation and polymerization stages to maximize yields and reduce energy consumption, lowering the overall carbon footprint of the product.

DRO & Impact Forces Of Compostable Cold Beverage Cup Market

The dynamics of the Compostable Cold Beverage Cup Market are strongly influenced by a synergy of legislative drivers, infrastructural constraints, and the opportunity presented by circular economy mandates. Key drivers include aggressive bans on conventional single-use plastics across developed economies, coupled with growing corporate commitments (e.g., from major global QSRs) to eliminate non-recyclable packaging, creating mandatory demand for certified compostable alternatives. However, market growth is significantly restrained by the uneven and insufficient availability of dedicated industrial composting facilities globally. If a compostable cup ends up in a landfill, its environmental benefit is negated, leading to consumer confusion and skepticism. This infrastructural gap represents a critical challenge that necessitates substantial public and private investment in composting infrastructure and standardized labeling systems.

A major opportunity lies in technological advancements leading to the development of 'home compostable' materials, which would bypass the industrial composting dependency and broaden accessibility and consumer acceptance. Furthermore, opportunities exist in penetrating emerging markets in Asia and Latin America, where rapid urbanization and increasing environmental awareness are beginning to pressure local governments to adopt sustainable waste management frameworks. Impact forces revolve heavily around regulatory risk—a sudden relaxation of single-use plastic restrictions or inconsistent enforcement could destabilize demand. Conversely, mandatory Extended Producer Responsibility (EPR) schemes that place the financial burden of waste management on manufacturers act as a strong positive force, compelling companies to invest in easily disposable materials like certified compostable cups.

The combined effect of these forces suggests a highly bifurcated market. In regions with mature composting infrastructure (e.g., specific European cities and parts of North America), drivers dominate, leading to rapid market penetration. In areas lacking such infrastructure, restraints are more pronounced, forcing brands to rely on offsetting carbon emissions or exporting waste, which challenges the fundamental value proposition of compostability. Strategic success requires navigating this dichotomy by engaging actively in infrastructure development and lobbying for clear, unified composting standards across different jurisdictions. The volatility of raw material costs, particularly agricultural commodities, also acts as a recurring impact force, necessitating robust risk mitigation strategies through long-term supply agreements and diversified sourcing.

Segmentation Analysis

The Compostable Cold Beverage Cup Market is segmented based on Material Type, Cup Structure, and End-Use Application, allowing for a granular understanding of purchasing patterns and technological preferences across various user groups. The Material Type segment is critical, determining the end-of-life process and cost structure, predominantly split between Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and Fiber-based (Paper) materials with specialized compostable linings. Segmentation by Cup Structure differentiates between single-wall, double-wall, and specialized insulated cups, reflecting functional requirements (e.g., condensation control for intensely cold beverages). End-Use Application segmentation focuses on the key consumer sectors driving volume, notably Quick-Service Restaurants (QSR), Institutions (Healthcare, Education), Cafes & Coffee Shops, and Events & Catering, each having distinct volume needs, regulatory adherence requirements, and brand visibility objectives. The interplay between these segments defines the competitive strategy, particularly regarding price point versus material performance and certified compostability claims.

- Material Type:

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Fiber/Paper (with compostable lining, e.g., PLA or aqueous dispersion coatings)

- Crystalline Polylactic Acid (CPLA) – used for lids and stronger structures

- Cup Structure:

- Single-Wall Cups

- Double-Wall Cups (Insulated)

- Custom Shaped Cups

- End-Use Application:

- Quick Service Restaurants (QSR) & Fast Casual Dining

- Cafes and Coffee Shops

- Institutional Catering (Corporate, Education, Healthcare)

- Events, Festivals, and Stadiums

- Airlines and Travel Catering

- Geography:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, Australia, India)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Compostable Cold Beverage Cup Market

The value chain for the Compostable Cold Beverage Cup Market is complex and distinct from traditional plastic packaging, starting with the agricultural sector (upstream analysis) and extending through specialized conversion and distribution networks (downstream analysis). Upstream activities involve the sourcing of renewable feedstocks—primarily corn starch, sugarcane, or other biomass—which are then processed into biopolymers like PLA or PHA. This phase is characterized by high capital intensity and susceptibility to agricultural commodity price volatility. Manufacturers specializing in biopolymer pelletization then supply these raw materials to cup converters. A major bottleneck often occurs here: ensuring high purity and consistent technical specifications of the biopolymer that can withstand rapid, high-volume manufacturing processes and meet strict food safety standards. Innovation at this stage focuses on developing second-generation bioplastics derived from non-food sources to mitigate the "food vs. fuel" ethical debate and further reduce environmental impact.

The midstream phase involves converting biopolymer resins or coated paper into the final cup products through thermoforming or injection molding, followed by printing and quality assurance checks for leak resistance and dimensional accuracy. Downstream analysis focuses on the distribution channels, which are highly specialized. Unlike standard plastics, compostable cups require distribution partners who can handle smaller, localized batches (especially for regional composting programs) and provide clear end-of-life guidance to the end-users. Direct sales to major QSR chains and institutional clients are common, driven by long-term contracts and sustainability mandates. Indirect sales move through established food service distributors and specialized eco-friendly packaging suppliers. A critical component of the downstream value chain is the engagement with composting facilities and waste haulers, closing the loop. The lack of synergy between the manufacturers and the waste management infrastructure often represents the weakest link, jeopardizing the product’s intended environmental outcome.

Furthermore, certification bodies, such as BPI (Biodegradable Products Institute) in North America or TÜV AUSTRIA, play an indispensable external role, verifying compostability claims and ensuring compliance with standards like ASTM D6400 or EN 13432. This verification adds an essential layer of trust and market entry validation. The high cost of biopolymer materials compared to conventional plastics means that margin optimization is critical throughout the chain, pushing converters toward lean manufacturing and efficient material utilization. The primary challenge remains educating the end-user (the consumer) on the correct disposal, as mis-sorting compostable cups significantly disrupts the efficacy of both recycling and composting operations, demanding increased investment in on-packaging communication and point-of-sale instructional materials.

Compostable Cold Beverage Cup Market Potential Customers

The primary customers and end-users of compostable cold beverage cups are concentrated within the high-volume, disposable foodservice industry, where speed, convenience, and increasingly, sustainability mandates dictate purchasing decisions. Quick-Service Restaurants (QSRs) and Fast Casual chains represent the most substantial buying power, requiring massive, consistent volumes globally as they transition away from conventional plastics to meet internal ESG (Environmental, Social, Governance) goals and regulatory requirements. These large corporations act as market movers, setting precedents for material choice and often negotiating direct, multi-year supply contracts to ensure price stability and supply certainty for certified materials like PLA-lined paper cups. Their procurement decisions often hinge on global material certification (e.g., BPI certification) and logistics capabilities.

A second significant customer group includes institutional buyers, encompassing corporate cafeterias, educational facilities (universities and K-12), and healthcare systems. Procurement decisions in this sector are often driven by centralized public health and sustainability policies, focusing on eliminating pollution within defined operational boundaries. While their volume is generally less concentrated than QSRs, their commitment to sustainability is often longer-term and less price-sensitive, provided the products meet stringent safety and hygiene standards. This segment is crucial for diversifying demand away from cyclical retail fluctuations. Moreover, the massive, though intermittent, demand generated by large public events, concerts, and professional sports stadiums constitutes a vital customer segment, often subject to local regulations mandating compostable service ware for zero-waste initiatives, particularly in major metropolitan areas with established composting infrastructure.

Finally, independent specialty coffee shops, small local eateries, and centralized catering companies form the fragmented customer base. These buyers often purchase through third-party distributors and prioritize certified products to align with their local, ethical branding. Their purchasing behavior is highly influenced by distributor stock availability and local municipal waste guidelines. For all customer types, the shift towards compostable cups is not merely an aesthetic choice but a direct response to operational necessity, driven by the desire to minimize landfill contributions and improve waste diversion rates, which are increasingly monitored metrics for corporate accountability and environmental impact reporting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki Oyj, Dart Container Corporation, BioPak Pty Ltd., International Paper Company, Genpak LLC, Pactiv Evergreen Inc., F Bender Ltd., Berry Global Group Inc., Fabri-Kal, Dixie (Georgia-Pacific), World Centric, Good Start Packaging, Eco-Products Inc., Novamont S.p.A., NatureWorks LLC, TIPA Corp Ltd., Stora Enso, WestRock Company, BASF SE, TotalEnergies Corbion. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compostable Cold Beverage Cup Market Key Technology Landscape

The technological landscape of the Compostable Cold Beverage Cup Market is dominated by advancements in biopolymer science and specialized coating techniques designed to enhance performance while maintaining certified compostability. The primary technology is centered around Polylactic Acid (PLA), derived from renewable resources, which requires continuous innovation to improve its inherent structural weaknesses, specifically low-temperature brittleness and poor barrier properties against moisture and oxygen. Researchers are focusing on stereocomplexation and blending with other biopolymers or natural fibers to create materials that are tougher, more flexible for cold cup applications, and processable on existing high-speed manufacturing equipment, thereby lowering conversion costs. Furthermore, the scaling up of Polyhydroxyalkanoates (PHA) production represents a major technological push, as PHA offers superior biodegradability in diverse environments, including marine and home composting settings, addressing the limitation of PLA which typically requires industrial composting conditions.

Another crucial technological frontier involves the development of bio-based and aqueous dispersion coatings for fiber-based cups. Traditional paper cups often use polyethylene (PE) linings, rendering them non-compostable and difficult to recycle. The industry has invested heavily in creating plant-based coatings (e.g., modified starches, waxes, or compostable poly-lactic acid derivatives) that provide excellent moisture barriers without compromising the paper's certified compostability (EN 13432). Success in this area is paramount for capturing the massive volume market currently served by standard paper cups. These aqueous coatings are chemically complex, needing to adhere strongly to the paper substrate, resist cold condensation, and degrade quickly during the composting cycle without leaving toxic residues. This area of innovation directly impacts the overall adoption rate by making paper-based options truly circular.

Beyond material science, manufacturing technologies are being optimized. This includes high-speed thermoforming machinery adapted for bioplastics, which often have a narrower processing window than petrochemical plastics, requiring precise temperature control and cooling cycles to prevent warping or crystallization. Quality control systems utilizing advanced sensors and machine vision are being implemented to detect minute structural flaws that could compromise the cup’s integrity during use. Finally, the development of standardized, scientifically rigorous testing protocols for compostability certification (e.g., testing for heavy metals and ecotoxicity of residues) provides the technological bedrock necessary for market credibility and regulatory compliance, ensuring that new material innovations meet genuine environmental performance standards globally.

Regional Highlights

- North America: North America, particularly the United States and Canada, represents a mature but rapidly evolving market driven by a complex patchwork of state-level and municipal regulations. Coastal states (e.g., California, New York) and major cities have aggressively banned specific single-use plastic items, directly boosting the demand for compostable alternatives in the QSR and institutional sectors. The region benefits from strong corporate sustainability commitments from major US-headquartered food and beverage chains. However, a major market fragmentation challenge exists due to the lack of unified composting infrastructure; adoption success is highly localized to areas with accessible industrial composting facilities, such as the Pacific Northwest and parts of the Northeast. The focus here is on BPI certification and clear labeling to navigate consumer confusion and regulatory diversity.

- Europe: Europe is a global leader in enforcing circular economy principles, primarily through the ambitious EU Single-Use Plastics Directive (SUPD), which mandated reductions and bans on specific plastic items. This regulatory clarity has created a strong, predictable market for certified compostable cups, particularly in Germany, France, and the UK. Market penetration is high, supported by established, albeit sometimes criticized, industrial composting networks and strong environmental awareness among consumers. The emphasis is on EN 13432 certification and ensuring materials meet strict ecotoxicity standards. Future growth will be driven by stricter rules on packaging targets and the expansion of harmonized waste collection schemes across member states.

- Asia Pacific (APAC): The APAC region is poised for the fastest growth, driven by massive urbanization, increasing disposable incomes, and mounting plastic waste crises in coastal nations. Countries like China and India are implementing phased bans on single-use plastics and investing in sustainable waste management infrastructure. While the overall volume of plastic consumption remains immense, the market for compostable cups is rapidly emerging in metropolitan centers serving global chains and affluent consumers. Challenges include the dominant role of highly cost-competitive conventional plastics, less standardized waste management systems, and lower consumer awareness compared to the West. Opportunities lie in establishing localized biopolymer production hubs leveraging indigenous agricultural resources.

- Latin America (LATAM): The LATAM market is characterized by intermittent regulatory action, with countries like Brazil, Chile, and Mexico showing localized bans in major cities. Growth is primarily observed in the tourism and major catering sectors where international standards are adopted. The lack of robust composting infrastructure is a major restraint, forcing manufacturers to focus on highly stable materials that can withstand long distribution times. The market potential is vast, but sustained growth requires greater regulatory cohesion and investment in waste processing facilities.

- Middle East & Africa (MEA): The MEA market is nascent, driven mainly by large international events (e.g., sporting events hosted in the Gulf states) and luxury tourism, where brand image and international compliance are priorities. Demand is highly concentrated, with limited municipal composting infrastructure. However, the region offers potential for sustainable biopolymer feedstock production (e.g., utilizing sugarcane waste) which could eventually support localized manufacturing and drive down logistics costs, positioning sustainability as an economic diversification strategy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compostable Cold Beverage Cup Market.- Huhtamaki Oyj

- Dart Container Corporation

- BioPak Pty Ltd.

- International Paper Company

- Genpak LLC

- Pactiv Evergreen Inc.

- F Bender Ltd.

- Berry Global Group Inc.

- Fabri-Kal

- Dixie (Georgia-Pacific)

- World Centric

- Eco-Products Inc.

- Novamont S.p.A.

- NatureWorks LLC

- TIPA Corp Ltd.

- Stora Enso

- WestRock Company

- BASF SE

- TotalEnergies Corbion

- Vegware

Frequently Asked Questions

Analyze common user questions about the Compostable Cold Beverage Cup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in compostable cold beverage cups?

The most common primary material is Polylactic Acid (PLA), a bioplastic derived from fermented plant starches, often used for clear cups or as a lining for fiber-based paper cups to provide a moisture barrier while ensuring certified industrial compostability.

Are compostable cups better for the environment than recyclable plastic cups?

Compostable cups offer an environmental advantage when they are correctly disposed of in certified industrial composting facilities, diverting organic material and packaging waste from landfills. However, their superior performance is dependent on the availability of proper waste infrastructure, which is highly localized.

What certifications are essential for compostable cold cups?

Key certifications include the BPI (Biodegradable Products Institute) certification in North America and the EN 13432 standard in Europe. These third-party standards verify that the product will safely break down into non-toxic components within a commercial composting timeline.

Do compostable cups cost more than traditional plastic cups?

Yes, compostable cold beverage cups generally command a price premium over conventional petroleum-based plastic cups (PET or PP) due to the higher cost of biopolymer raw materials, specialized manufacturing processes, and the necessary investment in maintaining strict material certifications.

What is the largest restraint limiting the adoption of compostable cups?

The largest restraint is the lack of ubiquitous industrial composting infrastructure. If consumers lack access to the correct disposal bins, compostable cups often end up in landfills or recycling streams, contaminating materials and negating their intended circular benefit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager