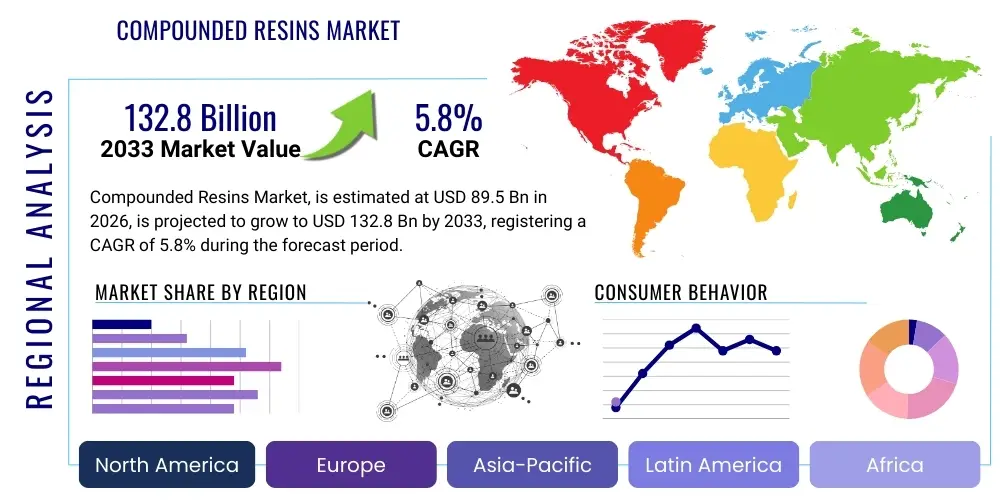

Compounded Resins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434994 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Compounded Resins Market Size

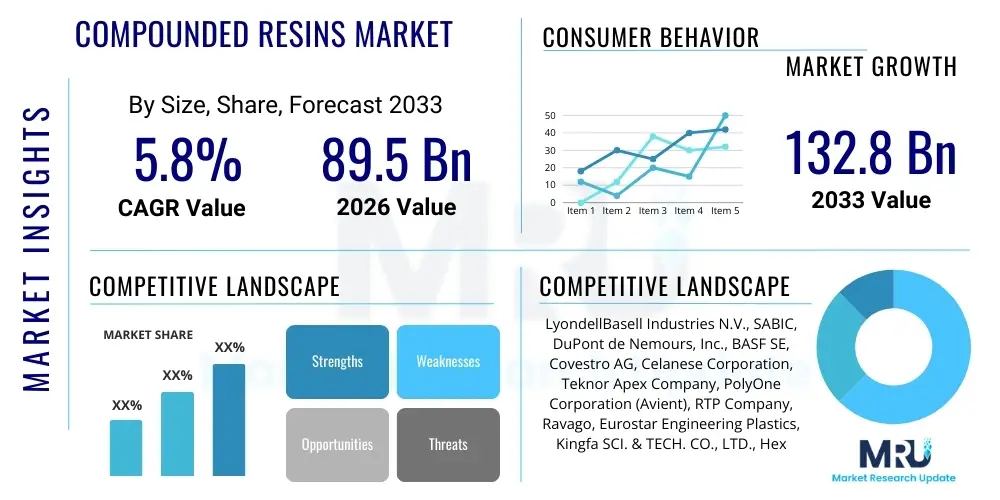

The Compounded Resins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 89.5 Billion in 2026 and is projected to reach USD 132.8 Billion by the end of the forecast period in 2033.

Compounded Resins Market introduction

Compounded resins are high-performance thermoplastic or thermoset materials created by blending base polymers with various additives, fillers, reinforcement agents, colorants, and stabilizers to achieve specific properties not present in the base resin alone. This customization process, known as compounding, allows manufacturers to tailor materials for stringent performance requirements, such as enhanced mechanical strength, improved heat resistance, specific electrical conductivity, flame retardancy, or aesthetic appeal. These tailored materials are essential across modern manufacturing industries, replacing traditional materials like metals or ceramics in applications demanding lightweight characteristics and high durability.

The primary applications of compounded resins span critical sectors, most notably the automotive, electrical and electronics (E&E), and construction industries. In the automotive sector, compounded resins facilitate vehicle lightweighting, a crucial trend driving fuel efficiency and reducing emissions, by replacing heavy metal components in interiors, exteriors, and under-the-hood applications. Similarly, the E&E industry relies on specialized flame-retardant and highly insulative compounds for enclosures, connectors, and wiring components. Beyond these, the packaging sector utilizes customized compounds for barrier properties, and the medical sector employs high-purity, sterilized compounds for device manufacturing.

Driving factors for sustained market growth include the accelerating demand for engineering plastics in complex applications and the relentless push for material substitution. The rapid expansion of electric vehicle (EV) production globally necessitates advanced thermal management and high-voltage resistant compounds, directly fueling market demand. Furthermore, technological advancements in compounding machinery and process optimization are enabling the cost-effective production of highly complex, multi-component resin systems, opening new application frontiers in aerospace and renewable energy infrastructure. The inherent benefits, such as design flexibility, corrosion resistance, and lower processing costs compared to metals, solidify the position of compounded resins as indispensable industrial inputs.

Compounded Resins Market Executive Summary

The Compounded Resins Market is characterized by robust growth, driven primarily by the global trends of lightweighting in the transportation sector and miniaturization in electronics. Business trends highlight increasing consolidation among major producers aiming for vertically integrated supply chains and enhanced material science capabilities, focusing heavily on developing bio-based and recycled resin compounds to meet sustainability mandates. Key innovations are centered around high-performance engineering thermoplastics (e.g., polyamides, ABS/PC alloys) tailored for demanding applications like battery components in EVs and 5G infrastructure. Market competition is intense, requiring continuous investment in R&D to provide application-specific solutions and maintain competitive pricing amidst fluctuating raw material costs.

Regionally, the Asia Pacific (APAC) stands out as the undisputed leader in both production and consumption, mainly attributed to the massive scale of the manufacturing and electronics industries in China, India, and Southeast Asian nations. North America and Europe demonstrate mature demand, characterized by high regulatory standards, driving innovation toward flame-retardant, low-smoke, and halogen-free compounds, particularly in the construction and aerospace industries. Latin America and the Middle East & Africa (MEA) are emerging regions, witnessing increased adoption driven by infrastructure development and the localization of automotive manufacturing capacities.

Segmentation trends indicate that Polypropylene (PP) compounds dominate the market volume due to their cost-effectiveness and versatility in automotive and packaging sectors. However, engineering plastics such as polyamides and ABS/PC blends are expected to exhibit the fastest revenue growth due to their superior performance characteristics required in high-heat and high-stress environments. The Automotive end-user industry maintains the largest market share, consistently demanding specialized compounds for structural, interior, and powertrain applications, thereby dictating material specification requirements and quality standards across the value chain. Customized injection molding compounds remain the leading application method.

AI Impact Analysis on Compounded Resins Market

User queries regarding AI's influence in the Compounded Resins Market often revolve around predictive modeling for material properties, optimization of compounding processes, and AI-driven quality control. Users are keen to understand how machine learning can accelerate the formulation and testing of novel compounds, potentially reducing the lengthy traditional R&D cycle. Key themes include the implementation of AI for predictive maintenance of complex extrusion lines, optimizing extruder temperature profiles and feed rates for maximum throughput and minimizing energy consumption, and leveraging computer vision for defect detection in extruded products. There is also significant interest in using AI algorithms to manage complex supply chain logistics for hundreds of disparate additives and base resins, ensuring better inventory management and mitigating price volatility risks.

- AI-driven Predictive Material Formulation: Machine learning models accelerate the identification of optimal polymer, filler, and additive ratios to achieve target mechanical or thermal specifications, drastically shortening R&D time.

- Process Optimization and Energy Efficiency: AI algorithms monitor real-time parameters (temperature, pressure, shear rate) in compounding extruders to maintain ideal processing conditions, reducing energy consumption and material waste.

- Quality Control and Defect Detection: Computer vision and deep learning are deployed for automated, high-speed inspection of compounded pellets and finished parts, ensuring consistent quality and detecting microscopic flaws.

- Supply Chain and Raw Material Risk Management: AI forecasts fluctuations in petrochemical feedstock prices and optimizes inventory levels of specialized additives, mitigating supply chain vulnerabilities.

- Simulation and Virtual Prototyping: AI enhances finite element analysis (FEA) and computational fluid dynamics (CFD) for simulating compound performance in end-use environments before physical prototyping, saving cost and time.

DRO & Impact Forces Of Compounded Resins Market

The Compounded Resins Market is governed by a strong interplay of positive and restrictive forces that collectively define its trajectory. The primary growth drivers stem from the global mandates for material substitution, particularly the substitution of metals with high-performance plastics in the automotive and aerospace industries to achieve significant weight reduction, essential for improving fuel economy and extending the range of electric vehicles. Concurrently, the proliferation of complex electronic devices, including consumer electronics and industrial automation systems, necessitates polymers with superior thermal stability, electromagnetic shielding, and precise dielectric properties, constantly increasing the demand for highly specialized resin compounds.

Restraints, however, pose significant challenges to market players. The most prominent constraint is the inherent volatility in the prices of crude oil and natural gas, which are the primary feedstocks for most virgin resins. This fluctuation makes consistent pricing difficult for compounders and pressures profit margins. Furthermore, increasingly stringent global environmental regulations regarding plastic waste and the use of certain chemical additives (like specific flame retardants) compel compounders to invest heavily in expensive, alternative, and often less established sustainable materials, adding complexity to formulation and compliance processes.

Opportunities for high-value growth lie primarily in the emerging fields of bio-based and recycled compounded resins, responding directly to corporate sustainability goals and circular economy initiatives. The expansion of additive manufacturing (3D printing) also presents a significant growth avenue, as specialized polymer powders and filaments derived from high-performance compounds are essential for producing structural parts with complex geometries. The combined impact forces strongly favor lightweighting and sustainability requirements, indicating that compounders capable of delivering eco-friendly, high-specification materials at scale will gain substantial competitive advantage throughout the forecast period.

Segmentation Analysis

The Compounded Resins Market is comprehensively segmented based on the type of base resin used, the specific application method, and the end-use industry utilizing the final product. This multidimensional segmentation allows for precise market sizing and strategic targeting. The resin type segmentation is critical, reflecting the fundamental performance characteristics of the compounded material, ranging from bulk commodity plastics like PP and PE to specialized engineering plastics such as polyamides and polycarbonates. The market dynamics within each segment are heavily influenced by the raw material availability, processing difficulty, and the stringent specifications imposed by key consuming sectors like Automotive and Electrical & Electronics, which demand reliability and safety compliance.

Application-wise, the market is dominated by traditional methods like injection molding and extrusion, which are essential for producing high-volume, precision components. Injection molding compounds, used for automotive dashboards, electronic housings, and medical devices, represent the largest sub-segment. Meanwhile, the end-user segmentation reveals a significant reliance on macro-economic cycles, particularly in construction and automotive manufacturing. The continuous trend toward replacing conventional materials across these industries ensures sustained demand, requiring compounders to maintain diverse product portfolios tailored to unique industry requirements, such as UV stability in construction materials and hydrolytic stability in medical devices.

- Resin Type:

- Polypropylene (PP)

- Polyethylene (PE) (LDPE, HDPE, LLDPE)

- Polyvinyl Chloride (PVC)

- Polyamides (PA 6, PA 66, Others)

- ABS/PC Alloys and Blends

- Polycarbonate (PC)

- Polyacetal (POM)

- PBT/PET

- High-Performance Resins (PEEK, PPS, PSU)

- Others (Thermosets, Elastomers)

- End-User Industry:

- Automotive

- Electrical & Electronics (E&E)

- Construction

- Packaging

- Consumer Goods

- Medical

- Industrial/Machinery

- Aerospace & Defense

- Application:

- Injection Molding

- Extrusion (Sheet, Film, Profile)

- Blow Molding

- Rotational Molding

- Others (3D Printing, Thermoforming)

Value Chain Analysis For Compounded Resins Market

The value chain for the Compounded Resins Market begins upstream with petrochemical companies that supply the basic raw materials—monomers and base resins derived primarily from oil and gas feedstocks. This upstream segment is highly capital-intensive and subject to global geopolitical and commodity price fluctuations. Key players here include major integrated oil and chemical companies. The immediate subsequent stage involves the production of bulk commodity polymers (like PP, PE) and engineering polymers (like PA, PC). Securing stable access to these base resins at competitive prices is a crucial determinant of profitability for compounders.

The core of the value chain is the compounding process itself. Midstream players (compounders) procure base resins, specialized additives (e.g., UV stabilizers, flame retardants, mineral fillers, glass fibers), and colorants, blending them using twin-screw extruders and other specialized equipment to create custom formulations. Differentiation at this stage relies heavily on material science expertise, process technology, and the ability to certify products for specific industrial standards (e.g., UL, FDA, automotive OEM specifications). Compounders act as critical intermediaries, bridging the gap between large polymer producers and diverse, specialized end-user requirements.

Downstream activities involve the distribution channel, which can be direct or indirect. Large, integrated compounders often sell directly to major Tier 1 and Tier 2 suppliers in the automotive and E&E sectors, offering technical support and customized deliveries. Smaller customers and localized markets are typically served through indirect channels, utilizing specialized distributors and agents who handle inventory management and localized logistics. The ultimate buyers (OEMs and fabricators) convert the compounded pellets into final products using manufacturing techniques like injection molding. The trend towards lightweighting and performance requires close collaboration throughout the value chain, from additive suppliers to compounders and finally to the end-product manufacturers, emphasizing technical service as a key competitive factor.

Compounded Resins Market Potential Customers

The primary customers for compounded resins are large-scale manufacturing enterprises across globally industrialized sectors, seeking high-performance, cost-effective alternatives to traditional materials. Automotive Tier 1 suppliers (e.g., Magna International, Continental, Bosch) are massive consumers, requiring compounds for interiors (dashboards, consoles), exteriors (bumpers, body panels), and critical under-the-hood components (engine covers, manifold systems) that must withstand high temperatures and vibration. These customers require materials certified for specific OEM standards (e.g., VW, Ford, Toyota) related to crash safety, flammability, and long-term durability, making quality and consistency non-negotiable purchasing criteria.

Another major customer segment resides within the Electrical & Electronics industry, encompassing manufacturers of household appliances, industrial machinery, and complex communication infrastructure components. Companies like Samsung, LG, and various data center hardware providers purchase specialized, flame-retardant compounds (often UL 94 V-0 rated) for electronic enclosures, circuit breaker components, and wire insulation. The demand here is driven by safety regulations, the need for excellent insulation properties, and aesthetic requirements for consumer-facing devices, pushing demand towards engineering plastics with high flow characteristics for complex molding.

Beyond the core sectors, the construction industry relies on compounded PVC and specialized high-density polyethylene (HDPE) for piping, window profiles, and insulation materials, demanding UV resistance and weatherability. The medical device sector represents a high-growth, high-margin customer base, requiring ultra-clean, biocompatible, and sterilizable compounds for surgical tools, drug delivery systems, and diagnostic equipment. These customers prioritize regulatory compliance (e.g., ISO 10993) and traceability, often leading to long-term supply agreements with validated compound suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 89.5 Billion |

| Market Forecast in 2033 | USD 132.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LyondellBasell Industries N.V., SABIC, DuPont de Nemours, Inc., BASF SE, Covestro AG, Celanese Corporation, Teknor Apex Company, PolyOne Corporation (Avient), RTP Company, Ravago, Eurostar Engineering Plastics, Kingfa SCI. & TECH. CO., LTD., Hexpol AB, Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., Exxon Mobil Corporation, Lotte Chemical Corporation, LG Chem, Trinseo PLC, SIBUR Holding. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compounded Resins Market Key Technology Landscape

The technological landscape of the Compounded Resins Market is primarily defined by advancements in extrusion equipment and sophisticated additive formulation strategies, focusing on achieving superior dispersion and homogenization of fillers within the polymer matrix. Twin-screw extrusion (TSE) remains the backbone technology, favored for its excellent mixing efficiency, capacity to handle high filler loadings (such as glass fibers or mineral fillers), and flexibility to process a wide variety of base polymers and specialty additives simultaneously. Recent innovations in TSE focus on developing modular barrel designs, optimized screw elements, and advanced process control systems (often integrated with AI) to maximize shear rate control, throughput, and ensure narrow tolerance compliance for performance-critical compounds.

Beyond core processing, the market is increasingly reliant on functional additive technologies to imbue resins with specific, high-value properties. This includes the development of highly efficient, non-halogenated flame retardants (NHFR) to meet stringent fire safety standards, especially in Europe and North America, reducing environmental impact compared to traditional halogenated chemistries. Furthermore, nanoparticle technology is being increasingly employed, utilizing fillers such as carbon nanotubes or graphene to achieve previously unattainable levels of mechanical strength, electrical conductivity, or barrier properties with minimal weight addition, driving adoption in aerospace and specialized electronics.

Material recycling and circularity technologies are also crucial, representing a significant area of technological investment. Advanced mechanical recycling, chemical recycling (depolymerization), and dissolution technologies are being developed to recover high-quality base resins from end-of-life plastic products, which can then be re-compounded with virgin resins or performance additives. This trend necessitates compounders to develop specialized formulations that can incorporate post-consumer or post-industrial recycled (PCR/PIR) content while maintaining performance specifications, ensuring compliance with pending regulatory requirements for minimum recycled content quotas across major consuming regions.

Regional Highlights

The global demand and production of compounded resins are unevenly distributed, reflecting regional differences in industrial maturity, regulatory frameworks, and automotive/electronics manufacturing capacity. Asia Pacific (APAC) currently holds the dominant position, driven by the massive scale of manufacturing operations, particularly in China, which serves as both a major consumer and a key global production hub for compounds used in automotive parts, consumer electronics, and infrastructure. Rapid industrialization and urbanization in countries like India, Vietnam, and Indonesia further fuel the region's robust demand, particularly for cost-effective PP and PVC compounds, although the region is rapidly scaling up its capacity for specialized engineering compounds to support its rapidly growing electric vehicle manufacturing base.

Europe and North America represent highly advanced and mature markets, characterized by stringent performance and safety standards. Demand in these regions is heavily skewed toward high-end engineering thermoplastics, driven by the need for advanced lightweight components in premium automotive manufacturing and the aerospace sector. Regulatory compliance is a major factor; European regulations (such as REACH and directives on end-of-life vehicles) necessitate a shift towards bio-based, recycled, and non-halogenated materials, compelling regional compounders to lead technological innovation in sustainability and specialty additives. The focus on electric vehicle battery enclosures and thermal management systems represents the single largest growth opportunity in both regions.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by moderate but accelerating growth. LATAM's growth is tied to the recovery and expansion of regional automotive production and construction projects, with Brazil and Mexico being the key markets. The MEA region, particularly the GCC countries, benefits from significant petrochemical investments, leading to increased localized compounding capacity and demand driven by large-scale infrastructure and construction development projects. However, market adoption in these regions is highly sensitive to imported pricing and is currently focused predominantly on commodity and semi-engineering compounds.

- Asia Pacific (APAC): Dominates the global market share; massive manufacturing base for E&E and Automotive; major growth fueled by China and India's EV production and infrastructure development; leading consumer of PP, PE, and specialized engineering plastics.

- North America: High demand for high-performance compounds used in automotive lightweighting and aerospace; strong regulatory push toward fire safety and low volatile organic compounds (VOC) emissions; technology leaders in advanced materials.

- Europe: Focus on sustainability, bio-based polymers, and recycled content mandates (Circular Economy); stringent standards drive demand for non-halogenated flame retardants and certified materials for construction and transportation.

- Latin America (LATAM): Growth linked to domestic automotive industry recovery (Mexico, Brazil) and construction projects; increasing local compounding capabilities reducing reliance on imports.

- Middle East & Africa (MEA): Emerging growth driven by downstream investment in petrochemical clusters (Saudi Arabia, UAE); high demand in infrastructure and domestic packaging industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compounded Resins Market.- LyondellBasell Industries N.V.

- SABIC (Saudi Basic Industries Corporation)

- DuPont de Nemours, Inc.

- BASF SE

- Covestro AG

- Celanese Corporation

- Teknor Apex Company

- PolyOne Corporation (Now Avient Corporation)

- RTP Company

- Ravago

- Eurostar Engineering Plastics

- Kingfa SCI. & TECH. CO., LTD.

- Hexpol AB

- Asahi Kasei Corporation

- Sumitomo Chemical Co., Ltd.

- Exxon Mobil Corporation

- Lotte Chemical Corporation

- LG Chem

- Trinseo PLC

- SIBUR Holding

Frequently Asked Questions

Analyze common user questions about the Compounded Resins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for compounded resins in the automotive sector?

The primary driver is vehicle lightweighting, which uses high-strength, high-performance compounded resins (such as polyamides and polycarbonates) to replace heavy metal components, significantly improving fuel efficiency and extending the range of electric vehicles (EVs).

How do volatile raw material prices affect the compounded resins market?

Volatility in crude oil and natural gas prices directly impacts the cost of base resins (feedstocks), leading to reduced profit margins for compounders and necessitating robust hedging strategies and efficient process management to mitigate financial risk.

Which resin type currently holds the largest volume share in the market?

Polypropylene (PP) compounds hold the largest volume share due to their superior cost-to-performance ratio, extensive use in packaging and automotive interiors, and ease of compounding and processing via injection molding.

What role does sustainability play in the future growth of compounded resins?

Sustainability is a core growth vector, driving massive investment into bio-based resins, chemical recycling technologies, and the development of compounds incorporating high percentages of post-consumer recycled (PCR) content to meet regulatory and consumer demand for circular materials.

Which region is expected to exhibit the highest growth rate in compounded resin consumption?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate, primarily fueled by the rapid expansion of the electric vehicle manufacturing supply chain and the continued dominance of the consumer electronics production base in East Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager