Compression Coupling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433914 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Compression Coupling Market Size

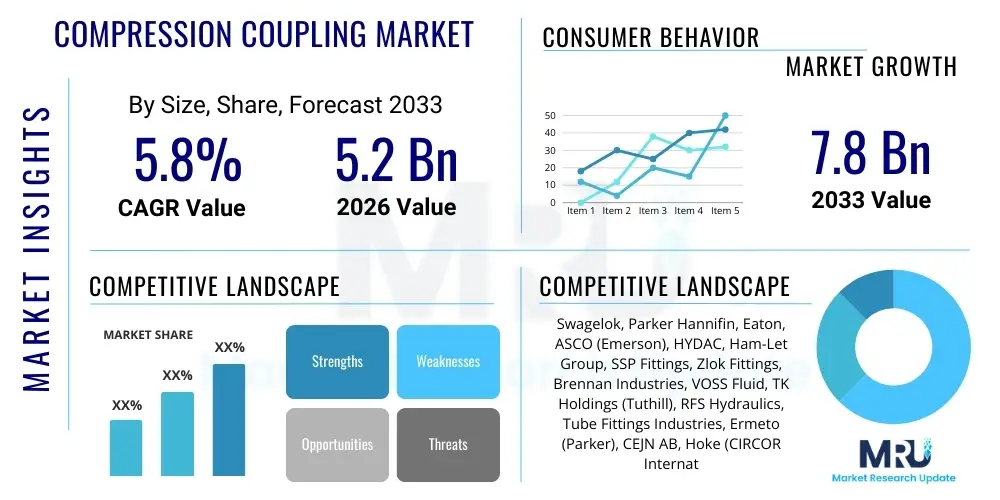

The Compression Coupling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by relentless expansion in critical infrastructure sectors globally, particularly in oil and gas transmission, water treatment and distribution networks, and sophisticated HVAC systems utilized in commercial real estate development. The demand is further solidified by the increasing necessity for leak-proof, reliable, and easily installable connection solutions that minimize downtime and maintenance costs across diverse industrial applications.

The estimation takes into account the burgeoning investment in smart city initiatives and the revitalization of aging utility infrastructure across mature economies like North America and Europe. Compression couplings, owing to their inherent simplicity of installation and superior sealing performance under varying pressure conditions, are increasingly favored over traditional welding or threading methods. This preference is particularly notable in environments where quick repairs or temporary connections are essential, contributing significantly to the overall market valuation. Furthermore, advancements in material science, leading to the production of high-performance polymer and composite compression couplings, are broadening the application scope in highly corrosive or high-temperature environments, pushing the market size upward.

Compression Coupling Market introduction

The Compression Coupling Market encompasses the global trade and utilization of mechanical fittings designed to join two tubes or pipes without requiring soldering, welding, or flaring. These couplings operate by utilizing a compression nut and a ferrule (or sleeve), which, when tightened, compress against the tubing, creating a robust, leak-tight seal. This mechanism makes compression couplings highly desirable in applications demanding quick, secure, and potentially reusable connections. They are foundational components in fluid handling systems, offering substantial advantages in terms of installation speed, ease of repair, and compatibility with numerous pipe materials, including copper, stainless steel, PVC, and polyethylene.

Major applications of compression couplings span across critical infrastructure and manufacturing domains. In the oil and gas sector, they are crucial for instrumentation lines and small-bore fluid transmission where pressure and temperature fluctuations are common. The residential and commercial plumbing sector heavily relies on these couplings for reliable connections in water and gas lines due to their non-destructive installation process. Furthermore, high-pressure hydraulic systems, pneumatic control circuits, and specialized chemical processing plants utilize robust, often metal-based, compression couplings (like double ferrule designs) to ensure system integrity and operational safety, highlighting their versatility and widespread necessity across the industrial landscape.

The primary benefits driving market adoption include enhanced system reliability, significant reduction in installation complexity and labor costs, and superior resistance to vibrations and thermal cycling compared to less flexible joining methods. Key driving factors fueling market expansion are stringent regulatory requirements related to leak mitigation, especially in hazardous fluid transportation; the global push for infrastructure modernization; and the continued rapid growth of the manufacturing sector, particularly in Asia Pacific, which demands extensive fluid and pneumatic delivery systems. The market is also propelled by innovation focused on developing higher-pressure rated, corrosion-resistant materials and tool-free installation designs, enhancing overall product utility.

Compression Coupling Market Executive Summary

The Compression Coupling Market is characterized by robust growth, propelled primarily by enduring business trends centered on efficiency and material innovation. A dominant business trend is the transition toward lightweight, durable, and chemically inert polymer-based couplings in utility and residential applications, driven by cost-effectiveness and ease of handling. Conversely, high-stakes industrial environments, such as aerospace and upstream oil and gas, are driving demand for specialized, high-nickel alloy couplings capable of enduring extreme pressures and temperatures, necessitating significant R&D investment from key players. Consolidation activities and strategic mergers aimed at expanding product portfolios and accessing niche application expertise are defining the competitive landscape, alongside an increasing focus on developing smart couplings integrated with IoT sensors for real-time leak detection and monitoring.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of growth, underpinned by massive infrastructure projects, rapid industrialization in China and India, and surging urbanization rates necessitating extensive new plumbing and utility networks. North America and Europe, while representing mature markets, maintain high demand due to constant maintenance and replacement cycles of aging infrastructure, coupled with rigorous environmental and safety regulations mandating superior connection reliability. The Middle East and Africa (MEA) exhibit promising growth linked directly to large-scale oil and and gas exploration projects and substantial investments in desalination plants, requiring specialized, high-performance couplings resistant to corrosive seawater environments. These regional dynamics create differential demands for product types—volume demand for standard brass/PVC in APAC, and specialized, high-specification demand in North America and MEA.

Segment trends reveal that the product type segment dominated by double ferrule couplings continues to capture significant market share due to their exceptional reliability in high-pressure instrumentation applications. However, the single ferrule segment is expanding rapidly in standard industrial and fluid power applications where cost and simplified installation are paramount. By material, the stainless steel segment retains its leadership due to widespread use across chemical and food processing industries, but engineered plastic couplings (such as PVDF and PEEK) are demonstrating the highest growth CAGR, driven by their superior chemical resistance and lighter weight profile. The end-user analysis confirms that the water and wastewater treatment sector and the oil and gas industry collectively represent the largest consumption base, dictated by the continuous need for extensive and reliable pipeline infrastructure maintenance and expansion.

AI Impact Analysis on Compression Coupling Market

Common user questions regarding AI's impact on the Compression Coupling Market often revolve around how automation can influence manufacturing precision, whether AI can optimize coupling design for specific stress profiles, and if predictive analytics can extend the lifespan of installed systems. Users are keenly interested in the integration of AI-driven quality control systems that eliminate human error during fabrication, especially for high-tolerance components used in critical applications. Furthermore, there is significant inquiry into how machine learning models can process real-world operating data (pressure, temperature, vibration) to predict potential failure points in pipeline networks, thereby revolutionizing maintenance strategies from reactive to predictive, directly impacting coupling reliability and replacement cycles.

The core theme summarizing user expectations is the shift towards "Intelligent Coupling Systems." This involves using AI to enhance every stage of the product lifecycle, from initial conceptualization through to end-of-life monitoring. In the design phase, Generative Design algorithms are expected to optimize coupling geometry for specific fluid dynamics and mechanical loads, minimizing material use while maximizing structural integrity. In the manufacturing phase, Computer Vision and Machine Learning algorithms monitor high-speed machining and assembly lines, ensuring micron-level precision and immediate identification of defects, far exceeding traditional inspection capabilities. This guarantees that couplings meet the demanding specifications of industries like semiconductor manufacturing and nuclear power, where failure is not an option.

Furthermore, AI plays a crucial role in enhancing the market's aftermarket services. Machine learning algorithms, analyzing data from thousands of installations across different climatic and operational environments, can provide extremely accurate recommendations for material selection, installation torque, and optimal maintenance schedules specific to the customer's application. This level of personalized, data-driven service creates significant added value, allowing manufacturers to move beyond merely selling components to offering integrated system reliability solutions. This capability addresses user concerns about longevity and performance under highly variable conditions, thereby solidifying customer trust and positioning AI as a key competitive differentiator in this historically traditional market segment.

- AI-Driven Generative Design optimization for superior mechanical performance and material efficiency.

- Predictive Maintenance models using IoT data to forecast coupling failure and schedule proactive replacement.

- Enhanced Manufacturing Quality Control via Computer Vision for defect detection and dimensional accuracy verification.

- Supply Chain Optimization using AI to manage inventory of raw materials and finished goods, improving lead times.

- Simulation and Digital Twin creation for testing coupling durability under extreme, simulated operational stresses.

DRO & Impact Forces Of Compression Coupling Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory. Key drivers include the relentless global focus on infrastructure development, especially in water and gas distribution, which inherently demands millions of secure connections annually. Simultaneously, increasingly stringent regulatory standards, particularly concerning methane emissions in the oil and gas sector and potable water integrity in utility systems, push end-users towards higher-quality, guaranteed leak-proof compression fittings. This is augmented by the need for quick installation solutions in retrofitting and maintenance projects, where minimizing system downtime provides substantial economic incentives for using compression technology over welding.

However, significant restraints temper the market's potential. The primary restraint is the higher initial cost of specialized, high-performance compression couplings (e.g., those made from exotic alloys or PEEK) compared to basic threaded or welded joints, especially in price-sensitive markets. Furthermore, the performance of compression fittings is highly dependent on precise, standardized installation torque; incorrect installation remains a common cause of premature failure, creating skepticism among some legacy industrial users and requiring ongoing installer training. Additionally, the proliferation of counterfeit or low-quality couplings, particularly in developing markets, undermines trust in the overall product category and poses safety risks, forcing legitimate manufacturers to invest heavily in brand protection and quality assurance.

Opportunities for expansion are abundant, centered around technological diversification and geographical penetration. The rise of new energy sectors, such as hydrogen transportation and carbon capture and storage (CCS), presents novel, high-pressure, and high-purity application environments requiring bespoke coupling designs, offering premium pricing potential. Furthermore, advancements in specialized sealing materials, such as elastomers and advanced polymers, allow manufacturers to target highly corrosive chemical processing and pharmaceutical cleanroom applications. The trend toward modular construction and prefabricated industrial skids also favors compression fittings due to their ability to provide reusable and reliable site connections. These forces—regulatory push, technological barriers, and new market demands—create a dynamic environment where innovation and compliance are paramount for market success.

Segmentation Analysis

The Compression Coupling Market is systematically segmented based on Product Type, Material Type, Pipe Size, Pressure Rating, and End-User Industry, allowing for a precise understanding of specialized market needs and competitive niches. Analyzing these segments provides strategic insights into which applications are experiencing the most vigorous demand and where manufacturers should concentrate their research and development efforts. For instance, while high-pressure ratings command a premium and are crucial for the upstream oil sector, the large volume market remains dominated by standard pressure couplings utilized in municipal water networks and HVAC installations. Understanding these bifurcations is key to effective market penetration and portfolio management.

Segmentation by material is particularly critical, reflecting the operational environment and required chemical compatibility. Stainless steel and brass remain the traditional backbone, offering robust performance for general industrial and plumbing uses, respectively. However, the fastest-growing segments are those utilizing advanced engineering plastics (such as PVDF and polypropylene) for applications requiring exceptional chemical resistance, lightness, and freedom from metallic corrosion, prevalent in semiconductor and chemical dosing systems. Simultaneously, the pipe size segmentation is directly correlated with infrastructure spending, with couplings designed for large diameter pipelines seeing substantial growth in long-haul transmission projects, while small diameter couplings dominate instrumentation lines.

- By Product Type:

- Single Ferrule Couplings

- Double Ferrule Couplings

- Bite Type Couplings

- Push-to-Connect Couplings

- Split Couplings

- By Material Type:

- Stainless Steel (316, 304)

- Brass

- Copper

- Plastics/Polymers (PVDF, Polypropylene, PEEK)

- Carbon Steel

- By Pipe Size:

- Small Bore (Up to 1 inch)

- Medium Bore (1 inch to 4 inches)

- Large Bore (Above 4 inches)

- By Pressure Rating:

- Low Pressure

- Medium Pressure

- High Pressure

- Ultra-High Pressure

- By End-User Industry:

- Oil and Gas

- Chemical and Petrochemical

- Water and Wastewater Treatment

- HVAC and Refrigeration

- Power Generation (Nuclear, Thermal)

- Pneumatics and Hydraulics

- Automotive and Transportation

Value Chain Analysis For Compression Coupling Market

The value chain for the Compression Coupling Market starts with upstream activities, primarily involving the procurement and processing of raw materials such as specialized steel alloys (316L stainless steel), brass, high-performance engineering plastics, and sealing elastomers. Efficiency in this upstream segment is critical as material costs represent a significant portion of the final product price, and sourcing high-quality, traceable materials is mandatory, especially for fittings used in critical applications. Key activities include precision casting, forging, and specialized heat treatment processes which determine the ultimate mechanical properties and corrosion resistance of the coupling components. Strategic partnerships with reliable material suppliers offering certified compliance standards are crucial for mitigating supply chain risks and maintaining quality consistency across various production batches.

Midstream processes involve manufacturing, characterized by high-precision machining, automated assembly, and stringent quality testing. Compression coupling production requires advanced CNC machining centers to achieve the tight tolerances necessary for reliable sealing, particularly for ferrules and coupling bodies. This stage also includes specialized surface finishing treatments and cleanroom assembly for products destined for highly sensitive sectors like semiconductor manufacturing or pharmaceutical processing. Optimization of manufacturing throughput, alongside investments in robotics and automation for high-volume standard product lines, defines competitive success in this segment. Intellectual property surrounding ferrule design and advanced sealing geometry provides a significant competitive advantage for leading market players.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution is multifaceted, utilizing direct sales for large, customized industrial projects (e.g., oil rig construction) and extensive indirect channels through specialized fluid power distributors, industrial supply houses, and wholesale plumbing suppliers for standard products. Direct channels ensure technical support and specialized installation advice, which is vital for high-pressure applications. Indirect channels prioritize geographical reach and stock availability. Potential customers are heavily influenced by product certifications (such as API, ISO, or specific regional standards like UL or CSA) and the reputation of the manufacturer for long-term reliability. Effective logistics management, ensuring timely delivery across a global network of installation sites, is the final critical component linking the manufacturer to the installer and end-user.

Compression Coupling Market Potential Customers

The potential customer base for the Compression Coupling Market is exceptionally broad, spanning nearly all sectors that involve fluid, gas, or pneumatic conveyance. The largest cohort of buyers resides within the Oil and Gas industry, encompassing upstream exploration and production companies, midstream pipeline operators, and downstream refineries and petrochemical plants. These customers purchase high-pressure, specialty alloy double ferrule couplings for instrumentation lines, chemical injection systems, and reliable sampling systems where system integrity under extreme operating conditions is non-negotiable. Their purchasing decisions are driven by total cost of ownership, compliance with safety standards (e.g., API 6A), and material longevity in corrosive hydrocarbon environments.

Another major segment includes municipal and private Water and Wastewater Treatment facilities and utility companies. These buyers require robust, often large-diameter, split or grip-type couplings for mainline connections and smaller brass or plastic fittings for residential and commercial service lines. The purchasing criteria here prioritize ease of installation, resistance to soil corrosion, and long service life (often 50+ years). Furthermore, the burgeoning demand from the HVAC (Heating, Ventilation, and Air Conditioning) and Refrigeration sectors represents a substantial market, particularly for flareless and push-to-connect copper fittings used in refrigerant lines, where rapid, repeatable, and leak-proof installation is essential for system efficiency and regulatory compliance concerning greenhouse gas emissions.

Finally, the industrial manufacturing sector, including automotive assembly, food and beverage processing, and pharmaceutical manufacturing, forms a diverse customer group. Automotive plants utilize high volumes of pneumatics and hydraulic couplings for robotics and assembly equipment. Food and beverage processors require hygienic, stainless steel couplings that meet FDA and 3-A standards for sanitary applications. These customers seek highly durable, easily cleanable, and often quickly detachable couplings to minimize system downtime during sanitization cycles. The diversity of end-user requirements necessitates that coupling manufacturers maintain a highly specialized product catalogue catering to specific pressure, chemical, and temperature specifications unique to each vertical market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swagelok, Parker Hannifin, Eaton, ASCO (Emerson), HYDAC, Ham-Let Group, SSP Fittings, Zlok Fittings, Brennan Industries, VOSS Fluid, TK Holdings (Tuthill), RFS Hydraulics, Tube Fittings Industries, Ermeto (Parker), CEJN AB, Hoke (CIRCOR International), DNP Group, NIBCO Inc., Mueller Industries, Watts Water Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compression Coupling Market Key Technology Landscape

The core technology landscape of the Compression Coupling Market is dominated by advancements in material science, precision manufacturing, and connection design optimization, all aimed at improving reliability and expanding the application envelope. A significant technological focus is placed on the ferrule design itself, which is the heart of the connection. Innovations such as proprietary progressive bite designs, specialized coating technologies (e.g., molybdenum disulfide for reduced friction during tightening), and novel geometric structures ensure optimal sealing pressure distribution and prevent tubing damage or cold flow. For high-vibration applications, resilient locking mechanisms and improved thread designs are critical to maintaining seal integrity over long operational periods, pushing manufacturers to utilize advanced Finite Element Analysis (FEA) simulations during the design phase to predict real-world performance accurately.

Furthermore, the material technology utilized in both the coupling body and the sealing elements is evolving rapidly. While traditional brass and standard stainless steel (304/316) remain standard, the growing demand from highly aggressive environments is necessitating the use of specialty alloys like Monel, Hastelloy, and Inconel, offering superior resistance to stress corrosion cracking and extreme temperatures prevalent in deep-sea oil exploration or harsh chemical processing. Similarly, the advancement of elastomeric and thermoplastic seals, including Kalrez, PEEK, and PTFE derivatives, allows couplings to function reliably across broader temperature and chemical exposure ranges, significantly broadening the market potential in pharmaceutical and semiconductor industries where purity and inertness are paramount.

A burgeoning technological trend involves the integration of Smart Coupling features, addressing the industry's shift towards Industrial Internet of Things (IIoT) frameworks. This includes couplings manufactured with integrated micro-sensors that monitor physical parameters such as pressure fluctuations, vibration levels, and even slight chemical changes indicative of material fatigue or early-stage leakage. These smart components transmit data wirelessly, enabling predictive maintenance protocols and real-time monitoring of pipeline health, thereby dramatically reducing the risk of catastrophic failures. This convergence of mechanical engineering and digital technology represents the leading edge of innovation, transforming the compression coupling from a passive component into an active, data-generating asset within the larger fluid system network.

Regional Highlights

The market exhibits distinct growth patterns and specific demand characteristics across the major geographical regions, influenced heavily by infrastructure maturity, industrial concentration, and regulatory frameworks. North America, encompassing the United States and Canada, is a mature market characterized by high demand for specialized, high-pressure, stainless steel compression couplings, primarily driven by the robust oil and gas sector (particularly shale gas exploration and midstream transportation) and stringent safety standards that mandate reliable, certified fittings. The region also sees substantial replacement and maintenance spending on aging municipal water and gas distribution networks, favoring quick-connect and easy-to-install solutions that minimize labor costs and system downtime.

Europe represents a highly fragmented yet technologically advanced market. Driven by sophisticated chemical and pharmaceutical manufacturing sectors, there is strong demand for couplings made from inert, high-purity materials, such as specialized polymers and non-corrosive alloys, to meet rigorous EU regulatory requirements (e.g., REACH compliance). Furthermore, the region's focus on sustainable energy, including offshore wind and nascent hydrogen infrastructure, is creating new, high-specification niches requiring uniquely robust connection technologies capable of handling volatile or cryogenic fluids. Germany, France, and the UK are key regional contributors, characterized by high adoption rates of automated installation techniques and certified, traceable products.

Asia Pacific (APAC) is unequivocally the fastest-growing region, dominated by the massive investment in infrastructure and unprecedented urbanization across China, India, and Southeast Asia. The demand here is dual-pronged: enormous volume demand for standard, cost-effective brass and plastic couplings for plumbing and general construction, alongside rapidly increasing demand for high-specification fittings driven by the expansion of capital-intensive industries like semiconductor fabrication (requiring ultra-high purity connections) and complex petrochemical complexes. The regional dynamics favor suppliers capable of high-volume manufacturing at competitive price points, while simultaneously requiring adherence to rising quality standards mandated by multinational corporations operating within the region.

The Middle East and Africa (MEA) market growth is intrinsically linked to energy sector investments and large-scale water projects. The extensive presence of massive oil and gas reserves necessitates vast amounts of specialized fittings capable of withstanding high pressures, high temperatures, and the corrosive nature of sour gas. Simultaneously, the region's intense reliance on desalination plants drives significant demand for corrosion-resistant couplings (often duplex stainless steel or specialty polymers) to manage seawater intake and brine effluent pipelines. Political stability and global commodity prices significantly impact investment cycles in MEA, making it a volatile but high-value segment for specialty coupling manufacturers.

- North America: Focus on high-pressure oil/gas instrumentation and infrastructure modernization, strict adherence to quality and safety standards.

- Europe: Driven by chemical/pharmaceutical purity requirements, early adoption of hydrogen infrastructure, and automated assembly technologies.

- Asia Pacific (APAC): Highest volume growth due to rapid urbanization, construction, and expansion of semiconductor and general manufacturing bases.

- Middle East & Africa (MEA): High-value market focused on upstream oil and gas applications and large-scale desalination projects requiring specialty alloy couplings.

- Latin America (LATAM): Growth tied to recovery in mining and commodity processing, driving demand for industrial fluid handling and hydraulic components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compression Coupling Market.- Swagelok

- Parker Hannifin

- Eaton

- ASCO (Emerson)

- Ham-Let Group

- SSP Fittings Corp

- Zlok Fittings

- Brennan Industries

- VOSS Fluid GmbH

- TK Holdings (Tuthill)

- RFS Hydraulics

- Tube Fittings Industries

- Ermeto (Parker)

- CEJN AB

- Hoke (CIRCOR International)

- DNP Group

- NIBCO Inc.

- Mueller Industries

- Watts Water Technologies

- GF Piping Systems

Frequently Asked Questions

Analyze common user questions about the Compression Coupling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between single and double ferrule compression couplings?

Single ferrule couplings offer simple, cost-effective sealing, typically utilized in low to medium-pressure applications. Double ferrule couplings, like those used in instrumentation, provide superior sealing integrity in high-pressure and high-vibration environments by utilizing two ferrules: one for sealing and one for gripping the tubing. Double ferrule designs offer higher reliability and are generally preferred for critical services in oil and gas or chemical processing.

Which materials are seeing the highest growth rate in the compression coupling market?

While traditional materials like stainless steel and brass maintain stable market shares, advanced engineering plastics and specialized polymers (such as PVDF, PEEK, and PTFE) are exhibiting the highest growth rates. This acceleration is driven by their adoption in specialized applications requiring superior chemical inertness, lighter weight, and resistance to corrosion, particularly within the semiconductor, pharmaceutical, and chemical dosing sectors.

How does AI technology affect the reliability and manufacturing of compression couplings?

AI technology enhances reliability through Generative Design, optimizing coupling geometry for maximum stress resistance. In manufacturing, Computer Vision systems provide ultra-precise, real-time quality control, inspecting dimensions and surface finishes faster and more reliably than manual methods, ensuring components meet the tight tolerances required for leak-proof performance, particularly for critical high-pressure fittings.

What major regulatory factors are driving demand for high-quality compression couplings?

Key regulatory drivers include environmental protection standards, such as those targeting methane emissions in the oil and gas sector (driving demand for guaranteed leak mitigation), and stringent public health regulations related to potable water and food safety. Compliance with specific industry standards (e.g., API, ASME, NACE) requires the use of certified, high-quality couplings, elevating the overall market demand for premium products.

Which end-user segment dominates the consumption of compression coupling products?

The Oil and Gas industry and the Water and Wastewater Treatment sector collectively dominate consumption. The Oil and Gas sector demands high-specification, high-pressure fittings for instrumentation and process lines, while the Water and Wastewater sector requires high volumes of durable, corrosion-resistant couplings for extensive municipal and commercial distribution networks, driving consistent and large-scale market volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager