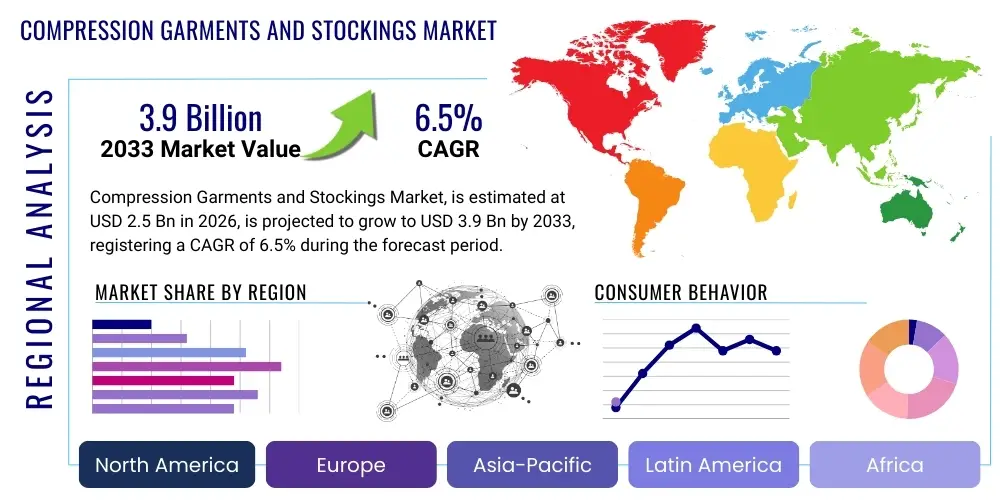

Compression Garments and Stockings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434758 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Compression Garments and Stockings Market Size

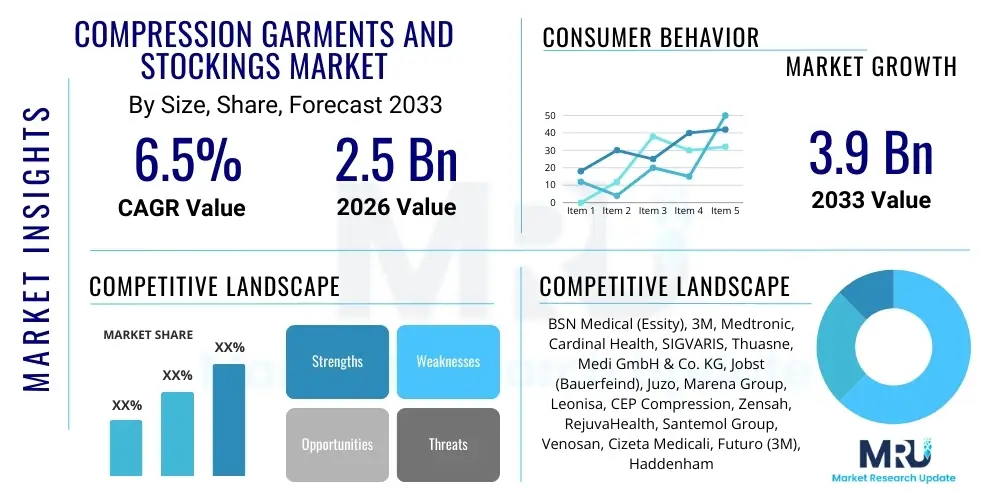

The Compression Garments and Stockings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033.

Compression Garments and Stockings Market introduction

The Compression Garments and Stockings Market encompasses specialized textile products designed to apply controlled pressure to limbs and other body parts, improving blood circulation, reducing swelling, and preventing venous disorders. These medical and athletic devices are crucial for managing conditions such as deep vein thrombosis (DVT), lymphedema, chronic venous insufficiency (CVI), and varicose veins. The core function of these products is to provide gradient pressure, typically tighter at the extremity (ankle or wrist) and gradually decreasing pressure further up the limb, thereby assisting venous return and preventing fluid accumulation in tissues. Products range from medical-grade compression stockings (Class I to Class III), anti-embolism stockings, and athletic wear designed for performance enhancement and recovery.

The primary applications driving market expansion include post-operative care, where compression garments aid in incision support and hematoma reduction; sports and fitness, where they are utilized to enhance oxygen delivery and expedite muscle recovery after intense physical activity; and geriatric care, addressing common circulatory issues associated with aging. Moreover, the increasing prevalence of obesity and diabetes, which often lead to secondary circulatory complications, further necessitates the use of these devices. The garments are typically constructed from sophisticated materials such as nylon, spandex, and specialized microfiber blends, requiring advanced knitting technology to ensure precise pressure application and anatomical fit.

Key benefits derived from the use of compression technology include enhanced hemodynamic performance, pain relief, edema management, and improved quality of life for patients with chronic conditions. Market growth is predominantly driven by the expanding elderly population, heightened awareness regarding DVT prevention, increased participation in sports and athletics requiring performance recovery tools, and technological advancements focusing on comfort, customization, and seamless integration of smart features into the fabric. The demand trajectory remains positive, underpinned by supportive clinical evidence demonstrating the efficacy of controlled compression therapy.

Compression Garments and Stockings Market Executive Summary

The Compression Garments and Stockings Market is undergoing significant evolution, characterized by a shift from purely clinical applications towards broader consumer adoption, particularly within the sports and wellness sectors. Business trends highlight intense competition among established medical device manufacturers and rapidly scaling direct-to-consumer (DTC) athletic apparel brands. Key strategic initiatives observed across the industry include mergers and acquisitions aimed at integrating advanced material science capabilities, and strong focus on R&D for developing customizable, breathable, and visually appealing garments that adhere strictly to required pressure standards. Furthermore, the rise of telemedicine and home healthcare is positioning specialized retailers and e-commerce platforms as vital distribution channels, streamlining access for end-users previously reliant solely on clinical prescriptions.

Regional trends indicate North America currently dominates the market, primarily due to high healthcare expenditure, significant sports injury incidence, and robust insurance coverage for medical-grade compression therapy. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This accelerated growth is attributed to rising health awareness, improving healthcare infrastructure, and the massive, expanding geriatric populations in countries like China and India, coupled with increasing disposable incomes allowing for greater adoption of premium athletic compression wear. European markets maintain stability, driven by standardized medical protocols for venous disease management and strong governmental emphasis on preventative care.

Segment trends reveal that while compression stockings and socks remain the largest segment by revenue, specialized compression garments (such as sleeves, shorts, and full body suits used in post-liposuction recovery or high-performance athletics) are experiencing the most dynamic growth. Application-wise, the sports performance and recovery segment is rapidly closing the gap with traditional clinical applications like Varicose Vein Treatment, driven by extensive marketing targeting amateur and professional athletes. Innovations in material technology—specifically the incorporation of anti-microbial treatments and moisture-wicking properties—are crucial determinants of success within these competitive consumer segments, ensuring products offer both therapeutic efficacy and user comfort.

AI Impact Analysis on Compression Garments and Stockings Market

User queries regarding the impact of Artificial Intelligence (AI) on the Compression Garments and Stockings Market frequently revolve around personalization, manufacturing efficiency, and predictive diagnostics. Users are primarily concerned with whether AI can deliver perfectly tailored compression levels, addressing the historical challenge of one-size-fits-most products causing discomfort or ineffective therapy. Expectations center on AI optimizing the entire supply chain, from predicting material needs based on localized disease prevalence to improving manufacturing yields through real-time quality control checks on knitting machines. Another key theme is the integration of AI-driven sensing capabilities into smart compression textiles to monitor biofeedback (e.g., muscle activity, hydration, localized swelling) for continuous, adaptive pressure adjustments, thus transforming static devices into dynamic therapeutic tools.

AI's influence is anticipated to be revolutionary, moving the industry towards Hyper-Personalization. By analyzing vast datasets derived from 3D body scans, patient medical histories, activity levels, and material properties, AI algorithms can calculate the precise pressure gradients required for optimal therapeutic outcomes for an individual. This transition from standardized sizing matrices to personalized digital patterns significantly reduces the incidence of improperly fitting garments, thereby increasing patient compliance and therapeutic efficacy. Furthermore, predictive maintenance powered by machine learning models will enhance the longevity and consistent performance of specialized knitting machinery, minimizing defects and ensuring stringent quality control measures are maintained throughout high-volume production cycles.

Beyond design and manufacturing, AI is set to redefine the retail and diagnostic landscape. Chatbots and AI assistants are already being deployed by compression retailers to guide users through complex product selection based on symptoms and intended use, acting as an initial triage layer. In clinical settings, AI algorithms analyzing patient demographic data and physiological indicators (like limb circumference changes over time) can help clinicians predict the risk of conditions like lymphedema recurrence, allowing for proactive adjustment of compression therapy schedules. This integration of AI supports a more personalized patient journey, moving therapeutic applications into the realm of truly adaptive medicine.

- AI-driven Predictive Sizing and Customization: Utilizing 3D scanning data and machine learning to create perfectly calibrated compression profiles for individual users, minimizing sizing errors.

- Optimized Manufacturing Processes: Implementing AI for real-time quality control on computerized knitting machines, ensuring consistent pressure accuracy and reducing waste.

- Smart Textile Integration and Biofeedback: Embedding AI modules in garments to continuously monitor physiological parameters (e.g., edema levels) and potentially adjust pressure dynamically.

- Demand Forecasting and Inventory Management: Using sophisticated algorithms to predict regional demand for specific compression types (e.g., DVT stockings vs. athletic sleeves), optimizing supply chain logistics.

- Enhanced Customer Service and Retail Guidance: AI-powered platforms assisting consumers and clinicians in selecting the most appropriate class and style of compression product based on detailed needs analysis.

DRO & Impact Forces Of Compression Garments and Stockings Market

The market dynamics for compression garments and stockings are significantly influenced by a confluence of demographic, clinical, and technological forces. Key drivers include the global aging population, which inherently leads to a higher incidence of venous disorders, chronic venous insufficiency, and diabetes-related circulatory issues, necessitating long-term compression therapy. Simultaneously, the burgeoning global interest in fitness and professional sports has catalyzed demand for high-performance recovery wear, moving compression technology beyond the clinic and into the mainstream consumer market. Restraints primarily involve the relatively high cost of custom-fitted and medical-grade compression garments, which can be prohibitive in emerging economies or for patients without adequate insurance coverage. Furthermore, a persistent lack of widespread awareness regarding the specific benefits and proper usage of graduated compression among the general public and sometimes even primary care providers limits initial adoption rates.

Opportunities for market expansion are centered around product innovation and geographical penetration. The most lucrative opportunities lie in developing next-generation materials that offer superior comfort, breathability, and aesthetic appeal while maintaining therapeutic efficacy—addressing the significant challenge of patient compliance often associated with traditional, bulky garments. The rise of non-traditional distribution channels, particularly sophisticated e-commerce platforms specializing in medical wearables, presents a vast opportunity to reach remote or underserved populations. Moreover, clinical opportunities are expanding in areas such as bariatric care and maternity support, requiring specialized, high-pressure, and anatomically complex garment designs.

Impact forces currently shaping the market include rapid technological advancements in computerized flat-knitting technology, enabling manufacturers to produce garments with highly precise pressure gradients and seamless designs, enhancing both comfort and effectiveness. Regulatory scrutiny, particularly in developed markets like the US (FDA) and EU (MDR), dictates the classification and clinical claims of these products, acting as a barrier to entry but ensuring product quality and safety, which strongly impacts consumer trust. The socio-cultural shift towards preventative health and wellness further impacts demand, as consumers increasingly seek out proactive tools, such as compression wear, to support active lifestyles and mitigate future health risks, solidifying the market's position in both the medical and consumer spheres.

Segmentation Analysis

Segmentation analysis of the Compression Garments and Stockings Market reveals distinct trends across product type, application, and distribution channel, reflecting the dual nature of the market—medical necessity versus consumer wellness. The market is primarily bifurcated into medical compression garments, requiring prescription and strict pressure standardization, and consumer compression wear, focused on performance and recovery with generally lower pressure ratings. Understanding these segments is critical for manufacturers to tailor their R&D and marketing strategies, ensuring compliance for clinical products and aesthetic appeal and comfort for consumer-facing lines. The growing convergence between these two segments, particularly in high-quality sports medicine apparel, necessitates blurred lines in material science and production precision.

By Product Type, stockings and socks dominate the revenue share due to their widespread use in DVT prophylaxis and chronic venous disease management, typically prescribed for use on lower extremities, which are most prone to circulatory issues. However, the fastest growth is seen in specialized garments, including abdominal supports, sleeves, and pants, driven by post-cosmetic surgery recovery and athletic training, where targeted compression on specific muscle groups is essential. Analyzing these product segments allows stakeholders to allocate resources effectively, perhaps focusing investment on high-growth segments like compression athletic wear, which offers higher margins and faster product lifecycle turnover compared to regulated medical devices.

The application segmentation clearly dictates purchasing volume and price sensitivity. Clinical applications, such as lymphedema and deep vein thrombosis prevention, often involve chronic usage and higher-grade garments, supported typically by insurance, thus prioritizing clinical efficacy over cost. Conversely, the Sports Performance and Recovery segment relies heavily on brand loyalty, endorsement, and innovative material features (like temperature regulation or moisture wicking), making marketing and direct-to-consumer engagement paramount. The distribution channel segmentation confirms the shift towards e-commerce, which offers greater product variety and price comparison for consumers, though hospital and pharmacy channels remain crucial for strictly medical-grade products requiring professional fitting and consultation.

- By Product Type:

- Compression Stockings and Socks (Knee-high, Thigh-high, Pantyhose)

- Compression Garments (Sleeves, Arm Supports, Body Suits, Pants, Vests)

- Compression Braces and Bandages

- By Application:

- Varicose Vein Treatment and Chronic Venous Insufficiency (CVI)

- Deep Vein Thrombosis (DVT) Prevention

- Lymphedema Management

- Post-Surgical and Trauma Recovery

- Sports Performance and Recovery

- By Distribution Channel:

- Hospital and Clinics

- Retail Pharmacies and Medical Supply Stores

- E-commerce and Online Channels

Value Chain Analysis For Compression Garments and Stockings Market

The value chain for compression garments and stockings is complex, starting with the sourcing of highly specialized synthetic fibers and extending through precision manufacturing to diversified patient and consumer distribution channels. The upstream segment involves the procurement of raw materials, primarily high-denier elastane (spandex) and specialized nylon or microfiber blends designed for elasticity retention and longevity. Due to the requirement for specific pressure standards, the quality and consistency of these materials are paramount. Key upstream challenges involve managing fluctuating raw material costs and securing consistent supply of specialized yarns necessary for computerized flat-knitting technology, which forms the manufacturing core.

The core manufacturing and midstream segment is characterized by capital-intensive, high-precision knitting processes. Unlike standard textile production, compression garment manufacturing requires rigorous quality control and technical expertise to ensure graduated pressure application, anatomical shaping, and seamless construction. Research and development activities, focusing on integrating antimicrobial properties, moisture management, and seamless technology, are critical midstream value additions. Regulatory compliance, including rigorous testing to meet therapeutic pressure standards (e.g., mmHg ratings), constitutes a significant cost and expertise barrier in this phase.

Downstream analysis highlights a fragmented but crucial distribution ecosystem. Direct channels involve sales to hospitals, specialized clinics, and sports teams, often supported by trained medical representatives who assist in proper sizing and usage education. Indirect distribution, which is rapidly expanding, includes retail pharmacies, general medical supply stores, and, most notably, e-commerce platforms. E-commerce facilitates direct-to-consumer sales for both medical and athletic applications, often bypassing traditional healthcare gatekeepers, but requires strong logistical support and clear, detailed sizing guides to mitigate returns due to improper fit. The efficacy of the distribution channel is increasingly reliant on minimizing the informational gap between the manufacturer and the end-user.

Compression Garments and Stockings Market Potential Customers

Potential customers for compression garments and stockings fall broadly into three distinct categories: chronic patient populations, athletic and performance-focused individuals, and demographics undergoing periods of high circulatory risk. The largest segment, in terms of chronic usage and prescription volume, comprises elderly individuals suffering from venous reflux disorders, lymphedema, and peripheral edema related to conditions such as diabetes and congestive heart failure. For these buyers, the product is an essential medical necessity, often covered by insurance, and purchasing decisions are heavily influenced by physician recommendation, durability, and measured therapeutic effectiveness rather than aesthetic appeal.

The second major consumer group consists of high-activity individuals, including professional athletes, fitness enthusiasts, and those involved in occupations requiring prolonged standing or sitting (e.g., nurses, airline pilots). These customers utilize compression wear primarily for physiological benefits such as improved blood flow, faster muscle recovery post-exercise by minimizing muscle oscillation, and prevention of travel-related DVT. Their purchasing decisions are highly influenced by brand reputation, material innovation (comfort, breathability), aesthetic design, and peer endorsement, often accessing products through specialized retail stores or online athletic platforms.

The final significant segment involves situational buyers requiring temporary compression therapy. This includes post-operative patients needing garments for surgical site stability and swelling reduction, pregnant women requiring support for venous issues, and trauma victims. Healthcare providers and surgical centers act as primary purchasers or recommenders for this group, prioritizing ease of application, anti-embolism properties, and clinical safety profiles. Market success relies on addressing the varying levels of medical urgency, price sensitivity, and specific functional requirements inherent across these diverse end-user profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BSN Medical (Essity), 3M, Medtronic, Cardinal Health, SIGVARIS, Thuasne, Medi GmbH & Co. KG, Jobst (Bauerfeind), Juzo, Marena Group, Leonisa, CEP Compression, Zensah, RejuvaHealth, Santemol Group, Venosan, Cizeta Medicali, Futuro (3M), Haddenham Healthcare, Bio Compression Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compression Garments and Stockings Market Key Technology Landscape

The technology landscape for compression garments is defined by sophisticated advancements in three main areas: material science, knitting machinery, and integrated sensing capabilities. Material innovation focuses on achieving high modulus elasticity and durability using advanced synthetic fibers, ensuring the garments maintain their therapeutic pressure profile over long periods of use and washing. Specialized fiber blends are being developed to incorporate properties such as thermal regulation, UV protection, and permanent anti-microbial finishing, addressing key compliance issues related to hygiene and comfort. Furthermore, the development of seamless, circular knitting technologies is crucial, enabling the production of anatomically shaped garments without irritating seams, which is essential for lymphedema patients and high-performance athletic wear.

The manufacturing process itself is highly dependent on Computerized Flat Knitting Machines (CFKM). These machines utilize complex software to map out specific pressure gradients, allowing for micro-level adjustments in tension and stitch density across the garment. The precision offered by CFKM is mandatory for meeting medical standards (e.g., Class II or Class III compression), which requires accuracy within a tight tolerance range for optimal clinical efficacy. Investment in these advanced manufacturing platforms represents a significant portion of a company's capital expenditure but is fundamental to differentiation in the high-quality segment of the market.

Looking forward, the emergence of smart compression technology is transforming the market. This involves embedding micro-sensors, conductive inks, and miniaturized processing units directly into the fabric to create e-textiles. These smart garments can monitor physiological parameters such as heart rate variability, localized edema levels, muscle fatigue, and hydration status. While still nascent, this technology promises adaptive compression, where the garment can potentially adjust pressure levels based on real-time biofeedback, moving far beyond static therapeutic devices. This integration positions compression wear as part of the broader connected health ecosystem.

Regional Highlights

- North America (United States, Canada, Mexico): North America currently holds the largest market share, driven by high disposable income, established healthcare infrastructure, and extensive insurance reimbursement policies that cover medical compression garments. The U.S. market is particularly mature, characterized by high adoption rates of both clinical stockings (for DVT prevention in surgical settings) and premium athletic compression wear. Strict regulatory oversight by the FDA ensures high quality standards for medical devices. The region is also a hub for innovation, with heavy investment in smart compression technology and personalized sizing solutions, positioning it as the primary market for premium, high-value products.

- Europe (Germany, France, UK, Italy, Spain): Europe represents a significant market, largely defined by stringent medical device regulations (MDR) and established clinical guidelines for the treatment of chronic venous diseases, particularly in Germany and France. Universal healthcare systems often provide comprehensive coverage for prescription compression therapy, maintaining stable demand for medical-grade products. The regional focus on preventative healthcare and an aging population ensures steady growth, with Germany being a key center for specialized manufacturing and high-end technical textiles. The popularity of running and cycling also fuels a robust market for professional athletic compression products.

- Asia Pacific (China, Japan, India, South Korea, Australia): The Asia Pacific region is projected to be the fastest-growing market globally due to rapidly developing healthcare infrastructure, increasing health consciousness, and a massive demographic base experiencing aging-related circulatory issues. Economic growth in countries like China and India is leading to higher disposable incomes and increasing willingness to spend on prophylactic health products, including high-quality compression wear. While market penetration remains lower than in Western nations, the sheer volume of potential patients and athletes, coupled with rising awareness campaigns, presents significant long-term expansion opportunities. However, navigating diverse local regulatory landscapes and overcoming price sensitivity remain primary challenges for international players entering this region.

- Latin America (Brazil, Argentina, Colombia): The Latin American market exhibits moderate growth, driven by a high prevalence of venous diseases and the burgeoning popularity of aesthetic and cosmetic surgery (such as liposuction and body contouring), which necessitates post-operative compression garments. Brazil leads the regional market in terms of both consumption and manufacturing presence. Economic volatility and varying access to specialized medical care can pose limitations, but increasing investment in private healthcare facilities is expected to gradually improve market access for high-quality compression products.

- Middle East and Africa (MEA): The MEA region is characterized by fragmented market development. Growth is strong in high-income Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), supported by advanced private healthcare facilities and medical tourism, particularly for complex surgeries requiring high-grade post-operative garments. In contrast, the African subcontinent faces challenges related to infrastructure, low awareness, and affordability. However, awareness campaigns targeting DVT prevention, particularly related to long-haul air travel and hospital stays, are slowly contributing to market expansion, albeit from a low base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compression Garments and Stockings Market.- BSN Medical (Essity)

- Medtronic

- 3M Company

- Cardinal Health

- SIGVARIS

- Thuasne

- Medi GmbH & Co. KG

- Jobst (Bauerfeind)

- Juzo

- Marena Group

- Leonisa

- CEP Compression

- Zensah

- RejuvaHealth

- Santemol Group

- Venosan

- Cizeta Medicali

- Futuro (3M)

- Haddenham Healthcare

- Bio Compression Systems

Frequently Asked Questions

Analyze common user questions about the Compression Garments and Stockings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Compression Garments Market?

The primary driver is the accelerating global aging population, leading to a higher prevalence of chronic venous diseases, lymphedema, and circulatory disorders that require prescription compression therapy for effective long-term management and improved quality of life. Secondary drivers include the robust demand from the athletic performance and recovery segment.

How do medical-grade compression garments differ from athletic compression wear?

Medical-grade garments are regulated Class I or Class II devices, prescribed by healthcare professionals, and feature precise, calibrated graduated pressure (measured in mmHg) required for clinical treatment of conditions like DVT and CVI. Athletic wear typically applies non-medical levels of compression and focuses on enhanced muscle stability, recovery acceleration, and comfort, often without strict regulatory adherence to clinical pressure standards.

What technological innovations are currently impacting the future of compression therapy?

Key innovations include advanced seamless knitting technology for better anatomical fit and comfort, the integration of smart textiles with embedded sensors for real-time physiological monitoring (biofeedback), and the adoption of 3D scanning and AI algorithms to enable hyper-personalized, custom-fit garments, significantly enhancing patient compliance and therapeutic efficacy.

Which geographical region exhibits the highest growth potential for the Compression Garments Market?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This growth is fueled by rapidly improving healthcare access, increased health awareness among large populations, and expanding consumer markets in countries like China and India, making it a critical area for future expansion.

What are the main constraints hindering widespread adoption of compression stockings?

The primary constraints include the high out-of-pocket cost associated with premium, custom-fitted medical-grade garments, particularly in regions lacking robust insurance coverage, and the common issue of poor patient compliance due to discomfort, heat retention, and difficulty in donning and doffing the high-pressure garments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager