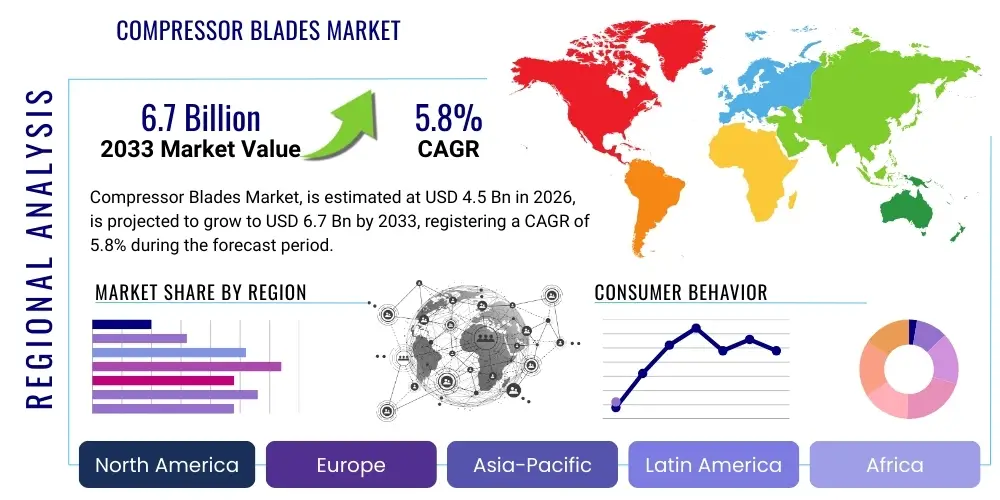

Compressor Blades Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438930 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Compressor Blades Market Size

The Compressor Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Compressor Blades Market introduction

The Compressor Blades Market encompasses the manufacturing, supply, and integration of essential components used within the compression stages of gas turbines, jet engines, and various industrial machinery. Compressor blades are critical aerodynamic components designed to efficiently compress the incoming air or working fluid, significantly increasing its pressure and temperature before it enters the combustion chamber. Their primary function dictates the overall efficiency, performance, and operational lifespan of the turbine system. Compressor blades operate under extreme mechanical stresses, high rotational speeds, and demanding thermal gradients, necessitating the use of specialized high-performance materials such as nickel-based superalloys, titanium alloys, and advanced composites, often fabricated using sophisticated techniques like precision forging, investment casting, and increasingly, additive manufacturing.

Major applications driving the demand for high-quality compressor blades include the aerospace and defense sector, particularly in commercial aircraft engines and military jet propulsion systems, where high thrust-to-weight ratios are paramount. Furthermore, the power generation industry utilizes these blades extensively in industrial gas turbines (IGTs) for electricity production, especially in combined cycle power plants. The oil and gas sector also represents a significant application area, employing large industrial compressors for natural gas liquefaction, transmission, and processing. The inherent benefits of utilizing advanced compressor blade technology include improved fuel efficiency, reduced emissions, enhanced durability, and the capability to achieve higher overall pressure ratios, directly contributing to superior operational performance and lower total ownership costs for end-users across these industrial verticals.

Driving factors propelling this market forward include the robust recovery and expansion of commercial aviation, leading to increased demand for new engine builds and comprehensive engine maintenance, repair, and overhaul (MRO) services. Technological advancements focused on developing lighter, stronger, and more heat-resistant materials, alongside the adoption of advanced manufacturing techniques like 3D printing for rapid prototyping and complex geometry fabrication, further stimulate market growth. Additionally, stringent environmental regulations necessitating improved fuel efficiency and lower NOx emissions push manufacturers toward implementing next-generation compressor designs optimized for aerodynamic efficiency and superior operational performance under variable load conditions.

Compressor Blades Market Executive Summary

The Compressor Blades Market is characterized by intense technological competition and a critical focus on material science breakthroughs, driven largely by the stringent performance demands of the aerospace and power generation sectors. Key business trends include the consolidation of manufacturing capabilities among major original equipment manufacturers (OEMs) and Tier 1 suppliers, alongside a strategic pivot towards long-term service agreements (LSAs) and MRO contracts, which secure recurring revenue streams throughout the engine lifecycle. There is a discernible shift towards using lighter composite materials in non-critical stages and adopting additive manufacturing (AM) for complex, intricate blade geometries, offering reduced lead times and material waste while enabling highly customized designs that were previously impractical with traditional methods like forging or casting. Sustainability pressures are also influencing design, with manufacturers focusing on components that reduce drag and increase thermal efficiency, thereby minimizing fuel consumption and greenhouse gas emissions.

Regionally, North America and Europe currently dominate the market due to the presence of major aerospace OEMs (such as Boeing, Airbus, GE, Rolls-Royce, and Pratt & Whitney) and a mature defense industrial base requiring continuous upgrades and maintenance of turbine fleets. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by massive investments in infrastructure, rapidly expanding commercial airline fleets, and increasing urbanization driving demand for centralized power generation utilizing advanced gas turbines. Segment-wise, the nickel-based superalloys segment remains critical for high-pressure compressor stages due to their unparalleled high-temperature strength, while the rotor blade segment holds the largest market share owing to the high frequency of replacement required during MRO cycles. Furthermore, the application segment of aerospace and defense maintains its position as the largest revenue generator, although the industrial gas turbine segment is demonstrating strong growth potential driven by energy transition strategies requiring flexible and efficient power generation solutions.

AI Impact Analysis on Compressor Blades Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Compressor Blades Market frequently revolve around optimizing design iteration, predicting component failure rates, enhancing quality control during manufacturing, and improving real-time engine performance monitoring. Users are particularly keen on understanding how AI-driven generative design tools can accelerate the development of complex aerodynamic profiles, leading to lighter and more efficient blades. Furthermore, there is significant concern regarding the integration of machine learning (ML) models for predictive maintenance (PdM), specifically how these models can analyze vast amounts of sensor data (vibration, temperature, pressure) collected from operating turbines to accurately forecast blade wear and schedule optimal MRO interventions, thereby minimizing unscheduled downtime. The key themes summarized from this analysis indicate high expectations for AI in revolutionizing the design-to-MRO lifecycle, promising unprecedented levels of efficiency, component reliability, and cost reduction across the entire value chain, while concerns mainly center on data security and the high initial investment required for sophisticated AI infrastructure implementation.

- Generative Design Optimization: AI algorithms facilitate the creation of complex, high-performance blade geometries optimized for specific flow conditions and material properties, significantly reducing design cycles.

- Predictive Maintenance (PdM): Machine Learning analyzes real-time sensor data to forecast blade fatigue, crack propagation, and erosion, allowing for proactive replacement scheduling and minimizing catastrophic failures.

- Quality Control and Inspection: AI-powered vision systems enhance automated non-destructive testing (NDT), rapidly identifying minute defects in cast or forged blades with higher accuracy than manual inspection.

- Supply Chain and Inventory Management: AI optimizes the procurement of specialized raw materials and manages spare parts inventory for MRO activities based on probabilistic engine usage models.

- Manufacturing Process Control: Integration of ML in additive manufacturing and precision machining processes optimizes parameters (e.g., laser power, cooling rates) to ensure consistent metallurgical quality and dimensional accuracy of the blades.

DRO & Impact Forces Of Compressor Blades Market

The dynamics of the Compressor Blades Market are shaped by a potent combination of drivers promoting expansion, stringent restraints limiting growth, and compelling opportunities for innovation, all governed by pervasive impact forces stemming from global economic stability, regulatory shifts, and technological maturity. The primary drivers include the mandatory replacement cycles inherent in the MRO requirements of large gas turbine fleets, the consistent global demand for electricity generated by efficient gas turbines, and the continuous technological push in the aerospace industry toward achieving higher thrust and better fuel economy through advanced engine architectures that demand superior compressor components. Furthermore, the expanding utilization of titanium aluminide (TiAl) and ceramic matrix composites (CMCs) in high-temperature sections necessitates parallel advancements in compressor blade materials science to manage the resultant thermal loads and structural integrity of the entire engine system.

Conversely, significant restraints hinder the market’s velocity. The extremely high cost of raw materials, particularly nickel-based superalloys and advanced titanium grades, coupled with the complex, capital-intensive nature of precision manufacturing processes (such as investment casting and five-axis machining), poses major entry barriers for new participants. Moreover, the long qualification and certification periods required for aerospace-grade components present substantial time-to-market challenges. The cyclical nature of the aerospace industry, heavily influenced by global geopolitical stability and economic downturns that affect airline profitability and defense spending, introduces volatility. Impact forces, driven predominantly by Porter's Five Forces analysis, highlight the substantial bargaining power of large buyers (major OEMs like GE, Rolls-Royce, and Pratt & Whitney), the high barriers to entry due to intellectual property protection and regulatory hurdles, and the relatively low threat of substitutes, as compressor blades remain indispensable to gas turbine function. The threat of substitutes, however, marginally exists through alternative power generation technologies, such as renewables, impacting the IGT segment demand in certain geographies.

- Drivers: Global expansion of the commercial aviation fleet; stringent emission standards requiring optimized engine efficiency; increasing demand for high-efficiency industrial gas turbines in power generation; critical MRO schedules and high replacement rates.

- Restraints: High cost and complexity of superalloys and specialized materials; lengthy qualification and certification processes; significant capital investment required for precision manufacturing infrastructure; cyclicality and vulnerability to geopolitical instability.

- Opportunities: Rapid adoption of Additive Manufacturing (3D Printing) for prototyping and spare parts; development of lightweight ceramic matrix composites (CMCs) and advanced TiAl alloys; growth of dedicated MRO service providers focusing on blade refurbishment; emergence of hydrogen and sustainable aviation fuels (SAF) driving new engine development and associated blade design optimization.

- Impact Forces: High bargaining power of major OEMs (Buyers); high entry barriers due to technology and regulation; moderate threat from new entrants; moderate internal competition among specialized suppliers; low threat of substitution for the core component function.

Segmentation Analysis

The Compressor Blades Market segmentation provides a granular view of the market structure, categorizing the components based on several critical dimensions including type, material composition, manufacturing process, and end-use application. This detailed breakdown is essential for understanding revenue streams, identifying high-growth niches, and formulating targeted market strategies. The primary segmentation by type distinguishes between rotor blades, which rotate to perform the compression, and stator vanes (or guide vanes), which remain stationary, guiding the flow of air onto the subsequent rotor stage. Both types require distinct material properties and geometric precision, although rotor blades typically experience higher dynamic stress loads.

Segmentation by material is perhaps the most crucial factor, reflecting the performance requirements of different engine stages. High-temperature stages mandate the use of nickel-based superalloys (such as Inconel and Waspaloy) for superior creep resistance, while lower-temperature, large front stages often utilize lightweight titanium alloys (like Ti-6Al-4V) to minimize weight and inertia. The growing adoption of advanced composites, particularly for fan blades and potentially large, low-pressure compressor stages, is driven by the need for weight reduction and enhanced fatigue resistance. The application spectrum delineates the market into Aerospace & Defense (the largest segment), Industrial Gas Turbines (IGTs) used in power generation, and Oil & Gas installations, each possessing unique purchasing dynamics and technical specifications for the compressor blades used.

- By Type:

- Rotor Blades

- Stator Vanes (Guide Vanes)

- By Material:

- Nickel Alloys (Superalloys)

- Titanium Alloys (Ti-6Al-4V, Ti-5553)

- Steel Alloys

- Composites (Carbon Fiber Reinforced Polymers)

- Ceramic Matrix Composites (CMCs)

- By Application:

- Aerospace & Defense (Commercial Aircraft, Military Jets)

- Industrial Gas Turbines (Power Generation)

- Oil & Gas (Pipelines, Liquefaction)

- Marine Propulsion

- By Manufacturing Process:

- Precision Forging

- Investment Casting (Lost-Wax Casting)

- Additive Manufacturing (3D Printing)

- Machining (Milling, Grinding)

Value Chain Analysis For Compressor Blades Market

The value chain for the Compressor Blades Market is highly specialized, beginning with the procurement of critical raw materials and extending through complex manufacturing processes, rigorous qualification, and final assembly or MRO services. Upstream analysis involves the sourcing of high-purity metals—primarily titanium, nickel, and cobalt—from specialized mining and refining entities. These materials are then transformed by metallurgy firms into proprietary superalloys, which require stringent quality control to ensure metallurgical integrity suitable for extreme turbine environments. The concentration of intellectual property within these material formulation processes grants significant bargaining power to the specialized material suppliers. Downstream analysis focuses on the integration and service aspects. Blades, whether produced by the OEM internally or sourced from Tier 1 suppliers (like Howmet Aerospace or PCC), are assembled into the compressor module by major engine manufacturers (GE, Rolls-Royce, Pratt & Whitney). The long-term profitability shifts downstream into the MRO phase, encompassing repair, refurbishment, and replacement services, often managed through dedicated service channels or authorized third-party MRO facilities.

The distribution channel is predominantly characterized by direct sales and long-term supply contracts between specialized manufacturers and the major engine OEMs. For new engine builds (OEM sales), the process is highly integrated, involving complex contractual agreements spanning decades. For the aftermarket (MRO), distribution often utilizes two primary paths: the OEM's certified service centers, which provide blades manufactured to original specifications, and independent MRO providers who might source FAA/EASA-PMA (Parts Manufacturer Approval) approved parts or refurbished components. Indirect channels, such as distribution partners or authorized aftermarket stockists, play a minor role, primarily in stocking standardized parts for smaller industrial or regional aviation needs. The entire chain is heavily regulated, ensuring traceability and quality, which ultimately drives up costs but guarantees component reliability critical for flight safety and power plant integrity.

The overall efficiency of this value chain is increasingly being optimized through digital transformation. The integration of digital twins and sophisticated supply chain management systems allows OEMs and material suppliers to forecast demand accurately and manage the complex logistics of high-value components. Furthermore, the rise of Additive Manufacturing (AM) offers a direct, digitally enabled path from design to component production, potentially bypassing traditional forging or casting steps for certain spare parts, thus compressing the time required in the middle stages of the value chain and offering greater resilience against supply chain disruptions, particularly in MRO operations.

Compressor Blades Market Potential Customers

Potential customers for the Compressor Blades Market are diverse yet concentrated primarily within industries utilizing large, high-performance gas turbine engines. The dominant end-users are major aircraft and aero-engine manufacturers, including GE Aviation, Rolls-Royce, Pratt & Whitney, and Safran, which procure blades either for new engine programs (line-fit) or for supporting their installed fleet's Maintenance, Repair, and Overhaul (MRO) requirements. These OEMs are the largest volume buyers, often demanding highly customized designs, materials, and stringent quality certifications, forming long-term, strategic partnerships with blade suppliers. Military agencies and defense contractors also represent a stable customer base, requiring blades for tactical fighter jets, transport aircraft, and naval propulsion systems, driven by national defense budgets and fleet modernization efforts.

Another significant customer group resides in the heavy industry sector, encompassing power generation utilities and independent power producers (IPPs). Companies operating large industrial gas turbines (IGTs) for base-load and peak-load electricity generation, such as Siemens Energy, Mitsubishi Power, and major utility operators, are continuous buyers. These industrial applications require robust, durable blades optimized for extended operational hours and efficient performance under diverse fuel mixtures. Finally, the oil and gas industry utilizes specialized compressor blades in gas pipeline compression stations, LNG (Liquefied Natural Gas) plants, and petrochemical facilities, where reliability and operational continuity are paramount. These customers prioritize components that can withstand corrosive environments and ensure high throughput with minimal downtime, making them crucial consumers in the industrial segment of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Aviation, Rolls-Royce, Siemens Energy, Pratt & Whitney, Safran S.A., Mitsubishi Heavy Industries, IHI Corporation, GKN Aerospace, Howmet Aerospace, Precision Castparts Corp. (PCC), MTU Aero Engines, Chromalloy, Arconic, Bharat Forge, Wood Group, Snecma. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compressor Blades Market Key Technology Landscape

The technology landscape governing the Compressor Blades Market is highly advanced and continuously evolving, driven by the relentless pursuit of thermal efficiency and weight reduction in gas turbines. Central to this landscape are advancements in material science, specifically the utilization of single-crystal nickel-based superalloys for high-pressure turbine stages, although compressor blades primarily utilize directionally solidified alloys, high-strength titanium alloys, and increasingly, advanced composites. Manufacturing technologies are critical; precision forging remains the benchmark for achieving superior grain structure and mechanical properties in metallic blades, while investment casting is utilized for complex internal cooling geometries and smaller vanes. The integration of advanced coatings, such as thermal barrier coatings (TBCs) and specialized erosion-resistant coatings, is essential for extending blade life and maintaining aerodynamic profiles under harsh operating conditions.

A transformative technology rapidly gaining traction is Additive Manufacturing (AM), or 3D printing. AM, particularly technologies like Electron Beam Melting (EBM) and Laser Powder Bed Fusion (LPBF), allows for the fabrication of compressor blades and vanes with highly complex, lightweight lattice structures and optimized internal cooling passages that are impossible to achieve via traditional methods. While currently more prevalent in prototyping and MRO for obsolete or low-volume parts, AM is progressing toward certified production parts, offering significant reductions in material waste and lead times. Furthermore, the adoption of digital technologies, including Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA), integrated with AI, drives the generative design process, enabling rapid virtual testing and optimization of aerodynamic profiles, ensuring blades meet stringent performance metrics before physical production begins.

The manufacturing process is further augmented by highly precise techniques such as electrochemical machining (ECM) and electro-discharge machining (EDM) used for finishing operations and creating cooling holes, ensuring micrometer-level accuracy crucial for aerodynamic performance. Non-Destructive Testing (NDT) technologies, including phased array ultrasonic testing and advanced radiographic inspection, are constantly being refined to guarantee that every manufactured blade is free of internal defects. The synergy between new material science (lighter, stronger alloys), advanced manufacturing methods (AM, precision machining), and digital modeling tools (CFD, AI) defines the competitive edge in this technologically demanding market, ensuring the continuous development of more powerful and fuel-efficient gas turbine engines across all application segments.

Regional Highlights

The geographical analysis of the Compressor Blades Market reveals stark differences in maturity, growth trajectory, and dominant application sectors across the globe. Market distribution is heavily correlated with the presence of major aerospace and power generation hubs, indicating a concentration of demand in industrialized regions. The maturity of regulatory frameworks, MRO infrastructure, and the capability of localized specialized supply chains also significantly dictate regional market shares.

- North America: This region holds the largest market share, primarily driven by the colossal presence of leading aerospace OEMs (Pratt & Whitney, GE Aviation) and major defense contractors. High spending on military aviation modernization and a mature commercial fleet requiring extensive MRO services provide a stable and high-value market. The industrial sector, particularly in the US and Canada, utilizes numerous large IGTs for reliable power supply and oil & gas pipeline compression, further cementing this region's dominance.

- Europe: Europe is the second-largest market, anchored by key players such as Rolls-Royce (UK/Germany), Safran (France), and Siemens Energy (Germany). Stringent EU environmental regulations accelerate the adoption of high-efficiency gas turbines, boosting demand for advanced blade designs. The regional focus on sustainable aviation fuel (SAF) initiatives is driving research and development into next-generation engine designs, particularly within the UK, France, and Germany, making it a critical hub for material science innovation and high-precision manufacturing.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by unprecedented growth in commercial air travel, requiring hundreds of new aircraft deliveries and corresponding engine maintenance capabilities, particularly in China and India. Furthermore, rapid industrialization and urbanization necessitate massive investments in power generation infrastructure (coal-to-gas switching), driving significant procurement of IGT components, establishing APAC as the engine of future market growth.

- Latin America: This region represents a developing market, with growth driven largely by investments in oil and gas infrastructure, particularly in Brazil and Mexico. Demand for compressor blades here is predominantly associated with maintaining gas compression stations and smaller regional commercial aircraft fleets. Market growth is sensitive to commodity price fluctuations, which impact investment decisions in the extractive industries that rely heavily on gas turbines.

- Middle East and Africa (MEA): The MEA market is characterized by substantial infrastructure projects, particularly in the Gulf Cooperation Council (GCC) nations, focusing on power generation and desalination plants that heavily rely on large industrial gas turbines. High demand for energy and large existing oil and gas exploration and processing operations necessitate a steady supply of high-performance compressor blades for new installs and MRO, making this a strategically important region despite being exposed to volatility in global energy prices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compressor Blades Market.- GE Aviation (A part of General Electric)

- Rolls-Royce plc

- Siemens Energy AG

- Pratt & Whitney (A part of RTX Corporation)

- Safran S.A.

- Mitsubishi Heavy Industries, Ltd. (MHI)

- IHI Corporation

- GKN Aerospace (A subsidiary of Melrose Industries)

- Howmet Aerospace Inc. (formerly Arconic)

- Precision Castparts Corp. (PCC - A part of Berkshire Hathaway)

- MTU Aero Engines AG

- Chromalloy Gas Turbine LLC

- Bharat Forge Limited

- Wood Group (Advanced Industrial Component Services)

- Turbine Components & Materials LLC

- Haysite Reinforced Plastics

- Dongfang Electric Corporation (DEC)

- Shanghai Electric Group Co., Ltd.

- Snecma (Safran)

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Compressor Blades market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Compressor Blades Market between 2026 and 2033?

The Compressor Blades Market is anticipated to register a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven primarily by aerospace MRO demand and growth in industrial gas turbine installations.

Which material segment dominates the high-pressure compressor stages?

Nickel-based superalloys (such as Inconel and Waspaloy) dominate the high-pressure compressor stages due to their superior creep resistance and ability to maintain structural integrity under extreme heat and mechanical stress.

How is Additive Manufacturing (AM) impacting the compressor blade value chain?

AM is revolutionizing the value chain by enabling the production of highly complex geometries, reducing material waste, and significantly accelerating prototyping and the supply of specialized spare parts for Maintenance, Repair, and Overhaul (MRO) activities.

Which regional market is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial investments in power generation capacity and the continuous expansion of large commercial aircraft fleets across nations like China and India.

What are the primary applications driving the demand for compressor blades?

The primary applications include the Aerospace and Defense sector (commercial and military jet engines), and the Industrial Gas Turbine (IGT) segment used for electric power generation and critical oil and gas processing operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager