Computed Tomography System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434638 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Computed Tomography System Market Size

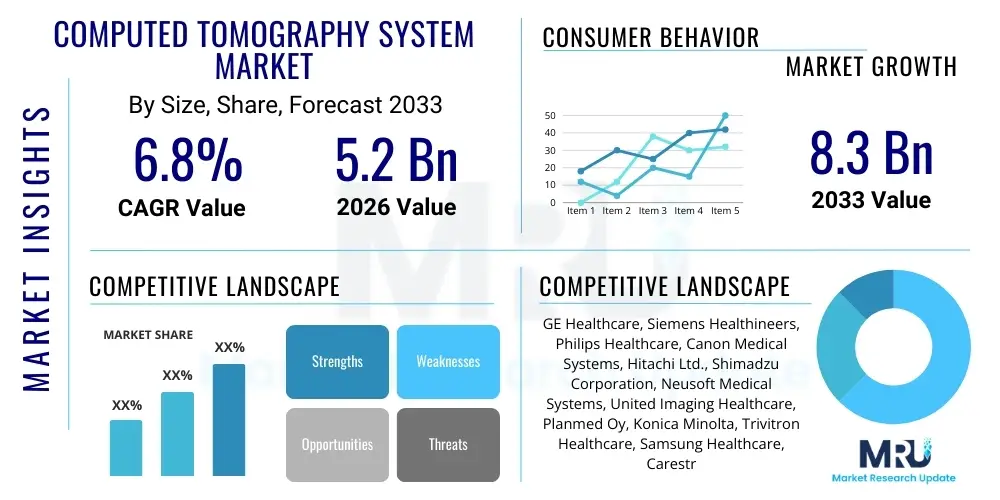

The Computed Tomography System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

Computed Tomography System Market introduction

The Computed Tomography (CT) System Market encompasses the manufacturing, distribution, and utilization of sophisticated medical imaging devices that employ X-rays and digital processing to generate detailed cross-sectional images (tomograms) of the human body. These systems are pivotal in modern diagnostics, enabling non-invasive evaluation of internal organs, bones, soft tissue, and blood vessels. Technological advancements, particularly the shift towards faster scan times, reduced radiation dosage, and higher resolution imaging, continue to define the competitive landscape, making CT indispensable in emergency medicine, oncology, cardiology, and neurological assessments. The evolution of multi-detector row CT (MDCT) and the introduction of advanced modalities like spectral CT and photon-counting CT are expanding clinical utility and driving replacement cycles globally.

Major applications of CT systems span a wide range of clinical scenarios, including the detection and staging of cancers, diagnosis of cardiovascular diseases such as coronary artery disease, assessment of traumatic injuries in emergency rooms, and guidance for interventional procedures. The inherent benefits of CT—speed, high spatial resolution, and the ability to visualize bone and soft tissue simultaneously—make it a cornerstone technology. Furthermore, the integration of CT with other modalities, such as Positron Emission Tomography (PET-CT), enhances diagnostic accuracy, particularly in metabolic and oncological imaging. The versatility of CT allows it to be deployed across various healthcare settings, from large academic medical centers to outpatient imaging facilities.

Key factors driving market expansion include the rapidly aging global population, which correlates directly with an increased incidence of chronic and degenerative diseases requiring advanced diagnostic imaging. Concurrent growth in healthcare infrastructure, particularly in emerging economies, coupled with increased public awareness regarding early disease detection, fuels demand for high-end CT systems. Moreover, continuous innovation aimed at improving workflow efficiency, incorporating artificial intelligence for image reconstruction and interpretation, and enhancing patient safety through dose optimization protocols are crucial driving forces stimulating sustained market growth throughout the forecast period. The replacement demand generated by systems reaching end-of-life also contributes significantly to market volume.

Computed Tomography System Market Executive Summary

The global Computed Tomography (CT) System Market is characterized by robust technological innovation, competitive pricing strategies, and increasing penetration into non-traditional diagnostic fields. Business trends indicate a strong move toward subscription-based models for software upgrades and service contracts, providing recurring revenue streams for major original equipment manufacturers (OEMs). Furthermore, strategic partnerships focusing on integrating AI algorithms for enhanced diagnostics and workflow efficiency are paramount, positioning companies that leverage these digital solutions favorably. The market observes a bifurcated demand structure, with high-end premium systems driving revenue in developed regions and cost-effective, refurbished, or low-slice count systems dominating emerging markets seeking basic diagnostic capabilities.

Regionally, North America maintains the dominant market share, driven by high healthcare expenditure, sophisticated technological adoption, and established reimbursement policies, although the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This accelerated growth in APAC is attributed to extensive government investments in public healthcare infrastructure, rising medical tourism, and a rapidly expanding patient pool requiring advanced imaging services. Europe shows mature market characteristics, with emphasis on replacement of installed bases and stringent regulatory adoption of low-dose protocols, pushing demand for sophisticated iterative reconstruction techniques and dose modulation technologies.

Segment trends highlight the significant dominance of the high-slice count segment (64-slice and above), reflecting the clinical need for rapid, high-resolution volumetric data acquisition, particularly in cardiac and trauma imaging. By application, the oncology segment remains the largest revenue contributor due to the critical role of CT in tumor detection, monitoring, and radiotherapy planning. In terms of technology, the emerging segments of spectral (dual-energy) CT and photon-counting CT are rapidly gaining traction, offering functional information beyond traditional morphological data, promising enhanced tissue characterization and reduced image artifacts, thereby setting new standards for diagnostic precision and becoming key investment areas for research and development.

AI Impact Analysis on Computed Tomography System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Computed Tomography System Market frequently center on automation, diagnostic accuracy improvements, and return on investment (ROI). Users often inquire about how AI can reduce false positives, manage escalating patient volumes efficiently, and standardize image quality across different operators and machines. Key themes summarized from these inquiries include the expectation that AI will transition CT scanning from a purely hardware-centric purchase to a sophisticated, integrated digital solution. Concerns often revolve around regulatory hurdles, data privacy, and the validation of AI algorithms in diverse clinical populations. The consensus is that AI is crucial for optimizing workflows, particularly in rapid image reconstruction and quantitative analysis, ultimately enhancing diagnostic throughput and contributing significantly to dose reduction efforts by improving signal-to-noise ratios in lower-dose acquisitions.

AI’s influence is profound, extending beyond mere image post-processing into fundamental aspects of CT operation and interpretation. For manufacturers, AI represents a critical differentiation point, enabling smart scanners that automate patient positioning, select optimal scanning protocols dynamically, and predict potential motion artifacts. Clinically, AI algorithms are becoming indispensable for triaging critical findings (e.g., pulmonary embolisms, intracranial hemorrhage) by highlighting areas of interest in real-time, thereby decreasing the time-to-diagnosis for emergent conditions. Furthermore, AI facilitates complex quantification tasks, such as automated lung nodule tracking, coronary artery calcium scoring, and liver fat quantification, which were previously time-consuming and operator-dependent, enhancing the reproducibility and precision of quantitative biomarkers derived from CT data.

- AI-powered image reconstruction (e.g., deep learning reconstruction, DLIR) minimizes noise, enabling significantly lower radiation doses without compromising image quality.

- Workflow optimization via automated protocol selection, patient positioning, and quality control checks reduces operator variability and increases scanner throughput.

- Triage and prioritization tools using AI highlight critical findings immediately, improving turnaround times for urgent cases in high-volume settings.

- Quantitative imaging analysis, including automated volumetric measurement and lesion tracking, enhances monitoring accuracy in oncology and chronic disease management.

- Predictive maintenance and remote diagnostics using machine learning ensure maximum system uptime and operational efficiency.

- AI aids in dose management and optimization strategies, adhering to strict regulatory requirements and improving patient safety profiles.

DRO & Impact Forces Of Computed Tomography System Market

The Computed Tomography System Market is driven primarily by the escalating prevalence of chronic diseases, necessitating detailed internal imaging for diagnosis and treatment planning, coupled with continuous technological advancements leading to the development of highly efficient, low-dose, and spectrally functional CT systems. Restraints largely stem from the high initial capital investment required for high-end CT scanners and the substantial maintenance costs, which pose financial barriers, particularly for smaller healthcare facilities and clinics in emerging economies. Moreover, increasing regulatory scrutiny regarding radiation exposure levels necessitates continuous hardware and software refinement, adding complexity and cost to manufacturing. Opportunities are centered on the vast untapped markets in developing nations, the integration of hybrid imaging modalities (e.g., PET-CT, SPECT-CT), and the accelerated adoption of mobile and point-of-care CT solutions, particularly during global health crises or in remote settings.

The market impact forces are categorized into demand-side and supply-side factors. Demand-side forces include the growing demand for preventative health screening programs, the expansion of CT applications in novel areas like interventional radiology and intra-operative guidance, and favorable reimbursement policies in developed healthcare systems. These forces collectively push healthcare providers towards adopting the latest generations of CT technology to improve patient outcomes and operational efficiency. Conversely, supply-side forces involve intense competition among major global OEMs, leading to accelerated R&D cycles focused on digitalization and AI integration, and pressures from group purchasing organizations (GPOs) negotiating lower pricing, which impacts manufacturer profit margins. The critical balance between maintaining cutting-edge technology leadership and offering competitive pricing dictates market performance.

The convergence of advanced computational power and imaging physics is creating powerful synergistic effects. For instance, the integration of deep learning reconstruction (DLR) algorithms is not just an incremental improvement; it fundamentally redefines the relationship between radiation dose and image quality, dissolving a major historical restraint. This shift transforms low-dose scanning from a clinical compromise into a standard practice, broadening CT's applicability. However, the lengthy process of securing regulatory clearances (e.g., FDA, CE mark) for new, complex technologies acts as a temporary brake on rapid global adoption, necessitating substantial upfront investment in validation and clinical trials, thereby impacting the speed at which innovative products reach the end-user market.

Segmentation Analysis

The Computed Tomography System Market is highly fragmented and segmented based on technology, slice count, application, and end-user, providing a granular view of market dynamics and targeted opportunities. Understanding these segments is crucial as technological differentiation drives pricing power and market penetration. High-slice count CT systems (64-slice and above) dominate revenue due to their superior capabilities in cardiac imaging and rapid trauma assessments, demanding premium pricing. Conversely, the mid- and low-slice segments maintain relevance in settings with limited budgets or specific non-critical applications like general radiography screening, often utilized in smaller community hospitals or mobile units. Technology segmentation is rapidly evolving with the emergence of advanced techniques such as Dual-Energy (Spectral) CT and Photon-Counting CT, which offer molecular and functional insights beyond traditional anatomical structure, marking them as high-growth segments poised for substantial market expansion.

- By Technology:

- High-Slice CT

- Mid-Slice CT

- Low-Slice CT

- Cone Beam CT (CBCT)

- Optical Coherence Tomography (OCT)

- Spectral/Dual-Energy CT

- Photon-Counting CT

- By Application:

- Oncology

- Cardiology

- Neurology

- Pulmonary

- Vascular

- Orthopedics

- Others (Interventional Procedures, Emergency Medicine)

- By End-User:

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutes

- By Device Architecture:

- Fixed Systems

- Mobile/Portable Systems

Value Chain Analysis For Computed Tomography System Market

The value chain of the Computed Tomography System Market is intricate, beginning with highly specialized upstream suppliers of critical components and concluding with complex service and maintenance contracts downstream. The upstream segment is dominated by niche providers specializing in sophisticated technological components such as X-ray tubes (the most critical and often replaced component), detectors (scintillators and photocathodes), gantry mechanisms, and high-performance computing units necessary for image reconstruction. Pricing power is often concentrated among these specialized component manufacturers, particularly those holding patents on advanced detector technology like cadmium zinc telluride (CZT) for photon-counting systems. Global OEMs, such as Siemens Healthineers and GE Healthcare, integrate these components, dedicating significant resources to proprietary software development and system assembly.

The middle segment focuses on the manufacturing, assembly, and rigorous quality control of the final CT systems. This stage is capital-intensive and subject to strict regulatory oversight (e.g., ISO certifications, FDA approvals). Distribution channels are critical; while direct sales forces manage relationships with large hospital networks and academic centers, indirect distribution channels, utilizing local distributors and value-added resellers (VARs), are crucial for penetrating regional markets, particularly in Asia Pacific and Latin America. These resellers often provide localized support and handle the complexities of importation and regulatory compliance specific to their territories, managing the interface between the global manufacturer and the local healthcare provider.

Downstream activities involve installation, clinical training, and long-term service and maintenance contracts, which represent a significant recurring revenue stream for OEMs. Direct distribution allows manufacturers better control over branding, pricing, and service quality, especially for premium, high-end systems. Indirect channels are more cost-effective for reaching geographically dispersed or smaller end-users. A critical element of the downstream value chain is the provision of continuous software updates, often incorporating AI algorithms, and offering system refurbishment services, which extends the lifecycle of installed machines and mitigates the environmental impact, simultaneously creating a secondary market for used CT equipment, thereby ensuring maximum asset utilization across the healthcare spectrum.

Computed Tomography System Market Potential Customers

The primary potential customers and end-users of Computed Tomography Systems are large, integrated healthcare networks and hospitals, which require a high volume of imaging services across multiple specialties. These institutions demand cutting-edge, high-slice count scanners (64-slice and above) capable of handling heavy patient loads, complex cardiac and neurological studies, and integrating seamlessly with existing Electronic Health Record (EHR) and Picture Archiving and Communication System (PACS) infrastructure. Their purchasing decisions are driven by total cost of ownership, long-term service agreements, and the ability of the systems to deliver exceptional image quality at minimal radiation dose, thus maximizing clinical utility and compliance with safety standards. They represent the largest segment of purchasing power and typically acquire fixed, high-performance units.

Secondary, yet rapidly growing, potential customers include stand-alone diagnostic imaging centers and specialized ambulatory surgical centers (ASCs). These facilities often prioritize workflow efficiency, rapid patient turnover, and a strong balance between image quality and cost-effectiveness. ASCs frequently invest in mid-slice or specialized Cone Beam CT (CBCT) systems tailored for specific procedures, such as orthopedic or dental imaging, where portability or limited field-of-view is acceptable. Their purchasing strategy often leans towards streamlined operational models, where AI-enabled features that reduce technician dependence and optimize scanning protocols offer a significant competitive advantage in attracting patient referrals.

Furthermore, academic medical centers and research institutions constitute a high-value customer segment, often purchasing the very latest technological innovations, such as Photon-Counting CT and dedicated research systems, to push the boundaries of clinical and translational research. Their motivation is not solely clinical volume but also the capability of the system to perform advanced applications, participate in multi-site clinical trials, and train the next generation of radiologists and technologists. Finally, government and military healthcare systems, particularly those focused on trauma and mobile deployment, represent niche but essential customers for robust, reliable, and sometimes portable CT solutions designed for extreme or remote operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Hitachi Ltd., Shimadzu Corporation, Neusoft Medical Systems, United Imaging Healthcare, Planmed Oy, Konica Minolta, Trivitron Healthcare, Samsung Healthcare, Carestream Health, Medtronic, Analogic Corporation, Varian Medical Systems (now part of Siemens Healthineers), CurveBeam, Koning Corporation, NeuroLogica Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computed Tomography System Market Key Technology Landscape

The Computed Tomography System Market is defined by a rapid pace of technological innovation focused on three core pillars: reducing radiation dose, improving spatial and temporal resolution, and incorporating functional imaging capabilities. Multi-Detector Row CT (MDCT) remains the industry standard, but advancements in detector materials and gantry rotation speed (sub-0.25 seconds per rotation) have dramatically enhanced throughput and reduced motion artifacts, particularly vital for pediatric and cardiac imaging. Modern systems rely heavily on iterative reconstruction (IR) and, increasingly, deep learning reconstruction (DLR) techniques. DLR uses convolutional neural networks trained on vast datasets to distinguish true signal from noise more effectively than traditional methods, allowing for ultra-low dose scans that maintain or even improve image quality, fundamentally shifting the dose-image quality paradigm.

The most significant emerging technologies poised to disrupt the market are Spectral Computed Tomography (often referred to as Dual-Energy CT or DECT) and Photon-Counting CT (PCCT). DECT utilizes two distinct energy spectra of X-rays, either sequentially or simultaneously, to differentiate materials based on their atomic number. This capability allows for material decomposition, such as separating bone from soft tissue or identifying iodine contrast enhancement, providing functional information and reducing metallic artifacts, which is particularly useful in oncology and musculoskeletal imaging. DECT’s clinical adoption is accelerating as it moves from being a specialized tool to a standard feature on premium CT scanners, offering enhanced tissue characterization at minimal additional scanning time.

Photon-Counting CT (PCCT) represents the next frontier, replacing traditional integrating detectors with detectors that count individual X-ray photons and measure their energy, thus eliminating electronic noise and inherently providing spectral data in a single acquisition without beam hardening artifacts. Although still in the early stages of commercial deployment and facing challenges related to component cost and data management complexity, PCCT promises superior spatial resolution, significantly improved contrast-to-noise ratio, and highly accurate quantitative material decomposition. This technology is expected to revolutionize fields such as atherosclerosis characterization, targeted cancer screening, and quantitative radiology by providing unprecedented diagnostic precision and reducing the need for follow-up imaging, serving as a long-term catalyst for premium market growth.

Regional Highlights

Regional dynamics within the Computed Tomography System Market exhibit distinct characteristics driven by varying levels of healthcare expenditure, regulatory environments, and disease prevalence patterns.

- North America (NA): Dominates the global market share due to high technology adoption rates, extensive private and public reimbursement frameworks supporting expensive diagnostic procedures, and the presence of leading global CT system manufacturers and key research institutions. Demand is heavily focused on premium, high-slice count systems and the integration of AI solutions for workflow optimization and quantitative imaging, driven by the intense competition among large hospital systems to offer cutting-edge diagnostic services.

- Europe: Characterized by a mature market with high regulatory standards, particularly concerning radiation dose reduction (e.g., EuroSafe Imaging campaign). The market growth is primarily driven by replacement demand for aging systems and the adoption of Spectral CT and low-dose technologies mandated by strict public health policies. Germany, France, and the UK are key markets, showing a strong preference for domestically manufactured or long-established European brands.

- Asia Pacific (APAC): Expected to be the fastest-growing region during the forecast period. This growth is fueled by massive government investments in expanding healthcare infrastructure (especially in China and India), rapidly increasing disposable incomes, and the rising burden of chronic diseases. While demand for basic and mid-slice systems is high in rural areas, metropolitan centers are rapidly adopting high-end, premium systems and hybrid solutions (PET-CT) to cater to the growing medical tourism industry and sophisticated private healthcare sectors.

- Latin America (LATAM): Exhibits moderate growth, constrained by economic volatility and complex procurement processes. The market is price-sensitive, with a strong demand for refurbished equipment and systems offering a low total cost of ownership. Brazil and Mexico are the largest markets, witnessing increasing private investment in diagnostic imaging centers seeking cost-effective imaging solutions and standardized diagnostic services.

- Middle East and Africa (MEA): Growth is localized, concentrated primarily in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to high government spending on establishing world-class healthcare facilities. These markets typically procure advanced, high-specification equipment directly from global OEMs, often skipping intermediate technology generations. Africa, excluding South Africa, relies heavily on international aid programs and specialized mobile units for basic diagnostic capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computed Tomography System Market.- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- Hitachi Ltd.

- Shimadzu Corporation

- Neusoft Medical Systems

- United Imaging Healthcare

- Planmed Oy

- Konica Minolta

- Trivitron Healthcare

- Samsung Healthcare

- Carestream Health

- Medtronic

- Analogic Corporation

- Varian Medical Systems (now part of Siemens Healthineers)

- CurveBeam

- Koning Corporation

- NeuroLogica Corporation

- Fujifilm Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the Computed Tomography System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological trends driving innovation in the CT System Market?

The primary trends include the rapid adoption of deep learning reconstruction (DLR) algorithms for low-dose imaging, the commercialization of Photon-Counting CT (PCCT) for enhanced spectral differentiation, and the integration of Spectral/Dual-Energy CT capabilities as standard features to improve tissue characterization and reduce metal artifacts.

How does AI contribute to reducing radiation exposure in Computed Tomography?

AI contributes by enabling ultra-low dose protocols through sophisticated DLR techniques that effectively remove image noise at dose levels previously considered diagnostically unusable. Furthermore, AI automates exposure settings and ensures accurate patient positioning, minimizing the need for repeat scans and unintended over-exposure.

Which geographic region is expected to show the fastest growth in the CT market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate, driven by escalating government investments in healthcare infrastructure, increasing prevalence of chronic diseases among large populations, and expanding patient access to modern diagnostic technologies, particularly in China and India.

What is the key difference between standard CT and the emerging Photon-Counting CT (PCCT)?

Standard CT uses integrating detectors that measure the total energy absorbed. PCCT uses direct conversion detectors that count individual X-ray photons and measure their exact energy level. This precise counting eliminates electronic noise, offers inherently superior spatial resolution, and provides spectral data without compromising dose efficiency.

What factors are restraining the adoption of high-end Computed Tomography systems?

The major restraints include the substantial initial capital outlay required for premium systems (often exceeding one million USD), high ongoing maintenance and service contract costs, and the complex process of obtaining regulatory approval for new technologies in different global jurisdictions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager