Computer Aided Detection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431498 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Computer Aided Detection System Market Size

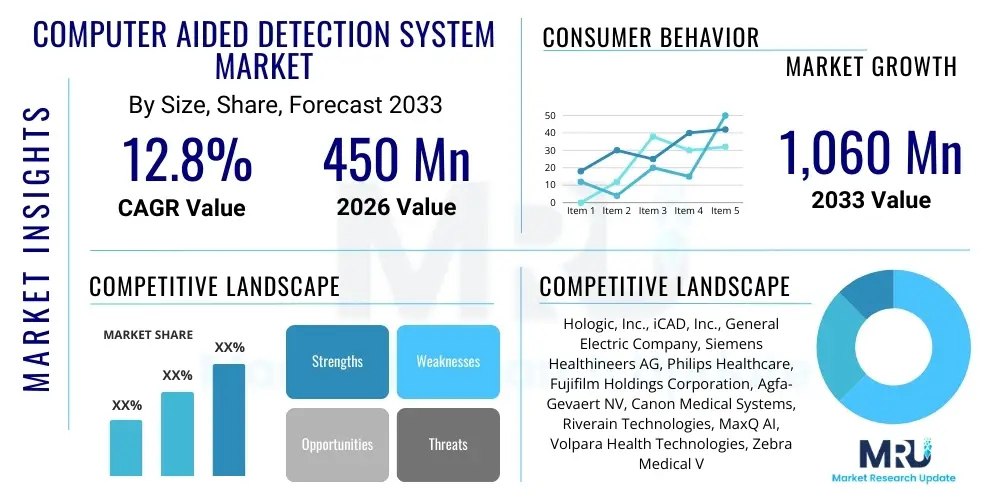

The Computer Aided Detection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,060 Million by the end of the forecast period in 2033.

Computer Aided Detection System Market introduction

The Computer Aided Detection (CAD) System Market encompasses sophisticated medical software solutions designed to assist radiologists and healthcare professionals in interpreting medical images, such as mammograms, CT scans, X-rays, and MRIs. These systems utilize advanced pattern recognition and machine learning algorithms to flag potentially problematic areas, lesions, or nodules that might be subtle or overlooked during standard human observation, thereby significantly improving the sensitivity and specificity of diagnostic procedures. The primary function of CAD is to serve as a 'second reader,' enhancing diagnostic throughput and confidence, particularly in high-volume screening programs for diseases like breast cancer, lung cancer, and colon cancer. This technological integration is pivotal in the shift towards preventive and personalized medicine, optimizing clinical workflows and ensuring early detection of critical pathologies. Key applications span across oncology, cardiovascular imaging, and neurology, fundamentally transforming the landscape of medical diagnostics.

The proliferation of digital imaging technologies, specifically Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHR), provides a robust infrastructure necessary for the deployment and effective functioning of CAD systems. These systems are constantly evolving, moving away from traditional rule-based algorithms to advanced deep learning models that can analyze complex radiological data with unprecedented accuracy. The substantial benefit derived from CAD systems lies in their ability to standardize interpretation quality across different clinical settings and reduce inter-observer variability among reading physicians. Furthermore, CAD aids in managing the increasing workload faced by radiologists globally due to rising volumes of imaging studies, allowing them to focus critical attention on the most challenging cases flagged by the software.

Driving factors propelling this market include the global escalation in the prevalence of chronic diseases, particularly various forms of cancer that require early intervention for improved survival rates. Governments and private healthcare providers are increasingly investing in advanced diagnostic tools to lower mortality rates associated with delayed diagnoses. Moreover, the integration of cutting-edge artificial intelligence (AI) and cloud computing capabilities is fostering a new generation of highly accurate, cost-effective, and scalable CAD solutions. Regulatory approvals are also becoming more streamlined for AI-driven diagnostic tools, encouraging rapid commercialization and adoption in major healthcare economies, solidifying the market's strong growth trajectory through the forecast period.

Computer Aided Detection System Market Executive Summary

The Computer Aided Detection (CAD) System Market is characterized by robust growth driven primarily by technological convergence, specifically the rapid adoption of deep learning algorithms within imaging diagnostics. Business trends indicate a strong move towards subscription-based software models (SaaS), offering scalability and lower initial capital expenditure for healthcare facilities, thereby democratizing access to advanced diagnostic intelligence. Major market players are focusing on strategic partnerships with large imaging equipment manufacturers (OEMs) and cloud service providers to ensure seamless integration and widespread deployment of their CAD software. Furthermore, the competitive landscape is shifting from general-purpose CAD towards highly specialized, organ-specific AI tools designed for complex pathologies, particularly in areas like lung nodule screening (low-dose CT) and personalized breast density assessment, demanding continuous innovation and significant R&D investment.

Regionally, North America maintains the largest market share, attributable to high healthcare spending, advanced regulatory frameworks favoring technology adoption (such as FDA clearances for novel AI diagnostic tools), and established infrastructure for digital health records and teleradiology networks. Europe follows closely, driven by comprehensive national screening programs and stringent quality mandates that encourage the use of secondary diagnostic aids. However, the Asia Pacific region is anticipated to demonstrate the highest CAGR, fueled by expanding healthcare access, increasing awareness regarding cancer screening, and massive government initiatives aimed at upgrading archaic healthcare IT systems. Key emerging economies like China and India present significant untapped opportunities for both localized and international CAD solution providers.

Segment trends highlight the dominance of oncology applications, specifically mammography CAD, which remains a foundational component of the market due to established screening protocols. However, the fastest-growing segment is expected to be CAD for CT imaging, particularly for lung and cardiovascular applications, propelled by global initiatives to screen high-risk populations for smoking-related lung diseases. From a component perspective, the software segment is outpacing hardware growth, reflective of the market's shift toward highly agile, software-as-a-medical-device (SaMD) models that offer perpetual updates and integration flexibility. End-user demand is heavily concentrated in large hospital networks and specialized diagnostic imaging centers that require high-throughput, error-minimizing diagnostic aids.

AI Impact Analysis on Computer Aided Detection System Market

User interest regarding the impact of Artificial Intelligence on the Computer Aided Detection Market centers predominantly around three core themes: the tangible improvement in diagnostic accuracy compared to legacy CAD systems, the practical implications for radiologist workflow and efficiency, and the complex regulatory and liability issues surrounding autonomous or semi-autonomous AI tools. Users frequently inquire about the clinical validation of deep learning models in real-world settings, questioning whether AI can truly reduce false positive rates—a traditional drawback of older CAD systems—while maintaining high sensitivity. Furthermore, there is significant focus on how AI-powered CAD integrates into existing PACS and EHR systems, and whether it aids in prioritizing urgent cases, rather than merely flagging potential findings. The expectation is that AI will transform CAD from a mere detection aid into a predictive and prognostic tool, influencing treatment pathways and patient management decisions, while navigating the crucial ethical concerns regarding data privacy and algorithmic bias in diverse patient populations.

The transition from traditional CAD (often based on pattern matching and heuristic rules) to AI-powered CAD, utilizing sophisticated deep learning architectures like Convolutional Neural Networks (CNNs), represents a fundamental technological paradigm shift. This shift significantly enhances the capability of detection systems to identify subtle visual patterns and perform quantitative analyses that are beyond human cognitive capacity. AI models are trained on vast datasets, allowing them to learn nuanced features of pathology, leading to improved differentiation between malignant and benign findings. This dramatic increase in analytical power is directly responsible for boosting the overall clinical utility of CAD systems, making them indispensable tools for modern radiological practices.

Moreover, AI is not only influencing the detection phase but is also extending into image segmentation, quantification, and reporting, paving the way for fully automated preliminary reports in screening settings. This automation promises substantial gains in operational efficiency and cost reduction across major healthcare systems. Regulatory bodies, such as the FDA, have begun developing specific pathways for AI/ML-based medical devices, acknowledging the need for adaptive algorithms and continuous learning models. The market anticipates that successful integration and standardization of these AI tools will unlock vast clinical value, positioning AI as the central driver of innovation and competitive differentiation within the CAD segment for the next decade.

- AI integration leads to up to 40% reduction in false positives compared to legacy CAD technology.

- Deep Learning (DL) models enhance detection sensitivity for early-stage lesions, particularly in dense tissue.

- AI algorithms facilitate workflow prioritization by identifying and highlighting critical findings (triage functionality).

- Development of Quantitative Imaging Biomarkers (QIBs) for prognostic assessment and treatment response monitoring.

- Cloud-based AI CAD solutions offer improved scalability and continuous model updates without hardware limitations.

- Increased regulatory scrutiny focuses on model explainability (XAI) and robustness across varied patient demographics.

- AI enables seamless fusion of multi-modal data (e.g., genetic markers with imaging) for holistic diagnostic insights.

DRO & Impact Forces Of Computer Aided Detection System Market

The dynamics of the Computer Aided Detection System Market are complex, dictated by a powerful combination of clinical necessities, technological advancements, cost constraints, and regulatory requirements. Key drivers include the persistently rising incidence of cancer globally, coupled with the aging demographic which inherently requires more frequent and accurate screening. This necessity is amplified by continuous improvements in imaging technology (like high-resolution CT and digital mammography), generating massive volumes of data that necessitate automated interpretation assistance. Restraints primarily involve the high initial cost of deploying advanced CAD systems, concerns regarding liability associated with diagnostic errors originating from automated tools, and historical issues related to high false positive rates in older generation systems, which can lead to unnecessary follow-up procedures and patient anxiety. Opportunities are abundant, specifically in emerging markets where digital infrastructure is rapidly expanding, the increasing shift towards teleradiology and remote diagnostics utilizing cloud-based CAD, and the potential for developing highly personalized CAD tools integrated with genomic data.

The impact forces within the market are predominantly shaped by technological innovation and evolving healthcare policies. The pervasive influence of AI is the foremost positive force, fundamentally altering the performance benchmarks for new CAD products. As AI improves accuracy and reduces workflow friction, the perceived value proposition of CAD dramatically increases for end-users. Conversely, regulatory inertia and the requirement for extensive, multi-center clinical trials to validate new AI algorithms act as restraining forces that slow down market entry. Economic pressures from payers and government health systems to demonstrate clear cost-effectiveness and improved patient outcomes necessitate that CAD vendors provide robust evidence of reduced unnecessary biopsies and decreased mortality rates, which serves as a powerful validation force shaping product development.

Another critical impact force is the integration challenge within heterogeneous healthcare IT environments. For a CAD system to be impactful, it must seamlessly communicate with existing PACS, RIS (Radiology Information Systems), and EHR systems without disrupting established clinical pathways. Vendors prioritizing open APIs and standardized data interchange protocols (like DICOM and HL7) gain significant competitive advantage. Furthermore, the shortage of skilled radiologists in many global regions drives the urgent demand for CAD systems that can automate preliminary screening tasks, making workforce augmentation a key strategic driver. The collective effect of these forces suggests a highly dynamic market where technological superiority and robust clinical validation are essential prerequisites for long-term success and widespread adoption.

Segmentation Analysis

The Computer Aided Detection System Market is meticulously segmented based on Modality, Application, Component, and End-User, reflecting the diverse utilization landscape of these diagnostic aids across clinical practice. Segmentation allows for a granular understanding of which technological areas are experiencing the fastest growth and where investment opportunities are most concentrated. The market is primarily dominated by mature segments related to breast cancer screening (mammography CAD), but significant expansion is anticipated in segments related to complex volumetric imaging modalities like CT and MRI, driven by the need for advanced 3D analysis and quantification capabilities. Understanding these segments is crucial for manufacturers to tailor product development, marketing strategies, and distribution channels to target specific clinical needs effectively.

- By Modality:

- Mammography (2D and 3D/Tomosynthesis)

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Ultrasound

- X-ray Imaging

- By Application:

- Oncology (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer)

- Cardiovascular

- Neurology

- Musculoskeletal

- By Component:

- Software (Standalone & Integrated)

- Hardware (Workstations & Servers)

- By End-User:

- Hospitals

- Diagnostic Imaging Centers

- Specialty Clinics

- Academic & Research Institutes

Value Chain Analysis For Computer Aided Detection System Market

The value chain for the Computer Aided Detection System Market begins with extensive upstream research and development, requiring deep expertise in clinical imaging, computer vision, machine learning, and medical informatics. This initial phase involves acquiring vast, high-quality, and ethically sourced annotated medical datasets essential for training sophisticated AI algorithms. Manufacturers must secure intellectual property and navigate stringent regulatory approval processes (e.g., FDA, CE Mark) before product commercialization. The manufacturing and assembly stage involves integrating software components onto optimized hardware platforms, though the trend is shifting towards software-as-a-service (SaaS) delivery models that minimize physical manufacturing requirements, focusing instead on robust cloud infrastructure management and security protocols.

Midstream activities focus intensely on distribution and strategic partnerships. Direct sales channels are often employed for large hospital systems and integrated delivery networks (IDNs), where complex installation and deep integration with existing vendor equipment are necessary. Indirect distribution relies heavily on value-added resellers (VARs) and established distributors specializing in medical imaging technology, particularly for reaching smaller clinics and international markets where local support is crucial. Key strategic alliances with PACS vendors, RIS developers, and leading imaging equipment OEMs (e.g., Siemens Healthineers, GE Healthcare) are vital for ensuring product compatibility and widespread market reach, often bundling CAD software directly into larger capital equipment sales.

Downstream activities center on deployment, training, and post-sales support, which is critical for maintaining high adoption rates and clinical efficacy. Given the complexity of AI-driven tools, comprehensive clinical training for radiologists and technologists is mandatory. The value chain concludes with the end-users—hospitals and diagnostic centers—who derive value through enhanced diagnostic efficiency, accuracy, and improved patient outcomes. Continuous software updates, performance monitoring, and compliance with evolving cybersecurity standards represent ongoing value additions, emphasizing the longevity and sustainability of the software segment over the life of the product contract, positioning ongoing support as a major revenue driver.

Computer Aided Detection System Market Potential Customers

The primary consumers of Computer Aided Detection Systems are large-scale healthcare providers operating high-volume diagnostic imaging departments that handle thousands of screening and diagnostic cases annually. This segment includes major hospital networks, particularly those with dedicated oncology or specialized screening units, where the efficiency and consistency offered by CAD systems provide immediate operational benefits. These institutional buyers prioritize systems with proven clinical performance metrics (high AUC, low recall rates), seamless interoperability with their installed base of imaging equipment, and strong vendor support for data migration and regulatory compliance. Furthermore, academic medical centers and university hospitals are key customers, not only for clinical use but also for integrating advanced CAD research into medical education and clinical trials, driving demand for the latest, cutting-edge AI-based platforms.

Independent diagnostic imaging centers and specialized radiology groups represent another significant customer base. These entities often focus exclusively on efficiency and turnaround time, making cloud-based or SaaS CAD solutions highly attractive due to their flexibility, scalability, and lower upfront investment requirements compared to on-premise solutions. For these centers, CAD is a critical competitive differentiator, enabling them to offer state-of-the-art diagnostic services and manage specialized workloads, such as dedicated breast imaging or lung cancer screening programs. The adoption is particularly high in regions with established teleradiology services, where CAD helps standardize reading quality across geographically dispersed interpretation sites.

A rapidly expanding segment of potential customers includes specialized clinics focused on preventative health and chronic disease management, such as cardiology and gastroenterology clinics. As CAD capabilities extend beyond oncology to applications like assessing coronary artery calcification (Cardiovascular CAD) or detecting subtle polyps in virtual colonoscopy (Colorectal CAD), the scope of end-users broadens significantly. These customers seek highly specific, application-focused CAD tools that can be easily integrated into non-traditional imaging workflows, facilitating early detection outside the main hospital setting and contributing to population health management initiatives. The global push for preventative medicine solidifies these specialized clinics as crucial future consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,060 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hologic, Inc., iCAD, Inc., General Electric Company, Siemens Healthineers AG, Philips Healthcare, Fujifilm Holdings Corporation, Agfa-Gevaert NV, Canon Medical Systems, Riverain Technologies, MaxQ AI, Volpara Health Technologies, Zebra Medical Vision, Konica Minolta, Eko Devices, DeepMind Health |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computer Aided Detection System Market Key Technology Landscape

The technological landscape of the Computer Aided Detection System Market is currently defined by the rapid evolution from classical computer vision techniques to sophisticated artificial intelligence and machine learning methodologies. Deep learning, particularly the use of Convolutional Neural Networks (CNNs), stands out as the core disruptive technology. CNNs enable CAD systems to process complex, high-dimensional imaging data (like 3D mammography or multi-slice CT scans) to detect and characterize subtle radiological findings with significantly higher accuracy and speed than previous generations of CAD. These advanced algorithms learn features directly from raw image pixels, eliminating the need for manual feature engineering, leading to systems that are more robust, adaptable, and clinically reliable across diverse patient populations and imaging protocols. This technological shift is driving the convergence of CAD software with advanced visualization tools and integrated reporting platforms, moving towards comprehensive diagnostic solutions.

Further innovation is concentrated on enhancing interoperability and scalability through cloud computing and edge computing infrastructure. Cloud-based CAD solutions offer tremendous flexibility, allowing access to cutting-edge AI models without the need for high-end local hardware and facilitating real-time updates and continuous learning capabilities. This paradigm is especially critical for teleradiology services and large healthcare organizations managing distributed imaging data. Furthermore, Edge AI deployments are emerging, where specific, high-speed computational tasks are executed directly on imaging equipment or local workstations, ensuring minimal latency and compliance with strict data sovereignty regulations, particularly in Europe. The market is also seeing increasing adoption of explainable AI (XAI) frameworks, which provide transparency into the algorithm's decision-making process, addressing the clinician's need for trust and accountability in AI-driven diagnostics.

Another crucial area involves the integration of CAD with quantitative imaging and multi-omics data. Advanced CAD systems are now capable of generating quantitative imaging biomarkers (QIBs) that measure tumor volume, density, and growth rate, offering predictive and prognostic information beyond simple detection. This capability allows for more personalized treatment planning and ongoing monitoring. Moreover, vendors are exploring ways to fuse imaging data analyzed by CAD with genomic or proteomic data, aiming to create holistic patient profiles that refine risk stratification and diagnostic certainty. Standardization efforts, particularly through organizations defining AI medical imaging data standards and protocols for model validation, are crucial for facilitating the widespread, safe, and effective deployment of these increasingly complex, integrated diagnostic technologies globally.

Regional Highlights

Regional dynamics play a significant role in shaping the adoption and growth trajectory of the Computer Aided Detection System Market, influenced by variations in healthcare infrastructure, regulatory environments, and disease screening prevalence.

- North America: North America, particularly the United States, commands the largest market share globally, driven by exceptionally high healthcare expenditure, established digital infrastructure (PACS/EHR), and favorable reimbursement policies for advanced diagnostic procedures, including cancer screening. The region is a primary hub for AI innovation and early adoption, with many leading CAD manufacturers headquartered here. Aggressive lung cancer screening programs and widespread utilization of 3D mammography (tomosynthesis) necessitate high-performance CAD/AI tools, ensuring continued market dominance and rapid integration of new technologies following FDA clearances.

- Europe: Europe represents a mature market, characterized by comprehensive, government-funded national screening programs, particularly for breast cancer. Regulatory requirements (CE Mark) emphasize clinical validation and safety, fostering a stable demand environment. Growth is driven by the mandate to improve efficiency within national health services (NHS, equivalent organizations) and the implementation of EU-wide digital health initiatives. Adoption of advanced AI CAD for CT imaging (lung cancer) is steadily increasing, though market penetration rates vary significantly among member states due to differing national health policies and spending priorities.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure modernization, increasing disposable incomes, and greater public awareness campaigns regarding preventative health and early disease detection. Countries like Japan, South Korea, and Australia are sophisticated early adopters, while populous emerging economies like China and India represent massive, untapped markets. Government investments in healthcare IT and a growing radiologist shortage contribute to the high demand for scalable, affordable, and cloud-based CAD solutions that can support remote diagnostics and large-scale screening initiatives.

- Latin America (LATAM): The LATAM market is in an emergent phase, characterized by localized growth primarily concentrated in private hospital systems in major economies such as Brazil and Mexico. Market growth is constrained by uneven distribution of advanced imaging equipment and economic volatility, but the increasing penetration of international diagnostic chains and focus on specialized clinics provides incremental growth opportunities for affordable CAD solutions.

- Middle East and Africa (MEA): The MEA market is highly heterogeneous. The Gulf Cooperation Council (GCC) nations exhibit strong growth fueled by high oil revenues invested in state-of-the-art medical infrastructure and digital hospitals. The rest of Africa faces infrastructural challenges, yet there is a growing necessity for cost-effective AI diagnostic aids to bridge the severe shortage of specialized medical personnel. Partnerships between global CAD vendors and regional health authorities focus on telemedicine and scalable, low-resource deployment models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computer Aided Detection System Market.- Hologic, Inc.

- iCAD, Inc.

- General Electric Company (GE Healthcare)

- Siemens Healthineers AG

- Philips Healthcare

- Fujifilm Holdings Corporation

- Agfa-Gevaert NV

- Canon Medical Systems Corporation

- Riverain Technologies, LLC

- MaxQ AI Ltd. (now part of Lunit)

- Volpara Health Technologies

- Zebra Medical Vision (now part of Nanox)

- Konica Minolta, Inc.

- DeepMind Health (part of Alphabet/Google)

- Lunit Inc.

- Bayer AG (Radiology Division)

- Esaote S.p.A.

- Median Technologies

- Viz.ai, Inc.

- Blackford Analysis Ltd.

Frequently Asked Questions

Analyze common user questions about the Computer Aided Detection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between traditional CAD and modern AI-powered CAD systems?

Traditional CAD systems rely on predefined, rule-based algorithms (feature engineering) to flag anomalies, often resulting in high false-positive rates. Modern AI-powered CAD utilizes deep learning (e.g., CNNs) trained on massive datasets, enabling superior pattern recognition, significantly reduced false positives, and the capacity for quantitative analysis and workflow prioritization. This advancement fundamentally transforms CAD from a detection aid to a comprehensive diagnostic assistant.

How does the integration of CAD systems impact the workload and efficiency of radiologists?

CAD integration significantly improves radiologist efficiency by acting as a 'second reader,' ensuring critical findings are not missed, and accelerating the screening process. AI-driven CAD also facilitates triage, prioritizing studies with the highest likelihood of critical pathology, allowing radiologists to focus their expertise on complex cases. This results in faster turnaround times and reduced burnout, particularly in high-volume screening environments.

Which application segment is driving the highest demand in the Computer Aided Detection Market?

Oncology remains the dominant application segment, specifically Computer Aided Detection for Mammography (CADm) due to widespread breast cancer screening programs globally. However, the fastest growth is currently observed in CAD for Computed Tomography (CT), driven by the increasing implementation of lung cancer screening protocols for high-risk individuals and advanced cardiovascular applications.

What are the major regulatory hurdles facing manufacturers of new AI-based CAD solutions?

Major hurdles include obtaining rigorous regulatory clearance (like FDA approval or CE Mark) for software as a medical device (SaMD), especially proving the clinical validity and generalizability of deep learning models across diverse patient populations. Manufacturers must also address challenges related to data privacy (HIPAA, GDPR compliance), cybersecurity, and the regulatory framework for continuously learning, adaptive algorithms.

Is the market shifting towards on-premise hardware or cloud-based CAD solutions?

The market is rapidly shifting towards flexible, cloud-based (SaaS) CAD solutions. Cloud deployment minimizes the need for substantial upfront hardware investments, offers superior scalability, facilitates seamless integration with teleradiology networks, and allows vendors to provide continuous, instantaneous algorithm updates. While some hospitals maintain on-premise solutions for data security, the cloud model is becoming the preferred choice for efficiency and technological agility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager