Computer-Aided Drug Discovery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438156 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Computer-Aided Drug Discovery Market Size

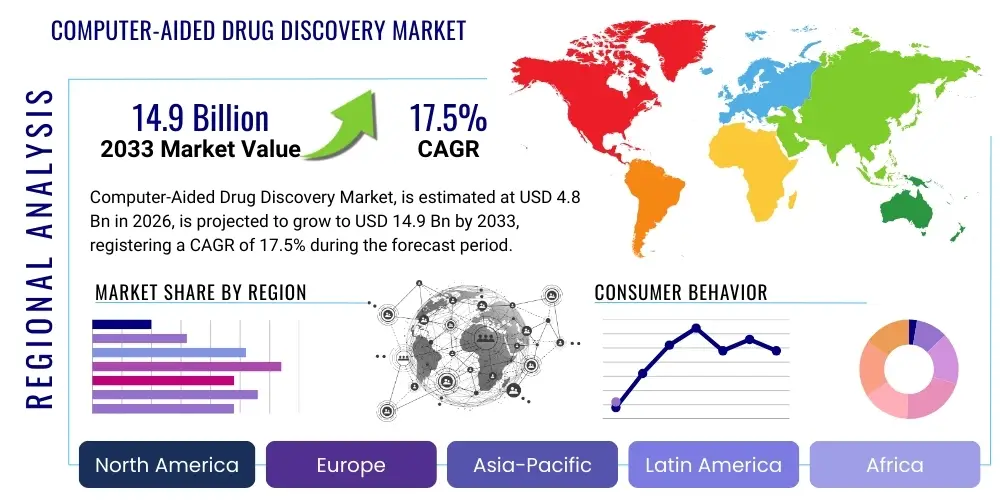

The Computer-Aided Drug Discovery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 14.9 Billion by the end of the forecast period in 2033.

Computer-Aided Drug Discovery Market introduction

Computer-Aided Drug Discovery (CADD) involves the use of computational methods and advanced software tools to expedite the identification, design, and optimization of therapeutically relevant molecules. These methodologies significantly reduce the time and cost associated with traditional wet-lab experiments, thereby accelerating the pipeline for novel pharmaceutical development. CADD encompasses various techniques, including molecular modeling, chemoinformatics, virtual screening, and quantitative structure-activity relationship (QSAR) analysis, all aimed at predicting the biological activity and pharmacokinetic properties of potential drug candidates before synthesis.

The core application of CADD lies in preclinical research across diverse therapeutic areas, such as oncology, infectious diseases, central nervous system disorders, and metabolic diseases. By utilizing high-performance computing resources, researchers can simulate complex biological interactions, screen massive chemical libraries virtually, and optimize lead compounds for improved efficacy and reduced toxicity. The primary benefit is the enhanced efficiency of the drug development lifecycle, shifting the paradigm from trial-and-error experimentation to a data-driven, predictive approach.

The market is predominantly driven by the escalating demand for faster drug discovery processes, the complexity inherent in developing treatments for chronic and emerging diseases, and substantial advancements in computational power and algorithms, particularly in machine learning and deep learning. Furthermore, the increasing pressure on pharmaceutical companies to improve R&D productivity and the growing prevalence of strategic collaborations between technology providers and biopharmaceutical firms further solidify the market's growth trajectory.

Computer-Aided Drug Discovery Market Executive Summary

The Computer-Aided Drug Discovery market is characterized by robust growth, primarily fueled by the integration of Artificial Intelligence (AI) and Machine Learning (ML) platforms, which are fundamentally transforming lead optimization and target identification processes. Business trends show a significant shift towards cloud-based CADD solutions, enabling small and medium-sized biotechnology companies to access powerful computational tools without large capital investments in infrastructure. Strategic mergers, acquisitions, and partnerships between computational biology software vendors and major pharmaceutical giants define the competitive landscape, focused on consolidating expertise in proprietary algorithms and expanding service portfolios, particularly in niche areas like personalized medicine and novel target discovery.

Regionally, North America remains the dominant market, driven by high R&D spending, the strong presence of key technology developers, and robust governmental funding for life sciences research. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, propelled by expanding pharmaceutical manufacturing sectors in countries like China and India, increased outsourcing of drug discovery services, and improving regulatory environments supporting biotech innovation. Europe also maintains a strong foothold, benefiting from advanced academic research institutions and significant investments in structural biology and computational chemistry.

Segment trends indicate that Structure-Based Drug Design (SBDD) continues to be the largest segment by methodology, due to its precision in modeling ligand-receptor interactions when the target structure is known. However, Ligand-Based Drug Design (LBDD) and virtual screening are rapidly gaining traction, especially for challenging targets where structural information is scarce. Services, rather than software, constitute the fastest-growing component of the market, reflecting the pharmaceutical industry's preference for specialized contract research organizations (CROs) capable of handling complex computational biology tasks and delivering ready-to-use insights, thereby mitigating the need for in-house computational expertise development.

AI Impact Analysis on Computer-Aided Drug Discovery Market

Common user inquiries concerning AI’s influence on the Computer-Aided Drug Discovery market primarily center on the capabilities of deep learning models to predict drug efficacy, toxicity, and synthesis pathways with unprecedented accuracy. Users frequently ask about the tangible return on investment (ROI) derived from AI integration, the necessary data infrastructure requirements (especially large, high-quality datasets), and the regulatory acceptance of AI-derived candidates. Key themes revolve around the disruption of traditional screening methods, the ability of AI to tackle "undruggable" targets, and concerns regarding model interpretability and bias. Users expect AI to minimize costly failures in clinical trials by providing superior predictive modeling during the preclinical phase, thereby radically compressing the timelines for drug development from years to mere months in certain stages.

The immediate impact of AI is visible in accelerating the hit-to-lead and lead optimization stages. Machine learning models excel at processing vast chemical and biological datasets, identifying patterns that human intuition or classical statistical methods might overlook. This capability is crucial for enhancing virtual screening campaigns, allowing researchers to prioritize molecules with the highest therapeutic potential while simultaneously predicting potential off-target effects and metabolic liabilities. Consequently, AI integration not only speeds up discovery but also significantly improves the quality and safety profile of preclinical candidates.

Furthermore, AI algorithms are playing a pivotal role in novel target identification and polypharmacology, where predicting the activity of a single molecule across multiple targets is essential for complex diseases. By employing techniques such as Generative Adversarial Networks (GANs) and Reinforcement Learning (RL), researchers can generate entirely novel chemical structures optimized for specific biological outcomes, moving beyond merely screening existing libraries. This generative chemistry approach represents a paradigm shift, unlocking new avenues for drug design that were previously inaccessible due to computational complexity or lack of structural data, cementing AI's role as a mandatory technology within the CADD ecosystem.

- AI accelerates target identification and validation, improving accuracy over manual methods.

- Deep Learning models enhance predictive toxicology and ADME (Absorption, Distribution, Metabolism, Excretion) profiling, reducing preclinical failure rates.

- Generative AI facilitates the design of novel molecules optimized for specific biological properties (de novo design).

- Machine Learning improves virtual screening throughput by accurately prioritizing active compounds from massive databases.

- AI tools streamline data processing and visualization for complex molecular dynamics simulations.

- Automation of computational workflows through AI-powered platforms decreases human intervention and operational costs.

- Adoption of cloud-based AI solutions democratizes access to high-performance CADD tools for smaller biotechs.

DRO & Impact Forces Of Computer-Aided Drug Discovery Market

The trajectory of the Computer-Aided Drug Discovery market is governed by a dynamic interplay of propelling drivers, restrictive challenges, and lucrative opportunities. The primary driver is the exponentially increasing computational power and the subsequent advancement in complex simulation software, allowing for more realistic and precise modeling of biological systems than ever before. Simultaneously, the persistent need to reduce the astronomical costs and extended timelines associated with conventional drug development pushes pharmaceutical companies toward computational alternatives. Restraints mainly revolve around the scarcity of highly skilled computational chemists and bioinformaticians required to operate and interpret sophisticated CADD tools, alongside the inherent limitations in accurately modeling highly flexible protein structures or poorly defined targets. Opportunities emerge particularly from the application of CADD in precision medicine, the development of specialized therapeutics for rare diseases, and the growing demand for Contract Research Organization (CRO) services focusing on computational drug design, offering accessible expertise to the industry.

Impact forces in the CADD market include the synergistic effect of digital transformation across the life sciences industry, which encourages the integration of high-throughput screening data with computational models for iterative refinement. Furthermore, the rise in chronic and infectious diseases, necessitating rapid discovery of new antiviral and antimicrobial agents, provides a strong market impetus. Regulatory support for expedited approval pathways for computationally designed drugs, coupled with substantial private and public investments in biopharmaceutical R&D infrastructure, acts as a significant positive impact force. Conversely, data privacy concerns and the difficulty in standardizing diverse biological and chemical databases present a restraining force that impacts the scalability and interoperability of global CADD platforms.

The long-term success of CADD adoption is heavily influenced by the ability of vendors to continually prove the predictive accuracy of their platforms against real-world clinical outcomes. As CADD methodologies become more refined, especially with the maturity of AI/ML, the risk associated with investing in novel molecular entities decreases, establishing computational methods as indispensable early-stage tools. The competitive landscape is forcing pharmaceutical companies to adopt CADD not just for cost reduction, but as a critical strategic capability necessary to maintain innovation speed and market relevance in a highly competitive global environment.

Segmentation Analysis

The Computer-Aided Drug Discovery market is broadly segmented based on methodology, therapeutic area, and the type of component (software vs. services). Analyzing these segments provides crucial insights into resource allocation and technological adoption trends within the pharmaceutical R&D landscape. The methodology segmentation, encompassing structure-based, ligand-based, and sequencing/modelling approaches, reflects the varying levels of structural information available for the target protein. Therapeutic areas delineate where CADD applications are most intensely focused, ranging from the highly capitalized oncology sector to emerging areas like neurodegenerative diseases, driven by unmet medical needs. The component segmentation highlights the increasing preference for specialized outsourcing services over outright software purchase, particularly among smaller entities seeking expertise and flexibility.

- By Methodology

- Structure-Based Drug Design (SBDD)

- Molecular Docking

- Molecular Dynamics (MD) Simulation

- Homology Modeling

- Ligand-Based Drug Design (LBDD)

- Pharmacophore Modeling

- QSAR (Quantitative Structure-Activity Relationship)

- Virtual Screening

- Sequence- and Structure-Modeling Approaches

- Structure-Based Drug Design (SBDD)

- By Component

- Software (Subscription and Licensed Models)

- Services (Contract Research Organizations, Consultancy, and Custom Modeling)

- By Therapeutic Area

- Oncology

- Neurology

- Cardiovascular Disease

- Infectious Diseases (Antivirals and Antibacterials)

- Metabolic Disorders

- Immunology and Inflammation

- By End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

Value Chain Analysis For Computer-Aided Drug Discovery Market

The value chain for the Computer-Aided Drug Discovery market begins upstream with raw computational power and data infrastructure providers, including specialized semiconductor manufacturers (GPUs/CPUs for simulation) and cloud computing service providers (AWS, Azure). This foundational layer is crucial as CADD workflows are highly data- and compute-intensive. Following this, specialized software developers and algorithm creators develop proprietary docking, simulation, and AI/ML modeling tools. These upstream activities determine the technological sophistication and speed of the entire downstream process, emphasizing continuous innovation in algorithm design and computational efficiency.

The midstream involves the core CADD service delivery and application layer, dominated by Contract Research Organizations (CROs) and specialized computational chemistry consultancies, alongside internal R&D departments of large pharmaceutical companies. CROs act as primary distribution channels for computational expertise, packaging complex modeling and screening services for clients. Direct channels are maintained by large pharmaceutical companies that license software for in-house use, while indirect channels rely heavily on academic collaborations or third-party service providers who manage the computational pipelines and deliver validated molecular data to the ultimate drug developers.

The downstream segment encompasses the pharmaceutical and biotechnology companies who utilize the CADD output (optimized lead compounds, predicted biological activities) to initiate subsequent preclinical testing (in vitro/in vivo assays) and ultimately, clinical trials. The effectiveness of the CADD phase directly impacts the success rate and cost of these downstream operations. Effective distribution relies on the seamless transfer of highly structured data and detailed computational reports, necessitating robust data management systems and strong collaboration protocols between computational modelers and experimental biologists to ensure the generated insights are actionable and translate reliably into tangible drug candidates.

Computer-Aided Drug Discovery Market Potential Customers

The primary customers in the Computer-Aided Drug Discovery market are pharmaceutical and biotechnology companies, ranging from large multinational corporations with extensive internal R&D capabilities to niche biotech startups focused on specific therapeutic targets. Large pharmaceutical companies are significant consumers of CADD software licenses, requiring comprehensive platforms for continuous, high-volume virtual screening and lead optimization across multiple programs. They also frequently outsource specialized modeling tasks, such as complex molecular dynamics simulations or bespoke AI model training, to specialized CROs to supplement internal capacity and access cutting-edge algorithmic knowledge.

Academic and governmental research institutes constitute another substantial customer base. These institutions utilize CADD tools for fundamental research, structural biology studies, and the early-stage identification of novel chemical probes or drug targets. They often rely on grant funding to acquire software licenses and collaborate with industry partners to translate their computational findings into marketable drug candidates. The accessibility of open-source CADD platforms and cloud-based solutions is particularly appealing to academic settings due to budgetary constraints.

Contract Research Organizations (CROs) are rapidly emerging as critical customers and facilitators within the market. CROs purchase advanced software and hire specialized computational talent to offer outsourced CADD services to their clients. Their potential lies in providing flexible, project-specific computational expertise, allowing pharmaceutical companies to rapidly scale their discovery efforts without permanent investment in infrastructure or personnel. CROs focusing on computational services often become power users of molecular modeling software, requiring high-throughput, highly scalable solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 14.9 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schrödinger, Inc., Dassault Systèmes (BIOVIA), Exscientia, Insilico Medicine, Certara, ChemAxon, Simulations Plus, Inc., Charles River Laboratories, Evotec SE, GVK Biosciences, ArisGlobal, BenchSci, Atomwise, Cyclica, Deep Genomics, Verge Genomics, NuMedii, Optibrium, OpenEye Scientific Software (Cadence), Collaborative Drug Discovery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computer-Aided Drug Discovery Market Key Technology Landscape

The technological backbone of the CADD market relies heavily on sophisticated computational techniques combined with high-performance computing infrastructure. Key technologies include Molecular Dynamics (MD) simulations, which model the time-dependent behavior of molecular systems, crucial for understanding protein folding, binding kinetics, and conformational changes. Coupled with MD are force fields and quantum mechanics methods that provide the accuracy necessary to predict detailed molecular interactions. The continuous advancement in GPU technology is critical for accelerating these intensive simulations, allowing researchers to explore longer timescales and larger systems than previously possible, directly improving the reliability of predictive modeling in drug binding studies.

Furthermore, the integration of Artificial Intelligence and Machine Learning represents the most disruptive technological shift. Technologies such as deep neural networks are applied to complex tasks like predicting ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity) properties, automating chemical synthesis planning, and performing rapid classification during virtual screening. Generative models, particularly Variational Autoencoders (VAEs) and Generative Adversarial Networks (GANs), are instrumental in de novo drug design, allowing the creation of entirely new chemical entities with optimized pharmacological profiles, rather than merely screening existing chemical libraries. This AI-driven synthesis of chemical novelty is rapidly changing the definition of what constitutes a feasible drug candidate.

Complementary technologies include advanced cheminformatics and bioinformatics tools, which manage and interpret the massive datasets generated by computational and high-throughput screening experiments. Specialized databases containing structural information (e.g., Protein Data Bank), chemical properties, and biological assay results are essential inputs for CADD models. Software platforms, often operating in a cloud environment, ensure seamless workflow integration, allowing for the centralized management of virtual screening campaigns, QSAR modeling, and collaborative drug design projects across geographically distributed research teams, thereby improving overall R&D efficiency and data security protocols.

Regional Highlights

The global CADD market exhibits distinct growth patterns across key geographic regions, heavily influenced by R&D expenditure, regulatory frameworks, and technological adoption rates.

- North America: Dominates the market share due to the highest concentration of leading pharmaceutical and biotechnology companies, significant governmental and private funding for drug discovery research (especially in the US), and early adoption of advanced AI/ML computational platforms. The region benefits from a robust ecosystem of specialized software vendors and major academic institutions pioneering computational chemistry research.

- Europe: Represents the second-largest market, characterized by strong governmental support for life science innovation in countries like the UK, Germany, and Switzerland. High investment in structural biology and a proactive approach to collaborative research between academia and industry drive market growth, focusing particularly on personalized medicine and advanced molecular dynamics simulations.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. Growth is fueled by the expansion of the pharmaceutical industry in China and India, increasing outsourcing of computational drug discovery services to regional CROs offering cost advantages, and rising government initiatives aimed at fostering domestic biotechnology innovation and research capacity.

- Latin America (LATAM): A nascent but growing market, primarily driven by increasing healthcare expenditure and efforts to modernize local pharmaceutical manufacturing capabilities. Adoption is slower but accelerating through partnerships with global software providers and increased focus on infectious disease research requiring computational modeling.

- Middle East and Africa (MEA): Currently holds the smallest share but shows potential, especially within established research hubs in the GCC countries (Saudi Arabia, UAE). Growth is tied to diversification efforts away from oil economies, leading to strategic investments in biotech and life science research infrastructure, often involving direct technology transfer and international collaborations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computer-Aided Drug Discovery Market.- Schrödinger, Inc.

- Dassault Systèmes (BIOVIA)

- Exscientia

- Insilico Medicine

- Certara

- ChemAxon

- Simulations Plus, Inc.

- Charles River Laboratories

- Evotec SE

- GVK Biosciences

- ArisGlobal

- BenchSci

- Atomwise

- Cyclica

- Deep Genomics

- Verge Genomics

- NuMedii

- Optibrium

- OpenEye Scientific Software (Cadence)

- Collaborative Drug Discovery

Frequently Asked Questions

Analyze common user questions about the Computer-Aided Drug Discovery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Computer-Aided Drug Discovery (CADD)?

CADD is primarily applied in lead identification, virtual screening of chemical libraries, lead optimization to improve efficacy and safety profiles, target validation, and predictive toxicology during the preclinical phase of drug development.

How is Artificial Intelligence (AI) transforming the CADD market?

AI, particularly Machine Learning and deep learning, accelerates drug discovery by improving predictive accuracy for ADMET properties, enabling generative design of novel molecules (de novo design), and significantly speeding up virtual screening and data analysis processes.

Which methodology—Structure-Based Drug Design (SBDD) or Ligand-Based Drug Design (LBDD)—is more utilized?

While SBDD is generally preferred when the high-resolution structure of the target protein is known, providing greater mechanistic insight, LBDD is heavily utilized for challenging targets where structural information is unavailable, relying instead on known active compounds.

What is the projected Compound Annual Growth Rate (CAGR) for the CADD Market?

The Computer-Aided Drug Discovery Market is projected to grow at a robust CAGR of 17.5% between 2026 and 2033, driven by increasing R&D investments and technological advancements in computational chemistry.

What are the major restraints affecting the growth of the CADD market?

Major restraints include the scarcity of highly trained computational biology professionals, the substantial initial infrastructure investment required for high-performance computing, and the inherent difficulty in accurately modeling complex, highly flexible biological systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager