Computer Assisted Anesthesia Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432598 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Computer Assisted Anesthesia Systems Market Size

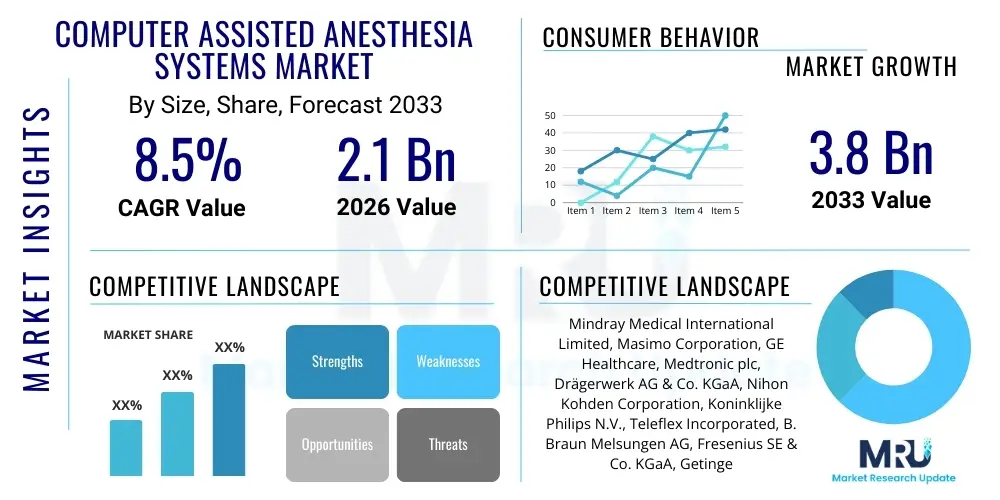

The Computer Assisted Anesthesia Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033. The robust growth trajectory is primarily attributed to the increasing emphasis on patient safety, the rising complexity of surgical procedures necessitating precision dosing, and the pervasive integration of advanced monitoring technologies that streamline anesthetic delivery.

Computer Assisted Anesthesia Systems Market introduction

The Computer Assisted Anesthesia Systems Market encompasses technologically advanced medical devices and software platforms designed to optimize the administration of anesthetic agents, integrating patient data, pharmacokinetic/pharmacodynamic (PK/PD) models, and automated infusion pumps. These systems significantly enhance precision by employing closed-loop delivery mechanisms, ensuring maintenance of specific target concentrations of anesthetic drugs in the patient's blood or effect site, thereby minimizing risks associated with human error and variability. The core product description includes advanced workstations, patient monitoring modules, sophisticated drug delivery mechanisms, and comprehensive data analysis software, all working synergistically to provide safe, individualized, and effective anesthesia during various medical procedures.

Major applications of these sophisticated systems span a wide range of clinical settings, including general surgery, cardiac procedures, neurosurgery, outpatient procedures, and interventional radiology. The primary benefits derived from the adoption of Computer Assisted Anesthesia Systems include superior patient outcomes, reduced intraoperative complications, faster recovery times, and substantial efficiency gains in operating room (OR) management. Furthermore, these systems facilitate the implementation of Total Intravenous Anesthesia (TIVA), a technique gaining popularity for its reduced environmental impact and enhanced patient satisfaction profiles, especially concerning post-operative nausea and vomiting (PONV).

The market is predominantly driven by compelling factors such as the escalating global burden of chronic diseases requiring surgical intervention, the continuous demand for non-invasive or minimally invasive surgical techniques, and significant technological advancements in sensor and computing capabilities that allow for real-time physiological response adjustment. Regulatory bodies are increasingly favoring technologies that demonstrate quantifiable improvements in patient safety and clinical workflow optimization, further propelling market adoption. Additionally, the shortage of highly specialized anesthesiologists in developing regions accelerates the need for automated and reliable anesthetic delivery tools, ensuring standardized high-quality care across diverse healthcare settings.

Computer Assisted Anesthesia Systems Market Executive Summary

The Computer Assisted Anesthesia Systems market is poised for significant expansion, driven primarily by favorable business trends centered around workflow automation, data integration capabilities, and the growing demand for precision medicine within perioperative care. Key business trends indicate a shift towards subscription-based software models (SaaS) and strategic partnerships between medical device manufacturers and AI/data analytics firms to enhance predictive modeling for patient stability during surgery. Regional trends highlight North America and Europe as established markets characterized by high technology penetration and strong reimbursement frameworks, while the Asia Pacific region is emerging as the fastest-growing segment, fueled by rapid infrastructural development, increasing healthcare expenditure, and a burgeoning medical tourism industry that demands advanced treatment options. Segment trends confirm that closed-loop anesthesia systems, offering autonomous drug titration based on real-time feedback, are expected to dominate the market share, followed closely by TIVA delivery systems, reflecting the clinical preference for multimodal pain management and avoidance of volatile agents.

AI Impact Analysis on Computer Assisted Anesthesia Systems Market

User queries regarding AI's impact on Computer Assisted Anesthesia Systems overwhelmingly focus on safety, autonomy, and the displacement of human expertise. Common questions revolve around the reliability of AI algorithms in managing patient variability, the ethical implications of autonomous decision-making in critical care scenarios, and the effectiveness of predictive analytics in preventing adverse events such as hypotension or hypoxic episodes. Users are deeply interested in how machine learning can improve the accuracy of PK/PD models to facilitate truly individualized drug dosing, moving beyond static population averages, and are keen to understand the regulatory pathway for fully autonomous systems. The consensus expectation is that AI will transform these systems from mere automation tools into sophisticated predictive co-pilots, significantly enhancing safety margins and reducing cognitive load on anesthesiologists, but robust validation data and regulatory clarity remain critical concerns for mass adoption.

- Enhanced Predictive Modeling: AI algorithms utilize historical and real-time patient data to forecast physiological instability (e.g., severe hypotension or changes in depth of anesthesia) minutes before conventional monitors detect them, allowing proactive intervention.

- Optimized Drug Titration: Machine learning refines closed-loop systems by adapting drug delivery parameters based on dynamic patient responses, minimizing anesthetic agent consumption and reducing recovery time.

- Clinical Decision Support (CDS): AI provides real-time recommendations to anesthesiologists concerning drug combinations, dosage adjustments, and fluid management strategies, acting as an intelligent safety layer.

- Workflow Automation and Documentation: AI streamlines chart documentation by automatically recording and analyzing intraoperative events, reducing administrative burden and improving data accuracy for quality assurance.

- Training and Simulation: Virtual reality and AI-driven simulators offer realistic training environments for anesthetists, allowing them to practice managing complex scenarios with personalized algorithmic feedback.

DRO & Impact Forces Of Computer Assisted Anesthesia Systems Market

The market landscape for Computer Assisted Anesthesia Systems is heavily influenced by a combination of strong drivers (D) focused on technological utility and patient outcomes, significant restraints (R) primarily related to cost and regulatory hurdles, and expansive opportunities (O) stemming from technological integration and market expansion into developing economies. The overarching impact forces dictate that while the need for precision and safety pushes adoption forward, high initial capital investment and complex interoperability requirements necessitate robust value propositions from manufacturers. The equilibrium between these forces is currently tilted toward growth, especially as healthcare systems worldwide prioritize long-term efficiency gains and demonstrable reductions in costly complications associated with sub-optimal manual anesthesia administration.

Drivers (D) are fundamentally rooted in the demonstrable clinical superiority and workflow enhancements provided by these systems. The rising prevalence of geriatric patients undergoing surgery, who require highly individualized and meticulously monitored anesthetic care, significantly boosts demand. Furthermore, regulatory mandates and institutional protocols increasingly encourage the adoption of technology that minimizes variance in medical practice, thereby improving overall quality metrics. The continuous evolution of wireless connectivity and sensor technology allows for seamless integration into existing hospital information systems (HIS) and electronic health records (EHR), maximizing data utility for research and quality improvement initiatives. The push for faster surgical throughput in ambulatory surgery centers (ASCs) also necessitates the efficiency provided by automated systems.

Restraints (R) primarily center on the substantial upfront investment required for purchasing and implementing these sophisticated units, which can be prohibitive for smaller healthcare facilities or those in budget-constrained markets. Concerns regarding system interoperability and compatibility with legacy monitoring equipment pose significant technical challenges during integration. Moreover, the steep learning curve and the necessity for specialized training for clinical staff to confidently operate and troubleshoot advanced closed-loop systems represent a substantial non-financial barrier to widespread adoption. Finally, stringent regulatory requirements, particularly in highly regulated markets like North America and Europe, necessitate lengthy and costly approval processes, slowing down the introduction of innovative, potentially autonomous systems.

Opportunities (O) are abundant, particularly in the realm of AI and data analytics integration, which promises to unlock the next generation of predictive, context-aware anesthetic delivery. The shift toward hybrid operating rooms and expansion of outpatient procedures creates new environments requiring portable and highly integrated anesthesia systems. Geographically, untapped markets in Asia Pacific and Latin America, characterized by rapid urbanization and improving access to advanced medical technology, represent massive potential growth areas. Furthermore, the development of specialized, low-cost computer-assisted systems tailored for specific procedural needs (e.g., obstetrics or dentistry) expands the total addressable market beyond traditional general surgery settings, fostering innovation in specialized pain management modalities.

Segmentation Analysis

The Computer Assisted Anesthesia Systems Market is meticulously segmented based on components, applications, end-users, and technology types, reflecting the diversity and complexity of product offerings tailored to various clinical needs and operational environments. Understanding these segmentation nuances is crucial for strategic planning, as distinct market dynamics drive adoption across different product categories. For instance, the market is currently seeing strong growth in the software and services segment, outpacing hardware sales, due to the continuous requirement for algorithmic updates, enhanced cybersecurity features, and remote monitoring capabilities.

The core segmentation differentiates products based on the level of automation achieved, ranging from advanced infusion pumps guided by computerized protocols to fully closed-loop systems that automatically adjust drug delivery based on real-time physiological feedback. Application-wise, general surgery remains the largest revenue generator, but the interventional cardiology and specialized pain management segments are experiencing the highest growth rates, driven by the increasing volume of minimally invasive procedures conducted under monitored anesthesia care (MAC). Geographically, segmentation highlights disparities in technological maturity and spending power, dictating the preference for high-end closed-loop systems in developed countries versus cost-effective, semi-automated systems in emerging markets.

- By Component:

- Hardware (Anesthesia Workstations, Advanced Delivery Modules, Integrated Patient Monitors, Sensors)

- Software (PK/PD Modeling Software, Clinical Decision Support Systems, Data Analytics Platforms, Electronic Anesthesia Record Systems)

- Services (Implementation, Training, Maintenance, Software Updates, Technical Support)

- By Technology:

- Closed-Loop Anesthesia Systems (CLAS) (Target Controlled Infusion (TCI), Adaptive Control Systems)

- Semi-Automated Anesthesia Systems (Protocol-Guided Systems)

- Smart Anesthesia Monitoring Systems

- By Application:

- General Surgery

- Cardiovascular Procedures

- Neurosurgery

- Orthopedic Surgery

- Dental Procedures

- Outpatient & Ambulatory Care

- By End-User:

- Hospitals (Large Hospitals, Mid-sized Hospitals)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Academic & Research Institutes

Value Chain Analysis For Computer Assisted Anesthesia Systems Market

The value chain for Computer Assisted Anesthesia Systems is highly complex, beginning with intensive upstream research and development, transitioning through precision manufacturing, and culminating in intricate distribution and post-sale service delivery. Upstream activities are dominated by specialized technology providers, including sensor manufacturers, embedded software developers, and pharmaceutical companies providing pharmacokinetic data for modeling. The initial phase is characterized by high intellectual property investment and rigorous regulatory compliance checks, focusing on creating safe and reliable control algorithms and high-fidelity monitoring sensors capable of real-time data acquisition and transmission, which forms the bedrock of system accuracy.

The core manufacturing stage involves the assembly of complex mechanical and electronic components into integrated workstations. Distribution channels are typically segmented into direct sales for large hospital groups, allowing for tailored installation and long-term service contracts, and indirect channels relying on specialized medical equipment distributors who provide local market access, technical support, and logistical expertise, particularly in fragmented or geographically dispersed markets. Quality control and supply chain integrity are paramount in this stage due to the critical nature of the medical devices involved, necessitating strict adherence to global medical device manufacturing standards (e.g., ISO 13485). Post-sale support, including mandatory software updates and calibration services, constitutes a significant recurring revenue stream and a vital element of maintaining device functionality and compliance.

Downstream analysis reveals that end-users—primarily large hospitals and major ASCs—are highly influential in product design, often providing feedback that dictates iterative system improvements, especially concerning user interface and interoperability with existing hospital IT infrastructure. Direct distribution ensures closer manufacturer-end-user relationships, facilitating complex customization and maximizing training efficiency. Indirect distribution allows manufacturers to leverage established local networks, speeding market penetration. The trend toward cloud-based software updates and remote diagnostics is optimizing the service component of the value chain, reducing downtime and improving the lifecycle management of these high-value capital assets, thereby creating a more efficient service delivery model.

Computer Assisted Anesthesia Systems Market Potential Customers

The primary and most lucrative potential customers for Computer Assisted Anesthesia Systems are large tertiary and quaternary care hospitals globally, particularly those with high surgical volumes across specialized fields such as cardiac, neuro, and transplant surgery. These institutions prioritize cutting-edge technology to maintain their reputation for clinical excellence, attract top surgical talent, and manage complex, high-risk patient populations where precision in anesthetic delivery is non-negotiable. Furthermore, these large hospital systems often have the necessary capital expenditure budgets, sophisticated IT infrastructure to support data integration, and in-house biomedical engineering teams capable of managing complex equipment maintenance schedules, making them ideal early and mass adopters of advanced systems.

A rapidly growing segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics. Driven by the shift of numerous procedures from inpatient to outpatient settings to reduce costs and improve patient convenience, ASCs require compact, highly efficient, and reliable anesthesia systems that facilitate fast turnover times. While ASCs may favor smaller, semi-automated or portable systems over the full-scale integrated workstations preferred by large hospitals, their high procedure volume and focus on efficiency make them key targets for manufacturers offering cost-effective and easy-to-use platforms. Manufacturers are increasingly developing modular and scalable solutions specifically designed to meet the space and budget constraints inherent in the ambulatory care environment.

Beyond traditional acute care settings, academic and research institutes represent another crucial customer segment. These institutions utilize Computer Assisted Anesthesia Systems not only for clinical care but also as essential tools for pharmacology research, clinical trials investigating novel anesthetic agents, and comprehensive medical education. Their procurement decisions are often influenced by the system's data acquisition capabilities, flexibility for research protocol adjustments, and ability to seamlessly integrate with advanced patient simulation equipment for teaching purposes. Sales to this segment, while perhaps lower in volume compared to major hospital groups, offer significant long-term influence by shaping future clinical standards and training the next generation of anesthesiology professionals on proprietary equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mindray Medical International Limited, Masimo Corporation, GE Healthcare, Medtronic plc, Drägerwerk AG & Co. KGaA, Nihon Kohden Corporation, Koninklijke Philips N.V., Teleflex Incorporated, B. Braun Melsungen AG, Fresenius SE & Co. KGaA, Getinge AB, ICU Medical, Inc., Sedana Medical AB, Shenzhen Comen Medical Instruments Co., Ltd., Penlon Ltd., Heyer Medical AG, Spacelabs Healthcare, Inc., Becton, Dickinson and Company (BD), Schiller AG, SunMed LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computer Assisted Anesthesia Systems Market Key Technology Landscape

The technology landscape of the Computer Assisted Anesthesia Systems market is defined by sophisticated integration across hardware, software, and data analytics, moving well beyond simple automated drug delivery toward true physiological responsiveness. The critical innovation lies in the evolution of closed-loop systems, which utilize advanced control algorithms, often based on proportional-integral-derivative (PID) controllers or fuzzy logic, to maintain a specific target level of anesthetic effect (measured via parameters like Bispectral Index – BIS) by automatically adjusting the infusion rate. This real-time feedback mechanism significantly enhances titration accuracy compared to traditional open-loop systems, leading to more stable depths of anesthesia and minimizing periods of awareness or excessive drug administration. Furthermore, the convergence of sophisticated monitors with the drug delivery unit ensures that the system acts as a single, coherent unit, dramatically reducing the risk of communication failure between separate devices.

A significant technological development is the pervasive adoption of Total Intravenous Anesthesia (TIVA) techniques facilitated by Target Controlled Infusion (TCI) pumps. TCI systems, powered by validated pharmacokinetic/pharmacodynamic models (e.g., Marsh or Schnider models for propofol), allow the clinician to input a desired drug concentration (Cpt or Ce) and the pump calculates and delivers the necessary dose to achieve that target, accounting for patient demographics such as age, weight, and gender. The integration of modern anesthesia workstations with high-definition capnography, spirometry, and multi-gas analysis capabilities ensures comprehensive respiratory monitoring, crucial for patient safety during both general and monitored anesthesia care. Wireless connectivity and secure cloud computing platforms are now standard, enabling remote monitoring, predictive maintenance, and streamlined integration with hospital EHRs, transforming raw physiological data into actionable clinical insights instantly.

The future technology trajectory is heavily invested in Artificial Intelligence and machine learning to create truly adaptive systems that learn from individual patient responses over time. The development of next-generation sensors capable of non-invasively monitoring critical physiological markers, such as continuous cardiac output or deep sedation levels, will further refine the inputs for closed-loop control. Emphasis is also placed on cybersecurity resilience, ensuring that interconnected systems are protected against malicious attacks, which is crucial as more critical functions rely on network connectivity. Finally, miniaturization and modular design are driving innovation, creating highly portable, battery-operated systems that retain the complexity and precision of large workstations, catering to the growing demand from military field hospitals, low-resource settings, and specialized office-based surgery centers requiring uncompromising safety standards.

Regional Highlights

- North America (United States and Canada): North America dominates the global market, primarily due to high healthcare expenditure, the presence of major key market players, robust reimbursement policies that favor advanced technology adoption, and a strong regulatory environment (FDA clearance) that mandates high safety standards. The U.S. market is characterized by a high volume of complex surgical procedures and a rapid uptake of AI-enabled predictive anesthesia systems within large integrated delivery networks (IDNs). Demand here is focused on highly integrated, data-rich closed-loop systems and TIVA solutions, reflecting the region's focus on reducing operative errors and improving patient recovery profiles.

- Europe (Germany, UK, France, Italy): Europe represents the second-largest market, marked by stringent medical device regulations (MDR) and a high degree of technological maturity, particularly in Western European nations like Germany and the Scandinavian countries. Market growth is spurred by government initiatives to digitize healthcare (e.g., eHealth policies) and a growing elderly population requiring frequent surgical interventions. The emphasis in Europe often lies on cost-effectiveness alongside clinical efficacy, leading to strong adoption of reputable European manufacturers' products and a steady shift towards standardized, protocol-driven semi-automated systems across public healthcare systems.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is projected to be the fastest-growing region during the forecast period. This rapid growth is fueled by significant investments in healthcare infrastructure development, particularly in emerging economies like India and China, increasing disposable incomes, and the expansion of medical tourism requiring world-class perioperative care. While Japan and South Korea are mature markets demanding sophisticated, high-end closed-loop systems, the vast market of China and India presents substantial opportunities for manufacturers offering scalable, moderately priced computer-assisted infusion devices that address high patient volumes and improving quality standards.

- Latin America (LATAM) (Brazil, Mexico): The Latin American market exhibits moderate growth, driven by increasing awareness regarding anesthesia safety, ongoing modernization of public and private hospitals, and rising demand for specialized surgical services. However, market adoption is often constrained by fluctuating economic conditions, limited capital investment budgets in some public sector hospitals, and challenges in establishing consistent technical support and training infrastructure. The region favors solutions that offer a strong balance between advanced functionality and long-term operational affordability, often relying on imported European and North American technologies.

- Middle East and Africa (MEA): The MEA market shows promising growth, concentrated primarily in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar) due to substantial government investments in establishing world-class medical cities and specialized healthcare centers. These highly capitalized markets prioritize the latest closed-loop and TIVA technologies to benchmark their services against global standards. Conversely, adoption in many parts of Africa remains nascent, limited by infrastructure constraints and affordability issues, suggesting that basic monitoring and semi-automated portable systems will see initial traction, supported by humanitarian and global health initiatives focused on essential surgical care improvement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computer Assisted Anesthesia Systems Market.- GE Healthcare

- Medtronic plc

- Drägerwerk AG & Co. KGaA

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Masimo Corporation

- Nihon Kohden Corporation

- B. Braun Melsungen AG

- Teleflex Incorporated

- Fresenius SE & Co. KGaA

- Getinge AB

- ICU Medical, Inc.

- Schiller AG

- Penlon Ltd.

- Becton, Dickinson and Company (BD)

- Shenzhen Comen Medical Instruments Co., Ltd.

- Spacelabs Healthcare, Inc.

- Sedana Medical AB

- Smiths Medical (a part of ICU Medical)

- Haplo Sciences, Inc.

Frequently Asked Questions

Analyze common user questions about the Computer Assisted Anesthesia Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Closed-Loop Anesthesia System (CLAS) and how does it improve patient safety?

A Closed-Loop Anesthesia System (CLAS) is a sophisticated device that autonomously monitors patient physiological parameters (such as the depth of anesthesia via BIS or entropy), compares them to a user-defined target, and automatically adjusts the delivery rate of anesthetic agents (infusion pumps or vaporizers) in real time. This automated feedback mechanism ensures highly stable anesthetic concentrations, minimizes over- or under-dosing, and significantly reduces the incidence of critical events like hypotension or intraoperative awareness, thus enhancing overall patient safety and outcome quality.

How is AI integrating into Computer Assisted Anesthesia Systems?

AI is primarily integrated through advanced predictive analytics and enhanced clinical decision support (CDS) tools. AI algorithms process massive amounts of patient data to create highly accurate pharmacokinetic/pharmacodynamic models, allowing for individualized drug dosing that goes beyond standard population models. This integration enables the system to forecast potential adverse events, such as acute drops in blood pressure, minutes before traditional monitoring alerts, facilitating proactive intervention by the anesthesiologist and optimizing perioperative management protocols.

What are the primary barriers to adoption of advanced Computer Assisted Anesthesia Systems in hospitals?

The main barriers to widespread adoption include the high initial capital expenditure required for purchasing fully integrated workstations and specialized software licenses. Furthermore, seamless interoperability with legacy electronic health record (EHR) systems and existing monitoring infrastructure presents technical challenges. Finally, the need for comprehensive, specialized training for anesthesia providers and support staff to effectively operate and maintain these complex, algorithm-driven systems represents a significant non-financial constraint.

Which end-user segment drives the highest growth in the Computer Assisted Anesthesia Systems Market?

While large hospitals remain the largest volume purchaser, the Ambulatory Surgical Centers (ASCs) segment is currently driving the highest percentage growth. This acceleration is due to the increasing volume of non-invasive procedures being performed outside traditional inpatient settings, necessitating efficient, reliable, and often portable computer-assisted systems to maximize throughput, ensure rapid recovery, and maintain high standards of patient safety in a cost-conscious environment.

What is the regulatory outlook for highly autonomous anesthesia systems?

The regulatory outlook for highly autonomous or 'self-driving' anesthesia systems is cautious but progressing. Agencies like the FDA require extensive clinical trials and robust evidence demonstrating superior safety and efficacy compared to human-administered anesthesia. Current systems operate under a supervised autonomy model, requiring clinician oversight. Future regulatory approval depends on manufacturers demonstrating impeccable system reliability, clear safety parameters, and standardized protocols for human intervention, alongside meticulous cybersecurity compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager