Computer Hardware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432146 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Computer Hardware Market Size

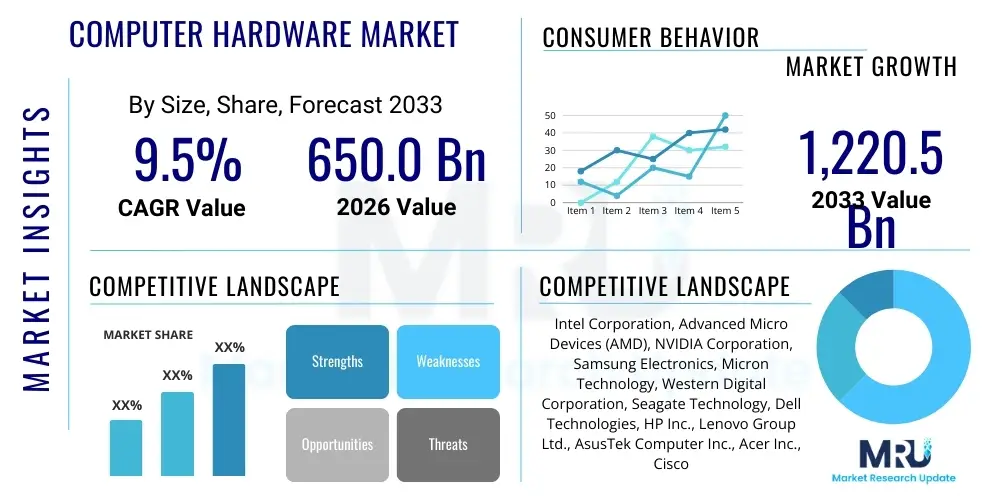

The Computer Hardware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 650.0 Billion in 2026 and is projected to reach USD 1,220.5 Billion by the end of the forecast period in 2033.

Computer Hardware Market introduction

The Computer Hardware Market encompasses all physical components essential for computer functions, ranging from core processing units (CPUs and GPUs) and memory (RAM, ROM) to storage devices (SSDs, HDDs) and crucial peripherals (monitors, input devices). This broad scope ensures its foundational role in the global digital infrastructure, powering everything from personal computing and mobile devices to massive enterprise data centers and specialized industrial systems. Rapid advancements in semiconductor fabrication, coupled with the increasing demand for high-performance computing (HPC), are primary product drivers, necessitating continuous innovation in component design, power efficiency, and integration capabilities to handle increasingly complex computational loads associated with AI and big data.

Major applications of computer hardware span across consumer electronics, corporate infrastructure, telecommunications, healthcare, and automotive sectors. The core benefit derived from advanced hardware lies in enabling faster processing speeds, greater data throughput, and enhanced reliability, which directly translates into improved operational efficiency and capabilities for end-users. For instance, the deployment of new generation server hardware allows corporations to manage complex cloud environments and perform sophisticated analytics in real-time. The constant refresh cycle, driven by the need for compliance with new software standards and energy efficiency mandates, maintains a high level of market activity and investment.

Key driving factors accelerating the market include global digital transformation initiatives, the proliferation of Internet of Things (IoT) devices necessitating embedded hardware, and the monumental expansion of cloud computing platforms requiring constant data center upgrades. Furthermore, the global shift towards remote work and hybrid education models has sustained robust demand for personal computers and high-performance networking equipment. These macro-environmental forces ensure that the computer hardware sector remains at the heart of technological evolution, constantly adapting to support emerging technologies like 5G, edge computing, and artificial intelligence frameworks which demand specialized and powerful silicon.

Computer Hardware Market Executive Summary

The Computer Hardware Market is characterized by intense technological competition and strategic consolidation, reflecting a significant shift towards specialized, high-margin components optimized for artificial intelligence and data center operations. Current business trends indicate a strong prioritization of resilient supply chains, driven by recent geopolitical instability and pandemic-related disruptions, leading major manufacturers to diversify production geographical locations and increase vertical integration where feasible. Furthermore, sustainability is becoming a key metric, with enterprise buyers increasingly favoring hardware components that demonstrate superior energy efficiency and adhere to circular economy principles, impacting product design and material selection across the industry value chain.

Regionally, the market growth is predominantly spearheaded by the Asia Pacific (APAC) region, largely fueled by aggressive government investments in digital infrastructure, the rapid expansion of hyperscale data centers in China and India, and high volume manufacturing capabilities, particularly in Taiwan and South Korea for advanced semiconductors. North America and Europe maintain their dominance in high-value, specialized segments such as high-end graphics processing units (GPUs) and sophisticated server components, driven by strong enterprise spending on cloud migration and R&D activities. The proliferation of localized data processing needs associated with edge computing is beginning to decentralize demand, fostering emerging regional hubs for component assembly and distribution, particularly in Southeast Asia and Latin America.

Segment trends highlight the exceptional growth trajectory of the specialized hardware segment, particularly specialized processors (accelerators, NPUs, TPUs) tailored for AI workloads, often surpassing the growth rates of traditional general-purpose components. Storage solutions are also undergoing a significant transition, moving almost entirely towards Solid State Drives (SSDs) in both consumer and enterprise applications due to their speed, reliability, and increasingly competitive price points. While peripheral segments remain stable, the high-performance computing (HPC) and server components segment continues to be the primary revenue generator, underpinned by continuous infrastructure modernization efforts undertaken by major cloud service providers (CSPs) and large corporate entities globally.

AI Impact Analysis on Computer Hardware Market

Common user questions regarding AI's impact on the Computer Hardware Market frequently center on the necessary specialized components for training large language models (LLMs), the future relevance of traditional CPUs versus specialized accelerators like GPUs and NPUs, and the long-term sustainability of current hardware supply chains to meet exponentially rising AI computation demands. Users are keenly interested in understanding which chip architectures will dominate the next generation of AI development and how the performance-per-watt metric will evolve as computational requirements escalate. Key concerns also revolve around the democratization of AI hardware, specifically, how smaller companies can access affordable and powerful enough processing power without relying solely on large hyperscalers. Consequently, the key themes summarizing user expectations are the inevitable shift towards purpose-built AI silicon, the necessity for robust thermal management solutions, and the critical role of advanced packaging technologies to maximize interconnectivity and throughput in AI clusters.

The integration of artificial intelligence is fundamentally redefining the architectural requirements of computer hardware, moving processing from general-purpose CPUs to specialized accelerators designed for parallel processing, such as highly optimized GPUs and specialized ASICs (Application-Specific Integrated Circuits). This shift necessitates massive increases in memory bandwidth and high-speed interconnects (e.g., NVLink, CXL) to ensure that the processors are continuously fed with data during intensive training and inference tasks. The demand for these components, especially in hyperscale data centers and emerging edge environments, is creating unprecedented revenue opportunities for companies capable of producing high-density, low-latency AI chips and integrated systems.

Furthermore, the drive for efficient AI implementation at the edge—in autonomous vehicles, smart manufacturing, and IoT devices—is stimulating the market for Neural Processing Units (NPUs) embedded directly into consumer and industrial devices. These NPUs handle localized AI inference tasks efficiently, reducing reliance on cloud connectivity and significantly lowering latency. This hardware evolution dictates that future computer systems must be inherently heterogeneous, featuring a mix of optimized compute engines managed by sophisticated software layers. This complex interplay between hardware specialization and software orchestration is the defining characteristic of the AI-driven computer hardware landscape, requiring continuous investment in advanced semiconductor manufacturing processes, particularly in sub-5nm lithography.

- Exponential growth in demand for High-Performance GPUs and custom ASICs (e.g., TPUs) for large-scale AI model training.

- Increased focus on Memory Bandwidth and High-Speed Interconnects (HBM, CXL) to mitigate data transfer bottlenecks in AI workloads.

- Proliferation of dedicated Neural Processing Units (NPUs) integrated into consumer devices and edge infrastructure for efficient AI inference.

- Requirement for advanced cooling solutions (liquid cooling) in data centers to manage the extreme heat generated by dense AI computing clusters.

- Shift in procurement strategy towards purpose-built, highly parallelized silicon over traditional general-purpose CPUs for computationally intensive tasks.

- Stimulation of the semiconductor industry to develop advanced packaging technologies (e.g., chiplets) to integrate diverse components (logic, memory, interconnects) into a unified system.

- Expansion of the market for specialized AI software frameworks optimized for specific hardware architectures, driving co-design strategies between hardware and software vendors.

DRO & Impact Forces Of Computer Hardware Market

The dynamics of the Computer Hardware Market are shaped by powerful forces categorized as Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive and non-negotiable global commitment to digital transformation, compelling organizations across all sectors to continually upgrade their computing infrastructure to remain competitive and compliant with modern data management standards. This is complemented by the exponential growth of data generated by billions of IoT devices and the necessity for sophisticated real-time processing capabilities, particularly for emerging technologies like 5G and autonomous systems. However, these drivers are counterbalanced by significant restraints, chiefly concerning the extreme volatility and fragility of the global semiconductor supply chain, compounded by soaring geopolitical tensions that impact raw material access and manufacturing capacity distribution.

Impact forces within this market are substantial and multi-directional. Technologically, the shift towards smaller lithography nodes (sub-5nm) imposes enormous capital expenditure burdens on foundries, creating high barriers to entry and concentrating manufacturing power, which in turn influences pricing and availability across the entire hardware ecosystem. Economically, inflation and recessionary fears can suppress consumer spending on peripherals and personal computing devices, although enterprise demand often remains robust due to long-term digital strategies. Environmentally, the growing pressure for sustainable manufacturing and the management of electronic waste (e-waste) are forcing innovation in material sciences and product lifespan extension, transforming hardware design from a performance-only focus to a performance-and-sustainability imperative.

Opportunities in this space are highly lucrative and centered around specialized computing niches. The most prominent opportunity lies in the rapid development of edge computing infrastructure, which requires rugged, low-power, yet high-performance hardware components designed for decentralized deployment outside traditional data centers. Furthermore, the burgeoning fields of quantum computing and neuromorphic computing present long-term strategic opportunities for companies that invest early in radically different processing paradigms, promising performance leaps far beyond conventional silicon architectures. Capitalizing on these specialized needs, particularly through modular designs and customized silicon, will define market leadership over the forecast period, helping to offset the structural challenges posed by supply chain constraints and escalating R&D costs.

Segmentation Analysis

The Computer Hardware Market is rigorously segmented based on component type, end-use application, and architectural requirements, allowing for a granular understanding of demand trends and technological prioritization. Component segmentation details the revenue generation streams from core processing units (CPUs, GPUs), memory modules (DRAM, Flash), and diverse storage solutions (HDD, SSD), highlighting the dominance of high-performance logic units due to AI acceleration needs. Application segmentation clearly delineates consumer-focused sales (laptops, gaming PCs) from high-value enterprise and industrial applications (data centers, HPC clusters, rugged systems), where performance, reliability, and security are the primary procurement criteria. This structural breakdown helps vendors tailor their product development roadmaps and sales strategies to capture growth pockets in both mature and nascent technology adoption areas.

- By Component:

- Processors (CPUs, GPUs, Specialized Accelerators/ASICs)

- Memory (DRAM, SRAM, NAND Flash, HBM)

- Storage Devices (SSD, HDD, Hybrid Arrays)

- Peripherals & Input Devices (Monitors, Keyboards, Mice)

- Networking Hardware (Routers, Switches, NICs)

- Motherboards & Chipsets

- By Type:

- Standard Computing Hardware (PCs, Laptops, Servers)

- Specialized & High-Performance Hardware (HPC Systems, AI Servers, Quantum Computing Hardware)

- Embedded Hardware (IoT, Industrial Control Systems)

- By Application/End-User:

- Enterprise & Data Center

- Consumer Electronics

- Industrial Automation

- Healthcare

- Government & Defense

- Telecommunications

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Computer Hardware Market

The value chain of the Computer Hardware Market is complex, beginning with upstream activities dominated by specialized raw material providers (silicon wafers, rare earth minerals) and highly capital-intensive semiconductor foundries (TSMC, Samsung Foundry) which handle the critical step of fabrication and lithography. Upstream analysis focuses on securing high-quality materials and managing the intricate supply agreements for leading-edge process technologies, which often dictates the final product's performance ceiling and market availability. Strategic sourcing and inventory management at this stage are crucial, particularly given the extended lead times and concentration of intellectual property among a few key suppliers globally. The intense R&D investment required for chip design (IP holders like ARM, Intel, AMD, NVIDIA) forms the technological backbone of the entire chain.

Midstream activities involve the assembly, packaging, and testing of components, often executed by Outsourced Semiconductor Assembly and Test (OSAT) providers, followed by the manufacturing of complete systems (e.g., motherboards, graphics cards, integrated servers). The efficiency of this stage hinges on rapid prototyping, rigorous quality control, and efficient global logistics to move components between various manufacturing hubs, predominantly located in East Asia. Component manufacturers, such as memory and storage producers (Micron, Samsung), convert raw chips into usable modules. These midstream firms must maintain flexibility to adapt to shifting demand signals from original equipment manufacturers (OEMs).

Downstream activities center on distribution, sales, and post-sale support. Products reach end-users through diverse distribution channels, including direct sales from major OEMs (Dell, HP) to large enterprises, indirect distribution via global retailers (Amazon, Best Buy), and specialized channel partners or system integrators who customize solutions for specific industrial needs. The distinction between direct and indirect sales is pronounced: large data center operators typically utilize direct procurement for custom server rack configurations, leveraging economies of scale and direct technical support, while the consumer segment relies heavily on indirect retail channels. Effective downstream management involves maintaining extensive service networks and managing software compatibility, ensuring the final hardware deployment is seamless and scalable for the end-user.

Computer Hardware Market Potential Customers

Potential customers for the Computer Hardware Market span virtually every sector of the global economy, broadly categorized into Enterprise/Business, Consumer, and Government/Public sectors, each with distinct requirements and procurement cycles. Large enterprises, including hyperscale cloud service providers (CSPs like AWS, Azure, Google Cloud) and financial institutions, are the dominant high-volume buyers, focused on high-performance, resilient server, storage, and networking hardware necessary to sustain their expansive cloud infrastructure and mission-critical applications. These buyers prioritize total cost of ownership (TCO), energy efficiency, and high Mean Time Between Failures (MTBF) statistics, often demanding customized component specifications.

The consumer segment represents a volatile but high-volume market, driven by discretionary income and the continuous refresh cycle of personal devices such as laptops, gaming PCs, smartphones (through embedded chip purchases), and smart home devices. Key drivers here include performance for gaming, portability, and aesthetic design, alongside affordability. The emergence of hybrid work and remote education models has sustained robust demand for high-quality peripherals and powerful personal computing rigs capable of handling complex multimedia tasks and videoconferencing requirements efficiently, often prioritizing integrated AI capabilities (NPUs) for enhanced user experiences.

Industrial, healthcare, and governmental sectors constitute highly specialized markets, demanding ruggedized, certified, and long-lifecycle hardware components. Industrial customers require embedded systems resistant to extreme temperatures and vibrations for automation and manufacturing. Healthcare mandates high-reliability hardware for medical imaging and patient data storage, adhering to strict regulatory standards like HIPAA. Government and defense clients demand highly secure and often custom-designed systems, prioritizing supply chain security and specialized communication capabilities, representing a high-value, albeit constrained, procurement stream focusing on domestic or trusted manufacturing sources.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Billion |

| Market Forecast in 2033 | USD 1,220.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intel Corporation, Advanced Micro Devices (AMD), NVIDIA Corporation, Samsung Electronics, Micron Technology, Western Digital Corporation, Seagate Technology, Dell Technologies, HP Inc., Lenovo Group Ltd., AsusTek Computer Inc., Acer Inc., Cisco Systems, International Business Machines (IBM), Qualcomm Technologies, Broadcom Inc., Taiwan Semiconductor Manufacturing Company (TSMC), SK Hynix, Fujitsu, Huawei Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computer Hardware Market Key Technology Landscape

The core of the Computer Hardware Market's technological landscape is defined by continuous breakthroughs in semiconductor manufacturing, particularly the push towards smaller process nodes (e.g., 3nm and 2nm lithography) which enhances transistor density, power efficiency, and overall chip performance. This advancement is critical for meeting the compute demands of modern software and hyperscale infrastructure. Concurrently, the rise of chiplet architecture, enabled by advanced packaging technologies like 2.5D and 3D stacking (e.g., heterogeneous integration), is becoming a standard practice. Chiplets allow designers to integrate multiple specialized dies (logic, memory, I/O) onto a single package, bypassing the yield challenges of massive monolithic chips and enabling customized, cost-effective high-performance computing solutions tailored for specific workloads like AI training or massive data analytics, significantly reducing latency and increasing bandwidth within the system.

Another crucial technological development is the deployment of high-speed interconnect standards and memory technologies designed to alleviate the "memory wall" bottleneck. Technologies such as Compute Express Link (CXL) are vital, offering cache-coherent communication between CPUs, GPUs, and specialized accelerators, enabling resource pooling and memory expansion within data center environments, drastically improving utilization and reducing system overhead. Similarly, High Bandwidth Memory (HBM) is increasingly adopted for AI accelerators and high-end GPUs, providing vastly superior memory throughput compared to traditional DDR technologies, which is essential for handling the large datasets characteristic of deep learning models. These interconnect and memory innovations are transforming server architecture from fixed, siloed components into flexible, composable infrastructure.

Furthermore, innovations in thermal management and power delivery are gaining prominence, transitioning from air cooling to advanced liquid cooling solutions (direct-to-chip or immersion cooling) within densely packed server racks to maintain optimal performance levels for increasingly powerful processors. Security hardware is also becoming a standard feature, with technologies like Trusted Platform Modules (TPMs) and secure enclaves integrated directly into silicon, addressing growing concerns about firmware attacks and data integrity. This holistic approach, encompassing core processing power, high-speed data movement, energy efficiency, and inherent security, defines the cutting-edge technological requirements across the modern computer hardware spectrum, driving massive R&D spending by market leaders to secure intellectual property advantages in these interconnected domains.

Regional Highlights

Regional dynamics within the Computer Hardware Market are heavily influenced by the concentration of manufacturing capabilities, technological adoption rates, and governmental investments in digital infrastructure, leading to divergent growth profiles across continents.

- Asia Pacific (APAC): This region is the undisputed global hub for both manufacturing and consumption. It hosts major semiconductor foundries (Taiwan, South Korea) and assembly facilities (China, Vietnam), controlling a significant portion of the global supply chain. Demand is soaring, driven by massive data center construction, high rates of consumer electronics adoption, and rapid urbanization fueling IT infrastructure upgrades in emerging economies like India and Indonesia. APAC's dominance in 5G deployment and smart city initiatives further cements its leading role in hardware consumption and innovation.

- North America: Defined by early and aggressive adoption of advanced technologies, North America leads the market in high-value segments, particularly specialized AI hardware, hyperscale cloud infrastructure, and sophisticated enterprise computing. The region is home to the largest cloud service providers (CSPs) and leading technology innovators (Intel, NVIDIA, AMD), ensuring continuous high investment in server and high-performance computing components. Emphasis is placed on performance, energy efficiency, and advanced interconnect technologies (CXL).

- Europe: Growth is primarily driven by regulatory requirements (e.g., GDPR necessitating localized data centers) and strategic governmental support for digital sovereignty initiatives. Europe shows strong demand for industrial automation hardware, embedded systems, and sustainable, energy-efficient server solutions. While not a primary manufacturing hub for leading-edge semiconductors, it remains a critical market for high-quality enterprise and industrial hardware integration, particularly in Germany, the UK, and Nordic countries focusing on green data centers.

- Latin America (LATAM): This region is characterized by accelerating digitalization, driven by expanding internet access and a growing mobile-first consumer base. Demand is centered on networking hardware, entry-level to mid-range personal computing devices, and the foundational buildup of localized cloud infrastructure, particularly in major economies like Brazil and Mexico. The market is increasingly attracting investment from global data center operators looking to expand regional reach.

- Middle East and Africa (MEA): Growth is tied to ambitious national digitalization agendas (e.g., Saudi Vision 2030, UAE's smart initiatives) and robust investments in telecommunications infrastructure, especially 5G and fiber optics. This drives significant procurement of networking hardware and enterprise-level server solutions for new smart cities and governmental data facilities. The MEA market is marked by high-value, large-scale projects, often requiring customized, secure hardware solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computer Hardware Market.- Intel Corporation

- Advanced Micro Devices (AMD)

- NVIDIA Corporation

- Samsung Electronics Co., Ltd.

- Micron Technology, Inc.

- Western Digital Corporation

- Seagate Technology Holdings plc

- Dell Technologies Inc.

- HP Inc.

- Lenovo Group Ltd.

- AsusTek Computer Inc.

- Acer Inc.

- Cisco Systems, Inc.

- International Business Machines (IBM)

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- SK Hynix Inc.

- Applied Materials, Inc.

- NetApp, Inc.

Frequently Asked Questions

Analyze common user questions about the Computer Hardware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of current growth in the Computer Hardware Market?

The foremost growth driver is the unprecedented global demand for high-performance specialized hardware required for Artificial Intelligence (AI) training, inference, and the continuous expansion of hyperscale cloud data centers that underpin modern digital economies.

How is the rise of edge computing impacting computer hardware design?

Edge computing necessitates the development of specialized hardware components that are highly power-efficient, ruggedized for non-data center environments, and feature integrated, localized processing capabilities (such as NPUs) to minimize latency and reliance on constant cloud connectivity.

Which component segment is experiencing the fastest technological evolution?

The processor segment, specifically Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs) designed for acceleration, is experiencing the fastest technological evolution due to the intense performance requirements of machine learning and deep neural network models.

What are the main risks associated with the computer hardware supply chain?

Key risks include extreme concentration of leading-edge semiconductor manufacturing capacity in specific geographic regions, geopolitical tensions affecting material flow, and the high capital intensity required for process node transitions, leading to potential supply bottlenecks and price volatility.

What role does sustainability play in hardware procurement today?

Sustainability is a critical factor, driving enterprise buyers to prioritize hardware components with superior energy efficiency (performance per watt), reduced material consumption, and extended operational lifecycles, often necessitating advanced cooling and material recovery practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager