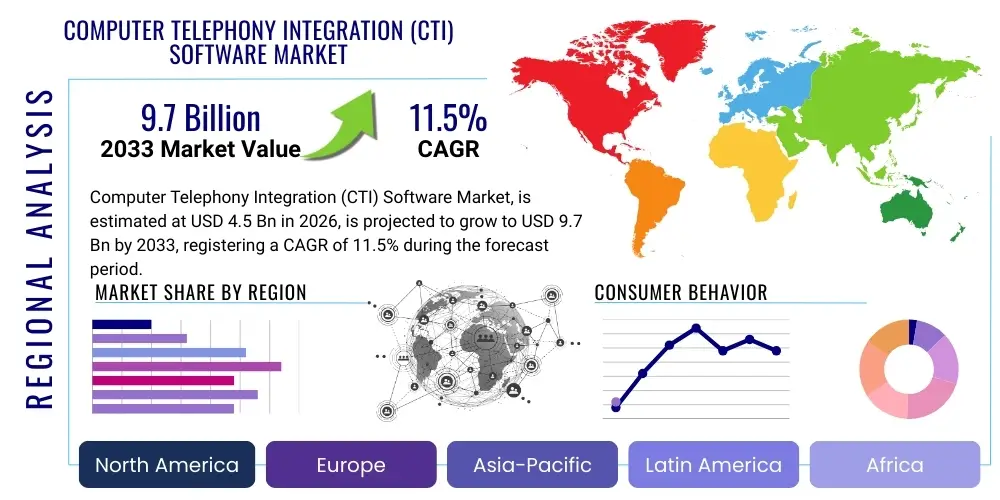

Computer Telephony Integration (CTI) Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438213 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Computer Telephony Integration (CTI) Software Market Size

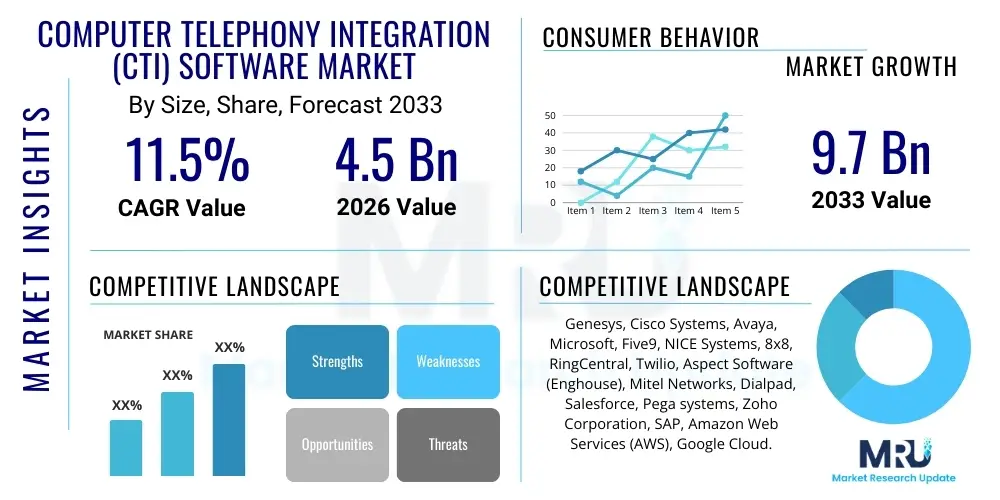

The Computer Telephony Integration (CTI) Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $9.7 Billion by the end of the forecast period in 2033.

Computer Telephony Integration (CTI) Software Market introduction

The Computer Telephony Integration (CTI) Software Market encompasses solutions that facilitate the interconnection between telephone systems (PABXs, VoIP networks) and computing systems (desktop applications, CRM systems, databases). CTI software is essential for modern contact centers and unified communications environments, enabling functions such as screen popping, automatic dialing, call routing based on data, and integrating communication history directly into enterprise resource planning (ERP) or customer relationship management (CRM) platforms. This integration significantly enhances agent productivity, improves operational efficiency, and allows businesses to deliver a seamless, personalized customer experience (CX). The core product description involves sophisticated middleware that translates and manages data flow between disparate voice and data networks.

Major applications of CTI software span across various critical business functions, including optimizing contact center queue management, facilitating proactive sales outreach through power dialers, and providing rapid context to helpdesk support staff. The principal benefits derived from CTI deployment include reduced average handling time (AHT), improved first call resolution (FCR) rates, and comprehensive logging of interaction data for compliance and analytical purposes. By automating routine data retrieval and screen navigation tasks, CTI solutions empower agents to focus entirely on customer interaction quality, transforming the contact center from a cost center into a strategic differentiator.

The market is predominantly driven by the accelerating global digital transformation initiatives, particularly the transition of customer engagement platforms to cloud-based architectures. The pervasive need for businesses across all sectors to improve customer retention rates and minimize service friction fuels the demand for integrated communication solutions. Furthermore, the rise of remote and hybrid work models necessitates sophisticated tools that can deliver enterprise-grade telephony functionality seamlessly across distributed environments, positioning CTI as a fundamental component of the modern distributed contact center ecosystem.

Computer Telephony Integration (CTI) Software Market Executive Summary

The CTI Software Market is characterized by robust growth, driven primarily by the global shift towards cloud-based Contact Center as a Service (CCaaS) models and the intense competition among enterprises to provide superior customer experiences. Business trends indicate a strong move toward API-first CTI solutions, allowing deeper integration into a wider array of specialized enterprise applications beyond traditional CRM systems. Key vendors are prioritizing the development of low-code/no-code integration tools to simplify deployment and reduce the dependence on complex custom development, thereby appealing to Small and Medium-sized Enterprises (SMEs) that require rapid deployment and minimal IT overhead. Furthermore, the convergence of Unified Communications as a Service (UCaaS) and CCaaS is blurring traditional boundaries, necessitating CTI solutions capable of managing multichannel and omnichannel interactions effectively.

Regional trends reveal North America maintaining market dominance, attributable to the early adoption of advanced contact center technologies, the presence of major industry players, and high investment in digital infrastructure across sectors like BFSI and IT. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by rapid economic expansion, increasing disposable incomes leading to higher customer service expectations, and significant investments in technology infrastructure upgrades, particularly in emerging markets like India and China. European markets are driven by stringent regulatory requirements, such as GDPR, which mandate highly secure and traceable customer interaction logging, thereby enhancing the requirement for robust CTI solutions that integrate seamlessly with compliance frameworks.

In terms of segment trends, the Cloud deployment segment is experiencing exponential growth, overshadowing on-premise solutions due to advantages related to scalability, reduced capital expenditure, and ease of maintenance. The Solutions component, particularly those focused on integrated workflow automation and sophisticated reporting capabilities, holds the largest market share. Organization size analysis indicates that while Large Enterprises remain the primary consumers, the adoption rate among SMEs is accelerating rapidly, primarily leveraging subscription-based cloud CTI offerings. Vertical analysis highlights the IT and Telecom sector, alongside the BFSI sector, as the largest users, given their high volume of customer interactions and critical need for secure, efficient service delivery channels.

AI Impact Analysis on Computer Telephony Integration (CTI) Software Market

User inquiries regarding AI's influence on CTI software center around automation capabilities, the transition from simple screen-pop functions to intelligent, context-aware interactions, and concerns about data security and job displacement. Common questions investigate how Artificial Intelligence (AI) and Machine Learning (ML) enhance automatic call distribution (ACD) by predicting customer intent, optimizing agent routing, and providing real-time sentiment analysis during live calls. Users are actively seeking solutions that integrate AI to automate mundane tasks, allowing agents to handle complex, high-value interactions. The fundamental consensus is that AI is moving CTI beyond mere connectivity to intelligent, predictive engagement orchestration.

The incorporation of AI fundamentally transforms the CTI value proposition, shifting it from a connection tool to an intelligence layer within the contact center architecture. AI engines leverage the data collected and centralized by CTI systems—such as customer records, interaction history, and transactional data—to provide intelligent recommendations, automate response generation (via chatbots and voicebots), and dynamically adjust call priority. This integration minimizes the administrative burden on human agents, as AI handles the initial triage, verification, and information retrieval steps that CTI traditionally only facilitated the connection for. The synergy ensures that when a human agent does engage, they possess comprehensive, AI-summarized context instantly, optimizing the resolution process.

Furthermore, AI significantly impacts the operational efficiency and predictive capabilities enabled by CTI. AI algorithms can analyze historical CTI data patterns to forecast call volumes, predict customer churn, and identify potential system bottlenecks before they impact service quality. This predictive maintenance and operational foresight are crucial for maximizing resource utilization. The future of CTI is intrinsically linked to intelligent routing (IR), where AI determines the optimal resource—be it a bot, a specialized agent, or an external system—to handle the interaction, rather than relying solely on predefined rule-based routing parameters traditional CTI systems employ.

- AI-driven intelligent routing (IR) optimizes call distribution based on intent and agent expertise, moving beyond simple data matching.

- Real-time sentiment analysis, fueled by ML, provides immediate agent coaching cues through the CTI interface.

- Integration of conversational AI (chatbots/voicebots) automates initial customer interaction triage and data retrieval, reducing agent workload.

- Predictive analytics use CTI data logs to forecast demand, resource needs, and potential customer service issues.

- AI enhances compliance recording and transcription accuracy, facilitating faster search and retrieval of specific customer interactions mandated by regulatory bodies.

DRO & Impact Forces Of Computer Telephony Integration (CTI) Software Market

The dynamics of the CTI Software Market are heavily influenced by the interplay of increasing demand for elevated customer experience standards, the technological pivot toward cloud services, and inherent challenges related to system interoperability and security. Drivers center on the necessity for businesses to integrate disparate communication channels into unified platforms, while restraints involve the complexity and cost associated with integrating modern CTI solutions with widespread, often rigid, legacy PBX systems and the pervasive concerns surrounding data privacy in cloud environments. Opportunities abound in niche applications leveraging emerging technologies like 5G and edge computing to deliver highly reliable, low-latency CTI services, especially in geographically dispersed or mobile operational settings.

The primary driving force is the competitive pressure to deliver instantaneous and contextual customer support across all touchpoints, pushing enterprises to adopt CTI to centralize and synchronize customer data before, during, and after an interaction. The shift to remote and hybrid work models has dramatically accelerated the adoption of cloud-based CTI solutions, which offer superior flexibility and accessibility compared to traditional on-premise systems. Furthermore, the growing sophistication of CRM platforms mandates equally sophisticated CTI tools to ensure data fluidity and accurate logging of voice interactions directly into the customer record, making CTI an indispensable productivity booster for sales and service teams.

Conversely, significant restraints exist, notably the substantial capital investment required for comprehensive CTI deployment, particularly in large organizations with complex, multi-vendor communication infrastructures. Integrating CTI middleware across varied operating systems, proprietary telephone protocols, and diverse application software often presents technical challenges and requires specialized IT expertise. Moreover, as CTI solutions increasingly handle sensitive customer and transactional data, compliance with global data protection regulations (like GDPR, CCPA, HIPAA) becomes a considerable hurdle, requiring vendors to build robust security and auditing features into their core product offerings, increasing development costs and implementation complexity.

Segmentation Analysis

The CTI Software Market is intricately segmented based on components, deployment models, organization size, specific applications, and the industry vertical served, reflecting the diverse operational needs of different enterprise environments. Understanding these segmentations is critical for both vendors and customers to tailor solutions effectively. The market structure is evolving rapidly, driven by the modularity of cloud services, allowing businesses to select and scale specific CTI functionalities—ranging from simple screen-pop features to complex workflow automation and integrated reporting suites—based on their current operational requirements and budget constraints. This granularity in segmentation highlights the industry’s move towards highly customizable, pay-as-you-go service models.

- By Component: Solutions (Cloud-based, On-premise), Services (Integration, Consulting, Maintenance and Support).

- By Deployment: Cloud, On-premise.

- By Organization Size: Large Enterprises, Small and Medium-sized Enterprises (SMEs).

- By Application: Contact Center Operations, Sales Management, Helpdesk Support, Unified Communications, Field Service Management.

- By Vertical: BFSI (Banking, Financial Services, and Insurance), IT and Telecom, Healthcare, Retail and E-commerce, Government and Public Sector, Manufacturing.

Value Chain Analysis For Computer Telephony Integration (CTI) Software Market

The value chain of the CTI Software Market initiates with upstream activities involving core technology providers, primarily specializing in hardware components like PBX and VoIP equipment, alongside the foundational developers of API frameworks and communication protocols. These upstream players provide the essential infrastructure that CTI software must interface with. Innovation at this stage focuses on developing open standards and robust, secure APIs that simplify interoperability, enabling CTI vendors to build sophisticated applications without needing deep modification of the underlying telephony network.

Midstream activities are dominated by CTI software developers and solution providers. This crucial stage involves designing, developing, and packaging the integration middleware, often specializing in specific platforms (e.g., Salesforce CTI, ServiceNow CTI). Value addition here lies in the intelligence and customization layers—such as intelligent routing logic, unified desktop interfaces for agents, and data synchronization modules. The quality of these midstream solutions determines the efficiency gains realized by the end-user, emphasizing usability, stability, and compatibility across diverse enterprise IT landscapes.

Downstream activities involve the distribution channels and the end-user implementation phase. Distribution heavily relies on a mix of direct sales channels, strategic partnerships with global telecommunications providers, and a robust network of value-added resellers (VARs) and system integrators (SIs). SIs play a vital role in customizing and deploying complex CTI solutions, integrating them with existing legacy systems, and providing ongoing support and maintenance. The direct channel is often leveraged by major vendors for large enterprise accounts seeking customized, mission-critical deployments, while indirect channels serve the high-volume SME market with standardized cloud offerings.

Computer Telephony Integration (CTI) Software Market Potential Customers

Potential customers for CTI software span any organization that relies on high-volume, structured communication with external stakeholders, where rapid access to customer data is critical for service efficiency and revenue generation. The primary end-users are contact centers, ranging from dedicated outsourced Business Process Outsourcing (BPO) centers to in-house customer service and technical support departments across various industries. These environments critically depend on CTI to streamline agent workflows, minimize dead time during calls, and provide a unified view of the customer journey across voice and digital channels.

Beyond traditional contact centers, CTI is increasingly vital for sales organizations utilizing predictive and power dialing technologies to optimize lead qualification and conversion rates. Sales teams require CTI integration with their CRM systems to ensure every outbound and inbound call is automatically logged, assigned proper dispositions, and tied back to specific campaign metrics. Furthermore, large professional services firms, healthcare providers, and financial institutions leverage CTI for secure, compliant communication logging and rapid customer identification, enhancing both security and operational speed during sensitive interactions.

The evolution of CTI capabilities, especially with mobile and softphone integrations, expands the potential customer base to encompass field service management teams and remote support staff who need enterprise-grade communication functionality outside of a physical office environment. Essentially, any business prioritizing a seamless, data-rich interaction experience, whether for customer support, sales, or internal communications requiring sophisticated logging, represents a key potential customer segment for CTI software vendors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $9.7 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Genesys, Cisco Systems, Avaya, Microsoft, Five9, NICE Systems, 8x8, RingCentral, Twilio, Aspect Software (Enghouse), Mitel Networks, Dialpad, Salesforce, Pega systems, Zoho Corporation, SAP, Amazon Web Services (AWS), Google Cloud. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computer Telephony Integration (CTI) Software Market Key Technology Landscape

The CTI software market is defined by several converging technology trends that enhance functionality and deployment flexibility. The most significant shift is the dominance of cloud-native architectures, utilizing technologies like microservices and containerization (e.g., Docker and Kubernetes) to ensure high availability, scalability, and rapid feature deployment. This architecture enables vendors to offer CTI solutions as true software-as-a-service (SaaS) products, facilitating easier updates and integration with other cloud platforms. Furthermore, the reliance on robust and well-documented Application Programming Interfaces (APIs), particularly RESTful APIs, is foundational, allowing third-party developers and enterprise IT teams to integrate CTI functionality directly into custom applications and specialized industry software without requiring proprietary knowledge of the underlying telephony systems.

A critical technology component is the ongoing refinement of Voice over Internet Protocol (VoIP) and Session Initiation Protocol (SIP) standards, which ensure efficient, cost-effective communication transport across IP networks. Modern CTI relies heavily on the stability and security of these protocols. Beyond basic connectivity, there is a substantial investment in technologies enabling omnichannel integration, utilizing WebRTC (Web Real-Time Communication) to embed voice and video interactions directly within web browsers or mobile applications, eliminating the need for separate telephony equipment and client software. This simplifies the end-user experience and provides developers with greater control over the interaction environment.

The emerging technological landscape is increasingly dominated by AI and Machine Learning components seamlessly woven into the CTI layer. This includes Natural Language Processing (NLP) for understanding customer requests, predictive analytics for optimizing queue management, and robotic process automation (RPA) tools that automatically execute data retrieval and transaction processes initiated by a voice command or call trigger. Furthermore, the development of secure, encrypted communication channels using advanced cryptographic techniques is paramount, ensuring that sensitive customer data handled by the CTI system adheres to stringent industry security standards like ISO 27001 and PCI DSS, which is vital for regulated sectors like BFSI and Healthcare.

Regional Highlights

Regional dynamics play a significant role in shaping the adoption and growth trajectory of the CTI Software Market, reflecting differences in digital infrastructure maturity, regulatory environments, and customer service expectations.

- North America (NA): NA holds the largest market share, driven by a high concentration of sophisticated contact centers, extensive digital transformation investments, and the presence of leading CTI and CCaaS providers. The region is characterized by early adoption of AI-powered and cloud-based CTI solutions across the BFSI, high-tech, and healthcare verticals.

- Europe: This region exhibits steady growth, primarily fueled by strict data privacy regulations (GDPR), necessitating robust, secure CTI systems for detailed interaction logging and compliance auditing. Western European countries demonstrate high demand for unified communications integration, merging back-office telephony with customer-facing contact center functions.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization, massive investment in IT infrastructure, and the expansion of offshore and outsourced contact centers in countries like India and the Philippines. The focus is increasingly on scalable, cost-effective cloud CTI solutions to serve diverse linguistic and cultural requirements.

- Latin America (LATAM): Growth in LATAM is driven by the need for improved service efficiency in retail and financial sectors. Market maturity is gradually increasing, with cloud adoption accelerating as businesses seek to bypass the high capital expenditure associated with traditional on-premise systems.

- Middle East and Africa (MEA): MEA adoption is focused primarily within the oil and gas, government, and telecommunications sectors. Investments are concentrated in high-growth economies like the UAE and Saudi Arabia, prioritizing integrated solutions that enhance digital government services and modern enterprise communications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computer Telephony Integration (CTI) Software Market.- Genesys

- Cisco Systems

- Avaya

- Microsoft

- Five9

- NICE Systems

- 8x8

- RingCentral

- Twilio

- Aspect Software (Enghouse)

- Mitel Networks

- Dialpad

- Salesforce

- Pega systems

- Zoho Corporation

- SAP

- Amazon Web Services (AWS)

- Google Cloud

Frequently Asked Questions

Analyze common user questions about the Computer Telephony Integration (CTI) Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of CTI software in a contact center?

The primary function of CTI software is to bridge the telephone system and computer applications (like CRM or ERP), enabling seamless data exchange. This allows for automated functions such as screen popping—where a customer’s record appears automatically when they call—significantly improving agent efficiency and service personalization.

Is cloud CTI or on-premise CTI the dominant deployment model?

Cloud CTI (Contact Center as a Service or CCaaS) is rapidly becoming the dominant deployment model. Cloud solutions offer superior scalability, lower total cost of ownership (TCO), and easier integration with remote work environments compared to traditional, rigid on-premise infrastructure, driving adoption across all organization sizes.

How does CTI contribute to improved customer experience (CX)?

CTI drastically improves CX by providing agents with instant access to the caller’s history and relevant context before the conversation begins. This reduces the need for customers to repeat information, accelerates resolution times (lower AHT), and facilitates better first call resolution (FCR), leading to higher customer satisfaction scores.

Which vertical is driving the most demand for advanced CTI solutions?

The BFSI (Banking, Financial Services, and Insurance) and IT and Telecom sectors are driving the highest demand for advanced CTI solutions. These industries handle high volumes of sensitive interactions, requiring secure, integrated systems for compliance, efficiency, and sophisticated fraud detection enabled by CTI data logging.

What is the role of AI in the future development of CTI software?

AI is transforming CTI by introducing intelligent routing and predictive analytics capabilities. AI leverages CTI data to determine the optimal agent or automated system for an incoming call, provides real-time coaching, and automates many administrative tasks, moving CTI from a connectivity tool to an intelligent engagement orchestration platform.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager