Computer Workstation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431826 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Computer Workstation Market Size

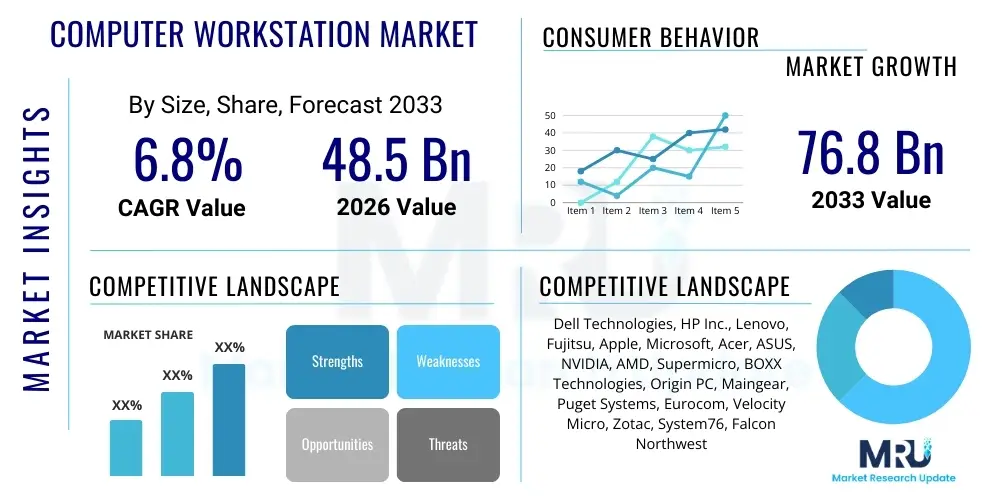

The Computer Workstation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 48.5 Billion in 2026 and is projected to reach USD 76.8 Billion by the end of the forecast period in 2033.

Computer Workstation Market introduction

The Computer Workstation Market encompasses high-performance computing systems specifically designed for computationally intensive tasks that standard personal computers cannot handle effectively. These specialized machines are engineered with professional-grade components, including certified GPUs, ECC memory, high-core count CPUs, and optimized storage solutions, ensuring stability and accuracy necessary for mission-critical applications. The primary product offerings include tower, rack-mounted, mobile, and specialized modular workstations, each catering to distinct deployment environments and user mobility needs. The robustness and superior technical specifications of workstations make them indispensable tools across numerous sophisticated industries, providing the foundation for complex digital creation and analysis.

Major applications driving market demand include Computer-Aided Design (CAD), engineering simulation (CAE), digital content creation (DCC), complex financial modeling, oil and gas exploration, and biomedical imaging. The inherent benefits of utilizing dedicated workstations over standard PCs or even cloud computing resources for certain tasks include lower latency for large data sets, enhanced security through local processing, and guaranteed software certification compatibility with professional applications like SolidWorks, Autodesk Maya, or Adobe Premiere Pro. Furthermore, modern workstations are increasingly incorporating features tailored for AI and machine learning development, requiring significant local parallel processing capabilities.

Key driving factors accelerating the adoption of computer workstations involve the increasing complexity and size of digital content, particularly the shift towards 4K, 8K, and VR/AR content production in the Media & Entertainment sector. Simultaneously, advancements in architectural and manufacturing engineering require ever more detailed simulations and real-time rendering capabilities, necessitating the dedicated resources offered by high-end workstations. The continuous introduction of powerful professional graphics cards and processors, alongside the demand for highly reliable systems in regulated industries, sustains the market’s steady growth trajectory, pushing the boundaries of what local computing infrastructure can achieve.

Computer Workstation Market Executive Summary

The global Computer Workstation Market is currently experiencing transformative business trends characterized by the hybridization of work environments and the accelerating adoption of deep learning and generative AI technologies. Key players are focusing on developing highly portable mobile workstations that do not compromise performance, effectively blurring the lines between high-end laptops and traditional desktop workstations. Supply chain resilience, particularly concerning the availability of cutting-edge CPUs and GPUs, remains a critical factor influencing vendor competitiveness and pricing strategies across all geographical segments. Furthermore, the market structure is shifting toward specialized configurations, with end-users prioritizing validated hardware ecosystems certified for specific industry applications, leading to closer collaborations between Original Equipment Manufacturers (OEMs) and Independent Software Vendors (ISVs).

Regionally, North America maintains its position as the largest revenue contributor, driven by robust spending in the Media & Entertainment, Aerospace, and financial services sectors, characterized by early adoption of new computational standards such as accelerated computing for AI model training. The Asia Pacific (APAC) region, however, is forecast to exhibit the fastest growth rate, fueled by rapid industrialization, burgeoning domestic IT services sectors in countries like India and China, and massive infrastructure projects demanding advanced CAD and simulation capabilities. European markets show stable growth, heavily influenced by strict regulatory standards in manufacturing (especially automotive and industrial design) requiring stringent data integrity and system reliability, reinforcing the demand for certified professional hardware.

Segment trends indicate a marked acceleration in the Mobile Workstation segment, driven by the need for high-fidelity computing resources outside traditional office settings, a trend firmly established post-pandemic. From an application perspective, the Design & Simulation segment, which includes CAE and mechanical engineering, continues to hold the largest market share due to the ubiquitous need for product lifecycle management (PLM) tools. However, the Scientific Research and Data Science segments are projected to experience exponential demand growth, directly correlated with the increasing complexity of data analysis tasks and the proliferation of large language models (LLMs) requiring substantial local computational horsepower for fine-tuning and inference tasks. Operating systems remain dominated by Windows, though Linux usage is highly concentrated within scientific, server-side, and high-performance computing applications due to its open-source nature and customization flexibility.

AI Impact Analysis on Computer Workstation Market

Common user questions regarding AI's impact revolve around the necessary specifications for effective local AI/ML development, particularly concerning the required VRAM capacity of professional GPUs (NVIDIA RTX A-series or AMD Radeon Pro W-series), the necessity of high-bandwidth interconnects (like NVLink or Infinity Fabric), and the optimal balance between CPU core count and GPU performance for training and inferencing workloads. Users frequently question whether general-purpose workstations can suffice for initial model development or if dedicated AI-optimized hardware platforms are mandatory for serious enterprise deployments. There is also significant interest in how AI tools, such as generative design or intelligent simulation processing, are transforming workflows in traditional sectors like architecture and manufacturing, thus mandating immediate hardware upgrades to support these new capabilities, thereby driving demand for systems capable of handling massive parallel processing tasks effectively.

- Increased Demand for High-VRAM GPUs: AI workloads, particularly LLM fine-tuning and complex image processing, necessitate professional GPUs with 24GB or more VRAM, making them the primary purchasing consideration for new workstations.

- Specialized AI Workstations: Emergence of purpose-built workstations optimized for AI/ML tasks, featuring multiple GPU configurations and specialized cooling solutions.

- Enhanced CPU Requirements: AI algorithms benefit from higher core counts (e.g., Intel Xeon or AMD Threadripper Pro) for data pre-processing and parallel tasks, ensuring balanced system throughput.

- Integration into Workflow Tools: AI features embedded in standard applications (e.g., generative fill in Adobe, AI-driven optimization in CAD software) drive mainstream workstation upgrades.

- Shift in Memory Technology: Higher adoption rates of ECC (Error-Correcting Code) memory to maintain data integrity during prolonged, complex AI training sessions.

- Influence on Mobile Workstations: Demand for powerful mobile workstations capable of running local AI models for edge computing applications and on-site demonstrations.

DRO & Impact Forces Of Computer Workstation Market

The market dynamics are governed by a complex interplay of growth drivers, structural restraints, and emerging opportunities, all amplified by critical impact forces related to technological obsolescence and competitive pricing. Key drivers include the exponential growth in data generation across enterprise environments, necessitating powerful local processing for visualization and analysis, alongside the relentless expansion of the digital content creation industry (film, gaming, animation) demanding real-time rendering capabilities. Restraints primarily involve the high initial capital expenditure associated with certified, professional-grade hardware, making entry difficult for smaller firms, and the intensifying competition from cloud-based virtual desktop infrastructure (VDI) and high-performance computing (HPC) alternatives which offer subscription flexibility. Opportunities lie in the customization of workstations for niche markets like industrial IoT edge processing and the expansion into developing economies that are rapidly digitizing their core industrial infrastructure.

Driving factors are inherently linked to the computational requirements of next-generation software, such as the adoption of Building Information Modeling (BIM) in construction and the expansion of advanced scientific modeling in pharmaceuticals. Furthermore, regulatory environments in sensitive sectors (like finance and healthcare) often mandate specific security and performance certifications that only dedicated physical workstations can reliably provide, insulating them somewhat from general-purpose desktop encroachment. The pressure to reduce product development cycles in manufacturing necessitates quicker iteration through simulation, placing continuous upward pressure on workstation specifications, ensuring a steady upgrade cycle every 3-5 years.

The primary impact forces influencing the market trajectory include rapid innovation in semiconductor technology, where new generations of CPUs and GPUs drastically increase performance per watt, accelerating hardware turnover. Economic downturns or supply chain disruptions act as significant external forces, affecting component costs and system availability. Competitive intensity is high, with major OEMs vying for strategic alliances with ISVs and developers to ensure their hardware is certified and optimized for critical professional applications, thereby locking in customer segments. The shifting preference towards as-a-service models also acts as a profound competitive force, pressuring OEMs to offer innovative financing and maintenance packages to maintain their market presence against cloud vendors.

The following summary provides a concise overview of the core dynamics:

- Drivers: Proliferation of 4K/8K content creation; increasing complexity of CAD/CAE simulations; rapid adoption of AI/ML across industries; rising demand for certified professional hardware.

- Restraints: High initial cost compared to consumer PCs; increasing competition from VDI and cloud-based HPC solutions; dependency on volatile component supply chains (CPU/GPU).

- Opportunity: Expansion into modular and highly specialized AI edge computing workstations; growth in emerging markets and adoption of personalized, custom-built systems; integration of sustainability features in design.

- Impact Forces: Technological obsolescence due to rapid semiconductor cycles (high); intense pricing competition among leading OEMs (medium-high); macroeconomic volatility affecting enterprise spending (medium).

Segmentation Analysis

The segmentation of the Computer Workstation Market offers a detailed view of its operational structure, primarily categorized by Type, Application, and Operating System. This granular analysis is crucial for understanding specific areas of growth and investment prioritization for both manufacturers and suppliers. The Type segment is critical, determining the physical form factor and mobility of the system, with Tower Workstations traditionally dominating due to their superior upgradeability and cooling capabilities, making them the standard for highly intensive, stationary tasks like high-end rendering and complex simulations. However, the Mobile Workstation segment has gained substantial traction, driven by the requirement for engineers, architects, and content creators to have powerful, certified computing resources available on location or during travel, leading to significant R&D investment in thermal management and battery efficiency.

The Application segmentation reveals the end-use ecosystem, where the Manufacturing and Design & Simulation sectors constitute the bedrock of demand, relying heavily on workstations for product development, finite element analysis (FEA), and computational fluid dynamics (CFD). The increasing sophistication of industrial design, requiring multi-physics simulations and digital twin creation, ensures sustained high demand in this area. Simultaneously, the Media & Entertainment (M&E) sector, covering film post-production, gaming development, and VFX, represents a highly lucrative segment characterized by frequent hardware refreshes driven by the demand for quicker turnaround times and higher visual fidelity (e.g., real-time ray tracing).

Segmentation by Operating System, while seemingly stable, reflects usage patterns unique to professional environments. Windows remains the dominant platform due to its broad compatibility with proprietary industry software (especially in CAD/CAM). Conversely, Linux maintains a strong foothold in high-performance computing (HPC), deep learning research, and server-side rendering farms, favored for its stability, command-line efficiency, and customization options. macOS caters almost exclusively to the creative sector, specifically video editing, graphic design, and some animation workflows, where the tightly integrated hardware and software ecosystem offers optimized performance for specific creative suites.

- By Type:

- Tower Workstations

- Rack Workstations

- Mobile Workstations

- All-in-One Workstations

- By Application/End-User:

- Manufacturing & Industrial Design (CAD, CAE, PLM)

- Media & Entertainment (VFX, Animation, Post-Production)

- Financial Services (High-Frequency Trading, Risk Modeling)

- Scientific Research & Data Science (Deep Learning, Computational Chemistry)

- Healthcare & Medical Imaging

- Architecture, Engineering, and Construction (AEC/BIM)

- By Operating System:

- Windows

- Linux

- macOS

- By Price Range:

- Entry-Level Workstations (Under $2,000)

- Mid-Range Workstations ($2,000 - $5,000)

- High-End/Premium Workstations (Above $5,000)

Value Chain Analysis For Computer Workstation Market

The value chain for the Computer Workstation Market is intrinsically complex, starting with highly specialized upstream activities involving semiconductor fabrication and component manufacturing. Upstream analysis focuses on the sourcing of high-performance CPUs (Intel Xeon, AMD Threadripper Pro) and professional GPUs (NVIDIA Quadro/RTX, AMD Radeon Pro), along with crucial components like ECC memory and high-speed NVMe storage. The performance and availability of these core components dictate the final product's specifications and pricing. OEMs maintain rigorous validation processes to ensure compatibility and stability between these disparate, high-end parts, a critical step distinguishing workstation manufacturing from consumer PC assembly. Strategic long-term contracts with key semiconductor suppliers are paramount to mitigating supply chain risks and ensuring access to cutting-edge technology ahead of competitors.

Midstream processes involve the design, assembly, and rigorous testing of the workstation systems. This stage includes sophisticated thermal management engineering, crucial for maintaining peak performance under sustained load, and the integration of certified drivers optimized for professional Independent Software Vendor (ISV) applications. The distribution channel is bifurcated into direct and indirect methods. Direct distribution, characterized by large corporate sales and custom configuration orders managed by the OEM (e.g., Dell, HP direct sales teams), offers better control over pricing and customer service. Indirect distribution relies heavily on Value-Added Resellers (VARs) and system integrators who provide localized support, customization, and bundled software solutions, particularly essential for small to medium-sized enterprises (SMEs) and specialized vertical markets.

Downstream analysis focuses on the end-user interaction, after-sales support, and the eventual disposal/recycling of the hardware. Given the mission-critical nature of workstation applications, robust maintenance contracts, rapid repair services, and technical support are vital components that enhance the total cost of ownership (TCO) value proposition. The trend is moving towards enhanced support services delivered remotely, utilizing advanced diagnostics. Effective management of this downstream phase, including secure data wiping and environmentally responsible hardware retirement, reinforces customer loyalty and adherence to stringent corporate and environmental governance policies. The choice of distribution strategy often determines the speed of deployment and the availability of specialized technical expertise specific to the customer's industry.

Computer Workstation Market Potential Customers

The target audience for the Computer Workstation Market consists primarily of highly skilled professionals and specialized enterprises requiring extreme stability, certified software compatibility, and computational resources far exceeding standard consumer hardware capabilities. These end-users, or buyers, prioritize system reliability and longevity over basic affordability, understanding that hardware failure or performance throttling can lead to substantial project delays and financial losses. Key customer groups include design engineers who utilize complex parametric modeling in CAD (Computer-Aided Design), financial analysts performing high-volume, real-time risk assessments, and scientists running computational simulations for climate modeling or drug discovery, all of whom represent highly discerning purchasers focused on ROI derived from efficiency and precision.

The largest segment of potential customers resides within large multinational corporations in the Manufacturing (Aerospace, Automotive) and Media & Entertainment sectors, characterized by bulk purchasing and stringent IT procurement standards favoring certified OEM products. These organizations require seamless fleet management, centralized IT support, and reliable component sourcing. Furthermore, boutique design firms, independent VFX studios, and university research laboratories represent critical, albeit smaller, customer bases that often prioritize highly customized, niche systems (e.g., multi-GPU deep learning rigs or specialized liquid-cooled overclocked systems) tailored for their unique and highly demanding computational workflows. The procurement decision in these environments is often driven not just by IT departments, but directly by the engineering or research team leaders who possess detailed knowledge of the required software and specific hardware acceleration needs.

A rapidly expanding segment involves independent data scientists and professional developers specializing in AI and machine learning. These professionals are increasingly opting for high-end workstations to perform localized model training, development, and rapid prototyping, thereby reducing reliance on potentially costly cloud compute hours, especially for sensitive data sets. This group specifically demands top-tier GPUs, massive amounts of high-speed RAM (128GB+), and powerful storage architectures. The market also sees strong demand from governmental and defense agencies, where security and guaranteed data sovereignty necessitate robust, non-networked or securely isolated high-performance local computing solutions, often favoring rack-mounted or secure tower workstation formats for centralized deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 48.5 Billion |

| Market Forecast in 2033 | USD 76.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dell Technologies, HP Inc., Lenovo, Fujitsu, Apple, Microsoft, Acer, ASUS, NVIDIA, AMD, Supermicro, BOXX Technologies, Origin PC, Maingear, Puget Systems, Eurocom, Velocity Micro, Zotac, System76, Falcon Northwest |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Computer Workstation Market Key Technology Landscape

The technological evolution of the Computer Workstation Market is fundamentally driven by advancements in core silicon components, specifically central processing units (CPUs) and graphics processing units (GPUs). Modern workstations rely on high-performance multi-core processors, such as Intel Xeon scalable processors or AMD Ryzen Threadripper Pro series, which offer substantially higher core and thread counts than consumer counterparts, optimized for parallel processing found in simulation and rendering tasks. Crucially, the move toward professional-grade GPUs—including technologies like NVIDIA's Ray Tracing Cores (RT Cores) and Tensor Cores (TC) or AMD’s equivalent professional acceleration hardware—has revolutionized workflows in design and media, enabling real-time photorealistic rendering and accelerating complex AI-driven tasks directly on the desktop. System stability is further guaranteed by the widespread use of Error-Correcting Code (ECC) memory, which detects and fixes data corruption, a non-negotiable feature for applications handling mission-critical data.

Beyond the primary processing components, the key technology landscape is characterized by high-speed interconnects and advanced storage solutions. The adoption of PCIe Gen 5 and emerging Gen 6 standards significantly increases the bandwidth between the CPU, GPU, and NVMe Solid State Drives (SSDs), enabling rapid data transfer necessary for handling massive datasets common in VFX and large engineering models. Thunderbolt and high-speed USB standards are crucial for connecting high-resolution external displays, storage arrays, and specialized input devices (e.g., 3D controllers). Furthermore, thermal management systems have become a core technology differentiator, with sophisticated liquid cooling solutions and optimized airflow designs necessary to sustain the high thermal design power (TDP) of flagship CPUs and GPUs under sustained maximum load without performance throttling, thereby maximizing system uptime and efficiency.

The integration of specialized security features and remote manageability tools also defines the technological maturity of this market. Workstations are increasingly incorporating hardware-based security elements, such as Trusted Platform Modules (TPM) and proprietary secure boot technology, to protect sensitive intellectual property. Remote management platforms (like Intel vPro or equivalent OEM solutions) allow IT departments to diagnose, update, and manage workstation fleets regardless of location, a feature that has become critical with the rise of remote and hybrid professional workforces. Looking ahead, the focus is shifting toward heterogeneous computing architectures, seamlessly integrating general-purpose CPUs with highly specialized accelerators (FPGAs or custom ASIC chips) specifically for tasks like advanced cryptographic analysis or tailored simulation routines, promising another leap in computational density and efficiency.

Regional Highlights

The global Computer Workstation Market exhibits distinct regional dynamics driven by varying levels of industrialization, technological maturity, and investment priorities across major economic zones. North America, encompassing the United States and Canada, remains the dominant revenue generator globally. This dominance is attributed to the presence of key technology hubs (Silicon Valley, Seattle), high defense spending, mature financial modeling services, and a robust Media & Entertainment industry (Hollywood, gaming studios) that consistently demands the highest performance, latest generation workstations for real-time production workflows. The early and widespread adoption of AI and machine learning development in this region further cements its leadership position, compelling frequent hardware refresh cycles to accommodate increasing computational complexity.

Europe represents a stable and mature market, characterized by stringent demands from the automotive (Germany, France), aerospace, and large-scale manufacturing sectors, particularly requiring certified workstations for CAD/CAE and digital twin environments. Central and Western Europe exhibit strong growth due to high R&D expenditures and regulatory requirements for design accuracy and data integrity in fields like precision engineering and pharmaceutical research. The transition toward Industry 4.0 principles, integrating digital manufacturing and simulation throughout the product lifecycle, continuously reinforces the need for powerful, reliable local computing resources, even as cloud adoption grows in parallel.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid expansion in manufacturing capabilities (China, South Korea), significant government investments in infrastructure development (India, Southeast Asia), and the burgeoning domestic IT and gaming development industries. Countries like China are heavily investing in indigenous design and simulation software ecosystems, requiring massive deployment of high-end workstations. While APAC initially focused on entry-level and mid-range systems, the increasing complexity of local content creation and AI development is quickly driving demand towards premium, high-specification mobile and tower workstations. The Middle East and Africa (MEA) and Latin America (LATAM) markets are characterized by selective growth, concentrating primarily in resource extraction (Oil & Gas) and large-scale urbanization projects, driving demand for specialized geographical information system (GIS) and architectural workstations.

- North America: Market leader; driven by M&E, aerospace, financial modeling, and early AI adoption; high average selling prices (ASPs) due to preference for premium configurations.

- Europe: Stable growth focused on automotive and industrial manufacturing (Industry 4.0); strong emphasis on system reliability and ISV certification for engineering applications.

- Asia Pacific (APAC): Highest growth rate; propelled by industrialization, infrastructure development, and rapidly expanding domestic IT and digital content creation sectors in China and India.

- Latin America (LATAM): Emerging market; growth tied to infrastructure development projects, education, and resource management; preference for cost-effective, durable mid-range solutions.

- Middle East and Africa (MEA): Niche growth concentrated in oil & gas, defense, and urban planning/AEC sectors; substantial procurement linked to major national development visions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Computer Workstation Market.- Dell Technologies

- HP Inc.

- Lenovo

- Fujitsu

- Apple

- Microsoft (Surface Workstations)

- Acer Inc.

- ASUS

- NVIDIA Corporation (Component supplier and system design influence)

- Advanced Micro Devices (AMD) (Component supplier)

- Supermicro

- BOXX Technologies

- Origin PC

- Maingear

- Puget Systems

- Eurocom

- Velocity Micro

- Zotac Technology Limited

- System76

- Falcon Northwest

Frequently Asked Questions

Analyze common user questions about the Computer Workstation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a professional workstation and a high-end gaming PC?

Workstations prioritize stability, reliability, and guaranteed compatibility through ISV (Independent Software Vendor) certification for professional applications (CAD, CAE). They use specialized components like ECC memory and professional GPUs (NVIDIA RTX A-series) optimized for accuracy and sustained performance under continuous load, whereas gaming PCs focus on high frame rates and consumer-grade components.

How is the rise of cloud computing and VDI impacting the demand for physical workstations?

While cloud computing offers flexibility for collaboration and burst workloads, physical workstations remain essential for data-intensive, low-latency tasks such as real-time 4K/8K editing, complex local simulation, and large-scale AI model fine-tuning where data sovereignty and immediate responsiveness are critical, limiting cloud adoption in the highest-end segments.

Which application segment currently drives the highest volume of workstation sales?

The Manufacturing and Industrial Design segment, encompassing Computer-Aided Design (CAD), Engineering Simulation (CAE), and Product Lifecycle Management (PLM), consistently drives the highest volume of workstation sales due to the pervasive necessity of high-precision computational tools across all phases of product development.

What are the key technological requirements for a workstation intended for AI/Machine Learning development?

Key requirements include a high-VRAM professional GPU (32GB+ VRAM), substantial amounts of fast ECC RAM (128GB or more), high core count CPUs for data pre-processing, and high-bandwidth interconnects like PCIe Gen 5 to ensure efficient data transfer during intense training cycles.

What is the projected growth rate (CAGR) for the Computer Workstation Market between 2026 and 2033?

The Computer Workstation Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven primarily by technological advancements in GPU capabilities and accelerating demand from the data science and digital content creation verticals globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager