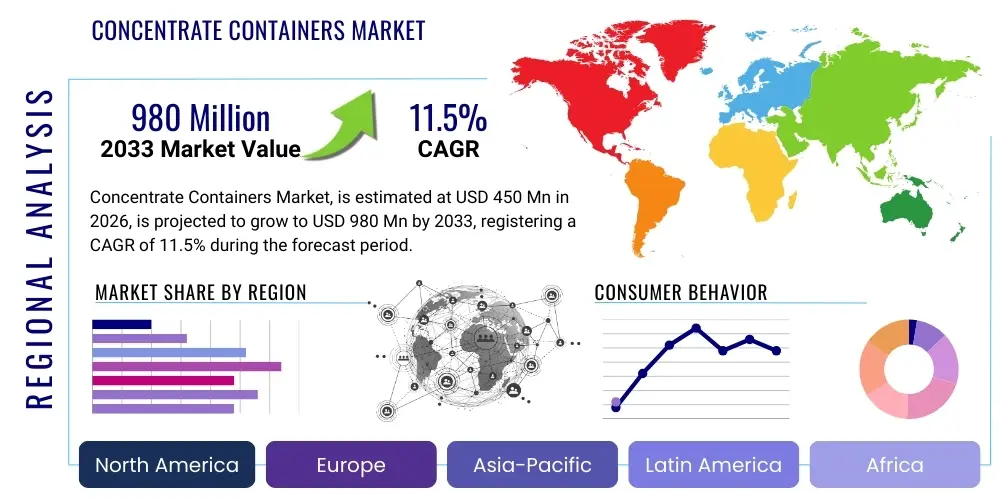

Concentrate Containers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437442 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Concentrate Containers Market Size

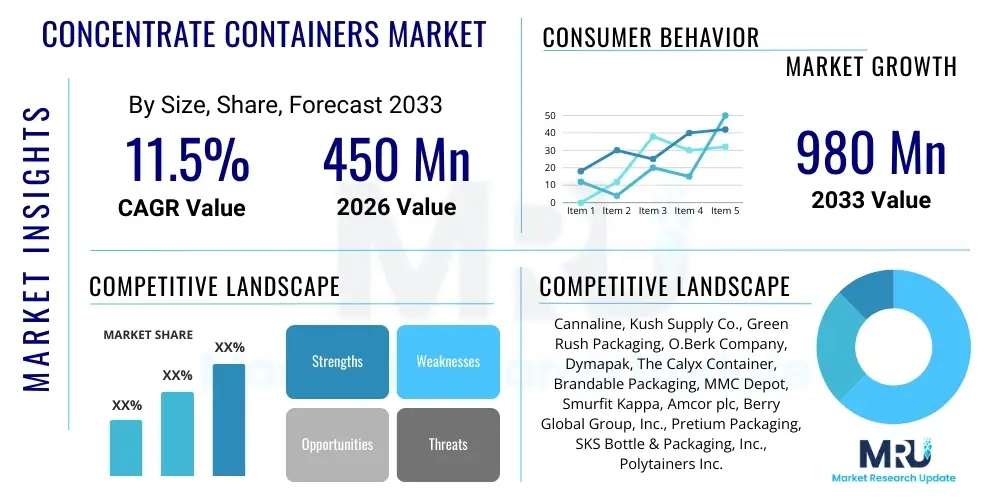

The Concentrate Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 980 Million by the end of the forecast period in 2033. This significant expansion is primarily driven by the burgeoning global legal cannabis industry, coupled with increasing consumer preference for highly potent, portable concentrate forms such as wax, shatter, and oils. The demand for specialized, tamper-evident, and child-resistant packaging solutions tailored to maintain product integrity and safety is fueling investment across the supply chain.

Concentrate Containers Market introduction

Concentrate containers are specialized packaging solutions designed to store, preserve, and transport highly concentrated substances, primarily derived from cannabis (such as dabs, live resin, or rosin) but also utilized in specific segments of the pharmaceutical and high-end food flavor industries. These containers are essential because concentrates are sticky, volatile, and sensitive to light, temperature, and moisture, necessitating robust, non-reactive materials like borosilicate glass, high-grade silicone, or specific polymer plastics. Effective concentrate packaging must prioritize airtight seals, UV protection, and ease of use, ensuring that the potency and chemical profile of the product are maintained from processing to end-user consumption, thereby safeguarding product quality and regulatory compliance.

The primary applications of concentrate containers revolve around the rapidly expanding cannabis concentrates market, which includes both recreational and medical usage across North America and increasingly, Europe. Key benefits offered by these containers include superior product preservation, prevention of degradation (especially thermal and oxidative stability), and compliance with stringent state and federal regulations concerning child resistance (CR) and tamper evidence. The physical design—often featuring non-stick surfaces, wide openings, and robust threading—is crucial for consumer convenience, minimizing product waste, which is particularly important given the high value of the substances contained within.

Major driving factors propelling this market include the global wave of cannabis legalization, which introduces massive commercial requirements for specialized packaging; advancements in concentrate extraction technologies leading to a wider variety of product forms needing tailored containers; and a heightened focus on consumer safety standards necessitating advanced CR mechanisms and quality control in packaging manufacturing. Furthermore, the trend toward sustainable and eco-friendly packaging materials, such such as recycled polymers and biodegradable options, is also influencing material innovation within the concentrate container sector, addressing growing environmental awareness among both producers and consumers.

Concentrate Containers Market Executive Summary

The Concentrate Containers Market is characterized by intense innovation centered on regulatory compliance and material science, positioning it for robust double-digit growth. Business trends indicate a strong move toward automation in packaging processes, driven by the need for high-volume efficiency and precision sealing, especially as major cannabis operators scale up production capacities. Furthermore, the emphasis on customized, aesthetically pleasing designs that function as brand differentiators is a significant commercial strategy, leading to partnerships between packaging providers and premium concentrate producers. Supply chain resilience, particularly the sourcing of high-purity glass and medical-grade silicone, remains a crucial operational focus due to geopolitical constraints and the need to maintain quality certifications, influencing pricing and lead times across the market.

Regional trends highlight North America, particularly the U.S. and Canada, as the foundational and largest markets due to early and widespread legalization, setting the standard for regulatory packaging requirements like ASTM certifications for child resistance. However, Europe is emerging as the fastest-growing region, stimulated by the gradual decriminalization and establishment of medical cannabis programs in countries like Germany and the Netherlands, driving immediate demand for internationally compliant packaging solutions. Asia Pacific remains nascent but shows high future potential, contingent on shifts in regulatory frameworks, particularly in markets exploring medicinal cannabis applications.

Segment trends reveal that the Material segment is dominated by glass containers due to their chemical inertness and premium perception, although high-performance silicone is gaining traction for ultra-sticky concentrates like live rosin due to its non-stick properties. Capacity analysis shows robust demand for small-capacity containers (under 3 grams) aligning with individual consumer purchase limits and high-potency product dosage requirements. The closure type segment is witnessing rapid adoption of advanced child-resistant screw caps featuring intricate locking mechanisms, ensuring compliance while improving ease of access for adults, a key factor in improving the overall consumer experience and market acceptance.

AI Impact Analysis on Concentrate Containers Market

User inquiries regarding AI's influence in the concentrate containers market largely focus on how technological integration can enhance supply chain predictability, improve quality assurance, and optimize custom design workflows. Key themes revolve around AI's ability to monitor real-time temperature and humidity control during shipping (smart packaging), streamline inventory management based on fluctuating concentrate production schedules, and accelerate the development of complex child-resistant mechanisms through advanced simulation and material failure prediction. Users are primarily concerned about the initial cost of implementing AI-driven quality checks (such as computer vision systems for defect detection) versus the long-term gains in regulatory compliance and reduction of product recalls.

The implementation of Artificial Intelligence and Machine Learning (ML) in the concentrate container sector is less about replacing physical packaging and more about optimizing the processes around production, testing, and logistics. AI algorithms can analyze historical market data and regulatory changes across different jurisdictions (e.g., California vs. Illinois requirements) to predict optimal container stock levels, material specifications, and production line adjustments, minimizing waste and ensuring compliance ahead of time. This predictive capability significantly reduces the operational risk associated with rapidly changing market demands and complex, diverse packaging regulations inherent to the cannabis industry.

Furthermore, AI-powered computer vision systems are revolutionizing quality control on high-speed manufacturing lines. These systems can instantly detect microscopic flaws in glass or silicone containers, verify the precise fit of child-resistant closures, and ensure the tamper-evident seals are correctly applied, operating at speeds far exceeding human capacity. This enhanced precision is crucial for highly regulated products where container failure could lead to degradation of expensive concentrates or violation of strict safety standards, thereby offering measurable improvements in product integrity and reducing liability for manufacturers.

- AI-driven Predictive Maintenance: Optimizing packaging line uptime and efficiency.

- Computer Vision Quality Control: Automated, high-speed detection of micro-defects in glass and closure alignment.

- Demand Forecasting and Inventory Optimization: ML models predicting material needs based on concentrate production cycles and regulatory shifts.

- Smart Packaging Integration: Use of AI/IoT to monitor environmental conditions (temp/humidity) during transit of sensitive concentrates.

- Accelerated Design Prototyping: AI simulation tools aiding in the development of complex child-resistant (CR) locking mechanisms.

DRO & Impact Forces Of Concentrate Containers Market

The Concentrate Containers Market is significantly influenced by the delicate balance between accelerating regulatory legalization (Driver), material cost volatility (Restraint), and the burgeoning opportunity in sustainable packaging innovation (Opportunity). The primary impact forces are concentrated around stringent consumer safety laws, particularly mandated child-resistant standards, which demand continuous innovation in closure technologies and material robustness. Compliance failures can lead to immediate market exclusion, making regulatory adherence the paramount force shaping manufacturing and supply chain decisions. This necessitates substantial R&D investment by container manufacturers to stay ahead of evolving legal frameworks across global jurisdictions.

Drivers include the widespread expansion of the legal cannabis market globally, leading to mass production requirements; the consumer trend towards concentrates as a preferred consumption method due to their potency and discrete nature; and technological advancements in packaging materials that enhance preservation qualities, such as superior UV protection coatings and non-reactive internal liners. Restraints primarily involve the high cost and supply chain complexity associated with sourcing medical-grade, non-contaminating materials like specialized silicone and borosilicate glass, which face global supply pressures. Additionally, the fragmented and highly localized nature of cannabis regulations across different states and countries creates complexity for manufacturers aiming for standardized, scalable container solutions.

Opportunities are abundant in the realm of advanced material science, particularly the development of fully sustainable, yet equally functional, child-resistant packaging. There is a strong market pull for biodegradable plastics or recycled content materials that can withstand the chemical properties of concentrates while meeting strict durability and safety standards. Furthermore, the integration of advanced anti-counterfeiting technologies, such as NFC tags or unique serialized QR codes printed directly on the containers, offers an untapped potential for enhancing brand security and consumer trust in a highly competitive and often illicitly impacted market.

Segmentation Analysis

The Concentrate Containers Market is meticulously segmented based on the material used, the capacity of the container, the type of closure mechanism employed, and the primary end-use application. This segmentation helps manufacturers tailor their production strategies to meet the precise technical and regulatory demands of diverse market niches, ensuring that specialized concentrates (like crystalline THCA or viscous terpene sauces) are matched with the most suitable packaging solution. The selection criteria often prioritize chemical compatibility, temperature stability, and compliance with child-resistant certification standards, reflecting the high value and controlled nature of the contents.

Key segmentation trends reveal that material choice is critical, heavily influencing both cost and product longevity. While glass provides the gold standard for non-reactivity and a premium feel, specialized silicone and PTFE-lined polymer containers are necessary for super-sticky extracts. Capacity segmentation is heavily skewed towards smaller sizes (1g and below) reflecting consumer buying habits and typical concentrate dosage units. The closure segment is arguably the most regulated, with innovation focused entirely on improving the complexity and reliability of certified child-resistant (CR) caps, often requiring two-step actions to open, a crucial compliance factor differentiating providers.

- By Material: Glass (Borosilicate, Soda-Lime), Silicone (Food Grade, Platinum Cured), Polymer Plastics (Polypropylene (PP), Polyethylene (PE), Polytetrafluoroethylene (PTFE) Lined).

- By Capacity: Under 1 Gram, 1 Gram to 3 Grams, Above 3 Grams.

- By Closure Type: Child-Resistant Screw Caps, Snap Caps (Push and Turn), Tamper-Evident Seals, Custom Dual-Locking Mechanisms.

- By End-Use Application: Cannabis Concentrates (Wax, Shatter, Live Resin, Oil Cartridges), Pharmaceuticals (High-Purity Oils), Specialized Food Flavors and Extracts.

Value Chain Analysis For Concentrate Containers Market

The value chain for concentrate containers begins with the upstream sourcing of raw materials, predominantly high-purity silica sand for borosilicate glass and specialized chemical compounds for medical-grade silicone and plastics. This stage involves significant capital investment in material processing facilities and is highly sensitive to commodity price fluctuations and quality control certifications. Key suppliers must adhere to stringent purity standards to ensure the packaging material does not leach contaminants into the highly concentrated substances, which could compromise consumer safety and regulatory compliance. Material procurement efficiency and maintaining long-term supplier relationships are critical to controlling manufacturing costs.

Midstream activities involve the specialized manufacturing and decoration of the containers. This includes glass molding or silicone injection techniques, followed by secondary processes like UV coating, non-stick lining application, and the integration of sophisticated child-resistant closure systems. Manufacturers invest heavily in precision tooling and automation to ensure dimensional accuracy and consistent sealing integrity, as failure at this stage invalidates compliance. Downstream logistics focus on direct distribution to concentrate producers and contract packagers. Direct sales channels are common for large-volume, customized orders where technical consultation on specific product needs (e.g., container size vs. concentrate viscosity) is required, fostering close partnerships.

Indirect distribution involves relationships with large packaging distributors and wholesale suppliers who cater to smaller producers or regions requiring rapid, localized inventory fulfillment. The efficiency of the distribution channel is paramount, as concentrate producers require just-in-time inventory to match their highly variable production schedules. Furthermore, the requirement for compliant labeling and serialization often means that packaging providers must integrate services related to printing and regulatory adherence into their downstream offerings, effectively transitioning from pure manufacturers to full-service packaging solutions partners.

Concentrate Containers Market Potential Customers

The primary end-users and buyers of concentrate containers are entities involved in the legal production and commercialization of cannabis extracts and refined oils. This segment includes licensed cannabis cultivators and processors (LPs) who conduct supercritical CO2 or solvent-based extraction and subsequent refinement processes to create products such as distillates, shatter, wax, and specialized resins. These companies demand containers that not only comply with regulatory standards (CR/TE) but also showcase the premium nature of their high-value contents, often requiring highly customized branding and robust chemical resistance.

A secondary, yet significant, customer base includes contract manufacturing and packaging organizations (CMOs/CPOs) specializing in white-label services for various cannabis brands. These CPOs often manage the complexities of sourcing, inventory, and packaging execution for multiple clients across different regulatory zones, necessitating large-volume, standardized container solutions with flexible customization capabilities. These customers prioritize supply reliability, economies of scale, and guaranteed certification documentation from their container suppliers to maintain continuous operation and regulatory standing.

Finally, the pharmaceutical industry, particularly specialized segments dealing with high-potency medicinal oils and precise-dose botanical extracts, represents a niche but highly demanding customer group. These buyers require packaging solutions that meet pharmaceutical-grade standards, including USP classification, extreme inertness, and often specialized sterilization processes (e.g., gamma radiation compatibility). While smaller in volume compared to recreational cannabis, the strict quality mandates in this sector drive innovation in material purity and advanced closure integrity for container manufacturers serving this segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 980 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cannaline, Kush Supply Co., Green Rush Packaging, O.Berk Company, Dymapak, The Calyx Container, Brandable Packaging, MMC Depot, Smurfit Kappa, Amcor plc, Berry Global Group, Inc., Pretium Packaging, SKS Bottle & Packaging, Inc., Polytainers Inc., GlaroBoxes, Specialty Container, Container and Packaging Supply, CannaPack Solutions, MJS Packaging, Drug Plastics & Glass Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Concentrate Containers Market Key Technology Landscape

The technology landscape for concentrate containers is defined by material science innovation and precision engineering, focused primarily on enhancing product safety, preservation, and regulatory compliance. A crucial technological element is the development and certification of advanced child-resistant (CR) closure systems. These mechanisms often utilize multi-step actions (such as push-and-turn or squeeze-and-pull designs) that rely on intricate mechanical tolerances and high-durability plastic resins (like PP or PET) to function reliably over the container's lifecycle. Manufacturers are employing CAD/CAM and rapid prototyping to develop and test these complex closure geometries quickly, ensuring they meet evolving ASTM or ISO standards for child safety without compromising adult convenience.

Furthermore, packaging material technology is progressing rapidly, especially in specialized coatings and liners. For highly viscous or sticky concentrates (like rosin or shatter), non-stick surfaces are essential to prevent product loss. Technologies such as PTFE (Teflon) liners or proprietary platinum-cured silicone treatments are increasingly used to minimize adhesion while maintaining chemical inertness. For glass containers, specialized UV-blocking additives and coatings are essential to filter out harmful light spectrums, thereby preventing the degradation of sensitive cannabinoids and terpenes, extending the shelf life of the concentrate and preserving its therapeutic efficacy.

In manufacturing, the adoption of high-precision injection molding and automated inspection systems (often incorporating machine vision technology) is becoming standard. These technologies ensure uniformity in container wall thickness, crucial for durability, and verify the structural integrity of the seal area to guarantee airtight closure, preventing oxidation. Serialization and track-and-trace technologies, integrating specialized printing or embedded QR codes directly onto the container, are also key technological requirements, enabling robust supply chain security, combating counterfeiting, and facilitating rapid product recalls if necessary, a critical component of regulatory infrastructure.

Regional Highlights

The regional analysis of the Concentrate Containers Market underscores significant disparities in maturity and growth drivers, heavily influenced by local regulatory environments concerning cannabis and specialized extracts. North America, encompassing the U.S. and Canada, currently holds the largest market share due to the early establishment of mature legal recreational and medical cannabis markets. This region mandates the most stringent standards for packaging, particularly in child resistance and testing transparency, driving the demand for high-specification glass and CR closure technology. Market players here focus on customization, branding, and large-scale, automated production to meet consistently high volumes.

Europe is positioned as the fastest-growing region, stimulated by the expansion of medical cannabis programs across member states like Germany, the UK, and Switzerland. While the total volume is currently lower than North America, the growth rate is aggressive, fueled by pharmaceutical standards that often necessitate even higher purity and quality specifications for packaging materials. European demand is concentrating on glass containers and precise dosing mechanisms suitable for medicinal applications, often prioritizing compliance with EU pharmacopoeial standards (EP) alongside CR mandates, requiring manufacturers to maintain dual regulatory adherence.

Asia Pacific (APAC) remains largely untapped, constrained by widespread prohibitive drug laws, but select markets like Australia and Israel (often grouped for market analysis due to their advanced medical cannabis research) show foundational growth. Future potential in APAC lies in the gradual adoption of medical programs, which would open immense opportunities for basic, yet compliant, container solutions. Latin America, particularly countries like Uruguay and emerging markets like Colombia, presents potential for cost-effective packaging solutions, where the focus is balanced between basic regulatory compliance and minimizing operational costs due to emerging economic environments.

- North America (U.S., Canada): Market leader; drives high-volume demand; focus on ASTM-certified Child Resistance (CR) and premium glass packaging.

- Europe (Germany, Netherlands, UK): Fastest-growing region; demand driven by medical standards (EP/GMP); focus on pharmaceutical-grade material purity and advanced security features.

- Asia Pacific (APAC) (Australia, Israel): Emerging potential; growth contingent on regulatory liberalization; initial demand centered on high-security medical packaging.

- Latin America (Uruguay, Colombia): Cost-sensitive market; emphasis on basic compliance and localized manufacturing solutions for volume efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Concentrate Containers Market.- Cannaline

- Kush Supply Co. (KushCo Holdings)

- Green Rush Packaging

- O.Berk Company

- Dymapak

- The Calyx Container

- Brandable Packaging

- MMC Depot

- Smurfit Kappa

- Amcor plc

- Berry Global Group, Inc.

- Pretium Packaging

- SKS Bottle & Packaging, Inc.

- Polytainers Inc.

- GlaroBoxes

- Specialty Container

- Container and Packaging Supply

- CannaPack Solutions

- MJS Packaging

- Drug Plastics & Glass Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Concentrate Containers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary materials used for concentrate containers?

The primary materials are chemically inert borosilicate glass, high-grade platinum-cured silicone (known for its non-stick properties), and specific food-grade polymer plastics like polypropylene (PP) used mainly for cost efficiency and child-resistant closures.

Why is Child-Resistant (CR) certification crucial for this market?

CR certification is mandated by regulatory bodies, especially in North America and Europe, to ensure that packaging prevents accidental ingestion by children, which is critical given the high potency of cannabis concentrates. Containers must pass rigorous ASTM standards to be legally marketable.

How does the container material impact the concentrate's shelf life?

The material directly impacts shelf life by providing chemical inertness (preventing leaching), airtight seals (preventing oxidation), and UV protection (preventing degradation of sensitive cannabinoids like THC and terpenes). Glass is often preferred for maximum preservation.

Which geographical region dominates the Concentrate Containers Market?

North America, particularly the United States and Canada, dominates the market share due to widespread legalization and mature operational supply chains for both medical and recreational cannabis concentrates, leading to the highest demand volume.

What is the current trend regarding sustainable concentrate packaging?

The market trend is moving toward sustainable alternatives, including the use of Post-Consumer Resin (PCR) plastics, biodegradable polymers, and materials with higher recycled content, driven by consumer demand and corporate environmental mandates, balancing sustainability with regulatory compliance.

The market for concentrate containers is fundamentally linked to the growth of the specialized extracts sector, driven by consumer preference for potent, high-quality, and discrete products. As regulations around the world continue to liberalize, the demand for sophisticated, compliant, and sustainable packaging solutions will intensify, necessitating ongoing investment in material science and automated manufacturing technologies to meet global safety standards and operational efficiency requirements. The transition toward pharmaceutical-grade standards, even in recreational markets, signifies a maturation of the packaging supply chain, emphasizing purity, traceability, and robust child-resistant functionality as non-negotiable elements for success in this dynamic industry.

Future growth will be significantly shaped by advancements in active packaging technologies, where containers might incorporate features that actively monitor or adjust internal conditions, such as micro-desiccants or oxygen absorbers, to extend the concentrate's stability further. This shift toward smart packaging, potentially integrated with IoT sensors, represents the next frontier in maintaining product integrity during complex global distribution. Furthermore, regulatory harmonization, if achieved across major international markets, would greatly simplify manufacturing processes, allowing companies to achieve economies of scale and accelerate global market entry, benefiting both suppliers and end-users by stabilizing pricing and ensuring wider availability of certified, high-quality container options.

The competitive landscape remains fragmented but is consolidating rapidly, with large global packaging firms acquiring specialized niche players to gain instant access to proprietary CR closure designs and established regulatory compliance expertise. Small and medium enterprises (SMEs) must therefore differentiate themselves through highly customized design services, superior material sourcing, or specialized application niches (e.g., containers optimized exclusively for crystalline structures or highly volatile terpenes). Successfully navigating this market requires a deep understanding of state-specific packaging laws, robust quality management systems, and a proactive approach to adopting sustainable manufacturing practices to secure long-term contracts with major legal cannabis operators.

Penetration of the market in emerging economies will require adapting container designs to local economic constraints while adhering to international safety benchmarks. This involves developing cost-effective, yet secure, polymer solutions where high-end glass might be cost-prohibitive. The educational role of container manufacturers will also expand, helping emerging producers understand and implement complex CR requirements and labeling standards necessary for safe and legal market operation. Ultimately, the concentrate container market is a high-growth sector where technical compliance and innovation in consumer experience are the key determinants of market leadership and sustainable commercial viability.

The increasing consumer awareness regarding environmental footprint necessitates that container providers invest heavily in life cycle assessments (LCA) for their products, identifying ways to reduce material input, increase recyclability, and minimize transportation emissions. This focus is leading to lighter-weight glass options and the development of monomaterial packaging designs that simplify end-of-life recycling processes. Companies successfully integrating circular economy principles into their packaging solutions while maintaining the stringent requirements for concentrate preservation will gain a considerable competitive advantage, especially in markets driven by environmentally conscious millennials and Generation Z consumers who prioritize brand alignment with sustainability goals.

Technological barriers, particularly related to the complex machinery needed for high-volume, precise child-resistant cap application, pose a significant entry challenge for new competitors. The investment required for automated inspection systems and specialized cleanroom manufacturing environments (to prevent contamination of pharmaceutical-grade products) creates high fixed costs. Therefore, established manufacturers benefit from significant economies of scope and scale, allowing them to offer more competitive pricing for high-volume orders while maintaining superior quality control, thereby reinforcing their market position against smaller, less capitalized entrants.

Regulatory harmonization is viewed by many industry participants as the single greatest potential catalyst for further market acceleration. Current fragmentation means a container compliant in California may require substantial modification or re-certification for sale in Germany or even neighboring states. The emergence of common international standards, potentially driven by UN or ISO committees specific to cannabis and high-potency extracts packaging, would allow for global standardization of production runs, drastically reducing complexity, cost, and time-to-market for new packaging innovations, thereby streamlining the entire global concentrate supply chain and facilitating easier cross-border commerce.

Furthermore, the evolution of concentrate products themselves is constantly pushing the boundaries of packaging science. Newer products, such as THCA crystalline or high-terpene full-spectrum extracts (HTFSE), have unique viscosity and thermal properties. These require specific storage conditions—for instance, containers capable of stable storage at extremely low temperatures without material degradation, or non-stick properties that handle both liquid and solid phases within the same package. Packaging providers must therefore work closely with extractors during R&D phases to co-develop packaging solutions that are optimally suited to the specific chemical matrices of next-generation concentrates, ensuring perfect compatibility and maximum potency retention.

The importance of branding and aesthetic appeal cannot be overstated in the highly competitive retail environment. Concentrate containers serve as the primary interface between the premium product and the consumer. Manufacturers are increasingly utilizing sophisticated decorating technologies, such as precision screen printing, metallic foiling, and customized tactile finishes, to enhance the visual and sensory appeal of the packaging. The psychological impact of a heavy, solid glass jar with a seamless closure system often translates to a perception of higher product quality, making the container an integral component of the overall brand strategy and market positioning, particularly for high-end luxury concentrate brands.

Security and anti-counterfeiting measures are becoming increasingly sophisticated. Beyond standard tamper-evident seals, packaging is integrating hidden security features. These include micro-text printing, holographic foils, color-shifting inks, or even embedded chips that allow consumers to verify authenticity using a smartphone app. Given the prevalence of illicit concentrate markets and the risk of product diversion, container security is a key differentiating factor, protecting both consumer health and the brand's reputation, especially when dealing with international distribution where regulatory oversight can vary substantially across jurisdictions.

Looking ahead, the shift towards micro-dosing and precise applications, particularly in the medical sector, is driving demand for highly specialized, small-format containers and integrated applicator systems. This includes precise droppers, calibrated syringes, or complex twist-up dispensers designed to manage highly viscous oils and semi-solid concentrates accurately. These products require manufacturers to blend traditional container design with complex medical device engineering principles, significantly raising the technological bar for entry and requiring adherence to both packaging and medical device quality standards.

In summary, the Concentrate Containers Market is a microcosm of the broader regulated cannabis and specialty extracts industry, defined by high regulatory scrutiny, rapid technological material evolution, and intense competition for brand differentiation. Success is predicated on achieving total regulatory compliance while simultaneously innovating in sustainability, product preservation, and consumer-friendly design. The convergence of AI-driven quality control and the persistent global expansion of legal markets ensures that this sector will remain one of the most dynamic and technically challenging segments within the global packaging industry throughout the forecast period.

The economic impact of reliable packaging cannot be underestimated, especially considering the high intrinsic value of the concentrates themselves. A single batch of premium live resin can be worth tens of thousands of dollars, making packaging failure—such as a non-airtight seal leading to oxidation, or a closure mechanism failure leading to spillage—an extremely costly event. Therefore, procurement decisions are highly focused on certified suppliers with proven track records for quality consistency, often justifying a premium price for guaranteed performance and minimized product loss risk, especially in automated filling environments where consistency is paramount.

Furthermore, the logistics surrounding concentrate containers are complicated by temperature sensitivity. For live resin and other terpene-rich extracts, containers must often withstand cold-chain logistics, meaning the materials must perform reliably under freezing conditions without becoming brittle or compromising the seal integrity. This adds another layer of complexity to material selection, favoring polymers and specialized glass that maintain structural stability across a wide temperature gradient, ensuring product quality is maintained during long-distance or international shipping routes.

The competitive strategy employed by market leaders often involves vertical integration or strategic partnerships that secure the supply of critical raw materials. For instance, manufacturers may partner directly with high-purity glass suppliers or specialized silicone compounders to buffer against supply chain shocks and material cost volatility. This integration ensures not only stable supply but also allows for greater control over the upstream quality control processes, ensuring the raw materials consistently meet the stringent non-reactive standards required for concentrate storage, giving integrated players a distinct advantage in reliability and cost management.

In terms of manufacturing processes, automation extends beyond simple production line speed. It now includes robotics dedicated to the precise handling of small, delicate containers, ensuring they are not scratched or compromised during sorting, sterilization, and preparation for filling. The accuracy required for applying labels, including regulatory warnings and batch numbers, demands advanced vision-guided robotics to ensure 100% placement accuracy, vital for preventing regulatory non-compliance fines related to mislabeled product.

Finally, market education plays a subtle but critical role. As new states or countries legalize concentrates, the initial demand is often accompanied by a steep learning curve for local producers regarding mandatory packaging standards (such as child-resistant certifications and appropriate material selection). Leading container providers often act as consultants, providing comprehensive training and documentation to guide new entrants through the regulatory maze, thereby establishing themselves as essential partners rather than just suppliers, which locks in long-term customer relationships and fosters brand loyalty within the rapidly evolving industry.

The development of customized concentrate container shapes represents a growing market niche. While standard jars are prevalent, brands seek unique, patented shapes (e.g., stylized hexagonal jars or custom clamshells) that stand out on dispensary shelves. This customization requires significant investment in specialized molds and tooling, often featuring intricate designs that must still accommodate standard automated filling equipment. Successfully translating a unique aesthetic vision into a functionally compliant and manufacturable container is a key challenge and opportunity for high-end packaging engineering firms, allowing brands to establish premium positioning through physical packaging differentiation.

Regulatory scrutiny regarding heavy metal contamination and material safety is continuously increasing. Manufacturers must provide rigorous evidence and third-party testing reports confirming that their containers—especially the plastics and closures—do not leach harmful substances into the high-potency solvents and oils. This demands continuous material testing and certification, often based on U.S. FDA or European Pharmacopoeia standards, even when the end product is designated for recreational use, elevating the base quality requirement for all participants in the concentrate container supply chain and ensuring consumer confidence in the safety of the packaged product.

Furthermore, the market is seeing innovation in tamper-evident features that go beyond simple shrink bands. Advanced solutions include integrated tear strips on caps that indicate first opening and complex physical seals that break upon attempted removal, providing irrefutable proof of product integrity prior to consumer purchase. These technologies are crucial for high-value products, deterring pilferage and ensuring that the consumer receives the product exactly as intended by the licensed producer, reinforcing the necessary chain of custody documentation throughout the retail supply process.

The shift towards vaporization methods also influences container design. While the primary market is focused on jars for dab concentrates, the need to package refill oils and components for vape cartridges demands robust, leak-proof syringes and small glass vials. These specialized containers must be manufactured with extreme precision to interface correctly with dosing equipment and specialized filling machines, highlighting the need for container manufacturers to understand and cater to the specific technical demands of the various consumption methods prevalent in the concentrate market segment.

In conclusion, the concentrate containers sector is characterized by a high degree of technical specialization, heavily influenced by global safety legislation and material performance demands driven by the volatile chemical nature of the contents. The blend of regulatory necessity, technological advancement in material science, and the imperative for strong brand presence ensures this market segment will continue its trajectory of robust growth and complex innovation throughout the projected timeframe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager