Concrete Batching Plant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438449 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Concrete Batching Plant Market Size

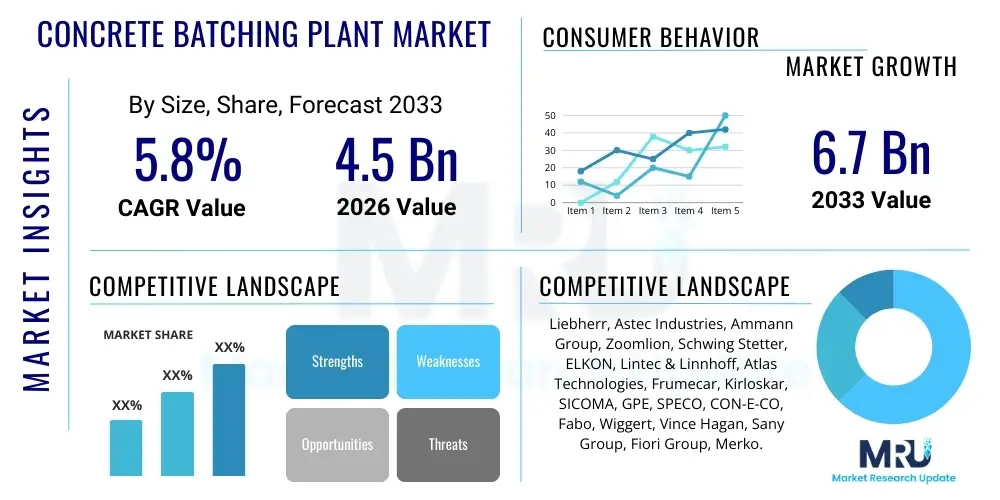

The Concrete Batching Plant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Concrete Batching Plant Market introduction

Concrete Batching Plants are essential components of modern construction infrastructure, serving as centralized facilities for combining precise quantities of cement, aggregates (sand and gravel), water, and admixtures to produce concrete. These sophisticated machines ensure quality consistency and scalability necessary for large-scale construction projects. The core function involves automated storage, weighing, mixing, and discharge of raw materials, ensuring that the final concrete mix conforms strictly to required engineering specifications. This level of precision is critical for structural integrity, particularly in high-rise buildings, extensive highway networks, and mass transit systems.

The market encompasses various configurations, primarily classified as stationary, mobile, and modular plants. Stationary plants are utilized for long-term projects or centralized ready-mix concrete production hubs, offering high capacity and consistent output. Mobile plants are designed for quick deployment and relocation, making them ideal for linear infrastructure projects such as roads, railways, and pipelines, where the construction site continuously shifts. Modular plants combine the benefits of both, offering high capacity with the advantage of easier dismantling and reassembly, appealing to large contractors managing multiple projects over a defined period.

Major applications driving market demand include governmental infrastructure development, fueled by economic stimulus packages globally, and rapid urbanization in emerging economies. The benefits derived from utilizing technologically advanced batching plants include superior quality control through computerized dosing, reduced material waste, increased operational speed, and enhanced safety standards compared to manual mixing methods. Key driving factors include increasing investment in sustainable construction materials, rising global population necessitating residential and commercial infrastructure, and the continuous push towards automated, high-efficiency construction processes.

Concrete Batching Plant Market Executive Summary

The Concrete Batching Plant Market exhibits robust growth, primarily propelled by favorable global business trends centered around aggressive infrastructure spending and the persistent demands of residential and commercial expansion. A dominant trend is the shift towards highly automated and energy-efficient plants that minimize environmental impact and maximize output precision. The industry is witnessing significant integration of IoT and telematics, allowing operators to monitor operational parameters, manage inventory remotely, and predict maintenance requirements, thereby reducing downtime and enhancing overall plant efficiency. Furthermore, the increasing complexity of modern concrete mix designs, requiring precise dosing of specialized chemical admixtures, is solidifying the necessity for advanced electronic control systems offered by newer batching plant models.

Regionally, the Asia Pacific (APAC) market maintains its strong leadership position, driven by massive public sector investments in rail, road, and port development, particularly in countries like China and India, alongside sustained urbanization across Southeast Asia. North America and Europe, characterized by market maturity, show high demand for replacement machinery equipped with enhanced digital capabilities and compliance features related to stringent emission and noise regulations. In Latin America and the Middle East & Africa (MEA), growth is linked to large-scale, planned megaprojects (e.g., smart cities and large mining developments), favoring high-capacity stationary and modular units capable of supporting prolonged construction schedules.

In terms of segmentation trends, the mobile batching plant segment is projected to experience the highest CAGR due to its inherent flexibility, catering to dispersed infrastructure projects that require rapid setup and mobility. Concurrently, the capacity segment exceeding 100 m³/h is seeing increased adoption globally, reflecting the scale and pace of modern construction mandates. Technology integration, specifically in moisture sensors and temperature control systems, remains a crucial differentiator among competitors. The market structure remains moderately fragmented, with intense competition centered on product durability, after-sales service quality, and integrated software solutions for fleet management and production optimization.

AI Impact Analysis on Concrete Batching Plant Market

User queries regarding the integration of Artificial Intelligence (AI) in the Concrete Batching Plant Market frequently revolve around optimizing concrete mix design for specific environmental conditions, predictive maintenance scheduling, and enhancing supply chain efficiency for raw materials. Key themes users are concerned about include the accuracy of AI-driven moisture control systems, the return on investment (ROI) for implementing complex machine learning algorithms into legacy plant operations, and how AI can ensure compliance with evolving sustainability and quality standards. There is a strong expectation that AI will transition the industry from reactive maintenance and standardized mixes to proactive, adaptive, and hyper-customized concrete production, dramatically reducing material wastage and operational risk.

The primary influence of AI lies in its ability to process vast streams of real-time data collected from sensors—including ambient temperature, aggregate humidity, and mixer torque—to make instantaneous adjustments to the batching process. This capability allows plants to maintain optimal slump and strength characteristics regardless of fluctuating material quality or changing environmental factors, which has historically been a major challenge in concrete production. Furthermore, AI-powered systems are being developed to analyze historical operational data to predict component failure with high accuracy, scheduling maintenance precisely when needed and thus minimizing unscheduled downtime, a critical factor for high-volume producers.

Beyond the plant floor, AI is revolutionizing logistical planning within the ready-mix ecosystem. Machine learning algorithms optimize the dispatch and routing of concrete mixer trucks, considering real-time traffic, delivery site requirements, and curing time constraints, thereby ensuring timely delivery and minimizing material spoilage. This holistic optimization, from raw material management through to final delivery, positions AI as a core transformative technology moving the batching plant industry toward 'Concrete 4.0,' characterized by fully autonomous and optimized production cycles, offering significant competitive advantages to early adopters.

- AI-Driven Mix Optimization: Real-time adjustment of water-cement ratio and admixture dosage based on sensor input, ensuring quality consistency and material efficiency.

- Predictive Maintenance: Analyzing vibration, temperature, and usage data to forecast equipment failure (e.g., mixers, conveyor belts), drastically reducing unplanned stoppages.

- Supply Chain Management: Using machine learning to forecast aggregate and cement demand, optimizing inventory levels and mitigating price volatility risks.

- Automated Quality Control: Employing computer vision and sensor fusion to continuously monitor and report concrete parameters, guaranteeing compliance with structural standards.

- Energy Consumption Optimization: Algorithms adjust motor speeds and cycle timing to minimize electricity use while maintaining throughput targets.

DRO & Impact Forces Of Concrete Batching Plant Market

The Concrete Batching Plant Market is primarily driven by global infrastructure rejuvenation and rapid urbanization, particularly across developing economies. These drivers necessitate robust, high-volume concrete production capabilities. However, the market faces significant restraints, including the high initial capital investment required for automated, high-capacity plants and increasing regulatory pressure concerning dust emissions and noise pollution, which mandate complex and costly environmental control systems. Opportunities are centered on technological advancements, such as the adoption of modular designs that offer enhanced flexibility, and the integration of IoT for remote diagnostics and performance monitoring. Furthermore, the growing trend toward green construction offers a substantial opportunity for manufacturers developing plants capable of efficiently handling recycled aggregates and alternative cementitious materials.

Impact forces acting upon the market demonstrate high complexity. Government policies, especially those related to public infrastructure spending (economic factor), represent a major accelerator for market growth. Technological advancements (technological factor), such as automation and digital twin integration, are driving efficiency and replacing older, manual equipment. Environmentally conscious procurement policies (environmental factor) increasingly favor plants with superior dust suppression and noise reduction technologies. Competition (competitive factor) remains intense, focusing on offering superior after-sales support and flexible financing options to contractors. Socioeconomic shifts, such as the increasing global emphasis on sustainable building practices, directly influence product design, requiring plants capable of processing alternative materials like fly ash and slag cement efficiently, shifting the industry standard toward sustainability-centric machinery.

The synergistic effect of these forces underscores a market rapidly evolving from traditional manufacturing to a highly specialized technological sector. The ability of manufacturers to navigate the twin challenges of regulatory stringency and high capital expenditure, while capitalizing on the digital transformation, will determine market leadership. The long-term trajectory is heavily skewed towards solutions that offer operational intelligence, minimizing the total cost of ownership (TCO) for large construction and ready-mix companies. Manufacturers investing in modular, easily transportable, and environmentally compliant high-capacity solutions are best positioned to capture market share, especially in regions characterized by large, temporary construction sites, where mobility and sustainability are paramount operational considerations.

Segmentation Analysis

The Concrete Batching Plant market is segmented based on Type, Capacity, and Application, providing a granular view of demand dynamics across various construction scenarios. The Type segmentation (Stationary, Mobile, Modular) reflects the trade-off between permanence, throughput, and logistical flexibility demanded by different construction projects. Stationary plants, while dominating the market share in terms of centralized concrete production volumes, are facing increasing competition from modular plants which offer comparable capacity but with significantly reduced setup and relocation times, catering specifically to large, temporary infrastructure works. The shift toward higher mobility is evident as contractors seek solutions that reduce transportation costs of concrete by producing closer to the site.

Capacity segmentation, ranging from small-volume plants (Under 30 m³/h) generally used for small residential or customized projects, to high-volume plants (Above 100 m³/h) essential for massive infrastructure endeavors like dams, airport runways, and metropolitan transit systems, highlights the market's dependence on the scale of global construction activity. The medium-capacity segment (30-100 m³/h) forms the backbone of the ready-mix market, serving general urban construction needs. Demand for high-capacity plants is inherently tied to government capital expenditure cycles in the infrastructure sector, while demand for smaller and mobile units is more reflective of private sector commercial and residential development stability.

Application segmentation illustrates the end-use demand profile, categorizing consumption into Residential, Commercial, Infrastructure, and Industrial sectors. Infrastructure remains the largest and most volatile segment, highly influenced by public spending. Residential and Commercial applications provide a stable, ongoing base demand, sensitive to economic cycles and urbanization rates. The industrial segment includes concrete required for specialized facilities such as power plants, petrochemical complexes, and manufacturing hubs, requiring batching plants capable of producing high-performance, specialized concrete mixes, often incorporating unusual aggregate types or chemical resistance requirements.

- By Type:

- Stationary Concrete Batching Plants

- Mobile Concrete Batching Plants

- Modular Concrete Batching Plants

- By Capacity:

- Under 30 m³/h

- 30 m³/h to 100 m³/h

- Above 100 m³/h

- By Application:

- Residential Construction

- Commercial Construction

- Infrastructure (Roads, Bridges, Dams, Railways, Airports)

- Industrial Construction

- By Mixer Type:

- Twin-Shaft Mixers

- Pan Mixers

- Drum Mixers

- By Control System:

- Manual/Semi-Automatic Control

- Fully Automatic Computerized Control

Value Chain Analysis For Concrete Batching Plant Market

The value chain for the Concrete Batching Plant Market begins with the upstream analysis, focusing on the procurement and processing of core raw materials such as specialized steel alloys for structural components, high-tolerance components like load cells and flowmeters, and complex electrical control systems. Key suppliers in the upstream segment are primarily industrial machinery component manufacturers and global automation technology providers. The quality and cost of high-grade steel plates significantly influence the final product cost, especially considering the structural integrity required to withstand abrasive aggregates and high operational stresses. Manufacturers increasingly seek long-term strategic partnerships with component suppliers to mitigate supply chain volatility and ensure consistent component quality necessary for meeting international machinery safety and performance standards.

The core manufacturing stage involves design, fabrication, assembly, and rigorous testing. Modern manufacturing emphasizes modular design principles to facilitate easier assembly, transportation, and setup at customer sites. Investment in advanced robotics for welding and precision machining is crucial for maintaining competitive edge. Downstream analysis centers on distribution, installation, commissioning, and after-sales service. Due to the high value and technical complexity of batching plants, direct sales channels are common, especially for major infrastructure contracts. However, regional distributors and dealerships play a vital role in providing local support, inventory management for spare parts, and facilitating service contracts, particularly in geographically dispersed markets.

The distribution channel is dichotomous: manufacturers often utilize direct channels for custom-built, high-capacity stationary plants sold to large engineering procurement and construction (EPC) firms, ensuring direct technical oversight. Conversely, indirect channels, relying on specialized construction equipment distributors, handle the majority of mobile and standardized modular units, offering localized sales and financing options. After-sales service, encompassing maintenance, spare parts supply, and software upgrades, represents a critical element of the value chain, often constituting a significant recurring revenue stream and influencing customer retention. Plant reliability and the speed of technical support are major competitive differentiators in this technically demanding market, driving manufacturers to integrate advanced telematics for remote diagnostics and preventative maintenance support.

Concrete Batching Plant Market Potential Customers

The primary consumers, or potential customers, in the Concrete Batching Plant Market are segmented across various sectors demanding large volumes of controlled-quality concrete. Engineering, Procurement, and Construction (EPC) companies form the largest buyer group, requiring high-capacity, often mobile or modular plants for major projects such as dams, metro systems, and large industrial complexes. These customers prioritize reliability, high throughput (above 100 m³/h), ease of relocation, and robust after-sales service, as any plant downtime can severely impact project timelines and incur massive financial penalties. Their purchasing decisions are heavily influenced by the total cost of ownership (TCO) and the plant’s ability to handle highly specific concrete mix specifications.

Ready-Mix Concrete (RMC) producers represent another core segment. These customers operate centralized, stationary plants intended for sustained, high-volume production for multiple local construction sites. RMC companies prioritize operational efficiency, integration with advanced enterprise resource planning (ERP) systems for inventory and dispatch management, and compliance with stringent environmental regulations, particularly regarding dust and noise mitigation. Their demand for batching plants is stable, driven by the overall health of the residential and commercial construction economy within their service radius. RMC firms often seek long-term service agreements to ensure continuous operation and regulatory adherence.

Governmental and Public Works agencies, either directly or through specialized infrastructure contractors, are significant purchasers, especially in emerging markets. These entities require batching plants for self-sufficiency in public infrastructure development, focusing on durability and adherence to national quality standards. Furthermore, specialized construction firms involved in highly niche markets—such as precast concrete manufacturing, tunneling, or mining operations—represent a growing segment demanding customized, often smaller or highly specialized batching units that can produce proprietary concrete formulations under controlled conditions. These customers value flexibility in aggregate handling and specialized mixer designs tailored to unique material inputs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Liebherr, Astec Industries, Ammann Group, Zoomlion, Schwing Stetter, ELKON, Lintec & Linnhoff, Atlas Technologies, Frumecar, Kirloskar, SICOMA, GPE, SPECO, CON-E-CO, Fabo, Wiggert, Vince Hagan, Sany Group, Fiori Group, Merko. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Concrete Batching Plant Market Key Technology Landscape

The technological landscape of the Concrete Batching Plant Market is rapidly evolving, driven by the need for increased accuracy, energy efficiency, and operational safety. A critical technological shift involves the widespread implementation of advanced metering and dosing systems, moving beyond traditional volumetric measurement to high-precision load cells and Coriolis flow meters. This ensures extremely accurate measurement of all components, particularly water and specialized chemical admixtures, which are vital for achieving high-performance concrete (HPC) and ultra-high-performance concrete (UHPC) mixes. Furthermore, innovative sensor technology, such as microwave moisture probes, is deployed directly within the aggregate hoppers and mixer drum to provide real-time humidity compensation, enabling instantaneous adjustments to the water-cement ratio and significantly enhancing mix consistency, which is paramount for structural integrity.

Digitalization is profoundly impacting the market, characterized by the integration of Industry 4.0 concepts. Telematics and Internet of Things (IoT) platforms are now standard offerings, enabling remote monitoring of plant performance, operational diagnostics, and maintenance scheduling. Plant operators can access dashboards providing key performance indicators (KPIs) such as cycle time, production volume, energy consumption, and raw material inventory levels from any location. This remote oversight capability is particularly valuable for large contractors managing a fleet of geographically dispersed mobile plants. Furthermore, sophisticated control software now incorporates features like 'recipe management,' allowing instant switching between dozens of complex concrete formulas while maintaining full traceability and generating automated compliance reports, streamlining quality assurance procedures.

Sustainability technologies are gaining prominence, reflecting both regulatory pressure and growing corporate responsibility. Key innovations include advanced dust collection and suppression systems, which utilize specialized filters and water misting to minimize particulate emissions, ensuring compliance with increasingly strict global air quality standards. Another significant area of focus is the development of mixers and aggregate feeding systems optimized for handling recycled concrete aggregates (RCA) and alternative binders like geopolymers and calcined clay. This requires robust material handling components and optimized mixing kinetics to compensate for the different processing requirements of sustainable materials. The convergence of these precision, digital, and green technologies is setting new benchmarks for productivity and environmental stewardship in the concrete industry.

Regional Highlights

The Concrete Batching Plant Market demonstrates highly diversified regional dynamics influenced by varying levels of infrastructure maturity, urbanization rates, and governmental capital expenditure cycles.

- Asia Pacific (APAC): APAC is the global powerhouse for the Concrete Batching Plant Market, primarily due to large-scale, ongoing infrastructure investment across China, India, and Southeast Asia. The region is characterized by aggressive urbanization, driving substantial demand for both residential and commercial high-rises. Key drivers include government initiatives such as the Belt and Road Initiative and India's National Infrastructure Pipeline. Demand in APAC favors high-capacity stationary plants for long-term RMC production and modular/mobile plants for linear infrastructure projects like high-speed rail and highway construction.

- North America: This region is defined by market maturity and high technological adoption. Demand is primarily driven by the replacement of aging equipment and the increasing need for automated plants compliant with stringent environmental (e.g., emissions, noise) and safety regulations. Contractors seek sophisticated, high-efficiency plants integrated with AI and IoT for predictive maintenance and precise quality control, focusing on minimizing operational costs and maximizing labor efficiency. The recent focus on infrastructure renewal, particularly in bridges and public transport, provides significant market stimulus.

- Europe: The European market emphasizes sustainability and low-emission operations. Demand is concentrated on technologically advanced, silent, and dust-controlled batching solutions. Manufacturers are focused on developing plants capable of handling recycled and secondary raw materials to meet EU circular economy objectives. Growth is steady, driven by urban renewal projects and cross-border infrastructure connectivity, with a strong preference for modular designs that minimize site footprint in densely populated urban areas.

- Middle East and Africa (MEA): Growth in MEA is highly project-specific, tied to megaprojects such as smart city developments (e.g., NEOM in Saudi Arabia) and massive oil and gas infrastructure expansion. These projects require exceptionally high-capacity stationary plants designed to operate reliably under extreme temperature and harsh environmental conditions. The market is characterized by bulk procurement and reliance on leading international suppliers for turnkey solutions, focusing heavily on durability and rapid deployment capabilities.

- Latin America (LATAM): The LATAM market growth is driven by increasing public and private investments in housing and transportation networks, though market stability can be sensitive to regional economic fluctuations. Demand is currently shifting towards cost-effective mobile plants that offer flexibility for smaller, dispersed construction projects and rural infrastructure development, focusing on robust yet simpler operational systems compared to the fully automated systems prevalent in North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Concrete Batching Plant Market.- Liebherr

- Astec Industries (Con-E-Co)

- Ammann Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Schwing Stetter GmbH

- ELKON Concrete Batching Plants

- Lintec & Linnhoff Holdings Pte Ltd.

- Atlas Technologies Pvt. Ltd.

- Frumecar, S.L.

- Kirloskar Construction and Allied Machinery Limited

- SICOMA S.r.l.

- GPE Group

- SPECO Industrial Co., Ltd.

- CON-E-CO (part of Astec Industries)

- Fabo Group

- Wiggert + Co. GmbH

- Vince Hagan Company

- Sany Group Co., Ltd.

- Fiori Group S.p.A.

- Merko Makine Sanayi ve Ticaret A.Ş.

Frequently Asked Questions

Analyze common user questions about the Concrete Batching Plant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between stationary and mobile concrete batching plants?

Stationary plants offer the highest capacity and are intended for long-term, centralized RMC production sites, providing superior throughput stability. Mobile plants are designed for rapid setup, portability, and redeployment, making them ideal for linear infrastructure projects or remote sites where concrete must be produced near the point of use to avoid transportation issues and setting time constraints.

How is technology impacting the quality control processes in batching plants?

Technology is enhancing quality control primarily through the use of high-precision load cells and advanced microwave moisture sensors. These systems provide real-time data on aggregate humidity and material weight, enabling fully automatic control software to adjust water dosage instantaneously. This ensures consistent concrete slump and strength characteristics, minimizing human error and ensuring compliance with stringent project specifications.

Which region currently dominates the global Concrete Batching Plant market?

The Asia Pacific (APAC) region currently dominates the market, largely driven by aggressive governmental infrastructure initiatives and rapid urbanization across major economies like China, India, and Southeast Asian nations. High demand for large-scale transportation, residential, and industrial construction projects fuels the need for both high-capacity stationary and flexible mobile batching solutions.

What role do environmental regulations play in the market dynamics?

Environmental regulations are a significant restraint and driver. Strict limits on noise pollution and particulate (dust) emissions necessitate substantial capital investment in advanced dust suppression and filtration systems, increasing the initial cost of compliant machinery. Conversely, these regulations drive innovation, creating opportunities for manufacturers specializing in sustainable plants optimized for handling recycled and secondary materials.

What are the key drivers expected to propel market growth through 2033?

The key drivers include sustained global investment in public infrastructure renewal projects (especially in developing nations), the ongoing need for residential and commercial construction driven by population growth and urbanization, and the increasing industry shift toward automated, high-precision equipment to mitigate labor shortages and improve material efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Concrete Batching Plant Market Statistics 2025 Analysis By Application (Building Industry, Infrastructure Construction), By Type (Stationary Concrete Batching Plant, Mobile Concrete Batching Plant), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ready Mix Concrete Batching Plant Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stationary, Mobile), By Application (Non-residential constructions, Residential constructions), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager