Concrete Mixers Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438146 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Concrete Mixers Equipment Market Size

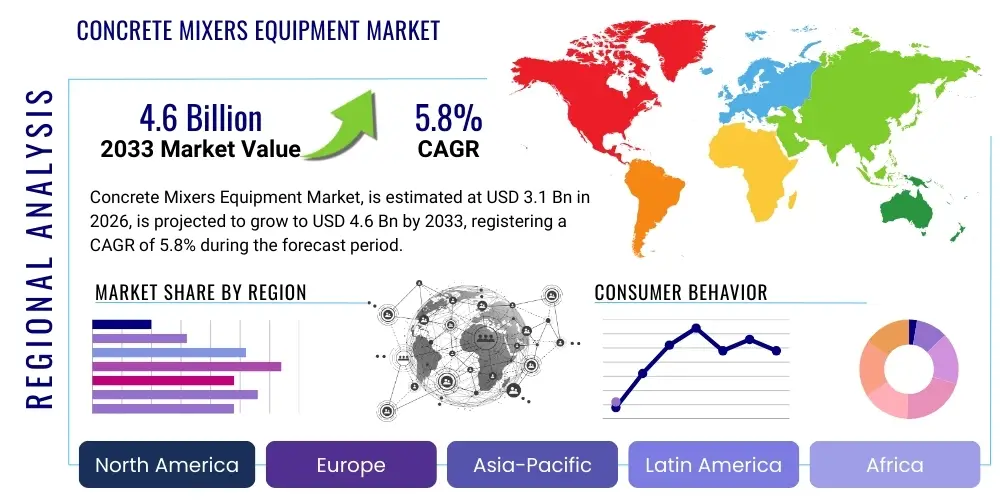

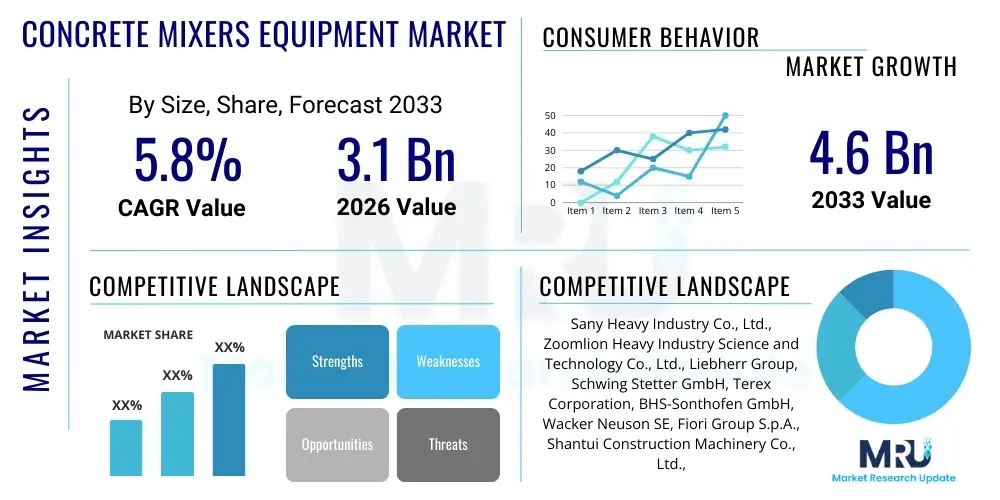

The Concrete Mixers Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.6 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by robust global infrastructure development initiatives, particularly in emerging economies where rapid urbanization necessitates large-scale construction projects. The increasing adoption of advanced, high-capacity concrete mixing solutions designed for efficiency and reduced environmental impact further contributes significantly to market expansion and value accumulation over the forecast horizon.

Concrete Mixers Equipment Market introduction

The Concrete Mixers Equipment Market encompasses machinery essential for uniformly combining cement, aggregates (sand or gravel), and water to produce concrete used in construction activities worldwide. Products range from small, portable drum mixers used in residential projects to large, stationary twin-shaft or continuous mixers employed in major infrastructural developments like highways, dams, and high-rise commercial complexes. These machines are crucial components of the construction industry's supply chain, ensuring the consistency, quality, and timely delivery of building material.

Major applications of concrete mixers equipment span across residential housing construction, complex commercial structures, and critical public infrastructure development. The primary benefits associated with utilizing specialized mixing equipment include enhanced operational efficiency, superior concrete homogeneity leading to improved structural integrity, reduced labor costs, and adherence to stringent project timelines. Furthermore, modern mixers often incorporate features focused on sustainability, such as reduced energy consumption and advanced washing systems, aligning with global green building trends.

Key driving factors fueling market growth include unprecedented governmental spending on public works projects globally, especially in Asia Pacific and the Middle East, aimed at modernizing aging infrastructure and building smart cities. The continuous introduction of technologically advanced equipment featuring automation, telematics, and improved fuel efficiency also serves as a significant market catalyst. Demand is further solidified by the steady population growth, leading to increased demand for housing and commercial real estate across all major regions.

Concrete Mixers Equipment Market Executive Summary

The global Concrete Mixers Equipment Market is characterized by intense technological competition and strategic acquisitions aimed at expanding product portfolios and regional dominance. Business trends indicate a strong pivot towards automation and the integration of IoT for predictive maintenance and real-time performance monitoring, improving the total cost of ownership for end-users. Leading manufacturers are focusing on developing high-capacity, energy-efficient models, especially the self-loading and continuous mixers, which cater to large-scale, time-sensitive infrastructure projects, thereby driving premium segment growth and boosting overall market valuation.

Regionally, the Asia Pacific dominates the market share due to massive infrastructure investments in countries like China, India, and Southeast Asian nations, coupled with rapid urbanization that requires constant residential and commercial construction activity. North America and Europe, while mature markets, demonstrate growth primarily through the replacement of aging fleets with modern, environmentally compliant, and highly automated equipment. The Middle East and Africa (MEA) are emerging as high-potential regions, driven by large-scale government visions such as Saudi Vision 2030 and significant construction associated with oil and gas sector expansions and tourism infrastructure.

Segment trends highlight the growing preference for automated and truck-mounted mixers due to their mobility and capacity, essential for urban construction environments. Based on capacity, the medium and large capacity segments are experiencing accelerated adoption, reflecting the shift towards larger project scales. The twin-shaft mixer segment is particularly notable in its growth trajectory within stationary applications, favored for its ability to produce high-quality, homogeneous concrete quickly, essential for high-performance concrete specifications required in specialized construction.

AI Impact Analysis on Concrete Mixers Equipment Market

Common user questions regarding AI's impact on the Concrete Mixers Equipment Market often center on how automation technologies can enhance mixing quality, reduce material waste, and improve job site safety. Users are keenly interested in predictive maintenance capabilities enabled by machine learning, asking how AI algorithms can anticipate equipment failure before it occurs, thereby minimizing costly downtime. Furthermore, there is significant inquiry into the application of computer vision and sensor fusion—often leveraged by AI—to monitor concrete slump, consistency, and temperature in real-time during the mixing and transport process, ensuring batch quality control without manual intervention. The overarching theme is optimization: users expect AI to transition concrete mixing from a labor-intensive, often inconsistent process into a highly precise, data-driven operation.

The implementation of Artificial Intelligence and Machine Learning (ML) is revolutionizing fleet management for concrete mixers. AI-driven telematics systems analyze vast streams of operational data—including fuel consumption, engine load, travel patterns, and mixing cycles—to identify efficiencies and potential bottlenecks. This optimization extends beyond simple logistics, allowing fleet managers to dynamically schedule maintenance based on predicted component wear rather than fixed intervals, significantly extending the operational life of the equipment and reducing overall ownership costs. AI integration is also facilitating autonomous concrete delivery vehicles on closed sites, minimizing human error and improving operational speed and precision in highly regulated environments.

Moreover, AI algorithms are proving invaluable in advanced material science relevant to concrete production. By analyzing inputs (cement type, aggregate gradation, admixture dosage) and environmental factors (ambient temperature, humidity), AI systems can recommend the optimal mix design adjustments instantly, ensuring that the resulting concrete meets exact strength and curing specifications, regardless of site variability. This precision minimizes off-spec batches, reduces waste, and enhances the sustainability profile of construction projects. The long-term impact of AI is expected to move the industry toward fully autonomous, smart batching plants and mixers that communicate seamlessly with construction execution software.

- AI optimizes predictive maintenance schedules by analyzing sensor data and operational history.

- Machine Learning algorithms enhance concrete mix design for optimal performance and consistency in real-time.

- Integration of computer vision monitors concrete slump and homogeneity during transit and pouring.

- AI-powered telematics improve fleet utilization, route optimization, and reduce fuel consumption.

- Autonomous operation capabilities are being developed for mixing and delivery vehicles on restricted sites.

- Data analytics derived from AI systems assist manufacturers in designing more robust and efficient next-generation equipment.

DRO & Impact Forces Of Concrete Mixers Equipment Market

The Concrete Mixers Equipment Market is predominantly driven by expanding global urbanization, necessitating continuous investment in residential and commercial buildings, alongside extensive public spending on large-scale infrastructure projects. These factors establish a foundational demand base that is consistent across various economic cycles. However, the market faces significant restraints, chiefly high capital investment costs for advanced, large-capacity mixing plants and the stringent regulatory environment regarding noise and emission standards, particularly in developed regions. Opportunities lie in the shift towards sustainable construction materials and the necessity for highly efficient mixing solutions required for specialized concretes, such as fiber-reinforced or ultra-high-performance concrete (UHPC).

The core impact forces shaping this market include economic indicators, which directly correlate construction activity with GDP growth; technological shifts, focusing on automation and digitization; and environmental regulations, pushing manufacturers toward electric and low-emission equipment. The balance between these forces dictates procurement patterns: while economic strength drives demand for volume, regulatory pressures increasingly demand efficiency and sustainability. Competitive intensity is high, characterized by a few global conglomerates vying for market share through product innovation and expansive service networks, pressuring mid-sized players.

Furthermore, the volatility in raw material prices (steel and components) significantly impacts manufacturing costs and, consequently, equipment pricing, representing an ongoing external impact force. Supply chain resilience, demonstrated particularly during global disruptions, has become a critical determinant of market success, favoring companies with diversified sourcing strategies and robust manufacturing footprints. The necessity to meet ever-tightening project deadlines further emphasizes the demand for high-throughput, reliable mixing equipment, cementing reliability as a key competitive factor.

Segmentation Analysis

The Concrete Mixers Equipment Market is intricately segmented based on operational characteristics, capacity, mixer type, and application, allowing manufacturers and buyers to target specific construction needs. Understanding these segmentations is critical for market strategists to identify high-growth areas. The primary segments differentiate between truck-mounted mobile mixers, which offer unmatched flexibility for delivery, and stationary batching plants, required for high-volume, continuous production at major construction sites. The trend towards modular, easily relocatable plants is bridging the gap between stationary capacity and mobile convenience.

Further segmentation by mixer type—drum, pan, twin-shaft, and planetary—reflects the desired mixing efficiency and concrete quality. Twin-shaft and planetary mixers dominate in precast concrete and specialized high-performance applications due to their superior homogeneity and rapid mixing cycles, commanding higher price points. Conversely, drum mixers remain prevalent in small-to-medium general construction projects due to their simplicity and lower acquisition cost. Capacity segmentation, from less than 5 cubic meters to over 10 cubic meters, directly reflects the scale of the construction project, with infrastructure and commercial segments primarily demanding large-capacity machinery to meet tight deadlines.

Geographical segmentation reveals stark differences in preferred technology, with developed markets favoring highly automated, large-capacity, environmentally compliant units, while emerging markets often prioritize cost-effectiveness and rugged reliability in their equipment purchases. The ongoing focus on sustainability is influencing segmentation by technology, creating a dedicated market for electric or hybrid mixers, particularly in urban areas where noise and pollution regulations are strictly enforced, ensuring the market remains diverse and responsive to varied global demands.

- By Type:

- Drum Mixers (Reversible Drum, Non-Reversible Drum)

- Pan Mixers

- Twin-Shaft Mixers (Preferred for high-quality, high-volume batching)

- Planetary Mixers (Used for specialty and precast concrete)

- Continuous Mixers

- By Product/Mounting:

- Truck Mixers (Transit Mixers)

- Stationary Batching Plants

- Portable/Mobile Mixers (Small Capacity)

- Self-Loading Concrete Mixers

- By Capacity:

- Small Capacity (Under 5 cubic meters)

- Medium Capacity (5 to 10 cubic meters)

- Large Capacity (Above 10 cubic meters)

- By Operation:

- Automatic (Fully Computerized Batching)

- Semi-Automatic

- Manual/Non-Automated

- By End-User Application:

- Residential Construction

- Commercial Construction (Office, Retail, Hospitality)

- Infrastructure Development (Roads, Bridges, Dams, Airports)

- Industrial Construction (Factories, Power Plants)

- Precast Manufacturing

Value Chain Analysis For Concrete Mixers Equipment Market

The value chain for concrete mixers equipment begins with upstream activities involving the sourcing and processing of core raw materials, predominantly high-grade steel, complex hydraulic systems, engines, and electronic components. Manufacturers rely heavily on specialized suppliers for robust mechanical and electrical systems that ensure the longevity and performance of the equipment under harsh construction conditions. Efficiency at this stage is crucial, as fluctuating commodity prices directly impact the final manufacturing cost. Advanced R&D and design play a significant role upstream, focusing on creating lightweight yet durable chassis designs and integrating complex computerized batching controls.

The midstream involves the core manufacturing process, assembly, quality control, and testing of the equipment. Companies often utilize proprietary fabrication techniques and advanced welding to ensure structural integrity. Following manufacturing, the distribution channel is primarily indirect, relying on an extensive network of regional dealers, distributors, and rental companies who provide localized sales, financing, and critical after-sales support, including maintenance and spare parts. This indirect channel minimizes the need for manufacturers to maintain vast localized service teams, leveraging dealer expertise instead.

Downstream activities center on the end-user—the construction companies, contractors, and precast concrete producers—who use the equipment. Direct sales are typically reserved for large, customized stationary batching plants, where manufacturers provide direct installation and commissioning services. For standard truck mixers and mobile units, the rental market is a critical component of the downstream segment, offering flexible options for short-term projects. Success in the downstream phase is heavily dependent on the effectiveness of the after-sales service, including telematics integration for remote diagnostics and rapid access to genuine replacement parts, ensuring high uptime for costly construction assets.

Concrete Mixers Equipment Market Potential Customers

The primary potential customers and end-users of concrete mixers equipment span a broad spectrum of the construction industry, ranging from small local contractors to multinational engineering and construction (E&C) firms. General building contractors involved in residential and commercial property development represent a fundamental customer segment, requiring a mix of small mobile mixers and medium-capacity batching plants. The demand from this sector is closely tied to interest rates and general housing market stability, creating a constant, cyclical demand for standard mixing equipment.

A second major customer segment includes large infrastructure developers and specialized civil engineering companies responsible for constructing critical public works such as highways, bridges, tunnels, and mass transit systems. These entities require high-volume, stationary, and continuous mixing plants (often twin-shaft or planetary mixers) capable of delivering massive quantities of high-specification concrete consistently over long periods. Their purchasing decisions are often driven by project scale, required concrete quality standards, and the manufacturer’s proven track record of reliability and service uptime.

Furthermore, precast concrete manufacturers constitute a specialized and high-value customer base. These producers require highly precise mixing equipment, typically utilizing planetary or intensive mixers, to achieve the superior homogeneity and density necessary for precast elements (like slabs, beams, and façade components). This segment emphasizes automation and quality control integration within the mixers, as the consistency of the concrete directly impacts the structural integrity and aesthetic finish of the manufactured product. Finally, equipment rental companies serve as key intermediaries, purchasing large fleets to cater to contractors preferring operational expenditure over capital investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sany Heavy Industry Co., Ltd., Zoomlion Heavy Industry Science and Technology Co., Ltd., Liebherr Group, Schwing Stetter GmbH, Terex Corporation, BHS-Sonthofen GmbH, Wacker Neuson SE, Fiori Group S.p.A., Shantui Construction Machinery Co., Ltd., KAIYUAN General Machinery Co., Ltd., CON-E-CO (Concrete Equipment Company Inc.), Ammann Group, Altrad Group, Apollo Infratech Pvt. Ltd., Speedcrafts Ltd., GOMACO Corporation, ELKON Group, D&D Concrete Machinery, Imer Group, and Putzmeister Holding GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Concrete Mixers Equipment Market Key Technology Landscape

The technology landscape in the Concrete Mixers Equipment Market is rapidly evolving, driven by the need for enhanced efficiency, precision, and sustainability on construction sites. One of the most significant technological advancements is the pervasive adoption of computerized batching control systems. These systems utilize sophisticated load cells and software to precisely measure and dispense aggregates, cement, and water, drastically minimizing human error and ensuring the consistent quality of the concrete mix across multiple batches, which is critical for compliance with strict engineering specifications.

Another crucial innovation involves telematics and IoT integration. Modern concrete mixers, particularly truck mixers and large batching plants, are equipped with sensors that transmit real-time operational data (GPS location, drum speed, temperature, fuel level, and diagnostic codes) back to fleet management platforms. This allows for predictive maintenance, optimized scheduling, and verifiable proof of mix quality delivery. Furthermore, the development of self-loading concrete mixers, which incorporate an automated batching system and mixing drum into a single mobile chassis, has dramatically improved efficiency for smaller, remote construction sites by eliminating the need for a separate batching plant.

Sustainability and power sources are also driving technological shifts. There is an increasing focus on developing hybrid and fully electric concrete mixers and batching plants to comply with urban emission regulations and reduce operational noise. Manufacturers are also improving mixer drum geometry and material science to minimize concrete adherence, simplifying cleaning processes, reducing water consumption, and extending the lifespan of the equipment. These energy-efficient designs address both environmental concerns and the rising cost of fuel and utilities for operators globally.

Regional Highlights

The global Concrete Mixers Equipment Market demonstrates distinct dynamics across key geographical regions, each contributing uniquely to overall market growth and technological adoption. The Asia Pacific (APAC) region stands out as the undisputed leader, driven by massive public sector investments in connectivity infrastructure (roads, rail, ports) and unprecedented rates of urbanization across China, India, and Southeast Asia. The sheer volume of housing and commercial projects in these nations necessitates high demand for both stationary batching plants and a large fleet of truck mixers. Manufacturers operating in APAC often focus on volume production, robust design, and scaling capacity to meet the region's ambitious construction timelines, though technological sophistication is rapidly catching up to Western standards.

North America and Europe represent mature markets characterized by replacement demand and a strong emphasis on technological sophistication and regulatory compliance. In these regions, growth is less about volume expansion and more about value creation through innovation, specifically the adoption of AI-enabled automation, telematics, and low-emission vehicles. Strict environmental regulations, particularly in the European Union (EU), mandate the transition towards equipment with lower noise footprints and reduced carbon emissions, thereby favoring hybrid and electric mixer models. Furthermore, the robust equipment rental market in North America plays a pivotal role, influencing procurement decisions towards highly reliable, durable equipment with high residual values.

Latin America (LATAM) shows steady growth tied closely to commodity cycles and internal infrastructure improvement projects, with Brazil and Mexico being the key markets. The Middle East and Africa (MEA) region, particularly the GCC countries (Saudi Arabia, UAE), is experiencing exponential demand fueled by massive national vision programs aimed at economic diversification (e.g., NEOM, Expo 2020 follow-up projects). These projects demand world-class construction standards, leading to high procurement of large-capacity, state-of-the-art batching plants and mixers from top-tier international suppliers. Africa’s burgeoning economies are also contributing to increasing demand for smaller, rugged, and portable mixers necessary for rapidly expanding urban centers.

- Asia Pacific (APAC): Dominates the market share due to unprecedented infrastructure development, rapid urbanization, and high volume residential construction across India and China. Focus is on high-capacity and durable equipment.

- North America: Driven primarily by replacement cycles, sophisticated telematics integration, and stringent environmental regulations favoring automated and fuel-efficient truck mixers. Strong growth in the equipment rental sector.

- Europe: Characterized by mandatory shifts toward low-emission (Stage V compliant) and electric/hybrid equipment. High demand for planetary and twin-shaft mixers for specialized and precast concrete applications.

- Middle East & Africa (MEA): High growth potential fueled by large-scale mega-projects in the Gulf Cooperation Council (GCC) states and emerging construction activity in South and North Africa. Emphasis on high-capacity stationary plants for demanding site conditions.

- Latin America (LATAM): Market stability dependent on government expenditure on public infrastructure; requires cost-effective, durable equipment suitable for varied geographical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Concrete Mixers Equipment Market.- Sany Heavy Industry Co., Ltd.

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Liebherr Group

- Schwing Stetter GmbH

- Terex Corporation

- BHS-Sonthofen GmbH

- Wacker Neuson SE

- Fiori Group S.p.A.

- Shantui Construction Machinery Co., Ltd.

- KAIYUAN General Machinery Co., Ltd.

- CON-E-CO (Concrete Equipment Company Inc.)

- Ammann Group

- Altrad Group

- Apollo Infratech Pvt. Ltd.

- Speedcrafts Ltd.

- GOMACO Corporation

- ELKON Group

- D&D Concrete Machinery

- Imer Group

- Putzmeister Holding GmbH

Frequently Asked Questions

Analyze common user questions about the Concrete Mixers Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences and applications of twin-shaft versus planetary concrete mixers?

Twin-shaft mixers are primarily utilized in high-volume, stationary batching plants for general and specialized construction where rapid mixing cycles and high throughput are essential, such as road construction or massive infrastructure projects. They excel at handling larger aggregate sizes and providing homogeneity efficiently across large batches. Conversely, planetary mixers are preferred for specialized applications like precast concrete manufacturing, high-performance concrete (HPC), and self-compacting concrete (SCC). Planetary mixers offer a more intensive, homogenous mixing action suitable for fine, sticky, or fiber-reinforced mixes, achieving superior quality and consistency, though typically operating at smaller batch sizes compared to their twin-shaft counterparts. The choice depends critically on the required concrete quality, batch size, and the precision demanded by the final application, with planetary systems usually representing a higher initial investment.

How is the integration of telematics and IoT impacting the operational efficiency and maintenance of concrete mixer fleets?

The integration of telematics and the Internet of Things (IoT) fundamentally transforms concrete mixer fleet management by enabling real-time monitoring of critical operational parameters, including vehicle location, fuel consumption, drum rotation speed, and engine diagnostics. This data facilitates optimized routing, reducing transit times and minimizing fuel wastage, which directly lowers operational costs. Crucially, IoT sensors enable predictive maintenance; by continuously analyzing component stress and performance trends, the system can alert operators to impending failures (e.g., worn hydraulic pumps or clutch issues) before they result in catastrophic downtime. This shift from reactive to predictive maintenance significantly increases equipment uptime, a vital factor for large construction projects with strict deadlines. Furthermore, telematics provides verifiable proof of service and mix delivery conditions, enhancing accountability and customer satisfaction by ensuring concrete is delivered within the specified time and temperature parameters, guaranteeing quality control.

What key environmental regulations are driving innovation in the concrete mixers equipment market, particularly in Europe and North America?

Key environmental regulations are compelling manufacturers to pivot towards sustainable equipment solutions, most notably the European Union’s Stage V emissions standards for non-road mobile machinery (NRMM) and similar Tier regulations in North America. These standards mandate significant reductions in particulate matter (PM) and nitrogen oxides (NOx), pushing manufacturers to adopt advanced engine technologies, including diesel particulate filters (DPFs) and selective catalytic reduction (SCR) systems. Beyond engine emissions, urban areas are increasingly implementing noise pollution controls, accelerating the development and adoption of electric and hybrid concrete mixers, which operate far more quietly than their traditional diesel counterparts. Furthermore, water usage regulations are prompting innovations in drum design and automatic washout systems to minimize wastewater generation and improve the efficiency of reusing wash water. Compliance with these regulations is not optional; it is a prerequisite for market access in mature economies, making environmental performance a primary differentiator and driver of R&D investment.

What is the role of self-loading concrete mixers, and why are they gaining traction in emerging and remote markets?

Self-loading concrete mixers serve as highly mobile and autonomous batching plants, capable of measuring, mixing, and transporting concrete without the need for auxiliary equipment or a centralized batching station. These machines feature an integrated shovel or scoop for loading aggregates and cement, onboard water tanks, and computerized weighing systems. They are gaining significant traction in emerging and remote markets, as well as smaller, dispersed construction sites, primarily due to their unparalleled versatility and cost-efficiency. They drastically reduce logistics complexity and the reliance on expansive infrastructure often lacking in developing regions or isolated project locations. For smaller contractors, a self-loading mixer represents a consolidated investment that minimizes manpower and operational footprint, offering a rapid, reliable solution for low-to-medium volume concrete needs, proving critical for decentralized infrastructure build-outs and housing projects outside major metropolitan areas.

How does the volatile price of raw materials, particularly steel, affect the manufacturing costs and pricing strategies in the concrete mixers market?

The volatile pricing of raw materials, especially high-grade steel which constitutes a major structural component of mixer drums, chassis, and frames, directly and significantly impacts the total manufacturing cost of concrete mixers equipment. Steel price fluctuations necessitate complex inventory management strategies and hedging activities by manufacturers. When steel prices rise sharply, companies must choose between absorbing the higher cost, which reduces profit margins, or passing the increase on to end-users, potentially affecting equipment demand elasticity. Manufacturers often employ flexible pricing models and long-term supply contracts to mitigate short-term volatility. Furthermore, prolonged material price increases incentivize manufacturers to invest in R&D aimed at utilizing lighter, high-strength alternative materials or optimizing equipment design to reduce the necessary material volume without compromising structural integrity or durability, ensuring the overall cost structure remains competitive within the global market landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager