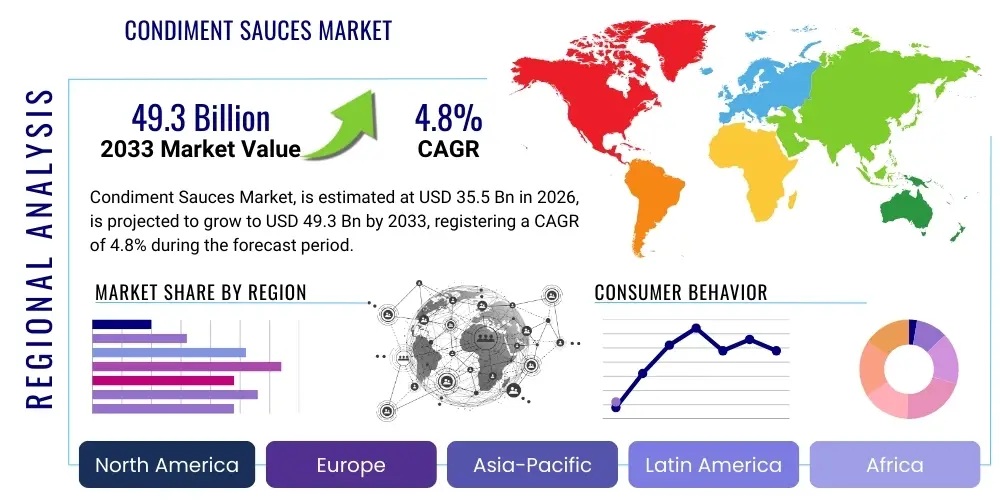

Condiment Sauces Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435565 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Condiment Sauces Market Size

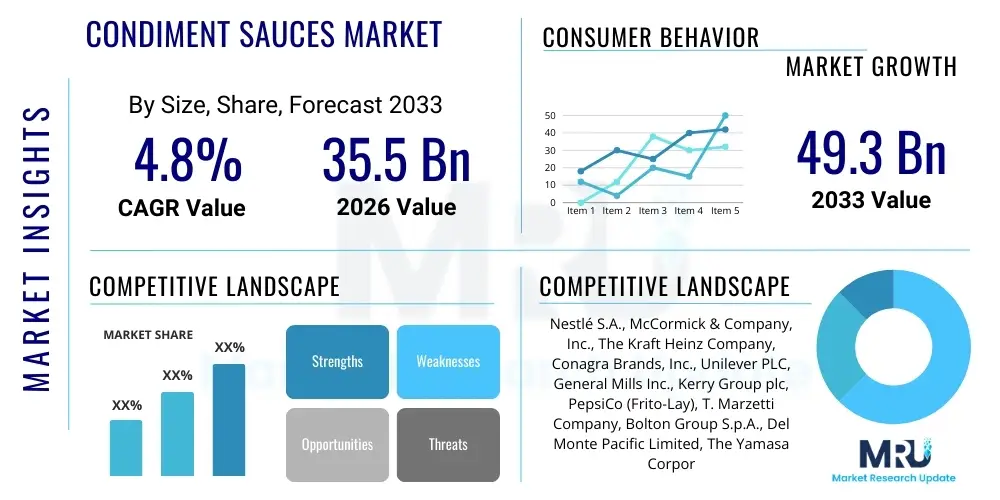

The Condiment Sauces Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 49.3 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by increasing global penetration of diverse culinary trends, rising disposable incomes in emerging economies, and the sustained consumer demand for convenient, flavorful food enhancers. The market size calculation factors in sales across retail channels, foodservice segments, and institutional buyers, reflecting a robust and mature but steadily innovating industry landscape.

Condiment Sauces Market introduction

The Condiment Sauces Market encompasses a wide variety of flavoring agents, dips, and spreads used to complement, enhance, or alter the taste profile of food dishes. Products range from staples like ketchup, mustard, and mayonnaise to specialized ethnic sauces such as soy sauce, hot sauce, barbecue sauce, and various international flavor profiles. The primary product description involves ready-to-use liquid or semi-solid preparations, often manufactured through standardized industrial processes ensuring quality and extended shelf life. Major applications span across household consumption, the fast-food industry, full-service restaurants, institutional catering, and food processing sectors where they function as key ingredients or table-side additions. The core benefits derived by consumers include convenience, rapid flavor augmentation, consistency in taste, and the ability to customize meals according to individual preference. Key driving factors propelling market growth include rapid urbanization, the globalization of food tastes leading to higher demand for authentic international flavors, the proliferation of quick-service restaurants (QSRs), and innovations focused on health-conscious formulations, such as low-sodium, low-sugar, and natural/organic varieties.

Condiment Sauces Market Executive Summary

The global Condiment Sauces Market is characterized by intense competition and dynamic shifts driven by consumer health trends and demand for culinary authenticity. Current business trends indicate a strong move toward product premiumization, focusing on artisanal, non-GMO, and clean-label ingredients, pushing manufacturers to reformulate classic products and introduce niche lines. Regional trends show robust growth in the Asia Pacific (APAC) region, fueled by rising middle-class disposable incomes and the increasing Westernization of diets, while mature markets like North America and Europe focus on sophisticated flavor profiles and sustainable sourcing practices. Segmentation trends highlight the rapid expansion of the hot sauce and chili-based sauce segment, alongside significant adoption of plant-based and vegan alternatives in the mayonnaise and creamy dressing categories. Furthermore, the foodservice channel continues to dominate consumption volumes, but the e-commerce retail segment is witnessing the fastest growth due to enhanced accessibility and convenience, challenging traditional supermarket distribution models and necessitating sophisticated digital supply chain strategies among leading market players.

AI Impact Analysis on Condiment Sauces Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Condiment Sauces Market primarily revolve around optimizing flavor profiles, enhancing supply chain efficiency, and ensuring food safety through predictive analytics. Consumers and industry stakeholders are highly interested in how AI can be leveraged to quickly analyze vast consumer preference data, particularly from social media and e-commerce reviews, to develop novel, hyper-personalized sauce flavors that meet transient market demands. Concerns often center on the ethical use of data in flavor mapping and the displacement of human expertise in traditional culinary development. Expectations are high regarding AI's role in predictive maintenance within manufacturing facilities and optimizing inventory levels across complex global distribution networks to minimize waste and ensure product freshness, thereby maximizing operational efficiency and reducing costs across the entire value chain.

The integration of advanced machine learning algorithms is fundamentally transforming how R&D teams approach product innovation. AI systems can process chemical compound data related to flavor, texture, and aroma, cross-referencing this with regional taste preferences and demographic data to simulate successful flavor combinations before costly physical prototypes are created. This capability drastically reduces time-to-market for new sauces and dressings, allowing companies to react almost instantaneously to emerging food trends, such as fermentation or ethnic fusion flavors. Furthermore, generative AI tools are assisting marketing teams in creating highly targeted advertising campaigns, optimizing pricing strategies based on competitor analysis and real-time demand fluctuations, leading to improved market penetration and optimized revenue streams.

In the manufacturing sphere, AI-driven automation is optimizing production lines, ensuring consistent blending ratios, and improving quality control far beyond human capability. Computer vision systems powered by AI are continuously monitoring product appearance and packaging integrity, dramatically reducing defect rates. Additionally, predictive maintenance schedules, informed by machine learning analysis of equipment performance data, minimize unplanned downtime, which is critical for high-volume, continuous production inherent in the condiment industry. This transition to intelligent manufacturing not only ensures consistency, which is paramount for brand loyalty in condiments, but also enhances adherence to stringent global food safety standards through immutable digital traceability records generated throughout the process.

- AI-Powered Flavor Prediction: Accelerates new product development by analyzing consumer data and chemical profiles to predict successful flavor combinations.

- Supply Chain Optimization: Uses machine learning for demand forecasting, inventory management, and route optimization, reducing logistics costs and spoilage.

- Quality Control Enhancement: Deploys computer vision systems for real-time monitoring of consistency, color, and packaging defects on production lines.

- Predictive Maintenance: Implements algorithms to analyze equipment sensor data, preventing unplanned manufacturing downtime and improving asset lifespan.

- Personalized Marketing: Utilizes AI to segment consumers and deliver hyper-targeted advertising and promotions based on purchasing history and behavioral data.

- Traceability and Safety: Enables blockchain integration and AI processing of traceability data, ensuring rapid identification and recall management in case of contamination.

- Operational Efficiency: Optimizes energy consumption and resource utilization within processing plants based on predictive operational load modeling.

DRO & Impact Forces Of Condiment Sauces Market

The Condiment Sauces Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate strategic direction and market growth. Key drivers include global culinary exploration and the rising popularity of home cooking spurred by media influence, alongside the continuous innovation in health-focused formulations designed to cater to wellness-conscious consumers. Restraints primarily revolve around stringent regulatory frameworks concerning food labeling and ingredients, especially trans fats and high-fructose corn syrup, as well as the volatility in raw material prices, notably tomatoes, sugar, and edible oils, which squeeze profit margins for manufacturers. Opportunities are highly concentrated in emerging markets where penetration rates are lower, and in the niche segment of gourmet, ethnic, and functional condiments (e.g., those fortified with probiotics), offering high-value growth pathways for market participants navigating these challenging operational landscapes.

The overall impact forces are strongly positive, indicating sustained, moderate growth. The increasing velocity of modern life drives demand for convenience foods, where condiments play a crucial role in making quick meals palatable and interesting. Demographic changes, such as smaller households and higher rates of single-person living, also contribute to the necessity for pre-prepared flavor solutions. However, the market faces intense scrutiny from public health organizations, pressuring the industry to mitigate the high sodium and sugar content traditionally associated with many staple sauces. This pressure acts as a restrictive force, necessitating substantial R&D investment into healthier alternatives, which paradoxically opens new avenues for product innovation and market differentiation, especially within premium segments.

Strategic success hinges on balancing cost efficiency, necessary due to volatile input costs, with innovation required to capture the shifting consumer demand towards naturalness, sustainability, and authentic global tastes. Companies that successfully leverage advanced sourcing technologies and supply chain hedging strategies while simultaneously investing in highly diversified product portfolios across functional and ethnic categories are best positioned to capitalize on market opportunities. The impact of these forces dictates that diversification, agility in flavor adaptation, and transparency in ingredient sourcing are non-negotiable strategic imperatives for maintaining competitive advantage and navigating the evolving global regulatory and consumer landscapes.

Drivers- Globalization of Cuisine and Flavor Experimentation: Increased international travel, media exposure, and migration patterns introduce consumers to diverse global flavors, boosting demand for authentic ethnic sauces like Sriracha, Gochujang, and various African chili sauces.

- Rising Demand for Convenience and Ready-to-Eat Meals: The accelerated pace of urban life fuels reliance on pre-prepared meals and fast-food, where condiments are essential for enhancing flavor profiles quickly and consistently.

- Product Innovation in Health and Wellness: Manufacturers are increasingly launching formulations with reduced sodium, sugar, and artificial additives, alongside organic, non-GMO, and gluten-free certifications, attracting health-conscious consumers.

- Expansion of Quick-Service Restaurants (QSRs) and Foodservice Sector: Rapid expansion of global and local QSR chains, which rely heavily on consistent, high-volume condiment supply, drives significant institutional market growth.

- Growth in At-Home Cooking and Culinary Creativity: Social media and cooking shows encourage consumers to experiment at home, utilizing specialized gourmet condiments to replicate restaurant-quality flavors.

- Stringent Government Regulations and Labeling Requirements: Tightening regulations in major markets regarding food safety, allergen declarations, and maximum permissible limits for sodium, sugar, and artificial coloring increase compliance costs.

- Volatility in Key Raw Material Prices: Fluctuations in the cost of agricultural commodities such as tomatoes, peppers, edible oils (soybean, rapeseed), and sweeteners directly impact production costs and compress profit margins.

- Public Health Concerns Regarding Nutritional Content: Increasing consumer awareness and anti-obesity campaigns highlight the high caloric, sugar, and sodium content in traditional condiments, leading to market pressure and consumption shifts.

- Short Product Shelf Life and Storage Complexity: Despite preservatives, many fresh or natural condiments require specific storage conditions (e.g., refrigeration), adding complexity and cost to the supply chain.

- Competition from Local and Artisanal Manufacturers: Small, local producers offering specialized, high-quality, or regionally authentic flavors often undercut major brand market share in gourmet segments, requiring continuous brand differentiation efforts.

- Development of Functional and Fortified Condiments: Launching sauces fortified with beneficial ingredients like probiotics, vitamins, or plant-based proteins caters to the functional food trend, opening premium pricing segments.

- Market Penetration in Emerging Economies: Untapped or underserved markets in regions like Southeast Asia, Africa, and Latin America offer significant growth potential driven by urbanization and rising disposable incomes.

- Sustainable and Ethical Sourcing: Adoption of sustainable practices, including regenerative agriculture for raw materials and eco-friendly packaging, attracts environmentally conscious consumers and enhances brand reputation.

- Customization and Personalized Flavor Solutions: Utilizing direct-to-consumer (D2C) channels and digital platforms to offer personalized flavor blends or subscription boxes creates enhanced consumer engagement and loyalty.

- Growth of Vegan and Plant-Based Alternatives: Expanding the portfolio of egg-free mayonnaise, dairy-free creamy dressings, and other plant-based sauces captures the burgeoning vegan and flexitarian consumer base.

Segmentation Analysis

The Condiment Sauces Market is highly fragmented and segmented across multiple dimensions, including product type, packaging, distribution channel, ingredient base, and application. The segmentation reflects diverse global consumption habits and varying consumer priorities, ranging from convenience and price sensitivity to health consciousness and premium quality. Analyzing these segments is critical for manufacturers to allocate resources effectively, tailor marketing messages, and optimize product portfolios. Dominant segments often include mainstream categories like Ketchup and Mayonnaise, which generate substantial volume, but the fastest growth is observed in niche categories like regional ethnic sauces and clean-label dressings, indicating a trend toward premiumization and diversification of consumer palettes, especially in developed economies.

Understanding the interplay between ingredient base (e.g., tomato, pepper, oil, vinegar) and application (household vs. foodservice) allows companies to strategically position their offerings. For instance, the foodservice segment demands bulk, stable, and highly consistent products, whereas the household segment increasingly prioritizes convenience and unique, seasonal flavors. The increasing focus on ingredients, particularly concerning organic or natural sourcing, directly impacts pricing power and distribution strategies. Manufacturers must therefore maintain agile production lines capable of switching between high-volume staples and lower-volume, specialized products to address the complexity inherent in this multi-dimensional market structure efficiently.

- By Product Type: Ketchup, Mayonnaise, Mustard, Hot Sauces & Chili Sauces, Soy Sauce & Other Asian Sauces, BBQ Sauces, Dressings, Spreads, Others (e.g., Mint Sauce, Tartare Sauce).

- By Ingredient Base: Tomato-based, Oil-based, Chili/Pepper-based, Vinegar-based, Fruit-based, Herbal & Spice-based.

- By Packaging: Bottles (Glass, Plastic), Pouches, Jars, Cans, Sachets.

- By Distribution Channel: Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Foodservice/Institutional (HORECA).

- By Application: Household/Retail, Foodservice/Institutional, Industrial Food Processing.

- By Nature: Conventional, Organic, Natural/Clean Label.

Value Chain Analysis For Condiment Sauces Market

The value chain for the Condiment Sauces Market is comprehensive, starting from the cultivation and sourcing of agricultural commodities and extending through complex manufacturing, packaging, distribution, and final sale. Upstream analysis focuses on the procurement of primary raw materials, including tomatoes, peppers, oilseeds, sugar, spices, and vinegar. Efficiency in this stage relies heavily on robust supplier relationships, vertical integration (in some large firms), and sustainable farming practices to ensure consistent quality and mitigate price volatility. The midstream involves core manufacturing, including preparation, blending, processing (pasteurization, fermentation), quality testing, and packaging, where technological integration and high-speed automation are critical for maintaining low unit costs and stringent quality standards necessary for large-scale production.

Downstream analysis covers the distribution channels, which are bifurcated between retail and foodservice. The retail distribution involves significant logistics complexity to supply hypermarkets, supermarkets, and increasingly, direct-to-consumer e-commerce platforms, requiring cold-chain capabilities for temperature-sensitive products. The foodservice channel involves bulk logistics, often managed through specialized distributors serving restaurants, hotels, and catering institutions. Direct and indirect distribution channels coexist; large multinational corporations often use indirect channels via third-party logistics (3PL) providers and wholesalers, while niche or artisanal producers may rely more on direct distribution or specialized gourmet food distributors to maintain product integrity and brand messaging.

The effectiveness of the distribution channel is paramount, as consumer proximity to the product, especially in impulse purchase categories like condiments, significantly drives sales volume. E-commerce represents a rapid growth area, challenging traditional models and requiring investment in optimized fulfillment centers and final-mile delivery networks. Successful companies manage raw material sourcing risks through contractual agreements and hedge buying while optimizing manufacturing scale and distribution speed to maintain freshness and minimize supply chain waste, thereby maximizing overall profit margins and competitive advantage across the fragmented marketplace.

Condiment Sauces Market Potential Customers

The potential customers and primary end-users of condiment sauces span a broad spectrum, fundamentally categorized into three main segments: households, the foodservice industry, and industrial food processors. Households represent the largest and most diverse consumer base, purchasing products for daily meal preparation, flavor enhancement, and specific culinary applications. Within the household segment, sub-segments include health-conscious individuals, gourmet food enthusiasts seeking premium ingredients, and budget-conscious families prioritizing value and large volume containers, reflecting differing brand loyalties and purchase motivations.

The foodservice sector, encompassing restaurants (QSRs, fine dining), cafes, hotels, catering services, and institutional facilities (schools, hospitals), is a crucial customer segment that demands bulk packaging, high consistency, and stringent quality assurance. These buyers prioritize reliable supply, consistent flavor profiles (essential for brand integrity), and customized formulations (e.g., proprietary sauce blends). The industrial food processing sector utilizes condiments as key ingredients in ready meals, snacks, frozen foods, and packaged meats, requiring high volumes of standardized, often concentrated, sauce bases tailored for large-scale integration and long shelf life properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 49.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., McCormick & Company, Inc., The Kraft Heinz Company, Conagra Brands, Inc., Unilever PLC, General Mills Inc., Kerry Group plc, PepsiCo (Frito-Lay), T. Marzetti Company, Bolton Group S.p.A., Del Monte Pacific Limited, The Yamasa Corporation, Kewpie Corporation, Cholula Food Company, Louisiana Fish Fry Products, Inc., Wingreens Farms, The French's Food Company LLC, Goya Foods, Inc., Mars, Incorporated (Dolmio/Uncle Ben's), Dr. Oetker. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Condiment Sauces Market Key Technology Landscape

The technology landscape within the Condiment Sauces Market is heavily focused on process optimization, food safety, and advanced flavor delivery systems, moving beyond traditional batch processing. Key technological advancements include the utilization of High Pressure Processing (HPP) for cold sterilization, which extends the shelf life of natural and clean-label sauces by eliminating pathogens without relying on high heat or excessive chemical preservatives. This addresses the dual consumer demand for preservative-free products and long shelf stability. Furthermore, automated blending and emulsification systems, often guided by sophisticated sensors, ensure unparalleled consistency in texture and viscosity across massive production batches, which is a critical factor for maintaining brand quality, particularly in high-volume products like mayonnaise and salad dressings.

In terms of ingredient management, advanced encapsulation technologies are increasingly employed to protect volatile flavor components and natural colors from degradation during processing and storage, ensuring that the final product delivers the intended sensory experience even after months on the shelf. This is particularly relevant for premium herbal and spice-heavy sauces. The manufacturing facilities themselves are being upgraded with Industrial Internet of Things (IIoT) sensors and smart monitoring systems that provide real-time data on temperature, pH levels, and processing flow. This digital transformation enables predictive quality control and minimizes waste, adhering to increasingly strict sustainability mandates and reducing operational costs simultaneously.

The packaging sector is also undergoing significant technological change, driven by sustainability targets and convenience. Lightweight, high-barrier plastic films and recyclable mono-materials are replacing traditional multi-layered packaging to enhance shelf life while minimizing environmental impact. Smart packaging, utilizing near-field communication (NFC) or QR codes, is being integrated to provide consumers with transparent sourcing information, nutritional data, and recipe suggestions, enhancing product engagement and traceability, fulfilling the rising consumer demand for brand transparency and interaction.

- High Pressure Processing (HPP): Non-thermal preservation method used to extend the shelf life of clean-label and organic condiments without compromising nutritional or sensory qualities.

- Advanced Emulsification Technology: High-shear mixing and ultrasonic emulsification systems used to create stable, consistent emulsions for mayonnaise and creamy dressings, preventing oil/water separation.

- Aseptic and Ultra-High Temperature (UHT) Processing: Used primarily for long-shelf-life sauces and bases (e.g., tomato paste or soy sauce derivatives) to achieve commercial sterility efficiently.

- Flavor Encapsulation: Micro-encapsulation techniques used to protect volatile flavor and aroma compounds from oxidation and heat, ensuring controlled release and long-term flavor stability.

- IIoT and Process Automation: Integration of sensor networks and cloud computing for real-time monitoring of viscosity, temperature, and ingredient flow, enabling predictive quality assurance and operational efficiency.

- Sustainable and Barrier Packaging: Development of fully recyclable, bio-based plastic bottles and pouches with high oxygen and moisture barriers to maintain product integrity and meet environmental goals.

- Digital Traceability Systems (Blockchain): Implementation of distributed ledger technology to provide end-to-end transparency of ingredients, manufacturing processes, and distribution, enhancing food safety confidence.

Regional Highlights

The global Condiment Sauces Market exhibits distinct consumption patterns and growth dynamics across key geographical regions, influencing multinational companies' strategic investments and product localization efforts. North America and Europe represent mature markets characterized by high per capita consumption and a strong demand for innovative, premium, and healthy product variants. In these regions, growth is primarily driven by portfolio diversification, particularly towards artisanal, low-sugar, and plant-based alternatives, rather than volume expansion, focusing on sustainability and high-value gourmet segments to maintain profitability.

The Asia Pacific (APAC) region is forecasted to be the engine of future market growth, fueled by rapid urbanization, rising middle-class disposable incomes, and the burgeoning organized retail sector. Countries like China, India, and Southeast Asian nations are witnessing increasing adoption of Western condiments (ketchup, mayonnaise) alongside sustained, high demand for traditional Asian sauces (soy, oyster, chili sauces). This region is characterized by significant demand for both convenience and ethnic authenticity, prompting local and international players to invest heavily in localized flavor development and expanding distribution networks into Tier 2 and Tier 3 cities to capture this dynamic consumer base.

Latin America and the Middle East & Africa (MEA) offer substantial opportunities but face unique distribution and economic challenges. Latin American consumers show strong preference for savory, bold, and often spicy flavors, driving the hot sauce segment. MEA markets are fragmented, with demand concentrated around major urban centers and tourism hubs; here, growth is tied to the expansion of global QSR franchises and increasing penetration of packaged goods, necessitating investment in robust supply chain infrastructure capable of handling high ambient temperatures and diverse regulatory environments efficiently.

- North America (USA, Canada): Mature, high-value market focused on clean-label, non-GMO, organic options, and diverse ethnic flavors; strong influence from foodservice trends and sustained demand for classic American sauces.

- Europe (Germany, UK, France): Characterized by stringent regulations and a rapid shift toward sustainable packaging and plant-based substitutes (especially vegan mayonnaise); high per capita consumption of savory spreads and dressings.

- Asia Pacific (China, India, Japan): Highest growth region driven by urbanization, Westernization of diets, and booming demand for traditional regional sauces (Soy, Oyster, Fish Sauce); significant investment in localized R&D.

- Latin America (Brazil, Mexico): Strong cultural preference for chili-based sauces, dips, and intense flavor profiles; growth is linked to expanding modern retail formats and stable economic development.

- Middle East & Africa (MEA): Emerging market growth driven by rapid expansion of the hospitality sector and quick-service restaurants; demand is diverse, encompassing both Western staples and local spicy pastes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Condiment Sauces Market.- Nestlé S.A.

- McCormick & Company, Inc.

- The Kraft Heinz Company

- Conagra Brands, Inc.

- Unilever PLC

- General Mills Inc.

- Kerry Group plc

- PepsiCo (Frito-Lay)

- T. Marzetti Company

- Bolton Group S.p.A.

- Del Monte Pacific Limited

- The Yamasa Corporation

- Kewpie Corporation

- Cholula Food Company (owned by McCormick)

- Louisiana Fish Fry Products, Inc.

- Wingreens Farms

- The French's Food Company LLC (owned by McCormick)

- Goya Foods, Inc.

- Mars, Incorporated (Dolmio/Uncle Ben's)

- Dr. Oetker

- Ajinomoto Co., Inc.

- Huntsman Corporation

- B&G Foods, Inc.

- Associated British Foods plc (ABF)

- S&B Foods Inc.

- Tsang Garden, Inc.

- Fujian Kenbo Food Co., Ltd.

- Lee Kum Kee Company Limited

- Reckitt Benckiser Group plc

Frequently Asked Questions

Analyze common user questions about the Condiment Sauces market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Condiment Sauces Market?

Market growth is principally driven by the globalization of food tastes, increasing consumer demand for convenient flavor enhancers, rapid expansion of the Quick-Service Restaurant (QSR) sector, and continuous innovation focused on developing healthier, low-sodium, and low-sugar product lines to meet wellness trends.

Which segment of the Condiment Sauces Market is expected to witness the highest growth rate?

The Hot Sauces and Chili Sauces segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is due to rising consumer preference for spicy, bold, and authentic international flavors, coupled with high product diversification and premiumization in this category globally.

How do volatile raw material prices affect the profitability of condiment manufacturers?

Volatility in commodity prices, particularly for agricultural inputs such as tomatoes, oilseeds (soy and rapeseed), and sugar, directly impacts the upstream costs. Manufacturers manage this by adopting robust supply chain hedging strategies, optimizing manufacturing processes, and strategically passing increased costs to the consumer in premium segments to protect profitability margins.

What role does e-commerce play in the distribution of condiment sauces?

E-commerce is the fastest-growing distribution channel, providing consumers with accessibility to niche and international brands previously unavailable in local retail stores. It allows manufacturers to implement direct-to-consumer (D2C) models, manage inventory efficiently, and offer personalized product bundles, revolutionizing the traditional retail reliance.

What technological innovations are shaping the future of condiment manufacturing?

Key technological innovations include the adoption of High Pressure Processing (HPP) for preservative-free preservation, AI-driven flavor profiling and optimization, and the integration of IIoT sensors for precise, real-time quality control and enhanced automation across blending and packaging lines to ensure consistent product quality and safety.

What is the current trend regarding the ingredient composition of mainstream condiments?

The prevailing trend is a major industry shift towards clean labels, meaning products with fewer, identifiable ingredients. Consumers are demanding sauces free from artificial colors, flavors, and preservatives. This also includes significant reformulation efforts to reduce high-fructose corn syrup, sodium, and fat content across staple products like ketchup and mayonnaise.

Which region holds the largest market share in the Condiment Sauces industry?

North America currently holds the largest market share, characterized by high per capita consumption and substantial volume demand from its extensive foodservice industry. However, the Asia Pacific (APAC) region is poised for the fastest future growth due to rapid economic development and increasing consumer exposure to global culinary trends.

How are consumer concerns about health and wellness influencing new product development?

Health and wellness concerns are mandatory drivers for R&D. Companies are launching functional condiments, such as those fortified with probiotics or vitamins, and expanding plant-based alternatives, particularly vegan mayonnaise and dairy-free dressings, to cater to flexitarian and specific dietary needs.

What impact does sustainability have on packaging in the condiment sauces market?

Sustainability is driving innovation towards recyclable and bio-based packaging solutions. Manufacturers are replacing complex multi-layer plastics with mono-materials and lightweight recyclable glass or PET bottles, aiming to reduce the overall environmental footprint and meet corporate and consumer sustainability commitments.

What is the strategic importance of private label brands in this market?

Private label brands, often offered by major retailers, are strategically important as they exert significant price competition, particularly in high-volume, staple categories like ketchup and mustard. They often push established national brands towards greater product differentiation and focus on premium, higher-margin segments to justify price gaps and maintain brand loyalty.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager