Conditioning Polymers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432425 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Conditioning Polymers Market Size

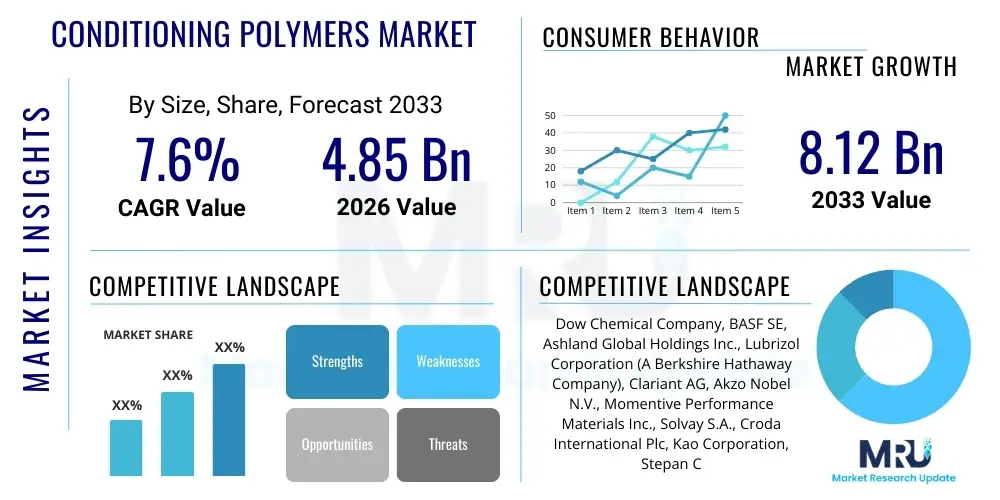

The Conditioning Polymers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 8.12 Billion by the end of the forecast period in 2033.

Conditioning Polymers Market introduction

Conditioning polymers are specialized macromolecular substances widely utilized across the personal care and cosmetic industries. These polymers are specifically designed to deposit onto surfaces such as hair, skin, and fabric, providing functional benefits like enhanced lubricity, reduced static electricity, improved combability, increased gloss, and effective moisture retention. Their primary function lies in mitigating the negative effects of cleansing agents, which often strip natural oils and leave surfaces feeling rough or brittle. Key examples include Polyquaterniums, various types of functionalized silicones, and cellulosic derivatives, each optimized for specific applications and performance characteristics. The efficacy of these polymers is highly dependent on their molecular weight, charge density (cationic or amphoteric nature), and structural conformation, allowing formulators to achieve diverse sensory attributes ranging from rich conditioning to lightweight detangling.

The market for conditioning polymers is fundamentally driven by the escalating global consumer demand for premium and specialized personal care products, particularly those targeting specific issues such as damaged hair repair, anti-aging skin care, and color protection. As product sophistication increases, manufacturers are continuously seeking novel polymeric materials that offer superior, long-lasting performance while also adhering to evolving consumer preferences for sustainability and natural origins. The versatility of conditioning polymers allows their integration into a vast array of formulations, including shampoos, conditioners, body washes, lotions, styling agents, and even specialized industrial textile softeners. This broad applicability, coupled with ongoing innovation in synthesizing more biodegradable and environmentally benign options, positions the market for consistent expansion over the forecast period, especially in high-growth regions like Asia Pacific.

The benefits derived from incorporating conditioning polymers are multifaceted, extending beyond mere sensory improvement to include significant functional enhancements. For hair care, they are essential for cuticle smoothing, reducing fiber friction, minimizing breakage during brushing, and improving the overall manageability of the hair shaft. In skin care, these polymers contribute to the formation of protective barriers, reducing transepidermal water loss (TEWL), and imparting a smooth, non-greasy feel. The driving factors propelling this market include demographic shifts leading to an aging population seeking intensive skin and hair treatments, increased disposable incomes in emerging economies boosting expenditure on premium personal care, and the sustained regulatory pressure encouraging the transition toward high-performance, yet eco-friendly, ingredients. Furthermore, the persistent focus on product differentiation through unique texture and long-lasting conditioning effects ensures continuous R&D investment by key market players.

Conditioning Polymers Market Executive Summary

The Conditioning Polymers Market demonstrates a robust growth trajectory, underpinned by critical business trends focusing on sustainable chemistry and ingredient transparency. Major corporations are strategically investing in developing bio-based and naturally derived conditioning agents, responding directly to the 'clean beauty' movement and increasingly stringent environmental regulations, particularly in Europe and North America. This shift requires significant reformulation efforts and technological advancements in synthesizing polymers from renewable resources, such as natural oils, sugars, and cellulose. Furthermore, mergers and acquisitions remain a crucial tool for expanding portfolio diversity and gaining market share, particularly allowing specialized ingredient manufacturers to be integrated into larger chemical conglomerates, thereby streamlining the supply chain for complex polymer materials. Innovation in delivery systems, such as microencapsulation of conditioning agents, is also a key business trend aimed at enhancing product stability and sustained release of active ingredients.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, characterized by a burgeoning middle class, rapid urbanization, and a high propensity for adopting sophisticated hair and skin care routines influenced by regional beauty trends (e.g., K-Beauty and J-Beauty). Countries like China and India are not only significant consumption centers but are increasingly becoming hubs for local manufacturing and ingredient synthesis, challenging the dominance of Western suppliers. North America and Europe, while mature markets, command high values due to a strong preference for high-end, specialized, and clinically-validated conditioning products, with a heavy emphasis on certified sustainable and non-toxic formulations. The regulatory landscape in the EU, specifically the REACH regulation and ongoing scrutiny of silicones, continues to heavily influence formulation strategies globally, pushing R&D towards alternatives that maintain performance standards while satisfying regulatory requirements.

Segment trends reveal that the Polyquaternium segment, driven by its effective charge neutralization capabilities in hair care, maintains a substantial market share, although the fastest growth is anticipated in specialized functionalized silicones and bio-based polymers (e.g., Guar derivatives and starch-based polymers). Application-wise, the hair care segment remains the largest consumer, encompassing shampoos, conditioners, and styling products where conditioning efficacy is paramount. However, the skin care application is experiencing accelerated growth, driven by consumer interest in advanced moisturizing and barrier-enhancing technologies, often incorporating conditioning polymers for improved sensory feel and longevity of hydration. Overall, the market is shifting toward multifunctional polymers that offer high performance across multiple applications while simultaneously meeting demanding sustainability metrics, signaling a future where green chemistry and high efficacy are indispensable for market success.

AI Impact Analysis on Conditioning Polymers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Conditioning Polymers Market predominantly center on three core themes: accelerated R&D for novel formulations, optimization of raw material sourcing and supply chains, and the personalization of cosmetic products. Consumers and industry professionals frequently ask how AI can predict the performance characteristics (e.g., deposition efficiency, sensory profile) of new polymer structures before expensive lab synthesis is undertaken, thereby drastically reducing time-to-market. Furthermore, questions related to AI’s role in managing the complex sourcing of bio-based raw materials, optimizing reaction parameters in polymerization processes, and ensuring product quality control across diverse manufacturing sites are highly prevalent. The key expectation is that AI will introduce a paradigm shift from traditional, trial-and-error chemistry to highly efficient, data-driven formulation science, ultimately leading to superior, personalized conditioning products and more resilient, sustainable supply chains.

AI’s influence is rapidly becoming foundational in the research and development phase of conditioning polymers. Machine learning algorithms are now utilized to analyze vast datasets relating polymer structure (molecular weight, charge density, backbone structure) to end-use performance characteristics (friction reduction, static dissipation, feel). This capability allows formulators to computationally screen thousands of potential polymer candidates, identify optimal synthesis pathways, and predict potential toxicological or environmental impact profiles, thus drastically improving the efficiency of green chemistry initiatives. By minimizing experimental failure rates and focusing resources only on the most promising compounds, AI substantially lowers the cost of innovation and accelerates the delivery of high-performance, sustainable polymer ingredients to the market. This computational approach is crucial for addressing the industry's need for fast responses to evolving consumer trends and regulatory changes.

Beyond the laboratory, AI is transforming manufacturing and market strategy. Predictive analytics are being deployed to forecast demand fluctuations based on seasonal changes, social media trends, and regional promotions, enabling manufacturers to optimize inventory levels of specialty polymers and mitigate risks associated with raw material price volatility. In terms of personalization, AI-driven digital platforms analyze individual consumer data (hair type, skin condition, environmental exposure) to recommend specific polymer combinations or custom blend ratios, leading to the development of micro-tailored products. This move towards 'Chemistry 4.0' ensures greater efficiency, resource optimization, and the creation of highly specialized conditioning polymers that meet the precise, nuanced needs of the modern consumer, solidifying AI as a critical disruptive force in this sector.

- AI accelerates the discovery of novel, high-performance polymer structures through predictive modeling and computational screening.

- Machine learning optimizes polymerization reaction conditions, improving yield, consistency, and reducing energy consumption.

- Predictive analytics enhance supply chain resilience by forecasting raw material demand and managing sourcing risks, especially for bio-based inputs.

- AI analyzes consumer data to drive the formulation of personalized conditioning polymer blends in customized cosmetic products.

- Advanced algorithms aid in regulatory compliance screening by predicting potential environmental and toxicological profiles of new compounds.

DRO & Impact Forces Of Conditioning Polymers Market

The Conditioning Polymers Market is shaped by a powerful confluence of drivers, restraints, and opportunities (DRO), which collectively form the impact forces steering its evolution. A primary driver is the pervasive consumer shift toward premiumization in personal care, where specialized, multi-functional conditioning properties are non-negotiable for product differentiation. Alongside this, the mounting pressure to adopt sustainable and natural ingredients fuels both innovation and market constraint; while it presents vast opportunities for bio-based polymer development, it simultaneously restrains the use of traditional, less biodegradable synthetic polymers, such as certain silicone types. The market's dynamism is high, characterized by continuous technological breakthroughs in polymer modification (e.g., precise control over charge density and molecular architecture) which consistently unlock new application potential and performance levels. These impact forces necessitate adaptive R&D strategies and nimble supply chain management to maintain competitive advantage in a highly regulated and consumer-driven environment.

Key drivers include the global expansion of the cosmetic and personal care industry, particularly in developing economies, coupled with increased consumer awareness regarding hair damage repair and intensive skin hydration needs. This is augmented by the necessity for polymers that improve the aesthetic properties and usability of products, such as improved wet/dry combing and enhanced texture modification. However, the market faces significant restraints. The most notable constraint is the increasing regulatory scrutiny, particularly concerning non-biodegradable or persistent organic pollutants, which pressures manufacturers to invest heavily in reformulation and testing. Furthermore, the volatility and rising cost of petrochemical-derived raw materials, essential for many synthetic polymers, pose an ongoing challenge to profit margins and supply stability. These challenges require strategic partnerships and backward integration to secure stable access to critical building blocks, especially those used in high-volume production.

The core opportunities in this market revolve around embracing green chemistry principles. The demand for conditioning polymers derived from renewable resources—such as starches, guar gum, and natural oils—is accelerating rapidly, offering manufacturers a pathway to tap into the lucrative 'natural' and 'clean label' segments. Furthermore, opportunities exist in developing polymers specifically engineered for niche applications, such as scalp health, microbiome-friendly formulations, or extreme-climate performance. The technological opportunity lies in advancing surface modification techniques and creating amphoteric or non-ionic polymers that can function effectively across a broader pH range and formulation type. These opportunities dictate that successful market players must not only focus on performance but also demonstrate a clear commitment to environmental stewardship and ingredient transparency to capture future market share.

Segmentation Analysis

The Conditioning Polymers Market is comprehensively segmented based on Type, Application, and End-Use, reflecting the diverse functional requirements across the personal care and industrial sectors. This structure enables a detailed analysis of specific growth pockets and technological preferences. The Type segmentation is critical, differentiating between various chemical classes such as Polyquaterniums, Silicones, Cationic Guar Derivatives, and Cellulosic Polymers, each offering distinct conditioning mechanisms and sensory profiles. Within the application matrix, Hair Care dominates due to the necessity of overcoming damage caused by routine cleansing and styling, though Skin Care is rapidly gaining momentum. The end-use segments, encompassing mass-market consumer products, professional salon products, and specialized industrial uses, highlight differences in required purity, concentration, and performance standards.

The dominance of the Hair Care segment stems from the complex structural needs of hair fibers, which require highly effective cationic polymers (like Polyquaternium-7 or Polyquaternium-10) to neutralize negative surface charges and smooth the cuticle, thereby enhancing shine and detangling properties. Conversely, the growth acceleration observed in the Skin Care segment is driven by sophisticated moisturizing and textural needs, favoring polymers like specific silicones (e.g., Dimethicone Copolyols) and various hydrocolloids that improve spreadability, reduce tackiness, and enhance the longevity of hydration barriers. Continuous innovation within these segments focuses on formulating multi-functional polymers that can provide benefits such as thermal protection, UV damage mitigation, and enhanced color retention, reflecting the premiumization trend across both hair and skin treatment categories globally.

The shift towards sustainable chemistry dictates significant changes within the Type segmentation. While silicones remain vital for high-end performance, the fastest-growing sub-segment is undoubtedly the bio-based and naturally derived polymers, fueled by consumer and regulatory pressure. Cationic guar derivatives and other bio-polymers are increasingly replacing synthetic counterparts, provided they can match the performance metrics—specifically in deposition and slip characteristics—demanded by formulators. This competitive dynamic ensures continuous optimization of naturally sourced materials, focusing on chemical modification to enhance their charge density and film-forming capabilities, thereby securing their long-term relevance and ensuring segmentation growth is aligned with global sustainability objectives.

- By Type:

- Polyquaterniums (PQ-7, PQ-10, PQ-11, PQ-37)

- Silicones (Dimethicone, Amodimethicone, Dimethicone Copolyol)

- Cationic Guar Derivatives (Guar Hydroxypropyltrimonium Chloride)

- Cellulosic Polymers (Polymeric Cellulose Ethers)

- Synthetic Conditioning Polymers (Copolymers, Polyethylene Glycols)

- Natural & Bio-Based Polymers (Starch-based, Protein Hydrolysates)

- By Application:

- Hair Care Products (Shampoos, Conditioners, Styling Gels, Hair Masks)

- Skin Care Products (Lotions, Creams, Body Wash, Cleansers)

- Fabric Care (Softening Agents, Detergent Additives)

- Others (Industrial Cleaners, Specialty Surface Treatments)

- By End-Use:

- Cosmetics and Personal Care Industry (Mass Market and Premium)

- Textile and Fabric Industry

- Pharmaceutical Industry (Topical Formulations)

- Household and Industrial Cleaning

Value Chain Analysis For Conditioning Polymers Market

The value chain for the conditioning polymers market is complex and highly integrated, spanning from the procurement of highly specialized raw materials through synthesis and final distribution to diverse end-use manufacturers. Upstream activities are dominated by the sourcing of petrochemical derivatives (e.g., acrylic monomers, vinylpyrrolidone) and increasingly, bio-based feedstocks (e.g., guar gum, cellulose, natural oils). Raw material volatility significantly impacts the initial cost structure, necessitating strategic procurement and long-term contracts. The core manufacturing stage involves complex chemical synthesis, primarily through polymerization (e.g., emulsion, suspension, or solution polymerization), followed by specific functional modifications (e.g., cationization) to achieve the desired charge density and molecular weight essential for conditioning performance. This stage requires high capital investment in specialized reactors and rigorous quality control protocols to ensure polymer purity and efficacy.

Downstream activities involve the incorporation of the synthesized conditioning polymers into final product formulations by cosmetic, personal care, or textile manufacturers. Performance testing, formulation stability, and compatibility assessment are crucial downstream steps, often involving close collaboration between polymer suppliers and end-product formulators to tailor ingredient specifications. The distribution channels for conditioning polymers are segmented into direct and indirect routes. Direct sales are common for high-volume orders or highly specialized custom polymers, where direct technical support and confidentiality agreements are required for large, multinational cosmetic manufacturers. This direct channel fosters deep technical partnerships aimed at co-developing innovative products and ensuring seamless integration into complex formulations.

Indirect distribution relies heavily on regional distributors and specialized chemical intermediaries who manage smaller volumes, provide localized warehousing, and handle logistical complexities across fragmented markets, especially in emerging regions like Southeast Asia or Latin America. These distributors often maintain technical sales teams capable of providing basic formulation guidance to smaller or medium-sized enterprises (SMEs) in the personal care sector. The efficiency of both direct and indirect channels is critical for market penetration and speed-to-market. Disruptions in global logistics, particularly affecting cross-border transport and regulatory clearance of chemical substances, pose ongoing challenges to maintaining the integrity and cost-effectiveness of this intricate global value chain.

Conditioning Polymers Market Potential Customers

Potential customers for conditioning polymers span a broad range of industries, unified by the requirement for surface modification, friction reduction, and enhanced sensory attributes in their final products. The primary and most significant customer segment is the Cosmetics and Personal Care industry, encompassing multinational corporations producing mass-market shampoos, body washes, and lotions, as well as specialized boutique brands focusing on premium, natural, or professional salon-grade products. These buyers utilize conditioning polymers to ensure product differentiation through superior performance characteristics, such as exceptional detangling, long-lasting smoothness, and improved hair manageability, directly influencing consumer repurchase rates and brand loyalty. Formulators in this segment prioritize efficacy, safety, sensory experience, and increasingly, verifiable sustainability claims associated with the polymers.

Another substantial customer base resides within the Textile and Fabric Care industries. Manufacturers of laundry detergents, fabric softeners, and textile finishing agents rely on conditioning polymers to impart softness, reduce static cling, ease ironing, and maintain color fastness in washed garments. The industrial requirements here often favor polymers designed for high-heat stability and excellent deposition onto synthetic and natural fibers during the washing or finishing process. Furthermore, the Pharmaceutical sector represents a niche but highly valuable potential customer segment. Conditioning polymers are often utilized in topical medical formulations, such as creams and gels, where they serve as rheology modifiers, film-formers, or specialized excipients that improve drug delivery, patient compliance, and the overall feel of the pharmaceutical preparation on the skin.

Finally, the Household and Industrial Cleaning (HIC) sector constitutes a growing segment. While conditioning is not the primary objective, specialized polymers are used in concentrated cleaning agents, surface polishes, and specialized car washes to improve surface gloss, aid drying, and provide a protective layer, minimizing re-soiling. These end-users typically purchase in large industrial volumes and prioritize cost-effectiveness and broad application compatibility. Therefore, successful market penetration requires tailored product offerings that address the specific performance demands, volume requirements, and regulatory adherence protocols unique to each major end-user category, whether it is a global cosmetic giant or a regional specialty chemical formulator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 8.12 Billion |

| Growth Rate | 7.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Chemical Company, BASF SE, Ashland Global Holdings Inc., Lubrizol Corporation (A Berkshire Hathaway Company), Clariant AG, Akzo Nobel N.V., Momentive Performance Materials Inc., Solvay S.A., Croda International Plc, Kao Corporation, Stepan Company, Evonik Industries AG, Guangzhou Tinci Materials Technology Co., Ltd., Wacker Chemie AG, SEPPIC (Air Liquide Healthcare), Galaxy Surfactants Ltd., KCI (Korea Chemicals Industry Co.), Innospec Inc., Hallstar Company, Miwon Commercial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Conditioning Polymers Market Key Technology Landscape

The technological landscape of the conditioning polymers market is defined by advanced synthetic methods focused on achieving precise molecular architecture, high-efficiency deposition, and enhanced biodegradability. A core technology involves Cationic Modification, which is crucial for creating polymers that efficiently adhere to the negatively charged keratin surface of hair and skin. This process requires precise control over the introduction of quaternary ammonium groups onto polymer backbones, such as those found in Guar or cellulose derivatives, ensuring high charge density and uniform distribution for optimal conditioning effect and reduced environmental persistence. Techniques like controlled free radical polymerization (e.g., ATRP or RAFT) are increasingly used to synthesize synthetic polymers with narrow molecular weight distributions and tailored monomer sequences, offering formulators superior control over performance attributes compared to traditional bulk polymerization methods.

Another significant technological advancement centers on Green Chemistry and the utilization of Bio-Polymer Synthesis. Driven by the urgent need for sustainable alternatives, researchers are employing enzymatic polymerization and fermentation processes to produce conditioning polymers from renewable feedstocks like starches, sugars, and bacterial cellulose. These technologies aim to create high-performing polymers that are readily biodegradable while maintaining or exceeding the sensory benefits offered by established synthetic counterparts, such as silicones. The challenge lies in scaling up these environmentally friendly production methods efficiently and cost-effectively, requiring continuous innovation in reactor design and purification techniques to meet the high volume demands of the personal care industry globally.

Furthermore, Emulsion Technology and Microencapsulation represent key technological differentiators, particularly for delivering oil-soluble conditioning agents like silicones or natural oils into aqueous formulations (e.g., shampoos). Microemulsions and nano-emulsions are utilized to create stable, highly dispersed systems that enhance the visual appeal, stability, and deposition efficiency of the conditioning ingredients onto the target surface. Specifically, microencapsulation technologies allow for the controlled, time-released delivery of specialized polymers or active ingredients, enhancing the longevity of the conditioning effect and protecting sensitive components from degradation within complex product matrices. The convergence of these advanced synthesis and delivery technologies is fundamentally reshaping the performance benchmarks for modern conditioning polymers, pushing the industry towards higher efficacy, greater stability, and improved sustainability profiles.

Regional Highlights

- North America: This region is characterized by high consumer spending on premium and specialized personal care products, driving significant demand for high-performance conditioning polymers, particularly advanced silicones and high-efficacy bio-based derivatives. North America, especially the United States, acts as a primary innovation hub, where rigorous R&D activities focus on developing niche products for specific consumer concerns, such as anti-pollution effects, thermal damage protection, and specialized ethnic hair care. The regulatory environment, while stringent, generally allows for a broader range of high-performance synthetics compared to Europe, provided safety data is robust. Demand is strongly influenced by sophisticated marketing and rapid response to trends driven by social media and influencer culture.

- Europe: The European market is defined by stringent regulatory standards, primarily dictated by the European Chemicals Agency (ECHA) and consumer demand for 'clean label' and certified natural ingredients. This regulatory pressure, particularly concerning the use and environmental impact of cyclicsiloxanes (e.g., D4, D5, D6), has necessitated a rapid pivot toward natural and readily biodegradable conditioning polymers, such as modified guar and cellulose derivatives. Consequently, European manufacturers are leaders in green chemistry innovation within this sector. Despite the regulatory hurdles, Europe remains a high-value market due to the established presence of global cosmetic giants and a strong consumer willingness to pay a premium for eco-certified and sustainably sourced personal care items.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by massive population density, rising disposable incomes, and the rapid expansion of local manufacturing capabilities in countries like China, India, and South Korea. Consumer behavior in APAC is heavily influenced by dynamic beauty trends (K-Beauty, J-Beauty) which emphasize meticulous multi-step routines, generating exceptionally high demand for both hair and skin conditioning agents. While mass-market synthetic polymers constitute a large volume of consumption, the region is also witnessing significant growth in premium segments requiring specialized ingredients. Investment in local R&D and manufacturing capacity is expanding rapidly to meet the scale and diversity of regional consumer preferences.

- Latin America (LATAM): This region is characterized by strong demand for hair care products, often driven by cultural preferences for voluminous, smooth, and frizz-free hair, necessitating high-performance cationic polymers. Brazil, in particular, is a global powerhouse in hair care product innovation and consumption. The market is competitive and price-sensitive, balancing the need for high-efficacy ingredients with cost management, leading to demand for both effective synthetic and cost-competitive natural polymers derived from local resources.

- Middle East and Africa (MEA): The MEA market is heterogeneous, with the GCC countries showing high consumption rates mirroring Western luxury trends, fueling demand for specialized, premium conditioning agents. Growth across the broader MEA region is driven by increasing urbanization and the expansion of the organized retail sector. Local climatic conditions, often involving high heat and humidity or extreme aridity, necessitate the use of polymers specifically designed for superior moisture retention and thermal stability, creating specialized market needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conditioning Polymers Market.- Dow Chemical Company

- BASF SE

- Ashland Global Holdings Inc.

- Lubrizol Corporation (A Berkshire Hathaway Company)

- Clariant AG

- Akzo Nobel N.V.

- Momentive Performance Materials Inc.

- Solvay S.A.

- Croda International Plc

- Kao Corporation

- Stepan Company

- Evonik Industries AG

- Guangzhou Tinci Materials Technology Co., Ltd.

- Wacker Chemie AG

- SEPPIC (Air Liquide Healthcare)

- Galaxy Surfactants Ltd.

- KCI (Korea Chemicals Industry Co.)

- Innospec Inc.

- Hallstar Company

- Miwon Commercial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Conditioning Polymers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of conditioning polymers in personal care products?

The primary function is to neutralize negative surface charges on hair and skin, enhancing lubricity, reducing static electricity, improving wet and dry combability, and forming a smooth protective film to retain moisture and increase gloss.

Which type of conditioning polymer segment is experiencing the fastest growth?

The fastest-growing segment is the bio-based and naturally derived conditioning polymers, such as cationic guar derivatives and starch-based polymers, driven by the global shift towards sustainable, 'clean label' formulations and increased regulatory pressure on synthetics.

How is AI transforming the formulation of conditioning polymers?

AI is used to accelerate R&D by computationally modeling and predicting the performance characteristics (e.g., deposition efficiency, sensory feel) of new polymer structures, drastically reducing lab synthesis time and optimizing sustainable ingredient selection.

What is the major market restraint currently impacting conditioning polymer manufacturers?

The major restraint is the increasing regulatory scrutiny and restrictions imposed on certain traditional synthetic polymers, particularly specific types of non-biodegradable silicones (like D4 and D5) in key markets such as the European Union.

Which region currently dominates the consumption of high-value conditioning polymers?

North America and Europe currently dominate the consumption of high-value, specialized conditioning polymers due to mature markets, high consumer demand for premium performance, and willingness to pay for validated, sustainable formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cationic Conditioning Polymers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cationic Conditioning Polymers Market Size Report By Type (Cationic Guar Conditioning Polymers, Cationic Cellulose Conditioning Polymers, Others), By Application (Skin Care, Hair Conditioners/Shampoos, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager