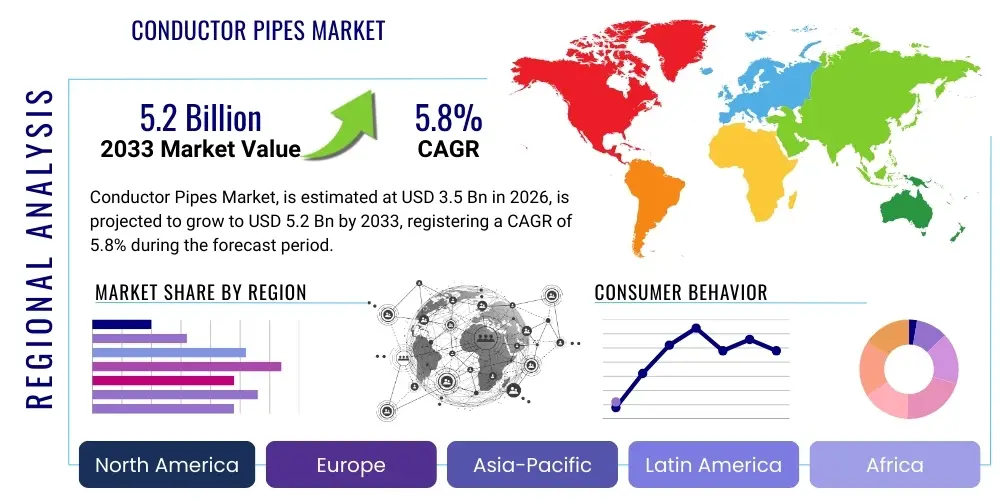

Conductor Pipes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434693 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Conductor Pipes Market Size

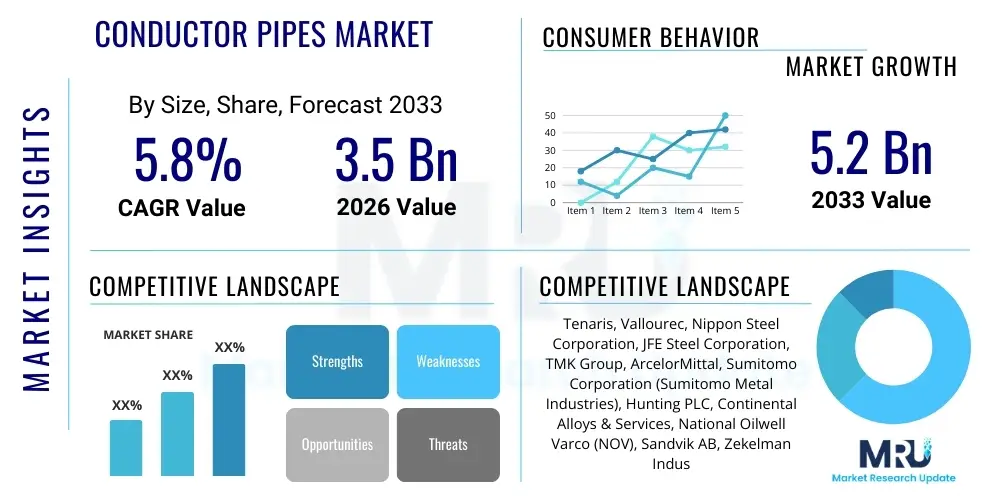

The Conductor Pipes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This substantial expansion is primarily underpinned by the global resurgence in upstream exploration and production (E&P) activities, particularly focused on challenging deep-water and unconventional oil and gas resources. The increasing complexity of well architectures demands robust foundational structures, driving the volume and value growth of high-specification conductor pipes, especially those manufactured from advanced steel alloys designed for enhanced durability and fatigue resistance in hostile operating environments.

The market's valuation reflects not only the quantity of pipe deployed but also the increasing average cost per unit, influenced by stricter regulatory standards and the necessity for premium connection technologies that ensure well integrity and operational safety over multi-decade lifecycles. Furthermore, adjacent sectors, such as geothermal drilling and large-scale infrastructure projects requiring deep foundational casings, are contributing peripheral demand, stabilizing the market against cyclical volatility inherent to the traditional oil and gas industry. The continuous pursuit of deeper, hotter, and more corrosive reservoirs globally guarantees the sustained requirement for technologically advanced conductor pipe systems capable of serving as the primary structural safeguard for all subsequent drilling operations, reinforcing the market's positive growth trajectory.

Conductor Pipes Market introduction

Conductor pipes represent the outermost and largest diameter casing string installed in a wellbore during the initial stages of drilling. Functionally, these pipes are foundational structural elements essential for establishing wellbore stability, preventing the collapse of unconsolidated near-surface formations, and providing a crucial conduit for drilling fluids and subsequent casing strings. Typically installed to depths ranging from a few hundred to several thousand feet, their placement is critical for isolating shallow aquifers from potential contamination by drilling fluids or hydrocarbons, thereby fulfilling essential environmental protection requirements. The pipes must withstand significant axial loads, bending moments, and hydraulic pressure differentials, demanding high precision manufacturing using robust materials, predominantly high-grade carbon and alloy steels, tailored to the anticipated subsurface stresses and corrosive exposure. The strategic application of conductor pipes is fundamental to securing the entire well infrastructure, providing the necessary anchoring point for the blow-out preventer (BOP) stack and ensuring safe, uninterrupted drilling operations through highly unstable zones.

The operational landscape for conductor pipes spans both onshore and offshore environments, with offshore installations—particularly deep-water and ultra-deep-water projects—representing the highest value segment due to their requirement for extremely heavy-walled pipes, specialized metallurgy (including Corrosion Resistant Alloys or CRAs), and complex, high-integrity connection systems capable of resisting fatigue from dynamic forces exerted by floating platforms. In onshore applications, while typically less demanding in terms of corrosion resistance, conductor pipes still rely on conductor pipes to manage shallow gas hazards and stabilize high-risk formations near the surface, especially in areas with seismic activity or unstable soil characteristics. The selection criterion for these pipes is a multifaceted technical assessment involving geotechnical data, expected well pressures, and the operational lifespan of the asset, ensuring the chosen product provides a guaranteed structural foundation for decades of resource extraction and regulatory compliance.

Key market drivers propelling demand include sustained global energy requirements leading to increased deep-water exploration, the technological advancement in extended-reach drilling (ERD) and horizontal drilling techniques which demand more rigorous initial casing integrity, and the increasingly stringent global safety and integrity standards imposed by regulatory bodies worldwide. The benefits derived from using high-quality conductor pipes extend beyond structural assurance; they include minimized drilling non-productive time (NPT) by reducing wellbore stability issues, reduced environmental liability by ensuring zonal isolation, and enhanced long-term well integrity, securing the asset’s production viability. This indispensable role cements the conductor pipe as a critical, high-value component within the overall oilfield services sector, with growth projections tightly correlated to the upstream capital expenditure cycles globally, particularly those focusing on complex well construction projects in challenging geological and marine settings and providing essential support for critical infrastructure projects.

Conductor Pipes Market Executive Summary

The Conductor Pipes Market is poised for stable expansion throughout the forecast period, underpinned by critical business trends focused on technological refinement, enhanced safety protocols, and supply chain efficiency. A major business trend is the transition towards integrated service models, where pipe manufacturers increasingly partner with specialized oilfield service companies (OFS) to provide bundled solutions encompassing pipe supply, custom connection fabrication, and logistics management, streamlining the procurement process for end-users and improving overall project timelines. Furthermore, the market is adapting to material science innovations, with significant research and development expenditure directed towards optimizing steel grades for sour service environments (high H2S content) and improved collapse resistance in ultra-deep wells, driving the average unit price upwards for specialized products while maintaining stable demand for standard carbon steel alternatives in mature onshore basins. Efficiency gains through automation in manufacturing and quality control, leveraging Artificial Intelligence (AI), are becoming critical competitive differentiators among leading vendors, improving consistency and reducing the total cost of ownership over the project lifecycle, aligning business objectives with structural performance demands.

Regionally, the market dynamics are heavily influenced by concentrated E&P activities and localized resource development. North America, driven by the Gulf of Mexico (GoM) and the ongoing maturation of unconventional resources, remains a dominant consumer, characterized by robust expenditure on well construction and stringent demand for premium tubular products. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by significant new offshore discoveries in countries like Australia, Malaysia, and India, coupled with substantial governmental initiatives to secure energy independence. This rapid expansion in APAC necessitates massive investment in foundational well infrastructure, providing substantial volume growth opportunities. Europe, though mature, maintains steady demand, primarily focused on decommissioning activities and specialized applications related to geothermal energy and carbon capture and storage (CCS) initiatives, utilizing similar foundational piping systems that demand extreme longevity and certified environmental containment capabilities.

Segment trends highlight the dominance of the Offshore Application segment in terms of revenue contribution, driven by the complexity and high cost associated with these environments, requiring larger diameters, thicker wall specifications, and advanced corrosion mitigation systems. By material, standard carbon steel remains prevalent due to cost efficiency in benign environments, but premium grades and specialty alloys, such as High-Strength Low-Alloy (HSLA) steel and Corrosion-Resistant Alloys (CRAs), are gaining traction across specialized segments where extreme pressure, high temperature, and high hydrogen sulfide (H2S) content pose significant material challenges. Service providers focusing on advanced welding techniques and optimized logistics for transporting these massive structural components are gaining competitive advantage, aligning segmentation trends with overall operational efficacy and safety standards, ensuring that pipe selection accurately matches the geotechnical and operational severity of the drilling location for maximized performance assurance.

AI Impact Analysis on Conductor Pipes Market

User inquiries regarding the application of Artificial Intelligence (AI) in the Conductor Pipes Market often center on how AI can optimize manufacturing consistency, predict material failure risks, and enhance installation precision in complex drilling scenarios. Key concerns revolve around the integration costs of advanced AI monitoring systems onto existing drilling rigs and the reliability of machine learning algorithms in interpreting real-time geotechnical data related to wellbore stability and subsurface stress environments. Users are actively seeking information on AI's ability to minimize non-productive time (NPT) by optimizing casing running procedures and identifying potential sticking points before they occur. Expectations are high concerning the deployment of predictive maintenance models that can assess the structural integrity of installed conductor pipes over the lifecycle of a well, particularly in harsh offshore conditions, leading to optimized inspection schedules and reduced operational expenditure. These themes suggest a strong market desire to leverage AI for risk mitigation and efficiency improvements throughout the pipe's entire value chain, moving beyond traditional statistical quality control methods and towards a more integrated, data-driven approach to asset assurance.

The integration of AI technologies is beginning to transform the lifecycle management of conductor pipes, moving beyond simple manufacturing quality control into predictive deployment optimization. Machine learning algorithms are now being utilized to analyze vast datasets encompassing historical drilling logs, geotechnical surveys, and material composition variations. This analysis allows operators to select the optimal pipe dimensions, material grade, and setting depth specific to highly localized geological parameters, drastically reducing the risk of wellbore instability which often necessitates expensive remediation or well abandonment. Furthermore, AI-powered image recognition systems are increasingly deployed during the welding and joint integrity testing phase, ensuring that every connection point meets stringent standards by automatically identifying microscopic defects that human inspectors might miss, thereby guaranteeing superior structural integrity. The application of sophisticated computational fluid dynamics models, powered by AI, also optimizes the cementing process around the conductor pipe, ensuring a consistent annular seal crucial for zonal isolation and long-term well integrity by dynamically adjusting slurry properties based on real-time downhole conditions.

AI also offers profound benefits in streamlining the supply chain and logistics associated with conductor pipes, which are large, heavy, and complex to transport and store. Predictive logistics models, informed by AI, forecast demand based on scheduled drilling campaigns globally, optimizing inventory levels and ensuring just-in-time delivery to remote operational sites, minimizing storage costs and transportation risks associated with specialized heavy haulage. In the operational phase, smart sensors embedded in or adjacent to the pipe structure can feed data into AI models, which then continuously monitor vibration, thermal stress, and corrosion rates. This real-time diagnostic capability enables operators to perform proactive maintenance rather than reactive repairs, significantly extending the service life of the well structure and enhancing overall safety compliance in deep-water and challenging environments. By transforming raw sensor data into actionable insights regarding structural fatigue, AI significantly extends the reliable service window of conductor pipe assemblies, which is critical in multi-billion-dollar offshore assets while enhancing regulatory reporting accuracy.

- Enhanced Material Quality Control: AI vision systems detect microscopic manufacturing defects in pipe walls and welds with ultra-high precision, surpassing conventional inspection methods and ensuring complete material traceability.

- Predictive Wellbore Stability: Machine learning analyzes historical and real-time geological data (seismic, geotechnical, pressure logs) to determine the optimal pipe setting depth, cement volume, and material load requirements, effectively minimizing drilling risks and optimizing technical specifications.

- Optimized Installation Procedures: Algorithms predict torque and drag issues, pressure fluctuations, and potential sticking points during pipe running, allowing rig operators to adjust parameters proactively, drastically reducing non-productive time (NPT) and mitigating severe operational hazards.

- Asset Integrity Monitoring: Real-time sensor data feeds sophisticated AI models to predict corrosion rates, metal loss, and structural fatigue in harsh, subsea environments, enabling optimized, condition-based inspection and maintenance schedules rather than time-based checks.

- Supply Chain Optimization: AI forecasts highly specific demand based on projected well schedules and regional constraints, managing the complex inventory and transport logistics for large-scale, heavy pipe components, reducing storage expenditures and mitigating transport-related risks.

- Automated Process Control: AI systems manage and dynamically adjust critical welding parameters in the fabrication phase and fluid mixing ratios in the cementing process, ensuring peak quality consistency across all pipe joints and optimal annular sealing performance.

- Simulation and Training: AI-driven simulation platforms allow drilling crews to train on complex installation scenarios, improving procedural efficiency and preparedness for real-world logistical and geotechnical challenges associated with setting conductor pipes.

DRO & Impact Forces Of Conductor Pipes Market

The Conductor Pipes Market dynamics are fundamentally shaped by a delicate interplay between robust growth drivers, inherent operational restraints, and substantial opportunities arising from technological evolution and diversification into new energy segments. The market is primarily driven by the sustained global investment in upstream oil and gas exploration, particularly in deep-water and ultra-deep-water areas where robust conductor pipe systems are mandatory for foundational well security due to complex subsurface formations and high environmental exposure risks. These frontier areas necessitate products with superior mechanical properties, driving value growth. Furthermore, significant opportunities are expanding through the increasing utilization of geothermal energy and large-scale Carbon Capture and Storage (CCS) projects, both of which require high-integrity foundational well casing systems that utilize manufacturing expertise and material specifications highly comparable to those developed for the hydrocarbon sector, thus expanding the traditional application base beyond oil and gas extraction and providing resilience against sector-specific cyclical downturns through application diversification.

However, the market faces significant structural restraints, chiefly the inherent volatility of crude oil prices, which directly and immediately impacts the capital expenditure allocated to new drilling projects; sharp price drops lead to project cancellations or deferrals, severely curbing demand for foundational components like conductor pipes in the short term. Furthermore, the sheer physical scale and weight of these pipes introduce complex logistical challenges associated with handling, storing, and installing extremely large and heavy pipe segments in remote or hostile operational environments, particularly offshore, which dramatically inflates operational costs and necessitates specialized heavy-lift vessels and sophisticated rig equipment, limiting the competitive pool of installation contractors. Supply chain risks, including the volatility of raw steel costs and dependency on a specialized manufacturing base capable of handling large-diameter specifications with precise metallurgical control, also act as structural restraints on market elasticity and price stability, requiring manufacturers to maintain significant strategic inventory buffers and long-term raw material contracts.

The operational and strategic stability of the Conductor Pipes Market is heavily influenced by a set of persistent impact forces. Regulatory oversight (Impact Force: High) dictates material standards, connection integrity requirements, and installation practices, ensuring that compliance is not just a cost component but a non-negotiable prerequisite for market participation, particularly in safety-critical jurisdictions like the North Sea or the U.S. Gulf of Mexico. Technological advancements (Impact Force: Moderate to High) continuously push for innovation in corrosion resistance, fatigue strength, and faster installation methods (e.g., improved weldability and running tools), influencing competitive positioning and favoring companies investing heavily in R&D for advanced connections and specialized metallurgy. Economic factors, specifically global oil price fluctuations and access to project financing (Impact Force: High), exert severe cyclical pressure on market demand and overall profitability, creating periods of intense activity followed by steep contractions. The substitution threat remains extremely low (Impact Force: Low) as the conductor pipe fulfills a unique and structurally indispensable role in securing the initial segment of a drilled wellbore; there is no viable alternative technology that can provide the necessary surface stability and zonal isolation required by current drilling methodologies, cementing the product's criticality in all deep subsurface operations.

Segmentation Analysis

The segmentation analysis for the Conductor Pipes Market provides critical insight into the varying technical requirements and demand drivers across different end-use scenarios, detailing how products are differentiated by the environment, material composition, and physical dimensions. This comprehensive breakdown allows stakeholders to accurately gauge market concentration, identify high-growth sub-segments, and tailor manufacturing and sales strategies to meet precise performance specifications. The differentiation between onshore and offshore applications is fundamental, reflecting major variances in required pipe specifications, complexity of connections, and overall pricing structures, with offshore segments consistently driving premium revenue due to harsh operating conditions and stringent performance demands that require maximized safety factors and superior material longevity, influencing capital expenditure prioritization for E&P companies globally.

A closer examination of segmentation by material type underscores the competitive dynamics; while standard Carbon Steel remains essential for cost-sensitive, conventional onshore wells, High-Strength Low-Alloy (HSLA) Steel is rapidly capturing market share in intermediate complexity projects, offering superior strength-to-weight ratios and moderate corrosion resistance at a more favorable cost than full Corrosion-Resistant Alloys (CRAs). CRAs, including various grades of stainless steel and nickel alloys, command the highest price premium and are exclusively reserved for ultra-deep-water, sour service (high H2S content), and highly corrosive geological formations where well integrity failure is intolerable. This material-based segmentation reflects a direct correlation with risk and capital expenditure, where higher risk profiles necessitate proportionally greater investment in foundational structural assurance provided by advanced metallurgy and rigorously certified quality control processes throughout the manufacturing phase, ensuring adherence to the most extreme performance envelopes.

The segmentation by diameter size directly reflects the scale and intended function of the wellbore, with the largest pipes (typically over 36 inches) being utilized for foundational stability in deep-water drilling, providing the structural anchor for subsequent smaller casings and the BOP system. Intermediate sizes (20-36 inches) are commonly used in standard offshore and heavy-duty onshore applications, defining the most active volume segment. The End-User segmentation confirms the strong dependency on the Oil and Gas Exploration sector, yet also highlights crucial diversification pathways into Geothermal Energy and Civil Construction (for large foundational piling), which, although niche, offer stable, predictable demand cycles less susceptible to the cyclical volatility of hydrocarbon prices, ensuring future market stability through broader application diversification and technological crossover opportunities, particularly as global regulatory focus intensifies on sustainable and low-carbon energy sources which require similar robust subsurface access infrastructure.

- By Application:

- Onshore Drilling: Characterized by standardized specifications, focus on cost efficiency, and managing shallow gas hazards in diverse geological settings.

- Offshore Drilling: High technical complexity, demanding specialized alloys, severe corrosion resistance, and high load-bearing connections. Includes sub-segments: Shallow Water, Deep Water, Ultra-Deep Water, each with unique technical demands.

- By Material Type:

- Carbon Steel: Standard, cost-effective option suitable for conventional wells and benign environments where high pressures or corrosion are not primary concerns.

- High-Strength Low-Alloy (HSLA) Steel: Offers improved yield strength, toughness, and fatigue resistance for moderate depth and pressure wells, balancing cost and enhanced performance requirements.

- Corrosion-Resistant Alloys (CRAs): Premium materials required for HPHT (High Pressure, High Temperature), sour gas, and highly corrosive subsea environments where absolute integrity is mandated.

- By Diameter Size:

- Up to 20 Inches: Primarily used in smaller onshore wells or as highly specific, localized casing segments in complex applications.

- 20 to 36 Inches: Standard size for most offshore wells and heavy-duty onshore exploration projects, representing the highest market volume and a critical focus area for connection innovation.

- Above 36 Inches: Large-scale foundational pipes predominantly utilized in critical deep-water projects for maximum surface stability and anchoring capabilities under extreme loads.

- By End-User:

- Oil and Gas Exploration Companies (Major IOCs and NOCs): Dominant market segment driving high volume and demand for premium specifications and advanced technical solutions.

- Geothermal Energy Producers: Utilizing foundational casing for stability and corrosion resistance in geothermal reservoir drilling, focusing on high-temperature performance.

- Civil Construction and Infrastructure: Niche applications requiring large-diameter foundational piping (e.g., deep-sea bridge pilings, tunnel supports, ground stabilization), leveraging similar heavy-wall pipe manufacturing expertise.

Value Chain Analysis For Conductor Pipes Market

The value chain for the Conductor Pipes Market initiates with the highly specialized and capital-intensive upstream segment, focusing on the sourcing and preparation of metallurgical inputs. This phase involves major global steel manufacturers that produce high-quality steel billets and plates, adhering to stringent API (American Petroleum Institute) specifications and other international standards required for oil country tubular goods (OCTG). Specific emphasis is placed on controlling carbon content, alloy additions, and thermal treatments to achieve the required yield strength, toughness, and fracture resistance critical for conductor pipe performance in high-stress applications. Upstream suppliers must maintain advanced process controls to ensure material traceability and consistency, which directly impacts the integrity and ultimate market value of the finished pipe product, establishing strong technical barriers to entry.

Midstream in the value chain involves the crucial manufacturing and logistics activities of specialized pipe mills. This phase includes rolling or welding the pipes, applying specialized surface treatments (such as anticorrosion coatings or internal liners), manufacturing and welding on advanced coupling systems (premium connections), and rigorous secondary NDT testing. Due to the bulk and weight of conductor pipes, specialized logistics and warehousing are necessary, often located near major fabrication yards or ports capable of handling heavy cargo, utilizing specialized transportation vessels or heavy-haul trucks. Distribution channels are varied but generally lean heavily towards direct sales to major integrated oil companies or large drilling contractors who place custom orders based on specific well programs, bypassing traditional wholesale distribution due to the technical nature and high-value status of the products.

Downstream activities focus entirely on installation and operational support. This phase involves highly specialized drilling contractors and rig operators who are responsible for transporting, handling, running, and cementing the conductor pipe into the wellbore, often utilizing complex automated handling equipment to mitigate safety risks and increase running speed. Post-installation support includes long-term asset integrity management, utilizing advanced inspection tools and monitoring technologies (like embedded sensors) to track corrosion rates and structural fatigue. The efficiency of the downstream operations, particularly the speed and precision of installation, heavily influences the economic viability of the entire drilling project. Therefore, the integration between pipe manufacturers (upstream) and drilling service providers (downstream) often involves close technical collaboration to ensure optimal compatibility between the pipe, connection system, and the rig's operational running tools, creating strong partnerships within the specialized market segment.

Conductor Pipes Market Potential Customers

Potential customers for the Conductor Pipes Market are predominantly concentrated within the global energy sector, spanning both traditional hydrocarbon exploration and emerging clean energy technologies that rely on deep subsurface access. The primary buyers are major national oil companies (NOCs) and international oil companies (IOCs) such as ExxonMobil, Shell, Sinopec, and Saudi Aramco, who initiate large-scale drilling campaigns requiring hundreds of kilometers of conductor piping annually. These large entities purchase directly or through major drilling contractors, demanding high volumes and adherence to strict corporate and regulatory specifications regarding material quality and performance standards, making technical compliance and certified reliability the key purchasing criteria. Their projects, especially in deep-water environments, often involve customized material grades and proprietary connection systems tailored to specific downhole conditions, requiring high technical engagement from the pipe manufacturer.

Beyond the major oil and gas players, specialized independent exploration and production (E&P) companies also constitute a significant customer base, particularly those focusing on niche areas like deep-water frontier exploration or challenging unconventional reservoirs. Furthermore, the evolving energy landscape introduces new customer segments, most notably geothermal energy developers and operators of Carbon Capture and Storage (CCS) facilities. These operations require deep, stable wells that utilize similar conductor pipe technologies to secure the near-surface strata and ensure safe containment of geothermal fluids or sequestered CO2, representing a critical diversification avenue for the market. These emerging customers prioritize long-term performance, environmental safety features, and material longevity over typical hydrocarbon-related price volatility concerns, favoring robust solutions that comply with stringent ecological mandates.

Purchasing decisions among these customers are heavily weighted by the overall total cost of ownership, operational reliability, and the manufacturer's proven safety record, especially in high-risk environments where the consequences of well failure are catastrophic. In high-risk environments, customers prioritize long-term integrity and failure prevention over initial material cost, often leading to the selection of premium corrosion-resistant alloys and specialized, high-integrity connections, demanding sophisticated failure analysis and engineering support from suppliers. Secondary purchasing influencers include major drilling service companies (e.g., Schlumberger, Baker Hughes) who often recommend or procure the necessary conductor pipe components as part of an integrated well construction package they offer to the ultimate end-user, emphasizing the importance of securing preferred supplier status and seamless logistical integration with these highly influential service providers globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tenaris, Vallourec, Nippon Steel Corporation, JFE Steel Corporation, TMK Group, ArcelorMittal, Sumitomo Corporation (Sumitomo Metal Industries), Hunting PLC, Continental Alloys & Services, National Oilwell Varco (NOV), Sandvik AB, Zekelman Industries, Welspun Corp Ltd., Interpipe, V&M Star, United States Steel Corporation (U. S. Steel), Salzgitter AG, EVRAZ, Sutor Group, TPCO (Tianjin Pipe Group Corporation) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Conductor Pipes Market Key Technology Landscape

The technological evolution within the Conductor Pipes Market is primarily centered on material science advancements and the engineering of superior connection systems designed to guarantee long-term well integrity under extreme operating conditions. A cornerstone technology involves the continuous development of high-performance steel grades, specifically High-Strength Low-Alloy (HSLA) steels that offer an optimal balance between yield strength, ductility, and resistance to environmental cracking, crucial for deeper, higher-pressure wells. Furthermore, there is significant investment in proprietary thermomechanical processing techniques that enhance the microstructural properties of the steel, minimizing residual stresses and improving resistance to fatigue failure caused by dynamic loading, particularly relevant for floating offshore drilling platforms subjected to continuous wave action and structural movements, ensuring the conductor pipe remains structurally sound throughout the life of the field.

Another pivotal technology involves premium connection systems. Standard threaded connections often struggle with the complex loading conditions and rigorous running processes involved in setting large-diameter conductor pipe. Consequently, manufacturers have developed proprietary, high-performance threaded and coupled (T&C) connections and weld-on connector systems designed specifically for large casings. These technologies provide superior gas and liquid sealing capabilities through metal-to-metal seals, enhanced tensile strength, and optimized torque resistance, ensuring that connections remain reliable under severe operational stresses. These advanced connections minimize the risk of joint failure during or after installation, a potentially catastrophic event in well construction, and are designed for faster make-up times on the rig floor, directly translating into reduced non-productive time (NPT) for the drilling contractor, adding significant economic value beyond the material cost.

Furthermore, technological innovation extends into installation methodologies and monitoring systems. Utilizing specialized running tools and automated handling equipment on drilling rigs reduces the manual effort and time required to deploy these massive components, contributing directly to non-productive time reduction and enhancing safety protocols on the rig floor. Integrating digital twin technology and real-time monitoring via fiber optic sensors or acoustic telemetry allows operators to continuously assess the stress state, temperature, and corrosion levels of the installed conductor pipe. This enables predictive maintenance strategies, shifting the technological focus from passive manufacturing quality assurance to active, intelligent structural asset management throughout the well’s operational lifetime, ensuring early detection of potential integrity breaches and adherence to the most stringent global safety standards mandated by international regulatory bodies and major operating companies.

Regional Highlights

The global Conductor Pipes Market exhibits distinct regional dynamics, directly correlating with capital expenditure cycles in the upstream oil and gas sector and regulatory regimes governing well construction integrity. North America, driven predominantly by intensive deep-water activity in the U.S. Gulf of Mexico (GoM) and robust onshore drilling in unconventional fields, remains the largest and most established market. The region’s focus on complex, high-pressure wells necessitates continuous demand for premium, large-diameter pipes and specialized corrosion-resistant metallurgy, supported by a technologically mature and highly responsive supply chain capable of delivering customized solutions rapidly. Furthermore, Canada’s heavy oil projects and ongoing development in the Arctic region, though subject to environmental complexities, contribute to specialized demand for extremely rugged, temperature-tolerant materials, maintaining North America's position as a critical center for technological adoption and high-value consumption of conductor piping systems.

Asia Pacific (APAC) is emerging as the fastest-growing market globally, characterized by aggressive national investments in offshore exploration across countries like Australia, Malaysia, Indonesia, and China. This region is witnessing the rapid development of new deep-water fields and significant near-shore gas projects, translating into escalating demand for both volume and high-specification conductor pipe systems to support new rig deployments and infrastructure development. Government policies aimed at securing domestic energy supply are accelerating E&P spending, creating substantial opportunities for both local and international pipe suppliers. The APAC market is integrating premium connection technologies to ensure compliance with escalating local regulatory requirements concerning well integrity and environmental safety standards in newly developed operational zones, balancing rapid growth with the increasing need for structural integrity assurance in complex geological environments and deep-sea drilling campaigns.

Europe and the Middle East & Africa (MEA) represent distinct but important markets. Europe, while mature, maintains steady demand driven by decommissioning activities (requiring specific abandonment procedures often involving cutting and stabilizing the conductor pipe) and new demand from geothermal and CCS projects in the North Sea and Mediterranean. The emphasis in Europe is overwhelmingly on product longevity, environmental compliance, and proven structural integrity due to strict regulatory oversight. The MEA region is characterized by substantial long-term development projects led by major NOCs, particularly in Saudi Arabia, UAE, and Qatar. Demand here is high-volume and stable, driven by massive conventional onshore and near-shore gas developments, requiring reliable, cost-effective conductor pipe solutions, often sourced via complex, long-duration contractual agreements that emphasize predictable delivery schedules and certified quality control protocols. Latin America, specifically Brazil and Guyana, represents a growing frontier market, focusing almost entirely on ultra-deep-water exploration, generating intense demand for the most technologically advanced and robust conductor systems available globally, due to the extreme depths and challenging subsea terrain.

- North America: Dominant market share due to extensive deep-water operations (Gulf of Mexico) and technologically advanced unconventional onshore drilling, driving demand for premium, large-diameter specifications and HSLA materials, supported by a mature supply chain.

- Asia Pacific (APAC): Fastest growth region, propelled by major offshore E&P investments in China, India, and Southeast Asia, fueled by national energy security initiatives and new field discoveries requiring foundational drilling infrastructure and advanced material performance.

- Europe: Stable, high-value market focused on decommissioning, geothermal energy projects, and burgeoning CCS installations, demanding stringent quality standards, long operational life, and superior environmental compliance, particularly in the North Sea basin.

- Middle East & Africa (MEA): High-volume, strategic market driven by stable, long-term conventional oil and gas field development by NOCs, emphasizing cost-efficiency alongside certified reliability and robust procurement contracts for large-scale, continuous projects.

- Latin America: High-growth frontier market (Brazil, Guyana) with intense focus on ultra-deep-water exploration, requiring the highest technical specification CRAs and advanced proprietary connection systems for complex wells in challenging oceanic environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conductor Pipes Market. These companies are central to global supply chains, driving innovation in material science, welding techniques, and premium connection technology, and maintaining extensive global distribution networks to support drilling operations worldwide while adhering to strict international quality standards such as API specifications.- Tenaris

- Vallourec

- Nippon Steel Corporation

- JFE Steel Corporation

- TMK Group

- ArcelorMittal

- Sumitomo Corporation (Sumitomo Metal Industries)

- Hunting PLC

- Continental Alloys & Services

- National Oilwell Varco (NOV)

- Sandvik AB

- Zekelman Industries

- Welspun Corp Ltd.

- Interpipe

- V&M Star

- United States Steel Corporation (U. S. Steel)

- Salzgitter AG

- EVRAZ

- Sutor Group

- TPCO (Tianjin Pipe Group Corporation)

Frequently Asked Questions

Analyze common user questions about the Conductor Pipes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a conductor pipe in drilling operations?

The primary function of a conductor pipe is to stabilize the unconsolidated near-surface formations and provide a structural foundation for the wellbore. It prevents washout and collapse near the surface, isolates shallow freshwater aquifers from drilling fluids, and serves as the anchor point for the subsequent casing strings and the Blowout Preventer (BOP) system, ensuring operational safety and environmental protection during initial drilling phases.

How does the material selection for conductor pipes impact well integrity?

Material selection is critical for ensuring long-term well integrity, particularly in challenging environments. Utilizing high-strength low-alloy (HSLA) steels or Corrosion-Resistant Alloys (CRAs) provides necessary resistance to tensile stress, collapse pressure, and corrosive elements like H2S or CO2, thereby preventing structural failure, minimizing environmental liability, and maintaining zonal isolation over the well's entire operational lifespan.

Which market segment is expected to drive the highest revenue growth for conductor pipes?

The Offshore Drilling segment, specifically deep-water and ultra-deep-water exploration, is projected to drive the highest value growth. These projects require the largest diameter pipes, premium materials (CRAs), and advanced connection systems with high fatigue resistance, resulting in significantly higher unit costs and overall revenue contribution compared to standard onshore operations, despite lower volume in some cases.

What role does Artificial Intelligence (AI) play in the conductor pipe value chain?

AI enhances the value chain by optimizing manufacturing quality control through advanced defect detection (vision systems), using machine learning to predict optimal setting depths based on complex geotechnical data, and enabling real-time integrity monitoring during the operational phase via embedded sensors. This reduces failure rates, minimizes non-productive time (NPT), and improves overall asset management efficiency.

What are the key differences between onshore and offshore conductor pipe applications?

Offshore applications demand thicker walls, specialized corrosion coatings, and complex, high-performance connection systems due to dynamic loading, hydrostatic pressure, and high corrosivity of the marine environment. Onshore applications generally use less complex steel grades and standardized connections, focusing more on stabilizing shallow gas zones, preventing formation collapse, and maintaining cost-efficiency within conventional drilling parameters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager