Connected Entertainment Ecosystems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433841 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Connected Entertainment Ecosystems Market Size

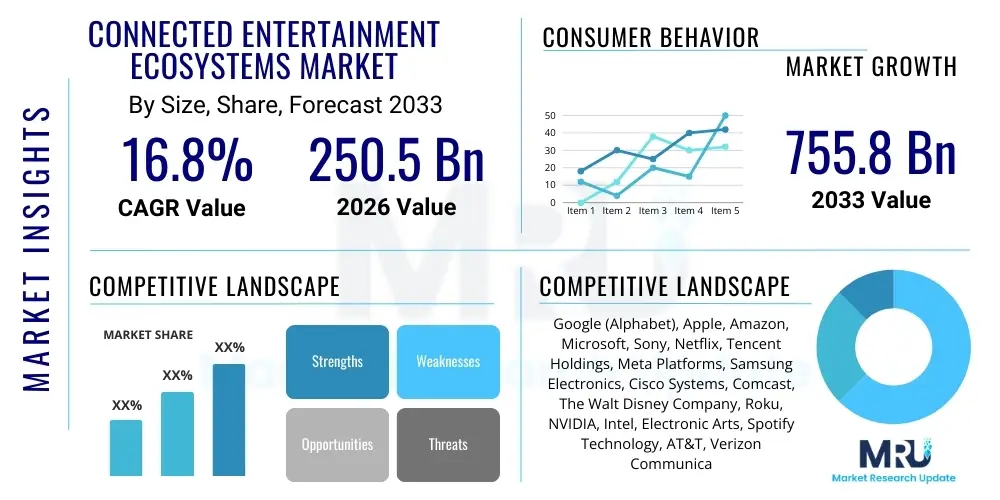

The Connected Entertainment Ecosystems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2026 and 2033. The market is estimated at USD 250.5 Billion in 2026 and is projected to reach USD 755.8 Billion by the end of the forecast period in 2033.

Connected Entertainment Ecosystems Market introduction

The Connected Entertainment Ecosystems Market encompasses the complex integration of hardware devices, software platforms, content services, and high-speed network infrastructure designed to deliver seamless, personalized, and interactive digital entertainment experiences to consumers. This ecosystem spans multiple technological domains, including smart televisions, gaming consoles, virtual and augmented reality (VR/AR) devices, mobile connectivity solutions, and over-the-top (OTT) streaming platforms. The primary objective of these ecosystems is to eliminate fragmentation, allowing users to transition effortlessly between consuming media, playing games, and interacting socially across various devices within a unified digital environment. The sustained growth is largely attributable to the proliferation of 5G networks, which provide the necessary bandwidth and low latency for sophisticated, real-time interactive content, alongside the increasing consumer demand for personalized, on-demand media consumption models.

A connected entertainment product fundamentally offers interoperability and continuity, enabling functions such as cross-device synchronization of watch lists, game progress, and user profiles. Major applications include high-definition video streaming, cloud gaming, immersive virtual concerts, and interactive educational content. The inherent benefit lies in enhanced user convenience, maximized content monetization opportunities for providers, and deeper data insights for content curation and targeted advertising. Furthermore, the development of proprietary operating systems and content hubs by major technology companies like Apple, Google, and Amazon has cemented the concept of closed-loop ecosystems, driving brand loyalty and optimizing the distribution of exclusive content to their respective user bases. This walled-garden approach, while potentially limiting open access, drives significant market valuation and innovation within the ecosystem framework.

Key driving factors accelerating market expansion include the global shift towards subscription-based entertainment models (SVoD and GaaS), advancements in display technology (8K resolutions and high refresh rates), and the rapid deployment of Internet of Things (IoT) devices in residential settings. The convergence of media, technology, and telecommunications sectors is creating robust investment in infrastructure capable of supporting high-fidelity, data-intensive entertainment experiences. Furthermore, consumer behavior has evolved, prioritizing immersive, shared digital experiences, particularly post-pandemic, which has necessitated providers to continuously enhance the interactivity and social features embedded within their connected platforms, ensuring continuous engagement and reduced churn rates across subscription services.

Connected Entertainment Ecosystems Market Executive Summary

The Connected Entertainment Ecosystems Market is characterized by intense vertical integration and strategic mergers aimed at controlling both the hardware access point and the proprietary content library. Current business trends indicate a strong move toward platform consolidation, where tech giants leverage their existing hardware install base (e.g., smart home devices, mobile phones) to push proprietary streaming, gaming, and interactive services. This strategy not only creates substantial switching costs for consumers but also optimizes the data collection pipeline, enabling hyper-personalized content recommendations and dynamic advertisement insertion, which are crucial for maintaining high Average Revenue Per User (ARPU). The gaming segment, particularly cloud gaming and metaverse applications, is emerging as the fastest-growing component, benefiting directly from enhanced 5G capabilities and sophisticated real-time rendering technologies.

Regionally, North America and Europe currently dominate the market share, driven by high disposable income, early adoption of advanced 5G networks, and the presence of numerous global content providers and technology innovators. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth in APAC is fueled by massive mobile penetration, rapidly expanding middle-class populations in China and India, and significant government investment in digital infrastructure supporting widespread content consumption via mobile-first strategies. Latin America and the Middle East & Africa (MEA) are also experiencing noteworthy expansion, largely driven by increasing urbanization and improved broadband infrastructure, although affordability remains a critical factor influencing uptake of premium ecosystem services in these emerging economies.

Regarding segment trends, the Content Delivery segment, specifically encompassing Subscription Video on Demand (SVoD) and Free-to-Play Gaming models, holds the largest revenue share. Nevertheless, the Device Segment, particularly relating to specialized dedicated streaming sticks and next-generation gaming consoles capable of handling 4K and 8K content, is experiencing revitalization driven by technological refresh cycles. Furthermore, the Technology segment is pivoting towards Augmented and Virtual Reality (AR/VR) integration, anticipating a future where entertainment is less about passive viewing and more about highly interactive, shared virtual presence. Investment is heavily concentrated in developing sophisticated middleware and backend infrastructure that can seamlessly manage the massive data load generated by cross-platform, high-fidelity content delivery.

AI Impact Analysis on Connected Entertainment Ecosystems Market

User queries regarding the impact of Artificial Intelligence (AI) on Connected Entertainment Ecosystems frequently center on three main areas: personalized content discovery, the development of immersive and dynamic digital content (e.g., procedurally generated game environments or adaptive music), and the operational efficiency improvements in content delivery and security. Users are keen to understand how AI-driven recommendation engines can move beyond basic collaborative filtering to truly anticipate viewing and playing preferences, reducing content fatigue. There is also significant curiosity about the role of generative AI in creating novel, high-quality content quickly and cost-effectively, fundamentally changing the traditional content creation pipeline. Finally, questions often address how AI optimizes network bandwidth management and detects piracy or fraudulent activity within these high-value digital ecosystems, ensuring smooth, secure, and cost-effective operations at scale.

The deployment of sophisticated machine learning algorithms is transforming every layer of the connected entertainment stack, moving systems from reactive responses to proactive personalization. AI is not just enhancing user-facing features but is also dramatically improving backend operations, including predictive maintenance for server infrastructure, dynamic content caching based on anticipated regional demand, and real-time scaling of streaming quality to match varying network conditions. This comprehensive implementation ensures higher quality of service (QoS) and lower operational expenditure (OpEx) for providers. Moreover, deep learning models are being utilized to analyze user engagement metrics in real-time, providing immediate feedback loops that influence content sequencing, marketing spend, and feature prioritization within the ecosystem roadmap.

Furthermore, AI is instrumental in fostering true interactivity within entertainment experiences, particularly in gaming and virtual reality environments. Generative Adversarial Networks (GANs) and reinforcement learning are enabling the creation of more realistic non-player characters (NPCs), highly responsive virtual assistants, and adaptive storytelling arcs that modify themselves based on user input and behavior. This move toward 'smart content' significantly enhances the immersive quality and replayability of digital products, thereby extending user lifetime value (LTV). As AI tools become more democratized, the barriers to entry for independent content creators utilizing these advanced techniques decrease, fostering greater diversity and volume of entertainment available within connected platforms.

- AI-driven Hyper-personalization: Optimizing content recommendations, targeted advertising, and user interface layouts in real time.

- Dynamic Content Generation: Utilizing generative AI to create adaptive narratives, procedurally generated environments, and virtual avatars.

- Operational Efficiency: Employing machine learning for predictive network load balancing, optimizing content delivery paths, and reducing latency.

- Enhanced Security and Anti-Piracy: Implementing AI for behavioral biometrics and pattern recognition to detect fraudulent accounts and unauthorized content distribution.

- Improved Accessibility: Using AI to automatically generate real-time captions, translations, and descriptive audio tracks for a wider audience.

DRO & Impact Forces Of Connected Entertainment Ecosystems Market

The Connected Entertainment Ecosystems Market is driven primarily by the rapid global expansion of high-speed internet infrastructure, particularly 5G, enabling seamless, high-fidelity content streaming and interactive experiences. Key restraints include the persistent challenge of content fragmentation, where users must subscribe to multiple proprietary services, leading to subscription fatigue and increased complexity. Opportunities abound in the integration of Web3 technologies, such as NFTs and blockchain, to facilitate ownership, verifiable digital scarcity, and new monetization models within virtual worlds and gaming ecosystems. These factors combine to create significant impact forces, notably through the competitive pressure among major tech entities to establish definitive closed-loop ecosystems, leveraging exclusive content libraries and integrated device portfolios to maximize user lock-in and lifetime value.

Drivers fueling the market include the continued decline in traditional broadcast viewership in favor of on-demand digital content, coupled with continuous innovation in device technology, making immersive experiences more accessible and affordable. The consumer desire for ubiquitous access, where content follows the user seamlessly across mobile devices, smart cars, and home consoles, necessitates continuous investment in cross-platform development and cloud infrastructure. Furthermore, the rising adoption of smart home technology facilitates easier integration of entertainment components, turning the entire residence into a connected media consumption environment. This integration strengthens the ecosystem’s resilience against standalone competition by embedding entertainment deeper into the user’s daily technological routine.

Restraints are dominated by concerns over data privacy, security vulnerabilities inherent in cross-platform data synchronization, and geopolitical hurdles impacting global content licensing and infrastructure deployment. The high initial capital expenditure required to establish and maintain proprietary cloud infrastructure capable of global real-time content delivery acts as a significant barrier to entry for smaller players, further consolidating power among the established market leaders. Moreover, technological fragmentation, such as incompatible VR/AR standards or differing regional content censorship laws, complicates global expansion strategies and necessitates localized operational adjustments, increasing overall operating costs and slowing deployment speed in certain high-growth emerging markets.

Segmentation Analysis

The Connected Entertainment Ecosystems Market is comprehensively segmented based on Device Type, Content Delivery Mechanism, and Core Technology Utilized. Analyzing these segments provides a nuanced understanding of consumer behavior and technological investment priorities across the industry. Device Type segmentation, which includes categories like Smart TVs, dedicated gaming consoles, and mobile devices, highlights the shift in primary content consumption venues and reveals the critical importance of optimizing user experience for the most prevalent access points. Content Delivery segmentation, focusing on streaming video, cloud gaming, and live events, illustrates the diversity of revenue streams and the varying infrastructural demands placed on network providers and content distributors.

The segmentation by Core Technology, encompassing areas such as 5G network integration, Augmented Reality (AR), Virtual Reality (VR), and advanced IoT solutions, identifies the innovation hotspots driving future market growth and competitive advantage. The integration of 5G, for instance, is not merely a connectivity upgrade but a foundational shift enabling ultra-low latency applications essential for competitive cloud gaming and immersive metaverse interactions. Understanding the interplay between these segments is crucial; for example, advancements in AR technology directly influence the development requirements for mobile devices (Device Type) and create new channels for interactive advertising (Content Delivery), necessitating a unified strategic approach rather than isolated product development.

This detailed segmentation framework allows market players to accurately target investment, focusing resources on high-growth areas such as the convergence of mobile devices and cloud gaming or the development of dedicated operating systems optimized for Smart TV streaming platforms. Furthermore, it aids regulators and policymakers in assessing market concentration and interoperability standards, ensuring a competitive environment. The granular division across these three major axes ensures that both hardware manufacturers and content creators can identify precise market opportunities, mitigate risks associated with technological obsolescence, and strategically position their offerings to capture diverse consumer needs across the global digital entertainment landscape.

- By Device Type:

- Smart Televisions and Set-Top Boxes

- Dedicated Gaming Consoles (e.g., PlayStation, Xbox, Nintendo)

- Mobile Devices (Smartphones and Tablets)

- Virtual Reality (VR) and Augmented Reality (AR) Headsets

- Streaming Media Players (Sticks and Boxes)

- By Content Delivery Mechanism:

- Video Streaming (SVoD, AVoD, TVoD)

- Cloud and Console Gaming (GaaS)

- Live Digital Events (Concerts, Sports, Esports)

- Interactive and Educational Content

- By Core Technology:

- 5G and Edge Computing Infrastructure

- Artificial Intelligence and Machine Learning

- Internet of Things (IoT) Integration

- Blockchain and Distributed Ledger Technology (for NFTs and Virtual Assets)

Value Chain Analysis For Connected Entertainment Ecosystems Market

The value chain for Connected Entertainment Ecosystems is characterized by significant integration, moving from upstream technological development and content creation through midstream platform integration and infrastructure management, culminating in downstream distribution and consumption. Upstream activities are dominated by chip manufacturers (e.g., NVIDIA, Intel, AMD) providing the high-performance processors necessary for 4K/8K rendering and low-latency operation, alongside independent content studios and rights holders (e.g., Disney, Warner Bros.) creating the proprietary media assets. The ability of major ecosystem providers to control these upstream assets, either through direct acquisition (content creation) or strategic partnerships (chip design), provides a crucial competitive advantage in terms of cost control and feature differentiation.

Midstream activities involve the development of operating systems, proprietary platforms (such as Xbox Live, Apple TV+, or Amazon Prime Video), and the vast cloud infrastructure required to host, process, and dynamically stream content globally. Companies like AWS, Azure, and Google Cloud are essential infrastructure providers, supporting the massive data traffic generated by millions of concurrent users. Distribution channels, both direct and indirect, are fundamental to market reach. Direct distribution involves platforms selling subscriptions directly to consumers via their own apps and websites, retaining full control over pricing and customer data. Indirect distribution relies on partnerships with mobile carriers, internet service providers (ISPs), and retail hardware stores, leveraging their existing customer bases and billing relationships to bundle entertainment services.

Downstream analysis focuses on customer acquisition, engagement, and monetization at the consumption point. Effective distribution relies heavily on optimizing both direct digital channels, such as app stores and proprietary device interfaces, and traditional retail channels for hardware sales (consoles, smart TVs). Direct channels allow for real-time iteration of user interfaces and rapid deployment of new features, while indirect channels provide critical market penetration in regions where hardware or connectivity bundling is the preferred consumer purchase model. The efficiency of the distribution system, supported by robust logistics and digital rights management (DRM), directly impacts market saturation and profitability, making strategic control over both physical and digital sales pipelines paramount for market leaders.

Connected Entertainment Ecosystems Market Potential Customers

The primary potential customers and end-users of the Connected Entertainment Ecosystems Market are diverse, ranging from individual high-fidelity media consumers to sophisticated corporate entities leveraging entertainment platforms for marketing, training, and internal communication. The largest segment remains the Household Consumer (B2C), specifically millennials and Gen Z, who exhibit high digital native behavior, prioritizing on-demand access, cross-platform compatibility, and social interaction embedded within their entertainment consumption. These users are typically willing to pay premium prices for tiered subscription models offering exclusive content, ad-free experiences, and enhanced features like 4K streaming and high frame rate gaming.

A rapidly growing customer segment includes the Extended Enterprise (B2B/B2B2C) users, encompassing businesses that utilize these ecosystems not just for entertainment but for strategic purposes. Examples include using VR/AR platforms developed within the ecosystem for remote employee training, virtual conferences, and sophisticated product showcases that demand high-fidelity, real-time rendering capabilities. Furthermore, advertisers and brands are crucial customers, purchasing targeted inventory across streaming and gaming platforms. They rely on the ecosystem providers' extensive user data profiles to execute highly granular advertising campaigns that maximize reach and conversion effectiveness, essentially treating the ecosystem as a high-value marketing channel.

The final significant category includes Educational Institutions and Healthcare Providers, who are increasingly integrating immersive content and interactive platforms for remote learning, therapeutic applications, and medical simulation. These institutions require robust, secure, and often specialized versions of connected ecosystem technologies that comply with stringent data privacy and accessibility standards. Therefore, potential customers span the spectrum from single-user subscription holders seeking personalized media to large institutional buyers requiring scalable, high-performance, and secure interactive digital environments supported by the underlying ecosystem infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.5 Billion |

| Market Forecast in 2033 | USD 755.8 Billion |

| Growth Rate | 16.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google (Alphabet), Apple, Amazon, Microsoft, Sony, Netflix, Tencent Holdings, Meta Platforms, Samsung Electronics, Cisco Systems, Comcast, The Walt Disney Company, Roku, NVIDIA, Intel, Electronic Arts, Spotify Technology, AT&T, Verizon Communications, Sky (Comcast subsidiary). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Connected Entertainment Ecosystems Market Key Technology Landscape

The technological landscape of the Connected Entertainment Ecosystems Market is defined by a convergence of advanced communication protocols, computational hardware, and sophisticated software layers designed to maximize fidelity and minimize latency. Core technology heavily relies on the deployment of fifth-generation (5G) wireless networks and subsequent edge computing infrastructure, which together provide the necessary bandwidth and proximity processing power to handle massive amounts of real-time streaming data essential for high-resolution video and complex cloud gaming. Further driving innovation is the continuous miniaturization and increased processing capability of specialized hardware components, such as Graphics Processing Units (GPUs) and custom silicon, crucial for delivering photorealistic graphics and immersive Virtual Reality experiences directly to consumer devices without performance degradation.

Artificial Intelligence (AI) and Machine Learning (ML) constitute a foundational software layer, impacting everything from operational logistics to user experience. AI algorithms are essential for dynamic content compression and adaptive bitrate streaming, ensuring uninterrupted quality regardless of network fluctuations. More critically, sophisticated ML models power recommendation engines and personalized content curation, a key differentiator in crowded markets. The integration of Internet of Things (IoT) protocols facilitates seamless cross-device synchronization and control, allowing the user experience to flow effortlessly between mobile phones, smart home speakers, and display devices, cementing the 'connected' aspect of the ecosystem architecture and reinforcing user reliance on a unified platform.

Looking forward, the technology landscape is increasingly incorporating distributed ledger technologies (DLT), particularly blockchain, to address emerging demands for verifiable digital asset ownership and decentralized identity management within gaming and metaverse applications. This technology enables new economic models, such as play-to-earn and creator monetization, by securely tracking digital items and transactions. Moreover, ongoing research and development in haptic feedback systems and spatial audio technologies are further enhancing the immersion quality, moving entertainment beyond visual and auditory senses. The strategic interplay of these technologies—connectivity (5G), processing (GPUs/Edge), intelligence (AI/ML), and ownership (Blockchain)—dictates the pace and direction of market evolution.

Regional Highlights

Regional dynamics within the Connected Entertainment Ecosystems Market are varied, reflecting differences in infrastructure maturity, consumer affluence, and regulatory environments. North America, driven by the United States and Canada, remains the market leader in terms of revenue and early adoption of premium services. This dominance is supported by the headquarters of many major global tech and content providers, extensive 5G coverage, and a deeply entrenched culture of subscription-based consumption across video and gaming platforms. High consumer spending power allows for faster penetration of high-cost hardware, such as 4K and 8K smart TVs and dedicated VR headsets. The regional focus remains on consolidating platform control and pushing high-tier, exclusive content to maintain competitive edge in a saturated but highly lucrative environment.

Europe represents a highly fragmented yet robust market, characterized by significant linguistic and regulatory diversity, necessitating tailored content localization and licensing strategies. Western European nations (Germany, UK, France) boast high penetration rates of broadband and SVoD services, echoing North American trends, while Eastern Europe is rapidly modernizing infrastructure, presenting significant growth opportunities for lower-cost, high-quality streaming solutions. A key regional characteristic is the strong push for data sovereignty and interoperability standards, which may impact the operations of closed ecosystems. The European focus is on balancing regulatory compliance with rapid technological deployment, particularly in cloud gaming and cross-border content delivery.

The Asia Pacific (APAC) region is indisputably the high-growth engine of the global market, anticipated to register the highest CAGR. This growth is predominantly mobile-driven, leveraging the enormous, highly engaged user bases in countries like China, India, and Southeast Asia. Factors driving this expansion include massive investments in digital infrastructure, rising urbanization, and the prevalence of mobile-first payment solutions. While North America focuses on premium subscriptions, APAC market success often hinges on scalable, ad-supported (AVoD) or microtransaction-heavy models, particularly in the rapidly expanding mobile gaming segment. Market players must adapt to diverse local content preferences and regulatory variances, making strategic partnerships with local telecom and tech entities crucial for market entry and sustained growth.

- North America: Market leader; driven by high consumer spending, early 5G adoption, and established technology giants (Google, Apple, Amazon). Focus on premium SVoD, cloud gaming, and AR/VR integration.

- Europe: High adoption rates across Western Europe; strong regulatory focus on data privacy (GDPR) and digital market regulation. Varied penetration levels, with high growth potential in Central and Eastern European regions.

- Asia Pacific (APAC): Highest CAGR; growth dominated by mobile entertainment (gaming and streaming); massive user bases in China and India; significant local content preference requires customization.

- Latin America (LATAM): Rapidly expanding due to improved fixed broadband and mobile infrastructure. Growth constrained somewhat by varying economic conditions and the necessity for flexible pricing models.

- Middle East & Africa (MEA): Emerging market characterized by strong government investment in digital transformation, particularly in the GCC countries. High potential for localized content and luxury entertainment services catering to affluent populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Connected Entertainment Ecosystems Market.- Google (Alphabet Inc.)

- Apple Inc.

- Amazon.com, Inc.

- Microsoft Corporation

- Sony Corporation

- Netflix, Inc.

- Tencent Holdings Ltd.

- Meta Platforms, Inc.

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- Comcast Corporation

- The Walt Disney Company

- Roku, Inc.

- NVIDIA Corporation

- Intel Corporation

- Electronic Arts Inc.

- Spotify Technology S.A.

- AT&T Inc.

- Verizon Communications Inc.

- Sky (Comcast subsidiary)

Frequently Asked Questions

Analyze common user questions about the Connected Entertainment Ecosystems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a Connected Entertainment Ecosystem and how does 5G influence its growth?

A Connected Entertainment Ecosystem is an integrated network of devices, content platforms, and infrastructure (hardware and software) designed to provide seamless, cross-platform digital media experiences. 5G is a critical growth driver because it provides the ultra-low latency and high bandwidth necessary to support real-time, high-fidelity applications like 4K/8K streaming, competitive cloud gaming, and immersive VR experiences, eliminating geographical performance barriers.

What are the primary monetization models currently utilized in these ecosystems?

The primary monetization models include Subscription Video on Demand (SVoD), where users pay a recurring fee for access to content libraries (e.g., Netflix); Advertising Video on Demand (AVoD), generating revenue through targeted ads (e.g., ad-supported tiers); and Games as a Service (GaaS), relying on microtransactions, battle passes, and subscription fees within gaming environments. Hardware sales and premium tier upgrades also contribute significantly to overall revenue.

How significant is the role of Artificial Intelligence (AI) in maintaining competitive advantage?

AI is critically significant, providing a strong competitive advantage by enabling hyper-personalization of user experiences, optimizing backend infrastructure for reduced operational costs, and driving enhanced content discovery. AI-powered recommendation engines ensure high user engagement, lower churn rates, and maximize the effectiveness of targeted advertising within the ecosystem.

Which segments within the market are experiencing the fastest technological disruption?

The gaming and immersive technology segments are undergoing the fastest technological disruption. Cloud gaming (GaaS) is rapidly displacing traditional console reliance, while the integration of AR/VR and emerging metaverse applications, fueled by generative AI and real-time rendering capabilities, is fundamentally altering how interactive content is created and consumed.

What are the major challenges facing the global expansion of Connected Entertainment Ecosystems?

Major challenges include managing content fragmentation, where consumers must navigate multiple non-interoperable platforms, leading to subscription fatigue. Other significant hurdles involve high initial infrastructure investment requirements, complex cross-border content licensing agreements, and increasing regulatory pressure concerning data privacy and market dominance in various global jurisdictions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager