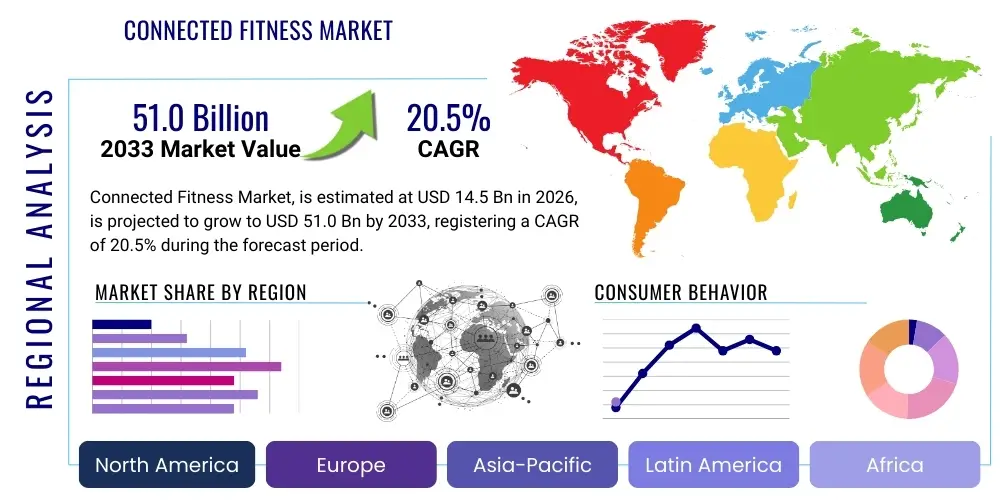

Connected Fitness Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438536 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Connected Fitness Market Size

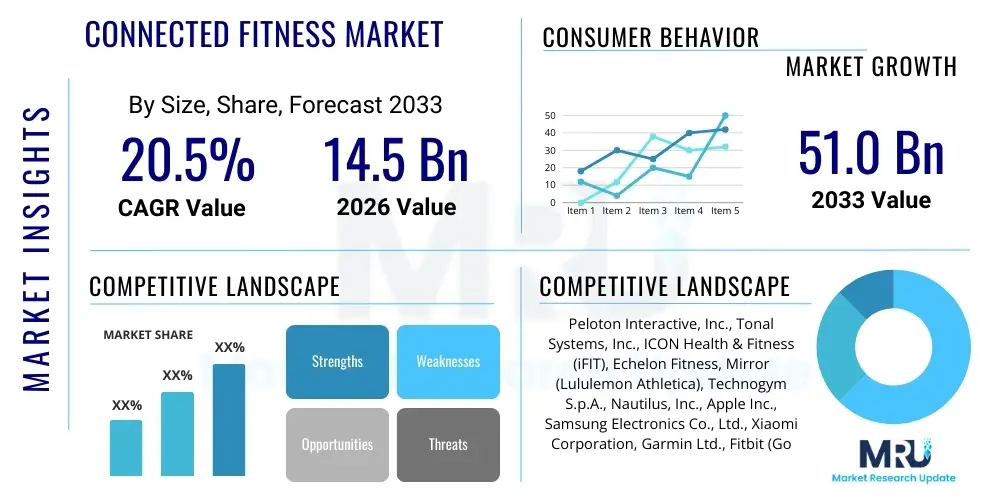

The Connected Fitness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at $14.5 billion in 2026 and is projected to reach $51.0 billion by the end of the forecast period in 2033.

Connected Fitness Market introduction

The Connected Fitness Market encompasses a vast array of internet-enabled physical activity equipment, wearable technology, and digital service platforms designed to track, analyze, and enhance user fitness journeys. This ecosystem integrates hardware, such as smart treadmills, connected rowing machines, and biometric sensors, with sophisticated software, including proprietary subscription services offering live and on-demand classes, personalized training programs, and community engagement features. The primary objective is to create an immersive and highly personalized fitness experience, bridging the gap between traditional gym environments and convenient, in-home workouts. Key applications span across residential use, professional athletic training centers, corporate wellness programs, and commercial gyms seeking to modernize their offerings and retain members through advanced technological engagement.

The core product description revolves around the connectivity element, often utilizing Wi-Fi or Bluetooth to transmit real-time data to a cloud infrastructure where complex algorithms process performance metrics, heart rate variability, calorie expenditure, and workout consistency. Major applications benefit users by providing immediate feedback and adaptive training modifications, ensuring workouts remain challenging and aligned with individual physiological goals. This integration of data science and exercise physiology delivers significant benefits, including improved accountability, access to world-class coaching irrespective of geographical location, and a substantial reduction in barriers to maintaining a consistent fitness routine.

Driving factors propelling this market include the global increase in health consciousness, particularly post-pandemic shifts accelerating the adoption of home-based exercise solutions. Furthermore, rapid advancements in IoT (Internet of Things) technology, coupled with the decreasing cost of sensors and sophisticated display interfaces, make high-quality connected equipment accessible to a broader consumer base. The rise of subscription-based models ensures continuous revenue streams for market players and facilitates ongoing content innovation, keeping users engaged and fostering high lifetime value. The confluence of technological maturity, changing consumer behavior, and robust venture capital investment in fitness technology solidifies the market's strong trajectory toward significant expansion.

Connected Fitness Market Executive Summary

The Connected Fitness Market is characterized by robust growth driven primarily by a shift towards digital health engagement and personalized wellness. Business trends indicate a strong move toward consolidated hardware-software ecosystems, where companies monetize not only the initial sale of equipment but increasingly through high-margin, recurring subscription services. This model, championed by industry leaders, establishes strong user lock-in and high switching costs, fostering stable revenue predictability. Regional trends highlight North America and Europe as the dominant markets due to high disposable incomes, early technology adoption, and established digital infrastructure, while the Asia Pacific region is emerging as the fastest-growing area, fueled by urbanization, rising middle-class disposable income, and increasing awareness of preventative healthcare measures.

Segmentation trends reveal significant traction in the software and services segment, which is outpacing the growth rate of the equipment segment. This is largely attributable to the consumer preference for flexibility and the constant demand for fresh, engaging content delivered through mobile applications and proprietary platforms. Within hardware, interactive smart equipment, such as connected cycling and rowing machines, maintains market dominance, but the wearable technology sub-segment continues to innovate rapidly, integrating more sophisticated biometric monitoring capabilities like continuous glucose monitoring and advanced sleep tracking. Furthermore, the commercial application segment is experiencing revitalization, with gyms implementing connected solutions to offer hybrid membership models, blending in-person training with digital convenience.

Overall, the market environment is intensely competitive, marked by frequent strategic partnerships between technology firms, fitness brands, and healthcare providers aiming to establish integrated wellness solutions. Key success factors include maintaining a differentiated content library, ensuring superior user interface and user experience (UI/UX), and harnessing artificial intelligence (AI) to deliver hyper-personalized feedback and training plans. The market remains sensitive to consumer data privacy regulations and cybersecurity concerns, requiring robust investment in data protection infrastructure to maintain user trust and compliance with evolving global mandates like GDPR and CCPA. The sustained investment in 5G and edge computing is expected to further enhance the seamless, real-time nature of connected fitness experiences globally.

AI Impact Analysis on Connected Fitness Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Connected Fitness Market largely center on the efficacy of personalized coaching, the security and utilization of sensitive health data, and the potential for algorithms to predict and prevent injuries or health issues. Key themes emerging from common user questions include concerns about algorithmic bias leading to suboptimal training recommendations, expectations for truly individualized content generation rather than mere template selection, and the role of AI in moving beyond simple activity tracking to genuinely prescriptive wellness management. Users are particularly interested in how AI can replicate the nuance of human personal training, focusing on real-time form correction using computer vision and dynamic intensity adjustment based on physiological stress metrics. The expectation is that AI will transform connected platforms from content libraries into proactive, intelligent wellness co-pilots, significantly enhancing the value proposition of subscription services by delivering outcomes previously exclusive to high-cost, one-on-one coaching.

- Enhanced Personalization: AI algorithms analyze vast datasets of user performance, physiological responses, and historical activity to create dynamically adapting workout plans, optimizing intensity, duration, and exercise selection in real-time.

- Real-Time Coaching and Form Correction: Integration of computer vision and machine learning allows connected equipment and apps to monitor user posture and movement patterns, providing immediate, corrective feedback to prevent injury and maximize training efficiency.

- Predictive Health Analytics: AI models leverage biometric data (heart rate, sleep quality, variability) to predict fatigue levels, risk of overtraining, and potential health anomalies, offering prescriptive recovery recommendations.

- Advanced Content Generation: AI assists in curating and generating personalized fitness content, matching users with specific instructors, music genres, and workout styles that maximize motivation and adherence.

- Optimized Resource Allocation: Commercial gyms use AI to monitor equipment utilization, energy consumption, and peak traffic hours, optimizing staffing and operational efficiency.

- Improved Customer Support: Implementation of AI-powered chatbots and virtual assistants provides instant troubleshooting and answers to common user queries regarding equipment setup or subscription management.

DRO & Impact Forces Of Connected Fitness Market

The market dynamics of the Connected Fitness sector are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing prevalence of chronic diseases linked to sedentary lifestyles, spurring greater consumer investment in preventative health technology, alongside the pervasive penetration of smartphones, smart wearables, and high-speed internet infrastructure globally, which makes digital fitness accessible. Restraints primarily involve the high initial capital investment required for premium connected equipment, creating an adoption barrier for lower-income segments, and significant concerns surrounding the privacy and security of highly sensitive personal health data, requiring continuous compliance and robust security infrastructure. Opportunities are abundant in areas such as corporate wellness programs seeking effective solutions for employee health management, the integration of Augmented Reality (AR) and Virtual Reality (VR) for highly immersive workout experiences, and expansion into telehealth and rehabilitative fitness, leveraging data-driven insights for patient monitoring and recovery protocols.

Impact forces acting on the market further modulate its growth trajectory. The Bargaining Power of Suppliers is moderately low to moderate; while specialized component manufacturers (e.g., advanced sensor producers) possess some leverage, the high volume of production and standardization of general electronics components (screens, chips) mitigates supplier power. Conversely, the Bargaining Power of Buyers (Consumers) is high due to the abundance of substitute products, ranging from low-cost fitness apps to traditional gym memberships, forcing connected fitness providers to maintain competitive pricing, constantly innovate their content offerings, and offer flexible subscription terms to ensure customer loyalty. The Threat of New Entrants is moderate; while the hardware segment requires substantial capital and R&D, the barrier to entry for software-only fitness applications is relatively low, leading to intense competition in the digital service space and driving consolidation among smaller players.

The Threat of Substitutes is high, encompassing traditional fitness methods, free online content (YouTube workouts), and hybrid fitness models. This constant competitive pressure compels leading connected fitness companies to deepen their ecosystem integration, focusing on data lock-in and developing proprietary metrics that provide unique insights unavailable elsewhere. Finally, Industry Rivalry among existing competitors is extremely high. Key players engage in aggressive marketing, content acquisition, and technological innovation battles, particularly within the lucrative subscription segment, striving to dominate market share through superior user experience and strategic partnerships that expand their demographic reach, such as collaborations with healthcare providers or prominent celebrities and athletes. These forces collectively necessitate continuous innovation and strategic differentiation for sustained market leadership.

Segmentation Analysis

The Connected Fitness Market is comprehensively segmented across several dimensions, providing clarity on consumer behavior, adoption rates, and revenue generation streams. Key segmentation involves differentiating between Equipment type, the nature of the Service offered, the specific Application environment, and the geographical Region. This detailed segmentation aids stakeholders in tailoring product development and marketing strategies. The equipment segment is crucial for understanding capital expenditure patterns, whereas the service segment provides insights into the recurring revenue models that are central to market profitability. Application segmentation distinguishes the high-volume, decentralized nature of home fitness from the specialized needs of commercial and institutional settings, while regional analysis highlights disparities in regulatory environments and market maturity, informing global expansion strategies.

- By Equipment Type:

- Connected Treadmills

- Connected Stationary Bikes (Cycling)

- Connected Rowing Machines

- Smart Strength Equipment (Mirrors, Tonal, etc.)

- Wearable Technology (Smartwatches, Fitness Trackers, Smart Clothing)

- By Service Type:

- Subscription Services (Live Classes, On-demand Content)

- Installation and Maintenance Services

- Personalized Training and Coaching

- By Application:

- Home/Residential

- Commercial (Gyms, Fitness Studios)

- Institutional (Hospitals, Corporate Wellness, Educational Institutions)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Connected Fitness Market

The Connected Fitness value chain begins with the upstream activities centered on component manufacturing and hardware development. This stage involves the procurement of high-tech sensors (biometric, motion), microprocessors, advanced display panels, and raw materials (metals, polymers) required for robust equipment construction. Critical upstream participants include semiconductor manufacturers, sensor specialists, and specialized IoT component suppliers. Efficiency in this segment depends heavily on global supply chain management, ensuring timely procurement and quality control of sophisticated electronics. Companies strive for vertical integration or close partnerships at this stage to secure component supply, reduce costs, and accelerate the integration of emerging technologies like custom ASICs for real-time data processing, thereby impacting the final product's capability and retail price point.

The midstream segment involves product design, software development, content creation, and equipment assembly. This is where intellectual property and brand value are significantly developed. Fitness equipment original design manufacturers (ODMs) and brand holders focus on industrial design for aesthetics and ergonomics, parallel to developing the proprietary operating systems and content platforms that define the connected experience. Distribution channels are varied, incorporating both direct and indirect methods. Direct channels, primarily e-commerce websites and flagship retail stores, allow companies to control the customer experience, gather direct feedback, and maintain higher margin control. Indirect channels involve partnerships with large electronics retailers (e.g., Best Buy), mass merchandisers, and specialized sporting goods stores, expanding geographical reach and accessibility.

Downstream activities focus on sales, marketing, service delivery, and post-sale support, crucially involving the continuous engagement driven by the subscription model. Direct-to-consumer (D2C) distribution has become paramount, enabling companies to build proprietary customer databases and manage the entire customer lifecycle, from initial purchase through long-term content consumption. Service delivery involves maintaining the stability of the cloud platform, managing the extensive content library (live and on-demand classes), and ensuring network security and data privacy. The effectiveness of the downstream segment, particularly customer service and community building, is a major differentiator, impacting customer retention rates and the overall success of the recurring revenue model, which is the ultimate driver of long-term profitability in the connected fitness ecosystem.

Connected Fitness Market Potential Customers

The primary segment of potential customers for the Connected Fitness Market comprises affluent Millennials and Generation Z individuals who are technologically savvy, highly prioritize health and wellness, and seek convenient, flexible alternatives to traditional gym routines. This demographic values personalization, immediate feedback, and community features integrated directly into their workout equipment and applications. These end-users are not only the primary buyers of high-cost smart equipment for residential use but are also heavy consumers of subscription content, demonstrating high willingness to pay for premium, on-demand experiences and the flexibility to exercise anytime, anywhere, fitting exercise into demanding professional schedules.

A second crucial segment includes institutional and commercial buyers, particularly high-end corporate organizations investing in comprehensive employee wellness programs and modern commercial gym operators. Corporate wellness programs utilize connected fitness platforms to offer scalable, trackable health benefits, aiming to reduce healthcare costs and improve employee productivity and retention. Commercial gyms, seeking to compete with the rise of home fitness and reduce membership churn, invest in connected equipment to offer advanced, digitally integrated classes and hybrid membership packages that blend in-studio experiences with at-home training continuity, catering to members demanding greater accessibility and variety in their fitness options.

The third significant group involves individuals undergoing physical rehabilitation or managing chronic health conditions. These buyers, often referred to as ‘Health Seekers,’ leverage connected devices and services for guided, monitored, and low-impact exercise prescribed by medical professionals. The ability to track progress remotely, share data securely with clinicians, and receive personalized adaptive feedback makes connected fitness an invaluable tool in the telehealth landscape. While historically focused on younger, high-income individuals, the market's expansion into rehabilitative and preventative health broadens the end-user base significantly to include older adults and individuals with specific medical requirements who benefit from structured, technology-assisted movement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $51.0 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Peloton Interactive, Inc., Tonal Systems, Inc., ICON Health & Fitness (iFIT), Echelon Fitness, Mirror (Lululemon Athletica), Technogym S.p.A., Nautilus, Inc., Apple Inc., Samsung Electronics Co., Ltd., Xiaomi Corporation, Garmin Ltd., Fitbit (Google LLC), Wahoo Fitness, Hydrow, WHOOP, Inc., Aviron Interactive, ClassPass (Mindbody), Life Fitness (Brunswick Corporation), Strava, Inc., Cure.Fit (Cult.fit) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Connected Fitness Market Key Technology Landscape

The Connected Fitness Market is underpinned by the convergence of several sophisticated technologies, with the Internet of Things (IoT) serving as the foundational infrastructure. IoT connectivity, facilitated through integrated Wi-Fi and Bluetooth modules, allows fitness equipment and wearables to continuously collect and transmit vast amounts of real-time physiological and performance data to the cloud. This seamless data flow is essential for generating personalized metrics and delivering live, interactive content. Advanced sensor technology, including optical heart rate sensors, accelerometers, gyroscopes, and pressure sensors embedded in equipment and apparel, ensures high accuracy in measuring exertion, movement efficiency, and biomechanics, providing the raw data necessary for machine learning analysis and form correction algorithms.

Cloud Computing and Big Data analytics form the backbone of the service delivery and personalization aspects of the market. High-performance cloud infrastructure is required to host extensive content libraries, manage millions of concurrent user sessions (especially during peak live classes), and process billions of data points generated daily. Big Data tools transform this collected information into actionable insights, feeding proprietary algorithms that optimize workout recommendations, detect patterns of overtraining, and enhance the content delivery network’s efficiency. Furthermore, the reliance on cloud infrastructure demands robust cybersecurity protocols and compliance with regional data governance mandates to protect sensitive personal health information (PHI), which is crucial for maintaining consumer trust and adhering to global regulatory frameworks.

Emerging technologies are continuously redefining the user experience. The deployment of 5G networks is critical for reducing latency, which is paramount for real-time interaction in live classes and synchronous multi-user experiences, enhancing the sense of community. Augmented Reality (AR) and Virtual Reality (VR) are moving beyond niche applications, integrating into smart mirrors and VR headsets to create highly immersive, gamified workout environments, driving higher engagement and adherence rates. Finally, Edge Computing is becoming increasingly important, allowing some data processing and basic AI analysis (like immediate form correction) to happen directly on the device, minimizing reliance on constant cloud connection and further reducing latency, thereby ensuring a smoother, more responsive user experience during intense physical activity.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for connected fitness globally. This dominance is attributed to high consumer awareness of health and wellness, significant disposable income levels allowing investment in premium equipment, and the presence of numerous leading industry pioneers such as Peloton, Tonal, and Nautilus. The region benefits from highly developed digital infrastructure, early adoption of subscription-based service models, and strong integration of wearable technology. Growth is sustained by continuous innovation in personalized coaching through AI and increasing interest in integrating fitness data with broader healthcare platforms, positioning the region as a primary driver for product development and market trends.

- Europe: The European market is robustly growing, driven by increasing regulatory focus on public health, high smartphone penetration, and cultural appreciation for cycling and home fitness, especially in countries like the U.K. and Germany. While facing higher data privacy scrutiny under GDPR, European consumers are rapidly adopting subscription services and interactive equipment. The market sees strong competition from both US-based companies and indigenous European brands like Technogym. The trend leans towards highly curated, boutique fitness content delivered digitally, often integrating diverse training methodologies like yoga, HIIT, and strength training through single, multifunctional connected platforms.

- Asia Pacific (APAC): APAC is poised to be the fastest-growing region during the forecast period. This accelerated growth is fueled by massive populations, rapidly increasing urbanization, rising disposable income, and a growing middle class focused on preventative health in major economies like China, India, and South Korea. Local brands are often more successful due to tailored content and pricing strategies adapted to local market preferences. The vast mobile-first population drives the high adoption of fitness applications and low-cost connected wearables, creating substantial opportunity for scalable digital fitness solutions, particularly those that integrate seamlessly with existing social media and e-health ecosystems.

- Latin America (LATAM): The LATAM market is emerging, characterized by increasing internet penetration and a rising appetite for digital consumer goods, though constrained by economic volatility and infrastructure gaps in certain areas. Growth is driven by young, tech-aware populations in countries like Brazil and Mexico. The primary focus initially remains on affordable wearable technology and mobile fitness applications, rather than high-cost heavy equipment, indicating a focus on entry-level digital fitness solutions that provide high value at a competitive price point.

- Middle East and Africa (MEA): The MEA market is exhibiting steady growth, particularly in the GCC countries (UAE, Saudi Arabia) driven by government-led initiatives promoting health and active lifestyles and high per capita income. These nations show high adoption rates for premium, imported connected fitness equipment for luxury residential and commercial settings. In less affluent areas, the market relies on basic fitness trackers and mobile applications. The unique challenges include adapting content for local cultural sensitivities and managing distribution logistics across diverse geographical territories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Connected Fitness Market.- Peloton Interactive, Inc.

- Tonal Systems, Inc.

- ICON Health & Fitness (iFIT)

- Echelon Fitness

- Mirror (Lululemon Athletica)

- Technogym S.p.A.

- Nautilus, Inc.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Xiaomi Corporation

- Garmin Ltd.

- Fitbit (Google LLC)

- Wahoo Fitness

- Hydrow

- WHOOP, Inc.

- Aviron Interactive

- ClassPass (Mindbody)

- Life Fitness (Brunswick Corporation)

- Strava, Inc.

- Cure.Fit (Cult.fit)

Frequently Asked Questions

Analyze common user questions about the Connected Fitness market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Connected Fitness Market?

The primary growth driver is the accelerated adoption of hybrid and home-based fitness solutions, intensified by increasing global health awareness and the technological integration of IoT and AI, which facilitate hyper-personalized training experiences and flexible workout schedules.

How does AI technology benefit connected fitness users?

AI significantly benefits users by providing real-time, personalized coaching, offering predictive injury prevention warnings, and dynamically adjusting workout intensity based on live physiological data, optimizing performance far beyond generic pre-set programs.

Which geographical region holds the largest market share?

North America currently holds the largest market share due to high consumer spending on health technology, advanced digital infrastructure, and the early establishment of robust market ecosystems defined by major industry innovators and widespread adoption of subscription models.

What are the main restraints impacting market expansion?

The main restraints are the substantial initial investment required for premium connected equipment, posing an affordability barrier, coupled with ongoing user concerns regarding the security and privacy implications of sharing sensitive personal health and biometric data.

Are subscription services essential for market profitability?

Yes, subscription services are essential for long-term market profitability as they generate reliable, high-margin recurring revenue, establish strong customer lock-in through proprietary content, and enable continuous value delivery beyond the initial hardware purchase.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager