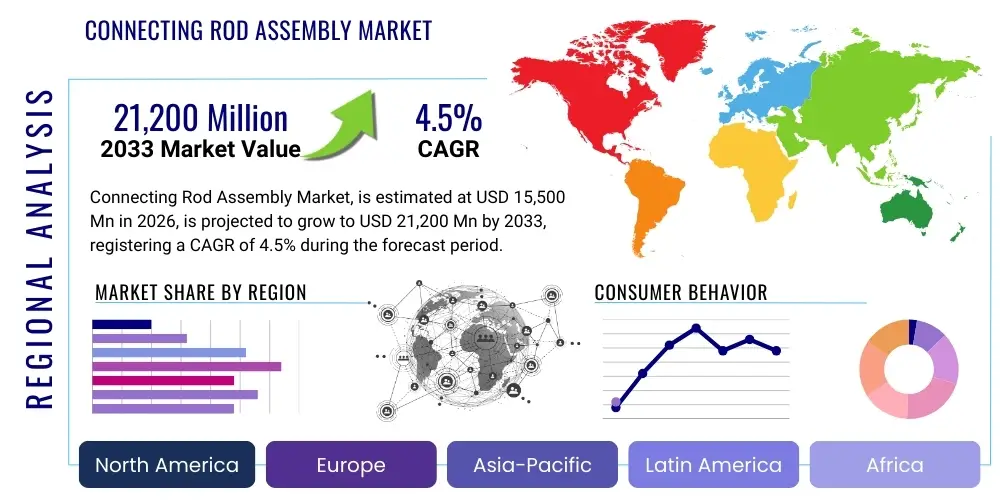

Connecting Rod Assembly Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437591 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Connecting Rod Assembly Market Size

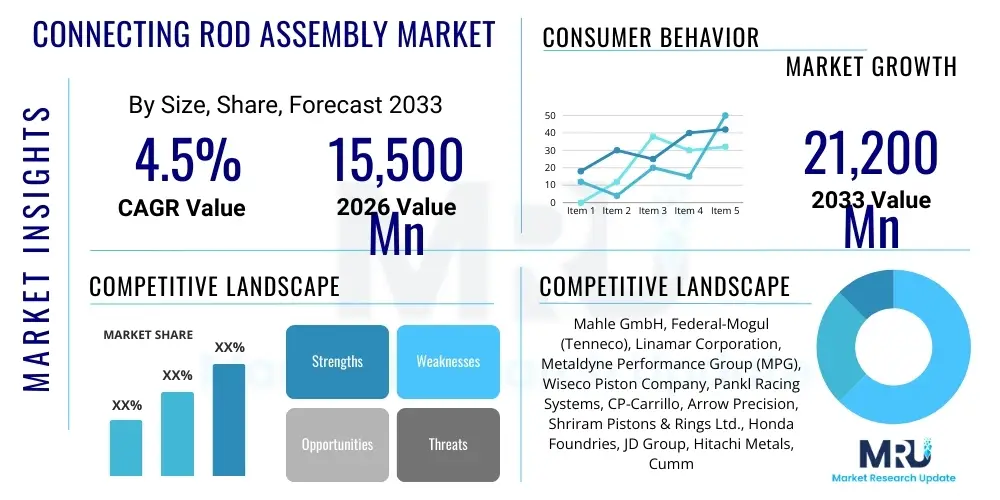

The Connecting Rod Assembly Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 15,500 Million in 2026 and is projected to reach USD 21,200 Million by the end of the forecast period in 2033.

Connecting Rod Assembly Market introduction

The Connecting Rod Assembly Market encompasses the global production and distribution of connecting rods—critical components in reciprocating piston engines, responsible for converting the reciprocating motion of the piston into the rotational motion of the crankshaft. These assemblies are foundational to the operation of internal combustion engines (ICE) used across automotive, marine, aerospace, and industrial sectors. The market dynamics are intricately linked to global vehicle production rates, regulatory standards concerning emissions, and the technological advancements in material science aimed at enhancing engine efficiency and durability. The core product, the connecting rod, must withstand immense thermal and mechanical stress, dictating the need for high-strength, fatigue-resistant materials like forged steel, powdered metal, or aluminum alloys, particularly in high-performance or heavy-duty applications.

Major applications of connecting rod assemblies span light-duty vehicles (passenger cars), heavy-duty vehicles (trucks and buses), motorcycles, and off-highway machinery (construction equipment, agricultural tractors). The primary benefit derived from these components is the efficient and reliable transfer of combustion force, ensuring optimal engine performance and longevity. Recent design innovations focus heavily on weight reduction, primarily through optimization of I-beam or H-beam profiles and the adoption of lightweight, high-performance composites or titanium for niche racing applications. Furthermore, the market is continually adapting to the stringent requirements imposed by downsizing and turbocharging trends in modern ICE design, which elevate peak cylinder pressures and thermal loads.

Key driving factors accelerating market growth include the robust demand for new commercial vehicles, particularly in emerging economies experiencing rapid industrialization and infrastructure development. The aftermarket segment also plays a significant role, driven by the requirement for replacement parts needed for engine overhauls and maintenance cycles across the vast global installed base of ICE vehicles. Although the long-term shift toward electric vehicles (EVs) introduces headwinds, the sustained dominance of ICE technology in commercial transport, long-haul logistics, and high-performance sectors ensures continuous, albeit modulated, growth for connecting rod manufacturers in the medium term. Technological investments in advanced forging and machining processes remain paramount for competitive differentiation.

Connecting Rod Assembly Market Executive Summary

The global Connecting Rod Assembly market is characterized by intense competition and technological innovation, primarily driven by the ongoing need for efficiency improvements in internal combustion engines (ICEs). Current business trends indicate a strong focus on strategic mergers and acquisitions among Tier 1 suppliers to consolidate market share, optimize supply chains, and gain access to proprietary advanced material technologies, such as advanced powdered metallurgy for cost-effective manufacturing. Furthermore, manufacturers are increasingly investing in sophisticated simulation software and finite element analysis (FEA) to perfect rod geometry, minimizing mass while maximizing strength—a critical requirement for meeting evolving engine performance standards and reducing overall vehicle weight for fuel economy gains. The shift towards modular engine designs also influences procurement strategies, favoring suppliers capable of providing highly customizable, precision-engineered components globally.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning automotive production in countries like China, India, and Southeast Asian nations, driven by expanding middle classes and increased commercial activity. North America and Europe, while mature markets, emphasize advanced materials and premium connecting rod assemblies for performance cars and stringent heavy-duty applications, driven by strict emission norms (e.g., Euro 7 and CAFE standards) that necessitate highly optimized engine components. Conversely, supply chain vulnerabilities, particularly concerning raw material sourcing (steel, aluminum), and geopolitical instabilities pose persistent challenges, requiring localized production strategies and robust inventory management across major manufacturing hubs.

Segment trends highlight the dominance of forged steel connecting rods due to their cost-effectiveness and proven reliability across standard automotive applications. However, the Powdered Metal segment is experiencing accelerated adoption due to lower waste generation and superior near-net shape capabilities, reducing post-processing costs. In terms of application, the Heavy-Duty Vehicles segment maintains a high value share, reflecting the larger component size and stringent durability requirements typical of commercial transport engines. The long-term outlook mandates continued technological alignment, focusing on developing components that can handle the high thermal efficiency requirements of future ICE iterations, even as the global industry slowly pivots toward electrification.

AI Impact Analysis on Connecting Rod Assembly Market

User queries regarding the integration of Artificial Intelligence (AI) in the Connecting Rod Assembly Market predominantly revolve around three critical themes: predictive quality control, optimization of manufacturing processes, and enhanced design iteration capabilities. Users are keen to understand how AI algorithms can minimize defects during critical stages like forging and machining, ensuring zero-defect output necessary for high-stress components. Another major concern focuses on utilizing machine learning to predict component fatigue life based on operational data, moving from scheduled maintenance to true predictive maintenance. Finally, there is significant interest in Generative Design, where AI explores thousands of potential geometries to create ultra-lightweight connecting rods optimized for specific engine characteristics, pushing the boundaries of traditional mechanical engineering design constraints while simultaneously reducing material waste and production cycle times. The overarching expectation is that AI integration will fundamentally shift manufacturing from reactive quality checks to proactive, optimized production environments, drastically improving component reliability and cost efficiency across the entire value chain.

- AI-driven Predictive Maintenance: Analyzing sensor data (vibration, temperature) from running engines to forecast connecting rod fatigue failure and scheduled replacement, reducing catastrophic failures.

- Generative Design Optimization: Using deep learning models to create ultra-lightweight, high-strength connecting rod geometries that meet stringent load requirements while minimizing material usage.

- Real-time Quality Inspection: Implementing computer vision and machine learning for immediate defect detection during forging, casting, and machining processes, ensuring dimensional accuracy and surface integrity.

- Supply Chain Forecasting: Utilizing AI to predict fluctuations in raw material prices (steel, aluminum) and optimizing inventory levels and procurement strategies to mitigate cost risks.

- Process Parameter Optimization: Applying reinforcement learning algorithms to fine-tune manufacturing variables (e.g., furnace temperature, forging pressure) for maximum yield and minimum energy consumption.

DRO & Impact Forces Of Connecting Rod Assembly Market

The market for connecting rod assemblies is shaped by a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively exert significant impact forces on market expansion and strategic development. The primary driver is the sustained, robust global demand for internal combustion engines (ICE) in commercial vehicles, marine, and industrial sectors, particularly in rapidly developing economies where heavy infrastructure projects necessitate reliable diesel engines. Parallelly, the continuous emphasis by regulatory bodies on improving fuel efficiency necessitates lighter, stronger connecting rods, compelling manufacturers to invest in advanced design and material technologies. These factors provide a strong foundation for steady demand and technological advancement across the medium term, forcing consistent innovation in metallurgy and manufacturing precision.

Conversely, the most significant restraint challenging the market's long-term trajectory is the accelerating global adoption of Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs). Since these powertrains eliminate the need for traditional connecting rod assemblies, the market faces structural obsolescence risk in the passenger vehicle segment, particularly post-2035 in developed nations. Furthermore, volatility in the prices of key raw materials, such as specialized alloy steels and nickel, coupled with stringent environmental regulations governing machining coolants and waste disposal, adds cost pressure and complexity to manufacturing operations, particularly for smaller market players struggling with economies of scale.

However, substantial opportunities exist through diversification and technological specialization. The shift towards high-performance and specialty engines (e.g., hybrid systems incorporating highly stressed ICE components) offers lucrative avenues for manufacturers specializing in premium materials (titanium, advanced composites) and precision engineering. Furthermore, the large and resilient aftermarket segment, driven by the need to maintain millions of existing ICE vehicles globally, presents a continuous revenue stream independent of new vehicle production trends. Finally, forging strategic partnerships with engine research laboratories and major Tier 1 automotive suppliers to co-develop components for future high-efficiency, multi-fuel engines (including hydrogen ICEs) represents a critical growth pathway, mitigating risks associated with the immediate shift to pure electric powertrains.

Segmentation Analysis

The Connecting Rod Assembly Market segmentation provides a granular view of market structure based on material type, manufacturing process, vehicle application, and geography, revealing key areas of growth and technological preference. Understanding these segments is crucial for strategic decision-making, allowing manufacturers to tailor production capabilities and product offerings to specific end-user requirements, particularly regarding durability, performance, and cost constraints. The analysis highlights that while traditional segments like forged steel remain dominant in terms of volume, segments utilizing advanced powdered metal technologies are rapidly increasing their market penetration due to favorable cost-to-performance ratios and minimized material waste during production.

Segmentation by application clearly delineates the market based on required stress tolerance and production volume. Passenger vehicles typically rely on high-volume, standardized production methods (forging and powdered metallurgy), balancing cost and performance. In contrast, heavy-duty applications demand superior structural integrity and fatigue resistance, leading to a preference for high-quality forged steel or specialized alloys, often incurring higher component costs but ensuring extended operational life critical for commercial use. The niche motorsports and aerospace segments, though smaller in volume, drive innovation in high-end materials like titanium and specialized aluminum, where weight savings are prioritized over manufacturing cost.

Geographically, market segmentation reflects global manufacturing hubs and consumer demand patterns. The APAC region is segmented by mass-market, high-volume requirements, while North America and Europe are segmented by higher regulatory compliance (emissions, safety) and a greater focus on performance and heavy-duty commercial transport. This geographical distinction necessitates localized supply chains and adherence to varying regional quality standards, influencing how international manufacturers allocate production capacity and research and development resources toward material science and process optimization tailored to regional specificities.

- By Material Type:

- Forged Steel

- Powdered Metal (Sintered)

- Aluminum Alloy

- Titanium and Composites (Niche)

- By Process Type:

- Forging (Cold and Hot)

- Casting

- Powder Metallurgy

- By Application:

- Light-Duty Vehicles (Passenger Cars, SUVs)

- Heavy-Duty Vehicles (Trucks, Buses)

- Motorcycles

- Off-Highway Vehicles (Construction, Agricultural)

- Marine Engines

- By Vehicle Type:

- Conventional Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV)

- Performance/Racing Engines

Value Chain Analysis For Connecting Rod Assembly Market

The value chain of the Connecting Rod Assembly Market begins with the upstream sourcing of raw materials, primarily high-grade alloy steel, aluminum, and various metal powders suitable for forging or sintering. Upstream activities are critical as material quality directly dictates the structural integrity and longevity of the final product. Key suppliers in this phase include specialized steel mills and metallurgical companies that must adhere to strict compositional tolerances. Manufacturers often engage in long-term supply agreements to mitigate price volatility and ensure consistent material availability, with a growing focus on sustainable sourcing practices and material traceability throughout the supply chain.

The midstream phase involves the core manufacturing processes: forging (the most prevalent method for high-stress applications), powder metallurgy (increasingly popular for mass production due to lower machining requirements), and precision machining (honing, boring, and grinding) to achieve precise dimensional specifications and surface finishes. Manufacturers in this stage, typically Tier 1 and Tier 2 suppliers, must maintain extremely high capital expenditure in advanced CNC machinery, heat treatment facilities, and quality control systems (like ultrasonic testing and magnetic particle inspection). Distribution channels from the manufacturer can be direct or indirect. Direct channels involve supplying original equipment manufacturers (OEMs) directly into their engine assembly lines, requiring Just-In-Time (JIT) delivery and highly synchronized logistics. Indirect channels primarily serve the vast global aftermarket through distributors, wholesalers, and independent repair shops, where packaging, inventory management, and regional warehousing become crucial.

Downstream activities center on the integration of the connecting rod assemblies into the final engine units by OEMs (e.g., Ford, Daimler, Cummins) and subsequent distribution to end-users across the transportation, industrial, and marine sectors. Post-sales services, including warranty provision and the supply of replacement components through the aftermarket network, complete the value chain. The influence of downstream customers, especially major automotive OEMs, is substantial; their design requirements, production forecasts, and strict quality audits dictate the operational standards and investment priorities for connecting rod manufacturers across all stages of production. Efficiency gains in the value chain are increasingly sought through digitalization, leveraging IoT and data analytics to optimize inventory flow and reduce manufacturing lead times.

Connecting Rod Assembly Market Potential Customers

The primary potential customers and end-users of connecting rod assemblies are stratified across several high-value sectors centered around internal combustion engine utilization. The largest customer group consists of global Automotive Original Equipment Manufacturers (OEMs), including major passenger car, light commercial vehicle, and heavy-duty truck manufacturers. These entities represent the bulk of demand, procuring components in high volumes and demanding the strictest adherence to quality standards, dimensional tolerances, and material specifications required for modern, efficient engine designs. Long-term contractual relationships and collaborative R&D are common features of these B2B engagements, establishing deep integration between the rod manufacturer and the engine assembler.

Another significant segment comprises engine manufacturers specializing in non-automotive applications, such as power generation units, marine propulsion systems, and industrial machinery. Customers in this segment, including companies like Caterpillar, Wärtsilä, and GE, require connecting rods capable of operating continuously under extremely rigorous conditions, often favoring specialized alloys and custom designs tailored for extended maintenance intervals and high thermal stability. The demand here is less volume-driven than automotive but focuses intensely on reliability and custom engineering expertise, resulting in higher per-unit prices for specialized components.

Finally, the independent aftermarket sector, including engine rebuilders, spare parts wholesalers, and certified repair garages, forms a persistent and crucial customer base. These buyers rely on the market for replacement rods necessary for engine maintenance and refurbishment of existing vehicles. This demand is resilient, sustaining market activity regardless of new vehicle sales trends, and typically focuses on balancing quality with cost-effectiveness. The purchasing decisions in the aftermarket are heavily influenced by brand reputation, part availability, and adherence to OEM specifications to ensure compatibility and engine performance following repair.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15,500 Million |

| Market Forecast in 2033 | USD 21,200 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mahle GmbH, Federal-Mogul (Tenneco), Linamar Corporation, Metaldyne Performance Group (MPG), Wiseco Piston Company, Pankl Racing Systems, CP-Carrillo, Arrow Precision, Shriram Pistons & Rings Ltd., Honda Foundries, JD Group, Hitachi Metals, Cummins Inc., Aisin Seiki Co., Ltd., Bharat Forge, Thyssenkrupp AG, Wossner Piston Group, Cosworth, Mitsubishi Heavy Industries, and Musashi Seimitsu Industry Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Connecting Rod Assembly Market Key Technology Landscape

The technological landscape of the Connecting Rod Assembly Market is focused intensely on achieving superior strength-to-weight ratios and optimizing manufacturing precision to meet modern engine demands for higher pressures and rotational speeds. A pivotal technological trend is the advancement in Powdered Metal (PM) technology. Modern PM rods utilize proprietary alloying techniques and hot-isostatic pressing (HIP) processes to achieve near full density, resulting in components that rival the strength of traditional forgings while offering significant cost savings due to reduced material waste and the ability to produce complex net or near-net shapes requiring minimal final machining. This technology is becoming standard in high-volume passenger vehicle segments due to its inherent efficiency gains and consistency.

Another crucial area of innovation lies in the precision machining and surface treatment of connecting rods. Manufacturers are heavily investing in advanced five-axis CNC machining centers to ensure micro-level dimensional accuracy, particularly in critical areas like the big end bore, which interfaces with the crankshaft. Furthermore, surface enhancement technologies, such as shot peening and specialized plasma nitriding, are being employed to induce compressive residual stresses on the rod surface, significantly boosting fatigue strength and overall component lifespan, crucial for turbocharged and downsized engines operating under extreme thermal cycling conditions. The integration of acoustic emission testing during assembly also ensures the integrity of the connection between the rod and the cap.

Material science remains at the forefront, especially for high-performance and lightweight applications. The use of specialized aluminum alloys (like 7075 T6 or 2618) and titanium alloys is expanding in motorsports and premium vehicles where inertia reduction is paramount. However, the manufacturing complexity and high cost associated with these materials necessitate extremely tight process control. Furthermore, simulation and modeling tools, including advanced Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD), are standard practice. These tools allow engineers to digitally stress-test new designs under thousands of theoretical load conditions before physical prototyping, drastically reducing R&D cycles and ensuring design robustness compliant with the ever-increasing performance benchmarks set by the automotive industry.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global connecting rod assembly market, primarily driven by massive automotive production volumes in China, India, Japan, and South Korea. China, as the world's largest vehicle manufacturing base, is the epicenter of volume demand for both conventional and powdered metal rods. Rapid urbanization and infrastructure projects fuel demand for heavy-duty commercial vehicle engines, ensuring sustained growth, despite localized policy pushes towards electrification in passenger segments. The region serves as a major manufacturing and export hub for global Tier 1 suppliers.

- North America: Characterized by strong demand for heavy-duty trucks, high-performance engines, and large marine and industrial diesel applications. The North American market emphasizes high-durability and specialized materials, driven by strict regulatory standards regarding emissions and engine longevity. The regional market is highly competitive, dominated by established domestic and international suppliers focused on advanced forging techniques and localized manufacturing to ensure supply chain security.

- Europe: Europe is defined by stringent emission regulations (e.g., Euro 7 proposals), pushing manufacturers towards high-precision, optimized connecting rods essential for maximizing fuel efficiency and minimizing emissions in sophisticated gasoline and diesel engines. The market exhibits a high demand for premium components for luxury and sports cars, necessitating specialized materials like aluminum and titanium alloys, alongside strong R&D investment in powdered metallurgy for mass-market vehicles.

- Latin America (LATAM): Market growth is steadily improving, linked closely to economic recovery and increasing commercial vehicle sales, particularly in Brazil and Mexico. While focusing primarily on cost-effective forged steel components, the region serves as an important production base due to favorable labor costs and trade agreements, catering both to internal regional needs and supporting export operations to other Americas markets.

- Middle East and Africa (MEA): Demand in MEA is largely dependent on the oil and gas sector, heavy machinery, and defense applications, coupled with consistent aftermarket demand from the large installed base of ICE vehicles. Growth is moderate and segmented, with high-end demand concentrated in regions with robust infrastructure projects (e.g., GCC countries) requiring reliable heavy-duty equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Connecting Rod Assembly Market.- Mahle GmbH

- Federal-Mogul (Tenneco)

- Linamar Corporation

- Metaldyne Performance Group (MPG)

- Wiseco Piston Company

- Pankl Racing Systems

- CP-Carrillo

- Arrow Precision

- Shriram Pistons & Rings Ltd.

- Honda Foundries

- JD Group

- Hitachi Metals

- Cummins Inc.

- Aisin Seiki Co., Ltd.

- Bharat Forge

- Thyssenkrupp AG

- Wossner Piston Group

- Cosworth

- Mitsubishi Heavy Industries

- Musashi Seimitsu Industry Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Connecting Rod Assembly market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material types dominate the connecting rod assembly market?

Forged steel and powdered metal are the dominant material types. Forged steel offers maximum strength and reliability, favored in heavy-duty and high-stress applications. Powdered metal is increasingly adopted in high-volume passenger vehicles due to its cost-efficiency, superior consistency, and near-net shape production capability, minimizing waste.

How does the shift towards electric vehicles (EVs) impact the connecting rod assembly market?

The accelerating transition to EVs poses a long-term structural restraint on the market, particularly in the light-duty passenger vehicle segment. However, the market is sustained in the medium term by the consistent demand from commercial transport, off-highway machinery, and hybrid vehicles, where high-efficiency internal combustion engines still necessitate advanced connecting rods.

Which geographical region exhibits the highest growth potential for connecting rod manufacturers?

The Asia Pacific (APAC) region, specifically countries like China and India, offers the highest growth potential. This growth is driven by massive domestic vehicle production volumes, rapid industrialization, and significant demand for heavy-duty commercial vehicle components essential for ongoing infrastructure development.

What are the key technological advancements driving innovation in connecting rod design?

Key technological advancements include the adoption of sophisticated Generative Design using AI for optimized, lighter geometries; continuous improvement in Powdered Metallurgy for cost-effective, high-density components; and advanced surface treatments, such as shot peening and nitriding, to significantly enhance the fatigue life of the rod under high thermal and mechanical stress.

What is the primary role of connecting rod suppliers in the automotive OEM value chain?

Connecting rod suppliers are critical Tier 1 or Tier 2 partners responsible for providing highly precise, performance-critical components that meet the exact dimensional and metallurgical specifications of engine manufacturers. Their primary role involves Just-In-Time (JIT) delivery, collaborative design verification (using FEA), and ensuring components integrate seamlessly into high-speed assembly lines, directly impacting overall engine quality and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager