Connectivity Enabling Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431720 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Connectivity Enabling Technology Market Size

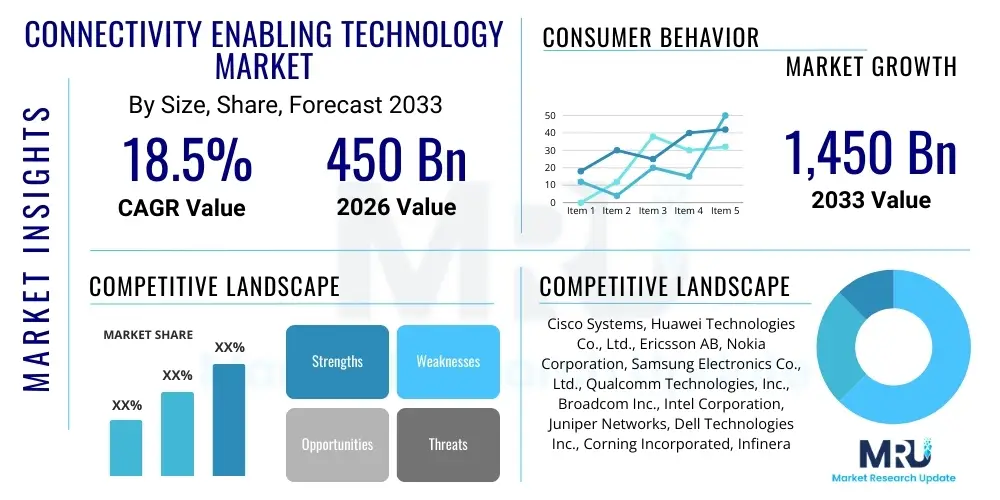

The Connectivity Enabling Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450 Billion in 2026 and is projected to reach USD 1,450 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global imperative for enhanced digital transformation, necessitating robust, low-latency, and high-bandwidth network infrastructure across all industrial and consumer sectors. The increasing proliferation of Internet of Things (IoT) devices, coupled with the mass deployment of 5G networks and the nascent development of 6G standards, is setting the stage for unprecedented growth in demand for technologies that enable seamless, ubiquitous connectivity. Investments are heavily concentrated in developing sophisticated networking hardware, optimized software-defined networking (SDN) solutions, and advanced satellite communication systems, ensuring that connectivity remains resilient and adaptable to evolving user requirements.

Connectivity Enabling Technology Market introduction

The Connectivity Enabling Technology Market encompasses a broad spectrum of hardware, software, and services designed to facilitate reliable, high-speed, and secure data transmission between diverse endpoints, encompassing core networks, edge devices, and cloud infrastructure. Products within this market include advanced networking components such as routers, switches, optical fiber systems, 5G and future generation network infrastructure, satellite communication modules, and sophisticated network management platforms based on software-defined architectures. Major applications span industrial automation (Industry 4.0), smart city initiatives, autonomous vehicle systems, remote healthcare services, and highly demanding consumer applications like augmented reality (AR) and virtual reality (VR). The key benefits derived from these technologies include significantly reduced latency, massive machine-type communication (mMTC) capabilities, enhanced network security, and dynamic resource allocation, which are critical for supporting real-time applications and complex operational environments.

The market is defined by continuous technological breakthroughs aimed at increasing network capacity and spectral efficiency. Connectivity enabling technologies are the foundational elements supporting the entire digital economy, moving beyond basic internet access to providing intricate network slices tailored for specific enterprise use cases. This shift necessitates innovations in areas such as Software-Defined Wide Area Networking (SD-WAN), Network Function Virtualization (NFV), and the integration of advanced cryptographic techniques to secure the increasingly complex mesh of connected devices. Furthermore, the development of open standards, like Open RAN (Radio Access Network), is disrupting traditional vendor lock-in models, promoting competition and faster innovation cycles globally.

Driving factors for this market are multifaceted, including the exponential rise in global data traffic, primarily fueled by video streaming and cloud computing services, the accelerated commercialization of 5G and the preparatory groundwork for 6G technologies, and the pervasive integration of IoT devices across commercial and consumer landscapes. Additionally, governmental mandates for universal broadband access and the necessity for robust communication systems during periods of disaster or remote work mandates further propel market growth. The ongoing need for optimized network performance to handle demanding applications like artificial intelligence (AI) and edge computing also reinforces the strategic importance and investment profile of connectivity enabling technologies.

Connectivity Enabling Technology Market Executive Summary

The Connectivity Enabling Technology Market is experiencing rapid structural transformation characterized by intense investment in infrastructure modernization and the widespread adoption of disaggregated network architectures. Key business trends indicate a strong move towards subscription-based network services (NaaS – Network as a Service), blurring the lines between traditional communication service providers (CSPs) and enterprise IT departments. Consolidation and strategic partnerships among hardware manufacturers, software developers, and cloud hyperscalers are prominent, aiming to deliver integrated solutions that simplify deployment and management of complex hybrid networks. The focus is shifting from pure hardware sales to providing value-added services centered on network intelligence, security monitoring, and performance optimization, thereby creating higher-margin revenue streams for market participants.

Regionally, the Asia Pacific (APAC) continues to lead in network deployment density, driven by massive public and private investments in 5G rollouts in China, South Korea, and Japan, coupled with rapid industrial digitalization in Southeast Asia. North America remains a leader in high-value innovation, particularly in edge computing and satellite broadband technology, capitalizing on a high concentration of tech companies and early adoption of advanced enterprise networking solutions like SD-WAN. Europe is focusing heavily on standardizing regulatory frameworks, fostering cross-border connectivity initiatives, and investing significantly in secure, resilient infrastructure, often guided by ambitious environmental sustainability goals that favor energy-efficient connectivity solutions.

In terms of segmentation trends, the Software-Defined Networking (SDN) and Network Function Virtualization (NFV) segments are witnessing the highest growth rates, reflecting the industry's pivot toward agility and operational efficiency. Wireless technology, particularly relating to millimeter-wave (mmWave) and mid-band spectrum access for 5G, dominates infrastructure investment. Within the application segment, the automotive sector, driven by connected and autonomous vehicle demands, and the industrial sector (smart factories) show the most aggressive adoption rates, requiring ultra-reliable low-latency communication (URLLC) capabilities that only advanced connectivity technologies can provide. Managed services related to network operations and security continue to expand rapidly as enterprises increasingly outsource complex network management tasks to specialized providers.

AI Impact Analysis on Connectivity Enabling Technology Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally alter network operations, specifically focusing on improved efficiency, enhanced security protocols, and the feasibility of self-optimizing networks. Common questions revolve around the use of AI for predictive maintenance, automating complex network slicing in 5G, and detecting sophisticated cyber threats that bypass traditional defenses. Concerns often center on data privacy implications of feeding vast amounts of network traffic data into AI models, the required computational infrastructure at the edge to support these AI operations, and the skills gap necessary to manage AI-driven network environments. Users expect AI to transition networks from reactive monitoring systems to proactive, highly resilient, and nearly autonomous infrastructures capable of managing hyper-scale complexity with minimal human intervention, driving down operational expenditure (OPEX) and maximizing network performance metrics.

- AI enables predictive network maintenance by analyzing performance data to anticipate hardware failures or congestion issues before they impact service quality, dramatically improving network uptime and reliability.

- Integration of Machine Learning (ML) algorithms is crucial for optimizing dynamic resource allocation in 5G and 6G networks, facilitating automated network slicing tailored specifically to application requirements (e.g., URLLC for remote surgery or enhanced mobile broadband for streaming).

- AI-driven security platforms provide superior threat detection capabilities by identifying anomalous behavior and zero-day attacks in real-time across the massive attack surface created by IoT devices and edge computing nodes.

- AI facilitates self-optimizing networks (SON), allowing base stations and core network functions to automatically adjust power levels, frequency reuse patterns, and traffic routing in response to fluctuating demand and environmental conditions.

- Automated deployment and provisioning of network services (AIOps) reduce operational complexity, decrease human error, and accelerate the time-to-market for new connectivity solutions, supporting rapid scaling.

- AI is essential for managing the massive influx of data generated by connected devices, enabling efficient data aggregation, processing, and localized decision-making at the network edge, thereby reducing backhaul traffic requirements.

DRO & Impact Forces Of Connectivity Enabling Technology Market

The market trajectory is shaped by a confluence of powerful drivers (D), significant restraints (R), compelling opportunities (O), and pervasive impact forces. The primary driver is the pervasive demand for bandwidth, fueled by cloud services, high-definition media consumption, and the expanding Internet of Things (IoT) ecosystem, which necessitates perpetual network upgrades. Restraints largely revolve around the extremely high capital expenditure (CAPEX) required for large-scale infrastructure deployment, particularly 5G millimeter-wave sites and deep fiber optic installations, coupled with regulatory hurdles related to spectrum allocation and international data sovereignty laws. However, immense opportunities exist in the commercialization of new technologies such as Non-Terrestrial Networks (NTN) provided by Low Earth Orbit (LEO) satellites and the development of 6G standards which promise terahertz frequency capabilities, opening new markets in remote and underserved geographies. These forces collectively dictate the speed of innovation, market accessibility, and competitive structure within the connectivity ecosystem.

Impact forces currently shaping the industry include geopolitical tensions affecting the global supply chain for crucial semiconductor components and networking equipment, which introduces volatility in pricing and deployment timelines. Furthermore, the accelerating pace of digital transformation across all vertical industries—healthcare, manufacturing, logistics, and retail—demands customized and highly resilient connectivity solutions, forcing providers to rapidly innovate on network slicing and quality of service (QoS) guarantees. Sustainability and energy efficiency are also major impact forces, as the energy consumption of data centers and cellular networks is under intense scrutiny, pushing manufacturers towards developing greener, more power-efficient hardware and network optimization software. This complex interplay of technological, economic, and geopolitical elements mandates agile strategic planning for all market stakeholders.

The imperative to secure highly distributed and hybrid network environments is a critical underlying impact force. As connectivity technologies enable more mission-critical applications—from remote industrial control to autonomous vehicles—the need for end-to-end security becomes paramount. This drives significant investment in technologies such as quantum-resistant cryptography, blockchain-enabled security frameworks for IoT device identity management, and integrated AI-driven anomaly detection systems. The market’s evolution is therefore not solely about increasing speed, but equally about maximizing reliability, guaranteeing service availability, and ensuring ironclad data protection across heterogeneous networking landscapes.

Segmentation Analysis

The Connectivity Enabling Technology Market is systematically segmented based on Technology, Component, Application, and End-User, reflecting the diverse landscape of solutions and target markets. The segmentation helps in understanding specific investment areas, competitive differentiation, and growth potential within specialized niches. For instance, the distinction between wired and wireless components illustrates the ongoing infrastructure evolution, where fiber deployment provides backbone capacity while 5G and Wi-Fi 6/7 enable high-density wireless access. Similarly, separating applications like Smart Cities from Industrial IoT allows for focused development of connectivity solutions that address the specific latency and security requirements inherent in those environments, providing tailored value propositions across the entire digital ecosystem.

- By Component:

- Hardware (Routers, Switches, Base Stations, Modems, Gateways, Optical Components, Antennas)

- Software (Network Management Solutions, Network Function Virtualization (NFV), Software-Defined Networking (SDN) Controllers, Orchestration Software)

- Services (Managed Services, Professional Services, Deployment and Integration Services, Consulting)

- By Technology:

- 5G and Future Generations (6G Research)

- Wireline (Fiber Optics, Ethernet, DOCSIS)

- Wireless Access (Wi-Fi 6/6E/7, Bluetooth, LPWAN technologies like LoRaWAN and NB-IoT)

- Satellite Communication (GEO, MEO, LEO constellations)

- By Application:

- Industrial IoT (IIoT) and Manufacturing

- Smart Cities and Smart Homes

- Connected and Autonomous Vehicles

- Healthcare (Telemedicine and Remote Monitoring)

- Agriculture (Smart Farming)

- Enterprise Networking and Data Centers

- By End-User:

- Communication Service Providers (CSPs) and Telecom Operators

- Enterprises (BFSI, Retail, Government, Education)

- Utility and Energy Sector

- Transportation and Logistics

Value Chain Analysis For Connectivity Enabling Technology Market

The value chain for the Connectivity Enabling Technology Market is extensive and highly complex, starting with upstream activities dominated by semiconductor foundries and component manufacturers. These entities provide crucial integrated circuits, specialized chipsets (ASICs, FPGAs), and optical components that form the foundational hardware for all networking devices. Downstream activities involve the integration and deployment of these components, primarily executed by network equipment manufacturers (NEMs) and infrastructure providers. Key players here transform raw components into deployable networking gear such as core routers, 5G base stations, and edge servers, focusing heavily on software integration (NFV/SDN) to maximize utility and scalability for end-users.

The distribution channel is multifaceted, relying on both direct and indirect sales strategies. Direct channels are typically utilized for large-scale infrastructure projects involving major telecom operators or hyperscale cloud providers, where custom solutions, long-term maintenance contracts, and direct technical consultation are required. Indirect channels, which include value-added resellers (VARs), system integrators (SIs), and specialized distributors, handle the majority of sales to small and medium-sized enterprises (SMEs) and specific vertical markets. These integrators often bundle connectivity hardware and software with customized application solutions, providing regional expertise and localized support services, thereby extending the market reach of the original equipment manufacturers (OEMs).

The efficiency of this value chain is increasingly determined by software capabilities rather than just hardware specifications. Players who can quickly integrate open-source solutions, offer robust cybersecurity features, and provide sophisticated orchestration tools gain a competitive edge. Upstream suppliers are constantly pressured to innovate on power efficiency and component size, while downstream service providers focus on offering Network-as-a-Service (NaaS) models to optimize customer OPEX. Successful navigation of this value chain requires deep collaboration between chip designers, system integrators, and the final service providers to ensure seamless, end-to-end network performance and scalability from the silicon level up to the application layer.

Connectivity Enabling Technology Market Potential Customers

Potential customers for Connectivity Enabling Technology are broadly defined as any organization or entity requiring high-performance, resilient, and scalable network infrastructure to support digital operations. Communication Service Providers (CSPs) and major telecom operators represent the largest and most frequent buyers, consistently investing billions in upgrading their core and access networks to support 5G, fiber-to-the-home (FTTH), and future 6G standards. Their purchasing decisions are primarily driven by the need for increased spectral efficiency, reduced operational costs through virtualization (NFV), and the ability to offer differentiated services like network slicing to enterprise customers. They require dense, high-capacity hardware and sophisticated management software capable of handling millions of simultaneous connections efficiently.

A rapidly growing customer segment is the Enterprise sector, encompassing large multinational corporations, financial services, healthcare providers, and major retailers. These entities are adopting connectivity enabling technologies, particularly SD-WAN and private 5G networks, to build highly secure, flexible, and geographically distributed networks that support cloud migration and remote workforce requirements. For industries like manufacturing (Industry 4.0), connectivity technologies are non-negotiable for enabling real-time control systems, robotics, and complex machine-to-machine communications, prioritizing Ultra-Reliable Low-Latency Communication (URLLC) characteristics over raw bandwidth. Their demand is focused on integrated solutions that offer superior security features and simplified, centralized network management across diverse sites.

Government bodies, defense organizations, and municipalities engaged in smart city projects constitute another significant customer base. Their procurement is often guided by public safety concerns, the need for resilient infrastructure during emergencies, and the deployment of sensor networks for urban management (traffic control, environmental monitoring). Furthermore, content delivery network (CDN) providers and cloud hyperscalers (like Amazon, Microsoft, Google) are massive consumers of high-capacity optical and data center interconnect technologies to ensure rapid and efficient data transfer between their vast server farms and to the final mile, making them continuous, high-volume buyers of the most advanced components in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Billion |

| Market Forecast in 2033 | USD 1,450 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, Samsung Electronics Co., Ltd., Qualcomm Technologies, Inc., Broadcom Inc., Intel Corporation, Juniper Networks, Dell Technologies Inc., Corning Incorporated, Infinera Corporation, Ciena Corporation, Hewlett Packard Enterprise (HPE), ZTE Corporation, NEC Corporation, Ribbon Communications, Arista Networks, CommScope Holding Company, Inc., and Viasat, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Connectivity Enabling Technology Market Key Technology Landscape

The current technology landscape is dominated by innovations centered on virtualization, disaggregation, and maximizing spectrum utilization. Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are foundational, allowing telecom operators and enterprises to decouple network functions from proprietary hardware, enabling rapid scalability and reducing vendor lock-in. This transition to programmable, agile networks is crucial for delivering specialized services, such as network slicing in 5G, efficiently. Furthermore, the adoption of Software-Defined Wide Area Networking (SD-WAN) is rapidly replacing traditional MPLS networks, providing secure, optimized, and cost-effective connectivity across distributed enterprise locations by intelligently managing multiple transport links based on application performance requirements.

In the wireless domain, the ongoing rollout of 5G infrastructure, particularly utilizing higher frequency bands like millimeter-wave (mmWave) for high capacity in dense urban environments and mid-band spectrum for broader coverage, defines a major area of technological focus. Simultaneously, the proliferation of Wi-Fi 6, 6E, and the nascent Wi-Fi 7 standard is addressing capacity bottlenecks within residential and enterprise indoor environments, offering multi-gigabit throughput and lower latency. A parallel technological shift is the move toward Open Radio Access Network (Open RAN) architectures, which disaggregate hardware and software in the RAN, promoting vendor diversity, increased flexibility, and significant cost reductions for deployment, especially critical in competitive market landscapes like APAC.

Looking ahead, significant technological investment is focused on Non-Terrestrial Networks (NTN), specifically the deployment and utilization of massive LEO satellite constellations. These systems promise ubiquitous global connectivity, particularly relevant for maritime, aviation, and remote rural areas, extending the reach of 5G and IoT services far beyond traditional terrestrial limits. Moreover, the preliminary research into 6G technology, focusing on Terahertz (THz) frequencies and the integration of AI natively into network orchestration, is starting to shape long-term strategic investment, aiming for ultra-high speeds (Tbps) and near-zero latency, potentially utilizing advanced capabilities such as holographic communication and precise sensing capabilities integrated directly into the network fabric.

Regional Highlights

The global market for connectivity enabling technologies exhibits distinct growth patterns and adoption drivers across key geographic regions. North America (NA), driven by technological early adoption, high spending power, and a concentrated presence of global tech giants and cloud providers, remains a powerhouse for innovation and high-value segment growth. The region leads in the deployment of advanced enterprise networking solutions, particularly SD-WAN and private 5G networks, fueled by the accelerating shift to hybrid cloud environments and demanding requirements for edge computing infrastructure. Investment is heavily prioritized in LEO satellite connectivity and specialized high-performance computing hardware required for network virtualization, supported by favorable regulatory policies regarding spectrum auctions and infrastructure financing.

Asia Pacific (APAC) dominates the market in terms of sheer volume and density of network deployments. Countries like China, South Korea, and Japan have achieved world-leading 5G penetration rates, necessitating continuous investment in high-capacity base stations, extensive fiber backbones, and sophisticated network management software to handle unprecedented mobile data usage. Furthermore, the rapid industrialization across emerging economies in Southeast Asia is driving massive adoption of IIoT connectivity, requiring tailored LPWAN (Low-Power Wide-Area Network) solutions and secure enterprise connectivity tailored for smart factories and complex supply chains. The region is characterized by high competitive intensity among local and international vendors, often resulting in faster technology rollout cycles but also requiring aggressive pricing strategies.

Europe shows steady growth, driven by stringent regulatory focus on cybersecurity (GDPR), data sovereignty, and cross-border connectivity goals mandated by the European Union. While 5G rollout lagged slightly behind APAC and NA initially, the region is now prioritizing fixed-mobile convergence (FMC) and investing heavily in standardized, energy-efficient connectivity solutions. There is a strong emphasis on smart city initiatives and smart grid modernization, which require robust, secure, and low-latency communication infrastructures. The Middle East and Africa (MEA), while smaller in market size, represents a high-potential future growth region. The Gulf Cooperation Council (GCC) countries are investing heavily in digital infrastructure as part of their national diversification plans (e.g., Vision 2030), pushing immediate adoption of cutting-edge 5G technologies, while Africa focuses on expanding mobile broadband access to underserved populations, prioritizing cost-effective, high-coverage connectivity technologies.

- North America: Leads in private 5G adoption, edge computing deployment, and LEO satellite technology innovation; characterized by high per-user data consumption and enterprise demand for secure, hybrid cloud-enabled networks.

- Asia Pacific (APAC): Highest volume market driven by rapid 5G infrastructure scaling, dense urbanization, and accelerated industrial digitalization (IIoT); strong government backing for digital transformation initiatives.

- Europe: Focused on regulatory compliance (GDPR, Network Security), sustainability in network operation, and extensive deployment of fiber and converged fixed-mobile access networks for smart grid and smart city applications.

- Latin America (LATAM): Growth driven by increased mobile data penetration and investments aimed at bridging the digital divide; primary focus on expanding mid-band 5G coverage and modernizing legacy wireline infrastructure.

- Middle East & Africa (MEA): High growth potential fueled by large-scale national digital transformation agendas and substantial infrastructure investments, especially in the GCC countries, rapidly adopting the latest wireless standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Connectivity Enabling Technology Market.- Cisco Systems

- Huawei Technologies Co., Ltd.

- Ericsson AB

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- Intel Corporation

- Juniper Networks

- Dell Technologies Inc.

- Corning Incorporated

- Infinera Corporation

- Ciena Corporation

- Hewlett Packard Enterprise (HPE)

- ZTE Corporation

- NEC Corporation

- Ribbon Communications

- Arista Networks

- CommScope Holding Company, Inc.

- Viasat, Inc.

Frequently Asked Questions

Analyze common user questions about the Connectivity Enabling Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Connectivity Enabling Technology Market?

The key drivers include the global expansion of 5G and impending 6G infrastructure rollouts, the exponential proliferation of Internet of Things (IoT) devices demanding massive machine-type communication (mMTC), and the pervasive shift towards cloud computing and high-definition video consumption, all necessitating higher bandwidth and ultra-low latency.

How is Software-Defined Networking (SDN) influencing network architecture?

SDN fundamentally simplifies network management by separating the control plane from the data plane, enabling centralized, automated control. This shift allows for rapid deployment of services, dynamic traffic management, optimized resource utilization, and significantly reduced operational expenditure (OPEX) compared to legacy hardware-centric approaches.

Which technological segments are experiencing the fastest adoption rates?

The fastest adoption rates are observed in the 5G infrastructure segment (mid-band and mmWave), Software-Defined Wide Area Networking (SD-WAN) solutions for enterprise connectivity, and the integration of Low Earth Orbit (LEO) satellite communication systems for global reach and remote access applications.

What are the biggest restraints challenging market growth?

Major restraints include the extremely high capital investment required for building dense 5G networks and deep fiber optic infrastructure, complex regulatory environments concerning spectrum allocation and network security standards, and the increasing vulnerability of highly distributed networks to sophisticated cyber threats.

What role does Artificial Intelligence play in future connectivity networks?

AI is crucial for enabling the next generation of highly autonomous, self-optimizing networks (SON). It facilitates predictive maintenance, automates resource allocation (network slicing), enhances real-time security threat detection, and dramatically reduces human intervention in complex network operation and deployment tasks (AIOps).

How do Connectivity Enabling Technologies support Industry 4.0?

Connectivity Enabling Technologies provide the foundation for Industry 4.0 by delivering Ultra-Reliable Low-Latency Communication (URLLC) necessary for real-time control of robotics, machine-to-machine coordination, remote diagnostics, and massive sensor networks within smart factories. This robust, dedicated connectivity ensures operational continuity and high-precision automation.

What is the significance of the Open RAN architecture?

Open RAN (Radio Access Network) promotes vendor diversity and innovation by disaggregating proprietary hardware and software components. This approach lowers deployment costs, allows operators to mix and match best-of-breed components from different suppliers, and accelerates the integration of new features, fostering a more competitive and dynamic supply chain.

Which regions are leading in private network deployment?

North America and Europe currently lead in the deployment of private 5G and LTE networks. This is driven by large enterprises in manufacturing, logistics, and port operations seeking secure, high-performance, dedicated wireless coverage tailored specifically for mission-critical industrial applications, often bypassing public networks.

What differentiates 6G technology from 5G in terms of connectivity enabling?

While 5G focuses on high speed and low latency in gigahertz bands, 6G research aims for even higher capacity (Terabits per second) and near-zero latency by potentially utilizing Terahertz (THz) frequencies. 6G is expected to natively integrate AI, sensing capabilities, and holographic communications, fundamentally broadening the scope of connected applications far beyond mobile broadband.

What is the primary function of Network Function Virtualization (NFV) in this market?

NFV allows network service providers to replace proprietary hardware appliances (like firewalls, load balancers, or routers) with software instances running on standard commercial off-the-shelf (COTS) servers. This virtualization significantly improves operational flexibility, reduces hardware dependency, and speeds up the introduction of new network services (service chaining).

How is the automotive sector driving demand for connectivity technologies?

The automotive sector requires advanced connectivity for autonomous driving, vehicle-to-everything (V2X) communication, infotainment, and over-the-air (OTA) software updates. This drives immense demand for robust, low-latency mobile broadband and specialized cellular connectivity modules capable of handling safety-critical, high-throughput data exchange instantly and reliably.

What are the key components within the hardware segment?

Key hardware components include core and aggregation routers, high-density switches (especially for data centers), optical transceivers and components for fiber networks, 5G radio access network (RAN) equipment such as base stations and small cells, and specialized customer premise equipment (CPE) like advanced gateways and modems.

How does the shift to hybrid cloud impact connectivity requirements?

The shift to hybrid cloud mandates secure, high-speed, and flexible connectivity solutions to link on-premise data centers with public cloud environments. This increases the demand for high-capacity data center interconnect (DCI) solutions, optimized wide area networking (WAN) using SD-WAN, and guaranteed quality of service (QoS) across heterogeneous network environments.

What role do semiconductor manufacturers play in the value chain?

Semiconductor manufacturers are crucial upstream players, designing and supplying the high-performance chipsets (e.g., specialized CPUs, FPGAs, ASICs, modems, and optical components) that define the speed, efficiency, and capacity limits of all networking hardware, making them foundational to innovation in connectivity enabling technologies.

What is Non-Terrestrial Network (NTN) technology?

NTN refers to communication networks utilizing flying or space-based platforms, most notably Low Earth Orbit (LEO) satellites. This technology enables connectivity in remote, rural, and maritime areas where terrestrial infrastructure is impractical, significantly expanding the global reach of 5G and IoT services.

Why is energy efficiency becoming a critical factor in connectivity hardware?

As network density and data traffic volumes grow exponentially, the energy consumption of data centers and massive cellular infrastructure becomes unsustainable. Therefore, hardware designers are intensely focused on developing highly power-efficient chipsets, optimized routing algorithms, and cooling systems to meet ambitious environmental sustainability targets and reduce operational costs.

How are smart cities relying on connectivity enabling technologies?

Smart cities utilize robust connectivity to deploy massive sensor networks for real-time monitoring of traffic, public safety, and utilities. They require high-capacity Wi-Fi, low-power wide-area networks (LPWAN) for sensors, and resilient cellular connectivity to connect municipal services, enabling efficient resource allocation and improved citizen services.

What challenges does spectrum scarcity pose to market growth?

Spectrum scarcity restricts the ability of service providers to increase network capacity, especially in dense urban areas, unless they deploy higher-frequency spectrum (like mmWave), which requires significantly more infrastructure (small cells). This challenge drives innovation in spectrum utilization techniques, such as dynamic spectrum sharing (DSS) and cognitive radio.

What is AIOps and its relevance to connectivity management?

AIOps (Artificial Intelligence for IT Operations) leverages AI and Machine Learning to automate complex operational workflows, analyze vast amounts of network data, predict outages, and automate troubleshooting. For connectivity, AIOps ensures proactive optimization and management of highly complex, multi-vendor, virtualized network infrastructures.

Which end-user segment is demanding customized connectivity solutions?

The Industrial and Manufacturing end-user segment is driving the demand for customized solutions, specifically tailored private 5G networks and Ultra-Reliable Low-Latency Communication (URLLC) slices, which are essential for supporting highly deterministic, mission-critical applications within automated factory environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager