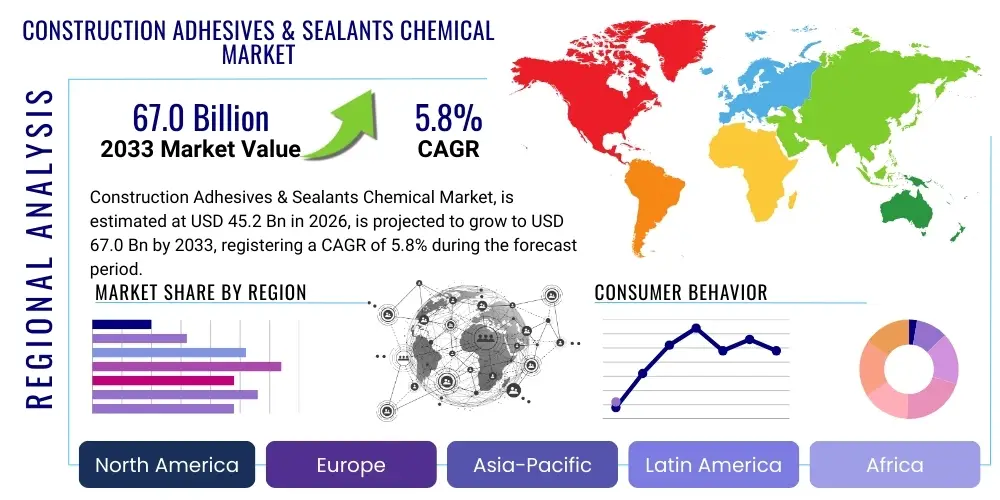

Construction Adhesives & Sealants Chemical Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434735 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Construction Adhesives & Sealants Chemical Market Size

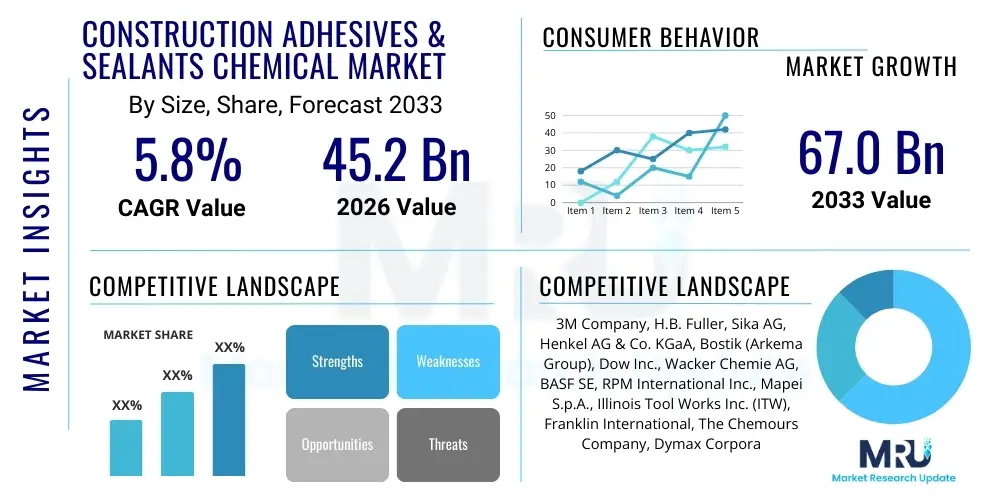

The Construction Adhesives & Sealants Chemical Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 67.0 Billion by the end of the forecast period in 2033.

Construction Adhesives & Sealants Chemical Market introduction

The Construction Adhesives & Sealants Chemical Market encompasses a sophisticated range of chemical compounds specifically formulated for binding, bonding, sealing, and waterproofing applications within the global construction industry. These specialized chemicals are critical components in modern construction practices, offering superior performance characteristics compared to traditional mechanical fasteners. The primary products include high-performance adhesives (such as epoxy, polyurethane, acrylic, and cyanoacrylate) and professional sealants (primarily silicone, polyurethane, and polysulfide), tailored for durability, flexibility, and resistance to environmental factors like moisture, temperature extremes, and UV radiation. The integration of these materials allows for lighter structures, improved insulation, faster construction times, and enhanced aesthetic finishes across diverse building types.

Major applications of these chemical products span residential, commercial, infrastructure, and industrial construction projects. Adhesives are widely used in flooring installation, panel assembly, façade bonding, roofing systems, and modular construction, where their ability to distribute stress evenly and provide vibration dampening is highly valued. Sealants are indispensable for gap filling, joint movement accommodation, weatherproofing curtain walls, glazing systems, and ensuring the long-term integrity of building envelopes. The increasing complexity of modern architectural designs, requiring materials that can bond dissimilar substrates (e.g., glass to metal, plastic to concrete), fuels continuous product innovation in this sector.

Key benefits driving the market include enhanced structural integrity, reduced construction waste, improved energy efficiency through superior airtightness achieved by advanced sealants, and the increasing global focus on sustainable building practices. Driving factors are predominantly rapid urbanization in emerging economies, massive investments in infrastructure development (bridges, tunnels, highways), the growing trend towards green buildings requiring low Volatile Organic Compound (VOC) formulations, and the need for renovation and retrofitting of aging structures in developed regions. Technological advancements, particularly the shift toward water-borne and reactive hot melt technologies, are reshaping the competitive landscape, emphasizing performance and environmental compliance.

Construction Adhesives & Sealants Chemical Market Executive Summary

The Construction Adhesives & Sealants Chemical Market exhibits robust growth driven by favorable business trends focused on sustainability, performance specialization, and regional construction booms. A significant business trend involves the shift from traditional solvent-borne systems to water-borne and high-solid content formulations, mandated by stricter environmental regulations across North America and Europe, and increasingly adopted in Asia Pacific. This transition requires substantial investment in R&D for advanced polymer synthesis capable of maintaining strength and durability without high VOC content. Furthermore, the rise of modular and prefabricated construction methods globally necessitates fast-curing, high-strength structural adhesives that accelerate assembly on-site, acting as a crucial technological accelerant across the value chain.

Regional trends clearly indicate that the Asia Pacific (APAC) region remains the epicenter of market expansion, primarily due to unprecedented rates of urbanization, extensive public works projects in countries like China and India, and the burgeoning residential sector in Southeast Asia. While APAC drives volume growth, North America and Europe lead in terms of innovation and regulatory compliance, commanding premium pricing for high-specification, low-emission products, especially within the high-end commercial and green building sectors. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, spurred by large-scale infrastructure investments (e.g., Saudi Vision 2030, Qatari infrastructure) and expanding residential construction, though regulatory frameworks are still maturing compared to Western counterparts.

Segmentation trends highlight the dominance of Polyurethane (PU) and Silicone chemistries, largely due to their versatile application profile, including high elasticity for sealants and superior bonding strength for adhesives in structural applications. The application segment sees non-residential construction, encompassing commercial, institutional, and infrastructure projects, generating the largest revenue share, reflecting the intensive use of high-performance sealants in curtain walls and specialized adhesives in large structural assemblies. However, the residential segment is projected to experience accelerated growth, particularly with the increased adoption of structural wood bonding agents and high-efficiency window and door sealing systems, driven by consumer demand for energy-efficient homes.

AI Impact Analysis on Construction Adhesives & Sealants Chemical Market

User inquiries regarding AI's impact on the Construction Adhesives & Sealants Chemical Market predominantly revolve around three key themes: optimization of formulation R&D, enhancement of quality control and application efficiency, and optimization of supply chain logistics. Users are keen to understand how AI and machine learning (ML) algorithms can predict the performance characteristics (e.g., cure time, adhesion strength, weathering resistance) of novel chemical compositions without extensive physical testing, thereby drastically reducing time-to-market for specialized products. There is also significant concern and interest in utilizing AI-powered vision systems for real-time monitoring of sealant application quality on construction sites to ensure consistency and minimize material failure, addressing common concerns regarding application variability.

The implementation of Artificial Intelligence and advanced analytics is transforming the traditionally empirical process of chemical formulation. ML models are being trained on vast datasets of material properties, reaction kinetics, and synthesis parameters to simulate and predict the optimal combination of raw materials (polymers, fillers, additives) for specific performance requirements, such as extremely low VOCs combined with high shear strength. This accelerates the development of bespoke adhesives and sealants for unique construction challenges, offering a competitive edge to companies that successfully integrate these predictive modeling tools into their innovation pipeline. Furthermore, AI helps in managing complex ingredient interactions, crucial for ensuring long-term product stability and performance under harsh operating conditions.

Beyond the laboratory, AI-driven solutions are profoundly affecting manufacturing and distribution. Predictive maintenance schedules for production machinery, determined by ML algorithms analyzing sensor data, minimize downtime and ensure consistent batch quality. In logistics, AI optimizes warehousing, manages inventory based on sophisticated demand forecasting tailored to regional construction cycles, and routes chemical shipments efficiently, which is particularly vital given the shelf-life constraints and hazard considerations of many adhesive and sealant components. This end-to-end integration enhances operational efficiency, reduces manufacturing costs, and ensures a more responsive supply chain, addressing the fluctuating demands of the global construction sector.

- Formulation Optimization: AI/ML algorithms accelerate R&D by predicting novel polymer compositions and material properties, significantly reducing physical testing cycles.

- Quality Control Enhancement: AI-powered computer vision systems monitor adhesive bead size, uniformity, and sealant application on-site, ensuring adherence to quality specifications in real-time.

- Supply Chain Efficiency: Predictive analytics optimize inventory levels, forecast regional demand fluctuations, and streamline logistics for time-sensitive or hazardous chemical transport.

- Manufacturing Process Control: AI monitors reaction kinetics and processing parameters in chemical reactors to maintain batch consistency and ensure product uniformity, crucial for structural applications.

- Sustainable Product Development: AI models aid in screening raw materials for lower environmental impact and higher recyclability, facilitating the shift towards green chemistry and bio-based alternatives.

DRO & Impact Forces Of Construction Adhesives & Sealants Chemical Market

The market is primarily driven by expanding global construction activities, particularly massive infrastructure projects in developing nations, coupled with stringent environmental regulations mandating the use of green, low-VOC products, pushing manufacturers towards advanced water-borne and solvent-free chemistries. However, growth is restrained by the high volatility and increasing cost of raw materials derived from petrochemical sources, which directly impacts the profitability and pricing stability of final products like polyurethane and epoxy systems. Opportunities exist in the specialized repair and maintenance market for aging infrastructure and the accelerating penetration of bio-based and sustainable sealants, especially within the European and North American retrofit sectors. These dynamics, combined with the accelerating pace of technological innovation in fast-curing structural formulations, create a strong positive impact force, slightly tempered by the reliance on stable crude oil prices and robust housing market activity.

Drivers: The sustained trend towards urbanization, especially in Asia and Africa, necessitates continuous construction of residential, commercial, and utility structures, generating massive demand for effective bonding and sealing solutions. Furthermore, the inherent performance benefits of modern adhesives and sealants—such as flexibility, weight reduction in structural assemblies, and superior insulation properties—are increasingly recognized as indispensable for achieving mandatory energy efficiency standards in modern buildings. Regulatory support, specifically the implementation of standards like LEED and BREEAM, favors manufacturers who can deliver certified green and high-performance chemical products, accelerating market demand for specific, environmentally compliant formulations.

Restraints: The market faces significant headwinds from the fluctuating costs of key raw materials, including crude oil derivatives (polyols, isocyanates, epoxy resins) and specialized silicone precursors. This cost instability makes long-term pricing contracts difficult and compresses profit margins, forcing manufacturers to continuously seek cost-efficient synthesis routes or alternative raw material sources. Moreover, the lack of standardized application techniques and the need for skilled labor to ensure optimal performance of high-specification chemical products (especially structural adhesives) in some developing regions present operational restraints, occasionally leading to slower adoption rates compared to traditional mechanical fastening methods.

Opportunities: Major opportunities lie in the adoption of innovative application technologies, such as automated dispensing robots and sophisticated mixing equipment, which ensure precise and rapid application, crucial for large-scale projects. The significant, yet largely untapped, market for repair, renovation, and maintenance (R&M) of existing building stock offers a stable revenue stream, as these projects often require highly specialized, durable, and quick-setting chemical solutions. The ongoing shift toward bio-based feedstocks and the development of truly circular economy products—adhesives and sealants that are easily debonded or recycled at end-of-life—represent a major long-term opportunity for differentiating sustainable product lines and capturing premium market segments focused on environmental, social, and governance (ESG) compliance.

Impact Forces: The combined influence of high infrastructure spending (positive force) and raw material price volatility (negative force) creates a moderate-to-high net impact. The overriding force driving the market is the regulatory pressure for sustainable building materials and energy efficiency, which structurally elevates the demand curve for high-performance chemical systems over traditional methods. However, geopolitical instability affecting global trade and supply chains for base chemicals can quickly undermine growth momentum. The constant pressure from competitive pricing in commodity segments, particularly in APAC, also acts as a dampening force on overall profitability, necessitating continuous process optimization and high-value product specialization to sustain long-term margin stability.

Segmentation Analysis

The Construction Adhesives & Sealants Chemical Market is intricately segmented based on chemical type, technology, application, and end-user, reflecting the diverse performance requirements across the construction sector. Chemical type segmentation is crucial as it determines the product's fundamental properties, such as elasticity, chemical resistance, and bond strength, with polyurethane and silicone dominating the volume due to their versatility in sealing and dynamic bonding. Technology classification highlights the shift toward sustainable solutions, distinguishing between solvent-based systems (declining) and water-borne, hot melt, and reactive chemistry technologies (growing rapidly), driven by regulatory constraints on Volatile Organic Compounds (VOCs).

Application analysis provides deep insight into where demand is strongest, with specific segments including flooring (requiring flexible, strong bonds), walls and panels (structural bonding), and roofing (demanding high weather resistance). The end-user perspective separates demand between residential (high volume, often DIY-friendly products) and non-residential (high-specification, large-scale, professional-grade products), with non-residential construction being the primary revenue generator due to the complexity and scale of commercial and infrastructure projects. Understanding these segments is vital for manufacturers to tailor product development, pricing strategies, and regional distribution efforts, ensuring specialized products meet stringent industry standards.

The market complexity is further emphasized by the varying demands placed by different building codes and climate conditions globally. For example, high-rise construction in seismic zones requires adhesives with exceptional dynamic load bearing and vibration damping capabilities, often fulfilled by specialized epoxy or advanced hybrid formulations. Conversely, regions focusing heavily on prefabricated housing drive demand for fast-curing, robust assembly adhesives that can withstand the stresses of transportation and rapid on-site installation. This granular segmentation allows stakeholders to accurately measure market opportunities within niche segments, such as fire-rated sealants or anti-microbial adhesives used in healthcare facilities.

- By Chemical Type (Adhesives):

- Epoxy

- Polyurethane (PU)

- Acrylic

- Vinyl Acetate Ethylene (VAE)

- Cyanoacrylate

- Others (e.g., Reactive Hot Melt, Polysulfide)

- By Chemical Type (Sealants):

- Silicone

- Polyurethane (PU)

- Polysulfide

- Acrylic

- Butyl

- Others (ee.g., Hybrid Sealants)

- By Technology:

- Water-borne

- Solvent-borne

- Reactive Systems (1K and 2K)

- Hot Melt

- By Application:

- Flooring (Installation, underlayment)

- Roofing (Membrane bonding, leak repair)

- Glazing and Windows (Insulating glass sealing, perimeter sealing)

- Wall and Panel Bonding (Façade, modular construction)

- Civil Engineering (Roads, bridges, tunnels, water structures)

- Others (e.g., HVAC, Interior Finishing)

- By End-User:

- Residential Construction (New and Repair & Maintenance)

- Non-Residential Construction (Commercial, Industrial, Institutional, Infrastructure)

Value Chain Analysis For Construction Adhesives & Sealants Chemical Market

The value chain for construction adhesives and sealants chemical market is highly complex, starting with specialized upstream chemical manufacturers who provide critical basic raw materials such as polymers (siloxanes, polyols, epoxy resins), monomers, and various additives (fillers, plasticizers, catalysts). Upstream consolidation and volatile pricing often pose significant risk, as these raw material costs constitute a substantial portion of the final product price. Key industry players frequently invest in backward integration or establish long-term supply contracts to mitigate this raw material dependency. The manufacturing stage involves complex formulation and mixing processes, where proprietary chemical expertise converts basic materials into high-performance adhesives and sealants tailored for specific construction needs, focusing heavily on R&D for compliant and high-strength products.

The downstream analysis focuses on distribution and end-use application. Finished products are moved through highly diversified distribution channels. Direct sales channels are typically used for large-scale, specialized structural adhesives sold directly to large engineering, procurement, and construction (EPC) firms or major prefabricated component manufacturers, requiring significant technical support and customization. Indirect channels, which handle the majority of volume, involve a network of regional distributors, specialized building material suppliers, and large retail hardware chains, catering to small to mid-sized contractors and the DIY segment. Effective channel management, including warehousing for products with limited shelf life, is paramount for maintaining market penetration and minimizing operational waste.

The distribution network is crucial for market access, especially considering the localized nature of construction projects and the need for rapid delivery. Direct distribution offers greater control over product integrity and provides a platform for technical service, while indirect channels provide the necessary breadth of reach and volume handling capability. The shift toward e-commerce and digital platforms is gradually influencing the distribution of commodity and repair-oriented products, offering new ways for contractors and homeowners to access technical data and procurement options. Ultimately, the successful players optimize their value chain by securing stable raw material sources and developing efficient, multi-tiered distribution systems capable of handling both high-volume, standard products and specialized, technical solutions.

Construction Adhesives & Sealants Chemical Market Potential Customers

The primary customers for construction adhesives and sealants chemicals span the entire spectrum of the building and infrastructure sectors, categorized largely by their scale of operation and their specific technical requirements. Large Engineering, Procurement, and Construction (EPC) companies represent a crucial segment, utilizing high-performance structural adhesives and specialized sealants for massive projects such as high-rise commercial buildings, large bridges, airports, and industrial complexes. These customers demand highly reliable products with extensive certification, coupled with robust technical service and application support, often procuring directly from manufacturers under multi-year contracts based on stringent performance criteria and consistency.

A second major customer group includes specialized trade contractors, such as flooring installers, façade contractors, window and glazing specialists, and roofing companies. These customers rely heavily on indirect distribution channels (specialty distributors) and require a balance of high performance and ease of application. Their buying decisions are often influenced by regional building codes, product curing speed, and compatibility with specific substrates encountered in daily operations. The residential construction sector, including home builders and renovation contractors, forms a high-volume demand base, focusing on general-purpose sealants, tile adhesives, and general bonding agents, where cost-effectiveness and accessibility through retail channels are significant purchasing factors.

Furthermore, component manufacturers represent a growing customer base, especially within the prefabrication and modular construction trends. These customers utilize automated systems to apply high-strength structural adhesives for manufacturing structural insulated panels (SIPs), modular wall assemblies, and prefabricated bathroom units off-site. For this segment, consistency, fast curing times for assembly line speed, and precise dispensing characteristics are non-negotiable requirements. Lastly, governmental and institutional bodies often act as end-users, particularly for public infrastructure maintenance (e.g., sealing joints in roads, runways, and water treatment facilities), focusing their purchasing on specialized chemical systems designed for extreme durability and longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 67.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, H.B. Fuller, Sika AG, Henkel AG & Co. KGaA, Bostik (Arkema Group), Dow Inc., Wacker Chemie AG, BASF SE, RPM International Inc., Mapei S.p.A., Illinois Tool Works Inc. (ITW), Franklin International, The Chemours Company, Dymax Corporation, Huntsman Corporation, KCC Corporation, Momentive Performance Materials Inc., Lord Corporation, Avery Dennison Corporation, Ashland Global Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Adhesives & Sealants Chemical Market Key Technology Landscape

The technological landscape of the Construction Adhesives & Sealants Chemical Market is characterized by a strong push toward sustainable chemistry and enhanced material performance, directly influenced by tightening global environmental standards, specifically concerning Volatile Organic Compound (VOC) emissions. The primary technological advancements center on the development of high-solid, 100% solid, and solvent-free systems, such as advanced water-borne acrylics and silane-modified polymers (SMPs). SMP technology, in particular, offers the robust performance of traditional polyurethane or silicone without the associated hazards, providing excellent adhesion, elasticity, and weatherability, making it a highly desirable solution for high-performance sealing and bonding in sensitive environments like schools and hospitals. The focus is shifting from simple commodity products to high-value, specialized formulations capable of achieving LEED or similar green building certification standards, which increasingly require extremely low-emission materials.

Another pivotal technological area is the advancement in reactive systems, specifically two-component (2K) and moisture-curing one-component (1K) formulations, designed to dramatically reduce curing times. Faster curing is essential for improving productivity and efficiency in large construction and prefabrication processes, minimizing disruption and allowing quicker access to finished surfaces. Examples include rapid-setting polyurethanes and structural epoxies used in concrete repair and modular assembly, which achieve functional strength in minutes rather than hours or days. This focus on speed is balanced by innovations in dispensing equipment and robotic application systems, which require chemical formulations to have precise rheological properties for consistent flow and application accuracy, regardless of ambient temperature variations on the construction site.

The long-term trajectory involves significant investment in bio-based and renewable chemical feedstocks to reduce reliance on petrochemical derivatives, addressing supply chain volatility and enhancing sustainability credentials. Research is ongoing in utilizing plant-based oils, sugar derivatives, and recycled materials to synthesize polymers and components that can serve as direct replacements for conventional polyols and resins without compromising structural performance. Furthermore, specialized functionalities are gaining traction, including fire-retardant additives, anti-microbial properties for sealants in hygiene-critical areas, and smart adhesives with self-healing capabilities or integrated sensors for structural health monitoring. These technological refinements position the market for higher-value contributions to sophisticated, long-life building projects.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, dominated by high-volume construction activities in China, India, and Southeast Asia (Indonesia, Vietnam). Growth is driven by rapid urbanization, massive government investment in infrastructure (roads, rail, ports), and expanding residential housing markets. The market here is price-sensitive but increasingly adopting specialized products due to rising awareness of energy efficiency and the introduction of local green building standards, particularly favoring polyurethane and acrylic chemistries.

- North America: This region is characterized by high demand for performance-driven, sustainable products, heavily influenced by strict VOC regulations (e.g., California’s SCAQMD rules). Growth is strong in the renovation, maintenance, and civil infrastructure sectors. Key drivers include the adoption of structural glazing systems and high-efficiency sealing systems in commercial buildings, favoring advanced silicone and SMP technologies. The market is mature, focusing on innovation and specialized niche applications.

- Europe: Europe is a leader in technological sophistication and regulatory compliance (REACH, national environmental standards). The market is mature, driven by rigorous energy efficiency mandates (e.g., Nearly Zero-Energy Buildings) which necessitate the use of high-performance perimeter sealants and bonding agents for superior thermal envelopes. Western Europe focuses on retrofitting and renovation projects, while Eastern Europe is seeing growth from new commercial and light industrial construction. Water-borne and reactive hot melt systems are preferred due to environmental pressures.

- Latin America: The market shows moderate, yet steady, growth driven by large-scale residential projects and essential infrastructure upgrades, particularly in Brazil and Mexico. Economic volatility remains a challenge, leading to a strong price competition for commodity products. However, international project specifications are gradually increasing the demand for professional-grade epoxy and PU solutions for high-stress applications.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, propelled by mega-projects (e.g., NEOM, Expo-related construction in Dubai/Qatar). The region requires materials capable of withstanding extreme heat, high UV exposure, and sand abrasion, making high-performance silicone and specialized polysulfide sealants essential for structural integrity and weather resistance. African markets show potential, tied directly to national development plans and foreign investment in commercial real estate and mining infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Adhesives & Sealants Chemical Market.- 3M Company

- H.B. Fuller

- Sika AG

- Henkel AG & Co. KGaA

- Bostik (Arkema Group)

- Dow Inc.

- Wacker Chemie AG

- BASF SE

- RPM International Inc.

- Mapei S.p.A.

- Illinois Tool Works Inc. (ITW)

- Franklin International

- The Chemours Company

- Dymax Corporation

- Huntsman Corporation

- KCC Corporation

- Momentive Performance Materials Inc.

- Lord Corporation

- Avery Dennison Corporation

- Ashland Global Holdings Inc.

Frequently Asked Questions

Analyze common user questions about the Construction Adhesives & Sealants Chemical market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards low-VOC adhesives and sealants in the construction sector?

The shift is primarily driven by stringent environmental regulations, particularly in North America and Europe, aimed at limiting Volatile Organic Compound emissions to improve indoor air quality and worker safety. Additionally, the growing global demand for green building certifications (like LEED and BREEAM) mandates the use of low-emission materials, accelerating the adoption of water-borne and solvent-free technologies.

Which chemical type holds the largest market share in the construction adhesives and sealants market?

Polyurethane (PU) and Silicone chemistries collectively hold the largest market share. Polyurethane is favored for its strong bonding strength and versatility in both adhesive and sealant applications, while Silicone dominates high-performance sealant segments due to its superior UV resistance, flexibility, and temperature stability, essential for structural glazing and weatherproofing.

How does the growth of modular construction impact the demand for construction adhesives?

Modular and prefabricated construction significantly increases demand for high-strength, fast-curing structural adhesives, such as specialized epoxies and polyurethanes. These adhesives are critical for rapid, durable assembly of components off-site, requiring formulations that can withstand transport stresses and accelerate production line speeds, replacing traditional mechanical fasteners.

Which region presents the most significant growth opportunities for the construction chemical market?

The Asia Pacific (APAC) region presents the most significant volume growth opportunities. This is due to massive government-led infrastructure investments, rapid urbanization, and a burgeoning residential sector, particularly across emerging economies such as India, China, and key Southeast Asian nations, fueling continuous, large-scale construction activity.

What are the primary restraints affecting the profitability of manufacturers in this market?

The primary restraint is the extreme volatility and rising cost of petrochemical-derived raw materials, including key precursors for polyurethane and epoxy resins. This instability makes managing manufacturing costs challenging and puts consistent pressure on profit margins, necessitating continuous research into alternative, bio-based or synthetic feedstocks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager