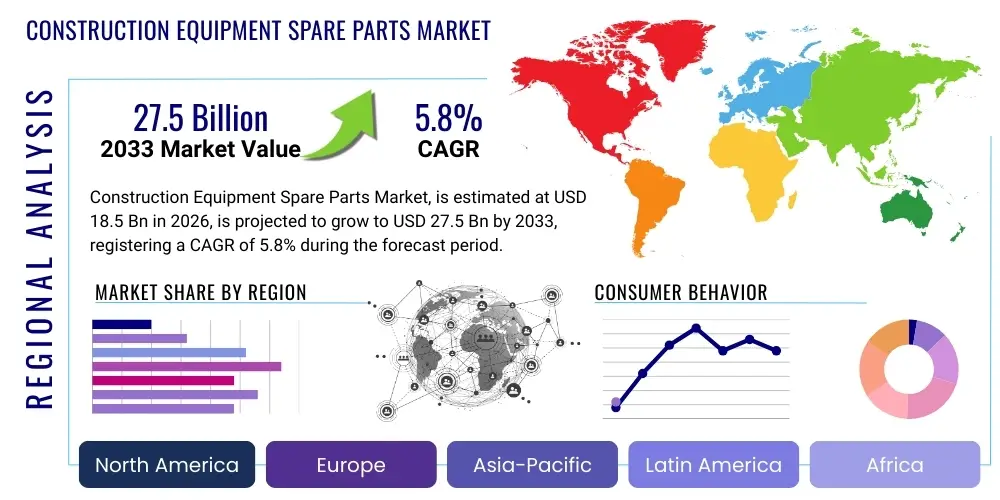

Construction Equipment Spare Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437806 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Construction Equipment Spare Parts Market Size

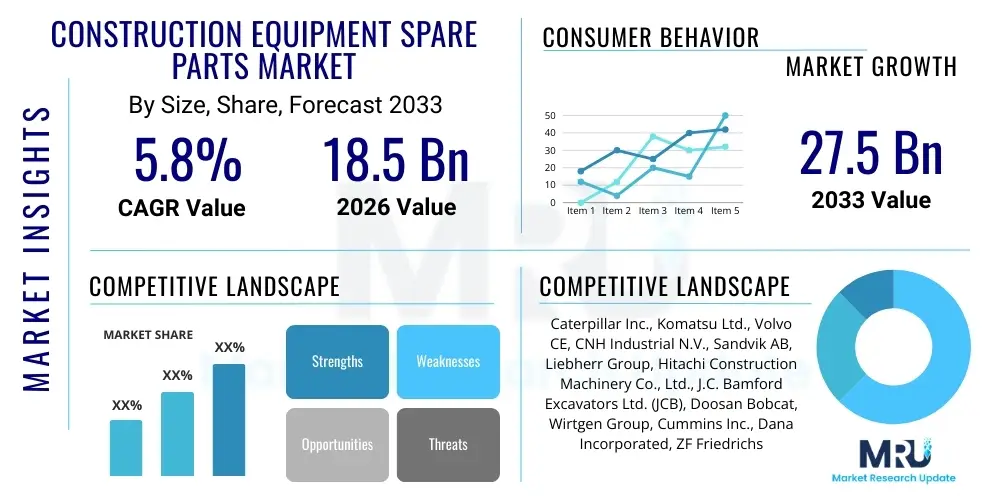

The Construction Equipment Spare Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

This steady expansion is intrinsically linked to global infrastructure spending, particularly in rapidly urbanizing economies across Asia Pacific and specific regions in the Middle East and Africa. The inherent nature of construction equipment—high utilization rates in demanding environments—necessitates frequent replacement of critical components, ensuring a robust and non-cyclical demand flow for spare parts. Furthermore, the increasing average age of existing global equipment fleets contributes significantly to the aftermarket segment, as operators prioritize repair and refurbishment over outright equipment replacement, especially in economically sensitive markets.

Market valuation reflects the integration of complex supply chain dynamics, covering both Original Equipment Manufacturers (OEMs) and independent aftermarket suppliers. Technological advancements, such as predictive maintenance systems utilizing IoT sensors, are beginning to influence replacement cycles, shifting demand from reactive failure replacement to proactive scheduled servicing, which stabilizes revenue streams for spare parts providers. The drive toward sustainability and electrification in construction equipment, while nascent, is also introducing new, specialized component requirements, further diversifying the market landscape and supporting the long-term growth trajectory projected through 2033.

Construction Equipment Spare Parts Market introduction

The Construction Equipment Spare Parts Market encompasses all components, modules, and accessories required for the maintenance, repair, and overhaul (MRO) of heavy-duty machinery utilized in construction, mining, and civil engineering projects. Key products include engine components (filters, pistons, gaskets), hydraulic systems (pumps, valves, cylinders), undercarriage parts (tracks, rollers, idlers), and electrical systems. This market is fundamentally driven by the operational necessity of minimizing equipment downtime, which directly impacts project timelines and profitability. The high operational intensity of machinery like excavators, bulldozers, loaders, and cranes ensures a continuous, high-volume requirement for replacement parts, forming the backbone of the global aftermarket industry supporting the construction sector.

Major applications of these spare parts span across residential and commercial construction, road building, bridge construction, heavy material handling, and large-scale public infrastructure development. The benefits derived from a well-managed spare parts supply chain include extended machinery lifespan, optimized total cost of ownership (TCO) for fleet managers, and enhanced safety compliance through the use of certified components. The quality and availability of spare parts are critical determinants of fleet readiness, especially in remote or challenging operational environments where delays in component delivery can translate into substantial financial losses for construction firms.

Driving factors propelling market growth include massive global investments in infrastructure stimulated by government initiatives (e.g., the US Infrastructure Investment and Jobs Act, China’s Belt and Road Initiative), increasing mechanization of construction processes in developing nations, and the stringent maintenance protocols mandated by safety regulations. The sheer volume of equipment in circulation, coupled with the inevitable wear and tear associated with heavy operational cycles, guarantees sustained demand. Furthermore, the transition toward digitalization in construction, favoring telematics and condition monitoring, is optimizing parts inventory management, further stabilizing the demand cycle for high-failure-rate components.

Construction Equipment Spare Parts Market Executive Summary

The Construction Equipment Spare Parts Market is characterized by robust resilience and consistent expansion, primarily fueled by the sustained global demand for infrastructure development and the operational longevity of existing machinery fleets. Business trends are dominated by the increasing penetration of the independent aftermarket, which offers competitive pricing and rapid component availability, challenging the traditional dominance of OEMs, particularly for standardized parts. Strategic focus among leading component manufacturers is shifting toward advanced material science for enhanced durability, and integrating digital tools like RFID tracking and e-commerce platforms to streamline distribution. OEMs, in response, are leveraging digital twins and specialized warranty programs to lock in high-value parts replacements, particularly for proprietary engine and electronic control units.

Regionally, the Asia Pacific (APAC) market represents the epicenter of growth, driven by unprecedented urbanization rates, substantial government investment in transportation networks, and the high volume of localized construction activity, especially in China, India, and Southeast Asian nations. North America and Europe maintain strong market shares, focusing primarily on high-value, technology-intensive components and driven by strict environmental and safety compliance, which mandates the replacement of older, less efficient parts. Emerging markets in Latin America and MEA are seeing rapid, though volatile, growth, heavily dependent on commodity prices and large-scale resource extraction projects, which require specialized heavy equipment parts subject to severe operating conditions.

Segment trends highlight the critical role of the heavy equipment category (excavators, dozers) in driving parts demand, specifically for undercarriage and hydraulic systems, which experience the highest rates of wear. The segment related to component type sees filtration and fluid management parts as volume leaders, while powertrain components lead in value. There is a discernible trend toward the utilization of certified used parts and remanufactured components, driven by cost-efficiency requirements and growing circular economy mandates. Furthermore, the increasing adoption of rental fleets globally is influencing purchasing patterns, with rental companies demanding highly reliable, standardized parts to ensure maximum asset utilization and minimum repair turnaround times.

AI Impact Analysis on Construction Equipment Spare Parts Market

User inquiries regarding AI's influence in the Construction Equipment Spare Parts Market predominantly center on predictive maintenance capabilities, optimizing inventory levels, and enhancing the efficiency of the spare parts supply chain. Key themes frequently addressed include how AI-driven diagnostics can forecast component failure with greater accuracy, thereby eliminating unnecessary preventative replacements and reducing emergency breakdowns. Users also express keen interest in AI's role in dynamically managing decentralized warehouse stock, matching fluctuating equipment usage patterns across various construction sites to immediate parts availability. Concerns often revolve around the initial investment required for sensor integration and data infrastructure, and the need for specialized training for maintenance personnel to effectively utilize AI-generated insights, signaling a transition from manual, reactive part procurement to a highly automated, proactive logistics framework.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms on telematics data (vibration, temperature, oil pressure) to forecast Remaining Useful Life (RUL) of critical components, shifting demand from reactive to scheduled procurement.

- Optimized Inventory Management: AI algorithms analyze usage history, regional project schedules, and lead times to set dynamic safety stock levels across distribution centers, minimizing capital tied up in slow-moving inventory.

- Automated Diagnostics and Troubleshooting: AI systems process fault codes and operational parameters to quickly pinpoint the exact spare part required, significantly reducing diagnosis time and ensuring the correct part is ordered the first time.

- Supply Chain Resilience: Machine learning models assess global logistics risks (geopolitical events, port congestion) and recommend alternative sourcing or routing for critical spare parts, enhancing supply chain robustness.

- Enhanced Parts Authentication: AI image recognition and blockchain technologies are increasingly used to verify the authenticity of high-value parts, combating the proliferation of counterfeit components in the aftermarket.

- Dynamic Pricing Strategy: Utilizing AI to analyze competitor pricing, demand elasticity, and component lifespan data to set optimal pricing for spare parts, maximizing profitability in both OEM and aftermarket segments.

DRO & Impact Forces Of Construction Equipment Spare Parts Market

The market dynamics are fundamentally shaped by the interplay between infrastructure investment cycles (Drivers), technological complexity and counterfeit concerns (Restraints), and the shift towards service-oriented business models (Opportunities). Global infrastructure spending remains the foremost driver, creating a perpetual demand base for heavy equipment operation and, consequently, necessary spare parts. However, the high capital cost of advanced diagnostic tools and the increasing complexity of machinery components, often proprietary, act as significant restraints, limiting independent aftermarket access and raising overall maintenance expenditure. The opportunity landscape is defined by the digitalization of construction maintenance, allowing spare parts providers to integrate deeper into the operational workflow of construction companies, moving beyond transactional sales to offering comprehensive maintenance contracts and subscription services for component supply.

Key drivers include the global trend of aging infrastructure requiring replacement or refurbishment, which sustains equipment usage, and the widespread adoption of equipment rental models. Rental companies maintain highly rigorous maintenance schedules to maximize asset utilization, leading to predictable and high-volume demand for certified replacement parts. Conversely, one major restraint is the difficulty in standardizing parts across different equipment manufacturers and models, which complicates inventory management for multi-brand repair shops and necessitates significant capital investment in diverse stock holdings. Furthermore, economic volatility in commodity-dependent regions can lead to abrupt cancellations of large infrastructure projects, temporarily suppressing spare parts demand, creating a cyclical risk.

The market is heavily influenced by the impact forces of technological advancement and environmental regulation. Technological forces push component design towards lighter, stronger materials and embedded sensors, making parts replacement more specialized but also potentially extending Mean Time Between Failures (MTBF). Simultaneously, environmental regulations require the phasing out of older, less efficient engines, creating a demand spike for compliant engine components during fleet modernization cycles. The major opportunity lies in expanding the remanufacturing segment, utilizing advanced techniques to refurbish complex components (e.g., transmissions, engines) to nearly new condition, offering cost-effective and sustainable alternatives that appeal strongly to budget-conscious end-users and align with global resource efficiency goals.

Segmentation Analysis

The Construction Equipment Spare Parts Market is meticulously segmented across various parameters, including equipment type, component type, sourcing channel, and application, providing granular insights into demand patterns and value generation across the industry. Equipment segmentation divides the market based on machinery class, such as heavy earthmoving equipment (excavators, loaders), material handling equipment (cranes, forklifts), and road construction machinery (pavers, compactors). Component type segmentation is critical as it reflects actual wear rates, separating highly consumable parts (filters, gaskets) from high-value, long-life parts (engines, transmissions). Understanding these segments is paramount for effective supply chain management and targeted marketing strategies for both OEMs and the aftermarket.

The sourcing channel segment distinguishes between OEM authorized dealers and the independent aftermarket, highlighting the competitive dynamics and pricing power differences between proprietary and generic components. OEM channels typically dominate the supply of warranty-critical and specialized electronic components, emphasizing quality assurance and integration expertise. In contrast, the independent aftermarket thrives on providing cost-effective alternatives, rapid fulfillment, and specialized repair services, particularly for older or general-purpose machinery models. The evolution of B2B e-commerce platforms is significantly blurring these traditional boundaries, allowing independent suppliers to gain better access to end-users directly.

Application-based segmentation provides insight into where the highest operational stress and subsequent part failure rates occur, such as in demanding mining environments versus less intense general building construction. This allows component manufacturers to tailor product specifications—for example, producing heavy-duty, reinforced undercarriage parts specifically for quarrying operations. Overall market growth is increasingly reliant on the hydraulic and undercarriage component segments due to the nature of construction work, which places immense mechanical strain on these systems, ensuring their consistent demand throughout the forecast period.

- Equipment Type:

- Heavy Earthmoving Equipment (Excavators, Loaders, Dozers)

- Material Handling Equipment (Cranes, Telehandlers, Forklifts)

- Road Construction Equipment (Pavers, Rollers, Graders)

- Concrete and Cement Equipment (Mixers, Pumps)

- Component Type:

- Engine Components (Filters, Pistons, Radiators, Turbochargers)

- Hydraulic Components (Pumps, Valves, Cylinders, Hoses)

- Undercarriage Components (Tracks, Rollers, Idlers, Sprockets)

- Powertrain Components (Transmissions, Axles, Drive Shafts)

- Electrical Components (Sensors, Wiring Harnesses, Batteries)

- Structural and Cabin Components (Frames, Glass, Seats)

- Sourcing Channel:

- Original Equipment Manufacturer (OEM) Dealers

- Independent Aftermarket (IAM)

- Application:

- Mining and Quarrying

- Infrastructure (Roads, Bridges, Utilities)

- Residential and Commercial Building Construction

- Others (Oil & Gas, Forestry)

Value Chain Analysis For Construction Equipment Spare Parts Market

The value chain for the Construction Equipment Spare Parts Market is complex and multi-layered, beginning with raw material sourcing and culminating in the final installation by maintenance technicians. The upstream segment involves the procurement of materials such as specialized steel alloys, high-performance polymers, and electronic components, requiring close collaboration between parts manufacturers and raw material suppliers to ensure material integrity and meet stringent performance standards. Manufacturers often specialize, producing highly precise components like engine blocks or advanced hydraulic pumps, while others focus on high-volume consumables. Quality control and certification at this stage are paramount, as component failure can lead to catastrophic equipment damage and significant safety hazards on site.

The midstream process involves manufacturing, assembly, inventory management, and distribution. Distribution channels are bifurcated into two major streams: direct OEM channels and the independent aftermarket network. OEM channels leverage centralized distribution hubs and authorized dealer networks, offering proprietary technology and guaranteed fitment, often serving the newer equipment under warranty. Conversely, the independent aftermarket utilizes a vast, decentralized network of regional distributors, wholesalers, and local repair shops, focusing on speed of delivery and cost competitiveness, particularly vital for older, out-of-warranty equipment. This midstream competition dictates pricing and availability dynamics across different geographic regions.

The downstream segment centers on the final consumption—the end-user, which includes large construction firms, rental fleet operators, and owner-operators. Direct distribution involves OEMs selling parts directly to fleet managers or through dedicated online portals, utilizing advanced logistics. Indirect distribution, predominant in the aftermarket, involves parts flowing through multiple tiers of intermediaries before reaching the independent service garage responsible for the installation. The critical factor in the downstream is the quality of service support, diagnostic expertise, and the speed of parts delivery, as minimizing equipment downtime is the primary metric of success for end-users, compelling the entire chain to prioritize efficiency and inventory depth.

Construction Equipment Spare Parts Market Potential Customers

The primary consumers and buyers in the Construction Equipment Spare Parts Market are diverse, ranging from multi-billion dollar construction conglomerates to small, independent equipment owners and specialized rental companies. Large general contractors (e.g., Bechtel, Vinci) operate massive, globally dispersed fleets and require centralized procurement and sophisticated inventory solutions, often negotiating high-volume contracts directly with OEMs or Tier 1 suppliers to ensure standardized quality and global component availability. These major buyers prioritize total cost of ownership (TCO) and rely heavily on preventative maintenance schedules dictated by equipment telematics and manufacturer guidelines, leading to highly predictable demand for high-wear components.

Equipment rental and leasing companies represent another significant customer segment with distinct purchasing needs. Companies like United Rentals or Ashtead Group manage vast, rotating inventories of diverse machinery and demand exceptional reliability and rapid turnaround times for repairs. Their purchasing strategy leans toward highly durable, standardized, and readily available parts, often sourcing heavily from the independent aftermarket for routine consumables to maintain cost efficiency, while reserving OEM channels for critical, high-technology components that impact warranty. Their operational models necessitate high-quality certified used or remanufactured parts to manage maintenance costs while upholding fleet quality standards.

Finally, independent service providers and small-to-medium enterprise (SME) construction firms form the backbone of the aftermarket consumption base. These customers are highly price-sensitive and value local availability, relying on regional distributors and wholesalers for quick access to necessary parts. Their purchasing decisions are often reactive, driven by component failure, rather than proactive, systematic replacement. The growth of specialized repair shops that focus on specific equipment types (e.g., hydraulic systems repair) also creates dedicated B2B demand for specific component subsets, relying on the efficiency and breadth of the independent spare parts supply chain to serve their clientele effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo CE, CNH Industrial N.V., Sandvik AB, Liebherr Group, Hitachi Construction Machinery Co., Ltd., J.C. Bamford Excavators Ltd. (JCB), Doosan Bobcat, Wirtgen Group, Cummins Inc., Dana Incorporated, ZF Friedrichshafen AG, Eaton Corporation, Parker Hannifin Corporation, Timken Company, ITT Corporation, Aisin Seiki Co., Ltd., Schaeffler AG, Bosch Rexroth AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Equipment Spare Parts Market Key Technology Landscape

The technological evolution within the construction equipment sector is fundamentally transforming the spare parts ecosystem, driven primarily by the proliferation of Internet of Things (IoT) sensors and advanced telematics. These technologies facilitate real-time performance monitoring of critical components, capturing data on usage hours, stress levels, and thermal fluctuations. This continuous data stream is essential for effective Condition-Based Monitoring (CBM) and enables the development of highly accurate predictive maintenance models, thereby optimizing the parts replacement schedule. The integration of advanced sensor technology, particularly in high-stress areas like hydraulic systems and powertrain assemblies, means that spare parts themselves are becoming increasingly ‘smart,’ often containing embedded memory or identification tags for traceability and diagnostics.

Material science innovation represents another core technological advancement shaping the market. Manufacturers are increasingly utilizing advanced composite materials, ceramics, and specialized metal alloys to enhance the durability and reduce the weight of spare parts, particularly in high-wear components such as bucket teeth, cutting edges, and brake components. This focus on durability extends the Mean Time Between Failures (MTBF) and alters the replacement frequency, shifting demand toward higher-priced, longer-lasting components. Furthermore, additive manufacturing (3D printing) is beginning to play a role, particularly for low-volume, highly complex, or obsolete spare parts, offering a cost-effective and rapid localized production capability, fundamentally changing the traditional inventory paradigm for niche components.

Digitalization extends deeply into the supply chain management of spare parts. Technologies such as Blockchain are being explored to enhance transparency, ensure authenticity, and track the provenance of high-value components, combating the persistent issue of counterfeit parts that plague the aftermarket. Simultaneously, the deployment of sophisticated Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS) integrated with AI forecasting tools allows for hyper-efficient inventory management. The key technological shift is the move from physical inventory optimization to data-driven logistics, where the physical delivery of the part is the final step in a highly automated and optimized procurement process, minimizing warehouse holding costs and maximizing delivery speed, crucial for the highly demanding construction industry.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC remains the largest and fastest-growing regional market, fueled by unprecedented infrastructure investment in China, India, and ASEAN nations. This region is characterized by high-volume parts consumption due to the sheer scale of construction activity and a mix of new and aging fleets. Localized manufacturing hubs for both equipment and components significantly drive market competition and aftermarket pricing strategies.

- North America (NA) Maturity: North America is a mature market defined by high technological adoption, strict environmental regulations (mandating engine upgrades/replacements), and a strong emphasis on preventative maintenance fueled by advanced telematics. Demand is concentrated in high-value components, sophisticated diagnostic tools, and the professional rental sector, where certified OEM and high-quality remanufactured parts are highly valued for reliability.

- Europe's Sustainability Focus: The European market is guided by stringent emissions standards and a strong push toward the circular economy. This necessitates specialized spare parts for low-emission engines and promotes a robust market for certified remanufacturing of heavy components (e.g., hydraulic pumps and transmissions). The focus here is on efficiency, certified quality, and traceability through digital supply chains.

- Latin America's Volatility: This region's demand is heavily correlated with commodity price cycles, particularly mining and large-scale resource extraction projects which are major consumers of heavy-duty spare parts (e.g., large dozers and haul trucks). Currency fluctuation and challenging logistics infrastructure often increase the operational cost of importing specialized parts, bolstering local independent repair capabilities.

- Middle East and Africa (MEA) Growth: MEA is witnessing rapid growth spurred by large-scale strategic infrastructure projects (e.g., Saudi Vision 2030). The demand profile is focused on heavy-duty components resilient to extreme climate conditions (heat and dust). Logistical efficiency and guaranteed availability, often achieved through regional distribution agreements with global OEMs, are critical factors in this market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Equipment Spare Parts Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- CNH Industrial N.V.

- J.C. Bamford Excavators Ltd. (JCB)

- Liebherr Group

- Hitachi Construction Machinery Co., Ltd.

- Doosan Bobcat

- Sandvik AB

- Wirtgen Group (John Deere)

- Cummins Inc.

- Dana Incorporated

- ZF Friedrichshafen AG

- Eaton Corporation

- Parker Hannifin Corporation

- Timken Company

- PACCAR Inc.

- Weichai Power Co., Ltd.

- Bosch Rexroth AG

- Schaeffler AG

Frequently Asked Questions

Analyze common user questions about the Construction Equipment Spare Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for construction equipment spare parts?

The primary driver is sustained global government investment in infrastructure development, including roads, bridges, and utilities. This investment ensures high utilization rates and increases the average age of existing heavy equipment fleets, necessitating consistent, high-volume replacement of wear-and-tear components like undercarriage and hydraulic parts to maintain operational uptime.

How does the independent aftermarket compete with Original Equipment Manufacturers (OEMs) in this sector?

The independent aftermarket primarily competes by offering significant cost savings (typically 20-40% lower than OEM pricing), faster delivery logistics for standardized parts, and superior local availability, especially for older or non-critical components. They focus on volume sales and rapid repair turnaround, contrasting with OEM focus on proprietary technology and guaranteed parts authenticity.

Which component segment exhibits the highest growth potential in the spare parts market?

The hydraulic components segment, including pumps, valves, and cylinders, shows high growth potential due to the intensive operational stress these parts endure. Additionally, components associated with engine emission control systems are experiencing rapid growth driven by increasingly strict environmental regulations (e.g., Tier 4/Stage V compliance) necessitating specialized replacement parts.

What role does digitalization, such as AI and IoT, play in the procurement of spare parts?

Digitalization enables predictive maintenance, using IoT sensors and AI to forecast component failure accurately before it occurs. This shifts procurement from reactive, emergency orders to proactive, optimized scheduling, minimizing downtime and allowing construction firms to manage parts inventory efficiently, thereby reducing carrying costs and ensuring just-in-time delivery.

What are the key regional trends shaping the construction equipment spare parts demand?

The key regional trend is the dominance of the Asia Pacific market due to massive urbanization projects and infrastructure build-out, driving high-volume demand. North America and Europe focus on high-value technological parts and remanufacturing, driven by stringent quality standards and a strong emphasis on service-oriented maintenance contracts.

What is remanufacturing, and why is it important in the spare parts value chain?

Remanufacturing is the process of restoring used, failed, or worn components (like engines or transmissions) to original equipment specifications. It is crucial because it offers a cost-effective, high-quality alternative to new parts, reducing waste and aligning with circular economy principles. This segment is highly valued by equipment rental fleets and budget-conscious end-users globally.

How do global economic factors, such as commodity prices, affect the spare parts market?

Commodity prices significantly influence the market, especially in regions dependent on mining (Latin America, MEA). High commodity prices stimulate large-scale extraction projects, dramatically increasing the demand for heavy mining equipment and associated spare parts. Conversely, price downturns can halt projects, leading to abrupt contractions in regional parts demand and increased pressure on aftermarket pricing.

What are the major challenges related to the supply chain for construction spare parts?

Major challenges include supply chain volatility (due to geopolitical events or logistical bottlenecks), the persistent threat of counterfeit parts impacting safety and quality, and the complexity of managing highly diverse inventories across multiple equipment brands and generations, requiring sophisticated global and local distribution networks.

How is the move toward electric construction equipment impacting spare parts demand?

While nascent, the shift to electric equipment is reducing demand for traditional engine consumables (filters, lubricants) but is creating new, specialized demand for electric powertrain components, high-voltage batteries, charging systems, and advanced thermal management parts. This transition requires significant investment in specialized training and inventory management for new component types.

What factors differentiate high-demand spare parts from low-demand parts?

High-demand parts are typically consumables or high-wear items (e.g., filters, undercarriage components, hydraulic hoses) subject to scheduled replacement or frequent failure due to mechanical stress. Low-demand parts include structural elements or electronic control units which fail rarely but command extremely high prices and often must be sourced directly from the OEM due to proprietary technology.

Why is the quality of spare parts crucial for fleet operators?

The quality of spare parts directly influences equipment reliability, safety compliance, and operational efficiency. Substandard parts can lead to catastrophic machine failure, lengthy downtime, and potential warranty voidance. Fleet operators prioritize certified or OEM parts to ensure compliance, maximize asset utilization, and minimize the total long-term maintenance expenditure (TCO).

How is B2B e-commerce changing the procurement landscape for spare parts?

B2B e-commerce platforms enhance transparency in pricing, provide comprehensive parts catalogs with cross-referencing capabilities, and significantly reduce procurement lead times. This digitalization empowers end-users and independent repair shops to source parts more efficiently across multiple suppliers, intensifying competition between OEM dealers and the independent aftermarket.

What are the primary components that drive the largest revenue share in the market?

The largest revenue shares are typically driven by high-value, complex components such as complete powertrain assemblies (transmissions and axles), hydraulic pump systems, and engine rebuild kits. Though less frequent than consumables, the high unit price of these critical systems dictates the overall market value distribution and profitability margins for suppliers.

What influence do government regulations have on the spare parts demand in developed regions?

Government regulations, particularly related to emissions (e.g., requiring specific exhaust aftertreatment components) and safety standards, directly dictate the type and quality of parts required. These regulations often force fleet operators to upgrade or replace legacy components, creating mandatory replacement cycles and ensuring sustained demand for new, compliant spare parts technology.

How do specialized construction projects, like tunneling, affect spare parts requirements?

Specialized projects, such as tunneling or deep-sea construction, require highly customized, ruggedized equipment. This niche usage drives specific demand for specialized spare parts designed for extreme conditions (e.g., high-pressure seals, corrosion-resistant components), leading to higher unit costs and often relying exclusively on bespoke OEM solutions for component supply.

What is the current trend regarding inventory management of spare parts globally?

The current trend is shifting toward decentralized, regional inventory coupled with advanced predictive forecasting. Suppliers are moving away from massive centralized warehouses to smaller, strategically located distribution centers closer to major construction hubs, utilizing AI and demand sensing to achieve optimal just-in-time delivery and reduce storage costs.

Why is component tracking and authentication becoming more important?

Component tracking and authentication are crucial to combat the high incidence of counterfeit parts, which pose safety risks and compromise machine integrity. Technologies like RFID, unique serial numbers, and potential blockchain usage are being deployed to ensure that high-value components sourced are legitimate, maintaining manufacturer warranty and operational reliability.

How does the average lifespan of construction equipment affect spare parts consumption?

As the average lifespan of construction equipment fleets increases globally (often due to improved quality and economic necessity), the total lifecycle demand for spare parts rises. Older machines require more frequent and specialized maintenance, heavily favoring the independent aftermarket and the demand for remanufactured and certified used components beyond the initial warranty period.

What is the significance of the undercarriage component segment for excavators and bulldozers?

The undercarriage segment (tracks, rollers, idlers) is highly significant because it experiences severe friction and abrasion, making it one of the costliest and most frequently replaced categories of wear parts, especially in earthmoving applications. Its continuous replacement cycle ensures a steady, high-volume revenue stream for specialized component manufacturers globally.

How do equipment rental companies influence the pricing structure of spare parts?

Rental companies are high-volume purchasers with strong negotiating power. They influence pricing by prioritizing value (reliability vs. cost) and driving demand for competitive sourcing. Their focus on minimal downtime pressures both OEMs and the aftermarket to maintain highly competitive pricing and guaranteed availability for common failure parts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager