Construction ERP Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436243 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Construction ERP Software Market Size

The Construction ERP Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033.

Construction ERP Software Market introduction

The Construction ERP Software Market encompasses specialized enterprise resource planning solutions designed to integrate and manage core business processes unique to the construction industry. These systems move beyond generic accounting tools to incorporate functionality critical for project-centric operations, including project costing, job site management, asset tracking, complex supply chain logistics, contract management, and regulatory compliance (such as prevailing wage requirements). The fundamental product description involves modular, integrated platforms—increasingly cloud-based (SaaS)—that provide real-time data visibility across the entire project lifecycle, from initial bidding and design to execution and post-completion maintenance. Major applications span residential, commercial, and heavy civil construction sectors, facilitating better resource allocation and risk mitigation.

The primary benefits driving the market's expansion include enhanced operational efficiency, superior financial oversight, and improved collaboration among stakeholders. By consolidating disparate data sources—such as field reports, material requisitions, payroll, and equipment logs—into a single source of truth, construction firms can make faster, data-backed decisions. This integration is crucial for maintaining project schedules, minimizing cost overruns, and ensuring adherence to safety standards. Modern Construction ERP systems often include integrated BIM (Building Information Modeling) capabilities and sophisticated scheduling tools, directly contributing to lean construction practices and improving profitability margins in a highly competitive sector.

Key driving factors fueling market growth are the accelerating adoption of digital transformation initiatives across the global construction industry, which historically lags in digitization. Governments worldwide are investing heavily in infrastructure projects, necessitating robust project management tools capable of handling large-scale, complex contracts. Furthermore, increasing regulatory complexities regarding labor laws, environmental standards, and financial reporting (e.g., IFRS 15 compliance) require advanced ERP solutions that offer built-in compliance features. The shift towards mobile and cloud deployment is also a significant driver, enabling field personnel to access and input critical project data instantaneously, dramatically reducing administrative lag time.

Construction ERP Software Market Executive Summary

The global Construction ERP Software Market is experiencing robust acceleration, fundamentally driven by the need for enhanced project margin control and the transition from fragmented legacy systems to integrated cloud environments. Current business trends indicate a strong preference for subscription-based Software-as-a-Service (SaaS) models over traditional on-premise deployments, owing to lower upfront costs, scalability, and automatic updates. Strategic mergers and acquisitions are shaping the competitive landscape, as established ERP giants look to acquire specialized construction functionality, while niche players focus on deepening their vertical integration, particularly around specific areas like equipment management or service management modules. The incorporation of advanced analytics, predictive modeling for project risk assessment, and prescriptive maintenance scheduling represents a key technological pivot that is influencing purchasing decisions among Tier 1 and Tier 2 contractors.

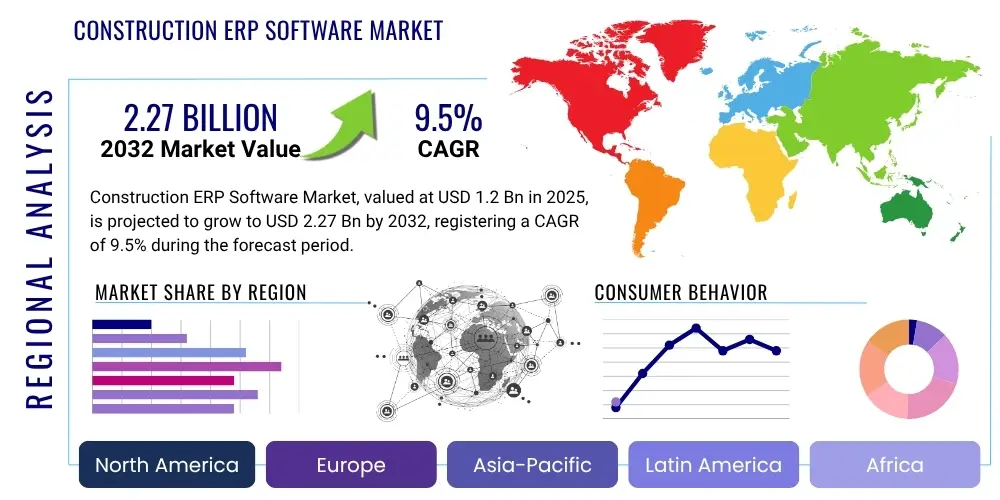

Regionally, North America maintains its dominance due to high technological maturity, extensive investment in private and public infrastructure, and stringent regulatory environments that necessitate formal data tracking. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapid urbanization, large-scale government infrastructure initiatives (like China’s Belt and Road Initiative and India’s burgeoning real estate sector), and increasing awareness among small-to-medium enterprises (SMEs) regarding the efficiency gains derived from digital systems. Europe demonstrates steady growth, characterized by strong demand for solutions supporting lean construction and sustainability compliance, especially within Western European economies focusing on retrofit projects and carbon footprint tracking.

In terms of segmentation, the cloud-deployed segment is overshadowing on-premise solutions across all regions, demonstrating superior flexibility vital for decentralized construction sites. Functionality-wise, the Project Management and Contract Management modules consistently account for the largest revenue share, reflecting the core challenges faced by construction firms in controlling project scope and financial agreements. Furthermore, segmentation by company size reveals that the Large Enterprise segment remains the primary revenue generator due to the complexity and scale of their operations, yet the SME segment is rapidly accelerating its adoption rate, catalyzed by cost-effective SaaS offerings tailored to less complex operational requirements and quicker deployment cycles. This market shift signals a pervasive move towards digitization across the entire industry spectrum.

AI Impact Analysis on Construction ERP Software Market

Common user questions regarding AI's impact on Construction ERP software predominantly revolve around its ability to enhance predictive cost management, automate risk identification, and optimize resource allocation in real-time. Users are keenly interested in whether AI can seamlessly integrate with existing project data (BIM, IoT sensor data, historical performance logs) to provide actionable foresight, thus moving beyond basic reporting to genuine predictive analytics. Key themes include concerns about data quality required to train effective AI models, the ethical implications of automated decision-making regarding labor scheduling, and the expected Return on Investment (ROI) from incorporating machine learning capabilities into core financial and operational modules. The overarching expectation is that AI will transform ERP systems from reactive recording tools into proactive strategic advisors, leading to dramatically reduced project overruns and improved forecasting accuracy.

- AI-driven Predictive Cost Forecasting: Utilizing historical project data and real-time inputs to predict potential cost overruns before they materialize, significantly improving budgetary adherence.

- Automated Risk Identification and Mitigation: Machine learning algorithms analyze contract clauses, procurement schedules, and site conditions to flag high-risk activities or supply chain dependencies automatically.

- Optimized Resource Scheduling: AI engines optimize the deployment of heavy equipment, specialized labor, and materials across multiple simultaneous projects, minimizing idle time and logistical waste.

- Intelligent Document Processing (IDP): Automated extraction and validation of data from unstructured documents (e.g., invoices, subcontracts, compliance forms), streamlining data entry into the ERP system.

- Enhanced Safety Monitoring: Integration of computer vision and AI with site monitoring systems to identify and flag unsafe practices or potential hazards in real time, linking incidents directly back to project safety modules.

- Predictive Maintenance for Assets: Leveraging IoT data from construction machinery to forecast equipment failure, allowing the ERP's asset management module to schedule preventive maintenance proactively.

- BIM and Digital Twin Synergy: AI facilitates the seamless flow of data between the 3D model (BIM) and the ERP, automating updates to cost and schedule based on design changes or site progress captured digitally.

DRO & Impact Forces Of Construction ERP Software Market

The dynamics of the Construction ERP Software Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces influencing market trajectories. A primary driver is the global infrastructure boom, which mandates sophisticated management tools to handle projects of unprecedented complexity and scale. Simultaneously, the pervasive demand for real-time visibility and data-driven decision-making pushes firms away from manual spreadsheets toward integrated ERP platforms. These drivers are amplified by the increasing availability and affordability of cloud computing infrastructure, lowering the entry barrier for SMEs and accelerating SaaS adoption across all company sizes. The critical impact force here is the shift from capital expenditure (CapEx) on IT infrastructure to operational expenditure (OpEx) on cloud subscriptions, democratizing access to powerful enterprise tools.

Conversely, significant restraints hinder growth, notably the high initial implementation costs and the substantial time commitment required for successful organizational change management. Construction firms often face resistance to technological adoption among long-tenured field personnel accustomed to traditional methods. Furthermore, data silos remain a formidable challenge; integrating new ERP systems with existing specialized field management tools (like specialized surveying or fleet telematics) can be technically complex and costly. A critical restraint is the acute shortage of IT talent within the construction sector capable of effectively managing, customizing, and utilizing these advanced ERP systems, leading to underutilization of expensive software features.

Opportunities abound, primarily driven by niche demands for specialized modules such as project lifecycle management integrated with sustainability and ESG (Environmental, Social, and Governance) compliance tracking. The rise of prefabrication and modular construction presents a unique opportunity for ERP vendors to develop solutions tailored for manufacturing processes within a construction context, integrating factory floor management with site installation logistics. Furthermore, the immense potential of AI and IoT integration offers the strongest long-term growth trajectory, enabling predictive scheduling, automated compliance checks, and vastly improved financial management. The ultimate impact forces pushing the market forward are regulatory necessity combined with the overwhelming pressure from global competition to maximize efficiency and secure tight project margins.

Segmentation Analysis

The Construction ERP Software Market is comprehensively segmented based on deployment model, application, organization size, and functionality, providing a granular view of market dynamics and purchasing patterns. The ongoing technological revolution has strongly favored the cloud segment, which offers scalability and accessibility unmatched by traditional on-premise systems, especially given the decentralized nature of construction projects. Segmentation by application reveals that core financial management and project scheduling remain universally critical components, yet advanced segments like equipment and asset management are gaining rapid traction due to the high capital cost associated with construction machinery.

Analyzing the market by organization size highlights distinct needs: large enterprises typically require highly customizable, comprehensive suites capable of handling multi-national projects and complex organizational hierarchies. In contrast, Small and Medium Enterprises (SMEs) prioritize ease of deployment, user-friendliness, and cost-effectiveness, favoring modular SaaS solutions. This segmentation dictates vendor strategies, with major players offering expansive, deep functionalities, while emerging vendors specialize in agile, vertically integrated solutions for smaller firms. Geographical segmentation underscores the diverse maturity levels globally, with North America and Europe demonstrating high penetration rates, while APAC and MEA regions exhibit exponential growth potential.

Understanding these segmentations is critical for vendors crafting targeted marketing and product development strategies. The future trajectory suggests increased convergence of functionality, where ERP systems will not just manage resources but will also serve as central data hubs, seamlessly integrating with specialized software for BIM, field productivity, and supply chain management, blurring the lines between traditional ERP and broader construction technology platforms (ConTech).

- Deployment Model

- On-Premise

- Cloud (SaaS)

- Hybrid

- Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Functionality/Module

- Financial Management and Accounting

- Project Management and Scheduling

- Customer Relationship Management (CRM)

- Human Resources and Payroll

- Supply Chain Management (SCM) and Procurement

- Equipment and Asset Management

- Document and Compliance Management

- Application/End-User Sector

- General Contractors

- Subcontractors (Specialty Trades)

- Engineers and Architects

- Heavy Civil and Infrastructure

- Residential Construction

- Commercial Construction

Value Chain Analysis For Construction ERP Software Market

The value chain for Construction ERP software begins with upstream activities focused on foundational development, encompassing core technology providers (e.g., cloud platforms like AWS or Azure) and specialized data providers (e.g., regulatory compliance databases). This stage involves intensive research and development (R&D) to build robust, scalable, and secure software architecture. Key decisions here involve platform choice, data security protocols, and defining the microservices that form the modular components of the ERP suite. Successful upstream activities are characterized by rapid iteration, security certification, and strategic partnerships with underlying technology vendors to ensure optimal performance and scalability, particularly for demanding applications like real-time IoT data processing.

Midstream activities involve the development, customization, and implementation phases. ERP vendors, along with independent software vendors (ISVs) and system integrators (SIs), tailor the generic ERP framework to specific construction workflows, addressing unique requirements like labor burden calculations, prevailing wage mandates, and multi-currency contract handling. System integrators play a crucial role in adapting the software to the client's existing IT ecosystem, migrating legacy data, and providing extensive training. The distribution channel is often bifurcated: direct sales channels handle large enterprise contracts requiring bespoke customization, while indirect channels (via value-added resellers or VARs, and channel partners) are crucial for reaching the expansive SME market efficiently, providing localized support and domain expertise.

Downstream analysis focuses on deployment, support, and ongoing value realization. This includes post-implementation technical support, continuous software updates (especially crucial in the SaaS model), and professional services aimed at optimizing the client's utilization of the ERP system (e.g., process re-engineering consulting). The longevity and success of the software heavily depend on reliable customer service, robust security maintenance, and the vendor's commitment to releasing functionality updates driven by emerging industry trends such as drone surveying integration and AI-powered scheduling. A strong, responsive downstream ecosystem enhances customer retention and generates critical feedback for future R&D cycles, completing the value chain loop.

Construction ERP Software Market Potential Customers

The primary end-users and buyers of Construction ERP Software span the entirety of the construction and engineering ecosystem, ranging from large, multinational general contractors to highly specialized subcontractors and infrastructure developers. General Contractors (GCs) represent the core customer base, as they require integrated solutions for managing the complex interplay of finances, personnel, contracts, and material flow across massive, concurrent projects. GCs are seeking systems that provide granular cost visibility at the work breakdown structure (WBS) level and robust forecasting capabilities to ensure project profitability and mitigate substantial financial risks inherent in fixed-price contracts.

Subcontractors, particularly those in high-value specialty trades such as mechanical, electrical, and plumbing (MEP), constitute a rapidly growing customer segment. While their operational scope is narrower than GCs, they require dedicated modules for labor tracking, specialized inventory management (e.g., complex pipe or wiring inventory), and stringent compliance reporting related to their specific trade certifications and local mandates. For these buyers, the integration capability with the General Contractor’s system (often required for billing and reporting compliance) is a significant purchasing factor. The demand is shifting towards tailored, functional modules that can operate effectively as standalone systems or seamlessly integrate into larger project ecosystems.

Beyond traditional builders, potential customers include real estate developers and property owners engaged in extensive capital expenditure projects, who utilize ERP systems primarily for portfolio management, budget tracking, and linking construction progress to investor reporting. Furthermore, public sector organizations and government agencies involved in large civil engineering and infrastructure projects are crucial buyers, prioritizing functionality related to public bidding process management, strict regulatory compliance, and transparent financial auditing. These diverse end-users collectively underscore the broad applicability of modern ERP solutions designed to streamline complex, project-based operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, Sage Group plc, Microsoft Dynamics 365, Trimble Inc., Viewpoint (Vista/Spectrum), Procore Technologies, Infor, Jonas Construction Software, ComputerEase, Deltek, CMiC, COINS Global, Acumatica, Epicor Software Corporation, Buildertrend, Penta Technologies, Construction Software Technologies (Maxwell Systems), Explorer Software. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction ERP Software Market Key Technology Landscape

The technological foundation of the Construction ERP Software Market is undergoing a fundamental transformation, shifting towards highly connected, modular, and data-centric architectures. Cloud computing, predominantly Software-as-a-Service (SaaS), is the dominant technological catalyst, enabling vendors to deliver frequent updates, ensure high availability, and support mobile workforce access crucial for construction sites. The underlying technology often leverages microservices architecture, which allows firms to deploy only the modules they require (e.g., job costing or equipment service management) and integrate them seamlessly with other specialized tools via robust Application Programming Interfaces (APIs). This architectural flexibility is critical for surviving the heterogeneous technology environments common in construction, where specialized field applications often run alongside the core ERP.

Integration capabilities represent a central competitive differentiator within the technology landscape. Modern Construction ERP systems are deeply integrating with specialized Building Information Modeling (BIM) software and Digital Twin technologies. This integration allows project managers to link the digital model directly to financial data, procurement schedules, and site progress tracking. Furthermore, the incorporation of Internet of Things (IoT) sensors and Telematics is transforming the Equipment and Asset Management module, providing real-time data on machinery utilization, location, and maintenance needs directly into the ERP database, automating ledger entries and depreciation calculations. This reliance on external data streams necessitates high-performance cloud infrastructure and sophisticated data security protocols to manage sensitive project and financial information.

A significant emerging technology area is the utilization of Artificial Intelligence (AI) and Machine Learning (ML) for advanced analytics and process automation. AI is being embedded into core ERP functions, particularly in areas like invoice processing automation, contract compliance auditing, and most critically, predictive project risk analysis. ML models analyze historical project performance against current variables (weather delays, material price fluctuations) to forecast accurate completion times and potential margin erosion, offering proactive insights rather than retrospective reporting. Furthermore, the adoption of blockchain technology, although nascent, holds future promise for enhancing the transparency and security of supply chain tracking and complex sub-contractor payment processes within the ERP framework.

Regional Highlights

Geographical market analysis reveals divergent maturity levels and growth drivers across major global regions. North America, driven by the United States and Canada, stands as the most mature market, characterized by high investment in enterprise software, advanced regulatory compliance requirements (such as federal contracting standards), and significant adoption rates among large-scale infrastructure and commercial builders. The region benefits from a robust vendor ecosystem, with many key industry players headquartered locally, leading to high-quality integration services and strong investment in vertical-specific R&D, especially focused on mobile field productivity tools and cloud migration strategies.

Europe represents a stable, high-value market segment. Western European nations, particularly Germany, the UK, and the Nordics, lead in adopting ERP solutions that support advanced manufacturing principles (modular construction) and stringent environmental, social, and governance (ESG) standards. The regulatory complexity across the European Union drives demand for highly localized and compliant software solutions. Conversely, the Asia Pacific (APAC) region is the fastest-growing market globally, propelled by massive urbanization, infrastructure projects in China and India, and increasing awareness among emerging construction firms. While implementation is often fragmented, driven by varying local regulations, the sheer volume of construction activity ensures explosive growth potential for scalable, affordable cloud ERP solutions targeted at the burgeoning SME sector.

Latin America and the Middle East & Africa (MEA) represent emerging markets with substantial long-term potential. In the MEA, large-scale governmental development projects (e.g., in the UAE and Saudi Arabia) are fueling demand for sophisticated, integrated project management systems necessary to manage international consortiums and complex megaprojects. However, these regions often face challenges related to political instability, fluctuating commodity prices, and less mature IT infrastructure, necessitating vendors to offer flexible deployment models and robust localization support for language, currency, and financial reporting standards.

- North America: Market leader; characterized by high SaaS adoption, advanced integration with BIM/IoT, and strong regulatory compliance requirements (e.g., DCAA compliance in the US). Focus on maximizing labor productivity and predictive risk management.

- Europe: Stable growth driven by regulatory compliance (GDPR) and demand for systems supporting modular/prefabricated construction and stringent sustainability reporting. Significant uptake in Germany and the UK.

- Asia Pacific (APAC): Highest growth rate due to rapid infrastructure development (China, India, Southeast Asia). Emphasis on mobile-enabled solutions and cost-effective cloud offerings tailored for high volumes of smaller projects.

- Latin America (LATAM): Emerging market focused on financial transparency and basic process standardization; growth is moderate but steady, centered around large industrial and energy projects.

- Middle East & Africa (MEA): High demand fueled by government megaprojects (Vision 2030 initiatives). Prioritizes complex contract and supply chain management for international consortia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction ERP Software Market.- SAP SE

- Oracle Corporation

- Sage Group plc

- Microsoft Dynamics 365

- Trimble Inc.

- Viewpoint (Vista/Spectrum, now part of Trimble)

- Procore Technologies

- Infor

- Jonas Construction Software (Part of Constellation Software)

- ComputerEase (Part of Deltek)

- Deltek

- CMiC

- COINS Global

- Acumatica

- Epicor Software Corporation

- Buildertrend

- Penta Technologies

- e-Builder (A Trimble Company)

- Explorer Software

- Hilti (through software acquisitions)

Frequently Asked Questions

Analyze common user questions about the Construction ERP Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between generic ERP and Construction ERP Software?

Construction ERP software is specifically designed to handle project-centric accounting, which includes complex features like job costing, progress billing (AIA format), retainage tracking, contract management, and integrated equipment fleet management, functionalities absent or simplified in generic ERP systems. It links financial data directly to the Work Breakdown Structure (WBS) of a project.

How is cloud deployment (SaaS) transforming the adoption of Construction ERP?

SaaS deployment lowers the total cost of ownership (TCO) by eliminating large upfront infrastructure investments, thereby making robust ERP solutions accessible to Small and Medium Enterprises (SMEs). It also facilitates real-time data access for field employees via mobile devices, critical for decentralized construction sites, and ensures continuous, automatic software updates.

What are the most critical modules sought after by general contractors today?

The most critical modules include integrated Project Financial Management (job costing, change order management), robust Document Control (linking project documents to contracts), and Equipment & Asset Management, which optimizes the utilization and maintenance scheduling of high-value construction machinery.

How does AI impact predictive project risk management in ERP systems?

AI integrates historical performance data, real-time site inputs (IoT), and external factors (supply chain volatility) to create predictive models. This allows the ERP system to flag potential budget overruns or schedule delays automatically, enabling project managers to implement proactive mitigation strategies before issues escalate.

What role does BIM play in modern Construction ERP integration?

BIM integration allows the digital model (the design) to link directly with the project’s financial data within the ERP. This synergy enables automated quantity take-offs, verifies material orders against the model, and provides a visual, cost-coded representation of progress, enhancing accuracy in budget tracking and procurement planning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager