Construction Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434493 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Construction Insurance Market Size

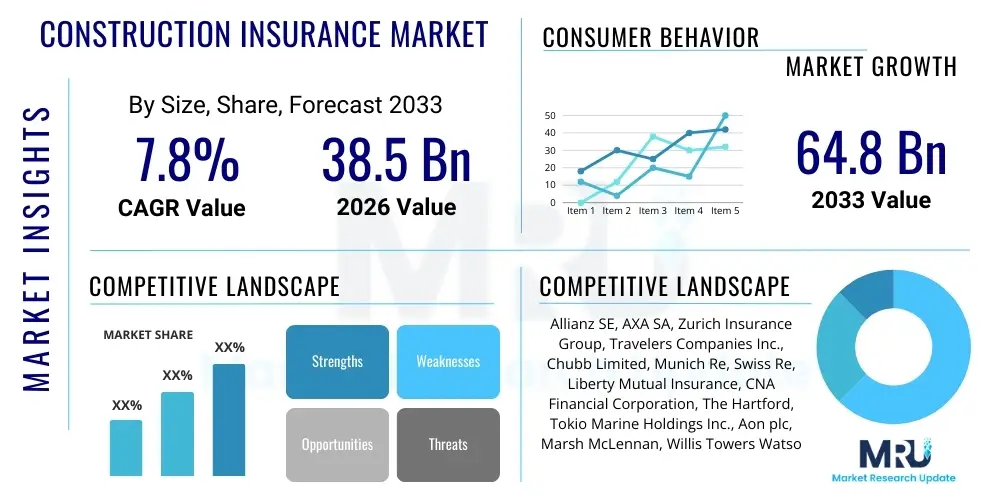

The Construction Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $64.8 Billion by the end of the forecast period in 2033.

Construction Insurance Market introduction

The Construction Insurance Market encompasses a specialized range of risk management products designed to protect stakeholders involved in building, infrastructure, and heavy civil projects from financial losses arising from physical damage, third-party liability, and professional negligence. This market is intrinsically linked to global capital expenditure in infrastructure and real estate development, providing essential coverage such as Builders Risk (CAR/EAR), Professional Indemnity (PI), and General Liability. As construction projects become larger, more complex, and technologically advanced, the demand for sophisticated insurance solutions that address emerging risks like cyber threats, environmental liabilities, and supply chain disruptions continues to drive market expansion. The core function of construction insurance is to transfer the substantial risks inherent in the project lifecycle, ensuring financial stability for contractors, developers, and financiers against unforeseen events ranging from natural disasters to on-site accidents.

Product offerings within this domain are highly customized, reflecting the unique exposures associated with different project types—from residential housing and commercial high-rises to specialized engineering works like tunnels, bridges, and power plants. Key benefits of robust construction insurance include ensuring project continuity, satisfying regulatory and contractual obligations (often mandated by lending institutions), and protecting the balance sheets of construction firms against catastrophic losses. The ability of insurers to offer comprehensive, integrated packages that combine physical asset protection with liability coverages is critical for market competitiveness. Moreover, the increasing adoption of modular construction and sustainable building practices introduces new risk profiles, compelling insurers to innovate and adapt their underwriting models to these evolving methodologies.

Driving factors for sustained market growth are multifaceted, primarily stemming from rapid global urbanization, significant government investment in infrastructure renewal (particularly in North America and Asia Pacific), and the necessity for robust protection against escalating material and labor costs. Furthermore, regulatory environments in developed economies are increasingly stringent regarding safety and environmental compliance, pushing construction firms to secure adequate liability coverage. The integration of advanced technologies like Building Information Modeling (BIM) and drones, while enhancing efficiency, also requires specialized insurance provisions to cover data integrity and technology failure risks, thereby stimulating product innovation within the construction insurance sector.

Construction Insurance Market Executive Summary

The Construction Insurance Market is characterized by robust growth, driven primarily by strong global infrastructure spending, urbanization trends in emerging economies, and the increasing complexity of large-scale engineering projects. Business trends indicate a significant shift towards technology-enabled underwriting, utilizing satellite imagery, AI-driven risk modeling, and telematics to improve loss prevention and claims handling efficiency. Insurers are actively transitioning from traditional indemnity products to more sophisticated offerings like parametric insurance, which provides faster payouts triggered by predefined catastrophic events, addressing the industry's need for swift financial recovery and reduced project downtime. Consolidation among major carriers and the emergence of specialized InsurTech providers focused solely on construction risk are reshaping the competitive landscape, pushing margins through enhanced data analytics capabilities and highly customized policy creation.

Regionally, Asia Pacific is projected to demonstrate the fastest growth rate, fueled by massive infrastructure deficits, particularly in countries like China, India, and Southeast Asian nations, alongside expansive real estate development. North America and Europe, while mature markets, are experiencing growth through the renewal of aging infrastructure, the shift toward green building standards, and the adoption of intricate risk transfer mechanisms like large-scale captive insurance programs and specialized project-specific policies. Political stability and regulatory frameworks favoring Public-Private Partnerships (PPPs) in infrastructure financing also significantly bolster insurance demand across these geographies, as lenders require comprehensive risk mitigation strategies spanning the full project lifecycle.

In terms of segmentation, the most dominant trend is the increased adoption of Contractors All Risks (CAR) and Engineering All Risks (EAR) policies due to mandatory requirements for large projects. Furthermore, the Professional Indemnity (PI) segment is experiencing accelerated growth, largely attributable to the proliferation of design-build contracts and the rising legal scrutiny placed on architects, engineers, and project managers regarding design flaws and scheduling delays. Technology integration, particularly in managing risk related to modular and offsite construction methods, is emerging as a critical sub-segment, requiring insurers to develop specific coverages for transit, storage, and installation risks inherent in these modern construction techniques, influencing how policies are structured and priced globally.

AI Impact Analysis on Construction Insurance Market

Common user inquiries regarding AI in the Construction Insurance Market center on how artificial intelligence and machine learning are fundamentally changing risk assessment, pricing models, and claims processing. Users frequently ask about AI's capability to predict project failures, mitigate inherent site risks, and automate complex regulatory compliance checks. The key themes summarized across these inquiries reveal strong expectations regarding efficiency gains—specifically, faster underwriting decisions and reduced administrative overhead—but also significant concerns about data privacy, model transparency (the 'black box' problem in AI pricing), and the potential for increased liability if AI models fail to accurately assess complex, unique construction projects. Users are seeking validation on whether AI-driven analytics can truly quantify dynamic risks like supply chain volatility and climate change impacts more effectively than traditional actuarial methods, aiming for policies that are both fairer and more reflective of real-time project conditions.

The integration of AI tools, coupled with geospatial data and IoT sensor feeds from construction sites, is allowing insurers to shift from reactive claims handling to proactive risk management. Machine learning algorithms analyze vast datasets, including historical claims, weather patterns, geological surveys, and contractor performance metrics, to generate highly accurate predictive risk scores for specific projects, influencing premium calculations and coverage limits. This allows insurers to offer dynamic pricing adjustments based on real-time safety metrics observed on site, fostering better risk behaviors among policyholders. Furthermore, AI-powered natural language processing (NLP) is dramatically accelerating the policy drafting and review process, ensuring contracts are consistent, compliant, and tailored quickly to the client's needs, reducing human error and time-to-market for specialized policies.

However, the successful deployment of AI relies heavily on the quality and volume of proprietary data related to construction losses, which remains a challenge due to fragmented industry data collection practices. Insurers investing heavily in AI are focusing on building platforms that standardize data inputs from various stakeholders, including safety managers, project financiers, and regulators. The long-term expectation is that AI will democratize sophisticated risk modeling, making it accessible even for small to mid-sized construction firms, leading to highly personalized risk control recommendations and potentially lowering overall loss ratios across the industry. This technological evolution mandates that construction companies and insurers collaboratively redefine standards for data sharing and transparency to maximize the preventative benefits offered by AI systems.

- AI-Powered Predictive Risk Modeling: Utilizing machine learning on historical claims, BIM data, and environmental factors to forecast potential losses and accurately price risks.

- Automated Claims Processing: NLP and computer vision rapidly analyze incident reports, photographs, and contracts to speed up claims verification and payout decisions, enhancing customer satisfaction.

- Real-Time Risk Mitigation: Integrating IoT sensor data from sites (e.g., structural stress, machinery telemetry) with AI to provide instant alerts regarding unsafe conditions or impending equipment failure, reducing preventable claims.

- Enhanced Underwriting Efficiency: Algorithms analyze complex contract documents and regulatory requirements faster than human underwriters, streamlining policy generation and compliance checks.

- Dynamic Pricing Models: Premium adjustments based on continuous monitoring of safety performance and adherence to risk control protocols, rewarding proactive risk management.

- Fraud Detection Improvement: Machine learning identifies unusual patterns or anomalies in claims submissions that suggest fraudulent activity, improving loss control.

- Supply Chain Risk Visualization: AI maps supplier networks and assesses geopolitical or environmental risks, allowing insurers to anticipate delays and offer specific coverage extensions for supply chain interruptions.

DRO & Impact Forces Of Construction Insurance Market

The trajectory of the Construction Insurance Market is significantly shaped by a confluence of accelerating drivers, persistent restraints, and transformative opportunities. Key drivers include aggressive global governmental spending on infrastructure renewal and expansion, particularly for sustainable and smart city projects, which mandates comprehensive insurance coverage as a prerequisite for financing and project commencement. Furthermore, the increasing complexity and scale of modern engineering feats, such as mega-bridges, high-speed rail networks, and offshore wind farms, inherently escalate the financial stakes and require higher limits and more specialized insurance products. The mandatory need for protection against escalating material and labor costs, which inflates total project values, also pushes up the demand and pricing for adequate coverage across the board. These drivers create an environment where risk transfer is not optional but foundational to project viability, ensuring consistent demand irrespective of short-term economic fluctuations in other sectors.

However, the market faces significant restraints that temper growth potential. A major restraint is the difficulty in accurately pricing and assessing risks related to climate change events, which are becoming more frequent and severe, leading to increased volatility in loss ratios, particularly in coastal or flood-prone regions. Furthermore, the persistent global shortage of skilled construction labor and experienced project managers contributes to poor execution, increased accidents, and project delays, leading to higher claims frequency. Insurers also struggle with the challenge of data fragmentation within the construction industry, where poor data quality and lack of standardization impede the full deployment of advanced analytical tools, maintaining reliance on traditional, sometimes less efficient, underwriting practices. Regulatory hurdles and inconsistencies across different national markets also add complexity and cost to offering global or multinational project insurance solutions.

Opportunities for expansion are primarily concentrated in technology adoption, particularly the development of parametric insurance solutions that promise swift claims settlements following catastrophic events, significantly enhancing client satisfaction and project continuity. Insurers have a substantial opportunity to integrate directly with Building Information Modeling (BIM) platforms and Internet of Things (IoT) data streams to offer proactive, preventative risk consulting services rather than just reactive compensation. Geographically, emerging markets in Southeast Asia and Latin America present vast untapped potential as their infrastructure development accelerates. The growing emphasis on environmental, social, and governance (ESG) standards offers a unique avenue for insurers to develop specialized 'Green Construction' policies that incentivize sustainable practices and cover specific liabilities related to achieving environmental certifications, positioning the insurance sector as a key enabler of sustainable development goals within the construction sector.

Segmentation Analysis

The Construction Insurance Market is comprehensively segmented based on the type of coverage, project type, and end-user, reflecting the diverse risk profiles inherent in global construction activities. Segmentation by coverage type—such as Contractors All Risks (CAR), Engineering All Risks (EAR), Professional Indemnity (PI), and General Liability—is crucial because different policies address distinct stages and aspects of a project, from physical material damage during construction to liability arising from professional advice or third-party injuries post-completion. The complexity of modern projects often necessitates a blend of these coverage types, packaged either as Project-Specific Policies or Annual Policies, driving varied demand across the industry landscape.

Segmentation by project type is equally critical, dividing the market into segments such as Commercial (e.g., offices, retail), Residential, Industrial (e.g., manufacturing plants, energy facilities), and Infrastructure (e.g., roads, ports, utilities). Infrastructure projects, often government-funded and capital-intensive, typically require high-limit, long-duration coverage like EAR policies, whereas residential and commercial sectors drive demand for standard CAR policies. The varying levels of risk associated with, for example, a high-rise tower versus a pipeline installation, necessitate specialized underwriting expertise and policy language tailored to the unique technical and operational exposures of each sector, ensuring accurate risk transfer.

End-user segmentation differentiates between large general contractors, specialized sub-contractors, property owners/developers, and financial institutions, as each group has distinct insurance needs and contractual obligations. Developers, for instance, often purchase coverage to protect their investment, while contractors require protection against legal liabilities and damage to their equipment and ongoing works. The shift towards integrated project delivery methods, where multiple parties share risk and responsibility, is further blurring these lines and increasing the complexity of policy structures, necessitating innovative products like integrated project insurance (IPI) that cover the entire project team under a single policy, streamlining claims and reducing litigation.

- By Coverage Type:

- Contractors All Risks (CAR) Insurance

- Engineering All Risks (EAR) Insurance

- Professional Indemnity (PI) Insurance

- Public Liability Insurance

- Workers' Compensation Insurance

- Equipment and Machinery Breakdown Insurance

- By Project Type:

- Commercial Construction (Office, Retail, Hospitality)

- Residential Construction (Housing, Apartments)

- Industrial Construction (Manufacturing, Logistics, Energy)

- Infrastructure and Heavy Civil Construction (Roads, Bridges, Utilities, Tunnels)

- By Policy Type:

- Project-Specific Policies

- Annual/Rolling Policies

- By End-User:

- General Contractors

- Developers/Owners

- Subcontractors

- Engineers and Architects

Value Chain Analysis For Construction Insurance Market

The value chain for the Construction Insurance Market begins with upstream activities dominated by data providers, risk modeling firms, and reinsurance companies. Reinsurers play a crucial role by providing the necessary capacity for insurers to underwrite mega-projects that require extremely high coverage limits, effectively spreading catastrophic risk across the global financial system. Data providers, utilizing satellite imagery, geographical information systems (GIS), and predictive analytics, supply critical information used by underwriters to assess site-specific hazards like seismic risk, flood exposure, and political volatility. The relationship between primary insurers and reinsurers is pivotal; innovations in reinsurance capital management, such as the use of Insurance-Linked Securities (ILS), directly influence the affordability and availability of coverage for complex construction risks worldwide.

The core of the value chain is the insurance carrier itself, which aggregates capital, develops proprietary underwriting models, prices risk, and manages claims. Downstream activities involve the distribution of these policies, primarily through specialized insurance brokers and independent agents who act as intermediaries, providing expert advice to clients (developers and contractors) on complex policy structures, endorsements, and contractual requirements. These intermediaries are vital because construction insurance is highly technical and often project-specific, requiring deep industry knowledge to match the client's risk profile with appropriate coverage. Specialized construction insurance brokers often work closely with legal counsel and project financiers, translating technical risks into insurable terms and managing the entire policy procurement and renewal process.

Distribution channels for construction insurance are predominantly indirect, relying heavily on professional brokers and agents due to the bespoke nature and high value of the policies. Direct channels, while increasing for standardized, lower-risk segments (e.g., small general liability policies for local contractors), remain less prevalent for large Project-Specific policies. The modern distribution landscape is increasingly influenced by digital platforms and InsurTech solutions that aim to streamline the quotation and binding process, especially for small to mid-market contractors. However, for significant infrastructure projects, the relationship-based advice and deep negotiation skills of experienced brokers remain indispensable for structuring complex, multi-layered insurance programs that often involve co-insurance and international syndication, ensuring that the full spectrum of project risk is adequately transferred and mitigated according to the precise legal requirements of the contract.

Construction Insurance Market Potential Customers

The primary consumers, or potential customers, of construction insurance span the entire ecosystem of capital projects, starting fundamentally with the Project Owners and Developers. These entities, whether private real estate firms, public utility companies, or government agencies, bear the ultimate financial risk of the investment and are contractually mandated by lenders and stakeholders to ensure the project assets are protected from initial groundbreaking through final handover. Developers seek comprehensive coverage packages (such as CAR and EAR) to safeguard their capital expenditure against physical loss or damage, and delay-in-start-up (DSU) insurance to protect future revenue streams tied to the project’s completion timeline. Their purchasing decisions are heavily influenced by lender requirements and the need for maximum financial predictability regarding unforeseen events.

The second major customer group comprises General Contractors (GCs) and specialized Subcontractors. GCs require robust general liability policies to cover third-party bodily injury and property damage, as well as specialized coverage for their equipment (Contractors' Plant and Machinery – CPM). Subcontractors, responsible for specific trades like electrical, plumbing, or structural work, often need to provide proof of insurance to the GC, ensuring their work is covered and that they meet the contractual indemnification requirements. For these operational customers, policy choice is driven by immediate contractual compliance, the need to protect their balance sheets from operational accidents, and the imperative to minimize downtime caused by equipment failure or site incidents.

A rapidly growing segment of potential customers includes Professional Service Providers such as architectural firms, engineering consultancies, and project management offices (PMOs). As design responsibility becomes more integrated into construction contracts (e.g., design-build models), the demand for Professional Indemnity (PI) insurance rises dramatically. These customers seek protection against financial losses resulting from errors or omissions in their professional services, which could lead to structural failure, cost overruns, or environmental liabilities. Additionally, financial institutions (banks, private equity firms) involved in financing large construction projects act as indirect customers, mandating specific insurance levels and often being named as loss payees on policies, ensuring the collateral is protected throughout the entire project duration, thereby securing their investment against physical and professional risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $64.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz SE, AXA SA, Zurich Insurance Group, Travelers Companies Inc., Chubb Limited, Munich Re, Swiss Re, Liberty Mutual Insurance, CNA Financial Corporation, The Hartford, Tokio Marine Holdings Inc., Aon plc, Marsh McLennan, Willis Towers Watson, Beazley Group, QBE Insurance Group, RSA Insurance Group, Sompo Holdings Inc., Berkshire Hathaway Specialty Insurance, Markel Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Insurance Market Key Technology Landscape

The technological landscape of the Construction Insurance Market is rapidly evolving, driven by the need for enhanced risk prediction, loss prevention, and operational efficiency. Central to this transformation is the utilization of sophisticated data capture and analysis tools. Key technologies include the Internet of Things (IoT), where embedded sensors on construction equipment and site environments continuously monitor parameters such as temperature, humidity, structural stress, and worker movements. This real-time data stream provides insurers with unprecedented visibility into the dynamic risks of an ongoing project, allowing for immediate intervention and pre-loss warnings, fundamentally shifting the insurer's role from payer to risk partner. Furthermore, the integration of telematics in construction fleet management provides detailed operational data crucial for underwriting equipment insurance and assessing maintenance risks, optimizing policy performance and claims assessment.

Building Information Modeling (BIM) and digital twin technology represent another critical technological pillar. BIM models, which serve as comprehensive digital representations of the physical and functional characteristics of a facility, are now being leveraged by insurers to conduct precise risk simulations before and during construction. By analyzing the BIM model, underwriters can identify potential structural flaws, material exposure risks, and logistical hazards well in advance, leading to highly tailored loss control recommendations and premium adjustments based on demonstrated design quality. Digital twins, which incorporate real-time IoT data onto the BIM model, further allow for continuous risk assessment, particularly valuable for long-duration infrastructure projects where environmental and operational conditions constantly change. This integration enhances the accuracy of project valuations and insurable values throughout the project lifecycle.

Beyond on-site data capture, the industry is increasingly reliant on geospatial intelligence and advanced analytics. High-resolution satellite and drone imagery provide frequent, standardized monitoring of construction progress, site logistics, and potential exposure to natural perils such as wildfires or floods, significantly improving catastrophe modeling accuracy. This technology reduces the reliance on manual site inspections, increasing efficiency, especially across large, remote projects. Coupled with AI and machine learning algorithms that process this vast inflow of structured and unstructured data, insurers can achieve superior segmentation of risk, detect fraudulent claims patterns earlier, and develop specialized parametric insurance products triggered automatically by defined external data points (e.g., wind speed thresholds or confirmed earthquake intensity), ensuring transparency and speed in the resolution of catastrophe-related claims, which is a major enhancement to the traditional construction claims experience.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Potential: APAC is anticipated to be the fastest-growing region, driven by explosive population growth, massive urbanization, and extensive government initiatives focused on modernizing infrastructure (e.g., China’s Belt and Road Initiative, India’s National Infrastructure Pipeline). The insurance market here is characterized by high demand for Engineering All Risks (EAR) coverage for large civil projects, coupled with a rapid uptake of specialized insurance for residential high-rises and integrated smart city developments. The regulatory environment in major economies like India and Indonesia is evolving, increasingly mandating higher liability and workmen's compensation standards, ensuring sustained market expansion.

- North America's Maturity and Technological Integration: North America remains a highly mature and significant revenue generator, characterized by high policy limits and a sophisticated understanding of complex risk transfer mechanisms, including captive insurance and multi-layered programs. Growth is primarily fueled by the renewal and repair of aging public infrastructure, driven by federal spending acts, and a strong commercial real estate sector adopting advanced construction methods like mass timber and modular building. The region is leading in the adoption of InsurTech and AI for underwriting and loss prevention, particularly utilizing drone technology and telematics to improve job site safety and reduce workers' compensation claims volatility.

- Europe's Focus on Sustainability and Regulation: European markets are shaped by stringent regulatory standards, especially concerning environmental liability and worker safety, driving high demand for Public Liability and Professional Indemnity insurance. A key regional driver is the massive capital allocation towards green infrastructure and renewable energy projects (wind farms, solar installations), which requires highly specialized EAR and operational insurance coverage tailored to renewable energy risks. The focus on Environmental, Social, and Governance (ESG) criteria mandates that insurers develop policies that support sustainable construction practices and cover related certifications and liabilities, particularly in Western European nations like Germany and the UK.

- Latin America's Infrastructure Catch-Up: Latin America is a burgeoning market where infrastructure development is crucial for economic stability. Political and economic volatility, however, creates higher perceived risk, resulting in complex and expensive insurance solutions. Key opportunities lie in energy and mining infrastructure projects, requiring bespoke coverage packages often placed through international syndicates due to capacity constraints in local markets. Regulatory improvements and economic stabilization efforts in countries like Brazil and Mexico are essential for unlocking sustained construction insurance growth and attracting higher levels of foreign investment.

- Middle East and Africa (MEA) Mega-Projects: The MEA region is characterized by unprecedented mega-projects, particularly in the Gulf Cooperation Council (GCC) states (e.g., NEOM in Saudi Arabia), driving immense demand for Project-Specific All Risks policies with exceptionally high limits. These projects involve extreme environmental conditions and complex logistics, requiring sophisticated reinsurance support. Africa, meanwhile, presents potential growth opportunities driven by Chinese investment in infrastructure, though political risk insurance remains a critical factor influencing overall underwriting appetite and capacity availability in sub-Saharan nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Insurance Market.- Allianz SE

- AXA SA

- Zurich Insurance Group

- Travelers Companies Inc.

- Chubb Limited

- Munich Re

- Swiss Re

- Liberty Mutual Insurance

- CNA Financial Corporation

- The Hartford

- Tokio Marine Holdings Inc.

- Aon plc

- Marsh McLennan

- Willis Towers Watson

- Beazley Group

- QBE Insurance Group

- RSA Insurance Group

- Sompo Holdings Inc.

- Berkshire Hathaway Specialty Insurance

- Markel Corporation

Frequently Asked Questions

Analyze common user questions about the Construction Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor driving current growth in the Construction Insurance Market?

The most critical factor driving current growth is the unprecedented global investment in infrastructure and heavy civil engineering projects, fueled by government stimuli and urbanization demands, which mandates comprehensive and high-limit Contractors All Risks (CAR) and Engineering All Risks (EAR) coverage as a prerequisite for project financing and regulatory compliance.

How is climate change impacting the risk assessment and pricing of construction insurance?

Climate change increases the frequency and severity of natural catastrophes (floods, hurricanes, extreme heat), leading to greater claims volatility. Insurers are integrating advanced climate modeling and geospatial data analysis into their underwriting processes to accurately price these escalating perils, potentially leading to higher premiums in high-risk zones and the increased use of parametric triggers.

What is Professional Indemnity (PI) insurance and why is its demand rising in construction?

Professional Indemnity (PI) insurance protects architects, engineers, and project managers against claims arising from financial losses caused by errors, omissions, or negligence in their professional advice or design work. Demand is rising due to the shift towards integrated project delivery models (like design-build) and increasing legal scrutiny and litigation related to complex structural failures or costly project delays caused by design flaws.

How are InsurTech solutions transforming the way construction risks are managed?

InsurTech is transforming risk management by utilizing IoT sensors, drones, and AI/ML algorithms to provide real-time project monitoring and predictive risk scoring. This allows insurers to offer proactive loss control services, automate claims processing, and implement dynamic pricing models that reward contractors for demonstrably superior safety and operational performance on site.

What is the difference between Project-Specific Policies and Annual Policies in construction insurance?

Project-Specific Policies are tailored to a single, usually large or unique, construction project, covering its entire duration until completion, often encompassing high-limit CAR/EAR and liability coverage. Annual Policies cover all projects undertaken by a specific contractor within a one-year period, typically favored by general contractors with a high volume of smaller or medium-sized projects, providing continuous, simplified coverage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager