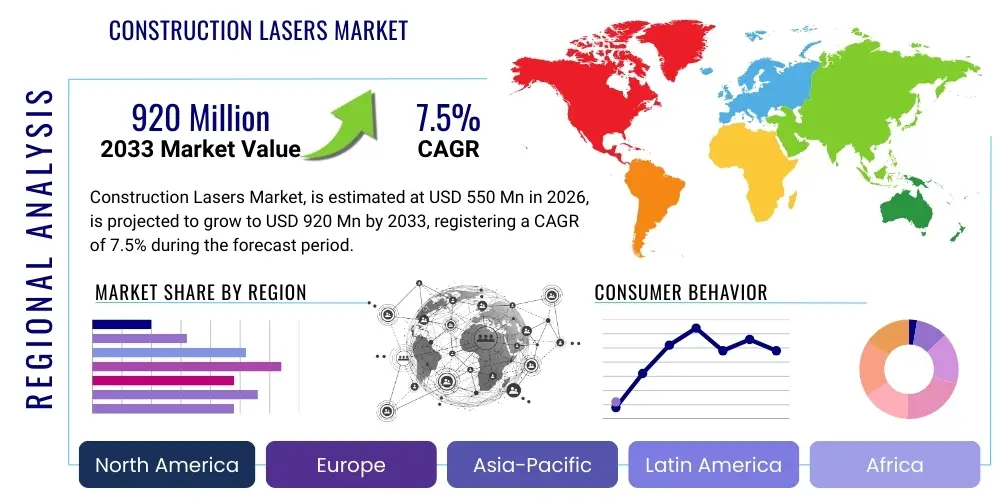

Construction Lasers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437248 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Construction Lasers Market Size

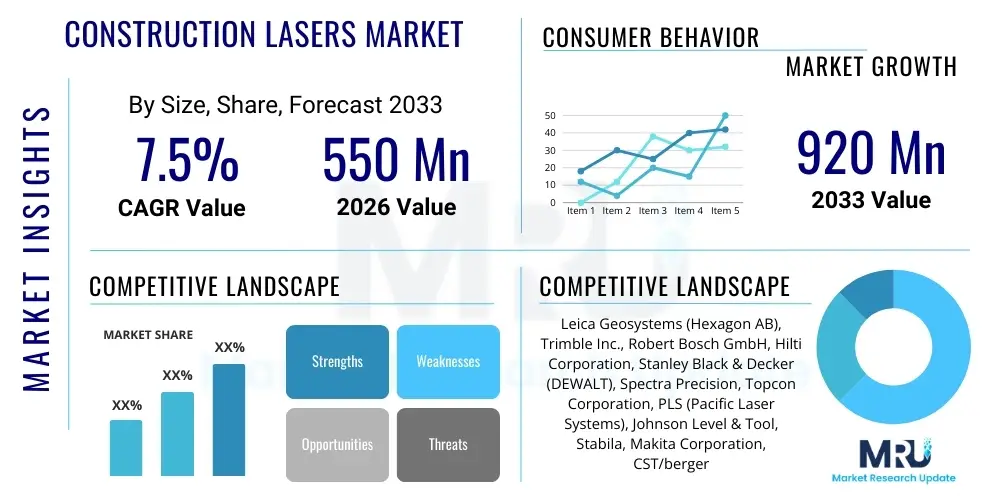

The Construction Lasers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 920 Million by the end of the forecast period in 2033.

Construction Lasers Market introduction

The Construction Lasers Market encompasses precision measuring and leveling instruments utilized across various construction and surveying applications. These devices, which include rotary lasers, line lasers, dot lasers, and pipe lasers, are fundamental tools for ensuring accuracy in grading, excavation, interior fitting, and foundation alignment. The integration of advanced optics and digital readout capabilities has significantly improved efficiency compared to traditional manual methods, driving widespread adoption in residential, commercial, and infrastructure projects globally. Construction lasers are crucial for minimizing errors, reducing material waste, and accelerating project timelines, thus directly impacting overall construction productivity and profitability. The market growth is inherently linked to global infrastructure spending and the ongoing digitalization of construction workflows.

Key products within this market segment are primarily categorized by their operational capability, ranging from basic line lasers used for interior layout tasks to sophisticated self-leveling rotary lasers essential for large-scale outdoor civil engineering projects. Major applications span structural alignment, elevation transfer, vertical plumbing, and accurate slope determination for drainage systems. The increasing complexity of modern architectural designs and the stringent requirements for dimensional accuracy necessitate the use of reliable, high-precision laser systems. Furthermore, the compatibility of modern construction lasers with Machine Control Systems (MCS) represents a pivotal evolutionary step, allowing for automated and highly accurate material movement and grading operations on construction sites, which is a major factor accelerating market penetration.

The primary benefit derived from the adoption of construction lasers is the quantifiable improvement in dimensional accuracy and the subsequent reduction in labor costs associated with manual measurements and rework. Driving factors include the global shift toward smart construction practices, increasing regulatory focus on construction safety and quality standards, and sustained investment in large-scale public infrastructure projects, particularly in developing economies. As labor shortages become more pronounced in developed markets, the efficiency gains offered by laser technology further solidify their position as indispensable tools on the modern job site, ensuring robust market expansion throughout the forecast period.

Construction Lasers Market Executive Summary

The Construction Lasers Market is currently experiencing robust expansion, fundamentally driven by the global imperative for enhanced construction productivity and the integration of digital workflow technologies. Business trends indicate a strong move towards multifunctional laser systems that offer superior durability and connectivity, capable of interacting seamlessly with Building Information Modeling (BIM) software and other site management platforms. Key manufacturers are focusing heavily on developing self-leveling features, green laser technology for improved visibility, and ruggedized designs suitable for harsh construction environments. Mergers and acquisitions focused on consolidating specialized technology portfolios, particularly in the realm of high-definition 3D laser scanning capabilities, are shaping the competitive landscape, pushing established players to innovate aggressively to maintain market share.

Regionally, Asia Pacific (APAC) is projected to exhibit the fastest growth trajectory, fueled by rapid urbanization, massive government expenditures on infrastructural development (such as high-speed rail networks and smart city projects), and increasing awareness among local contractors regarding the long-term cost benefits of precision equipment. North America and Europe, representing mature markets, maintain high market values due to their stringent quality standards and the high adoption rate of advanced machine control technologies in heavy construction sectors. Trends across these regions emphasize retrofitting older construction equipment with laser-based guidance systems and a growing demand for subscription-based service models for high-end surveying equipment, optimizing capital expenditure for construction firms.

Segmentation trends highlight the increasing dominance of rotary lasers due to their versatility in large-area applications, while the line and point lasers segment witnesses high volume sales driven by interior finishing and general contractor needs. Technology-wise, the self-leveling segment commands the majority share, reflecting the industry's desire for instruments that minimize setup time and human error. In terms of end-use, the commercial construction segment remains the largest consumer, primarily due to the complex layout requirements of large commercial buildings and industrial complexes. However, infrastructure development, particularly road construction and utilities, represents a rapidly expanding segment, propelled by global stimulus spending packages targeting economic recovery and modernization.

AI Impact Analysis on Construction Lasers Market

User inquiries regarding AI's influence on construction lasers often center on themes of automation accuracy, predictive maintenance, and the integration of real-time site data into planning models. Users frequently ask how AI algorithms can interpret 3D scan data collected by laser systems to detect anomalies instantly, predict equipment failure before downtime occurs, or autonomously adjust grading based on dynamic environmental factors. Concerns revolve around data privacy, the required expertise to manage AI-driven systems, and the initial investment cost. The underlying expectation is that AI will transform construction lasers from simple measuring tools into intelligent data collection and decision-making endpoints, allowing for truly autonomous site management and unprecedented levels of precision and safety on complex projects.

- AI-driven real-time data fusion: Integrating laser measurements with drone imagery and BIM models for comprehensive, instantaneous site status updates.

- Predictive maintenance analytics: Utilizing embedded sensor data from lasers to predict component failure, minimizing unexpected downtime and optimizing servicing schedules.

- Automated layout and alignment: AI algorithms guide robotic total stations and laser levels to perform complex layout tasks without constant human intervention.

- Enhanced quality control: AI processes laser scan data to automatically identify deviations from design specifications, ensuring immediate corrective action.

- Optimized resource allocation: Using AI analysis of laser-generated topographical data to calculate precise material volumes and optimize earthmoving logistics.

DRO & Impact Forces Of Construction Lasers Market

The market dynamics of construction lasers are governed by a complex interplay of drivers, restraints, opportunities, and persistent external impact forces. A primary driver is the accelerating pace of global construction activity, particularly in high-growth economies that prioritize infrastructure modernization. Furthermore, the stringent safety regulations imposed by governmental bodies mandate the use of highly accurate, reliable measuring tools to reduce on-site hazards and ensure structural integrity. Opportunities are largely concentrated in the integration realm, where lasers act as foundational data sources for advanced technologies such as Machine Control, robotics, and integrated BIM workflows, offering manufacturers avenues for high-value product development and service offerings. The confluence of these factors suggests a positive growth outlook, contingent upon overcoming market barriers related to initial investment cost and user training.

Restraints, however, temper this growth. The significant initial capital expenditure required for sophisticated, high-end laser systems, particularly 3D scanners and robotic total stations, remains a barrier to entry for small and medium-sized construction enterprises (SMEs) in emerging markets. Additionally, while the technology is increasingly user-friendly, the requirement for skilled labor to operate and calibrate advanced laser equipment, particularly in regions with labor skill deficits, presents an operational challenge. The volatility in raw material prices for components like specialized optics and durable housings also affects manufacturing costs, potentially leading to price instability for end-users, thereby restraining mass market adoption.

Impact forces currently shaping the market include rapid technological obsolescence, where continuous innovation in sensing and connectivity necessitates frequent equipment upgrades, pushing companies towards leasing models. The intense competition from low-cost manufacturers, primarily based in Asia, exerts downward pressure on the pricing of basic line and point lasers. Moreover, the industry's ongoing sustainability shift places pressure on manufacturers to develop energy-efficient devices and systems that minimize waste by ensuring greater construction accuracy. The shift toward digitalization post-COVID-19 has created an irreversible demand for tools that facilitate remote monitoring and data sharing, cementing the laser's role as a digital asset rather than just a physical tool.

Segmentation Analysis

The Construction Lasers Market is meticulously segmented based on product type, technology, application, and end-use, allowing for precise market targeting and strategic development. This segmentation reflects the diversity of construction needs, ranging from simple internal fitting jobs requiring basic line lasers to massive civil engineering projects demanding highly sophisticated rotary and grade lasers integrated with machine control systems. Understanding these distinct segments is crucial for manufacturers, as product differentiation often hinges on features like self-leveling capabilities, operational range, beam color, and environmental ruggedness. The ongoing trend toward specialization means that while high-volume segments remain crucial, high-margin opportunities exist in niche areas such as 3D laser scanning used for historic preservation or complex industrial plant modeling.

- Product Type: Rotary Lasers, Line and Point Lasers, Pipe Lasers, Laser Distance Measures (LDMs).

- Technology: Self-leveling Lasers, Manual Lasers.

- Application: Layout and Alignment, Leveling and Grading, Excavation and Surveying.

- End-Use: Commercial Construction, Residential Construction, Infrastructure and Civil Engineering, Industrial Construction.

- Laser Type: Red Beam Lasers, Green Beam Lasers.

Value Chain Analysis For Construction Lasers Market

The value chain for construction lasers commences with upstream activities involving the sourcing of highly specialized components, primarily high-precision optical components, laser diodes, microprocessors, and ruggedized housing materials. Key suppliers include specialized semiconductor and optics manufacturers globally. Ensuring supply chain resilience and securing high-quality, durable components are critical upstream challenges, especially concerning the availability and pricing stability of green laser diodes, which offer superior visibility but higher production costs. Manufacturers focus on sophisticated assembly, quality control testing, and intellectual property protection related to self-leveling mechanisms and machine control integration protocols.

The distribution channel represents a crucial bottleneck and differentiation point. Due to the technical nature and high cost of the equipment, direct sales through dedicated manufacturer sales teams are common for large-scale enterprise clients (such as major civil engineering firms). However, the majority of sales, particularly to smaller contractors and general builders, are routed through indirect channels: authorized national and regional distributors, specialized surveying equipment retailers, and, increasingly, e-commerce platforms specializing in construction tools. Value-added services, including calibration, repair, and technical training provided through these channels, significantly influence customer loyalty and product adoption rates.

Downstream activities involve the end-users—construction firms, surveyors, rental companies, and trade specialists—who utilize the equipment for site preparation, structural erection, and interior finishing. The downstream market is highly sensitive to product reliability and post-sales support, emphasizing the importance of robust warranties and accessible service networks. The rise of rental markets is a significant downstream trend, allowing smaller firms access to high-end equipment without significant capital outlay. The feedback loop from downstream users regarding durability and software compatibility is essential for driving future product development and ensuring the laser systems meet rigorous real-world construction demands.

Construction Lasers Market Potential Customers

The primary end-users and buyers of construction laser products are highly diversified across the construction ecosystem, ranging from large multinational engineering firms to independent specialized trade contractors. Major infrastructure projects, including highway construction, dam building, and energy pipeline installations, require high-end rotary lasers and robotic total stations for precise grading and alignment over vast distances. These buyers prioritize integration capabilities with heavy equipment machine control systems and demand rugged, reliable units that can withstand extreme environmental conditions and continuous use. Government procurement agencies are also significant customers, often purchasing large fleets of standard and specialized leveling equipment for public works departments.

Another substantial customer segment comprises commercial and residential building contractors. Commercial builders frequently utilize line lasers for interior fit-outs, ceiling alignment, and partitioning, where speed and accuracy are paramount. Residential builders rely on basic to mid-range rotary lasers for foundation leveling and establishing site benchmarks. For these segments, ease of use, durability, and a competitive price point are key purchasing criteria. Specialized subcontractors, such as HVAC installers, plumbers, and electrical contractors, form a significant niche, relying on specific application-focused tools like pipe lasers and specialized dot lasers for routing and positioning utility lines accurately within structures.

Rental companies constitute a rapidly expanding customer base, particularly as construction firms increasingly seek to manage costs and avoid asset depreciation. Rental fleet operators purchase equipment robust enough to handle multiple users and constant mobilization. They are key influencers of market trends, often favoring brands known for reliability and easy serviceability. Furthermore, professional surveyors and geotechnical firms represent the highest-tier users, demanding millimeter-level accuracy from specialized instruments, including advanced 3D laser scanners used for detailed topographical mapping and complex structural monitoring applications. Their purchasing decisions are heavily influenced by calibration services and software compatibility with industry-standard surveying platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 920 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leica Geosystems (Hexagon AB), Trimble Inc., Robert Bosch GmbH, Hilti Corporation, Stanley Black & Decker (DEWALT), Spectra Precision, Topcon Corporation, PLS (Pacific Laser Systems), Johnson Level & Tool, Stabila, Makita Corporation, CST/berger, Fluke Corporation, ADA Instruments, PENTAX Surveying Instruments, Ryobi Limited, Sola-Messwerkzeuge GmbH, Geo-Fennel GmbH, Kesson International, ACI Laser GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Lasers Market Key Technology Landscape

The technological landscape of the Construction Lasers Market is characterized by continuous refinement aimed at improving accuracy, ruggedness, and digital connectivity. The shift from manual setups to sophisticated self-leveling mechanisms remains the most critical technological advancement, significantly reducing setup time and virtually eliminating manual leveling errors. Modern lasers increasingly incorporate gyroscopic sensors and electronic calibration systems to maintain accuracy even on unstable terrain. Furthermore, the adoption of green laser diodes, which offer significantly higher visibility (up to four times greater) than traditional red diodes in brightly lit environments, is rapidly becoming a standard feature across premium and mid-range product lines, enhancing user productivity both indoors and outdoors.

Integration technology is another major frontier. High-end rotary and grade lasers are now standardly equipped with advanced radio communication protocols, enabling seamless integration with Machine Control Systems (MCS) used on excavators, dozers, and graders. This direct link allows for real-time elevation and slope adjustments, drastically improving the precision and speed of earthmoving operations. The development of intelligent laser sensors that can withstand high vibration levels and harsh weather conditions is crucial for these MCS applications, forming a symbiotic relationship between surveying tools and heavy equipment automation, thus generating high market value in civil construction segments.

Looking ahead, the convergence of laser measuring tools with 3D scanning and reality capture is redefining the market. Modern laser scanning systems generate dense point clouds rapidly, enabling detailed three-dimensional documentation of existing conditions and construction progress. These systems leverage sophisticated algorithms for noise reduction and data alignment, providing highly accurate inputs for BIM modeling and quality verification. This evolution positions construction lasers not just as tools for alignment, but as vital components in the overall digital construction ecosystem, facilitating rapid comparison between as-built conditions and digital design models, thereby driving the industry toward full digitalization.

Regional Highlights

Geographically, the Construction Lasers Market displays varied growth patterns dictated by regional economic factors, infrastructure investment levels, and the maturity of construction practices. North America, driven by massive federal infrastructure initiatives and a high adoption rate of sophisticated machine control technology, remains a high-value market. The stringent requirements for surveying accuracy in US and Canadian civil engineering projects ensure steady demand for high-precision, connected laser systems. Furthermore, the need to upgrade aging infrastructure and the widespread use of BIM necessitate advanced measuring tools, solidifying the region's position as a leader in high-end laser technology consumption.

Europe mirrors North America in terms of technological maturity, with a strong focus on high-quality manufacturing standards and energy-efficient building practices. Western European countries, particularly Germany and the UK, exhibit strong market penetration due to advanced commercial and residential construction sectors that mandate laser precision for achieving optimal energy performance and structural integrity. The European market also benefits from a robust rental sector, facilitating easier access to expensive equipment for small and mid-sized contractors. Regulatory frameworks promoting workplace safety further encourage the adoption of accurate, easy-to-use laser measuring tools across all project sizes.

Asia Pacific (APAC) stands out as the primary growth engine for the forecast period. Rapid urbanization, coupled with mega-infrastructure projects in China, India, and Southeast Asian nations (including extensive rail, road, and power plant construction), generates enormous demand for construction lasers, both entry-level and high-performance. While price sensitivity is higher in certain APAC sub-regions, the move toward modern construction methods, driven by foreign investment and governmental digitalization pushes, is rapidly increasing the market share for sophisticated, branded laser equipment. The Middle East and Africa (MEA) exhibit selective growth, primarily concentrated in the Gulf Cooperation Council (GCC) states due to large-scale real estate and infrastructure development funded by oil wealth, focusing heavily on commercial and hospitality construction that requires exacting precision.

- North America: High adoption of integrated Machine Control Systems; driven by significant governmental infrastructure spending (e.g., US Infrastructure Investment and Jobs Act).

- Europe: Market maturity characterized by stringent quality standards; strong reliance on rental market for equipment accessibility and sustainability goals in construction.

- Asia Pacific (APAC): Fastest growing region fueled by urbanization and substantial investment in smart city and transportation infrastructure (China, India, Indonesia).

- Latin America: Moderate growth driven by mining and energy infrastructure projects, characterized by increasing, yet price-sensitive, demand for basic and mid-range equipment.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to large commercial and industrial development projects demanding high-precision surveying tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Lasers Market.- Leica Geosystems (Hexagon AB)

- Trimble Inc.

- Robert Bosch GmbH

- Hilti Corporation

- Stanley Black & Decker (DEWALT)

- Spectra Precision

- Topcon Corporation

- PLS (Pacific Laser Systems)

- Johnson Level & Tool

- Stabila

- Makita Corporation

- CST/berger

- Fluke Corporation

- ADA Instruments

- PENTAX Surveying Instruments

- Ryobi Limited

- Sola-Messwerkzeuge GmbH

- Geo-Fennel GmbH

- Kesson International

- ACI Laser GmbH

Frequently Asked Questions

Analyze common user questions about the Construction Lasers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Construction Lasers Market?

Market growth is primarily driven by the increasing demand for dimensional accuracy and precision in construction projects, the global surge in infrastructure development, and the essential integration of laser technology with digital construction workflows such as BIM and Machine Control Systems (MCS).

How do Green Beam Lasers differ from Red Beam Lasers in construction applications?

Green beam lasers offer significantly enhanced visibility, appearing up to four times brighter to the human eye than traditional red beam lasers, particularly in brightly lit indoor environments or sunny outdoor conditions. This improved visibility increases working range and reduces eye strain, thus boosting on-site efficiency.

Which technology segment dominates the Construction Lasers Market?

The Self-leveling Lasers technology segment currently dominates the market. Self-leveling mechanisms automate the complex and time-consuming process of manual calibration, reducing setup time, minimizing human error, and ensuring high accuracy, which is highly valued by modern construction firms.

What role does Artificial Intelligence (AI) play in the future of construction lasers?

AI is projected to transform construction lasers into intelligent data collection points, enabling applications such as predictive maintenance, automated site layout guidance, and real-time quality control checks by instantly comparing laser-generated 3D scan data against design specifications.

Is Asia Pacific (APAC) the fastest-growing region for construction lasers?

Yes, APAC is forecasted to be the fastest-growing regional market, driven by extensive investment in large-scale governmental infrastructure projects, rapid urbanization rates, and the continuous adoption of modern construction and surveying practices across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager