Construction Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434633 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Construction Management Software Market Size

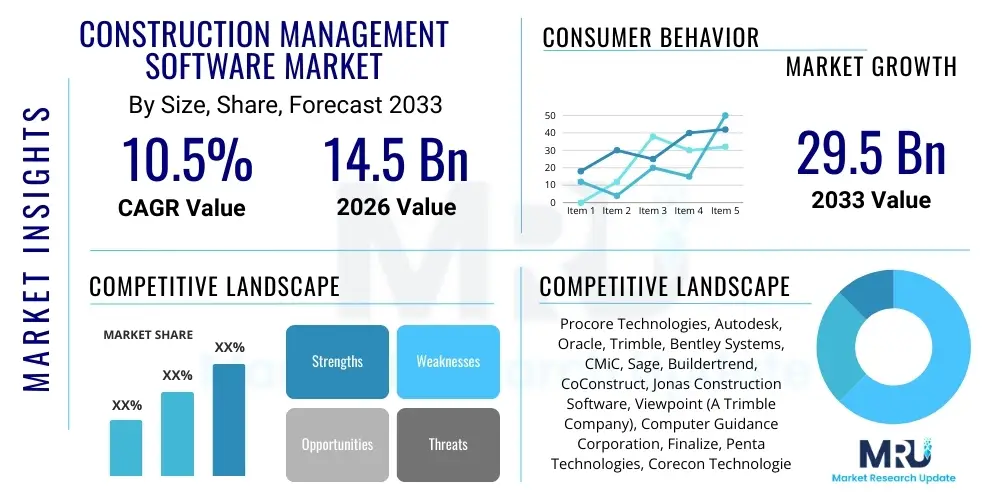

The Construction Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 29.5 Billion by the end of the forecast period in 2033. This substantial growth is driven by the global imperative for digital transformation within the Architecture, Engineering, and Construction (AEC) sector, aiming to enhance operational efficiency, mitigate project risks, and improve collaboration across diverse construction teams and supply chains.

Construction Management Software Market introduction

The Construction Management Software Market encompasses a range of integrated software solutions designed to plan, execute, monitor, and control construction projects from conception through completion. These tools address critical industry challenges such as budget overruns, scheduling delays, resource allocation issues, and complex regulatory compliance. Products offered include project scheduling, labor management, financial accounting, document control, and Building Information Modeling (BIM) coordination tools. Major applications span residential, commercial, and heavy infrastructure projects, serving general contractors, specialty trade contractors, and project owners.

The primary benefits delivered by these platforms include real-time data accessibility, improved collaboration among stakeholders (designers, engineers, subcontractors), enhanced job site safety monitoring, and precise cost tracking. Key driving factors fueling market expansion are the increasing adoption of cloud-based solutions, the necessity for centralized project data management to comply with stringent industry standards, and the rising complexity of modern construction mega-projects which demand sophisticated analytical and management capabilities to maintain profitability and timely delivery.

Construction Management Software Market Executive Summary

The Construction Management Software market is characterized by rapid technological adoption, primarily focusing on cloud-based deployment models and mobile accessibility, which are transforming traditional operational workflows. Business trends indicate a strong move toward platform consolidation, where providers are integrating diverse functionalities (e.g., project management, accounting, field service) into unified enterprise resource planning (ERP) systems tailored for construction. This trend addresses the fragmented nature of the construction technology stack and seeks to provide end-to-end visibility. Furthermore, the increasing demand for advanced analytics and predictive modeling capabilities is accelerating the shift from simple record-keeping software to intelligent project control solutions.

Regional trends highlight North America and Europe as dominant markets due to high technology readiness, significant investment in infrastructure, and strict regulatory environments necessitating robust compliance tracking. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by massive urbanization projects, government mandates for digitalization in countries like China and India, and increasing foreign direct investment in commercial construction. Segment trends reveal that cloud-based solutions are overwhelmingly preferred over on-premise deployments owing to flexibility, scalability, and reduced upfront IT infrastructure costs, making them particularly attractive to Small and Medium-sized Enterprises (SMEs) seeking cost-effective digital tools.

AI Impact Analysis on Construction Management Software Market

User inquiries regarding the integration of Artificial Intelligence (AI) into Construction Management Software predominantly revolve around three critical themes: automation potential, risk mitigation capabilities, and data-driven decision-making. Users frequently ask how AI can automate routine tasks like document sorting, progress reporting, and invoice processing, thereby freeing up project managers for strategic oversight. Significant concerns are centered on AI’s ability to accurately predict project timelines and budget deviations by analyzing vast historical data sets, specifically focusing on its effectiveness in identifying unforeseen risks and optimizing resource scheduling in real-time. Additionally, users are highly interested in AI-powered safety monitoring systems, utilizing computer vision to detect non-compliance or hazardous situations on job sites, signaling a strong user expectation for improved site safety and operational efficiency through intelligent automation.

The deployment of AI and Machine Learning (ML) algorithms is fundamentally reshaping the capabilities offered by Construction Management Software. AI facilitates predictive analytics, allowing software platforms to forecast potential delays or cost overruns by analyzing complex variables, historical project data, and real-time operational feeds. This shift enhances proactive management over reactive crisis resolution. Furthermore, AI is crucial in optimizing scheduling and resource allocation, dynamically adjusting plans based on supply chain fluctuations or labor availability, leading to tighter control over project budgets and timelines. AI-driven quality assurance, using image recognition to compare 'as-built' conditions against BIM models, is also gaining traction, minimizing rework and ensuring higher quality standards are met across all project phases.

The impact of AI extends significantly into administrative and compliance functions. AI tools are increasingly utilized for automating contract analysis, ensuring compliance with local building codes, and managing complex regulatory documentation with minimal human intervention. This automation reduces administrative overhead and minimizes the legal exposure associated with documentation errors. As construction firms generate exponentially more data (from IoT sensors, drones, and mobile devices), AI provides the necessary processing power to derive meaningful, actionable insights, cementing its role as a core component of next-generation construction software platforms focused on delivering superior predictive power and operational resilience.

- AI enhances risk prediction by analyzing historical project performance and external market volatility.

- Machine Learning algorithms optimize resource allocation and dynamic scheduling in complex projects.

- Computer vision technology, powered by AI, enables real-time job site safety monitoring and compliance checks.

- AI automates routine administrative tasks such as invoice processing, contract vetting, and document indexing.

- Predictive maintenance schedules for equipment are generated using sensor data analyzed by ML models.

- Natural Language Processing (NLP) improves search functionality and data extraction from unstructured documents like construction plans and email correspondence.

DRO & Impact Forces Of Construction Management Software Market

The Construction Management Software market is propelled by key Drivers (D) such as the increasing need to improve operational efficiency and reduce the high rate of project failures globally, coupled with the mandatory requirement for regulatory compliance and advanced safety standards across major industrialized economies. However, growth is tempered by Restraints (R), including the high initial implementation costs of sophisticated software solutions, reluctance among smaller traditional construction firms to adopt new technology due to existing low technology readiness, and significant challenges related to data security and interoperability between diverse proprietary systems utilized in large-scale projects.

Opportunities (O) are abundant, primarily stemming from the rapid advancements in cloud-based and mobile technologies, allowing remote access and real-time updates from job sites, which is vital for global operations. Furthermore, the increasing integration of technologies like BIM, IoT, and AI presents significant avenues for vendors to develop highly differentiated and predictive solutions. The growing global focus on sustainable construction and green building practices also offers a niche opportunity for software that can track and optimize environmental performance and material usage accurately.

The Impact Forces driving market dynamics are substantial. The compelling need for digital collaboration, especially in multi-phase and geographically dispersed projects, forces firms to adopt centralized platforms. Regulatory pressures, particularly concerning worker safety and environmental accountability, necessitate the deployment of software capable of meticulous record-keeping and instantaneous reporting. The cumulative impact of these forces dictates that construction firms must move beyond manual methods to remain competitive, creating a continuous demand for advanced, integrated management software solutions that promise higher return on investment through optimized project execution.

Segmentation Analysis

The Construction Management Software Market is segmented based on component, deployment model, application, organization size, and end-user. The analysis across these dimensions provides a granular understanding of purchasing behavior and specific industry needs. Component segmentation, for instance, differentiates between software and service offerings, where services (implementation, training, maintenance) play a crucial role in ensuring successful software adoption, especially for complex enterprise deployments. The market’s dynamism is particularly evident in the deployment model, where the transition from on-premise installations to cloud-based Software-as-a-Service (SaaS) models is defining the competitive landscape, offering scalability and reduced infrastructural barriers.

Application-based segmentation reveals specific demand patterns, with Project Management, Financial Management, and Field Service Management systems constituting the core functional requirements across all end-users. Project Management remains the largest segment, driven by the critical need for scheduling, documentation, and coordination tools. Furthermore, the distinction by organization size is vital, as large enterprises often require extensive, custom ERP solutions, while SMEs typically favor accessible, modular, and subscription-based SaaS products focusing on essential functions like accounting and basic project scheduling, impacting pricing strategies and feature development across the vendor ecosystem.

- Component:

- Software (Project Planning, Document Management, Resource Management, Financial Management, Safety Management)

- Services (Consulting, Implementation, Support & Maintenance, Managed Services)

- Deployment Model:

- Cloud (SaaS)

- On-Premise

- Application:

- Project Management and Scheduling

- Financial Management and Accounting

- Customer Relationship Management (CRM)

- Inventory and Supply Chain Management

- Field Service Management

- Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- End-User:

- General Contractors

- Subcontractors and Specialty Trade Contractors

- Project Owners/Builders

- Engineering & Architecture Firms

Value Chain Analysis For Construction Management Software Market

The value chain for Construction Management Software begins with Upstream Analysis, which involves core activities such as software development, research and development (R&D) focusing on integrating emerging technologies (AI, IoT, BIM), and data warehousing solutions. Key upstream participants include specialized software developers, data scientists, and intellectual property providers. The efficiency and innovation in this stage directly influence the final product's quality, features, and competitive positioning. Investment in secure, scalable cloud infrastructure providers (such as AWS, Azure, Google Cloud) is also a critical upstream component.

The value then moves through the software creation and packaging phase, where solutions are customized, integrated, and scaled for various organizational sizes and construction project complexities. Distribution Channel analysis highlights both Direct and Indirect methods. Direct distribution involves vendors selling their proprietary solutions directly to end-users via internal sales teams and online portals, often supplemented by implementation and support services. Indirect distribution relies heavily on channel partners, Value-Added Resellers (VARs), system integrators, and independent software vendors (ISVs) who bundle construction software with hardware or specialized consulting services, particularly crucial for penetrating regional markets with complex local compliance requirements.

Downstream analysis focuses on the delivery, adoption, and post-sales support activities. This stage includes comprehensive implementation services, user training (often mandated for advanced features like BIM coordination), ongoing technical support, and critical updates to maintain compliance and security. The end of the value chain rests with the End-Users—general contractors and specialty trade firms—whose feedback drives subsequent product development cycles and feature enhancements, ensuring the software remains relevant and addresses evolving industry pain points, such as mobile access and enhanced interoperability across diverse platforms.

Construction Management Software Market Potential Customers

The primary End-Users and buyers of Construction Management Software span the entire spectrum of the Architecture, Engineering, and Construction (AEC) industry. General Contractors represent the largest customer base, requiring comprehensive, integrated platforms that manage all aspects of large, complex projects, from bidding and procurement to final closeout and warranty management. Their demand centers around robust project planning, labor tracking, and financial reconciliation modules that can handle high volumes of transactions and multiple ongoing projects simultaneously.

Specialty Trade Contractors, including HVAC, electrical, and plumbing firms, represent another high-potential segment. While their operational needs are often more focused (e.g., specific job costing, material tracking, and field service management), they increasingly require cloud-based solutions that integrate seamlessly with the general contractor's primary management platform. The adoption among these smaller firms is often driven by the necessity for digital collaboration mandated by the general contractors they work for, pushing them towards modular, mobile-enabled software packages that offer quick implementation and ease of use.

Furthermore, Project Owners and Real Estate Developers constitute a growing customer segment, seeking software primarily for portfolio oversight, financial tracking, risk assessment, and capital project governance. Their focus is on high-level reporting and predictive analytics to ensure long-term asset value and regulatory adherence. Public sector organizations managing large infrastructure projects (roads, utilities) also represent significant potential customers, demanding highly secure, compliant, and transparent management systems capable of handling complex public-private partnership documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procore Technologies, Autodesk, Oracle, Trimble, Bentley Systems, CMiC, Sage, Buildertrend, CoConstruct, Jonas Construction Software, Viewpoint (A Trimble Company), Computer Guidance Corporation, Finalize, Penta Technologies, Corecon Technologies, PlanGrid (now part of Autodesk), Kahua, Aconex (now part of Oracle), BuildStar, e-Builder (now part of Trimble) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Management Software Market Key Technology Landscape

The technology landscape of the Construction Management Software Market is rapidly evolving, driven by the need for greater integration, mobility, and predictive capabilities. Cloud computing remains the foundational technology, enabling Software-as-a-Service (SaaS) delivery models that provide scalability and accessibility from any location. This facilitates real-time collaboration between remote teams, job sites, and back offices, fundamentally transforming document control and project reporting cycles. Mobile technology, through dedicated applications, ensures that field personnel can access plans, submit daily reports, track labor hours, and manage safety checklists directly on site, enhancing data accuracy and immediacy.

Building Information Modeling (BIM) integration is paramount, allowing construction management software to move beyond 2D plans into 3D model coordination. This integration enables clash detection, accurate quantity take-offs, 4D (scheduling) and 5D (cost) simulations directly within the management environment, significantly reducing design errors and improving procurement precision. Furthermore, the incorporation of Internet of Things (IoT) sensors and connected devices is providing platforms with continuous streams of data regarding equipment performance, material location, and environmental conditions, feeding critical information necessary for robust resource management and preventative maintenance scheduling.

The future technology landscape is heavily invested in AI and Machine Learning for advanced analytics, as previously discussed, but also relies on sophisticated Application Programming Interfaces (APIs) and open data standards. Open APIs are essential for interoperability, allowing construction software to communicate effectively with specialized third-party tools (e.g., drone mapping software, enterprise accounting systems, and material suppliers’ platforms). This push toward a highly interconnected digital ecosystem reduces data silos and ensures a unified source of truth across complex construction projects, driving overall market efficiency and technological maturity.

Regional Highlights

- North America (USA and Canada)

North America holds the largest market share in the Construction Management Software market, characterized by high digitalization maturity, significant capital investment in commercial and infrastructure projects, and stringent regulatory compliance requirements, particularly regarding worker safety and environmental impact. The United States, in particular, showcases high adoption rates among large general contractors who utilize sophisticated, integrated ERP systems to manage complex, multi-state projects. Key drivers include the robust adoption of BIM standards, the early proliferation of cloud-based SaaS solutions, and a competitive landscape that forces companies to adopt technology to enhance margins.

The region is a hub for innovation, hosting major industry players and witnessing continuous venture capital funding into construction technology startups, focusing on areas like AI-powered analytics and drone integration. The demand here is shifting from basic project management tools to comprehensive platforms that incorporate risk analysis, supply chain management integration, and robust financial modules that adhere to complex local accounting practices. High labor costs also necessitate the implementation of software that can optimize labor utilization and reduce administrative overhead associated with human resource management.

- Europe (Germany, UK, France, Italy, Spain)

Europe is a mature market driven by government initiatives pushing digital construction adoption, such as mandatory BIM usage in the UK and Scandinavia for public sector projects. The market growth is substantial, supported by substantial investments in rebuilding infrastructure and promoting energy-efficient construction practices. European firms place a high emphasis on data privacy and security, driving demand for software vendors that offer robust compliance with GDPR and other local regulations, often preferring European cloud service providers.

Germany and the UK are leading adopters, with a focus on integrating planning and execution phases through modular and interconnected software suites. The structure of the European construction market, which includes many small and medium-sized specialty contractors, increases the demand for accessible, mobile-first solutions tailored to specific trade needs. Collaboration tools are vital, given the common cross-border nature of construction firms and supply chains within the European Union, necessitating platforms that support multilingual and multi-currency operations effectively.

- Asia Pacific (APAC) (China, Japan, India, South Korea, Australia)

The Asia Pacific region is projected to register the fastest growth rate, fueled by massive urbanization, burgeoning population demands, and significant government spending on large-scale infrastructure and residential development projects, particularly in emerging economies like India and China. While adoption was historically slower, government mandates promoting "smart construction" and the increased presence of foreign construction firms are accelerating the uptake of advanced management software.

The market in APAC is characterized by a strong move toward mobile technology due to high mobile penetration rates and a need for real-time data input from geographically vast construction sites. While large enterprises in Japan and Australia utilize highly advanced integrated systems, the dominant trend across the developing parts of the region involves initial adoption of modular, task-specific software (e.g., documentation, site monitoring) before migrating to full ERP systems, reflecting a phased digitalization strategy influenced by cost sensitivity and varying levels of technological expertise across firms.

- Latin America (LATAM) (Brazil, Mexico)

The Latin American market is exhibiting steady growth, primarily driven by substantial investments in energy, mining, and housing sectors. The market faces unique challenges, including economic volatility and complex regional regulatory frameworks, which necessitate flexible and localized software solutions that can quickly adapt to changing economic conditions and specific tax laws. Brazil and Mexico are the largest markets, where foreign investment mandates standardized project management practices, boosting demand for international, yet localized, software platforms.

Adoption rates are often tied to project financing, where large institutional lenders require digital tracking and transparency, pushing contractors toward utilizing recognized construction management software. The focus here is strongly placed on financial management, procurement optimization to counteract inflationary pressures, and efficient resource tracking due to widespread supply chain logistical issues.

- Middle East and Africa (MEA) (GCC Countries, South Africa)

The MEA market, particularly the Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia, Qatar), is experiencing explosive growth driven by mega-projects in infrastructure, hospitality, and smart cities (e.g., NEOM in Saudi Arabia). These large-scale, high-value projects mandate the use of world-class, sophisticated construction management software for complex scheduling, inter-disciplinary coordination, and high-security data handling.

Investment in technology is high, often leapfrogging older systems directly to advanced cloud and mobile deployments. Demand is focused on specialized solutions for project portfolio management (PPM) and sophisticated risk visualization. South Africa leads the African continent in adoption, driven by established construction firms, though the broader African market remains nascent, with demand gradually increasing, focusing mainly on basic project control and compliance features due to lower technology budgets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Management Software Market.- Procore Technologies, Inc.

- Autodesk, Inc.

- Oracle Corporation

- Trimble Inc.

- Bentley Systems, Incorporated

- CMiC Global

- Sage Group plc

- Buildertrend

- CoConstruct (a Buildertrend Company)

- Jonas Construction Software

- Viewpoint (A Trimble Company)

- Computer Guidance Corporation

- Kahua, Inc.

- Penta Technologies, Inc.

- Corecon Technologies, Inc.

- Aconex (an Oracle subsidiary)

- e-Builder (a Trimble Company)

- Wrike (a Citrix company)

- InEight, Inc.

- Finalize, Inc.

Frequently Asked Questions

Analyze common user questions about the Construction Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Construction Management Software Market between 2026 and 2033?

The Construction Management Software Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 10.5% throughout the forecast period, reflecting strong demand for digitalization and efficiency tools in the global AEC sector.

Which deployment model dominates the Construction Management Software market?

The Cloud-based (Software-as-a-Service or SaaS) deployment model dominates the market. SaaS solutions offer superior scalability, lower upfront costs, remote accessibility, and ease of updates, making them the preferred choice for both large enterprises and SMEs.

How is Artificial Intelligence (AI) impacting construction management software capabilities?

AI significantly enhances construction software by enabling predictive analytics for risk mitigation, optimizing dynamic project scheduling, automating administrative tasks, and facilitating real-time safety monitoring through computer vision on job sites.

Which region currently leads the global market in terms of revenue share?

North America holds the largest revenue share in the global Construction Management Software Market, driven by high technological maturity, substantial infrastructure investments, and widespread early adoption of integrated BIM and cloud solutions.

What are the primary challenges restraining market growth for construction software?

Key restraints include the high initial cost of enterprise software implementation, significant challenges related to software interoperability across different vendor platforms, and resistance to technology adoption, particularly among traditional small and medium-sized construction firms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager