Construction Project Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435074 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Construction Project Insurance Market Size

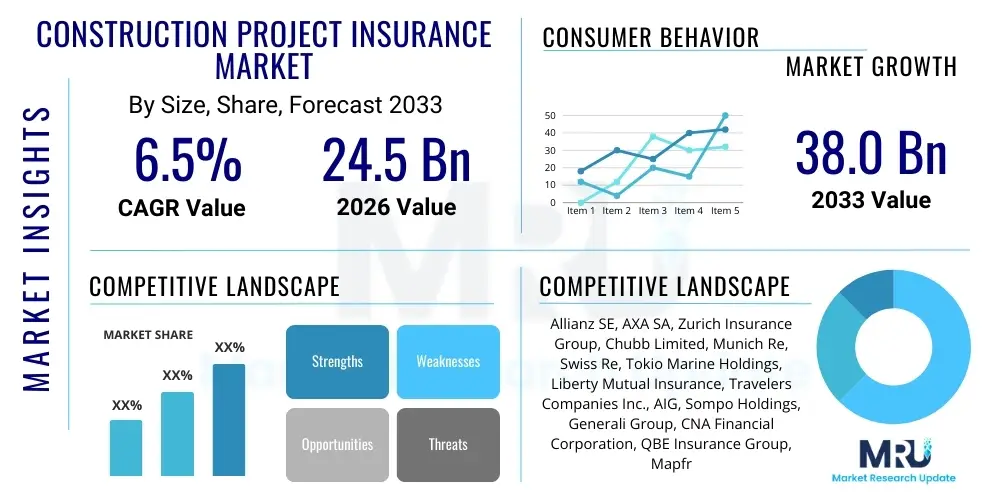

The Construction Project Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $38.0 Billion by the end of the forecast period in 2033.

Construction Project Insurance Market introduction

The Construction Project Insurance Market encompasses specialized insurance products designed to mitigate the inherent risks associated with construction activities, ranging from small residential developments to massive infrastructure undertakings. This market primarily provides coverage against property damage, third-party liability claims, and delays that can halt or severely impair a project's completion schedule. Key products include Builders Risk Insurance (also known as Construction All Risks - CAR) and Erection All Risks (EAR) policies, which cover physical loss or damage to the works being executed, temporary structures, and construction materials stored on or off-site. The complexity of modern construction projects, involving sophisticated technology, intricate supply chains, and stringent environmental regulations, necessitates comprehensive risk transfer mechanisms provided by this insurance segment.

The principal applications of construction project insurance span across residential, commercial, and heavy infrastructure sectors. Residential applications focus on insuring single-family homes and multi-unit dwellings under construction, safeguarding the builder and developer from unforeseen site damages. Commercial applications cover office buildings, retail centers, and industrial facilities, where the sheer size and contract value necessitate high-limit coverage. Infrastructure projects, such as bridges, tunnels, power plants, and utilities, represent the most capital-intensive segment, requiring highly customized and often syndicated insurance solutions to manage catastrophic risks and political instability in certain operating environments. The underlying objective across all applications is to ensure financial stability and continuity for all project stakeholders—owners, contractors, and lenders.

Major benefits driving the market's growth include enhanced financial security for multi-billion dollar projects, compliance with regulatory mandates often required by governmental bodies or lending institutions, and improved risk management practices. Contractors are increasingly adopting advanced insurance solutions due to mounting regulatory pressure regarding workplace safety and environmental protection, making robust liability coverage essential. Furthermore, the global trend toward mega-projects and Public-Private Partnerships (PPPs) places greater emphasis on predictable project financing, where insurance acts as a vital security layer protecting against delays and cost overruns. This dynamic environment, characterized by global supply chain volatility and escalating natural catastrophe risks, fuels continuous innovation in policy structuring and risk pricing within the construction insurance domain.

Construction Project Insurance Market Executive Summary

The global Construction Project Insurance Market demonstrates robust growth driven primarily by a surge in public infrastructure spending, especially in emerging economies, and the rapid pace of urbanization necessitating new commercial and residential developments. Business trends indicate a strong shift towards digitalization, with underwriters leveraging geospatial data, Building Information Modeling (BIM), and Internet of Things (IoT) sensors to gain granular insights into project risk exposure, moving away from traditional reliance solely on historical claims data. This technological integration is enhancing underwriting precision and leading to the development of usage-based insurance (UBI) models tailored for specific construction phases. Furthermore, heightened scrutiny on Environmental, Social, and Governance (ESG) criteria is pushing insurers to offer specialized coverage for sustainable construction practices and green building materials, influencing premium structures globally.

Regionally, the Asia Pacific (APAC) market is poised for the most rapid expansion, fueled by massive government investments in transport infrastructure, coupled with booming real estate markets in countries like India, China, and Southeast Asian nations. North America and Europe, while mature, are characterized by high-value, complex projects requiring sophisticated professional liability and parametric coverage, particularly concerning cybersecurity risks embedded in smart building technologies and critical infrastructure. Political and economic stability remains a crucial factor, with regions like the Middle East and Africa (MEA) experiencing high demand, predominantly for energy and large-scale urban development projects, although these areas often require specialized political risk components within their insurance packages.

Segment trends highlight the dominance of the Construction All Risks (CAR) segment due to its comprehensive coverage structure, essential for almost all general building projects. However, the Liability insurance segment, particularly Professional Indemnity (PI) for engineers and architects, is growing fastest due to increasing litigation complexity and accountability in design flaws. The reinsurance sector is playing an ever-critical role, providing the necessary capacity for high-limit placements, especially for Catastrophe (CAT) prone zones. Insurers are actively seeking diversification geographically and product-wise, focusing on integrating risk mitigation services, such as drone-based site inspections, directly into their policy offerings to reduce overall claims severity and frequency, thereby redefining the traditional insurer-client relationship.

AI Impact Analysis on Construction Project Insurance Market

Common user questions regarding AI's impact on construction insurance revolve around the capacity of AI to revolutionize risk assessment, streamline the painfully slow claims process, and potentially reduce premiums for clients who adopt advanced safety technologies. Users frequently inquire if AI-driven predictive modeling can accurately foresee project failures or major weather events, and how the use of machine learning algorithms affects pricing fairness and data privacy. Key concerns also focus on the displacement of human underwriters and claims adjusters, and the regulatory framework required to govern AI-generated risk evaluations. The overarching expectation is that AI will introduce unprecedented efficiency and accuracy, moving the market from reactive claims handling to proactive risk prevention and management throughout the project lifecycle.

AI's primary influence is manifested in automating high-volume, repetitive tasks and enhancing data analysis capabilities that surpass human capacity. In underwriting, AI analyzes massive datasets—including historical claims, real-time weather patterns, project schedules, and contractor safety records—to generate highly precise risk profiles and optimal premium calculations. This shift allows human underwriters to concentrate on complex, bespoke risks requiring specialized knowledge. For claims management, natural language processing (NLP) and computer vision are employed to rapidly assess damage documentation (photos, sensor data, drone footage), accelerating settlement times significantly and reducing fraudulent claims. Furthermore, AI facilitates better accumulation management for insurers by modeling potential losses across multiple concurrent projects in the same geographic area, particularly crucial for natural catastrophe modeling.

- AI-Powered Predictive Modeling: Enhances risk assessment accuracy by analyzing complex, multi-source data points (BIM, IoT, geospatial).

- Automated Claims Processing: Accelerates claim resolution through computer vision analysis of damage and NLP processing of documentation.

- Improved Underwriting Efficiency: Reduces manual effort in data gathering and initial risk profiling, lowering operational costs.

- Enhanced Fraud Detection: Machine learning algorithms identify anomalies and suspicious patterns in claims submissions more effectively than traditional methods.

- Dynamic Premium Adjustment: Allows for policies where premiums adjust based on real-time risk mitigation efforts observed via IoT data.

- Catastrophe Risk Aggregation Management: Provides superior modeling capabilities for calculating total exposure across portfolios exposed to severe weather events or seismic activity.

DRO & Impact Forces Of Construction Project Insurance Market

The Construction Project Insurance Market is fundamentally shaped by powerful drivers, notably the accelerating global pace of urbanization and the subsequent governmental commitment to modernizing infrastructure, especially transportation and renewable energy networks. Restraints, however, temper this growth; chief among them is the increasing volatility of underwriting results caused by escalating severity and frequency of natural catastrophe events (climate risk), alongside inherent uncertainty in construction material costs and labor shortages, leading to unpredictable project valuations and higher claims exposure. Opportunities reside in the rapid deployment of advanced Insurtech solutions, such as parametric insurance structures that pay out based on defined triggers (e.g., specific wind speed or rainfall intensity), bypassing lengthy claims adjustments, and the integration of loss prevention services directly into insurance offerings. These dynamics are subjected to impact forces including macroeconomic cycles affecting capital expenditure, stringent regulatory frameworks enforcing worker safety and environmental standards, and the overall capacity and pricing stability within the global reinsurance market.

Key drivers include substantial investment in green infrastructure projects globally, spurred by net-zero commitments, which require specialized insurance products covering novel technologies like offshore wind farms and large-scale battery storage facilities. The global housing deficit and the continuous need for commercial expansion further stabilize demand. Conversely, significant restraints include the cyclical nature of the construction industry, where economic downturns can lead to stalled projects and reduced premium volumes. Furthermore, the inherent complexity and uniqueness of mega-projects often make risk assessment challenging, leading to high-cost reinsurance dependency and potentially unaffordable premiums for smaller contractors.

Opportunities center around customizing coverage for emerging risks that traditional policies struggle to address, such as cyber risks associated with digital construction management systems and professional liability arising from the increasing use of advanced robotics and AI in building design and execution. The adoption of risk engineering services, focusing on proactive mitigation using digital tools, allows insurers to differentiate their offerings and capture higher-quality risks. Impact forces such as geopolitical instability can drastically affect supply chains and material costs, directly translating into inflationary pressure on sum insured values and claim settlement costs. Additionally, evolving global safety standards necessitate continuous adjustments to policy wording and coverage limits to remain compliant and relevant to modern construction practices.

Segmentation Analysis

The Construction Project Insurance Market is segmented primarily based on Type of Coverage, End-User Sector, and Policy Duration, reflecting the diverse risk profiles within the global construction ecosystem. The segmentation by type is critical as it delineates coverage based on the nature of the loss event—physical damage versus third-party liability or professional errors. End-user segmentation helps insurers tailor policies to the specific risks and regulatory requirements of residential builders versus those involved in highly specialized industrial projects. Segmentation by policy duration addresses the difference between short, rapid construction cycles and multi-year mega-projects, which require varying levels of long-tail liability coverage and renewal structures.

The dominance of the Construction All Risks (CAR) and Erection All Risks (EAR) segments reflects the market's core requirement for physical damage coverage during construction. However, the fastest-growing segments are often those addressing specialized liabilities, such as latent defects insurance, which covers structural flaws discovered years after completion, and specialized professional indemnity required for high-tech engineering firms. Geographically, markets are segmented based on economic development levels; mature markets emphasize liability and professional risk, while rapidly developing economies focus heavily on primary property damage coverage driven by sheer volume of new construction starts.

- By Type of Coverage:

- Construction All Risks (CAR)

- Erection All Risks (EAR)

- Third-Party Liability Insurance (TPL)

- Professional Indemnity (PI) Insurance

- Advance Loss of Profits (ALOP) / Delay in Start-Up (DSU)

- Latent Defects Insurance

- By End-User Sector:

- Residential Construction

- Commercial Construction (Office, Retail)

- Industrial Construction (Manufacturing Plants, Warehouses)

- Infrastructure Construction (Roads, Bridges, Utilities, Energy)

- By Policy Duration:

- Short-Term Policies (Under 1 Year)

- Long-Term Policies (Multi-Year Contracts)

Value Chain Analysis For Construction Project Insurance Market

The value chain in the Construction Project Insurance Market begins upstream with capital providers and reinsurers, who supply the financial capacity necessary to underwrite multi-billion dollar risks, determining the overall pricing environment and risk appetite. These large institutions absorb excess risk beyond the capacity of primary carriers. Midstream, the value chain is dominated by primary insurance carriers (underwriters) and insurance brokers/agents. Brokers act as crucial intermediaries, leveraging deep market knowledge to match complex construction risks with appropriate carrier capacity and coverage structures. Underwriters, using sophisticated actuarial models and risk engineering reports, determine policy terms and premiums. This phase is increasingly reliant on data analytics and predictive modeling for efficient risk selection.

Downstream, the chain involves the distribution channels—both direct sales to large, captive clients and indirect channels through independent brokers and managing general agents (MGAs)—and finally reaches the ultimate end-users: construction firms, property developers, and public entities. Crucially, post-sales services like risk engineering, loss prevention consultation, and efficient claims settlement form the final critical link. The quality and speed of claims handling directly impact customer retention and market reputation. Direct distribution is common for highly standardized or captive programs, while complex, unique risks typically flow through specialized brokerage firms that manage international placements and syndicated coverage.

The efficiency of the value chain is increasingly influenced by digitalization. Insurtech platforms are streamlining interactions between brokers and underwriters, reducing friction and accelerating the quote-to-bind process. The shift toward integrated risk management means that upstream capital providers are demanding better data visibility throughout the midstream and downstream activities. This pressure ensures that construction firms adopting advanced technologies like BIM and telematics are rewarded with favorable terms, thereby connecting technical innovation on the construction site directly back to the financial structure of the insurance product.

Construction Project Insurance Market Potential Customers

The core potential customers for Construction Project Insurance are diverse entities that bear financial risk during the planning and execution phases of building projects. This group primarily includes General Contractors (GCs), who are typically responsible for securing comprehensive site coverage as mandated by contract agreements with project owners. GCs require robust CAR/EAR policies, along with high-limit public liability coverage to protect against third-party injuries or property damage arising from their operations. Specialty subcontractors, such as those focusing on high-risk activities like steel erection, mechanical, electrical, and plumbing (MEP) work, also represent a significant customer base, often requiring specialized coverage extensions to protect their equipment and installed works, sometimes secured via Subcontractor Default Insurance (SDI).

Project Owners and Property Developers constitute another major customer segment, especially those requiring Owner Controlled Insurance Programs (OCIPs) or Contractor Controlled Insurance Programs (CCIPs), which consolidate all coverages under one master policy, standardizing terms and simplifying claims for all parties involved. Financial institutions and lenders are indirect but powerful customers, as they mandate adequate insurance coverage (especially ALOP/DSU) before releasing funds, ensuring their investment is protected against physical loss and subsequent financial delays. Public works agencies and governmental departments represent substantial buyers when commissioning major infrastructure projects, where regulatory compliance and long-term liability protection (like latent defects) are paramount concerns.

The shift towards integrated project delivery models and complex Public-Private Partnerships (PPPs) has broadened the customer base to include consortiums and special purpose vehicles (SPVs). These entities require bespoke, multi-line insurance solutions that integrate traditional property and casualty coverage with political risk, surety bonding, and specialized delay insurance. Effective risk mitigation, supported by insurance, is a critical success factor for these highly capitalized, long-duration projects. Therefore, professional insurance services are not merely a cost but an essential financial tool for risk transfer and project feasibility across the entire spectrum of construction stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $38.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allianz SE, AXA SA, Zurich Insurance Group, Chubb Limited, Munich Re, Swiss Re, Tokio Marine Holdings, Liberty Mutual Insurance, Travelers Companies Inc., AIG, Sompo Holdings, Generali Group, CNA Financial Corporation, QBE Insurance Group, Mapfre S.A., Hiscox Ltd., Beazley Group, Markel Corporation, R+V Versicherung, Hanover Insurance Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Project Insurance Market Key Technology Landscape

The technological landscape transforming the Construction Project Insurance Market is centered on the integration of Insurtech solutions designed to improve risk visibility and automate operational processes. Building Information Modeling (BIM) stands as a foundational technology; it provides underwriters with a complete, digital twin of the project before construction even begins, allowing for detailed analysis of material placement, structural integrity, and potential exposure to hazards. This integration significantly improves the accuracy of calculating the Maximum Probable Loss (MPL) and enables tailored coverage based on precise construction phases rather than generalized estimates. Furthermore, the increasing reliance on cloud-based platforms facilitates real-time data exchange between contractors, brokers, and insurers, accelerating the quoting and issuance processes, which traditionally were cumbersome and time-consuming.

IoT and sensor technology represent a major paradigm shift in proactive risk mitigation. Devices deployed on construction sites monitor environmental conditions (temperature, humidity), asset location, worker safety compliance, and machinery performance. This real-time telemetry data is fed into insurer platforms, allowing for immediate alerts regarding unsafe practices or impending material damage risks, effectively shifting the insurance relationship from pure financial indemnification to a partnership focused on loss prevention. For instance, sensors monitoring concrete curing can prevent premature structural failure, mitigating a significant source of claims. These data streams are also crucial for supporting the growing trend of usage-based and parametric insurance products, tying premium costs directly to observed risk behaviors and objective external data triggers.

The use of drones and geospatial intelligence further enhances the claims and underwriting processes. Drones conduct rapid, detailed site inspections and damage assessments, especially after major incidents, providing high-resolution visual evidence that speeds up the claims cycle and reduces adjustor travel time and associated costs. Satellite imagery provides ongoing monitoring of large infrastructure projects, verifying construction progress and detecting unauthorized activities or deviations from plan, which is vital for long-term project monitoring and DSU policy enforcement. Artificial Intelligence (AI) and Machine Learning (ML) algorithms underpin all these data inputs, analyzing patterns to refine pricing models, optimize reinsurance placement strategies, and predict future claims severity with increasing accuracy.

Regional Highlights

Regional dynamics heavily influence the demand, pricing, and specific types of coverage required within the Construction Project Insurance Market. Mature markets in North America (NA) and Europe are characterized by stringent liability laws, sophisticated financial structuring, and a strong focus on professional indemnity and delay-in-start-up coverage for high-value commercial and specialized infrastructure projects. Conversely, the Asia Pacific (APAC) region is the primary engine of volume growth, driven by unprecedented infrastructure development in emerging economies, necessitating high volumes of standard CAR and EAR policies, though often facing challenges related to differing regulatory standards and increased exposure to natural catastrophes like typhoons and floods. The Middle East and Africa (MEA) region presents a highly complex environment, marked by massive capital projects (e.g., smart city developments, energy infrastructure) that require significant political risk insurance and specialized coverage due to geopolitical instability and highly concentrated project values.

- North America (NA): Characterized by high litigation rates, driving demand for elevated limits in general liability and professional indemnity. Focus on standardized OCIP/CCIP programs for large projects. Technological adoption (BIM, Insurtech) is highly advanced, enabling sophisticated risk modeling.

- Europe: Regulatory environment, particularly regarding environmental and latent defects liability, is strict. High demand for specialized coverage related to renewable energy installations (onshore and offshore wind) and compliance with EU safety standards. Emphasis on sustainability and green construction risks.

- Asia Pacific (APAC): Highest volume growth region, fueled by rapid urbanization and government infrastructure initiatives (e.g., Belt and Road Initiative). Market capacity is expanding rapidly, but challenges remain regarding reinsurance dependency for mega-risks and high catastrophe exposure (earthquakes, cyclones).

- Latin America (LATAM): Growth is tied heavily to commodity cycles and political stability. Demand is solid in urban centers for commercial and residential construction. Pricing is often volatile due to high inflation and macroeconomic uncertainties affecting project costs and timelines.

- Middle East and Africa (MEA): Defined by extremely large, concentrated project values, particularly in the Gulf Cooperation Council (GCC) states (e.g., Saudi Arabia, UAE). Requires specialized political risk and terrorism coverage alongside standard project insurance. Market growth is heavily influenced by sovereign spending on diversification projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Project Insurance Market.- Allianz SE

- AXA SA

- Zurich Insurance Group

- Chubb Limited

- Munich Re

- Swiss Re

- Tokio Marine Holdings

- Liberty Mutual Insurance

- Travelers Companies Inc.

- American International Group (AIG)

- Sompo Holdings

- Generali Group

- CNA Financial Corporation

- QBE Insurance Group

- Mapfre S.A.

- Hiscox Ltd.

- Beazley Group

- Markel Corporation

- R+V Versicherung

- Hanover Insurance Group

Frequently Asked Questions

Analyze common user questions about the Construction Project Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CAR and EAR insurance policies?

Construction All Risks (CAR) insurance covers civil projects and general building risks, such as residential or commercial structures. Erection All Risks (EAR) specifically targets installation risks associated with machinery, steel structures, and plant equipment, typically used in power plants or industrial facilities, covering the assembly and testing phases.

How is climate change impacting the cost and availability of construction project insurance?

Climate change increases the frequency and severity of extreme weather events (e.g., floods, wildfires), directly raising the insurer’s risk exposure. This leads to higher premiums, stricter underwriting terms, increased deductibles, and sometimes reduced capacity, especially for projects located in catastrophe-prone areas.

What role does Building Information Modeling (BIM) play in construction insurance underwriting?

BIM provides insurers with a detailed digital model of the project, enabling precise risk assessment before construction begins. It allows underwriters to accurately calculate maximum probable loss (MPL), identify potential design flaws, and offer more precise pricing based on structural integrity and specific construction phases.

What are Owner Controlled Insurance Programs (OCIPs), and why are they used?

OCIPs (also known as Wrap-Ups) are master policies purchased by the project owner to cover all contractors and subcontractors on a single site. They standardize coverage, eliminate gaps between different policies, ensure adequate limits, and often simplify the claims process, leading to lower overall project insurance costs.

Which segments are showing the fastest growth rate in the construction project insurance market?

The fastest growth is observed in the Professional Indemnity (PI) segment, driven by increasing complexity and accountability in engineering and design, and in the Advance Loss of Profits/Delay in Start-Up (ALOP/DSU) segment, reflecting rising awareness among project owners regarding financial protection against project delays.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager