Construction Safety Helmets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435087 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Construction Safety Helmets Market Size

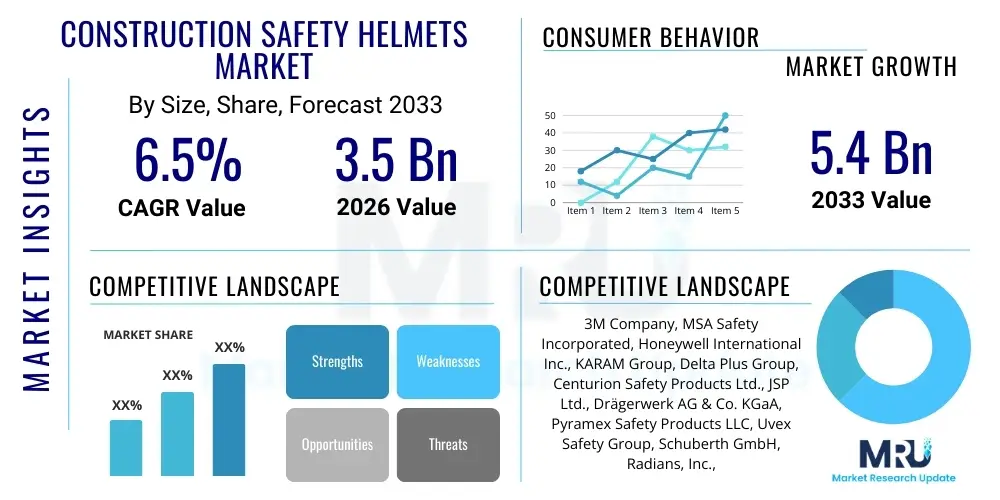

The Construction Safety Helmets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Construction Safety Helmets Market introduction

The Construction Safety Helmets Market encompasses the production, distribution, and utilization of protective headgear specifically designed to mitigate risks and prevent severe injuries on construction and industrial sites. These helmets, often referred to as hard hats, are mandated by stringent occupational safety regulations globally, serving as essential Personal Protective Equipment (PPE) to guard against falling objects, blunt force trauma, electrical hazards, and lateral impact penetration. The increasing complexity of construction projects, coupled with a renewed focus on worker welfare and liability reduction, forms the fundamental market driver, necessitating continuous innovation in helmet design, materials science, and integration of smart technologies.

Products within this market range from conventional Type I helmets (designed primarily for top impact) to advanced Type II helmets (offering protection against top and lateral impacts), utilizing materials such as High-Density Polyethylene (HDPE), Acrylonitrile Butadiene Styrene (ABS), and advanced polycarbonate composites. Major applications span the entirety of the construction lifecycle, including civil infrastructure development, commercial building construction, residential projects, and specialized industrial maintenance and refurbishment activities. The primary benefit derived from these products is the drastic reduction in catastrophic head injuries, leading to decreased healthcare costs, minimal project downtime, and enhanced compliance with international standards set by bodies like OSHA (Occupational Safety and Health Administration) and ANSI (American National Standards Institute).

Key driving factors accelerating market expansion include rapid urbanization in developing economies, leading to a surge in infrastructure spending; stricter enforcement of workplace safety legislation across North America and Europe; and the technological shift towards integrating IoT and sensor technology into helmets for real-time monitoring of worker safety and environmental conditions. Furthermore, the mandatory replacement cycles for safety helmets, typically dictated by material degradation and regulatory standards (often every 5 years), ensures persistent demand regardless of temporary construction slowdowns, solidifying the market's resilience and growth trajectory through the forecast period.

Construction Safety Helmets Market Executive Summary

The Construction Safety Helmets Market is undergoing significant evolution, driven primarily by technological integration and shifting regulatory landscapes, positioning safety and connectivity as paramount industry standards. Business trends are characterized by a strong emphasis on material innovation—moving beyond traditional materials to incorporate lightweight composites and sustainable polymers that offer superior impact absorption and longevity. Strategic mergers, acquisitions, and partnerships between PPE manufacturers and technology firms are commonplace, aiming to accelerate the development of 'smart helmets' equipped with GPS tracking, proximity sensors, environmental monitoring, and communication systems. Furthermore, manufacturers are increasingly focusing on customization and ergonomic design to improve worker comfort and compliance, recognizing that adoption rates correlate directly with wearability and reduced physical strain during long shifts.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, fuelled by massive government investments in mega-infrastructure projects, particularly in China, India, and Southeast Asian nations, alongside the rapid industrialization demanding greater safety oversight. North America and Europe, while mature markets, maintain dominance in terms of adopting premium, high-specification safety helmets and leading the charge in implementing strict Type II lateral impact protection standards. Regional trends also reflect variations in preferred helmet style, with hard hats being traditional in North America, while safety helmets conforming to EN standards (often incorporating integrated face shields or earmuffs) are prevalent in European construction settings. Regulatory convergence and standardization efforts across these regions are gradually simplifying global trade but simultaneously raising the minimum performance threshold for all market participants.

Segment trends reveal that the Type II helmet category is experiencing faster growth than Type I, reflecting global efforts to mandate comprehensive side and lateral impact protection, moving safety protocols beyond basic overhead protection. In terms of material, High-Density Polyethylene (HDPE) remains the dominant choice due to its cost-effectiveness and durability, yet Acrylonitrile Butadiene Styrene (ABS) and advanced carbon fiber composites are gaining traction in specialized, high-risk environments, valued for their higher strength-to-weight ratio and greater temperature resistance. The end-user segmentation shows that the general Construction and Infrastructure sector retains the largest market share, though specialized segments like Oil & Gas and Mining are critical revenue streams for premium, high-visibility, and electrically insulated helmet variants, demonstrating inelastic demand for specialized safety features crucial to extreme operating conditions.

AI Impact Analysis on Construction Safety Helmets Market

User queries regarding AI's influence on the safety helmets market frequently center on three main themes: the efficacy of predictive analytics in preventing accidents, the integration challenges of incorporating complex sensor data into existing safety infrastructure, and the ethical implications surrounding continuous worker monitoring. Users are keen to understand how AI algorithms can analyze real-time data collected from smart helmets—including heart rate, posture, gas detection, and geo-location—to predict fatigue or imminent hazards, moving safety protocols from reactive reporting to proactive intervention. Key concerns revolve around data privacy, the cost-prohibitive nature of large-scale smart helmet deployment for small to medium-sized enterprises (SMEs), and ensuring the interoperability of AI-driven safety platforms with other construction management systems like Building Information Modeling (BIM) or project scheduling software.

The practical application of AI in this domain fundamentally shifts the role of the safety helmet from a passive protective barrier to an active data collection and risk mitigation tool. AI models are trained on historical accident data combined with current operational parameters (e.g., temperature, noise levels, proximity warnings) to identify behavioral patterns or environmental stress factors that typically precede incidents. For instance, if an AI detects irregular movement patterns or prolonged periods of inactivity in a high-risk zone via helmet sensors, it can trigger immediate alerts to both the worker and the supervisor. This capability transforms site management by providing objective metrics on compliance, optimizing resource deployment during emergencies, and offering granular insights into specific site dangers that are otherwise invisible through manual inspection processes.

Furthermore, AI algorithms are vital for optimizing the longevity and reliability of the PPE itself. Predictive maintenance models, using data on material exposure (UV radiation, chemical splashes) gathered by helmet sensors, can accurately determine the optimal replacement time for individual helmets, potentially extending their useful life while guaranteeing compliance with safety integrity standards. This not only reduces waste but ensures that the protective quality of the gear never falls below the mandated threshold. The market’s successful transition will hinge on developing robust, edge computing capabilities within the helmet unit to process data locally before transmitting aggregated, anonymized insights, thereby addressing data latency and privacy concerns while maintaining operational efficiency.

- AI enhances risk prediction by analyzing real-time biometric and environmental data from smart helmets.

- Predictive analytics models facilitate proactive safety alerts regarding fatigue, proximity risks, and hazardous gas exposure.

- AI optimizes compliance monitoring by providing objective metrics on mandatory helmet usage in designated zones.

- Computer vision integrated into helmet-mounted cameras uses AI for object detection and hazard identification (e.g., approaching machinery).

- Machine learning improves the accuracy of fall detection and non-movement alerts, significantly reducing emergency response times.

DRO & Impact Forces Of Construction Safety Helmets Market

The dynamics of the Construction Safety Helmets Market are predominantly shaped by a robust legislative framework compelling utilization, contrasted by cost pressures and resistance to technological upgrades. Key drivers (D) include the expansion of infrastructure globally and the increasing severity of penalties for workplace safety violations, making investment in high-quality PPE a necessity rather than a choice. Restraints (R) primarily involve the high upfront cost of advanced smart helmets, which deter smaller construction firms, and the pervasive issue of non-compliance or improper helmet use among workers who cite discomfort or poor ventilation. Opportunities (O) are plentiful in emerging markets through the introduction of affordable, yet standard-compliant, smart safety solutions and the development of sustainable, lightweight materials that address worker comfort issues.

The market is subjected to significant impact forces stemming from regulatory changes and technological disruption. The intensification of regulatory oversight, especially the push for comprehensive lateral protection (Type II certification) in regions previously focused only on top-impact protection, forces manufacturers to redesign existing product lines and drives replacement cycles for non-compliant equipment. Simultaneously, the rapid evolution of IoT and sensor technology profoundly impacts the competitive landscape, creating a bifurcation between traditional PPE manufacturers and those actively integrating sophisticated digital solutions. Companies that fail to adapt their product portfolios to include connectivity and data analytics capabilities risk losing market share to specialized tech-enabled competitors, fundamentally shifting the competitive advantage from mere material strength to data utility and integration potential.

External impact forces also include macroeconomic volatility and sustainability mandates. Fluctuations in raw material prices (HDPE, ABS) directly affect manufacturing costs and pricing strategies across the industry, requiring complex supply chain risk management. Furthermore, the construction industry faces increasing environmental scrutiny, pushing the market towards adopting recyclable, low-carbon footprint materials and transparent manufacturing processes. Companies successfully demonstrating commitment to sustainability, while maintaining high safety performance, are better positioned to capture contracts from large governmental and corporate clients who prioritize Environmental, Social, and Governance (ESG) criteria in their procurement decisions. These combined forces mandate a strategic shift towards innovation-led growth and operational resilience.

Segmentation Analysis

The Construction Safety Helmets Market is systematically segmented based on Type, Material, Application, and Distribution Channel, allowing for precise market targeting and strategic development. The segmentation reflects both regulatory requirements and varied end-user needs across diverse operational environments. Analyzing these segments provides critical insights into the areas of fastest growth, which currently lean towards high-performance materials and products offering advanced multi-directional protection (Type II), demonstrating a global commitment to superior safety standards that address complex construction hazards like swings, lateral impact, and entanglement risks. This granular view assists stakeholders in identifying lucrative niche markets, such as specialty helmets for electrical maintenance or high-heat environments, which demand specific material properties and certifications.

- By Type:

- Type I (Top Impact Protection)

- Type II (Top and Lateral Impact Protection)

- By Material:

- High-Density Polyethylene (HDPE)

- Acrylonitrile Butadiene Styrene (ABS)

- Polycarbonate (PC)

- Fiberglass

- Aluminum

- By Application (End-Use Industry):

- Construction and Infrastructure

- Oil & Gas

- Mining

- Manufacturing and Industrial

- Utilities and Energy

- By Distribution Channel:

- Direct Sales

- Indirect Sales (Distributors, E-commerce, Retailers)

Value Chain Analysis For Construction Safety Helmets Market

The value chain for construction safety helmets begins with upstream activities, focusing heavily on raw material procurement and advanced polymer synthesis. Key upstream players include chemical manufacturers supplying crucial materials such as HDPE, ABS resins, and specialized polycarbonate compounds, which form the shell, as well as textile manufacturers providing suspension systems and padding. The efficiency and quality consistency in this initial phase are critical, as they directly impact the helmet's final performance characteristics, including impact resistance, UV stability, and overall weight. Strategic partnerships with raw material suppliers are essential for manufacturers to maintain cost control, secure consistent supply volumes, and facilitate the development of novel composite materials aimed at enhancing safety and sustainability credentials.

The manufacturing and downstream segment encompasses the core production processes, including injection molding, assembly of suspension systems, quality testing, and certification alignment (e.g., meeting ANSI Z89.1 or EN 397 standards). This phase is capital-intensive, particularly for companies integrating advanced features like sensor technology, communication modules, and specialized coating processes. Following manufacturing, the distribution channel plays a vital role. Direct sales channels, where manufacturers interface directly with large construction conglomerates or governmental agencies, ensure volume efficiency and provide customized supply solutions. Conversely, indirect channels, involving specialized PPE distributors, hardware retailers, and increasingly, robust B2B e-commerce platforms, ensure market penetration to smaller enterprises and facilitate swift regional availability, optimizing logistical responsiveness across vast geographical areas.

Effective downstream management involves not only efficient logistics but also comprehensive post-sale support, including regulatory guidance, product training, and material disposal advisories. End-users, comprising project managers, safety officers, and procurement departments, prioritize reliability, certification compliance, and worker acceptance. The integration of technology, particularly through third-party software developers providing AI safety platforms compatible with smart helmets, represents a growing secondary downstream ecosystem. Successful firms prioritize streamlined distribution networks capable of handling high-volume, global orders, alongside developing strong distributor relationships that act as local knowledge centers for regulatory adherence and product demonstration, ensuring the final mile of delivery is timely and informative.

Construction Safety Helmets Market Potential Customers

The primary customers for construction safety helmets are organizations and entities legally or ethically mandated to provide a safe working environment for their personnel, predominantly revolving around sectors characterized by high levels of physical hazard exposure and regulated work zones. These end-users are not merely consumers of the product but active participants in the safety ecosystem, driving demand for specific features based on their operational profiles, such as anti-static properties for explosive atmospheres or high-voltage insulation for utility work. Procurement decisions are typically centralized, led by dedicated safety or procurement departments, where long-term cost of ownership, compliance track record, material certification, and supplier reliability often outweigh initial purchase price, particularly among large multinational construction firms (Tier 1 contractors) and major industrial operators.

The most significant cohort of buyers resides within the general Construction and Infrastructure sector, encompassing both residential and commercial development, along with massive public works projects like bridge construction, highway upgrades, and mass transit system development. These customers require high-volume, durable, standard-compliant helmets, with a growing preference for comfort features to maximize worker compliance. Another critical customer segment includes highly regulated industries such as Mining, Oil & Gas (onshore and offshore operations), and the Utilities sector (electric power generation, transmission, and distribution). These groups frequently purchase premium, specialized helmets that meet rigorous supplementary standards, such as flame resistance (FR), specialized chemical resistance, or those integrating complex communication systems essential for remote or confined space operations.

Furthermore, government agencies and municipal maintenance departments represent stable, high-volume purchasers. Their procurement processes are often characterized by mandatory adherence to specific national safety standards and long-term supply contracts. Smaller potential customers, such as local subcontractors and specialized trade firms (e.g., roofing contractors, scaffolding companies), typically source their PPE through indirect distribution channels like industrial supply houses and e-commerce platforms. The market is also seeing increasing adoption from the manufacturing sector, particularly within heavy manufacturing and assembly lines, where overhead hazards or material handling risks necessitate certified head protection, broadening the traditional customer base beyond strictly outdoor construction sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, MSA Safety Incorporated, Honeywell International Inc., KARAM Group, Delta Plus Group, Centurion Safety Products Ltd., JSP Ltd., Drägerwerk AG & Co. KGaA, Pyramex Safety Products LLC, Uvex Safety Group, Schuberth GmbH, Radians, Inc., Protective Industrial Products (PIP), Mallcom (India) Ltd., Gateway Safety Inc., SureWerx (Pioneer), Bullard, Ergodyne, Midas Safety, HexArmor |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Construction Safety Helmets Market Key Technology Landscape

The technological landscape of the construction safety helmets market is rapidly transforming, moving from passive protection to integrated, active monitoring systems, commonly termed 'smart helmets.' Material science remains foundational, with continuous research into lightweight, high-performance polymers and composites that enhance energy absorption capabilities, especially against oblique impacts, while minimizing overall weight to improve worker comfort and adoption. Innovations in suspension systems, such as adjustable ratchet mechanisms, foam liners, and complex webbing designs, are crucial for mitigating rotational forces—a leading cause of severe brain injuries—and ensuring the helmet maintains proper positioning even during dynamic work activities. This focus on rotational energy management, drawing inspiration from sports safety technology, represents a significant performance benchmark.

The most disruptive technological shift involves the incorporation of Internet of Things (IoT) sensors and connectivity modules into the helmet shell. These integrated technologies enable a wide array of functions, including environmental monitoring (detecting toxic gases, excessive noise, or high temperatures), GPS tracking for geo-fencing and real-time location services (RTLS), and biometrics tracking (heart rate, fatigue detection). Furthermore, smart helmets are often equipped with communication capabilities, such as integrated noise-cancelling microphones and speakers, facilitating hands-free communication across loud job sites. The data generated by these sensors is transmitted wirelessly, often utilizing low-power wide-area networks (LPWAN) or dedicated site networks, to a centralized safety platform for analysis using artificial intelligence and predictive algorithms.

Augmented Reality (AR) and Heads-Up Displays (HUDs) are emerging technologies beginning to find application in specialized high-end safety helmets. These displays project crucial information—such as schematics, safety checklists, hazard warnings, or machinery status—directly into the worker's field of vision, eliminating the need to look away from the task and increasing operational efficiency and situational awareness. Power management remains a key technical challenge, necessitating the development of highly efficient, rechargeable battery systems that can reliably support the integrated electronic suite for an entire shift without adding excessive bulk. The convergence of superior material engineering, miniaturized electronics, and robust software analytics defines the competitive edge in the modern construction safety helmet market.

Regional Highlights

Regional dynamics play a crucial role in shaping the Construction Safety Helmets Market, primarily due to variances in regulatory enforcement, industrial maturity, and climate-specific requirements. North America (NA) and Europe maintain their lead in demanding high-specification products, especially Type II helmets that comply with rigorous lateral impact standards (e.g., ANSI Z89.1-2014 Type II or EN 397/EN 12492 standards). In North America, strict enforcement by OSHA, coupled with a strong emphasis on reducing liability costs, drives rapid adoption of smart safety solutions and premium, comfort-focused designs. The European market, characterized by mature safety cultures and defined CE marking requirements, shows a high penetration rate for aesthetically integrated helmets often featuring accessories like integrated eye protection and hearing protection.

Asia Pacific (APAC) represents the dominant growth engine, driven by unprecedented investment in urbanization and massive infrastructure expansion projects across China, India, and Southeast Asia. While cost sensitivity remains a factor in procurement across many APAC nations, the increasing visibility of international safety standards among global construction firms operating in the region is rapidly raising the minimum quality expectation. Governments in key APAC economies are also strengthening their labor safety laws, translating directly into increased mandatory use of certified PPE. This region offers the highest potential for volume growth, although the pace of smart helmet adoption is slower than in the West, concentrating initial demand on durable, affordable HDPE and ABS Type I helmets.

The Latin America (LATAM) and Middle East and Africa (MEA) markets are characterized by segmented demand. LATAM is seeing moderate growth fueled by recovering economies and increased mining activity, often adopting standards influenced by US or European regulations. The Middle East, particularly the Gulf Cooperation Council (GCC) states, shows robust demand for high-specification, high-heat resistant helmets, driven by large-scale commercial and energy infrastructure projects. MEA requires products designed to withstand extreme environmental conditions (high temperatures, intense UV exposure) and often prioritize durability and reliability over advanced smart features, though the oil and gas sector remains a lucrative market for connected safety devices.

- North America (NA): High adoption of Type II and smart helmets; driven by stringent OSHA compliance and focus on liability reduction; leading region in technology integration.

- Europe: Mature market emphasizing ergonomic design, integrated accessories, and compliance with EN standards; strong demand for materials offering advanced rotational protection.

- Asia Pacific (APAC): Fastest-growing region due to infrastructure boom; increasing regulatory pressure; high volume demand primarily for cost-effective Type I helmets, with slow but accelerating smart technology adoption.

- Latin America (LATAM): Growth linked to mining and construction recovery; demand influenced by international safety protocols; rising importance of affordable, certified protection.

- Middle East and Africa (MEA): Focus on specialized, high-durability helmets resistant to extreme heat and harsh UV exposure, particularly in Oil & Gas and large-scale urban development projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Construction Safety Helmets Market.- 3M Company

- MSA Safety Incorporated

- Honeywell International Inc.

- KARAM Group

- Delta Plus Group

- Centurion Safety Products Ltd.

- JSP Ltd.

- Drägerwerk AG & Co. KGaA

- Pyramex Safety Products LLC

- Uvex Safety Group

- Schuberth GmbH

- Radians, Inc.

- Protective Industrial Products (PIP)

- Mallcom (India) Ltd.

- Gateway Safety Inc.

- SureWerx (Pioneer)

- Bullard

- Ergodyne

- Midas Safety

- HexArmor

Frequently Asked Questions

Analyze common user questions about the Construction Safety Helmets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used in modern safety helmets?

Modern safety helmets predominantly use High-Density Polyethylene (HDPE) and Acrylonitrile Butadiene Styrene (ABS) due to their durability and cost-effectiveness. High-performance models often incorporate polycarbonate or advanced composites like carbon fiber for enhanced protection, lower weight, and increased resistance to electrical or chemical hazards, meeting specific industrial requirements for superior impact absorption.

What is the difference between Type I and Type II construction safety helmets?

Type I helmets are certified to protect against vertical (top) impact and penetration only, safeguarding the crown of the head. Type II helmets offer comprehensive protection, certified against both vertical impact and lateral impact (side, front, and rear), addressing complex hazards such as swinging objects or falls where angular impact is a risk. Regulatory trends favor Type II for enhanced worker safety.

How does the integration of IoT technology enhance construction safety helmets?

IoT integration transforms helmets into smart safety devices by embedding sensors for real-time monitoring. These sensors track worker location (GPS), environmental conditions (gas, temperature), and worker biometrics (fatigue). This data enables predictive analytics and instant alerts for supervisors, allowing for proactive intervention and significantly reducing emergency response times in critical situations.

What regulatory standards primarily govern the market globally?

The market is globally governed by key standards: the American National Standards Institute (ANSI) Z89.1 in North America, specifying requirements for impact, penetration, and electrical insulation; and the European Standard (EN) 397 or EN 12492, which dictate performance requirements for industrial safety helmets and mountaineering helmets adapted for industrial use, respectively. Compliance with these standards is mandatory for market entry.

What is the typical lifespan or replacement cycle for a construction safety helmet?

Most manufacturers and regulatory guidelines recommend replacing safety helmet shells every five years, irrespective of apparent damage, due to material degradation caused by UV exposure, temperature fluctuations, and chemical contact which compromises impact resistance. Suspension systems, which absorb impact energy, typically require more frequent inspection and replacement, often annually or biannually.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager