Consumer Audio Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434240 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Consumer Audio Market Size

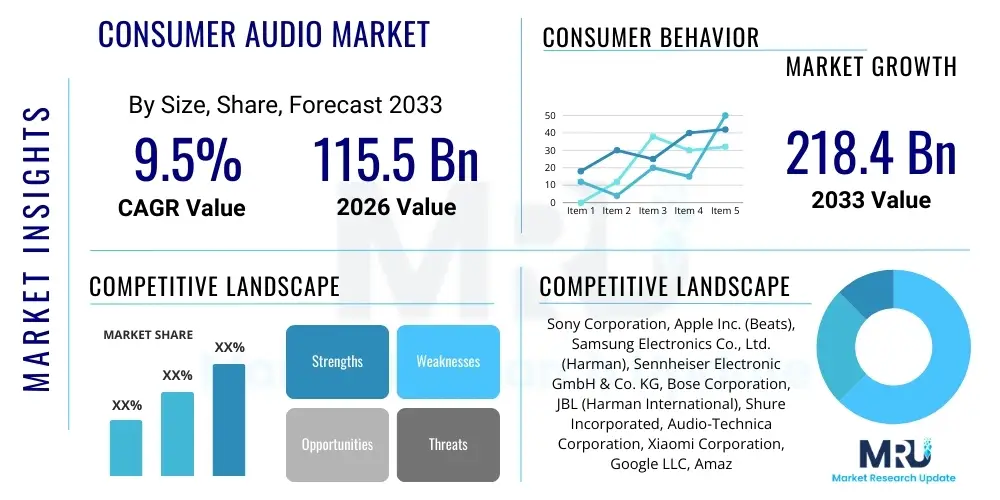

The Consumer Audio Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 218.4 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the ubiquitous adoption of smartphones and streaming services, which necessitate high-quality, portable audio solutions for everyday use. The shift away from wired connections toward truly wireless stereo (TWS) devices represents the most significant structural change contributing to this robust market valuation.

The valuation reflects not only volume growth but also a crucial transition toward premiumization. Consumers are increasingly willing to invest in features such as Active Noise Cancellation (ANC), spatial audio capabilities, and personalized sound calibration, elevating the average selling price (ASP) across key product categories including headphones, soundbars, and smart speakers. Furthermore, advancements in battery life and the integration of sophisticated chipsets supporting low-latency transmission protocols are cementing wireless audio as the standard, accelerating market proliferation in developing and developed economies alike.

Consumer Audio Market introduction

The Consumer Audio Market encompasses a diverse range of devices designed for personal and domestic sound reproduction, including headphones, earphones, soundbars, home theatre systems, and portable wireless speakers. Key products like True Wireless Stereo (TWS) earbuds have revolutionized personal audio mobility, offering unparalleled convenience and performance, while smart speakers integrate artificial intelligence and voice assistants, transforming how households interact with media and smart home ecosystems. Major applications span entertainment (music listening, movies), communication (voice calls, conferencing), and health and fitness (tracking via integrated sensors).

The principal benefits derived from modern consumer audio devices include immersive listening experiences facilitated by technologies like spatial audio and high-resolution streaming codecs, freedom of movement enabled by robust wireless connectivity, and the ability to mitigate environmental noise through advanced ANC features. Driving factors include the global expansion of digital music streaming platforms, the surge in mobile gaming requiring low-latency audio, and the permanent shift toward hybrid work models necessitating high-clarity communication tools. Technological convergence, marrying audio performance with smart functionalities and seamless device interoperability, continues to propel consumer spending and market innovation.

Consumer Audio Market Executive Summary

The Consumer Audio Market is experiencing dynamic growth, characterized by the continued dominance of the wireless segment, particularly True Wireless Stereo (TWS) earbuds, which now represent the highest volume growth category. Business trends indicate aggressive mergers and acquisitions focused on acquiring specialized acoustic technology and sophisticated software capabilities, moving beyond hardware differentiation. Companies are prioritizing software ecosystem integration and subscription services (e.g., personalized sound profiles or premium content access) to secure recurring revenue streams and enhance customer loyalty, signaling a move from purely transactional sales toward service-oriented models. Supply chain resilience has also improved significantly, adapting to geopolitical shifts by diversifying manufacturing footprints, notably expanding operations in Southeast Asia beyond traditional centers.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by a massive, young population exhibiting high disposable income growth and rapid smartphone adoption. This region is characterized by intense price competition in the entry-to-mid-range segment but is simultaneously showing a strong appetite for premium audio brands. North America and Europe, while more mature, remain critical markets for innovation, acting as early adopters of high-end features such as spatial audio, advanced noise cancellation, and integrated hearing enhancement technologies. These regions drive the ASP (Average Selling Price) upward, focusing on brand heritage and seamless integration within existing digital ecosystems (Apple, Google, Amazon).

Segmentation trends highlight the shift in consumer preference toward multifunctional devices. Headphones, particularly TWS, are evolving into lifestyle platforms incorporating health monitoring (heart rate, temperature) and enhanced communication tools. Conversely, the smart speaker segment is maturing, focusing less on novelty and more on audio quality improvements, multi-room synchronization, and robust privacy features. Soundbars continue to see increased adoption as home entertainment centers evolve, driven by consumer demand for cinema-quality sound without the complexity and space requirements of traditional multi-speaker setups. The market is consolidating around wireless ecosystems, making interoperability and battery efficiency central competitive battlegrounds across all product types.

AI Impact Analysis on Consumer Audio Market

Common user inquiries regarding AI's influence in the Consumer Audio Market center on four key areas: the effectiveness and personalization of Active Noise Cancellation (ANC), the intelligence and capability of integrated voice assistants, the creation of personalized sound profiles (adaptive EQ), and the future of spatial audio processing. Users are particularly concerned about how AI can enhance the listening experience beyond simple sound reproduction, asking if AI can filter only specific, unwanted noises in real-time or automatically adjust audio settings based on the listener's environment and health data. The core theme is the expectation that AI will deliver highly individualized, context-aware, and predictive audio performance, moving devices from passive receivers to active, intelligent companions.

This user demand highlights a pivot toward computational audio, where sound is not merely reproduced but actively processed and managed by sophisticated algorithms. AI facilitates highly granular control over noise profiles, enabling 'adaptive transparency' modes that dynamically adjust the level of ambient sound permitted, enhancing situational awareness or focus. Furthermore, AI models are essential for improving beamforming microphones in communication devices, drastically enhancing voice clarity during calls by accurately separating the user's voice from background chatter, a critical feature for the expanding remote work demographic. The long-term expectation is that AI will be foundational to future hearing health integration, using machine learning to detect early signs of hearing degradation and automatically compensating audio output for the individual user's auditory needs.

- AI-Powered Active Noise Cancellation (ANC): Utilizes machine learning to dynamically identify and cancel complex, non-static noises (e.g., human voices, keyboard clicks) more effectively than traditional fixed-algorithm ANC, offering superior noise isolation precision.

- Personalized Audio Profiles (Adaptive EQ): AI algorithms analyze the listener's ear canal shape, environmental acoustics, and hearing sensitivity to automatically calibrate the frequency response curve for optimal individualized sound quality and safety.

- Enhanced Voice Assistant Integration: AI enables more natural language processing, predictive responses, and complex task execution via smart speakers and headphones, integrating seamlessly into smart home and IoT ecosystems.

- Computational Spatial Audio: Machine learning improves the accuracy and immersion of spatial audio technologies by optimizing head tracking and psychoacoustic modeling in real-time, creating a more realistic and responsive 3D soundscape.

- Predictive Device Maintenance: AI monitors the performance metrics of drivers and internal components, alerting users to potential hardware issues or necessary firmware updates before audio degradation occurs, enhancing product longevity.

- Biometric Data Processing: Integration of AI with embedded sensors (e.g., heart rate, body temperature) allows audio devices to double as sophisticated health and wellness trackers, tailoring audio output or suggesting breaks based on physiological data.

DRO & Impact Forces Of Consumer Audio Market

The Consumer Audio Market is principally driven by the relentless consumer demand for seamless wireless connectivity, primarily fueled by the ubiquity of high-bandwidth streaming content and the mobile-centric lifestyles of younger generations. The transition to advanced Bluetooth standards, coupled with decreasing component costs for powerful chipsets, has democratized premium features like TWS and ANC, making high-quality audio accessible to broader segments. However, the market faces significant restraints, chiefly concerning rapid technological obsolescence, which shortens product lifecycles and places persistent pressure on manufacturers to innovate frequently. The continued influx of counterfeit products, particularly in fast-growing emerging markets, also erodes consumer trust and brand revenue.

Opportunities abound in specialized market niches, especially in the realm of personalized sound and health integration. The development of next-generation features such as high-resolution wireless streaming (Hi-Res Audio Wireless), Ultra-Low Latency (ULL) technologies critical for gaming and VR/AR applications, and the embedding of sophisticated hearing aid functionality into conventional earbuds present substantial avenues for premium segment growth. Impact forces driving the market include socio-economic factors like the increase in disposable income globally and regulatory trends promoting audio safety standards (preventing noise-induced hearing loss), which influence product design and feature mandates.

Furthermore, the competitive landscape is intensified by the entry of technology giants (like Apple, Amazon, and Google) who prioritize ecosystem integration over singular device features, forcing traditional audio specialists to partner or specialize intensely. The primary impact force remains the standardization of connection protocols (such as Bluetooth LE Audio), which promises lower power consumption and improved audio quality across devices, driving the next wave of product refresh cycles. Sustainability and repairability are also emerging as key purchasing criteria, prompting companies to rethink materials and modular design, although this adds complexity to manufacturing processes.

Segmentation Analysis

The Consumer Audio Market is highly segmented based on product type, connectivity, distribution channel, and application, reflecting the diverse needs and budgets of the global consumer base. The proliferation of specialized audio use cases, ranging from competitive gaming requiring ultra-low latency to professional video conferencing demanding superior voice clarity, dictates the ongoing refinement of product categories. The segmentation strategy is crucial for manufacturers, allowing targeted innovation in areas like TWS features for mobility, dedicated soundbars for home cinema immersion, or robust portable speakers for outdoor environments. The primary competitive dynamics are currently playing out within the wireless segment, where differentiation is achieved through battery performance, sound tuning, and smart feature integration.

By technology, the shift from wired to wireless is near-complete, but within wireless, the segmentation by codec (SBC, AAC, aptX, LDAC, LC3) determines the potential for high-resolution audio delivery, strongly influencing pricing and target demographics. The distribution channel remains critical, with online sales gaining continuous momentum due to better price transparency and direct-to-consumer (D2C) models, although traditional brick-and-mortar stores retain importance for hands-on demos, particularly for high-end headphones and complex home theatre systems. Analyzing these segments is essential for understanding regional variations, such as the preference for lower-cost, high-volume TWS units in emerging APAC markets versus the demand for premium, multi-functional home audio setups in North America and Western Europe.

- By Product Type:

- Headphones and Earphones

- True Wireless Stereo (TWS) Earbuds (Highest Growth Segment)

- Neckband/Collar Headphones

- Over-Ear Headphones (Wired and Wireless)

- On-Ear Headphones

- Speakers

- Portable Wireless Speakers (Bluetooth and Wi-Fi)

- Smart Speakers (Voice Assistant Integrated)

- Multi-Room Wireless Systems

- Traditional Hi-Fi Loudspeakers (Passive and Active)

- Soundbars and Home Audio

- Standard Soundbars (2.1 channel)

- Premium Soundbars (Dolby Atmos/DTS:X enabled)

- A/V Receivers and Amplifiers

- Microphones (Consumer Grade)

- Headphones and Earphones

- By Connectivity:

- Wireless (Bluetooth, Wi-Fi, proprietary protocols)

- Wired (USB-C, 3.5mm Jack, Lightning)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, D2C Websites)

- Offline Retail (Specialty Stores, Consumer Electronics Chains, Departmental Stores)

- By Application:

- Entertainment (Music, Movies, Gaming)

- Communication (Voice/Video Conferencing)

- Fitness and Sports

Value Chain Analysis For Consumer Audio Market

The value chain for the Consumer Audio Market begins with upstream activities focused heavily on raw material sourcing and the design and fabrication of complex electronic components. Critical inputs include specialized materials for acoustic drivers (e.g., beryllium, aluminum, composite plastics), high-efficiency battery cells (lithium-ion), and, most importantly, semiconductor chips for processing (DSPs, Bluetooth controllers, and dedicated AI accelerators). Innovation upstream centers on miniaturization, power efficiency, and acoustic performance enhancement. Key upstream players are semiconductor manufacturers (Qualcomm, Broadcom) and specialized driver manufacturers, whose expertise directly determines the potential sound quality of the final product. Procurement strategies are complex due to volatile global supply chains for semiconductors, necessitating strong, diversified supplier relationships.

Midstream activities involve sophisticated product design, prototyping, and large-scale manufacturing, predominantly concentrated in East Asia (China, Vietnam, Malaysia). Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs) handle the assembly, quality control, and testing. Downstream analysis focuses on bringing the finished product to the end consumer. This involves logistics, branding, and marketing, where significant investment is made in creating appealing lifestyle narratives and securing favorable placement in both physical and digital retail spaces. The efficiency of the distribution channel dictates time-to-market and final consumer pricing.

Distribution channels are broadly segmented into direct and indirect routes. Direct channels, primarily utilizing proprietary e-commerce platforms (D2C), allow manufacturers greater control over branding, pricing, and customer data, fostering higher margin potential. Indirect channels, which include large-scale electronics retailers (e.g., Best Buy, Amazon, specialized audio dealers), offer massive market reach and visibility. For high-volume, low-margin products like entry-level TWS, efficient online retail logistics are paramount. For premium, high-fidelity equipment, specialty retail stores that offer experiential listening rooms and expert consultation remain a vital link, serving the informed audiophile segment who value sound performance demonstrations.

Consumer Audio Market Potential Customers

Potential customers for the Consumer Audio Market are broadly diversified but can be categorized into high-growth segments based on their primary use case and purchasing power. The largest cohort comprises Millennials and Gen Z consumers, who are digital natives heavily reliant on streaming media (audio and video) and mobile gaming. This segment prioritizes wireless convenience, aesthetic design, brand image, and multifunctional performance (e.g., TWS used for both music and remote work calls). Their purchasing behavior is often influenced by social media trends and technological freshness, driving rapid adoption cycles for new features like spatial audio.

Another crucial customer group is the Professional and Hybrid Workforce segment. Following global shifts in employment structure, these users require high-quality, reliable audio equipment focused on superior microphone array performance, robust noise isolation (ANC), and extended battery life to support long conferencing sessions. They typically invest in mid-to-high-end headphones or specialized soundbars optimized for voice clarity rather than sheer bass output. Furthermore, the segment of health-conscious consumers and athletes is rapidly growing, utilizing audio devices integrated with biometric sensors and rugged, water-resistant designs for fitness tracking and motivational content consumption during workouts.

Finally, the Audiophile and Home Entertainment Enthusiast segment remains a lucrative but smaller niche. These customers demand the highest possible fidelity, driving the market for high-resolution audio equipment, specialized wired components, premium soundbars supporting advanced formats like Dolby Atmos, and multi-room wireless systems. This segment is characterized by high ASPs and a strong loyalty to established Hi-Fi brands, focusing on long-term investment rather than fast fashion audio technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 218.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Apple Inc. (Beats), Samsung Electronics Co., Ltd. (Harman), Sennheiser Electronic GmbH & Co. KG, Bose Corporation, JBL (Harman International), Shure Incorporated, Audio-Technica Corporation, Xiaomi Corporation, Google LLC, Amazon.com, Inc., Panasonic Corporation, Skullcandy, Inc., Jabra (GN Audio), Logitech International S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Consumer Audio Market Key Technology Landscape

The current technology landscape in the Consumer Audio Market is defined by a rigorous pursuit of superior wireless performance, enhanced personalization, and functional convergence. Bluetooth LE Audio (Low Energy Audio) represents a foundational shift, promising significantly lower power consumption while maintaining, and in some cases improving, audio quality through the new LC3 codec. This standard is critical for extending the battery life of small form-factor devices like TWS earbuds and for enabling advanced features such as Auracast (broadcast audio), which allows a single source device to transmit audio to multiple listening devices simultaneously, redefining public and shared listening experiences in venues and homes.

Furthermore, Spatial Audio, often implemented via technologies like Dolby Atmos for Headphones or proprietary brand solutions, is moving from a niche feature to a critical differentiator across all high-end headphones and soundbars. This technology uses advanced head-tracking and acoustic modeling to create an immersive, three-dimensional sound field, significantly enhancing movie and gaming experiences. The technological focus is on reducing latency and improving the accuracy of the spatialization algorithms to ensure the sound stage remains stable and believable even with rapid head movement. This relies heavily on embedded Inertial Measurement Units (IMUs) and sophisticated digital signal processing (DSP) power within the audio device itself.

The integration of advanced biometric and sensing technologies is rapidly transforming audio devices into comprehensive wellness platforms. High-end TWS earbuds are incorporating optical sensors for heart rate monitoring, temperature sensors, and even electroencephalography (EEG) sensors for tracking brain activity and focus. This convergence necessitates powerful, miniaturized processors capable of running both audio processing algorithms (ANC, EQ) and complex health data analysis simultaneously. The evolution of Active Noise Cancellation (ANC) from simple analog circuitry to complex hybrid digital ANC, often powered by dedicated AI chips, demonstrates the market's commitment to delivering personalized silence and optimized listening environments regardless of the surrounding noise profile.

Regional Highlights

Regional dynamics within the Consumer Audio Market are highly polarized, reflecting varying levels of economic maturity, technology adoption rates, and consumer purchasing power. Asia Pacific (APAC) holds the highest potential for volume growth and is projected to maintain the largest market share throughout the forecast period. This dominance is driven by high population density, rapid urbanization, increasing per capita disposable income, and the massive scale of smartphone penetration, particularly in emerging markets like India and Southeast Asia. The region is both a primary consumer base and the global manufacturing hub for major audio components and final assembly. Competition here is fierce, with regional brands often dominating the budget and mid-range TWS segments through aggressive pricing and fast innovation cycles aimed at maximizing feature-to-price ratios.

North America is characterized by its early adoption of premium, high-feature devices. Consumers in this region exhibit strong brand loyalty to ecosystem providers (e.g., Apple, Google) and are the primary market for high-ASP products featuring the latest spatial audio, proprietary high-definition codecs, and sophisticated health tracking integrations. The strong presence of competitive gaming and professional remote work demographics drives demand for ultra-low latency peripherals and high-clarity communication microphones. Europe follows a similar trend but maintains a traditional appreciation for classical Hi-Fi audio quality, leading to steady demand for premium wired headphones and specialized home audio components, alongside robust growth in the smart speaker segment due to high smart home adoption.

Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting accelerating growth, primarily centered on affordable wireless solutions and portable Bluetooth speakers. Market expansion here is contingent on improving digital infrastructure and increasing access to formal retail channels. In these regions, the emphasis is often placed on durability, battery longevity, and volume, making highly portable and robust speaker systems particularly popular for social and outdoor use. While premium segmentation is nascent, increasing affluence in urban centers across the GCC and South Africa is beginning to create viable markets for global high-end brands, diversifying the regional product mix.

- North America: Dominates the premium and ecosystem-integrated segments; high demand for ANC, spatial audio, and low-latency gaming peripherals. Characterized by high Average Selling Prices (ASP).

- Asia Pacific (APAC): Largest market by volume; major manufacturing hub; driven by explosive growth in TWS adoption in China and India; strong focus on value-for-money and mid-range wireless products.

- Europe: Strong market for traditional Hi-Fi audio components; steady growth in smart speakers and high-end headphones; compliance with strong consumer protection and environmental regulations (e.g., WEEE).

- Latin America (LATAM): High growth in portable wireless speakers for social use; increasing smartphone penetration driving entry-level TWS market expansion; price sensitivity is a major factor.

- Middle East and Africa (MEA): Rapid adoption of entry-to-mid-level wireless devices; market growth linked to improving digital infrastructure and internet connectivity; focuses on battery life and durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Consumer Audio Market.- Sony Corporation

- Apple Inc. (including Beats Electronics)

- Samsung Electronics Co., Ltd. (including Harman International Industries)

- Bose Corporation

- Sennheiser Electronic GmbH & Co. KG

- Jabra (GN Audio)

- Audio-Technica Corporation

- Shure Incorporated

- Google LLC

- Amazon.com, Inc.

- Xiaomi Corporation

- Logitech International S.A. (including Ultimate Ears and Jaybird)

- Panasonic Corporation

- Skullcandy, Inc.

- Klipsch Group, Inc.

- Denon (Sound United LLC)

- Pioneer Corporation

- Vizio, Inc.

- Bang & Olufsen A/S

- Master & Dynamic

Frequently Asked Questions

Analyze common user questions about the Consumer Audio market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the Consumer Audio Market growth?

The key driver is the massive global proliferation and adoption of high-bandwidth digital streaming services (music, video, gaming) combined with the resulting consumer demand for convenient, high-quality True Wireless Stereo (TWS) devices and advanced Active Noise Cancellation (ANC) features, facilitating mobile and immersive listening experiences.

How significant is the impact of AI on noise cancellation technology?

AI's impact is highly significant, enabling the shift from fixed-algorithm ANC to computational audio, which uses machine learning to dynamically analyze, isolate, and cancel complex, non-static environmental noises (such as specific human voices or unpredictable sounds) in real-time, greatly enhancing the effectiveness and personalization of noise isolation features.

Which product segment is projected to exhibit the fastest growth rate?

The True Wireless Stereo (TWS) Earbuds segment is projected to maintain the fastest Compound Annual Growth Rate (CAGR) due to continuous innovations in battery life, miniaturization, seamless integration into various ecosystems (iOS/Android), and the rapid adoption by cost-conscious consumers in developing economies like APAC and LATAM.

What is the importance of Bluetooth LE Audio in the current market landscape?

Bluetooth LE Audio is crucial as it facilitates the next generation of wireless audio standards by providing lower power consumption, superior battery longevity for small devices, and supporting the new LC3 codec, which delivers better audio quality at lower bitrates, alongside enabling Auracast for broadcast audio functionality across multiple devices.

What are the main regional trends observed in the Consumer Audio Market?

The primary regional trend is the domination of the high-volume, cost-competitive TWS market by the Asia Pacific (APAC) region, while North America and Europe lead in the adoption of premium features like spatial audio, integrated health monitoring, and high-fidelity soundbars, driving the global Average Selling Price (ASP) for advanced devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager