Consumer Durables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434141 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Consumer Durables Market Size

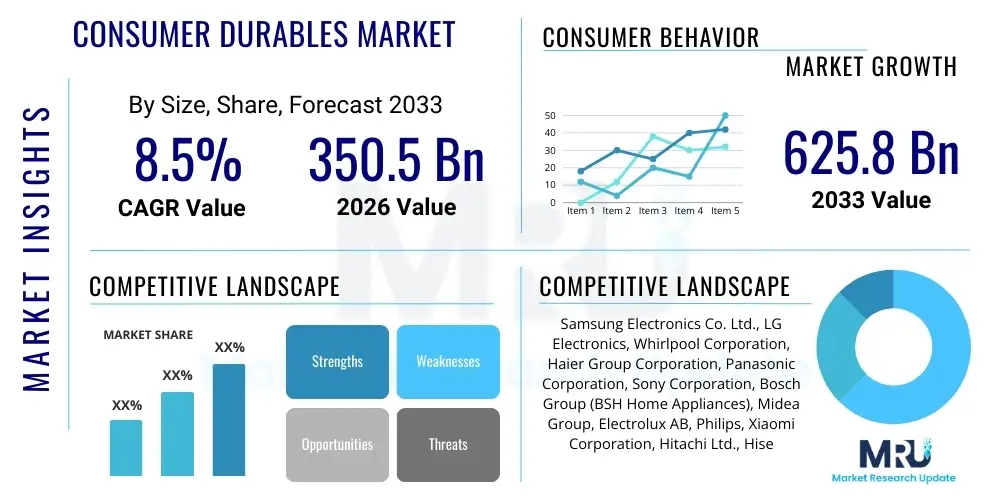

The Consumer Durables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 625.8 Billion by the end of the forecast period in 2033.

Consumer Durables Market introduction

The Consumer Durables Market encompasses goods intended for extended use, typically lasting three years or more, and includes major appliances, electronics, furniture, and other household necessities. These products are characterized by their high unit cost relative to consumables and are essential components of modern living standards, deeply intertwined with housing stability and disposable income levels. The product landscape is continuously evolving, driven by rapid technological advancements, particularly in smart home integration and energy efficiency. Major applications span residential use, commercial settings (such as hotels and large office complexes requiring efficient cooling and entertainment systems), and specialized institutional environments. The ongoing transition towards digitalization and connectivity is redefining product capabilities, transforming static appliances into dynamic, connected ecosystems that offer enhanced user experiences and remote management capabilities. This transformation is crucial for market differentiation and capturing the premium segment of the consumer base worldwide. The sustained growth of the global middle class, particularly in emerging economies, provides a vast expansion opportunity for both entry-level and premium product categories, stabilizing the market’s inherent cyclical nature.

Key benefits derived from consumer durables include enhanced convenience, improved safety, and significant contributions to resource conservation through advanced energy-saving technologies like inverter technology in air conditioners and refrigerators. For consumers, modern durables offer productivity gains, superior entertainment options, and crucial improvements in quality of life, ranging from healthier food preservation to automated cleaning processes. The market is intrinsically driven by demographic shifts, such as urbanization and the increasing number of nuclear households, which necessitates investment in essential home equipment. Moreover, government regulations emphasizing sustainability and mandates for minimum energy ratings actively push manufacturers towards innovation, simultaneously creating market pull for compliant and environmentally friendly products. Economic stability, coupled with favorable financing options and cyclical replacement demand, acts as a primary driving factor ensuring consistent market movement, even amid short-term economic fluctuations. The rise of e-commerce platforms has also democratized access to a wide array of products, overcoming geographical barriers and accelerating the market’s reach into previously underserved regions globally.

Consumer Durables Market Executive Summary

The Consumer Durables Market trajectory is characterized by strong fundamental growth, predominantly fueled by demographic dividends in Asia Pacific and the increasing adoption of smart technologies across North America and Europe. Business trends indicate a clear pivot towards sustainability, modular design, and service-oriented models, where companies are increasingly offering bundled warranties, maintenance packages, and subscription services for high-value durables. Regional trends show that while mature markets focus intensely on replacement cycles, premiumization, and high-tech integration (AIoT), emerging economies are focused on penetration rates and electrification, with significant demand for core appliances like refrigerators and washing machines. Supply chain resilience has emerged as a crucial competitive differentiator post-2020, leading to a geographical diversification of manufacturing bases and increased vertical integration among major players to mitigate geopolitical risks and logistics bottlenecks, thus optimizing inventory management and time-to-market metrics.

Segmentation trends highlight the dominance of the Major Appliances segment, driven by essential replacement needs and the shift toward larger capacity, multi-functional units. Concurrently, the Consumer Electronics segment is witnessing exponential growth propelled by demand for high-definition displays, wearables, and advanced audio equipment, constantly refreshed by short product life cycles and rapid innovation cycles. The distribution landscape is experiencing structural changes, with direct-to-consumer (D2C) channels gaining significant traction, particularly for electronics, allowing brands to control the customer experience and gather proprietary data. Furthermore, the convergence of technology and aesthetics is paramount; consumers demand products that are not only functional but also seamlessly integrate into modern architectural and interior design schemes. This interplay of technology, aesthetics, and robust distribution strategies defines the contemporary competitive environment within the global consumer durables space.

AI Impact Analysis on Consumer Durables Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Consumer Durables Market frequently revolve around three core themes: personalization, predictive maintenance, and energy optimization. Consumers are primarily concerned with how AI integration will translate into tangible benefits, such as appliances that adapt proactively to household schedules and preferences, minimizing manual intervention. There is significant interest in predictive failure analysis—the ability of a device to diagnose impending issues and schedule maintenance automatically, drastically reducing downtime and extending product lifespan. Furthermore, energy consumption optimization, driven by AI algorithms learning usage patterns and adjusting power levels in real-time, is a key expectation, driven by rising utility costs and increasing environmental awareness. These inquiries collectively indicate a shift in consumer demand from mere functionality towards autonomous, smart ecosystems that deliver efficiency, durability, and a highly customized user experience, elevating the value proposition of consumer durables beyond simple utility.

The integration of AI is fundamentally reshaping the product development lifecycle and customer relationship management within the consumer durables sector. AI algorithms are enabling a new generation of appliances, often termed 'cognitive durables,' that learn and evolve with user interaction. For instance, smart refrigerators using computer vision and AI can track inventory, suggest recipes based on available ingredients, and automatically compile grocery lists, shifting their role from simple cooling devices to household management hubs. Similarly, smart HVAC systems utilize machine learning to predict micro-climatic changes within a home, optimizing temperature settings to maximize comfort while minimizing energy waste. This level of intelligent operation is becoming a standard expectation for premium and mid-range products, forcing manufacturers to invest heavily in machine learning models and robust cloud connectivity infrastructure to support real-time data processing and firmware updates, ensuring continuous improvement post-purchase.

Beyond the operational benefits, AI is critical for manufacturing and supply chain efficiency. Predictive analytics, fueled by AI, allows manufacturers to forecast demand with greater accuracy, optimizing production schedules and reducing excess inventory, thereby shortening lead times and increasing profitability. In the customer service domain, AI-powered chatbots and virtual assistants provide instant technical support and troubleshooting, reducing the burden on human support teams and improving customer satisfaction scores. This holistic application of AI, spanning from manufacturing floor automation and inventory prediction to intelligent end-user functionality and after-sales support, marks AI as an indispensable technological cornerstone for future competitive advantage in the consumer durables sector, dictating the pace of innovation and market acceptance globally.

- AI enhances personalized user experiences through adaptive operational settings based on usage patterns.

- Predictive maintenance driven by AI minimizes appliance downtime and reduces warranty claim costs for manufacturers.

- Energy efficiency is maximized via machine learning algorithms optimizing power usage in real-time for appliances like HVAC and washing machines.

- AI-powered voice assistants and interfaces streamline control and integration within smart home ecosystems.

- Improved supply chain efficiency through AI-driven demand forecasting and inventory management optimization.

DRO & Impact Forces Of Consumer Durables Market

The Consumer Durables Market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping its future trajectory. Key drivers include robust global urbanization trends and rising disposable incomes, particularly in the APAC region, which increase the demand for essential home appliances and advanced electronic gadgets. Simultaneously, technological innovations suchating smart connectivity (IoT) and superior energy efficiency standards act as significant market accelerators, driving replacement cycles and promoting premium product adoption. The market’s dynamism is further augmented by favorable credit environments and the availability of easy financing options, lowering the barrier to entry for high-value purchases and encouraging quicker consumer adoption of new technologies across various income demographics worldwide. These drivers create persistent upward pressure on market volume and value.

However, the market faces significant restraints that necessitate strategic mitigation. Economic volatility, including inflation and supply chain disruptions, substantially increases raw material costs and final product prices, potentially dampening consumer spending, particularly for discretionary durables. The inherent cyclical nature of consumer durables, characterized by long product lifecycles and infrequent replacement, often leads to periods of demand saturation in mature markets, posing a challenge for sustained revenue growth without significant innovation. Furthermore, the intense competitive landscape, marked by price wars and rapid technological obsolescence, requires continuous, heavy investment in Research and Development (R&D), placing considerable financial strain on smaller manufacturers. Addressing these restraints requires manufacturers to focus on value-added services, enhancing product durability, and developing resilient, diversified supply chains capable of absorbing external economic shocks effectively.

Opportunities for expansion lie prominently in the development of sustainable, eco-friendly products that appeal to the growing environmentally conscious consumer base, fostering 'green replacement' cycles. The underserved rural and semi-urban populations in emerging markets represent a massive untapped potential for basic and affordable durables, requiring tailored product offerings and localized distribution networks. The transition towards an integrated 'Smart Home Ecosystem,' where various durables communicate seamlessly, offers manufacturers an opportunity to capture recurring revenue streams through software services, premium support, and data monetization. Impact forces, which summarize the collective effect of DRO, indicate a strong shift towards resilience, digitalization, and sustainability as the core tenets of future market success. The overall impact force is moderately positive, driven by accelerating technological progress and fundamental demographic growth, provided manufacturers successfully navigate macroeconomic uncertainties and manage competitive pressures effectively. The need for differentiation through advanced features and superior service quality has never been greater in this highly competitive consumer environment.

Segmentation Analysis

The Consumer Durables Market is analyzed based on product type, distribution channel, and application, providing a granular view of market dynamics and consumer preferences across different categories. Product segmentation typically categorizes the market into Major Appliances (white goods), Small Appliances (brown goods), and Consumer Electronics. Major appliances, such as refrigerators, washing machines, and air conditioners, form the backbone of the market due to their essential function and high unit value, characterized by longer replacement cycles and significant energy consumption considerations. Consumer Electronics, encompassing televisions, smartphones, and audio equipment, are defined by short innovation cycles and high penetration rates, often serving as technology adoption barometers.

From a distribution perspective, the market is broadly divided between offline and online channels. Offline channels, including hypermarkets, exclusive brand stores, and specialized electronics retailers, still account for a substantial share, particularly for major appliances where tactile inspection and immediate service consultation are valued by consumers. Conversely, online channels, driven by e-commerce giants and brand direct-to-consumer (D2C) platforms, are rapidly gaining ground due to competitive pricing, vast product selections, and logistical efficiencies, particularly favored for consumer electronics and smaller, less installation-intensive products. This dual-channel approach necessitates robust omnichannel strategies from market participants to ensure seamless customer experience across all touchpoints, optimizing inventory flow and maximizing geographical reach.

Application segmentation differentiates between residential and commercial use. The residential segment dominates the market volume and is driven by household formation, replacement demand, and discretionary upgrades tied to disposable income. The commercial segment, comprising hotels, offices, hospitals, and educational institutions, demands large-capacity, high-durability, and often custom-designed appliances, with purchasing decisions heavily influenced by B2B contracts, energy efficiency mandates, and long-term maintenance costs. Understanding these segment-specific requirements is critical for manufacturers designing product portfolios, tailoring marketing campaigns, and allocating R&D resources effectively to capture the highest growth potential across the varied end-user landscape globally.

- By Product Type:

- Major Appliances (Refrigerators, Washing Machines, Air Conditioners, Dishwashers)

- Small Appliances (Microwaves, Vacuum Cleaners, Coffee Makers, Toasters)

- Consumer Electronics (Televisions, Audio Equipment, Home Computing, Wearables)

- By Distribution Channel:

- Offline (Hypermarkets, Exclusive Brand Stores, Independent Retailers)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

- By Application:

- Residential

- Commercial/Institutional

Value Chain Analysis For Consumer Durables Market

The Value Chain for the Consumer Durables Market begins with upstream activities involving raw material procurement and component manufacturing. Upstream suppliers are critical and include producers of plastics, specialized metals (aluminum, copper), electronic components (semiconductors, microprocessors), and specialized motor assemblies. Volatility in the commodity markets directly impacts the cost of goods sold, making strategic long-term procurement contracts and diversification of material sources paramount. The shift towards smart durables has dramatically increased the reliance on specialized semiconductor suppliers and software developers, adding significant complexity to the upstream segment. Manufacturers must manage relationships with a global network of suppliers to ensure quality control, cost efficiency, and compliance with ethical sourcing standards, particularly concerning rare earth minerals and sustainable materials, thereby establishing the foundation for robust and scalable production capabilities.

The core manufacturing stage involves assembly, quality assurance, and packaging, often utilizing highly automated and specialized production facilities located strategically across different geographies to leverage cost advantages and optimize logistics. Following manufacturing, the value chain moves to the distribution and marketing stages. The distribution channel is multifaceted, comprising direct sales, reliance on third-party distributors, and substantial utilization of both traditional retail networks and modern e-commerce platforms. Direct channels offer greater control over pricing and customer data, fostering a stronger brand-consumer relationship, while indirect channels provide immediate, extensive market penetration, especially in vast, disparate geographic territories. Effective channel management, including optimized logistics and inventory deployment, is critical for minimizing warehousing costs and ensuring rapid market responsiveness to fluctuating consumer demand.

The downstream segment focuses on installation, after-sales service, and end-of-life management. For major appliances, professional installation and reliable warranty services are non-negotiable determinants of customer satisfaction and brand loyalty. After-sales support, encompassing maintenance, spare parts availability, and technical troubleshooting, represents a significant source of recurring revenue and brand differentiation. Furthermore, regulatory pressures focusing on Extended Producer Responsibility (EPR) are making end-of-life management—including recycling and refurbishment programs—an increasingly important component of the downstream value chain. This focus on circular economy principles not only ensures regulatory compliance but also enhances the corporate sustainability profile, completing the value chain loop from raw material extraction to responsible disposal or repurposing of the product, thereby guaranteeing the long-term viability of the product portfolio.

Consumer Durables Market Potential Customers

The potential customer base for the Consumer Durables Market is incredibly diverse, spanning across various income levels, demographics, and institutional requirements. The largest segment comprises individual households, classified based on whether they are first-time buyers establishing a new home, upgrade buyers seeking premium or technologically superior replacements, or necessity buyers replacing broken essential items. First-time buyers, primarily young urban professionals and newly formed families, drive the demand for foundational, reliable, and often mid-range appliances and electronics. Upgrade buyers, typically older, affluent consumers in developed economies, seek high-end, connected, and specialized durables like integrated smart kitchens and sophisticated home entertainment systems, demonstrating low price elasticity and high demand for specialized feature sets and aesthetic superiority in their purchases.

Beyond the residential sector, significant potential lies within the commercial and institutional domains. This includes the hospitality sector (hotels, resorts), which requires large volumes of high-durability, energy-efficient refrigeration, laundry, and climate control systems designed for continuous operation and ease of maintenance. The real estate and construction industry, focusing on large-scale residential and commercial development projects, represents a high-volume, bulk purchasing segment driven by contractual deadlines and compliance with building safety and energy codes. Furthermore, government agencies and public institutions, such as schools and hospitals, frequently issue tenders for bulk purchases of specialized durables, focusing on reliability, long-term operational costs, and adherence to public sector procurement guidelines, thus diversifying the customer profile considerably.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 625.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics Co. Ltd., LG Electronics, Whirlpool Corporation, Haier Group Corporation, Panasonic Corporation, Sony Corporation, Bosch Group (BSH Home Appliances), Midea Group, Electrolux AB, Philips, Xiaomi Corporation, Hitachi Ltd., Hisense Group, Godrej & Boyce Mfg. Co. Ltd., Gree Electric Appliances Inc. of Zhuhai, Daikin Industries Ltd., Vizio Inc., TCL Technology, Kenwood Limited, Bajaj Electricals Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Consumer Durables Market Key Technology Landscape

The technological landscape of the Consumer Durables Market is dominated by the convergence of the Internet of Things (IoT), advanced sensing technologies, and sophisticated energy management systems. IoT is the foundational technology enabling the 'smart' capabilities of modern durables, facilitating seamless communication between appliances, smartphones, and cloud services. This connectivity is crucial for remote monitoring, diagnostic checks, and over-the-air software updates, transforming a collection of disparate appliances into a unified, managed home ecosystem. Advanced sensor technology, including precise humidity, temperature, and motion sensors, allows devices like refrigerators and air conditioners to operate with unprecedented accuracy, optimizing performance based on real-time environmental data and minimizing energy waste. The reliance on robust and secure wireless protocols, such as Wi-Fi 6 and specialized low-power wide-area networks (LPWAN) for long-distance device management, is paramount to ensure reliable operation and data integrity within the connected home architecture.

Energy efficiency technologies represent another crucial area of innovation, largely driven by global regulatory mandates and rising consumer demand for sustainability. Inverter technology, widely adopted in HVAC and refrigeration units, precisely controls motor speed and power consumption, leading to substantial energy savings compared to traditional fixed-speed compressors. Furthermore, the development of highly efficient materials, advanced insulation techniques, and optimized internal component designs contributes significantly to minimizing the operational carbon footprint of durables. Manufacturers are increasingly integrating renewable energy compatibility, designing appliances that can interface directly with home solar power systems or participate in smart grids for load balancing during peak times. This focus on green technology is not just about compliance; it is a major competitive advantage, often influencing consumer choice in mature markets where utility savings are a primary consideration in the purchase decision process.

The increasing importance of Human-Machine Interaction (HMI) technologies, particularly Voice User Interfaces (VUIs) and gesture control, is simplifying the operation of complex appliances, broadening accessibility across diverse user groups. Integrating powerful processors and specialized chips allows for on-device (edge) computing capabilities, enabling instantaneous response times for critical functions without relying solely on cloud processing. This trend towards decentralized intelligence enhances data privacy and reduces latency. Furthermore, modular design and enhanced material durability, leveraging advanced polymers and alloys, are becoming standard features, supporting ease of repair and upgradeability, aligning with the circular economy ethos. These combined technological thrusts—smart connectivity, superior energy performance, and enhanced user interaction—define the current innovation battleground, moving the market towards highly personalized, autonomous, and ecologically responsible product solutions, ensuring that technology remains the single biggest catalyst for change and premiumization in the sector.

Regional Highlights

The global Consumer Durables Market exhibits significant regional disparities in growth rate, technological adoption, and consumer behavior, necessitating customized market strategies for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America represents a mature, high-value market characterized by high penetration rates and strong demand for premium, smart, and integrated appliance solutions. Consumer spending is heavily focused on replacement and upgrade cycles, driven by a preference for large-capacity units and energy-efficient certifications. The region leads in the adoption of interconnected smart home ecosystems, with AI and IoT being integral to product differentiation, often facilitated by competitive broadband infrastructure and high average disposable incomes.

Europe mirrors North America in maturity but is heavily influenced by stringent energy efficiency and sustainability regulations (e.g., the EU's Ecodesign Directive). Demand in Europe emphasizes compact, aesthetically refined, and modular durables suitable for smaller living spaces, alongside a strong preference for brands that demonstrate clear environmental stewardship and circular economy commitments. Replacement cycles are relatively long, but consumers are willing to invest in high-quality, long-lasting products. Germany, the UK, and France remain the largest markets, focusing on sophisticated technology integration and minimalist design philosophies, while Eastern European markets show increasing penetration rates for mid-range appliances.

Asia Pacific (APAC) stands out as the primary growth engine for the global consumer durables market, driven by favorable demographics, rapid urbanization, and exponential growth in the middle-class population across India, China, and Southeast Asia. This region presents a dual market: high-volume demand for essential, affordable appliances (first-time purchases) and surging demand for premium, high-tech electronics and white goods in major metropolitan areas. China dominates the market both in consumption and manufacturing capacity, driving global price points. Furthermore, the APAC region is swiftly adopting e-commerce channels for consumer durables purchases, often bypassing traditional retail infrastructure entirely, making logistics efficiency and digital marketing highly critical for regional success.

Latin America (LATAM) shows consistent, albeit slower, growth, often characterized by economic volatility which impacts consumer financing and confidence. Key drivers include stable household formation and a preference for durable, reliable products that can withstand fluctuating power supply conditions. Brazil and Mexico are the dominant markets, where local manufacturing and brand presence are highly valued. Market penetration for specialized durables is increasing, but core white goods remain the primary category. Distribution complexity due to varied infrastructure and regulatory landscapes makes localized partnership essential for effective market access and service delivery.

The Middle East and Africa (MEA) region is experiencing accelerated demand, primarily fueled by infrastructural development, rapid population growth, and high urbanization rates, particularly in the Gulf Cooperation Council (GCC) countries. Extreme climate conditions drive high demand for specialized cooling and refrigeration systems. Africa, while offering vast untapped potential, requires highly localized strategies focusing on energy access (off-grid solutions), affordability, and distribution tailored to fragmented retail networks. High-net-worth consumers in the UAE and Saudi Arabia drive demand for ultra-premium and luxury durables, often imported, while other parts of the region prioritize basic functionality and long-term durability over advanced smart features.

- North America: Focus on premiumization, smart home ecosystems, and high-efficiency standards; strong replacement demand.

- Europe: Driven by strict energy regulations, sustainability, and demand for compact, aesthetically integrated appliances; mature replacement market.

- Asia Pacific (APAC): Highest growth region driven by urbanization, increasing disposable income, and first-time buyers; strong manufacturing hub and massive e-commerce adoption.

- Latin America: Moderate growth, focused on reliable core appliances; significant market shares held by regional players; susceptible to economic fluctuations.

- Middle East & Africa (MEA): High demand for specialized cooling solutions due to climate; rapid urbanization; emerging market focus on basic electrification and affordability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Consumer Durables Market.- Samsung Electronics Co. Ltd.

- LG Electronics

- Whirlpool Corporation

- Haier Group Corporation

- Panasonic Corporation

- Sony Corporation

- Bosch Group (BSH Home Appliances)

- Midea Group

- Electrolux AB

- Philips

- Xiaomi Corporation

- Hitachi Ltd.

- Hisense Group

- Godrej & Boyce Mfg. Co. Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- Daikin Industries Ltd.

- Vizio Inc.

- TCL Technology

- Kenwood Limited

- Bajaj Electricals Ltd.

Frequently Asked Questions

Analyze common user questions about the Consumer Durables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Consumer Durables Market?

The Consumer Durables Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 8.5% between the forecast years of 2026 and 2033, driven largely by emerging market demand and technological adoption.

Which technology is most significantly impacting the future design of consumer durables?

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is the most significant technological impact, enabling predictive maintenance, energy optimization, and creating fully integrated, autonomous smart home ecosystems.

What major factor is driving the high demand for consumer durables in the Asia Pacific region?

Rapid urbanization combined with the substantial growth of the middle-class population and increasing household formation are the primary factors fueling massive volume demand and consumption in the Asia Pacific market.

How are environmental sustainability regulations affecting the manufacturing of consumer durables?

Strict global and regional environmental regulations, particularly in Europe, are forcing manufacturers to prioritize inverter technology, use sustainable materials, and design products for superior energy efficiency and long-term recyclability.

Which segmentation dominates the consumer durables market in terms of value?

The Major Appliances segment (white goods) dominates the market value due to the high unit cost of products like refrigerators, washing machines, and air conditioners, which are essential for household functionality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Molded Fiber Trays Market Statistics 2025 Analysis By Application (Food and Beverage Packaging, Consumer Durables and Electronics, Automotive and Mechanical Parts, Healthcare Products), By Type (Recycled Paper and Pulp, Primary Pulp, Molded Fiber Trays are mainly classified into the following types: recycled paper & pulp, primary pulp. Recycled paper & pulp is the most widely used type which takes up about 90% of the total sales in 2019.), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Molded Fiber Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thick-Wall, Transfer, Thermoformed (Thin-wall), Processed), By Application (Food and Beverages Industry, Consumer Durables and Electronic Goods Industry, Automotive Packaging Industry, Home and Personal Care Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager