Consumer Loan Origination System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439963 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Consumer Loan Origination System Market Size

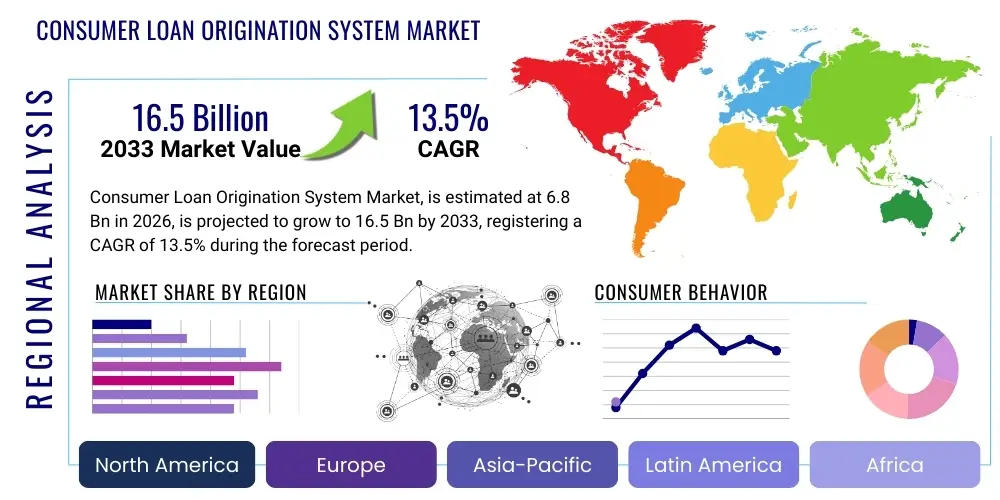

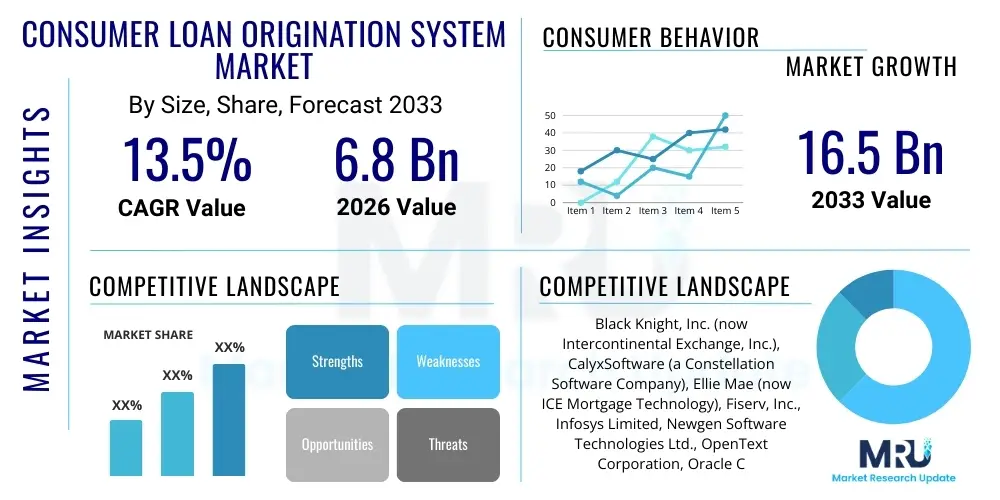

The Consumer Loan Origination System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2033.

Consumer Loan Origination System Market introduction

The Consumer Loan Origination System (CLOS) market encompasses a sophisticated ecosystem of software solutions designed to automate and streamline the entire lending process, from initial application to final disbursal for various consumer loan products. These systems are critical for financial institutions, including banks, credit unions, and non-banking financial companies, in managing the complex workflows associated with personal loans, mortgages, auto loans, student loans, and other consumer credit offerings. A CLOS typically integrates functionalities such as application intake, credit assessment, underwriting, decisioning, document generation, and loan funding, significantly enhancing efficiency, reducing processing times, and mitigating operational risks. The primary product description revolves around a comprehensive, often modular, software suite that provides a centralized platform for lenders to handle a high volume of loan applications with consistency and compliance. Major applications span across diverse consumer lending portfolios, supporting both secured and unsecured loan products, and catering to various customer segments from prime to subprime borrowers. The intrinsic benefits of adopting a CLOS are multifaceted; they include accelerated loan processing, improved customer experience through faster approvals and digital self-service options, enhanced regulatory compliance through automated checks and audit trails, reduced manual errors, and significant cost savings due to operational efficiencies. Furthermore, these systems provide robust analytics capabilities, enabling lenders to make data-driven decisions regarding credit risk, marketing strategies, and product development. Key driving factors propelling the growth of the CLOS market include the escalating demand for digital lending experiences, consumer preference for speed and convenience in accessing credit, the increasing competitive pressure among financial institutions to innovate and differentiate their services, and the continuous evolution of regulatory frameworks that necessitate robust and auditable lending processes. The proliferation of mobile banking and online loan applications further underscores the need for agile and interconnected origination systems, capable of seamless integration with existing core banking infrastructure and third-party data providers. Moreover, the global push towards financial inclusion and the expansion of credit markets in emerging economies are creating new opportunities for CLOS providers to support a broader spectrum of lenders and borrowers. The market is also being shaped by advancements in technologies such as artificial intelligence, machine learning, and cloud computing, which are embedding predictive analytics, automated underwriting, and scalable deployment options into next-generation CLOS solutions, transforming traditional lending paradigms into highly intelligent and adaptive processes. This technological infusion is not merely about automation but about intelligent automation, where systems learn and adapt to changing market conditions and regulatory landscapes, thus ensuring long-term operational resilience and competitive advantage for lenders.

Consumer Loan Origination System Market Executive Summary

The Consumer Loan Origination System (CLOS) market is experiencing robust growth driven by a confluence of evolving business trends, significant regional dynamics, and distinct segment-specific developments. From a business trends perspective, the paramount shift is towards end-to-end digital lending, where financial institutions are investing heavily in technologies that can fully automate the loan lifecycle, minimizing human intervention and maximizing operational efficiency. This includes an intensified focus on seamless customer onboarding, real-time credit decisioning, and personalized loan product offerings, all underpinned by sophisticated data analytics. There is a growing emphasis on modular and API-driven architectures, allowing lenders to integrate CLOS with diverse third-party applications like identity verification services, credit bureaus, and payment gateways, fostering an agile and interconnected lending ecosystem. Furthermore, compliance management remains a critical business trend, with CLOS solutions continually evolving to meet stringent regulatory requirements across different jurisdictions, providing audit trails and automated policy enforcement. The rise of embedded finance and non-traditional lenders (fintechs) is also pushing incumbents to adopt advanced CLOS platforms to remain competitive, often leading to partnerships and acquisitions within the market. From a regional trends standpoint, North America and Europe continue to be dominant markets, characterized by high adoption rates, technological maturity, and a strong regulatory landscape that drives demand for robust compliance features. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by increasing internet penetration, a burgeoning middle class, rapid digitalization of financial services, and supportive government initiatives promoting digital payments and lending. Countries like India, China, and Southeast Asian nations are witnessing significant investments in CLOS to cater to a vast, underserved population and to modernize existing banking infrastructure. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit from a smaller base, as financial inclusion initiatives and digital transformation efforts gain momentum. Specific regional nuances, such as varying credit assessment methodologies and cultural preferences, are driving localized solutions within these markets. Lastly, segment trends reveal significant shifts. By component, the software segment, particularly cloud-based solutions, is experiencing accelerated growth due to its scalability, cost-effectiveness, and ease of deployment, overshadowing traditional on-premises deployments. The services segment, encompassing implementation, consulting, and support, remains crucial for successful CLOS adoption and customization. By application, personal loans and mortgages continue to be major revenue generators, but specialized segments like motor vehicle loans and small business loans (which often cater to individual proprietors) are showing strong expansion. The emergence of Buy Now, Pay Later (BNPL) models and other innovative credit products is also driving demand for flexible CLOS platforms capable of rapid product configuration. By end-user, fintech lenders are demonstrating agility in adopting cutting-edge CLOS technologies, often leveraging them to disrupt traditional banking models. Meanwhile, established banks and credit unions are undertaking large-scale digital transformation projects to upgrade their legacy systems, presenting significant opportunities for CLOS vendors specializing in enterprise-grade, integrated solutions. The increasing complexity of financial products and the need for speed and accuracy in lending decisions are further reinforcing the necessity for advanced CLOS across all segments.

AI Impact Analysis on Consumer Loan Origination System Market

Common user questions regarding the impact of AI on the Consumer Loan Origination System Market frequently revolve around its potential to revolutionize credit assessment, streamline application processing, enhance fraud detection, and personalize customer experiences, while also raising concerns about algorithmic bias, data privacy, and the 'black box' nature of advanced AI models. Users are keen to understand how AI can move beyond traditional rule-based systems to offer more dynamic and nuanced risk assessments, enabling lenders to expand their reach to previously underserved segments. There is also significant interest in AI's role in automating repetitive tasks, thereby reducing operational costs and human error, and its capacity to provide predictive insights for loan portfolio management. However, questions also arise concerning the ethical implications of AI-driven decision-making, the potential for discriminatory outcomes if not properly trained and monitored, and the challenges associated with integrating complex AI models into existing legacy infrastructure. Lenders are looking for clarity on how AI can be implemented compliantly and transparently within the highly regulated financial services industry, and what safeguards are necessary to ensure fairness and accountability in lending decisions powered by artificial intelligence.

- AI-driven credit scoring models leverage vast datasets and machine learning algorithms to assess creditworthiness more accurately and comprehensively, often incorporating alternative data points beyond traditional credit scores. This enables lenders to identify reliable borrowers who might be overlooked by conventional methods, expanding the addressable market and reducing default rates through more granular risk profiling.

- Automation of data extraction and validation through AI-powered optical character recognition (OCR) and natural language processing (NLP) significantly reduces manual processing time, accelerates application intake, and minimizes errors, leading to faster loan approvals and an improved customer experience. This allows human resources to focus on complex cases and relationship management.

- Enhanced fraud detection capabilities utilize AI to identify suspicious patterns and anomalies in application data, transaction histories, and digital footprints in real-time, proactively preventing fraudulent activities and minimizing financial losses for lenders. AI systems can detect sophisticated fraud schemes that might bypass traditional rule-based checks.

- Personalized loan product offerings and dynamic pricing become feasible with AI, as it can analyze individual customer profiles, financial behaviors, and preferences to recommend tailored loan solutions, improving conversion rates and customer satisfaction. This moves beyond one-size-fits-all products to highly customized financial services.

- Predictive analytics powered by AI helps lenders forecast market trends, anticipate loan demand, and optimize portfolio performance by identifying potential risks and opportunities, enabling proactive strategic adjustments. This supports better capital allocation and risk management strategies.

- Streamlined regulatory compliance is supported by AI through automated policy adherence checks, real-time monitoring for rule violations, and robust audit trail generation, ensuring that lending practices meet evolving regulatory standards and minimizing non-compliance risks. AI can adapt to changing regulations faster than manual updates.

- Operational cost reduction is achieved through the automation of numerous manual tasks, from document processing to initial underwriting, freeing up human staff for more value-added activities and increasing overall processing efficiency. This leads to a lower cost-per-loan originated.

DRO & Impact Forces Of Consumer Loan Origination System Market

The Consumer Loan Origination System (CLOS) market is shaped by a complex interplay of driving forces, significant restraints, and compelling opportunities, all subject to broader impact forces. Key drivers include the ever-increasing demand for digital lending solutions, fueled by consumer expectations for speed, convenience, and seamless online experiences. The ongoing digital transformation initiatives within financial institutions, aimed at modernizing legacy systems and improving operational efficiency, are a primary catalyst. Furthermore, the intensified competition from agile fintech companies and challenger banks is compelling traditional lenders to adopt advanced CLOS platforms to innovate their service offerings and retain market share. The need for robust regulatory compliance, driven by evolving frameworks such as GDPR, CCPA, and various anti-money laundering (AML) and know-your-customer (KYC) regulations, mandates the adoption of systems that can automate compliance checks and maintain detailed audit trails. The cost-saving potential through automation, reduced manual errors, and faster processing times further motivates investment in these systems. On the other hand, several restraints impede market growth. High initial implementation costs and the complexity associated with integrating new CLOS platforms with existing diverse legacy IT infrastructures pose significant barriers, especially for smaller financial institutions with limited budgets and technical expertise. Data security concerns and the increasing threat of cyberattacks are also major restraints, as lenders handle sensitive customer financial information, making data protection a paramount concern. The lack of skilled professionals capable of deploying, managing, and optimizing advanced CLOS technologies, particularly those incorporating AI and machine learning, is another critical bottleneck. Furthermore, resistance to change within organizations and cultural inertia can slow down the adoption and full utilization of new systems. Opportunities within the market are abundant and varied. The burgeoning demand for cloud-based CLOS solutions presents a substantial growth avenue, offering scalability, flexibility, and reduced infrastructure costs, making advanced lending technology accessible to a wider range of lenders, including small and medium-sized enterprises (SMEs). The integration of artificial intelligence (AI) and machine learning (ML) for enhanced credit scoring, fraud detection, and personalized customer experiences represents a transformative opportunity, enabling more accurate risk assessment and tailored product offerings. Expansion into emerging markets, particularly in Asia Pacific, Latin America, and Africa, where digital lending is rapidly gaining traction and financial inclusion efforts are prominent, offers significant untapped potential. The rise of embedded finance, where lending services are seamlessly integrated into non-financial platforms, also creates new distribution channels and market niches for CLOS providers. Moreover, the development of modular and API-driven CLOS platforms allows for greater customization and interoperability, catering to the specific needs of diverse lenders and facilitating ecosystem partnerships. Broader impact forces influencing the market include global economic volatility and fluctuating interest rates, which affect consumer borrowing behavior and lenders' profitability, driving the need for flexible and adaptive origination systems. Geopolitical shifts and trade policies can also impact market dynamics, influencing investment flows and technological adoption. Social trends, such as increasing digital literacy and expectations for instant services, continuously push the boundaries of what is expected from loan origination processes. Technological advancements, particularly in areas like blockchain for enhanced security and transparency, and advanced analytics for deeper insights, serve as fundamental impact forces, continuously redefining the capabilities and potential of CLOS solutions. The collective influence of these forces dictates the pace and direction of innovation and adoption across the Consumer Loan Origination System market, necessitating continuous adaptation and strategic foresight from market participants.

Segmentation Analysis

The Consumer Loan Origination System (CLOS) market is broadly segmented across several key dimensions, providing a comprehensive view of its intricate structure and diverse offerings. These segmentations allow for a granular understanding of market dynamics, competitive landscapes, and growth opportunities tailored to specific needs and operational models within the lending industry. The market can be primarily dissected by component, distinguishing between software solutions and associated services, each playing a critical role in the deployment and ongoing management of CLOS platforms. Further differentiation occurs based on the deployment model, categorizing solutions as either on-premises, where software is installed and run locally, or cloud-based, leveraging remote servers and internet connectivity for accessibility and scalability. Organization size is another pivotal segmentation, acknowledging the varying requirements and resource capacities of large enterprises versus small and medium-sized enterprises (SMEs), each often necessitating different scales and complexities of CLOS. The application segment delineates the market based on the specific type of consumer loan being processed, such as mortgages, personal loans, auto loans, and student loans, reflecting the specialized workflows and regulatory considerations inherent to each product. Finally, the end-user segmentation classifies the market by the type of financial institution utilizing CLOS, including traditional banks, credit unions, and the rapidly growing sector of fintech lenders and specialized financial institutions, each with distinct operational imperatives and technological adoption strategies. Each of these segments, individually and in combination, influences the demand, feature sets, and market penetration of CLOS solutions, driving innovation to meet the evolving demands of a dynamic lending ecosystem. The evolution within each segment reflects broader trends like digitalization, cloud adoption, and the increasing sophistication of data analytics and artificial intelligence in financial services, transforming how loans are initiated and managed across the entire consumer credit landscape.

- By Component:

- Software (On-premises, Cloud-based)

- Services (Implementation, Consulting, Support & Maintenance)

- By Deployment Model:

- On-premises

- Cloud-based

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Application:

- Mortgages

- Personal Loans

- Motor Vehicle Loans

- Student Loans

- Small Business Loans

- Other Consumer Loans

- By End-User:

- Banks

- Credit Unions

- Fintech Lenders

- Specialized Financial Institutions

Value Chain Analysis For Consumer Loan Origination System Market

The value chain of the Consumer Loan Origination System (CLOS) market is a multi-faceted process involving several key stages, from initial software development and data provision to final deployment, integration, and ongoing support for end-users. The upstream analysis primarily focuses on technology providers, who are the foundational enablers. This segment includes core software developers who build the platforms, often specializing in specific components such as credit scoring engines, document management systems, or compliance modules. It also encompasses data providers, including credit bureaus (e.g., Experian, TransUnion, Equifax) and alternative data aggregators, whose information is crucial for robust credit assessment and identity verification within the CLOS. Technology infrastructure providers, such as cloud service platforms (AWS, Azure, Google Cloud), are also critical upstream partners, offering scalable and secure environments for deploying cloud-based CLOS solutions. Additionally, there are niche service providers offering specialized APIs for integrations, such as payment gateways, e-signature solutions, and identity verification tools, which enrich the functionality of the core CLOS. Moving downstream, the value chain extends to the distribution channels and the ultimate end-users. Distribution channels can be broadly categorized into direct and indirect methods. Direct channels involve CLOS vendors selling and implementing their solutions directly to financial institutions. This often entails engaging sales teams, pre-sales consultants, and solution architects who work closely with clients to understand their specific needs, customize the software, and oversee the implementation process. Direct channels are particularly prevalent for large enterprise clients with complex requirements and for vendors offering highly specialized or proprietary solutions. Indirect channels, conversely, leverage a network of partners, including system integrators, value-added resellers (VARs), and consulting firms. These partners often have deep industry expertise and local market knowledge, acting as intermediaries to market, sell, implement, and support CLOS solutions. They can bundle CLOS with other financial technology offerings or provide comprehensive digital transformation services, making the solutions more accessible to a broader range of financial institutions, including SMEs who might prefer a packaged service approach. The choice of distribution channel often depends on the vendor's market strategy, the target customer segment, and the complexity of the solution. The end-users of the CLOS are diverse financial institutions, including retail banks, commercial banks, credit unions, mortgage lenders, auto finance companies, student loan providers, and fintech startups. Each end-user type has unique requirements, from the volume of applications to specific regulatory landscapes, influencing the feature sets and integration capabilities demanded from a CLOS. The value chain culminates in the successful adoption and continuous optimization of the CLOS by these institutions, leading to improved operational efficiency, enhanced customer experience, and sustained compliance. Post-implementation support, maintenance, and regular software updates provided by the CLOS vendor or their partners are crucial for the long-term value realization, ensuring the system remains current, secure, and aligned with evolving business and regulatory demands.

Consumer Loan Origination System Market Potential Customers

The potential customers for Consumer Loan Origination Systems (CLOS) represent a broad and diverse spectrum of financial institutions and entities involved in providing various forms of credit to individuals and small businesses. Primarily, the largest segment of end-users consists of traditional retail and commercial banks. These institutions, ranging from global banking giants to regional and community banks, process a high volume and variety of consumer loans, including mortgages, personal loans, auto loans, and student loans. For banks, CLOS solutions are essential for modernizing legacy systems, improving customer experience, reducing operational costs, and ensuring compliance with stringent banking regulations. They seek robust, scalable, and integrated platforms that can handle complex workflows and seamlessly connect with their existing core banking infrastructure. Another significant customer group comprises credit unions. Although often smaller in scale than banks, credit unions share many of the same challenges and objectives, prioritizing member service, efficiency, and compliance. They require CLOS solutions that are cost-effective, user-friendly, and capable of fostering personalized relationships with their members while adhering to specific cooperative banking principles. The rapidly expanding sector of fintech lenders and challenger banks represents a dynamic and growing customer base for CLOS providers. These agile, often digitally native, entities leverage technology to disrupt traditional lending models, offering innovative products and faster, more convenient application processes. Fintechs often seek cloud-native, API-first CLOS solutions that enable rapid deployment, high scalability, and seamless integration with a wide array of third-party data sources and digital channels. Their demand is typically driven by the need for speed-to-market and the ability to personalize lending experiences. Furthermore, specialized financial institutions form another critical customer segment. This includes dedicated mortgage lenders, auto finance companies, student loan providers, and increasingly, Buy Now Pay Later (BNPL) providers. These institutions focus on specific loan products and require CLOS solutions tailored to the unique regulatory requirements, underwriting criteria, and operational nuances of their niche. They benefit from highly specialized modules within a CLOS that can optimize their specific lending workflows. Finally, companies venturing into embedded finance, such as large retailers or e-commerce platforms offering financing options at the point of sale, are emerging as new potential customers. These entities require CLOS capabilities that can be seamlessly integrated into their primary customer journeys, providing instant credit decisions and facilitating a smooth purchasing experience. The common thread among all these potential customers is the overarching need for efficiency, accuracy, compliance, and an enhanced customer journey in the increasingly competitive and digitally-driven consumer lending landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Black Knight, Inc. (now Intercontinental Exchange, Inc.), CalyxSoftware (a Constellation Software Company), Ellie Mae (now ICE Mortgage Technology), Fiserv, Inc., Infosys Limited, Newgen Software Technologies Ltd., OpenText Corporation, Oracle Corporation, Q2 Holdings, Inc., Sagent Lending Technologies, Sopra Banking Software, Temenos AG, VeriPro, Wipro Limited, Accenture, Experian, TransUnion, LexisNexis Risk Solutions, Blend, LendingFront |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Consumer Loan Origination System Market Key Technology Landscape

The technological landscape of the Consumer Loan Origination System (CLOS) market is undergoing rapid evolution, driven by the relentless pursuit of efficiency, enhanced customer experience, and robust risk management. At its core, the modern CLOS leverages a blend of established and emerging technologies to automate and intelligently streamline every stage of the loan lifecycle. Cloud computing stands as a foundational technology, with a significant shift from on-premises deployments to Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models. Cloud-native architectures offer unparalleled scalability, flexibility, reduced infrastructure costs, and enhanced data security, enabling lenders to adapt quickly to changing market demands and implement new features with agility. This also facilitates seamless integration with other cloud-based financial services. Artificial Intelligence (AI) and Machine Learning (ML) are transformative forces, moving beyond basic automation to intelligent automation. AI algorithms are increasingly employed for advanced credit scoring, leveraging alternative data sources (e.g., utility payments, rental history, social media footprints, behavioral data) to provide a more holistic and accurate assessment of creditworthiness, particularly for thin-file or underserved populations. ML models also drive predictive analytics, identifying potential default risks, forecasting market trends, and optimizing loan portfolio performance. Natural Language Processing (NLP) is crucial for automating the extraction and validation of data from unstructured documents, such as income statements, bank statements, and legal agreements, significantly reducing manual effort and processing errors. Robotic Process Automation (RPA) plays a vital role in automating repetitive, rule-based tasks within the origination process, such as data entry, reconciliation, and system-to-system transfers, freeing up human resources for more complex decision-making and customer interaction. Furthermore, Application Programming Interfaces (APIs) are central to the modern CLOS architecture, enabling seamless integration with a myriad of third-party services. These include external data providers (credit bureaus, identity verification services), payment gateways, e-signature platforms, core banking systems, and customer relationship management (CRM) software. API-first design principles foster a modular and extensible ecosystem, allowing lenders to customize their CLOS stack with best-of-breed solutions and adapt quickly to new technologies without rip-and-replace strategies. Advanced data analytics and business intelligence tools provide lenders with deep insights into customer behavior, operational bottlenecks, and market opportunities. These tools allow for real-time monitoring of key performance indicators (KPIs), identification of trends, and data-driven decision-making, which are crucial for optimizing conversion rates, managing risk, and personalizing product offerings. Distributed Ledger Technology (DLT), including blockchain, is an emerging technology gaining traction for its potential to enhance security, transparency, and immutability of loan records and transactions, particularly in areas like identity management, smart contracts for loan agreements, and cross-border lending. While still nascent in widespread CLOS adoption, DLT holds promise for future innovations. Cybersecurity measures are also deeply embedded within the technology landscape, with robust encryption, multi-factor authentication, intrusion detection systems, and compliance with data privacy regulations (e.g., GDPR, CCPA) being non-negotiable features. The convergence of these technologies creates a dynamic and resilient CLOS ecosystem, empowering financial institutions to deliver faster, smarter, and more secure lending experiences in the digital age.

Regional Highlights

- North America: This region stands as a mature and dominant market for Consumer Loan Origination Systems, driven by a highly developed financial sector, high adoption rates of advanced technologies, and stringent regulatory environments that necessitate robust compliance solutions. The United States, in particular, leads in innovation and market size, with strong demand from large banks, mortgage lenders, and an expanding fintech ecosystem. Canada also contributes significantly, with a focus on digital transformation within its banking sector. The emphasis here is on integrating AI/ML for enhanced credit risk assessment and improving the digital customer journey to meet high consumer expectations for speed and convenience.

- Europe: Europe represents another significant market, characterized by a fragmented regulatory landscape across different countries, which drives demand for flexible and adaptable CLOS solutions capable of handling diverse compliance requirements. Western European countries like the UK, Germany, and France are early adopters, investing in cloud-based and AI-powered systems to modernize banking operations and combat intense competition. The Nordic countries are particularly advanced in digital banking, leading to high penetration of sophisticated CLOS. The region's focus is on GDPR compliance, open banking initiatives, and improving cross-border lending efficiency.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for CLOS, fueled by rapid economic development, increasing internet penetration, a burgeoning middle class, and aggressive digitalization initiatives in the financial sector. Countries such as China, India, Australia, Singapore, and Japan are experiencing significant investments in digital lending infrastructure. The vast underserved population and the rise of mobile-first consumers are creating immense opportunities for both established banks and new fintech players to leverage CLOS for financial inclusion and scalable loan processing. Regulatory sandboxes and government support for fintech innovation further accelerate adoption.

- Latin America: This region is an emerging market for CLOS, driven by increasing efforts towards financial inclusion, digital transformation in the banking sector, and a growing adoption of digital payment methods. Countries like Brazil, Mexico, and Argentina are seeing rising demand as financial institutions seek to streamline their lending processes, reduce operational costs, and cater to a younger, digitally savvy population. Regulatory changes aimed at modernizing financial services are also contributing to market growth, although economic instability in some areas can present adoption challenges.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth in the CLOS market, spurred by government-led digital transformation agendas, increasing urbanization, and efforts to diversify economies away from oil. The Gulf Cooperation Council (GCC) countries are leading in technology adoption, with significant investments in fintech and smart banking initiatives. In Africa, particularly South Africa, Nigeria, and Kenya, the expansion of mobile banking and microfinance is creating a fertile ground for CLOS, as lenders look to serve large, often unbanked, populations efficiently and securely. The focus is on leapfrogging traditional banking infrastructure with innovative digital lending solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Consumer Loan Origination System Market.- Black Knight, Inc. (now Intercontinental Exchange, Inc.)

- CalyxSoftware (a Constellation Software Company)

- Ellie Mae (now ICE Mortgage Technology)

- Fiserv, Inc.

- Infosys Limited

- Newgen Software Technologies Ltd.

- OpenText Corporation

- Oracle Corporation

- Q2 Holdings, Inc.

- Sagent Lending Technologies

- Sopra Banking Software

- Temenos AG

- VeriPro

- Wipro Limited

- Accenture

- Experian

- TransUnion

- LexisNexis Risk Solutions

- Blend

- LendingFront

Frequently Asked Questions

What is a Consumer Loan Origination System (CLOS)?

A Consumer Loan Origination System (CLOS) is a comprehensive software solution that automates and streamlines the entire consumer loan application process, from initial inquiry and credit assessment to underwriting, decisioning, and final loan disbursal. It helps financial institutions manage various loan products efficiently while ensuring compliance.

How does AI impact the Consumer Loan Origination System market?

AI significantly impacts the CLOS market by enhancing credit scoring accuracy through alternative data, automating document processing with NLP, improving fraud detection, and enabling personalized loan offers. It leads to faster approvals, reduced operational costs, and better risk management for lenders, revolutionizing traditional lending practices.

What are the primary benefits of implementing a CLOS for financial institutions?

Implementing a CLOS offers numerous benefits, including accelerated loan processing times, improved customer experience, enhanced regulatory compliance through automated checks, significant reduction in manual errors and operational costs, and the ability to make data-driven decisions through advanced analytics.

What are the key deployment models for Consumer Loan Origination Systems?

The key deployment models for CLOS are on-premises and cloud-based. On-premises solutions are installed and managed locally, offering full control but higher initial costs. Cloud-based solutions (SaaS) leverage remote servers for accessibility, scalability, and lower upfront investment, making them increasingly popular due to their flexibility.

Which regions are driving the growth of the Consumer Loan Origination System Market?

Growth in the Consumer Loan Origination System Market is primarily driven by North America and Europe, which are mature markets with high technological adoption. However, Asia Pacific is emerging as the fastest-growing region, fueled by rapid digitalization, increasing financial inclusion, and strong government support for fintech innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager