Consumer Pressure Washers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433871 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Consumer Pressure Washers Market Size

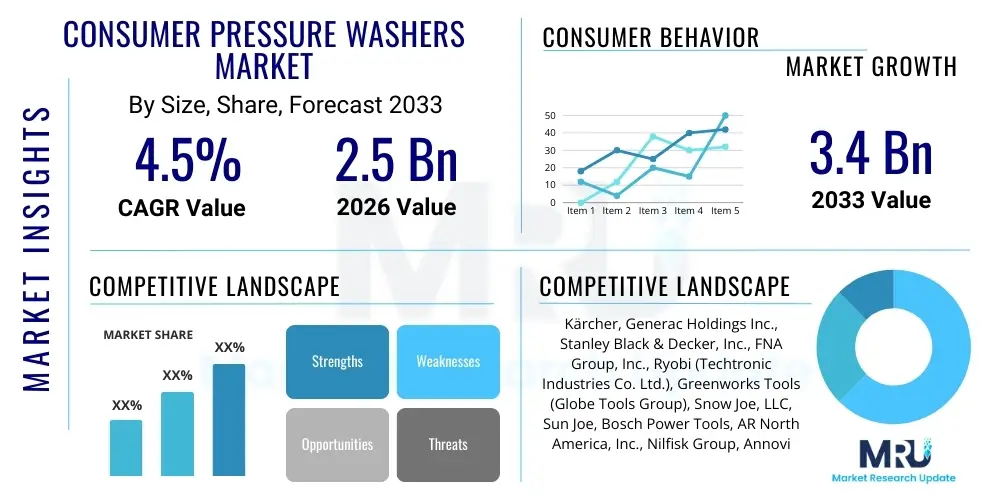

The Consumer Pressure Washers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.4 Billion by the end of the forecast period in 2033. This growth trajectory is significantly fueled by the increasing disposable income in emerging economies, coupled with a persistent consumer trend toward DIY (Do-It-Yourself) home maintenance and automotive care. The market expansion is further supported by continuous product innovation, particularly the introduction of highly efficient, lightweight, and user-friendly electric pressure washer models that cater specifically to residential cleaning needs.

Consumer Pressure Washers Market introduction

The Consumer Pressure Washers Market encompasses devices designed primarily for non-professional, residential, and light commercial cleaning applications. These systems utilize high-pressure water streams to remove loose paint, mold, grime, dust, mud, and dirt from surfaces such as vehicles, decks, patios, siding, and walkways. Product offerings range widely, including electric (corded and battery-powered) and gas-powered models, categorized by pressure output (measured in PSI) and flow rate (measured in GPM). The primary distinction from industrial counterparts lies in their portability, lighter duty cycle, and focus on ergonomic design tailored for the average homeowner.

Major applications of consumer pressure washers include exterior home maintenance, such as cleaning fences and pool areas, detailed car washing, and preparatory work for painting or staining outdoor surfaces. The critical benefits these tools offer include significant reduction in cleaning time, superior removal of stubborn dirt compared to conventional methods, and efficient conservation of water when compared to standard garden hoses. Furthermore, modern pressure washers are increasingly integrating specialized nozzles and detergent injection systems, enhancing their versatility and operational effectiveness across diverse cleaning scenarios, thereby driving their adoption rate among urban and suburban households globally.

Driving factors for this market include the rise in aesthetic standards for residential properties, particularly in developed regions where curb appeal dictates property value. The technological shift towards brushless induction motors in electric models is increasing reliability and reducing noise, addressing historical pain points for consumers. Additionally, aggressive marketing and digital content creation showcasing the ease and effectiveness of these tools are educating consumers and stimulating first-time purchases, especially among younger homeowners who prioritize efficiency and convenience in home upkeep activities.

Consumer Pressure Washers Market Executive Summary

The Consumer Pressure Washers Market is characterized by intense competition and rapid innovation, primarily centered around battery technology advancements and improved portability. Current business trends indicate a strong pivot toward sustainable products, with manufacturers focusing on energy-efficient motors and reduced water consumption features to appeal to environmentally conscious consumers. Strategic mergers, acquisitions, and partnerships are common as major players seek to expand their geographical footprint and integrate specialized component technologies, such as advanced pump designs and smart connectivity features, aiming for product differentiation in a highly saturated market environment. Digital marketing and e-commerce channel dominance continue to shape consumer purchasing pathways, necessitating robust online sales and service infrastructures for market leaders.

Regionally, North America and Europe hold significant market share due to high consumer awareness, widespread homeownership, and established DIY cultures. However, the Asia Pacific (APAC) region is demonstrating the highest growth potential, driven by rapid urbanization, increasing middle-class disposable incomes, and the growing availability of affordable, feature-rich pressure washer models. Governments in APAC are also indirectly supporting market growth through regulations promoting clean infrastructure and public hygiene standards. Manufacturers are thus tailoring product lines to meet the specific voltage requirements and space constraints prevalent in dense urban settings across countries like China and India.

Segment trends highlight the sustained dominance of the electric pressure washer segment, largely due to convenience, lower maintenance requirements, and zero operational emissions, making them ideal for enclosed residential areas. Within this segment, the battery-powered sub-segment is experiencing exponential growth, capitalizing on the increasing performance density of lithium-ion batteries, which now offer sufficient runtime and power for most common residential tasks, effectively challenging the traditional reliance on corded electric models. Furthermore, the accessories and attachments segment is growing rapidly, reflecting consumer demand for specialized tools (e.g., surface cleaners, turbo nozzles) that maximize the utility of the base pressure washer unit.

AI Impact Analysis on Consumer Pressure Washers Market

User inquiries regarding AI's impact on the Consumer Pressure Washers Market often center on two core themes: how smart technology can automate or optimize the cleaning process, and how AI can improve equipment maintenance and longevity. Users frequently ask if future pressure washers will possess "smart sensing" capabilities to automatically adjust pressure based on the surface material (e.g., wood vs. concrete) or the detected level of grime, thus preventing surface damage and ensuring optimal cleaning efficiency. There is also significant consumer interest in predictive maintenance—users want to know if AI diagnostics can forecast pump failure or motor wear, prompting proactive service reminders and thereby extending the lifespan of their investment.

The current application of AI, though nascent, is focused primarily on user experience and predictive reliability rather than full operational autonomy. Manufacturers are employing machine learning algorithms in their application software to analyze user cleaning patterns, offering personalized recommendations for optimal nozzle selection, detergent mixing ratios, and scheduling routine maintenance. Furthermore, AI-driven digital assistants, accessible via companion apps, provide real-time troubleshooting guidance, simplifying the repair process for the typical consumer who may lack technical expertise. This emphasis on enhancing usability and reducing friction points is crucial for maintaining competitive advantage in the DIY market.

In the near future, AI integration is expected to revolutionize advanced diagnostic capabilities, particularly in high-end, connected models. By analyzing operational data streams (motor temperature, vibration, pressure fluctuations), AI models can establish baseline operational profiles. Any deviation from these norms triggers alerts, transforming the consumer experience from reactive repair to proactive care. While fully autonomous cleaning remains limited by water source and movement constraints, this diagnostic and prescriptive maintenance capability is set to significantly raise consumer expectations regarding durability and smart features in household cleaning appliances.

- AI-Powered Diagnostic Systems: Enabling predictive maintenance alerts and real-time fault identification for motors and pumps.

- Smart Pressure Adjustment: Using machine learning to identify surface types (e.g., based on sensor feedback) and automatically regulate water pressure to prevent damage.

- Optimized Detergent Dosing: AI algorithms recommending or controlling precise detergent quantities based on the cleaning task and water hardness.

- User Pattern Analysis: Utilizing data to personalize cleaning recommendations and optimize energy/water consumption profiles.

- Enhanced Customer Support: AI chatbots and digital assistants offering immediate, context-aware troubleshooting for operational issues.

DRO & Impact Forces Of Consumer Pressure Washers Market

The dynamics of the Consumer Pressure Washers Market are governed by a robust interplay of Drivers, significant Restraints, and evolving Opportunities, which together define the Impact Forces shaping the industry's future trajectory. Key drivers include the global expansion of disposable incomes, particularly in rapidly urbanizing developing nations, fueling demand for convenient home maintenance tools. The growing trend of home improvement projects, often accelerated by changes in consumer living habits, such as increased time spent at home, further solidifies the foundational demand for efficient cleaning equipment. Concurrently, technological advancements leading to the development of quieter, more powerful, and exceptionally lightweight battery-powered units are overcoming traditional barriers related to portability and noise pollution, thus expanding the target consumer base significantly.

However, the market faces notable restraints, primarily centered around high initial costs associated with premium, high-performance models, which can deter price-sensitive consumers. Furthermore, the cyclical nature of demand, often spiking during seasonal cleaning periods (spring and summer), presents inventory and operational management challenges for manufacturers. Another substantial restraint involves the perceived complexity and risk associated with high-pressure cleaning, leading to consumer apprehension regarding potential damage to property if the equipment is misused. This necessitates continuous investment in user education and the development of intuitive, fail-safe product designs to mitigate these concerns and ensure safe operation across diverse user skill levels.

Significant opportunities exist in the continued development of highly energy-efficient components, specifically brushless motors and advanced pump technologies that extend product longevity and enhance operational performance. The market is also ripe for expansion through strategic accessory bundling and the introduction of specialized tools tailored for niche applications, such as gutter cleaning attachments or professional-grade surface scrubbers adapted for consumer use. The integration of IoT capabilities and smart home ecosystems offers substantial potential, allowing pressure washers to integrate cleaning schedules with other smart outdoor maintenance devices. The cumulative effect of these Impact Forces is driving a shift towards premium, technologically advanced offerings, forcing market consolidation and increased R&D spending among leading industry participants.

Segmentation Analysis

The Consumer Pressure Washers Market is meticulously segmented based on key criteria including Power Source, Output Range (PSI), and Application, allowing manufacturers to tailor products precisely to diverse consumer needs and operational environments. The Power Source segmentation, separating Electric (Corded and Cordless/Battery) from Gas-Powered units, remains the most defining characteristic, impacting factors like mobility, power, and environmental footprint. Electric pressure washers dominate residential sales due to ease of use and maintenance, while gas-powered units maintain a foothold in areas requiring high mobility and extreme cleaning power, typically for larger properties or semi-commercial applications requiring sustained, high-pressure output.

Further granularity is achieved through segmenting by pressure output (PSI), typically categorized into light-duty (under 1900 PSI), medium-duty (1900–2800 PSI), and heavy-duty (above 2800 PSI) applications. This segmentation is crucial for matching product capability to the intended cleaning task, ensuring customer satisfaction and safety. Light-duty models are preferred for basic tasks like cleaning patio furniture and small vehicles, while medium and heavy-duty models are reserved for demanding jobs such as driveway degreasing and large area surface cleaning. The evolving consumer preference is leaning toward robust medium-duty electric models that strike a balance between power and manageable form factor.

Application segmentation, covering automotive cleaning, home exterior cleaning (decks, patios, siding), and specialized industrial DIY applications, helps in targeted marketing and accessory design. The rapid growth of the home exterior segment reflects the overall increase in residential refurbishment spending. Understanding these segments is vital for developing effective distribution strategies, optimizing pricing tiers, and directing innovation efforts toward features that address specific end-user pain points, such as surface compatibility and chemical resistance features in the pumps and hoses.

- Power Source: Electric (Corded, Cordless/Battery-powered), Gas-Powered.

- Output Range (PSI): Light-Duty (Under 1900 PSI), Medium-Duty (1900–2800 PSI), Heavy-Duty (Above 2800 PSI).

- End-Use Application: Automotive Cleaning, Home Exterior (Patio, Deck, Siding), Specialty DIY Cleaning.

- Component: Pumps (Axial Cam, Triplex Plunger), Motors (Induction, Universal), Hoses and Nozzles.

- Distribution Channel: Online Retail, Offline Retail (Home Improvement Stores, Specialty Stores).

Value Chain Analysis For Consumer Pressure Washers Market

The value chain for the Consumer Pressure Washers Market begins with the upstream activities involving the sourcing and manufacturing of critical components, including high-efficiency motors (both universal and induction), robust pumps (axial and triplex plunger types), durable high-pressure hoses, and specialized nozzle sets. Key raw materials include specialized plastics for housing, high-grade aluminum and brass for pump components, and lithium-ion cells for battery-powered systems. Component suppliers, often specialized in fluid dynamics and electric motor technology, hold significant bargaining power, especially those providing proprietary brushless motor technology, which dictates the overall performance and cost structure of the finished product. Manufacturing processes involve intricate assembly, quality control checks for pressure integrity, and stringent compliance with international safety standards (e.g., UL, CE), representing a major cost center in the upstream phase.

Downstream activities center intensely on distribution, marketing, and post-sales service. The distribution channel is heavily bifurcated between direct sales (primarily through proprietary company websites and specialized industrial suppliers for professional-grade consumer models) and indirect sales, which leverage massive scale through big-box home improvement retailers (e.g., Home Depot, Lowe’s) and rapidly growing e-commerce platforms (e.g., Amazon, Alibaba). E-commerce platforms are increasingly critical, offering broad visibility, competitive pricing, and extensive customer reviews, which significantly influence purchasing decisions. Effective logistics and inventory management are paramount in the downstream segment to handle seasonal demand fluctuations efficiently and maintain market responsiveness.

The structure of the distribution channel impacts pricing and profit margins considerably. Direct sales generally offer higher margins but require substantial investment in brand building and customer relationship management. Indirect sales, while yielding slightly lower margins per unit, benefit from the retailer's extensive network and foot traffic. Customer service, including warranty fulfillment, spare parts availability, and technical support, constitutes the final, crucial stage of the value chain. Excellent post-sales support enhances brand loyalty and drives positive word-of-mouth recommendations, which are essential factors in the consumer tools market where product reliability is a key purchase criterion.

Consumer Pressure Washers Market Potential Customers

The primary end-users and buyers of consumer pressure washers are typically homeowners and tenants who are actively involved in maintaining the cleanliness and aesthetic appeal of their residential properties. This core demographic includes DIY enthusiasts who prefer undertaking home improvement and cleaning tasks themselves rather than hiring external services, valuing the convenience and cost savings provided by owning the equipment. Within this segment, those living in single-family detached homes with extensive exterior surfaces (decks, patios, driveways, vehicles) represent the highest consumption volume. These customers prioritize equipment durability, ease of storage, and sufficient power output (medium to heavy duty) to tackle varied outdoor cleaning challenges.

A rapidly expanding segment of potential customers includes automotive enthusiasts and vehicle owners who frequently wash their cars, motorcycles, or recreational vehicles (RVs). For this group, the primary focus is on units that offer precise pressure control and specialized accessories (e.g., foam cannons, soft wash nozzles) that minimize the risk of damaging vehicle paint while ensuring deep cleaning. This cohort often favors lightweight, highly portable electric models, particularly cordless options, due to the need for flexibility when moving around a vehicle and limited access to continuous power sources in driveways or shared parking areas. They are highly responsive to innovations that improve efficiency and minimize effort.

Furthermore, small business owners and micro-enterprises, such as mobile detailing services, small facility management teams, and landscape maintenance professionals, constitute a vital sub-segment of potential customers, though their needs sometimes border on light commercial applications. These buyers require consumer-grade pressure washers that offer superior robustness, extended operational lifecycles, and easy access to replacement parts, effectively using high-end consumer or entry-level commercial units. Their purchasing decisions are often driven by the unit's longevity, warranty coverage, and the cost-efficiency of the investment relative to the frequency of use, making the Total Cost of Ownership (TCO) a crucial metric.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.4 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kärcher, Generac Holdings Inc., Stanley Black & Decker, Inc., FNA Group, Inc., Ryobi (Techtronic Industries Co. Ltd.), Greenworks Tools (Globe Tools Group), Snow Joe, LLC, Sun Joe, Bosch Power Tools, AR North America, Inc., Nilfisk Group, Annovi Reverberi S.p.A., Comet S.p.A., Campbell Hausfeld, BE Power Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Consumer Pressure Washers Market Key Technology Landscape

The technological landscape of the Consumer Pressure Washers Market is rapidly evolving, driven primarily by innovations aimed at enhancing user convenience, extending product durability, and improving environmental performance. The most significant shift is the proliferation of high-performance lithium-ion battery technology, enabling robust cordless pressure washers that offer power previously exclusive to corded electric or gas models. This technological advancement relies on optimized battery management systems (BMS) and efficient energy transmission to ensure sustained high-pressure output without overheating. Furthermore, the adoption of brushless induction motors, replacing traditional universal motors, is critical. Brushless motors offer substantial benefits, including significantly longer life expectancy, reduced noise levels, and superior energy efficiency, making them a standard feature in mid-to-high-end consumer units and addressing core consumer complaints regarding equipment longevity and operational disturbance.

In terms of water delivery systems, the transition from basic axial cam pumps to more robust, albeit slightly more complex, triplex plunger pumps is observed in premium consumer and light commercial models. Triplex pumps are better suited for extended use cycles, handling high pressures more reliably, which directly increases the product's value proposition for serious DIY users. Another key technological area is nozzle design and management. Quick-connect systems and specialized rotating turbo nozzles are now standard, maximizing cleaning efficiency. Moreover, sophisticated detergent injection systems, often featuring adjustable dosing controls, are becoming integrated, allowing consumers to switch seamlessly between cleaning modes without complex manual setup, thereby enhancing the overall utility of the washer.

Digital integration, though still emerging, represents a significant technological frontier. The implementation of IoT features, connectivity through Bluetooth or Wi-Fi to companion smartphone applications, allows users to monitor maintenance schedules, access instructional videos, and remotely check battery charge status. While these features are currently focused on diagnostic and informational support, future developments are anticipated to include automated monitoring of water flow and pressure through smart sensors, integrating with AI analysis to optimize cleaning parameters based on real-time feedback. This digital convergence transforms the pressure washer from a simple mechanical tool into a smart, interconnected maintenance appliance.

Regional Highlights

- North America: Characterized by high penetration rates due to widespread homeownership and a strong DIY culture. The US leads in technology adoption, particularly for high-end, battery-powered systems and smart-featured pressure washers.

- Europe: Driven by stringent environmental regulations encouraging the use of electric and energy-efficient models. Germany and the UK are key markets, prioritizing quality, noise reduction, and long-term durability, leading to high sales volumes for premium European brands.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization and rising disposable incomes in economies like China, India, and Southeast Asia. Market growth is sensitive to price, leading to high demand for value-oriented, entry-level electric pressure washers.

- Latin America: Characterized by a growing acceptance of power tools for property maintenance. The market here is fragmented, with increasing demand for imported, reliable medium-duty models for both residential and small-scale professional cleaning tasks.

- Middle East and Africa (MEA): Growth is steady but focused largely on gas-powered models in areas where consistent electricity supply is a concern, though increasing infrastructure development is boosting the demand for high-pressure industrial-grade consumer units, especially in Saudi Arabia and UAE.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Consumer Pressure Washers Market.- Kärcher

- Generac Holdings Inc.

- Stanley Black & Decker, Inc.

- FNA Group, Inc.

- Ryobi (Techtronic Industries Co. Ltd.)

- Greenworks Tools (Globe Tools Group)

- Snow Joe, LLC

- Sun Joe

- Bosch Power Tools

- AR North America, Inc.

- Nilfisk Group

- Annovi Reverberi S.p.A.

- Comet S.p.A.

- Campbell Hausfeld

- BE Power Equipment

- YARD FORCE

- Craftsman

- Pulsar Products

- Westinghouse Outdoor Power Equipment

- Mi-T-M Corporation

Frequently Asked Questions

Analyze common user questions about the Consumer Pressure Washers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between gas-powered and electric pressure washers for residential use?

Gas-powered pressure washers typically offer significantly higher PSI and GPM ratings, providing superior cleaning power for large, demanding tasks like stripping paint or cleaning heavily soiled driveways, but they are louder, require more maintenance, and produce emissions. Electric models are quieter, maintenance-free, lighter, and ideal for smaller residential tasks like cleaning cars, patios, and furniture, increasingly favored due to advancements in powerful cordless battery technology.

How is the market influenced by advancements in battery technology?

Battery technology advancements, specifically in high-density lithium-ion cells and sophisticated battery management systems (BMS), are major growth drivers. These innovations allow cordless pressure washers to deliver sufficient run time and pressure for medium-duty tasks, eliminating the reliance on power cords and expanding the versatility and portability of electric units, thereby challenging the market dominance of traditional corded and low-end gas models.

Which pressure output (PSI) range is recommended for general home exterior maintenance?

For general home exterior maintenance, which includes cleaning decks, fences, siding, and patios without causing damage, a medium-duty pressure washer with an output range between 1900 PSI and 2800 PSI is generally recommended. This range balances sufficient power for grime removal with adequate safety margin for various common residential surfaces.

What are the key technological features driving product differentiation in the consumer market?

Key technological differentiators include the adoption of durable and quiet brushless induction motors, integrated smart features (IoT connectivity for diagnostics and maintenance scheduling), advanced axial or triplex pump designs for extended lifespan, and specialized nozzle sets such as turbo nozzles and dedicated surface cleaners, all aimed at enhancing user experience and cleaning efficiency.

What are the most significant restraints affecting market growth in developed regions?

The primary restraints in developed regions include market saturation among traditional homeowners, intense price competition forcing margin erosion in the lower-end segment, and consumer apprehension regarding the safe operation of high-pressure equipment, necessitating manufacturers to focus heavily on intuitive design and robust safety features to mitigate accidental property damage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Consumer Pressure Washers Market Size Report By Type (1500 - 1750 psi, 1800 - 2000 psi, 2000 - 3000 psi, 3000 - 4200 psi, By Product Type, Electric Motor, Petrol Engine, Diesel Engine), By Application (Residential, Commercial, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Consumer Pressure Washers Market Statistics 2025 Analysis By Application (Residential, Commercial, Industrial), By Type (Electric Motor, Petrol Engine, Diesel Engine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Consumer Pressure Washers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Electric Motor, Petrol Engine, Diesel Engine), By Application (Residential, Commercial, Industrial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager