Consumer Wi-Fi Router Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433541 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Consumer Wi-Fi Router Market Size

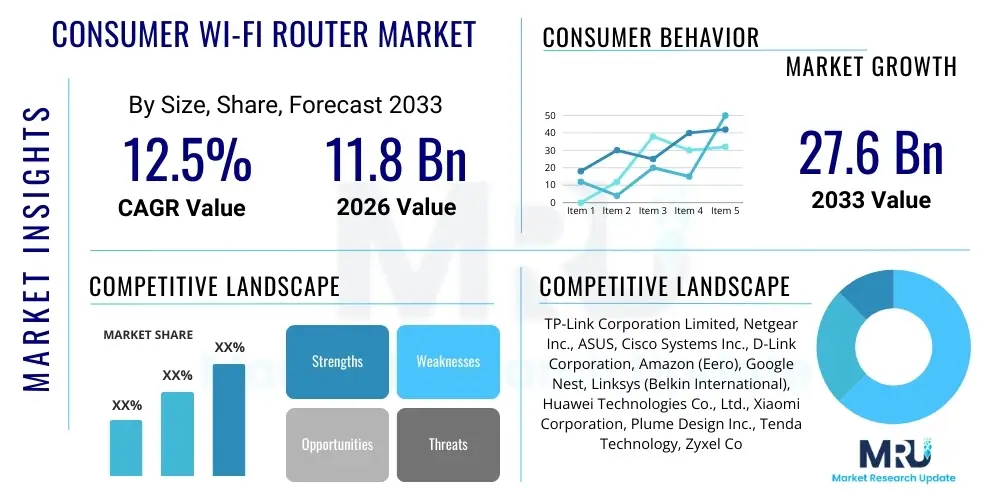

The Consumer Wi-Fi Router Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 11.8 Billion in 2026 and is projected to reach USD 27.6 Billion by the end of the forecast period in 2033.

Consumer Wi-Fi Router Market introduction

The Consumer Wi-Fi Router Market encompasses hardware devices designed for home and small office environments that facilitate wireless networking and internet connectivity. These devices serve as the central hub, managing data traffic, assigning IP addresses, and ensuring seamless communication between connected devices and the broader network infrastructure. The core function of a Wi-Fi router is to translate incoming signals from an internet service provider (ISP) into a localized wireless signal, enabling smartphones, laptops, smart home devices, and gaming consoles to access the internet simultaneously. Recent advancements, particularly in Wi-Fi 6 (802.11ax) and the emerging Wi-Fi 7 (802.11be) standards, have drastically improved network efficiency, capacity, and latency, catering to the exponential growth in bandwidth consumption driven by high-definition streaming and cloud-based applications.

Major applications for consumer Wi-Fi routers include enabling smart home ecosystems, facilitating remote work (SOHO), and supporting high-fidelity digital entertainment, such as virtual reality (VR) and 4K/8K video transmission. The primary benefit derived by consumers is the establishment of a robust, high-speed, and secure local area network (LAN) that supports numerous connected devices without performance degradation. Modern routers often integrate sophisticated features like parental controls, Guest Network access, and Quality of Service (QoS) prioritization, optimizing performance for specific tasks like gaming or video conferencing, thereby significantly enhancing the overall digital experience.

Key driving factors accelerating market growth include the global expansion of fiber optic broadband infrastructure and the widespread adoption of bandwidth-intensive applications. Furthermore, the proliferation of Internet of Things (IoT) devices in residential settings necessitates high-capacity routers capable of reliably managing hundreds of simultaneous connections. The continuous need for faster, more reliable, and lower-latency connectivity, especially in densely populated urban areas where signal interference is common, fuels continuous replacement cycles and upgrades to advanced standards like Mesh Wi-Fi systems and Wi-Fi 6E/7 capable devices.

Consumer Wi-Fi Router Market Executive Summary

The Consumer Wi-Fi Router Market is experiencing robust expansion, fundamentally driven by the accelerated digital transformation of residential spaces and the necessity for superior wireless performance to support modern digital lifestyles. Key business trends indicate a significant shift from traditional standalone routers towards advanced Mesh Wi-Fi systems, which offer superior coverage, seamless roaming, and simplified management through mobile applications. Market players are increasingly focusing on incorporating high-security protocols, integrating AI-driven network optimization features, and designing devices compatible with the latest Wi-Fi 6E and Wi-Fi 7 standards to differentiate their product offerings in a highly competitive landscape. This trend ensures that networking hardware evolves rapidly alongside consumer demands for low latency and high throughput, crucial for cloud gaming and augmented reality applications.

Regional trends highlight that North America and Europe currently dominate the market share due to high disposable incomes, early adoption of cutting-edge networking technologies, and the widespread availability of high-speed fiber internet services. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, primarily fueled by massive infrastructure investments in developing nations like India and China, rapid urbanization, and a surging middle class demanding reliable home internet connectivity. The increasing penetration of smart devices in emerging economies is creating a fertile ground for high-performance router upgrades, shifting the geographical focus of growth towards APAC.

Segment-wise, the Mesh Wi-Fi Systems segment is expected to outpace traditional routers in growth due to their ability to eliminate dead zones and simplify installation for non-technical users. Regarding standards, the migration to Wi-Fi 6/6E is mature, but the nascent Wi-Fi 7 segment is anticipated to witness exponential growth toward the latter half of the forecast period, driven by enthusiast users, professional home setups, and future-proofing demands. Distribution channel trends show that online retail continues to gain dominance, offering competitive pricing, direct-to-consumer models, and access to a wider variety of specialized networking hardware compared to traditional brick-and-mortar stores, influencing purchasing decisions across all consumer demographics.

AI Impact Analysis on Consumer Wi-Fi Router Market

User inquiries regarding AI's impact on Wi-Fi routers predominantly center on how artificial intelligence can enhance network stability, security, and performance without requiring complex manual configurations. Common questions explore AI's role in optimizing bandwidth allocation (Quality of Service), identifying and neutralizing novel security threats in real-time, and automatically adjusting signal strength and channel selection to minimize interference. Users expect AI to transform their home network from a static infrastructure into a dynamic, self-optimizing system capable of predicting congestion, tailoring connectivity based on user activity (e.g., prioritizing video calls over background downloads), and simplifying troubleshooting processes. The underlying theme is a strong expectation for 'smarter' networking that provides a consistently superior user experience with minimal input.

The integration of AI and machine learning (ML) algorithms is fundamentally redefining the consumer Wi-Fi router market. AI-driven routers are moving beyond simple routing capabilities to become intelligent network managers. This includes advanced features such as automatic network mapping, anomaly detection to flag suspicious traffic patterns indicative of malware, and dynamic frequency hopping to ensure minimal interference in crowded wireless environments. This technological integration not only enhances performance but significantly improves security, as AI can learn normal network behavior patterns and instantly identify deviations, offering a level of protection far exceeding traditional firewall approaches.

Furthermore, AI algorithms are crucial for optimizing Mesh Wi-Fi systems. They analyze the spatial environment, device load, and interference sources to determine the optimal signal path and load distribution across multiple access points, ensuring seamless handoff and consistent speeds throughout the coverage area. This automation reduces technical friction for consumers and positions AI-enabled routers as essential components of the modern smart home, ready to handle the increasing demands of high-throughput applications and massive IoT device arrays.

- AI-Driven QoS Optimization: Automatic prioritization of latency-sensitive applications (e.g., gaming, video conferencing) over bulk data transfers based on learned usage patterns.

- Real-time Security Threat Detection: Machine learning models identify zero-day exploits and malware by analyzing traffic anomalies and behavioral deviations instantaneously.

- Dynamic Channel Selection (DCS): AI scans the electromagnetic environment and autonomously selects the least congested Wi-Fi channels to minimize interference and maximize throughput.

- Self-Healing Mesh Networks: Algorithms automatically reconfigure network topology and redistribute load when an access point fails or experiences congestion, ensuring uninterrupted connectivity.

- Predictive Network Maintenance: AI analyzes performance metrics over time to anticipate potential failures or service degradation, proactively alerting users or initiating self-correction protocols.

- Enhanced Parental Controls: ML-based classification of internet content and adaptive time limits based on user profiles and activity monitoring.

DRO & Impact Forces Of Consumer Wi-Fi Router Market

The Consumer Wi-Fi Router Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces shaping vendor strategies and consumer adoption cycles. The primary driver is the pervasive demand for high-capacity bandwidth fueled by the global shift towards 4K/8K media consumption, cloud gaming, and high-fidelity streaming services, alongside the mandatory requirement for robust connectivity to support the widespread adoption of smart home ecosystems and the enduring trend of remote work. These drivers necessitate frequent hardware upgrades to leverage new standards like Wi-Fi 6E and Wi-Fi 7, generating strong replacement demand in established markets. Simultaneously, rapid urbanization and infrastructure deployment, especially 5G and fiber rollout in developing economies, open up vast opportunities for market penetration.

However, the market faces structural restraints that moderate growth. A significant restraint is the inherent security vulnerabilities associated with connected devices, which often leave home networks susceptible to cyber-attacks, leading to consumer reluctance or delayed adoption of advanced smart networking features. Furthermore, the high initial cost associated with cutting-edge technologies like Mesh Wi-Fi 7 systems and the potential confusion among consumers regarding complex technical specifications (e.g., tri-band vs. quad-band, specific Wi-Fi standards) can hinder widespread adoption. The relatively long lifecycle of basic routers, especially in price-sensitive segments, means that replacement cycles are often slower than technology evolution, delaying the full market transition to newer standards.

The most compelling opportunities lie in the integration of highly intelligent network management capabilities, specifically those leveraging AI/ML for automated optimization, security, and troubleshooting, transforming the router into an intelligent hub. The expansion of the 6 GHz spectrum through Wi-Fi 6E and Wi-Fi 7 offers unprecedented low-latency capacity, crucial for demanding applications like AR/VR and industrial IoT applications being managed remotely. Strategic partnerships with Internet Service Providers (ISPs) and smart home platform developers are also key opportunities, ensuring wider distribution channels and interoperability. These impact forces—driven by technological advancement and constrained by security and cost—create a highly dynamic environment where innovation in efficiency and ease of use dictates market leadership.

Segmentation Analysis

The Consumer Wi-Fi Router Market is segmented based on critical technical specifications, product types, and end-user requirements, reflecting the diverse needs of modern consumers, ranging from basic connectivity to highly demanding networking environments. Segmentation provides a granular view of market trends, allowing vendors to tailor product strategies based on consumer willingness to pay for specific features like higher speed, better coverage, or advanced security protocols. Key segmentation criteria include the underlying Wi-Fi standard implemented (e.g., Wi-Fi 5, Wi-Fi 6, Wi-Fi 7), the architectural design of the network (Traditional Routers versus Mesh Systems), the bandwidth capacity supported (Single-Band, Dual-Band, Tri-Band), and the primary end-use application (Residential versus SOHO/Gaming).

The evolution of Wi-Fi standards represents the most active segmentation dynamic. While Wi-Fi 5 (802.11ac) devices still hold a substantial installed base, the rapid migration to Wi-Fi 6 (802.11ax) and Wi-Fi 6E is dominating new purchases due to enhanced efficiency (OFDMA) and access to the uncongested 6 GHz band. The emerging Wi-Fi 7 (802.11be) segment, characterized by extremely high throughput and low latency via Multi-Link Operation (MLO), is poised to capture the premium market segment, appealing to early adopters, content creators, and dedicated gamers requiring professional-grade home networks. This standards-based segmentation directly correlates with pricing tiers and performance capabilities.

Product type segmentation emphasizes the growing preference for coverage and ease of installation, driving the Mesh Wi-Fi systems segment into a high-growth trajectory. Mesh networks, offering scalable and unified coverage across large or complex home layouts, are gradually replacing traditional standalone routers, particularly in multi-story residences. Furthermore, the segmentation by frequency band—especially the tri-band and quad-band categories—reflects the need to dedicate specific bands for backhaul communication (in mesh systems) or for specific high-bandwidth devices, maximizing simultaneous performance and minimizing internal network contention.

- By Standard:

- Wi-Fi 5 (802.11ac)

- Wi-Fi 6 (802.11ax)

- Wi-Fi 6E (802.11ax on 6 GHz band)

- Wi-Fi 7 (802.11be)

- By Product Type:

- Traditional (Standalone) Routers

- Mesh Wi-Fi Systems

- Gateways/Modem-Router Combos

- By Frequency Band:

- Single-Band

- Dual-Band

- Tri-Band/Quad-Band

- By Distribution Channel:

- Online Retail

- Offline Stores (Specialty Electronics Stores, Carrier Stores)

- By Application/End-User:

- Residential (General Use)

- Gaming/Performance-Specific

- Small Office/Home Office (SOHO)

Value Chain Analysis For Consumer Wi-Fi Router Market

The value chain for the Consumer Wi-Fi Router Market begins with the upstream activities centered on component manufacturing and software development. Upstream analysis highlights the critical role of semiconductor companies (e.g., Broadcom, Qualcomm, MediaTek) that supply the core chipsets, processors, and specialized radio frequency (RF) modules necessary for wireless communication standards compliance (Wi-Fi 6/7). Innovation and cost reduction at this stage are crucial, as component costs significantly impact the final price. Intellectual property related to networking protocols, security standards, and antenna design is also highly valued upstream. Sourcing and efficient inventory management of specialized components are key challenges due to global supply chain volatility.

Midstream activities involve Original Equipment Manufacturers (OEMs) and branded vendors responsible for product design, assembly, quality control, and firmware development. This stage focuses on integrating the core chipset with specialized proprietary software (firmware) that manages network operations, user interface, security features, and AI optimization tools. Differentiation often occurs here through industrial design (antenna placement, cooling) and sophisticated software features like parental controls and mobile management applications. Efficient manufacturing processes, often located in East Asia, are essential for maintaining competitive pricing and high-volume output.

Downstream activities include distribution and sales, covering both direct and indirect channels. Indirect distribution relies heavily on large e-commerce platforms (Online Retail), specialized electronics retailers, and crucially, Internet Service Providers (ISPs) who often bundle routers or offer subsidized hardware as part of their service packages. Direct channels involve vendors selling customized or premium models directly to consumers through their own websites, allowing for greater control over brand messaging and customer data. The effectiveness of the after-sales support and warranty services provided by these distribution channels heavily influences customer satisfaction and brand loyalty, closing the value chain loop.

Consumer Wi-Fi Router Market Potential Customers

The primary customer base for the Consumer Wi-Fi Router Market is highly segmented yet broadly defined by their digital dependency and networking requirements. The largest segment comprises residential users seeking basic to advanced reliable internet access for daily tasks, streaming, and managing a modest number of IoT devices. These customers typically prioritize ease of use, stability, and affordable pricing, often opting for dual-band or entry-level Mesh systems to eliminate common dead zones within standard home layouts. This group is highly susceptible to ISP recommendations and price promotions, often viewing the router as a utility rather than a performance-enhancing tool.

A rapidly growing customer segment consists of 'Power Users' and 'Digital Natives,' including professional gamers, content creators, and those operating Small Offices/Home Offices (SOHO). These buyers are technologically savvy, often conduct their own detailed research, and place paramount importance on ultra-low latency, maximum throughput, and advanced network management capabilities. They drive demand for premium, high-performance hardware, specifically tri-band Wi-Fi 6E/7 routers and robust, high-core Mesh systems capable of supporting hundreds of devices and managing constant, high-volume data transfers critical for professional activities like 4K video editing or large-scale data backup.

The third major segment involves users driven by specific structural or security needs, such as inhabitants of large homes, multi-story residences, or individuals with a high concentration of smart home devices (smart speakers, security cameras, thermostats). These customers seek reliable whole-home coverage and often purchase integrated Mesh systems or specialized routers with enhanced security features (like built-in VPNs or subscription-based security software) to secure their extensive network of connected devices. Their purchasing decision is heavily influenced by coverage guarantees, simplicity of installation, and reputation for long-term stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.8 Billion |

| Market Forecast in 2033 | USD 27.6 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TP-Link Corporation Limited, Netgear Inc., ASUS, Cisco Systems Inc., D-Link Corporation, Amazon (Eero), Google Nest, Linksys (Belkin International), Huawei Technologies Co., Ltd., Xiaomi Corporation, Plume Design Inc., Tenda Technology, Zyxel Communications Corp., Ubiquiti Inc., Samsung Electronics Co., Ltd., Comcast (Xfinity), Arris International PLC, Nokia Corporation, MikroTik, Synology Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Consumer Wi-Fi Router Market Key Technology Landscape

The technological landscape of the Consumer Wi-Fi Router Market is defined by continuous evolution in wireless standards aimed at maximizing throughput, enhancing efficiency, and minimizing latency, primarily driven by the increasing density of connected devices. Wi-Fi 6 (802.11ax) introduced orthogonal frequency-division multiple access (OFDMA) and Multi-User Multiple-Input Multiple-Output (MU-MIMO), which are foundational technologies enabling simultaneous data transmission to multiple devices and dramatically improving network efficiency in congested environments. Wi-Fi 6E extended these capabilities into the 6 GHz band, providing a wide, uncongested channel specifically dedicated to high-speed, low-latency applications, effectively alleviating the pressure on the traditional 2.4 GHz and 5 GHz bands.

The next major leap is Wi-Fi 7 (802.11be), dubbed Extremely High Throughput (EHT). This standard introduces several transformative features, including 320 MHz channels (doubling the maximum channel size of Wi-Fi 6/6E), 4096-QAM modulation for significantly higher data rates, and the pivotal Multi-Link Operation (MLO). MLO allows devices to simultaneously transmit and receive data across different frequency bands (2.4 GHz, 5 GHz, 6 GHz), effectively aggregating bandwidth and providing unparalleled robustness and low latency, essential for future high-demand applications like true wireless VR and industrial automation within the home environment. The widespread adoption of Wi-Fi 7 chipsets and certified devices is anticipated to redefine the high-end segment of the consumer market.

Beyond core wireless standards, advanced software technologies, especially those centered around networking intelligence, are critical differentiators. Mesh networking architecture utilizes sophisticated software algorithms to ensure seamless roaming and unified coverage across multiple nodes, replacing traditional extenders. Furthermore, the integration of AI for dynamic Quality of Service (QoS), automated cybersecurity scanning, and self-optimization is rapidly becoming a standard expectation. Security protocols are also advancing, with WPA3 replacing WPA2 as the standard for enhanced encryption and resilience against brute-force attacks, strengthening the overall security posture of consumer networks against increasingly sophisticated cyber threats.

Regional Highlights

- North America: North America holds a dominant position in the Consumer Wi-Fi Router Market, largely attributed to the high penetration rate of fixed broadband services, particularly high-speed fiber deployments, and the widespread consumer willingness to invest in premium networking equipment. The region is characterized by early adoption of new Wi-Fi standards (Wi-Fi 6E and Wi-Fi 7), driven by sophisticated demand for 4K/8K streaming, competitive online gaming, and a large concentration of SOHO users requiring enterprise-grade home connectivity. Market maturity means growth is primarily fueled by replacement cycles and upgrades to advanced Mesh systems, emphasizing security and AI-driven optimization features.

- Europe: The European market demonstrates significant steady growth, supported by robust regulatory frameworks promoting digital connectivity and high standards of living allowing for consistent investment in modern home networking infrastructure. Western European countries, such as Germany, the UK, and France, exhibit strong demand for high-performance routers and mesh systems to manage complex residential properties and support high IoT device counts. Regulatory emphasis on data privacy and security also drives demand for routers offering integrated cybersecurity features. The rollout of the 6 GHz spectrum has accelerated the uptake of Wi-Fi 6E devices across the continent.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period due to rapid infrastructure development, increasing urbanization, and expanding middle-class disposable incomes in populous nations like China, India, and Southeast Asian countries. Government initiatives to promote digital connectivity and the massive, accelerating adoption of smartphones and smart home devices are key catalysts. While price sensitivity remains a factor in developing APAC economies, the growing market for gaming and high-definition mobile content is driving significant demand for affordable high-capacity Wi-Fi 6 routers and entry-level mesh solutions.

- Latin America (LATAM): The LATAM region presents significant opportunity, marked by improving internet penetration rates and the ongoing transition from DSL to fiber optic services, particularly in countries like Brazil and Mexico. The market is currently focused on dual-band routers and basic Wi-Fi 6 models as foundational infrastructure catches up. Growth is constrained somewhat by economic volatility and slower broadband deployment compared to mature markets, but rising consumer demand for video conferencing and streaming services ensures stable demand, often driven by bundled offerings from local ISPs.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, centered predominantly around the Gulf Cooperation Council (GCC) countries where high-speed internet adoption and smart city initiatives drive investment in advanced networking technologies, including premium Mesh Wi-Fi systems. In contrast, sub-Saharan Africa represents an emerging market where basic, reliable Wi-Fi 5 and low-cost Wi-Fi 6 solutions are entering the market, largely influenced by mobile broadband expansion and government efforts to improve digital access. Demand is highly polarized between the luxury segment in the Gulf and the value segment in broader Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Consumer Wi-Fi Router Market.- TP-Link Corporation Limited

- Netgear Inc.

- ASUS

- Cisco Systems Inc.

- D-Link Corporation

- Amazon (Eero)

- Google Nest (Alphabet Inc.)

- Linksys (Belkin International)

- Huawei Technologies Co., Ltd.

- Xiaomi Corporation

- Plume Design Inc.

- Tenda Technology

- Zyxel Communications Corp.

- Ubiquiti Inc.

- Samsung Electronics Co., Ltd.

- Comcast (Xfinity)

- Arris International PLC

- Nokia Corporation

- MikroTik

- Synology Inc.

Frequently Asked Questions

Analyze common user questions about the Consumer Wi-Fi Router market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of upgrading to a Mesh Wi-Fi system over a traditional router?

Mesh Wi-Fi systems offer superior whole-home coverage and eliminate dead zones by utilizing multiple interconnected access points, whereas traditional routers rely on a single central point. Mesh systems also provide centralized management, simplified setup, and seamless roaming, ensuring consistent high-speed connectivity as users move throughout the coverage area, which is vital for large homes or complex layouts.

How does the new Wi-Fi 7 standard impact consumer networking performance?

Wi-Fi 7 (802.11be) significantly boosts performance by introducing Multi-Link Operation (MLO), which aggregates bandwidth across 2.4 GHz, 5 GHz, and 6 GHz bands simultaneously. It also doubles the channel size to 320 MHz and utilizes 4096-QAM modulation, resulting in extremely high throughput (up to 4.8x faster than Wi-Fi 6) and dramatically lower latency, making it ideal for future AR/VR, cloud gaming, and high-density device environments.

Are consumer Wi-Fi routers incorporating Artificial Intelligence (AI) features?

Yes, advanced consumer Wi-Fi routers increasingly integrate AI and machine learning (ML) for network optimization and security. AI features include dynamic Quality of Service (QoS) to prioritize specific traffic (like video calls or gaming), autonomous selection of optimal channels to mitigate interference, and real-time security scanning to detect and neutralize traffic anomalies indicative of malware or intrusion attempts proactively.

What are the key security concerns related to modern consumer Wi-Fi routers?

Key security concerns include weak default passwords, lack of timely firmware updates, and vulnerabilities in IoT devices connected to the network. To address this, users should utilize WPA3 encryption, enable automatic firmware updates, use strong, unique passwords, and consider routers offering advanced, subscription-based network protection (e.g., firewall, intrusion prevention systems) to secure connected smart devices.

Which segment, by product type, is exhibiting the highest growth rate?

The Mesh Wi-Fi Systems segment is currently exhibiting the highest growth rate in the market. This surge is driven by consumer demand for reliable, seamless, and wide-ranging coverage throughout residential properties, coupled with the simplicity of setup and scalability offered by mesh architectures, surpassing the growth trajectory of traditional, standalone routing devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager