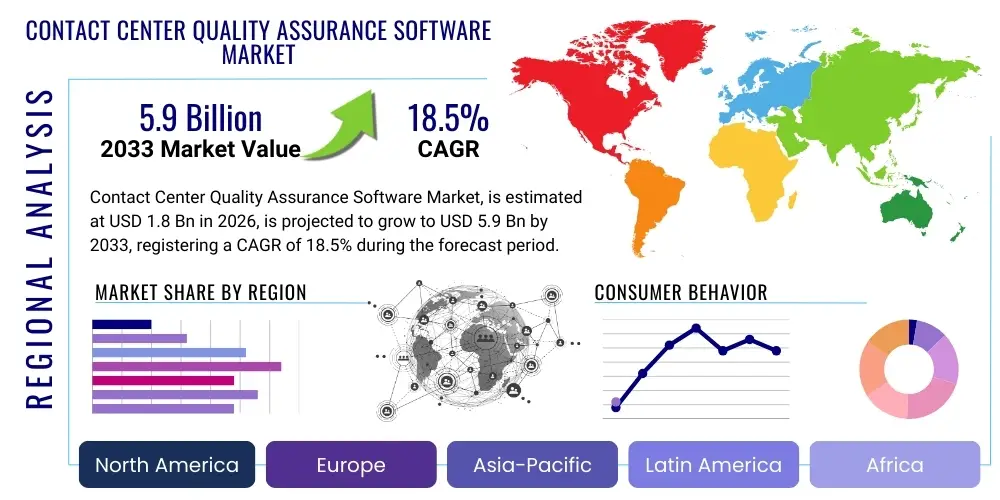

Contact Center Quality Assurance Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438815 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Contact Center Quality Assurance Software Market Size

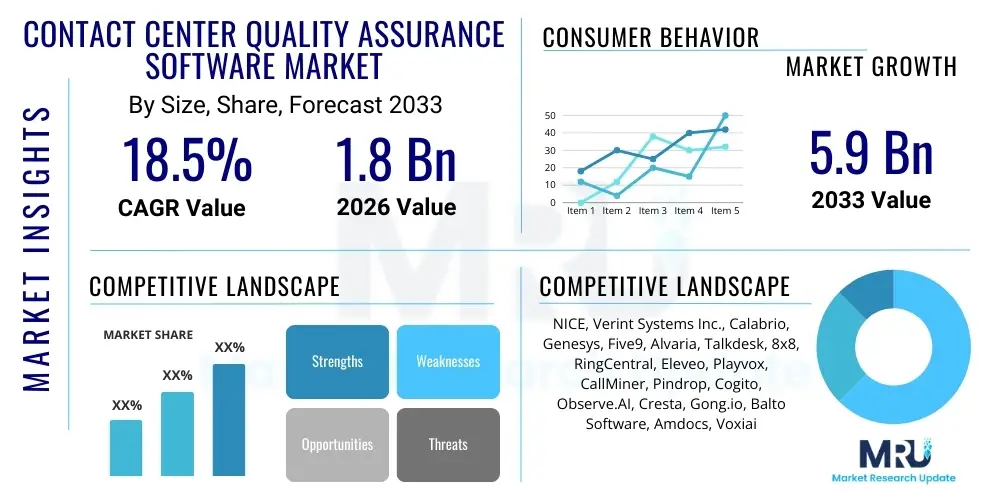

The Contact Center Quality Assurance Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Contact Center Quality Assurance Software Market introduction

The Contact Center Quality Assurance (QA) Software Market encompasses advanced digital solutions essential for monitoring, evaluating, and strategically improving the efficiency and compliance of customer service interactions across all communication channels, including traditional voice, digital chat, email, and emerging social media platforms. These solutions are fundamental components of modern Workforce Engagement Management (WEM) suites, moving beyond simple scorecards by utilizing sophisticated analytical engines, comprehensive speech and text recognition, and artificial intelligence (AI) to automate and objectify the QA process. The fundamental driver for adoption is the pursuit of operational excellence, ensuring interactions align with corporate standards and increasingly stringent regulatory requirements, thereby directly mitigating financial and reputational risks associated with non-compliance or poor service delivery.

The sophistication of contemporary QA software allows enterprises to perform root-cause analysis on systemic failures, linking specific agent behaviors and process deviations directly to measurable business outcomes, such as customer churn rates or successful sales conversions. Key product offerings span high-volume interaction recording and archiving, real-time agent desktop monitoring, and specialized AI-driven modules for sentiment analysis and emotion detection. Major applications are concentrated in industries where transactional integrity and data privacy are non-negotiable, notably Banking, Financial Services, and Insurance (BFSI), and the highly competitive Telecommunications sector. Furthermore, the rising global trend towards outsourcing (BPO) necessitates standardized, auditable QA frameworks, bolstering demand for scalable, cloud-native solutions that can manage diverse languages and regulatory environments effortlessly.

The primary benefits derived from the deployment of comprehensive QA software include a dramatic increase in the volume of interactions analyzed—shifting from a statistically irrelevant 1-2% sample rate to near 100% analysis—leading to vastly improved data fidelity and deeper insights into agent performance bottlenecks. This automation leads to substantial reductions in the manual effort required by QA supervisors, allowing them to shift their focus from scoring to high-value coaching and agent development. Critical driving factors underpinning market expansion include the exponential growth in digital interaction volume, the permanent shift to distributed (remote and hybrid) contact center models requiring centralized visibility, and the intensifying competitive landscape where customer experience (CX) has become the primary battleground for brand loyalty. Technological convergence, particularly the integration of QA data with Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems, further amplifies the strategic value of these software solutions.

Contact Center Quality Assurance Software Market Executive Summary

The global Contact Center QA Software Market is characterized by rapid technological innovation centered around generative AI and advanced predictive analytics, dictating a landscape where software vendors are rapidly consolidating their offerings into unified Workforce Engagement Management (WEM) platforms. A dominant business trend involves the mass migration from legacy on-premise systems to flexible, subscription-based Software-as-a-Service (SaaS) cloud deployments, driven by the need for elastic scalability to handle fluctuating customer demands and simplified maintenance for remote workforces. Competitive strategies are increasingly focused on achieving technological superiority in automated transcription accuracy, multilingual support capabilities, and seamless integration depth with third-party Customer Experience (CX) tools, placing substantial pressure on legacy providers to modernize their core offerings or face market displacement.

Regionally, the market exhibits a clear contrast between maturity and growth potential. North America maintains its leadership position, underpinned by mature technological infrastructure, high corporate spending on specialized enterprise software, and rigorous compliance mandates across its large BFSI and Healthcare sectors. Conversely, the Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR), fueled by the aggressive expansion of Business Process Outsourcing (BPO) hubs and the widespread digital transformation occurring across key developing economies, particularly in retail and telecommunications. European growth remains steady, primarily motivated by the necessity to comply with strict data residency and privacy regulations (GDPR), favoring vendors that demonstrate robust data governance capabilities and reliable cloud architecture.

Segmentation analysis highlights that the Solutions component segment, specifically modules offering automated scoring and sophisticated analytics, commands the majority market share due to the tangible efficiency gains derived from AI implementation. The shift toward smaller, modular software deployments benefits Small and Medium-sized Enterprises (SMEs), allowing them to access enterprise-grade QA features without prohibitive upfront capital investment, further democratizing market access. Within the end-user landscape, while BFSI and Telecom remain core revenue generators, the Healthcare sector is showing accelerated adoption rates, driven by the need to manage sensitive patient health information (PHI) and ensure regulatory adherence, making compliance features a paramount purchasing criteria across all market segments globally.

AI Impact Analysis on Contact Center Quality Assurance Software Market

Common inquiries from users and potential buyers heavily focus on verifying the reliability and unbiased nature of AI-driven scoring models against human evaluation subjectivity, often questioning the ethical implications of automating sensitive performance reviews. Users are intensely interested in the quantifiable return on investment (ROI) offered by AI systems, specifically how quickly they can transition from auditing sampled interactions to achieving effective 100% analysis, and what this transition means for the required skill evolution of existing QA supervisors. A recurring concern is the operational viability of real-time AI guidance tools, asking whether the automated prompts and coaching suggestions truly enhance agent performance without causing distraction or adding unnecessary complexity during live customer interactions, ensuring the technology serves as an assistant rather than a hindrance.

The overriding theme is the expectation that AI should facilitate predictive quality management, allowing organizations to intervene preemptively rather than reactively. Users anticipate that AI integration will lead to a fully integrated quality loop: identifying a systemic performance gap, automatically assigning relevant micro-training, and subsequently tracking the agent’s improvement through follow-up interactions, all without manual supervisor input. This expectation mandates highly sophisticated Natural Language Understanding (NLU) capabilities that can grasp nuances, sarcasm, and complex compliance scenarios, ensuring the AI systems accurately reflect real-world interaction quality. Ultimately, the market expects AI to transition QA from a necessary cost center focused on retrospective auditing into a core strategic asset driving agent retention, customer loyalty, and optimized operational expenditure.

- AI enables 100% interaction coverage, eliminating reliance on small, subjective sampling methods.

- Automated scoring algorithms significantly reduce evaluator time and ensure objective, consistent performance metrics across the organization.

- Natural Language Processing (NLP) and Speech Analytics automatically categorize calls, identify compliance breaches (e.g., missed disclosure statements), and detect emotional states.

- Predictive analytics forecasts agents likely to underperform, engage in risky behavior, or exhibit high churn potential based on historical QA scores and behavioral patterns.

- AI shifts human QA teams from manual scoring roles to advanced coaching, strategic root-cause analysis, and validating AI model accuracy.

- Real-time agent guidance powered by AI delivers contextual coaching prompts, script adherence reminders, and knowledge base suggestions during live customer interactions.

- Identification of emerging process failures, ineffective marketing language, or widespread training gaps across diverse contact center floors and geographies.

DRO & Impact Forces Of Contact Center Quality Assurance Software Market

The market's acceleration is fundamentally driven by robust technological integration and shifting workforce dynamics. The proliferation of hybrid and remote work models has made centralized, digital QA monitoring an indispensable operational requirement, moving quality assurance away from physical supervisor oversight. Furthermore, the intensifying competitive focus on Customer Experience (CX) mandates proactive identification and resolution of service failures, pushing organizations to adopt AI-driven systems capable of analyzing massive data volumes for actionable insights. Regulatory adherence, particularly in sectors dealing with sensitive data (e.g., financial disclosure laws, healthcare privacy acts), acts as a non-negotiable driver, compelling continuous investment in auditable recording and analysis capabilities.

Conversely, significant restraints hinder growth, most notably the substantial initial capital investment required for adopting advanced AI platforms, training these sophisticated models, and the cost associated with integrating these systems into complex legacy IT architectures prevalent in older enterprises. Data privacy and security remain persistent friction points; navigating varying international data residency laws, ensuring secure encryption of recorded interactions, and mitigating the potential for algorithmic bias in automated scoring are complex challenges that can delay large-scale deployment. Moreover, organizational resistance to change, particularly among long-standing QA teams skeptical of AI accuracy, necessitates substantial organizational change management efforts from vendors and customers alike.

Opportunities abound, centering on the vast, untapped market potential within Small and Medium-sized Enterprises (SMEs) that are increasingly migrating their customer service functions to formal contact center structures and require simplified, scalable QA solutions delivered via SaaS. The market is also poised for expansion into highly specialized governmental and municipal service centers that are undergoing rapid digitalization and require robust, secure monitoring. The strongest impact forces currently are technological convergence—where QA merges with WFM and analytics into a unified WEM suite—and the sustained global pressure for superior CX. Vendors that successfully reduce implementation complexity and demonstrate rapid, measurable ROI through compliance risk reduction and agent productivity gains will capture the largest market share, overriding initial budgetary restraints by proving long-term operational savings.

Segmentation Analysis

A comprehensive analysis of the Contact Center QA Software market reveals a segmented structure defined by delivery method, functionality, and end-user requirements, reflecting the diversity in organizational complexity and regulatory needs worldwide. The division between Solutions (Software) and Services underscores the reliance of the market on not only proprietary technology but also the specialized consulting, customization, and continuous managed support necessary to integrate complex AI and analytical tools effectively within heterogeneous IT environments. This segmentation is crucial as it highlights the recurring revenue streams generated through subscription-based services and maintenance contracts, which are growing faster than one-time software license sales, particularly in the cloud environment.

The Deployment Model segmentation showcases the accelerated preference for Cloud solutions, which offer unparalleled benefits in scalability, rapid feature updates, and support for the geographically dispersed contact center workforce that has become standard since 2020. While On-Premise deployments still maintain a significant presence, especially in highly regulated industries like national banking or defense where data sovereignty is paramount, the long-term trend strongly favors SaaS due to reduced infrastructure maintenance overhead and ease of integration with other cloud-native CX platforms. The ability of Cloud solutions to handle peak transactional volumes elastically further solidifies their position as the preferred deployment architecture for high-volume retailers and telecom providers.

Organization Size segmentation confirms that Large Enterprises, requiring complex WEM suites tailored to tens of thousands of agents, remain the primary revenue drivers. However, the burgeoning demand from Small and Medium-sized Enterprises (SMEs) for affordable, entry-level cloud QA tools signifies a significant future growth vector. Application segmentation emphasizes the financial imperative driving adoption, with the BFSI sector demanding sophisticated, tamper-proof audit trails, while the IT & Telecom segment requires real-time analysis to diagnose technical support issues and proactively improve product offerings. Understanding these segmentation nuances is critical for vendors to tailor their marketing and product development efforts toward specific compliance and operational pain points.

- By Component:

- Solutions (Core Software, Interaction Recording, Speech Analytics, Desktop Analytics, Reporting)

- Services (Professional Services: Implementation, Consulting, Training; Managed Services: Outsourced Monitoring, Support)

- By Deployment Model:

- Cloud (SaaS, multi-tenant and single-tenant architectures)

- On-Premise (Self-hosted, requiring substantial internal infrastructure investment)

- By Organization Size:

- Large Enterprises (5,000+ seats, complex regulatory needs)

- Small and Medium-sized Enterprises (SMEs) (50 to 5,000 seats, preferring scalable SaaS solutions)

- By Application/End-User:

- Banking, Financial Services, and Insurance (BFSI) (Highest compliance requirement, focus on fraud detection)

- IT & Telecommunications (High volume, focus on technical support efficiency and FCR)

- Healthcare and Life Sciences (Critical data privacy requirements - HIPAA, PHI handling)

- Retail and E-commerce (Focus on customer sentiment, sales conversion, and peak season management)

- Government and Public Sector (Emphasis on security, transparency, and specific accessibility standards)

- Others (Travel, Media, Utilities, Manufacturing)

Value Chain Analysis For Contact Center Quality Assurance Software Market

The upstream segment of the Contact Center QA Software value chain is centered on rigorous research and development, where core intellectual property (IP) is generated. This involves specialized data scientists, linguists, and software engineers developing proprietary algorithms for speech recognition, Natural Language Understanding (NLU), and deep learning models optimized for contact center jargon and emotional detection. Crucial upstream activities also include securing strategic data partnerships to train these models on diverse, real-world datasets, ensuring high accuracy across multiple languages and dialects. Innovation in this stage focuses heavily on cybersecurity resilience and architectural efficiency, minimizing latency for real-time analysis tools and ensuring compliance frameworks are baked directly into the software's foundational code, establishing the product's quality and differentiation from competitors.

The midstream phase involves software production, packaging, and distribution. Distribution channels are increasingly sophisticated, moving away from purely direct sales towards comprehensive indirect strategies utilizing global System Integrators (SIs) and specialist Value-Added Resellers (VARs). Direct distribution is typically reserved for highly customized enterprise deals, especially those involving multi-year contracts or complex hybrid cloud installations for global banks. Indirect channels allow vendors to scale rapidly into SME markets and specific geographies, leveraging partners’ localized sales networks and established customer trust. The rise of cloud computing significantly streamlines midstream operations by replacing physical distribution with digital delivery, reducing logistical complexity and accelerating time-to-market for software updates and new features.

The downstream component emphasizes post-implementation services, customer success, and ongoing product optimization, which is vital for maximizing the software's lifecycle value. This includes expert professional services for initial configuration, integration with proprietary CRM/WFM systems, and customized training for contact center managers and agents. The continuous feedback loop from downstream users—who report on the effectiveness of automated scores, coaching module efficacy, and overall system usability—is essential for informing upstream R&D cycles. Furthermore, the provision of managed QA services, where vendors or third-party providers handle the ongoing monitoring and analysis on behalf of the client, is a growing segment that allows customers to access advanced capabilities without maintaining large internal QA teams, completing the end-to-end value delivery system.

Contact Center Quality Assurance Software Market Potential Customers

The primary purchasers and end-users of Contact Center Quality Assurance software are organizations that rely heavily on scalable and consistent customer interaction for their core business operations, encompassing a wide spectrum of corporate sizes from global Fortune 500 companies to rapidly scaling small and medium-sized enterprises (SMEs). Within these organizations, the key buying centers include the Vice President of Customer Experience (CX), the Director of Contact Center Operations, and the Chief Compliance Officer, as the software serves both operational efficiency and risk mitigation purposes. Enterprises with stringent regulatory burdens, such as those in the BFSI and Healthcare sectors, represent the most critical customer base due to the mandated requirement for detailed interaction documentation and audit trails.

The Telecommunications and high-volume Retail/E-commerce sectors form the second tier of major customers, driven by the intense competition for customer loyalty and the need to rapidly diagnose and resolve customer pain points across numerous digital and voice channels. These buyers prioritize solutions offering real-time sentiment analysis and high efficiency in automating repetitive scoring, directly linking QA results to reductions in Average Handle Time (AHT) and increases in First Call Resolution (FCR). For the rapidly growing Business Process Outsourcing (BPO) industry, QA software is a fundamental tool used to standardize performance across different client accounts, providing verifiable proof of service quality as a competitive differentiator in global tenders.

Furthermore, the public sector, including federal, state, and local government agencies, is rapidly emerging as a substantial customer base as digital citizen services expand. Government entities require highly secure, compliant, and often hybrid-deployed QA solutions to manage sensitive constituent data and ensure equitable service delivery, often purchasing through large-scale government contracts that favor vendors with strong security accreditations and verifiable data sovereignty controls. Finally, the growing market of Small and Medium-sized Enterprises (SMEs) that are professionalizing their customer service operations seek accessible, cloud-only QA solutions, often integrated directly within their existing CCaaS (Contact Center as a Service) platform, signaling a key growth area for vendors offering entry-level or modular pricing structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NICE, Verint Systems Inc., Calabrio, Genesys, Five9, Alvaria, Talkdesk, 8x8, RingCentral, Eleveo, Playvox, CallMiner, Pindrop, Cogito, Observe.AI, Cresta, Gong.io, Balto Software, Amdocs, Voxiai |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contact Center Quality Assurance Software Market Key Technology Landscape

The contemporary technology landscape for Contact Center QA software is defined by its deep reliance on Artificial Intelligence and comprehensive big data analytics frameworks necessary to process and derive value from petabytes of interaction data. At the core, high-fidelity interaction recording, encompassing full audio, desktop screen activity, and digital text threads, provides the raw material. This data is immediately fed into advanced Speech-to-Text (STT) engines and Natural Language Processing (NLP) frameworks. Modern NLP utilizes deep learning techniques to accurately transcribe complex conversations, including multilingual interactions, and apply sophisticated models for sentiment analysis, topic spotting, and identifying underlying customer intent with extremely high accuracy, which is paramount for minimizing false positives in compliance breach detection.

A major technological differentiator is the implementation of Machine Learning (ML) for predictive and prescriptive analytics. ML algorithms are trained not just to score historical interactions against static criteria, but to dynamically identify patterns that predict future negative outcomes, such as imminent customer churn or high-risk non-compliant agent behavior. This moves the QA function from backward-looking assessment to forward-looking risk mitigation. Furthermore, desktop analytics software, often powered by computer vision or behavioral modeling, monitors agent workflow efficiency, ensuring adherence to optimal process flows and identifying desktop usage patterns that correlate with high Average Handle Time (AHT) or repeated errors, providing crucial data for process optimization beyond voice analysis.

Integration architecture is vital, with Microservices and API-first designs becoming industry standard, ensuring that the QA platform can seamlessly ingest data from diverse Customer Experience (CX) ecosystems, including major CCaaS providers (e.g., Genesys Cloud, Five9, Talkdesk) and large CRM platforms (e.g., Salesforce, Oracle). This interoperability is mandatory for delivering a unified WEM experience. Furthermore, ethical AI governance and bias mitigation techniques are emerging as critical technologies, ensuring that the automated scoring models are fair, transparent, and auditable, addressing growing regulatory scrutiny regarding the fairness of performance management systems. Finally, secure, distributed cloud infrastructure (leveraging technologies like Kubernetes and serverless computing) provides the necessary resilience and geo-redundancy required for global, 24/7 contact center operations and adherence to diverse data residency requirements across different geographic regions.

Regional Highlights

North America continues to lead the global Contact Center QA Software market, commanding the largest revenue share, primarily due to the region's high propensity for early adoption of advanced enterprise software and substantial corporate investment in comprehensive WEM solutions. The United States market is particularly buoyant, driven by robust activity in the financial services and healthcare sectors where regulatory mandates (Dodd-Frank, HIPAA, PCI DSS) necessitate highly auditable and secure interaction monitoring platforms. Furthermore, the presence of major technological innovation hubs and leading global vendors ensures continuous R&D and rapid feature deployment, establishing North America as the benchmark for technological maturity and integrated QA deployment strategies, particularly regarding sophisticated real-time agent guidance tools.

Europe demonstrates a strong and consistent growth trajectory, profoundly shaped by the General Data Protection Regulation (GDPR) and various national labor laws that mandate stringent requirements for data privacy, consent management, and employee monitoring transparency. Consequently, European enterprises prioritize QA software that offers robust data anonymization, selective recording capabilities, and demonstrable compliance frameworks, often preferring solutions hosted within specific European data centers to satisfy residency requirements. The necessity to effectively analyze and score interactions conducted in numerous languages (German, French, Spanish, etc.) across fragmented regulatory zones also drives demand for vendors offering superior multilingual NLP and dedicated regional professional services support for complex cross-border deployments.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) globally, largely attributable to the massive influx of investment into the Business Process Outsourcing (BPO) sector in countries such as India and the Philippines, which require world-class QA standards to service international clientele. Rapid digitalization, urbanization, and the aggressive expansion of the e-commerce and Fintech industries across emerging economies, including China and Southeast Asia, create a massive demand for scalable, cloud-native QA solutions. This region's growth is characterized by a strong focus on high-volume processing capabilities and the necessity for robust support for complex regional dialects and low-bandwidth connectivity scenarios, often prioritizing efficiency and affordability in their purchasing criteria over highly specialized bespoke features.

- North America: Dominates market share due to high technology expenditure, stringent regulatory requirements (HIPAA, PCI DSS), and concentration of key vendors and early adopters of WEM. Market maturity dictates a focus on predictive and prescriptive analytics.

- Europe: High growth driven by GDPR compliance, necessity for multilingual interaction analysis, and strong adoption across the highly regulated BFSI and Telecommunications sectors. Focus on data residency and ethical AI compliance.

- Asia Pacific (APAC): Highest projected CAGR, fueled by massive expansion of BPO operations, rapid digital transformation in e-commerce, and the need for scalable cloud infrastructure in high-volume, emerging markets like India and China.

- Latin America (LATAM): Exhibits solid growth driven by regional digitalization efforts, increasing penetration of SMEs into formal contact center operations, and demand for cost-effective SaaS solutions localized for Spanish and Portuguese markets.

- Middle East & Africa (MEA): Emerging market characterized by significant state-led infrastructural development (especially in the GCC countries) and nascent adoption of sophisticated QA technologies, primarily focused on national security, government services, and expanding financial hubs like Dubai and Riyadh.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contact Center Quality Assurance Software Market.- NICE

- Verint Systems Inc.

- Calabrio, Inc.

- Genesys

- Five9, Inc.

- Alvaria (formerly Aspect Software and Teleopti)

- Talkdesk, Inc.

- 8x8, Inc.

- RingCentral, Inc.

- Eleveo (formerly ZOOM International)

- Playvox

- CallMiner, Inc.

- Pindrop Security, Inc.

- Cogito Corp.

- Observe.AI

- Cresta

- Gong.io

- Balto Software

- Nodion (Acquired by NICE)

- Amdocs

- Voxiai

- Scorebuddy

Frequently Asked Questions

Analyze common user questions about the Contact Center Quality Assurance Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Contact Center QA Software Market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033, driven largely by the shift towards AI-powered automated interaction analysis and cloud deployment models, moving the market value towards USD 5.9 Billion.

How does AI impact traditional contact center QA processes?

AI transforms QA from retrospective manual sampling to proactive, 100% interaction analysis via automated scoring, sentiment detection, and NLP, fundamentally shifting human roles from evaluators to high-value coaches focused on systemic improvement.

Which deployment model dominates the market for QA Software?

The Cloud (SaaS) deployment model is increasingly dominant, favored for its elastic scalability, rapid implementation, lower Total Cost of Ownership (TCO), and essential support for globally distributed or remote contact center workforces.

Which industry vertical is the largest consumer of Contact Center QA solutions?

The Banking, Financial Services, and Insurance (BFSI) sector represents the largest end-user segment due to the critical requirement for rigorous regulatory compliance, audit trail maintenance, fraud prevention, and secure handling of sensitive transactional data.

What is the primary difference between traditional QA and modern WEM platforms?

Traditional QA focuses solely on scoring historical interactions, whereas modern Workforce Engagement Management (WEM) platforms integrate QA with Workforce Management (WFM), coaching, and real-time guidance to offer a unified, strategic ecosystem focused on agent development and maximized CX outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager